Yatra Online, Inc. (NASDAQ: YTRA) (the “Company”), India’s

leading corporate travel services provider and one of India’s

leading online travel companies, today announced its unaudited

financial and operating results for the three months ended December

31, 2024.

“We are pleased to report a strong quarter, delivering revenue

growth and continued momentum across key segments. Our revenue for

the quarter reached INR 2,350.7 million (USD 27.5 million), marking

year-over-year increase of 111.4%.

“Adjusted Air Ticketing Margins saw a 23.0% decline, primarily

attributable to reduced volumes in the B2C segment as we

strategically adjusted discounts to address supplier-induced

intensified price competition. Our corporate travel business

continued to be a key growth driver. Notably, Adjusted Hotels &

Packages margin saw a strong 65.8% year-over-year increase,

primarily fueled by the expansion of our MICE (Meetings,

Incentives, Conferences, and Exhibitions) business.

“Our profit was INR 39.8 million (USD 0.5 million) for the three

months ended December 31, 2024 versus a loss of INR 39.5 million

(USD 0.5 million) for the three months ended December 31, 2023.

Additionally, Adjusted EBITDA surged 173.0% year-over-year to INR

121.5 million (USD 1.4 million), reflecting our disciplined focus

on profitable growth and cost optimization.

“Our ongoing emphasis on operational efficiency has yielded

tangible results, including improved cost rationalization,

supply-side synergies, and enhanced margin sustainability. The

strategic pivot toward higher-margin segments like Hotels &

Packages and MICE has effectively mitigated the impact of B2C air

margin pressures, reinforcing our balanced revenue mix.

Furthermore, our success in onboarding 50 new corporate clients—a

quarterly record—has added an annual billing potential of INR 2,804

million (USD 32.2 million), strengthening our leadership in the

corporate travel domain.

“Following our successful acquisition of Globe All India

Services Limited (GAISL) on September 11, 2024, for INR 1,280.0

million (USD 15.3 million) in cash, integration efforts are

progressing ahead of schedule. We are already seeing early

synergies, particularly in supplier consolidation, operational

streamlining, and technology adoption. By leveraging Yatra’s tech

platform within GAISL’s customer base, we expect to unlock further

efficiencies, drive incremental revenue, and enhance our long-term

competitive positioning.

“The Company continues to work with its counsels in the relevant

jurisdictions to simplify its legal and corporate structure which

is expected to streamline administrative overheads and facilitate

growth for the Company. These initiatives, combined with

disciplined execution and a scalable cost structure, are expected

to support sustained margin expansion and operational

excellence.

“Looking ahead, we remain excited about the opportunities before

us. With record corporate client acquisitions, continued expansion

in MICE, and disciplined execution of our strategic priorities, we

are confident in our ability to reinforce our market leadership and

drive sustainable value for all stakeholders.” - Dhruv Shringi,

Co-founder and CEO.

Financial and operating highlights for the three months

ended December 31, 2024:

- Revenue of INR 2,350.7 million (USD 27.5 million),

representing an increase of 111.4% year-over-year basis

(“YoY”).

- Adjusted Margin (1) from Air Ticketing of INR 857.6

million (USD 10.0 million), representing a decrease of 23.0%

YoY.

- Adjusted Margin (1) from Hotels and Packages of INR

438.0 million (USD 5.1 million), representing an increase of 65.8%

YoY.

- Total Gross Bookings (Air Ticketing, Hotels and Packages and

Other Services)(3) of INR 17,997.1 million (USD 210.4 million),

representing a decrease of 3.4% YoY.

- Profit for the period was INR 39.8 million (USD 0.5

million) versus a loss of INR 39.5 million (USD 0.5 million) for

the three months ended December 31, 2023, reflecting positive swing

of INR 79.3 million (USD 0.9 million) YoY.

- Result from operations were a profit of INR 14.8 million

(USD 0.2 million) versus a loss of INR 58.2 million (USD 0.7

million) for the three months ended December 31, 2023, reflecting

positive swing of INR 73.0 million (USD 0.9 million) YoY.

- Adjusted EBITDA(2) was INR 121.5 million (USD 1.4

million) reflecting an increase by 173.0% YOY.

Three months ended December

31,

2023

2024

2024

YoY Change

Unaudited

Unaudited

Unaudited

(In thousands except

percentages)

INR

INR

USD

%

Financial Summary as per IFRS

Revenue

1,112,047

2,350,740

27,478

111.4

%

Results from operations

(58,213

)

14,799

172

125.4

%

Profit/(Loss) for the period

(39,457

)

39,769

463

200.8

%

Financial Summary as per non-IFRS

measures

Adjusted Margin (1)

Adjusted Margin - Air Ticketing

1,114,395

857,599

10,025

(23.0

)%

Adjusted Margin - Hotels and Packages

264,129

438,035

5,120

65.8

%

Adjusted Margin - Other Services

69,938

72,843

851

4.2

%

Others (Including Other Income)

180,593

185,956

2,174

3.0

%

Adjusted EBITDA (2)

44,493

121,458

1,420

173.0

%

Operating Metrics

Gross Bookings (3)

18,631,771

17,997,061

210,369

(3.4

)%

Air Ticketing

16,096,263

13,828,120

161,638

(14.1

)%

Hotels and Packages

1,992,602

3,603,122

42,117

80.8

%

Other Services (6)

542,906

565,819

6,614

4.2

%

Adjusted Margin% (4)

Air Ticketing

6.9

%

6.2

%

Hotels and Packages

13.3

%

12.2

%

Other Services

12.9

%

12.9

%

Quantitative details (5)

Air Passengers Booked

1,659

1,314

(20.8

)%

Stand-alone Hotel Room Nights Booked

362

418

15.5

%

Packages Passengers Travelled

7

18

162.9

%

Note:

(1)

As certain parts of our revenue are

recognized on a “net” basis and other parts of our revenue are

recognized on a “gross” basis, we evaluate our financial

performance based on Adjusted Margin, which is a non-IFRS

measure.

(2)

See the section below titled “Certain

Non-IFRS Measures.”

(3)

Gross Bookings represent the total amount

paid by our customers for travel services, freight services and

products booked through us, including taxes, fees and other

charges, and are net of cancellation and refunds.

(4)

Adjusted Margin % is defined as Adjusted

Margin as a percentage of Gross Bookings.

(5)

Quantitative details are considered on a

gross basis.

(6)

Other Services primarily consists of

freight business, IT services, bus, rail and cab and others

services.

As of December 31, 2024, 61,922,426 ordinary shares (on an

as-converted basis), par value $0.0001 per share, of the Company

(the “Ordinary Shares”) were issued and outstanding.

Conference Call

The Company will host a conference call to discuss its unaudited

results for the three months ended December 31, 2024 beginning at

8:30 AM Eastern Daylight Time (or 7:00 PM India Standard Time) on

February 11, 2025. Dial in details for the conference call is as

follows: US/International dial-in number: +1 404 975 4839.

Confirmation Code: 492901 (Callers should dial in 5-10 minutes

prior to the start time and provide the operator with the

Confirmation Code). The conference call will also be available via

webcast at https://events.q4inc.com/attendee/813192329.

Safe Harbor Statement

This earnings release contains certain statements concerning the

Company’s future growth prospects and forward-looking statements,

as defined in the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995, as amended. These

forward-looking statements are based on the Company’s current

expectations, assumptions, estimates and projections about the

Company and its industry. These forward-looking statements are

subject to various risks and uncertainties. Generally, these

forward-looking statements can be identified by the use of

forward-looking terminology such as “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “will,” “project,” “seek,” “should”

similar expressions and the negative forms of such expressions.

Such statements include, among other things, statements regarding

the long-term growth trajectory for the Indian travel market,

statements concerning management’s beliefs as well as our strategic

and operational plans; the anticipated benefits of the Indian IPO;

the degree to which and how we will utilize debt facilities or the

proceeds from the Indian IPO and the results we anticipate from how

such funds are utilized; expected buyback activity with respect to

our share repurchase program; and our future financial performance.

Forward-looking statements involve inherent risks and

uncertainties. A number of important factors could cause actual

results to differ materially from those contained in any

forward-looking statement. Potential risks and uncertainties

include, but are not limited to, the impact of increasing

competition in the Indian travel industry and our expectations

regarding the development of our industry and the competitive

environment in which we operate; the slowdown in Indian economic

growth and travel industry in particular, including disruptions

caused by safety concerns, terrorist attacks, regional conflicts

(including the ongoing conflict between Ukraine and Russia and the

evolving events in Israel, Gaza and the Middle East), pandemics and

natural calamities, our ability to successfully negotiate our

contracts with airline suppliers and global distribution system

service providers and mitigate any negative impacts on our Revenue

that result from reduced commissions, incentive payments and fees

we receive; the risk that airline suppliers (including our GDS

service providers) may reduce or eliminate the commission and other

fees they pay to us for the sale of air tickets; our ability to

pursue strategic partnerships and the risks associated with our

business partners; the potential impact of recent developments in

the Indian travel industry on our profitability and financial

condition; political and economic stability in and around India and

other key travel destinations; our ability to maintain and increase

our brand awareness; our ability to realize the anticipated

benefits of any past or future acquisitions; our ability to

successfully implement our growth strategy; our ability to attract,

train and retain executives and other qualified employees, and our

ability to successfully implement any new business initiatives.

These and other factors are discussed in our reports filed with the

U.S. SEC. All information provided in this earnings release is

provided as of the date of issuance of this earnings release, and

we do not undertake any obligation to update any forward-looking

statement, except as required under applicable law.

About Yatra Online, Inc.

Yatra Online, Inc. is the ultimate parent company of Yatra

Online Limited, India's leading corporate travel services provider

with over 1200 large corporate customers and one of India's leading

online travel companies. The company provides information, pricing,

availability and booking facility for domestic and international

air travel, domestic and international hotel bookings, holiday

packages, buses, trains, in city activities, inter-city and

point-to-point cabs, homestays and cruises. With approximately 108K

hotels and homestays contracted in approximately 1,500 cities

across India, as well as approximately 2 million hotels around the

world, the company is India's largest platform for domestic

hotels.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250211678929/en/

For more information, please contact: Manish Hemrajani

Yatra Online, Inc. VP, Head of Corporate Development and Investor

Relations ir@yatra.com

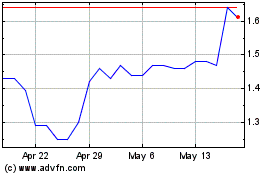

Yatra Online (NASDAQ:YTRA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Yatra Online (NASDAQ:YTRA)

Historical Stock Chart

From Feb 2024 to Feb 2025