Focus Impact Acquisition Corp. (“

Focus Impact”)

(Nasdaq: FIAC), a special purpose acquisition company, and

DevvStream Holdings Inc. (“

DevvStream” or the

“

Company”) (CBOE: DESG) (OTCQB: DSTRF) (FSE: CQ0),

a leading carbon credit project co-development and generation firm

specializing in technology-based solutions, today announced the

filing of a registration statement on Form S-4 (the "Registration

Statement") with the U.S. Securities and Exchange Commission

("SEC") on December 4, 2023. The closing of the Business

Combination (as defined below), previously announced on September

12, 2023, is expected to result in DevvStream being the first

publicly traded carbon streaming company on a major U.S. stock

exchange.

The Registration Statement contains a

preliminary proxy statement/prospectus in connection with the

proposed business combination between DevvStream and Focus Impact

(the “Business Combination”). While the Registration Statement has

not yet become effective and the information contained therein is

subject to change, it provides important information about

DevvStream, Focus Impact, and the Business Combination.

Through DevvStream’s Carbon Management and

Carbon Investment platforms, the Company is focused on the

co-development and generation of technology-based carbon offset

credits, in partnership with governments and corporations

worldwide, across voluntary and compliance markets. These programs

leverage a systematic approach to the process of generating high

quality technology-based carbon credits by partnering with project

owners to either directly invest as a co-developer or execute

project design, documentation, and certification efforts and

associated costs in exchange for a substantial portion of

multi-year carbon credit streams. Typical projects incur ongoing

management and administrative costs during the contract term and

generate recurring streams of carbon credits. Through a curated,

technology-focused approach to the implementation of green

technology projects, DevvStream aims to democratize access to

carbon markets while helping governments and corporations worldwide

meet their sustainability goals. To date, the Company has signed

multiple contracts with partners, including Go-Station, Inc.,

TS-Nano Sealants LLC, and Prosper Technologies & Affiliates,

for the generation of carbon credits. In addition, the Company has

received contractual orders for the purchase of 250,000 credits

over the next 3 years with options for an additional 400,000

credits from a global energy company.

DevvStream’s co-development strategy allows the

Company to target a portfolio of opportunities that require limited

or zero upfront capital investment, enabling high margin revenue

streams. DevvStream’s management believes that its unique, capital

light business model and existing customer relationships which

enable immediate monetization of carbon credit streams generated,

combined with a commitment to transparency and reliability, enable

significant opportunity for sustained long-term growth. According

to Research and Markets, the global carbon credit market value was

$1.16 trillion in 2022, and is expected to grow to $2.68 trillion

by 2028.

The Business Combination is currently expected

to close in the second quarter of 2024, subject to the satisfaction

of closing conditions under the Business Combination Agreement,

dated as of September 12, 2023, by and among Focus Impact, Focus

Impact Amalco Sub Ltd. and DevvStream. Upon completion of the

Business Combination, the combined company will operate as

DevvStream and is expected to be listed on the Nasdaq Stock Market

LLC (“Nasdaq”) under the ticker "DEVS”.

About DevvStream

Founded in 2021, DevvStream is a

technology-based sustainability company that advances the

development and monetization of environmental assets, with an

initial focus on carbon markets. DevvStream works with governments

and corporations worldwide to achieve their sustainability goals

through the implementation of curated green technology projects

that generate renewable energy, improve energy efficiencies,

eliminate or reduce emissions, and sequester carbon directly from

the air—creating carbon credits in the process.

On September 13, 2023, DevvStream and Focus

Impact (Nasdaq: FIAC) announced that they have entered into a

definitive business combination agreement for a business

combination that would result in the combined company (DevvStream)

to be listed on the Nasdaq Stock Market under the ticker symbol

“DEVS”.

About Focus Impact Acquisition

Corp.

Focus Impact Acquisition Corp. is a newly

organized blank check company formed for the purpose of effecting a

merger, capital stock exchange, asset acquisition, stock purchase,

reorganization or similar business combination with one or more

businesses.

Disclaimer

Certain statements in this news release may be

considered forward-looking statements. Forward-looking statements

are statements that are not historical facts and generally relate

to future events or Focus Impact’s or DevvStream’s future financial

or other performance metrics. In some cases, you can identify

forward-looking statements by terminology such as “may”, “should”,

“expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”,

“predict”, “potential” or “continue”, or the negatives of these

terms or variations of them or similar terminology. These

forward-looking statements, including, without limitation, Focus

Impact’s, DevvStream’s and the combined company’s expectations with

respect to future performance and anticipated financial impacts of

the proposed transaction, the satisfaction of the closing

conditions to the proposed transaction and the timing of the

completion of the proposed transaction, are subject to risks and

uncertainties, which could cause actual results to differ

materially from those expressed or implied by such forward-looking

statements. These forward-looking statements are based upon

estimates and assumptions that, while considered reasonable by

Focus Impact and its management, and DevvStream and its management,

as the case may be, are inherently uncertain and subject to

material change. New risks and uncertainties may emerge from time

to time, and it is not possible to predict all risks and

uncertainties. certain other risks are identified and discussed in.

Factors that may cause actual results to differ materially from

current expectations include, but are not limited to: (1) the

occurrence of any event, change or other circumstances that could

give rise to the termination of negotiations and any subsequent

definitive agreements with respect to the proposed transaction; (2)

the outcome of any legal proceedings that may be instituted against

Focus Impact, DevvStream, the combined company or others; (3) the

inability to complete the proposed transaction due to the failure

to obtain approval of the stockholders of Focus Impact and

DevvStream or to satisfy other conditions to closing; (4) changes

to the proposed structure of the proposed transaction that may be

required or appropriate as a result of applicable laws or

regulations; (5) the ability to meet Nasdaq’s or another stock

exchange’s listing standards following the consummation of the

proposed transaction; (6) the risk that the proposed transaction

disrupts current plans and operations of Focus Impact or DevvStream

as a result of the announcement and consummation of the proposed

transaction; (7) the ability to recognize the anticipated benefits

of the proposed transactions, which may be affected by, among other

things, competition, the ability of the combined company to grow

and manage growth profitably, maintain relationships with customers

and retain its management and key employees; (8) costs related to

the proposed transaction; (9) changes in applicable laws or

regulations; (10) the possibility that Focus Impact, DevvStream or

the combined company may be adversely affected by other economic,

business, and/or competitive factors; (11) Focus Impact’s estimates

of expenses and profitability and underlying assumptions with

respect to stockholder redemptions and purchase price and other

adjustments; (12) various factors beyond management’s control,

including general economic conditions and other risks,

uncertainties and factors set forth in the section entitled “Risk

Factors” and “Cautionary Note Regarding Forward-Looking Statements”

in the Registration Statement on Form S-4 that includes a proxy

statement and prospectus of Focus Impact (the “proxy

statement/prospectus”), filed with the SEC on December 4, 2023, and

other filings with the SEC; and (13) certain other risks identified

and discussed in DevvStream’s Annual Information Form for the year

ended July 31, 2023, and DevvStream’s other public filings with

Canadian securities regulatory authorities, available on

DevvStream’s profile on SEDAR at www.sedarplus.ca.

These forward-looking statements are expressed

in good faith, and Focus Impact, DevvStream and the combined

company believe there is a reasonable basis for them. However,

there can be no assurance that the events, results or trends

identified in these forward-looking statements will occur or be

achieved. Forward-looking statements speak only as of the date they

are made, and none of Focus Impact, DevvStream or the combined

company is under any obligation, and expressly disclaim any

obligation, to update, alter or otherwise revise any

forward-looking statement, whether as a result of new information,

future events or otherwise, except as required by law. Readers

should carefully review the statements set forth in the reports,

which Focus Impact has filed or will file from time to time with

the SEC and DevvStream’s public filings with Canadian securities

regulatory authorities. This news release is not intended to be

all-inclusive or to contain all the information that a person may

desire in considering an investment in Focus Impact or DevvStream

and is not intended to form the basis of an investment decision in

Focus Impact or DevvStream. All subsequent written and oral

forward-looking statements concerning Focus Impact and DevvStream,

the proposed transaction or other matters and attributable to Focus

Impact and DevvStream or any person acting on their behalf are

expressly qualified in their entirety by the cautionary statements

above.

Additional Information and Where to Find

It

In connection with the Business Combination,

Focus Impact and DevvStream have prepared, and Focus Impact has

filed with the SEC, the Registration Statement containing the proxy

statement/prospectus with respect to the combined company’s

securities to be issued in connection with the Business

Combination, a proxy statement with respect to the stockholders’

meeting of Focus Impact to vote on the Business Combination and

certain other related documents. Investors, securityholders and

other interested persons are urged to read the preliminary proxy

statement/prospectus in connection with Focus Impact’s solicitation

of proxies for its special meeting of stockholders to be held to

approve the Business Combination (and related matters) and general

amendments thereto and the definitive proxy statement/prospectus,

when available, because the proxy statement/prospectus contains

important information about Focus Impact, DevvStream and the

Business Combination. Once the Registration Statement is declared

effective, Focus Impact will mail the definitive proxy

statement/prospectus and other relevant documents to its

stockholders as of a record date to be established for voting on

the Business Combination. This communication is not a substitute

for the Registration Statement, the definitive proxy

statement/prospectus or any other document that Focus Impact will

send to its stockholders in connection with the Business

Combination. Once the Registration Statement is declared effective,

copies of the Registration Statement, including the definitive

proxy statement/prospectus and other documents filed by Focus

Impact or DevvStream with the SEC, may be obtained, free of charge,

by directing a request to Focus Impact Acquisition Corp., 250 Park

Avenue, Suite 911, New York, New York 10177. The preliminary and

definitive proxy statement/prospectus to be included in the

Registration Statement, once available, can also be obtained,

without charge, at the SEC’s website (www.sec.gov). Additional

details relating to the proposed Business Combination will also be

available in the management information circular to be provided to

shareholders of DevvStream to seek approval of the proposed

Business Combination. Once mailed to the shareholders of DevvStream

it will also be filed under DevvStream’s profile on SEDAR at

www.sedarplus.ca.

Participants in the

Solicitation

Focus Impact and its directors, executive

officers, other members of management, and employees, may be deemed

to be participants in the solicitation of proxies of Focus Impact's

stockholders in connection with the Business Combination under SEC

rules. Information regarding the persons who may, under SEC rules,

be deemed participants in the solicitation of Focus Impact's

stockholders in connection with the Business Combination is

available in the Registration Statement and the proxy

statement/prospectus included therein. To the extent that holdings

of Focus Impact's securities have changed since the amounts printed

in Focus Impact's registration statement on Form S-1 relating to

its initial public offering, such changes have been or will be

reflected on Statements of Change in Ownership on Form 4 filed with

the SEC. Investors and security holders may obtain more detailed

information regarding the names and interests in the Business

Combination of Focus Impact's directors and officers in Focus

Impact's filings with the SEC and in the Registration Statement,

which includes the proxy statement/prospectus of Focus Impact for

the Business Combination.

DevvStream and its directors and executive

officers may also be deemed to be participants in the solicitation

of proxies from the stockholders of Focus Impact in connection with

the Business Combination. A list of the names of such directors and

executive officers and information regarding their interests in the

Business Combination are included in the proxy statement/prospectus

of Focus Impact for the Business Combination. You may obtain free

copies of these documents as described above.

No Offer or Solicitation

This news release is for informational purposes

only and does not constitute a solicitation of a proxy, consent or

authorization with respect to any securities or in respect of the

transactions described herein. This news release shall also not

constitute an offer to sell or the solicitation of an offer to buy

the securities of Focus Impact, DevvStream or the combined company

following consummation of the Business Combination, nor shall there

be any sale of securities in any states or jurisdictions in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended, or an exemption therefrom.

On Behalf of the Board of Directors,

Sunny Trinh, CEO

DevvStream Media Contacts

DevvStream@icrinc.com and info@fcir.ca

Phone: (332) 242-4316

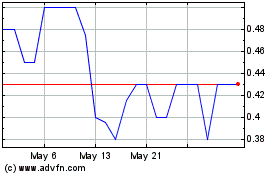

Devvstream (NEO:DESG)

Historical Stock Chart

From Nov 2024 to Dec 2024

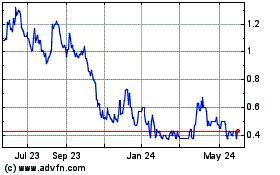

Devvstream (NEO:DESG)

Historical Stock Chart

From Dec 2023 to Dec 2024