Arcosa, Inc. Announces Closing of $600 Million of 6.875% Senior Notes Due 2032

August 26 2024 - 3:15PM

Business Wire

Arcosa, Inc. (NYSE: ACA) (“Arcosa”) today announced it has

closed the previously announced private offering of $600.0 million

aggregate principal amount of 6.875% senior notes due 2032 (the

“Notes”).

Arcosa intends to use the net proceeds from the offering,

together with expected borrowings under the previously announced

Term Loan B Facility due 2031, to fund its previously announced

acquisition of the construction materials business of Stavola

Holding Corporation and its affiliated entities (the “Transaction”)

and to use any remaining net proceeds to repay amounts outstanding

under Arcosa’s revolving credit facility.

The Notes are senior unsecured obligations of Arcosa and are

guaranteed on a senior unsecured basis by each of Arcosa’s domestic

subsidiaries that is a guarantor under its senior credit facility.

Additionally, the Notes are subject to a special mandatory

redemption if the Transaction is not consummated on or before the

timeframe set forth in the indenture governing the Notes.

The Notes and the related guarantees were offered and sold only

to persons reasonably believed to be “qualified institutional

buyers” in reliance on Rule 144A under the Securities Act of 1933,

as amended (the “Securities Act”), and outside the United States to

certain non-U.S. persons in compliance with Regulation S under the

Securities Act. The Notes and the related guarantees have not been

registered for sale under the Securities Act or the securities laws

of any other jurisdiction and may not be offered or sold in the

United States absent registration or an applicable exemption from

registration requirements. This press release shall not constitute

an offer to sell, or a solicitation of an offer to buy, the Notes

or any other securities, and shall not constitute an offer to sell,

solicitation of an offer to buy, or sale of any securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful.

About Arcosa

Arcosa, Inc., headquartered in Dallas, Texas, is a provider of

infrastructure-related products and solutions with leading

positions in construction, engineered structures, and

transportation markets. Arcosa reports its financial results in

three principal business segments: Construction Products,

Engineered Structures, and Transportation Products. For more

information, visit www.arcosa.com.

Cautionary Statements About Forward-Looking

Information

Some statements in this release, which are not historical facts,

are “forward-looking statements” as defined by the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include statements about Arcosa’s estimates,

expectations, beliefs, intentions or strategies for the future.

Arcosa uses the words “anticipates,” “assumes,” “believes,”

“estimates,” “expects,” “intends,” “forecasts,” “may,” “will,”

“should,” “guidance,” “outlook,” “strategy,” “plans,” “goal” and

similar expressions to identify these forward-looking statements.

Forward-looking statements speak only as of the date of this

release, and Arcosa expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein, except as required by

federal securities laws. Forward-looking statements are based on

management’s current views and assumptions and involve risks and

uncertainties that could cause actual results to differ materially

from historical experience or present expectations, including but

not limited to, the intended use of offering proceeds, the

contingencies related to the special mandatory redemption, the

failure to successfully complete and integrate acquisitions,

including the Transaction, or divest any business, or failure to

achieve the expected benefits of acquisitions or divestitures;

market conditions and customer demand for Arcosa’s business

products and services; the cyclical nature of, and seasonal or

weather impact on, the industries in which Arcosa competes;

competition and other competitive factors; governmental and

regulatory factors; changing technologies; availability of growth

opportunities; market recovery; ability to improve margins; the

impact of inflation and costs of materials; assumptions regarding

achievements of the expected benefits from the Inflation Reduction

Act; the delivery or satisfaction of any backlog or firm orders;

the impact of pandemics on Arcosa’s business; and Arcosa’s ability

to execute its long-term strategy, and such forward-looking

statements are not guarantees of future performance. For further

discussion of such risks and uncertainties, see “Risk Factors” and

the “Forward-Looking Statements” section of “Management's

Discussion and Analysis of Financial Condition and Results of

Operations” in Arcosa's Form 10-K for the year ended December 31,

2023 and as may be revised and updated by Arcosa's Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240826104841/en/

MEDIA CONTACT: media@arcosa.com

INVESTOR CONTACTS Erin Drabek Director of Investor Relations T

972.942.6500 InvestorResources@arcosa.com

David Gold ADVISIRY Partners T 212.661.2220

David.Gold@advisiry.com

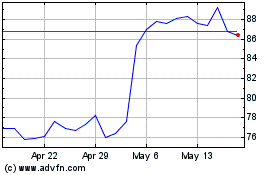

Arcosa (NYSE:ACA)

Historical Stock Chart

From Nov 2024 to Dec 2024

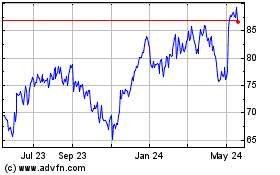

Arcosa (NYSE:ACA)

Historical Stock Chart

From Dec 2023 to Dec 2024