0001739445trueArcosa, Inc., a Delaware corporation (“Arcosa”), is filing this Current Report on Form 8-K/A (this “Amendment No. 1”) in order to file the historical financial statements and pro forma financial information required by Items 9.01 (a) and (b) of Form 8-K, as well as the independent auditor consent, which were omitted as permitted in paragraphs (a)(4) and (b)(2) of such Item from its Current Report on Form 8-K, filed with the U.S. Securities and Exchange Commission on October 1, 2024 (the “Original Form 8-K”) in connection with the consummation of the transactions contemplated by that certain Membership Interest and Asset Purchase Agreement, dated August 1, 2024, by and among Arcosa, the Target (as defined below), and the other parties thereto, pursuant to which Arcosa acquired all of the issued and outstanding membership interests and certain identified assets, as applicable, of Stavola Holding Corporation, a New Jersey corporation, Stavola Holdings Pennsylvania LLC, a Delaware limited liability company, Stavola Trucking Company, Inc., a New Jersey corporation, Stavola Management Company, Inc., a New Jersey corporation, and Stavola Realty Company, a New Jersey general partnership (together, the “Target,” and such transaction, the “Transaction”). The financial statements and information filed with this Amendment No. 1 consist of the historical financial statements of the Target specified in Rule 3-05(b) of Regulation S-X and the pro forma financial information required in connection with the Transaction pursuant to Article 11 of Regulation S-X. The pro forma financial information included in this Amendment No. 1 has been presented for informational purposes only, as required by Form 8-K; it does not purport to represent the actual results of operations that Arcosa would have achieved had it completed the Transaction prior to the periods presented in the pro forma financial information and it is not intended to project the future results of operations that Arcosa may achieve after the Transaction.00017394452024-10-012024-10-01

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | | | | | | | | |

| Date of Report (Date of Earliest Event Reported): | | October 1, 2024 |

Arcosa, Inc.

__________________________________________

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | |

| Delaware | | 1-38494 | | 82-5339416 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | |

| 500 N. Akard Street, Suite 400 | | | | |

| Dallas, | Texas | | | | 75201 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant's telephone number, including area code: (972) 942-6500

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

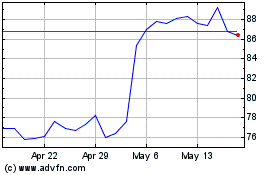

| Common Stock ($0.01 par value) | ACA | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

Arcosa, Inc., a Delaware corporation (“Arcosa”), is filing this Current Report on Form 8-K/A (this “Amendment No. 1”) in order to file the historical financial statements and pro forma financial information required by Items 9.01 (a) and (b) of Form 8-K, as well as the independent auditor consent, which were omitted as permitted in paragraphs (a)(4) and (b)(2) of such Item from its Current Report on Form 8-K, filed with the U.S. Securities and Exchange Commission on October 1, 2024 (the “Original Form 8-K”) in connection with the consummation of the transactions contemplated by that certain Membership Interest and Asset Purchase Agreement, dated August 1, 2024, by and among Arcosa, the Target (as defined below), and the other parties thereto, pursuant to which Arcosa acquired all of the issued and outstanding membership interests and certain identified assets, as applicable, of Stavola Holding Corporation, a New Jersey corporation, Stavola Holdings Pennsylvania LLC, a Delaware limited liability company, Stavola Trucking Company, Inc., a New Jersey corporation, Stavola Management Company, Inc., a New Jersey corporation, and Stavola Realty Company, a New Jersey general partnership (together, the “Target,” and such transaction, the “Transaction”). The financial statements and information filed with this Amendment No. 1 consist of the historical financial statements of the Target specified in Rule 3-05(b) of Regulation S-X and the pro forma financial information required in connection with the Transaction pursuant to Article 11 of Regulation S-X. The pro forma financial information included in this Amendment No. 1 has been presented for informational purposes only, as required by Form 8-K; it does not purport to represent the actual results of operations that Arcosa would have achieved had it completed the Transaction prior to the periods presented in the pro forma financial information and it is not intended to project the future results of operations that Arcosa may achieve after the Transaction.

Capitalized terms used in this Amendment No. 1 without definition have the respective meanings given to them in the Original Form 8-K. No other amendments are being made to the Original Form 8-K by this Amendment No. 1. This Amendment No. 1 should be read in connection with the Original Form 8-K, which provides a more complete description of the Transaction.

Item 9.01 Financial Statements and Exhibits.

(a) Financial Statements of Business Acquired

The (i) audited consolidated financial statements of the Target and accompanying notes related thereto as of and for the year ended September 30, 2023 are filed herewith as Exhibit 99.1 and (ii) unaudited consolidated financial statements of the Target for the nine months ended June 30, 2024 are filed herewith as Exhibit 99.2.

(b) Pro Forma Financial Information

The unaudited pro forma condensed combined financial information of Arcosa and accompanying notes related thereto as of and for the period ended June 30, 2024 and the fiscal year ended December 31, 2023 are filed herewith as Exhibit 99.3.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 23.1 | |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Arcosa, Inc. |

| (Registrant) |

| | |

| December 16, 2024 | By: | /s/ Gail M. Peck |

| | Name: Gail M. Peck |

| | Title: Chief Financial Officer |

CONSENT OF INDEPENDENT AUDITORS

We hereby consent to the incorporation by reference in the Registration Statements on Form S-8 (No. 333-228098) and on Form S-3 (No. 333-276065) of Arcosa, Inc. of our report dated September 25, 2024, relating to the consolidated financial statements of Stavola Holding Corporation and Subsidiaries and Affiliates as of September 30, 2023 and for the year then ended which appears in this Amendment No. 1 to Current Report on Form 8-K.

/s/ CBIZ CPAs P.C. 1

West Conshohocken, Pennsylvania

December 16, 2024

1 In certain jurisdictions, CBIZ CPAs P.C. is licensed and operates under its previous name, Mayer Hoffman McCann P.C.

STAVOLA HOLDING CORPORATION

AND SUBSIDIARIES AND AFFILIATES

CONSOLIDATED FINANCIAL STATEMENTS

Year Ended September 30, 2023

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

Year Ended September 30, 2023

CONTENTS

| | | | | |

| Pages |

| |

| |

| INDEPENDENT AUDITORS' REPORT | 1 - 2 |

| |

| CONSOLIDATED FINANCIAL STATEMENTS | |

| |

| Balance Sheet | 3 - 4 |

| Statement of Operations | 5 |

| Statement of Changes in Equity | 6 |

| Statement of Cash Flows | 7 |

| |

| |

| NOTES TO FINANCIAL STATEMENTS | 8 - 26 |

INDEPENDENT AUDITORS’ REPORT

To the Board of Directors of

Stavola Holding Corporation

Opinion

We have audited the consolidated financial statements of Stavola Holding Corporation and Subsidiaries and Affiliates, which comprise the consolidated balance sheet as of September 30, 2023, and the related consolidated statements of operations, changes in equity, and cash flows for the year then ended, and the related notes to financial statements.

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of Stavola Holding Corporation and Subsidiaries and Affiliates as of September 30, 2023, and the results of their operations and their cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of Stavola Holding Corporation and Subsidiaries and Affiliates and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Other Matter - Related-Party Transactions

As explained in the notes to financial statements, Stavola Holding Corporation and Subsidiaries and Affiliates have significant balances and transactions with numerous related parties, some of which are consolidated and others that are not consolidated in these consolidated financial statements. Our opinion is not modified with respect to this matter.

Change in Accounting Principle

As discussed in Note 1 to the financial statements, the Company changed its method of accounting for leases as a result of the adoption of Accounting Standards Codification Topic 842, Leases, effective October 1, 2022, under the modified retrospective transition method. Our opinion is not modified with respect to this matter.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about Stavola Holding Corporation and Subsidiaries and Affiliates’ ability to continue as a going concern for one year after the date that the consolidated financial statements are available to be issued.

Auditors’ Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and, therefore, is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements.

In performing an audit in accordance with GAAS, we:

•Exercise professional judgment and maintain professional skepticism throughout the audit.

•Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements.

•Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of Stavola Holding Corporation and Subsidiaries and Affiliates’ internal control. Accordingly, no such opinion is expressed.

•Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements.

•Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about Stavola Holding Corporation and Subsidiaries and Affiliates’ ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit.

/s/ CBIZ CPAs P.C.1

West Conshohocken, Pennsylvania

September 25, 2024

1 In certain jurisdictions, CBIZ CPAs P.C. operates under its previous name, Mayer Hoffman McCann P.C.

-2-

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

CONSOLIDATED BALANCE SHEET

September 30, 2023

| | | | | | | | |

| ASSETS |

| CURRENT ASSETS | | |

| | |

| Cash | | $ | 25,396,673 | |

| Accounts receivable and contract receivables, net of allowance for losses of $1,074,621 | | 55,659,718 | |

| Contract assets | | 1,014,427 | |

| Inventories | | 15,348,970 | |

| Prepaid expenses and other current assets | | 4,149,206 | |

| Current portion of derivative financial instrument | | 1,191,110 | |

| TOTAL CURRENT ASSETS | | 102,760,104 | |

| | |

| Property, plant, and equipment, at cost, less accumulated depreciation, amortization, and depletion | | 154,334,586 | |

| Investment in affiliate | | 6,442,433 | |

| Advances to related parties, net | | 513,332 | |

| Derivative financial instrument, noncurrent portion | | 3,767,190 | |

| Goodwill | | 4,884,732 | |

| Receivables from unconsolidated affiliated companies | | 3,759,644 | |

| Plant permit, net of accumulated amortization of $350,000 | | 1,150,000 | |

| Right-of-use lease assets, net of accumulated amortization of $780,727 | | 22,344,721 | |

| Intangibles, net of accumulated amortization of $2,061,096 | | 2,148,904 | |

| Other assets, net | | 1,424,916 | |

| Cash surrender value of officers' life insurance | | 696,544 | |

| TOTAL OTHER ASSETS | | 47,132,416 | |

| | |

| TOTAL ASSETS | | $ | 304,227,106 | |

See Notes to Financial Statements

-3-

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

CONSOLIDATED BALANCE SHEET (CONTINUED)

September 30, 2023

| | | | | | |

| LIABILITIES AND EQUITY |

| CURRENT LIABILITIES | | |

| | |

| Current portion of long-term debt obligations | | $ | 6,836,700 | |

| Accounts payable and accrued expenses | | 14,642,257 | |

| Lease liabilities, current portion | | 509,571 | |

| Contract liabilities | | 23,689 | |

| TOTAL CURRENT LIABILITIES | | 22,012,217 | |

| | |

| LONG-TERM LIABILITIES | | |

| Long-term debt obligations, less current portion above | | 35,811,925 | |

| Payables to unconsolidated affiliated companies | | 858,491 | |

| Lease liabilities, less current portion above | | 22,732,850 | |

| Asset retirement obligations | | 3,475,500 | |

| TOTAL LIABILITIES | | 84,890,983 | |

| | |

| STOCKHOLDERS' EQUITY | | |

| Common stock, no par value, 1,000 Class A voting shares authorized; 96 shares issued and outstanding | | 775,840 | |

| Common stock, no par value, 200,000 Class B nonvoting shares authorized; 102,962 shares issued and outstanding | | 102,962 | |

| Additional paid-in capital | | 3,977,555 | |

| Retained earnings | | 215,135,806 | |

| TOTAL STOCKHOLDERS' EQUITY | | 219,992,163 | |

| NONCONTROLLING INTEREST | | (656,040) | |

| TOTAL EQUITY | | 219,336,123 | |

| TOTAL LIABILITIES AND EQUITY | | $ | 304,227,106 | |

See Notes to Financial Statements

-4-

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

CONSOLIDATED STATEMENT OF OPERATIONS

Year Ended September 30, 2023

| | | | | | | | |

| Product revenue | | $ | 224,850,930 | |

| Service revenue | | 30,549,166 | |

| TOTAL REVENUES | | 255,400,096 | |

| | |

| Cost of products sold | | 146,992,684 | |

| Cost of services provided | | 32,394,643 | |

| TOTAL COST OF REVENUES | | 179,387,327 | |

| | |

| GROSS PROFIT | | 76,012,769 | |

| | |

| General and administrative expenses | | 25,097,632 | |

| Gain on disposal of property, plant, and equipment | | 7,344,720 | |

| OPERATING INCOME | | 58,259,857 | |

| | |

| OTHER INCOME (EXPENSES) | | |

| Unrealized losses on derivative financial instrument | | (32,594) | |

| Other income, net | | 152,851 | |

| Rental income | | 1,711,820 | |

| Interest income | | 15,458 | |

| Interest expense | | (1,292,265) | |

| OTHER INCOME (EXPENSES), NET | | 555,270 | |

| | |

| NET INCOME | | 58,815,127 | |

| NET LOSS ATTRIBUTABLE TO NONCONTROLLING INTERESTS | | 1,155,627 | |

| NET INCOME ATTRIBUTABLE TO STAVOLA HOLDING CORPORATION | | $ | 59,970,754 | |

See Notes to Financial Statements

-5-

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Year Ended September 30, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional | | | | Total | | | | |

| Class A | | Class B | | Paid-in | | Retained | | Stockholders' | | Noncontrolling | | Total |

| Shares | | Amount | | Shares | | Amount | | Capital | | Earnings | | Equity | | Interests | | Equity |

| Balances, September 30, 2022 | 96 | | | $ | 775,840 | | | 102,962 | | | $102,962 | | $ | 3,977,555 | | | $ | 204,196,494 | | | $ | 209,052,851 | | | $ | 499,587 | | | $ | 209,552,438 | |

| Net income (loss) | — | | | — | | | — | | | — | | | — | | | 59,970,754 | | | 59,970,754 | | | (1,155,627) | | | 58,815,127 | |

| Distributions to stockholders | — | | | — | | | — | | | — | | | — | | | (49,031,442) | | | (49,031,442) | | | — | | | (49,031,442) | |

| Balances, September 30, 2023 | 96 | | $ | 775,840 | | | 102,962 | | | $102,962 | | $ | 3,977,555 | | | $ | 215,135,806 | | | $ | 219,992,163 | | | $ | (656,040) | | | $ | 219,336,123 | |

See Notes to Financial Statements

-6-

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

CONSOLIDATED STATEMENT OF CASH FLOWS

Year Ended September 30, 2023

| | | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | |

| Net income | | $ | 58,815,127 | |

| Adjustments to reconcile net income to net cash flows from operating activities: | | |

| Depreciation, amortization and depletion | | 16,986,690 | |

| Amortization of intangible assets and other assets, net | | 584,628 | |

| Accretion expense | | 127,500 | |

| Bad debt recovery | | (405,349) | |

| Unrealized losses on fair value of derivative financial instrument | | 32,594 | |

| Gain on disposal of property, plant, and equipment | | (7,344,720) | |

| Non-cash lease expense | | 780,727 | |

| Increase in cash surrender value of officers' life insurance | | (11,720) | |

| Decrease (increase) in operating assets | | |

| Accounts receivable and contract receivables, net | | 20,468,722 | |

| Contract assets | | 449,098 | |

| Inventories | | (3,809,870) | |

| Prepaid expenses and other current assets | | (844,358) | |

| Decrease in operating liabilities | | |

| Accounts payable and accrued expenses | | (7,216,517) | |

| Operating lease liabilities | | (1,096,425) | |

| Contract liabilities | | (95,136) | |

| Total adjustments | | 18,605,864 | |

| NET CASH FLOWS FROM OPERATING ACTIVITIES | | 77,420,991 | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | |

| Purchase of property, plant, and equipment | | (23,842,750) | |

| Proceeds from sale of property, plant, and equipment | | 10,208,438 | |

| Increase in receivables from unconsolidated affiliated companies | | (251,942) | |

| Increase in other assets, net | | (406,369) | |

| NET CASH FLOWS FROM INVESTING ACTIVITIES | | (14,292,623) | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | |

| Net repayments under revolving line of credit | | (5,000,000) | |

| Repayments of long-term debt obligations | | (8,083,910) | |

| Distributions of stockholders | | (49,031,442) | |

| NET CASH FLOWS FROM FINANCING ACTIVITIES | | (62,115,352) | |

| NET INCREASE IN CASH AND CASH EQUIVALENTS | | 1,013,016 | |

| CASH AND CASH EQUIVALENTS - BEGINNING OF YEAR | | 24,383,657 | |

| CASH AND CASH EQUIVALENTS - END OF YEAR | | $ | 25,396,673 | |

See Notes to Financial Statements

-7-

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(1) Summary of significant accounting policies

Nature of business - Stavola Holding Corporation and Subsidiaries and Affiliates (collectively referred to as the “Company”) conduct operations principally in three industries: (1) mining, processing, and selling of various types of crushed stone and sand, representing approximately 20% of revenues; (2) construction and maintenance of roadways, representing approximately 15% of revenues; and (3) the production and sale of asphalt, representing approximately 65% of revenues. The Company conducts business primarily in the State of New Jersey. As a condition for entering into certain construction contracts, the Company had outstanding surety bonds as of September 30, 2023.

Principles of consolidation - The consolidated financial statements include the accounts of Stavola Holding Corporation (“SHC”), its wholly-owned subsidiaries, and certain affiliates.

As of September 30, 2023, SHC's wholly-owned subsidiaries are: Stavola Sand and Gravel, Inc. (“SS&G”); Stavola Construction Materials, Inc. and its wholly-owned subsidiaries Stavola Beaver Run Quarry, LLC (“SBR”), Chimney Rock Crossing West, LLC (“CRCW”), and Stavola Quarries, LLC (collectively referred to as “SCMI”); Stavola Contracting Company, Inc. (“SCC”); Stavola Flemington Land, LLC (“SFL”); Nivek Properties, LLC (“Nivek”); and Stavola Asphalt Company, Inc. (“SAC”) and its wholly-owned subsidiaries Stavola Flemington Asphalt, LLC (“SFA”), Stavola Industries, LLC, and Stavola Old Bridge Materials, LLC (collectively referred to as “SAC”).

SHC's affiliates that are included in these consolidated financial statements are: Rosano Howell Asphalt Company, LLC (“RHA”), Stavola Mining and Development, LLC (“SMD”) and its wholly-owned subsidiary Rosano Howell Land, LLC (“RHL”), and Stavola Holdings Pennsylvania, LLC and its wholly-owned subsidiaries Stavola Summit Land, LLC (“SSUL”), Summit Anthracite, Inc. d/b/a Stavola Summit Materials (“SSM”), and Stavola Silverbrook Land, LLC (“SSIL”) (collectively referred to as “SHP”).

All material intercompany accounts and transactions are eliminated. Comprehensive loss includes net loss as well as other changes in stockholders’ deficit that result from transactions and economic events other than those with stockholders. For the year ended September 30, 2023, there was no difference between net income and comprehensive income.

Use of significant estimates - Management uses significant estimates and assumptions in preparing these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. Actual results could vary from the estimates that were used. Management’s estimates and assumptions include, but are not limited to, estimates of the collectability of accounts receivable, of estimated useful lives of property, plant, and equipment, of estimated useful lives of intangible assets, of estimated costs and gross profit on uncompleted construction contracts and fair value of intangible assets and reporting units for the purposes of impairment testing. Management’s estimates and assumptions are derived from, and are continually evaluated based upon, available information, judgment, and experience. Because of inherent uncertainties in estimating costs on construction contracts, it is at least reasonably possible that the estimates used will change within the near term.

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(1) Summary of significant accounting policies (continued)

Revenue and cost recognition - The Company recognizes revenue from the sale of asphalt, quarried stone, and sand as well as fixed-price construction contracts in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Update (“ASU”) 2014-09, “Revenue from Contracts with Customers,” as amended by subsequent ASU 2015-14, “Revenue from Contracts with Customers (“Topic 606”), which provides a five-step model for recognizing revenue from contracts with customers as follows:

1.Identify the contract;

2.Identify the performance obligation;

3.Determine the transaction price;

4.Allocate the transaction price; and

5.Recognize revenue.

The Company derives its revenues from fixed-price, unit-price, guaranteed maximum-price, and time and materials construction contracts, as well as from the sale of asphalt, quarried stone, and sand. The amount of revenue to be earned from construction contracts is measured based on the amount of consideration specified in the original contract, adjusted for the value of subsequent modifications to the original contract. Revenue from the sale of asphalt, quarried stone, and sand is recognized when pickup or delivery occurs.

The Company evaluates whether its contracts represent one or more performance obligations to account for revenue recognition. Generally, each of the Company’s contracts represents a single performance obligation. This evaluation requires significant judgment and could change the amount of revenue and profit recorded in a given period.

The Company recognizes revenue from fixed-price, unit-price, and guaranteed maximum-price construction contracts over time as performance obligations are satisfied, due to the continuous transfer of control to the customer. The Company measures progress towards satisfaction of performance obligations and the amount of revenue to recognize using the cost-to-cost method, based on the ratio of costs incurred to date to total estimated costs at completion. The cost-to- cost method is used as it most accurately depicts the Company’s performance as it directly measures the value of the services transferred to the customer. The Company recognizes revenue from time and materials contracts as services are performed. Generally, this occurs when the Company has the right to invoice.

Contract costs include all direct labor, material, subcontract costs, and other direct costs and allocated indirect costs related to contract performance. General and administrative costs are charged to expenses as incurred. Provisions for estimated losses on uncompleted contracts are made in the period in which such losses are determined. Changes in estimated job profitability resulting from job performance, job conditions, contract penalty provisions, claims, change orders, and settlements are accounted for as changes in estimates in the current period.

Due to the nature of work to be performed on many of the Company’s performance obligations, estimating total revenue and cost at completion is subject to many variables and requires significant judgment. Assumptions as to the occurrence of future events and the likelihood and amount of variable consideration, including the impact of change orders, claims, contract disputes, the achievement of contractual performance criteria, and awards or other incentive fees, are made during the contract performance period. The Company estimates variable consideration at the most likely amount it expects to receive. The Company includes estimated amounts in the transaction price to the extent that a significant reversal of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is resolved.

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(1) Summary of significant accounting policies (continued)

Revenue and cost recognition (continued) - Estimates of variable consideration and determination of whether to include estimated amounts in the transaction price are based largely on an assessment of anticipated performance and all information that is reasonably available to management.

Accounts receivable and contract receivables - Accounts receivable and contract receivables are carried at cost, net of allowance for credit losses. The Company extends credit to its customers, performs ongoing credit reviews, generally requires no collateral, and retains lien rights, if needed and available, against the property. The Company does not accrue finance or interest charges. The Company estimates expected credit losses based on the Company’s historical loss information, current and future economic and market conditions, and ongoing review of customers’ account balances. An account is written off when it is determined that all collection efforts have been exhausted and collection of the receivable is no longer being actively pursued. This determination is based on the delinquency of the account, the financial condition of the customer, and the Company’s collection experience. The Company recognized current expected credit losses in the amount of $1,074,621 during the year ended September 30, 2023.

Contract assets - Contract assets include amounts due from customers under contractual retainage provisions and costs and estimated earnings in excess of billings on uncompleted contracts. Retainage represents amounts billed to customers where payments have partially been withheld pending the completion of certain milestones, the satisfaction of other contractual conditions, or the completion of the project. Retainage agreements vary from project to project and balances could be outstanding for several months or years, depending on a number of circumstances, such as contract-specific terms, project performance, or other variables that may arise as the Company makes progress toward completion. Costs and estimated earnings in excess of billings on uncompleted contracts represent amounts earned and reimbursable under contracts, but have a conditional right for billing and payment, such as the achievement of milestones or completion of the project. Noncurrent portions of contractual amounts due from customers and estimated earnings in excess of billings expected to be collected are immaterial.

Inventories - Inventories consist of various types of crushed stone, sand, and oil and are valued at the lower of cost or net realizable value. Cost is determined by the first-in, first-out (FIFO) method. Maintenance, operating, and other supplies are expensed as incurred.

As of September 30, 2023, inventories consisted of the following:

| | | | | | | | |

| Raw materials | | $ | 1,313,230 | |

| Finished goods | | 14,035,740 | |

| | |

| Total inventories | | $ | 15,348,970 | |

Property, plant, and equipment - Property, plant, and equipment are stated at cost. Gains and losses on dispositions are reflected in current operations. Depreciation is computed using the straight-line and accelerated methods for financial reporting purposes. Building improvements are amortized over the shorter of the estimated life of the improvement or the remaining term of the lease. Depletion of the cost of mineral rights of properties is computed on the units-of- production method, based on estimated mineral reserves of the related properties. Maintenance and repairs are expensed as incurred, and the cost of improvements and betterments is capitalized.

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(1) Summary of significant accounting policies (continued)

Property, plant, and equipment (continued) - The estimated useful lives of property, plant, and equipment are as follows:

| | | | | | | | |

| | Estimated |

| ASSETS | | Useful Lives |

| | |

| Land improvements | | 3-20 Years |

| Buildings and building improvements | | 5-39 Years |

| Plants | | 7-15 Years |

| Machinery and equipment | | 3-10 Years |

| Automobiles and trucks | | 3-5 Years |

| Capitalized quarry reclamation costs | | 20 Years |

| Furniture, fixtures, and office equipment | | 7 Years |

The Company assesses the impairment of long- lived assets whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held for use is based on expectations of future undiscounted cash flows from the related operations and, when circumstances dictate, the Company adjusts the asset to the extent the carrying value exceeds the fair value of the asset. The Company’s judgments related to the expected useful lives of long- lived assets and its ability to realize undiscounted cash flows in excess of the carrying amounts of such assets are affected by factors such as the ongoing maintenance and improvements of the assets, changes in economic conditions, and changes in operating performance. The estimated future cash flows of the assets, on an undiscounted basis, are compared to the carrying values of the assets. If the undiscounted cash flows exceed the carrying value, no impairment is needed. If the undiscounted cash flows do not exceed the carrying value, then impairment is recorded based on the fair value of the asset, typically measured using a discounted cash flow model, which is a Level 3 fair value measurement. There was no impairment charge for property, plant, and equipment during the year ended September 30, 2023.

Investment in affiliate - SCMI holds an interest in an affiliated general partnership. The Company accounts for this investment under the equity method (see Note 6).

Fair value measurements - The FASB ASC Topic 820 provides guidance for using fair value to measure financial assets and liabilities. This guidance defines fair value and establishes a hierarchy for reporting the reliability of input measurements used to assess fair value for all assets and liabilities. The guidance defines fair value as the selling price that would be received for an asset, or paid to transfer a liability, in the principal or most advantageous market on the measurement date. The hierarchy established prioritizes fair value measurements based on the types of inputs used in the valuation technique. The inputs are categorized into the following levels:

Level 1 - Observable inputs such as quoted prices in active markets for identical assets or liabilities;

Level 2 - Directly or indirectly observable inputs for quoted and other than quoted prices for identical or similar assets and liabilities in active or nonactive markets; and

Level 3 - Unobservable inputs not corroborated by market data, therefore requiring the entity to use the best information available in the circumstances, including the entity’s own data.

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(1) Summary of significant accounting policies (continued)

Fair value measurements (continued) - Certain financial instruments are carried at cost on the consolidated balance sheet, which approximates fair value due to their short-term, highly liquid nature. These instruments are classified as current assets and liabilities on the balance sheet. The Company also believes that the fair value of its long-term debt approximates its carrying cost as interest rates on these obligations approximate the current market rates.

The Company determined that the recorded amount of cash surrender value - life insurance approximates fair value. This determination was based on the contractual policy exit prices with the respective insurance companies and would be considered a Level 3 input. Because the Company relies on its third-party insurance provider to develop the inputs without adjustment for the valuations of its Level 3 investments, quantitative information about significant unobservable inputs used in valuing these investments is not reasonably available to the Company.

The following tables present information about the Company’s assets and liabilities measured at fair value on a recurring basis as of September 30, 2023, which indicate the fair value hierarchy of the valuation techniques utilized by the Company to determine such fair value.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Quoted Prices in | | Significant Other | | |

| | | | Active Markets for | | Observable | | Unobservable |

| | | | Identical Assets | | Inputs | | Inputs |

| Description | | Fair Value | | (Level 1) | | (Level 2) | | (Level 3) |

| Cash surrender value of life insurance | | $ | 696,544 | | | $ | — | | | $ | — | | | $ | 696,544 | |

| Derivative financial instrument | | $ | 4,958,300 | | | $ | — | | | $ | 4,958,300 | | | $ | — | |

A reconciliation of financial instruments using Level 3 inputs as of September 30, 2023, is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, beginning of year | | | | | | | | $ | 684,824 | |

| Total unrealized gains | | | | | | | | 11,720 | |

| Balance, end of year | | | | | | | | $ | 696,544 | |

There were no transfers in or out of level 3 during the year ended September 30, 2023. The Company recognized the unrealized gains on the cash surrender value of the life insurance policy in the statement of operations.

The Company obtains the estimated fair value of the derivative financial instrument held at the reporting dates from the corresponding third-party financial institution, which utilizes an income approach in the form of a discounted cash flow model to estimate the fair value of the derivative financial instrument as of each reporting date. The cash flows for the Company are based upon the Secured Overnight Financing Rate ("SOFR") plus a factor as specified in the respective agreement, for which the third party utilizes an adjusted forward curve as determined by its internally developed proprietary models. In order to ensure that this third-party's model is appropriately estimating the fair value of the derivative financial instrument, the Company compares the estimated value as determined by the third-party financial institution to that value as determined by the market-based forward curve for SOFR based on the closing prices for the SOFR futures contracts in existence as of the reporting date. These future contracts are an effective proxy for the estimated forward SOFR as of each reporting date.

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(1) Summary of significant accounting policies (continued)

Fair value measurements (continued) - The Company neither deposited nor holds any collateral related to its derivative financial instrument. Any difference between the third party's value and the value as determined by the market-based forward curve that is determined to be material is then reconciled to obtain the estimated fair value of the derivative financial instrument as of each reporting date. As of September 30, 2023, the estimated fair value of the Company’s derivative financial instrument was $4,958,300.

The Company records the fair value of its derivative financial instrument on the consolidated balance sheet as either an asset or a liability. The change in fair value of this derivative financial instrument is recognized in the statement of operations. The Company uses this derivative financial instrument principally to manage the risk associated with the changes in interest rates that will affect the cash flows of its debt transactions. See Note 7 for further information on this derivative financial instrument.

Goodwill - Goodwill represents the excess of the purchase price over the fair value of net identifiable assets assumed in a business combination. The Company’s goodwill is recorded within two reporting units. The Company conducts a goodwill impairment assessment during the fourth quarter of each fiscal year, or more frequently if facts and circumstances indicate that goodwill may be impaired.

The Company has the option to either first perform a qualitative assessment to determine whether it is more likely than not that the goodwill is impaired, which means the carrying value of the reporting unit exceeds its fair value, or to proceed directly to the quantitative assessment, which requires a comparison of the fair value of the reporting unit to its carrying value.

The fair value of the reporting units for goodwill purposes is determined using a blend of the income and the market approach. The major assumptions applied in an income approach, using a discounted cash flow analysis, include (i) forecasted sales growth rates and (ii) forecasted profitability, both of which are estimated based on historical performance and management’s estimate of future performance, and (iii) discount rates that are used to calculate the present value of future cash flows. The major assumptions in the market approach include the selected multiples applied to certain operating statistics. The Guideline Public Company Method is based on multiples observed for other public companies. These approaches reflect the similarity of the Company to the comparable companies identified and utilized.

The Company did not recognize any goodwill impairments during the year ended September 30, 2023. The Company has not recognized any goodwill impairments through September 30, 2023.

Intangible assets - Intangible assets are recorded at fair value, using level three inputs, on the date of acquisition and evaluated to determine their estimated useful life. These assets primarily consist of customer relationships and coal plants permits and are amortized using the straight-line method. The estimated useful lives for definite-lived intangible assets are: customer relationships - 10 to 12 years; plant permits - 10 years.

Plant permit consists of a permit to operate the coal mining permit owned by SSUL and is amortized on the straight-line basis over a ten-year estimated useful life. Management determined fair value based on an appraisal performed by a third party.

Amortization expenses related to intangible assets totaled $540,000 for the year ended September 30, 2023.

Other assets - Included in other assets on the consolidated balance sheet are long-term deposits and capitalized loan closing costs, which are being amortized over terms ranging from 5 to 15 years. Amortization expenses for other assets totaled $44,628 for the year ended September 30, 2023.

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(1) Summary of significant accounting policies (continued)

Contract liabilities - Contract liabilities include billings in excess of costs and estimated earnings on uncompleted contracts and amounts due to vendors under contractual retainage provisions. Billings in excess of costs and estimated earnings on uncompleted contracts are billings to customers on contracts in advance of work performed, including advance payments negotiated as a contract condition. Retainage represents amounts invoiced from vendors where payments have partially been withheld pending the completion of certain milestones, the satisfaction of other contractual conditions, or the completion of the project.

Capitalized quarry reclamation costs/asset retirement obligations - The Company has legal obligations to reclaim and restore certain quarry land and property at the termination of its useful life for one quarry, which is estimated to be 20 years as of September 30, 2023, and at the end of the current permit term for another quarry, which is March 30, 2029, and is subject to extension. In accordance with FASB ASC Topic 410 "Asset Retirement and Environmental Obligations," a liability has been established equal to the present value of each obligation, and the carrying amount of the property has been increased by the same amount. For property which there is no legal obligation for reclamation, the costs incurred to voluntarily reclaim the property are charged to operations as incurred.

For the year ended September 30, 2023, operating costs related to the accretion of the liabilities and amortization of the assets were $127,500 and $221,596, respectively.

Leases - The Company leases real estate from third parties and related parties. The Company determines if an arrangement is a lease at inception. In evaluating contracts to determine if they qualify as a lease, the Company considers factors such as if it has obtained substantially all of the rights to the underlying asset through exclusivity, if it can direct the use of the asset by making decisions about how and for what purpose the asset will be used, and if the lessor has substantive substitution rights. This evaluation may require significant judgment. Operating leases are included in right-of-use (“ROU”) lease assets, lease liabilities, current portion, and lease liabilities, net of the current portion above on the accompanying consolidated balance sheet.

ROU assets represent the Company’s right to use an underlying asset for the lease term, and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. ROU assets and lease liabilities are recognized at the commencement date based on the present value of lease payments over the lease term. As most of the Company’s leases do not provide an implicit rate, the Company uses its estimated long-term borrowing rate based on the information available at the commencement date in determining the present value of lease payments. The ROU asset also includes any lease payments made and excludes lease incentives. Lease terms may include options to extend or terminate the lease when it is reasonably certain that the Company will exercise that option. Lease expense for lease payments is recognized on a straight-line basis over the lease term.

Certain lease agreements include rental payments that are adjusted periodically for inflation or other variables. In addition to rent, the leases may require the Company to pay additional taxes, insurance, maintenance, and other expenses, which are generally referred to as non-lease components. Such adjustments to rental payments and variable non-lease components are treated as variable lease payments and recognized in the period in which the obligation for these payments was incurred. Variable lease components and variable non-lease components are not measured as part of the right-of-use asset and lease liability. The Company accounts for the lease and the non- lease components as a single lease component, which applies consistently to all asset classes under lease agreements.

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(1) Summary of significant accounting policies (continued)

Recently adopted accounting guidance - In February 2016, the FASB issued Accounting Standards Update ("ASU”) 2016-02, “Leases (Topic 842),” to increase transparency and comparability among organizations by recognizing ROU assets and lease liabilities on the consolidated balance sheet and disclosing key information about leasing arrangements. The Company adopted Topic 842 effective October 1, 2022, using the modified retrospective transition method. The Company used the package of practical expedients permitted under the transition guidance that allowed the Company to not reassess: (1) whether any expired or existing leases are or contain leases, (2) lease classification for any expired or existing leases, and (3) initial direct costs for any expired or existing leases. The Company also used the practical expedient that allows the lessee to treat the lease and non-lease components of leases as a single lease component. The Company did not recognize an adjustment to the opening balance of retained earnings upon adoption. Because of the transition method used to adopt Topic 842, Topic 842 was not applied to periods prior to adoption. As a result of the adoption of Topic 842 on October 1, 2022, the Company recognized operating lease ROU assets of approximately $23.1 million and lease liabilities of approximately $24.3 million on its consolidated balance sheet. Adoption of Topic 842 did not materially impact the Company’s net income or cash flows. The Company’s lease agreements do not contain any material residual value guarantees or material restrictive covenants. Leases with an initial term of twelve months or less are not recorded on the consolidated balance sheet. Lease expense on such leases is recognized on a straight-line basis over the lease term.

Effective as of October 1, 2022, the Company adopted Accounting Standards Update No. 2016-13, “Financial Instruments - Credit Losses”, (“ASU 2016-13”), which amends the existing accounting guidance for recognizing credit losses on financial assets and certain other instruments not measured at fair value through net income, including financial assets measured at amortized cost, such as trade receivables and contract assets. ASU 2016-13 replaces the existing incurred loss impairment model with an expected credit loss model that requires consideration of a broader range of information to estimate expected credit losses over the lifetime of the asset. The adoption of this guidance did not have a material effect on the Company’s consolidated financial statements.

Income taxes - The stockholders of SHC and its subsidiaries have elected to be taxed under the provisions of Subchapter S of the Internal Revenue Code and the applicable New Jersey Revenue Code. Under these provisions, SHC and its subsidiaries do not pay corporate income taxes on their taxable income. Instead, the stockholders report their proportional share of SHC and its subsidiaries’ income or loss on their personal tax returns. The affiliates of SHC are treated as partnerships for federal and state income tax purposes. Consequently, income taxes are not payable by these affiliates. Members are taxed individually on their respective shares of the affiliates’ taxable earnings, which are allocated among the members in accordance with the Agreement of each affiliate.

The Company and its affiliates account for the effect of any uncertain tax positions based on a “more likely than not” threshold applied to the recognition of the tax positions being sustained based on the technical merits of the position under scrutiny by the applicable taxing authority. If a tax position or positions are deemed to result in uncertainties of those positions, the unrecognized tax benefit is estimated based on a “cumulative probability assessment” that aggregates the estimated tax liability for all uncertain tax positions. Interest and penalties assessed, if any, are accrued as income tax expense. The Company and its affiliates have determined that they have no tax positions resulting in an uncertainty requiring recognition.

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(1) Summary of significant accounting policies (continued)

Variable interest entities - In accordance with FASB ASC Topic 810, Consolidation, the Company consolidates entities that are variable interest entities (“VIEs”) where it holds a controlling financial interest and is thereby deemed to be the primary beneficiary. In determining whether the Company is the primary beneficiary, analyses are performed to evaluate the economic interests held by the Company and its subsidiaries and affiliates. A controlling financial interest is defined as (i) the power to direct the activities of the VIE that most significantly impact the VIE’s economic performance and (ii) the obligation to absorb losses of the VIE or the right to receive benefits from the VIE that could potentially be significant to the VIE.

As of September 30, 2023, SHC and certain subsidiaries have determined that they are the primary beneficiary/beneficiaries of SHP and its subsidiaries, RHA, and SMD and its subsidiary. These entities have been included in these consolidated financial statements as these entities are dependent on SHC and these subsidiaries for cash flow and working capital or are listed as co-borrowers on the Company's credit facility in Note 8. Summarized financial information as of and for the year ended September 30, 2023, related to these entities are as follows:

| | | | | | | | | | | | | | | | | | | | |

| As of September 30, 2023 |

| | Stavola Mining and | | Rosano Howell | | Stavola Holdings |

| | Development, LLC | | Asphalt | | Pennsylvania, LLC |

| Balance sheets | | and Subsidiary | | Company, LLC | | and Subsidiaries |

| Assets | | | | | | |

| Cash | | $ | — | | | $ | — | | | $ | 200 | |

| Accounts receivable | | 1,141,895 | | | 1,830,806 | | | 2,592,985 | |

| Inventories | | — | | | — | | | 1,936,671 | |

| Prepaid expenses and other current assets | | 73,704 | | | 616,815 | | | 922,934 | |

| Property, plant, and equipment, net | | 3,045,318 | | | 443,228 | | | 31,723,607 | |

| Goodwill | | — | | | — | | | 1,097,250 | |

| Intangible assets, net | | — | | | — | | | 1,689,863 | |

| Plant permits, net | | — | | | — | | | 1,150,000 | |

| Total assets | | $ | 4,260,917 | | | $ | 2,890,849 | | | $ | 41,113,510 | |

| Liabilities and members' equity (deficit) | | | | | | |

| Accounts payable and accrued expenses | | $ | 25,701,632 | | | $ | 6,233,975 | | | $ | 16,985,709 | |

| Members' equity (deficit) | | (21,440,715) | | | (3,343,126) | | | 24,127,801 | |

| Total liabilities and members' equity (deficit) | | $ | 4,260,917 | | | $ | 2,890,849 | | | $ | 41,113,510 | |

| For the Year Ended September 30, 2023 |

| | Stavola Mining and | | Rosano Howell | | Stavola Holdings |

| Summarized statements of operations | | Development, LLC | | Asphalt | | Pennsylvania, LLC |

| Revenues | | $ | — | | | $ | — | | | $ | 6,585,164 | |

| Cost of sales | | — | | | — | | | (6,370,456) | |

| General and administrative expenses | | — | | | — | | | (663,098) | |

| Other income (expense), net | | (177,064) | | | (581,919) | | | 51,746 | |

| Net loss | | $ | (177,064) | | | $ | (581,919) | | | $ | (396,644) | |

Included in the numbers above are receivables and payables from consolidated affiliated companies. Stavola Mining and Development Company, LLC, Rosano Howell Asphalt Company, LLC, and Stavola Holdings Pennsylvania, LLC and Subsidiaries had receivables from consolidated affiliated companies of $1,141,895, $1,830,805, and $2,072,113 as of September 30, 2023, respectively, that eliminate in consolidation.

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(1) Summary of significant accounting policies (continued)

Variable interest entities (continued) - Stavola Mining and Development Company, LLC, Rosano Howel Asphalt Company, LLC, and Stavola Holdings Pennsylvania, LLC and Subsidiaries had payables from consolidated affiliated companies of $25,288,012, $5,925,215, and $15,801,599 as of September 30, 2023, respectively, that eliminate in consolidation.

The Company has investments in entities which are considered VIEs. However, the Company does not participate in the management of these entities, including the day-to-day operating decisions or other decisions which would allow the Company to control the entity, and therefore, the Company is not considered the primary beneficiary of these VIEs.

The carrying amounts of the Company’s investments in these VIEs for which the Company is not the primary beneficiary were $6,442,433 as of September 30, 2023, and are included in investments in affiliates in the consolidated balance sheet. See Note 7. for more information related to the Company’s equity investment. The Company’s maximum exposure is equal to the carrying value of our investments.

(2) Cash flow disclosures and concentration of credit risk

Cash - Historically, the Company considered temporary investments with an original maturity of three months or less to be cash equivalents. There were no cash equivalents as of September 30, 2023. The Company maintains cash balances with several banks, which, at times, are in excess of the federally insured limit. The Company has not experienced any losses in such accounts.

The following is a summary of supplemental cash flow information:

Cash paid for interest during the year ended September 30, 2023, was $1,437,626.

The following is a summary of noncash investing and financing activities:

During the year ended September 30, 2023:

•The Company acquired property, plant, and equipment costing $1,122,692 by incurring long-term obligations in the same amount.

•The Company disposed of property, plant, and equipment with a cost of $15,971,735 and accumulated depreciation of $13,108,017, resulting in a gain on disposal of $7,344,720.

•The Company recorded an asset retirement obligation, along with the related capitalized quarry reclamation cost, of $1,500,000.

(3) Revenue, contract assets, and contract liabilities

In the following table, revenue from contracts with customers for the year ended September 30, 2023, is disaggregated by major products and services:

| | | | | | |

| Asphalt | | $ | 156,830,796 | |

| Aggregates | | 59,758,375 | |

| Contracting | | 30,549,166 | |

| Recycling | | 8,261,759 | |

| Total revenues | | $ | 255,400,096 | |

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(3) Revenue, contract assets, and contract liabilities (continued)

The following table outlines the significant changes in contract assets and contract liability balances from October 1, 2022 to September 30, 2023. Also included in the table is the net change in the estimate as a percentage of aggregate revenue for such contracts:

| | | | | | |

| Contract assets: | | |

| Contract assets, beginning of year | | $ | 1,463,525 | |

| Change in costs and estimated earnings in excess of billings on uncompleted contracts | | (354,804) | |

| Change in retainage receivable | | (94,294) | |

| Contract assets, end of year | | $ | 1,014,427 | |

| | |

| Contract liabilities: | | |

| Contract liabilities, beginning of year | | $ | 118,825 | |

| Change in billings in excess of estimated costs and estimated earnings on uncompleted contracts | | (62,441) | |

| Change in retainage receivable | | (32,695) | |

| Contract liabilities, end of year | | $ | 23,689 | |

As of September 30, 2023, contract assets and contract liabilities consist of the following:

| | | | | | |

| Contract assets: | | |

| Costs and estimated earnings in excess of billings on uncompleted contracts | | $ | 304,051 | |

| Retainage receivable | | 710,376 | |

| | $ | 1,014,427 | |

| | |

| Contract liabilities: | | |

| Retainage payable | | $ | 23,689 | |

Costs and estimated earnings in excess of billings on uncompleted contracts and billings in excess of costs and estimated earnings on uncompleted contracts, as included in contract assets and liabilities, are calculated as follows:

| | | | | | |

| Costs incurred on uncompleted contracts | | $ | 18,865,096 | |

| Estimated earnings on uncompleted contracts | | 685,104 | |

| | 19,550,200 | |

| Less billings on uncompleted contracts | | 19,246,149 | |

| | $ | 304,051 | |

Included in contract assets and contract liabilities as follows:

| | | | | | |

| Costs and estimated earnings in excess of billings on uncompleted contracts | | $ | 304,051 | |

The Company recognized $118,825 of revenue during the year ended September 30, 2023, related to amounts that were included in contract liabilities as of September 30, 2022.

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(4) Property, plant, and equipment

As of September 30, 2023, property, plant, and equipment consist of the following:

| | | | | | | | |

| Land and land improvements | | $ | 39,535,507 | |

| Mineral rights of properties | | 17,063,061 | |

| Buildings and building improvements | | 12,665,712 | |

| Plants | | 96,351,525 | |

| Machinery and equipment | | 83,031,568 | |

| Automobiles and trucks | | 10,410,879 | |

| Capitalized quarry reclamation costs | | 2,107,632 | |

| Furniture, fixtures, and office equipment | | 886,055 | |

| Construction-in-progress | | 5,713,134 | |

| | 267,765,073 | |

| Less accumulated depreciation, amortization, and depletion | | 113,430,487 | |

| | $ | 154,334,586 | |

Depreciation, amortization, and depletion expenses for the year ended September 30, 2023, totaled $16,986,690.

Construction-in-progress consists primarily of costs incurred for improvements on land, buildings, plants, and equipment owned by SAC, SCMI, and SSM that have not yet been completed and placed in-service. A portion of these improvements may be performed by SCC.

(5) Intangible assets

As of September 30, 2023, intangible assets, net consist of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Weighted | | Gross | | | | |

| | Average | | Carrying | | Accumulated | | Net Carrying |

| | Useful Life | | Amount | | Amortization | | Amount |

| Customer relationships | | 5.3 | | | $ | 4,200,000 | | | $ | (2,051,096) | | | $ | 2,148,904 | |

| Plant permit | | 7.7 | | | 1,500,000 | | | (350,000) | | | 1,150,000 | |

| Other | | — | | | 10,000 | | | (10,000) | | | — | |

| | | | $ | 5,710,000 | | | $ | (2,411,096) | | | $ | 3,298,904 | |

The annual future estimated amortization expense as of September 30, 2023, is as follows:

| | | | | | | | |

| Years Ending September 30, | | |

| 2024 | | $ | 540,000 | |

| 2025 | | 540,000 | |

| 2026 | | 540,000 | |

| 2027 | | 249,000 | |

| 2028 | | 240,000 | |

| Thereafter | | 1,189,904 | |

| | $ | 3,298,904 | |

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(6) Investment in affiliate

SCMI has a partnership interest in Stavola Realty Company (“SRC”), an unconsolidated affiliate. Under the partnership agreement, SCMI does not participate in, or have any rights to, the operating profits or losses of the partnership. Accordingly, the investment in affiliate on SHC’s consolidated balance sheet does not equal 49% of the $22,051,179 of SRC’s partners’ capital as of September 30, 2023. Instead, SCMI’s partnership interest is frozen, except that it will receive 49% of the proceeds of future sales of, or refinancing proceeds from, partnership assets (principally land and buildings). Selected financial information related to SRC as of and for the year ended September 30, 2023, is as follows:

| | | | | | | | |

| Balance sheets | (Unaudited) | September 30, 2023 |

| Assets | | |

| Current assets | | $ | 9,024,318 | |

| Other assets | | 17,230,253 | |

| Total assets | | $ | 26,254,571 | |

| | |

| Liabilities and partners' capital | | |

| Long-term liabilities | | $ | 4,203,392 | |

| Partners' capital | | 22,051,179 | |

| Total liabilities and partners' capital | | $ | 26,254,571 | |

| | |

| | Year Ended |

| Summarized statements of income | (Unaudited) | September 30, 2023 |

| Revenues | | $ | 3,494,599 | |

| Gross profit | | $ | 2,600,612 | |

| Net income | | $ | 2,544,302 | |

(7) Accounting for derivative financial instrument

The Company has a derivative financial instrument which consists of an interest rate swap agreement on an original notional principal amount of $42,500,000. The Company pays a weighted average fixed rate of 1.115% on this notional amount, which is being amortized, and, in addition, receives a weighted average variable rate equivalent to the SOFR plus 1.25%. The derivative financial instrument matures in September 2031. Effective April 28, 2023, the interest rate swap agreement was amended to revise the interest rate index used for the derivative financial instrument from the Bloomberg Short-Term Bank Yield Index to SOFR.

The estimated fair value of the Company’s interest rate swap agreement as of September 30, 2023, totaled $4,958,300 and was recorded in the accompanying consolidated balance sheet. The agreement is intended to economically hedge floating rate debt relating to the term loan, as discussed in Note 9. The Company elected not to apply hedge accounting treatment in accordance with the provisions of FASB ASC Topic 815, including formal hedge designation and documentation. The Company is recording the fair value of the derivatives on the consolidated balance sheet with the offsetting entry to earnings. See Note 1 for fair value measurement disclosures related to this interest rate swap agreement.

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(7) Accounting for derivative financial instrument (continued)

In accordance with FASB ASC Topic 815, as amended, the Company recorded unrealized losses of $32,594, representing the change in estimated fair value of the related interest rate swap agreement for the year ended September 30, 2023. During the year ended September 30, 2023, the Company received $1,492,151 of net interest rate swap settlements that occurred in accordance with the terms of the related agreement, which are recorded in interest expense in the statement of operations.

(8) Revolving line of credit

SHC and certain subsidiaries have a revolving line of credit agreement with a bank that provides for maximum borrowings of $65,000,000 and bears interest at a variable rate determined by certain financial ratios. The line of credit is secured by the assets of SHC and its subsidiaries. The Agreement contains certain restrictive covenants and conditions (see Note 9). As of September 30, 2023, there were no borrowings outstanding under the line of credit. The line of credit expires on September 30, 2026. Outstanding letters of credit held against this line totaled $305,080 as of September 30, 2023. As of September 30, 2023, the amount available under this line of credit totaled $64,694,920. As of September 30, 2023, the Company was in compliance with all covenants.

(9) Long-term debt obligations

As of September 30, 2023, long-term debt obligations consist of the following:

| | | | | | | | |

| Term loan agreement | | $ | 40,000,000 | |

| Notes payable | | 2,329,455 | |

| Term loan payable | | 319,170 | |

| Total long-term debt | | 42,648,625 | |

| Less current portion | | 6,836,700 | |

| Noncurrent portion | | $ | 35,811,925 | |

SHC, along with certain subsidiaries, have a term loan agreement (the "Agreement") with a bank (the “Lender”). The loan calls for repayments in consecutive quarterly installments of $1,250,000 through September 30, 2031. Borrowings under the Agreement, including the line of credit agreement discussed in Note 8 with the Lender, are collateralized by a first-priority interest in all of the assets of SHC and its subsidiaries. The Agreement contains certain restrictive covenants and conditions. Interest is charged at a variable rate determined by certain financial ratios. As of September 30, 2023, the effective interest rate was 7.15%.

Notes payable to finance companies, which are due in monthly amounts totaling approximately $147,500 and expire at various dates through April 2025. These notes are collateralized by equipment purchased with these funds.

Term loan payable to a bank, which is due in monthly installments totaling approximately $14,700 per month, including interest at 5.86%, through August 2025, and is secured by land.

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(9) Long-term debt obligations (continued)

Annual maturities of long-term debt as of September 30, 2023, are as follows:

| | | | | | | | |

| Years Ending September 30, | | |

| | |

| 2024 | | $ | 6,836,700 | |

| 2025 | | 5,811,925 | |

| 2026 | | 5,000,000 | |

| 2027 | | 5,000,000 | |

| 2028 | | 5,000,000 | |

| Thereafter | | 15,000,000 | |

| | $ | 42,648,625 | |

(10) Advances to related parties

Advances to related parties represent unsecured advances to entities related through common ownership and are noninterest bearing with no formal repayment terms. Advances outstanding as of September 30, 2023, totaled $513,332.

(11) Asset retirement obligations

Following is a reconciliation of the aggregate retirement liability associated with the Company’s obligations to retire certain property at the end of its useful life as of September 30, 2023:

| | | | | | | | |

| Balance, beginning of year | | $ | 1,848,000 | |

| Present value of new asset retirement obligation | | 1,500,000 | |

| Accretion expense | | 127,500 | |

| Balance, end of year | | $ | 3,475,500 | |

(12) Employee benefit plan

The Company, along with another affiliated company, participates in a 401(k) plan covering all nonunion employees. The Company matches 100% of employee contributions up to 4% of participating employee compensation. Contributions charged against the Company’s operations for the year ended September 30, 2023, were approximately $871,000.

(13) Related-party activity

SHC operates as the main financing source within the consolidated group of entities along with other unconsolidated affiliated companies. All receivables and payables, along with any interest income or interest expense within the consolidated group, are eliminated upon consolidation. The remaining balances represent amounts due from/(to) unconsolidated affiliated companies. SHC has agreed to accept repayment beyond September 30, 2024.

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(13) Related-party activity (continued)

As of September 30, 2023, balances due from/(to) unconsolidated affiliates are as follows:

| | | | | | | | |

| Stavola Management Company | | $ | 2,934,395 | |

| Stavola Realty Company | | 551,274 | |

| Other Affiliates | | 273,975 | |

| Progress Park Associates, Inc. | | (858,491) | |

| | $ | 2,901,153 | |

Shown on the accompanying consolidated balance sheets as follows:

| | | | | | | | |

| Receivables from unconsolidated affiliates | | $ | 3,759,644 | |

| | |

| Payables from unconsolidated affiliates | | $ | 858,491 | |

Certain management services for the Company are performed by Stavola Management Company, Inc. Charges for these services were $19,025,813 for the year ended September 30, 2023.

The Company leases real estate through March 2030 for an asphalt plant in Tinton Falls, New Jersey, from SRC, a related party. Rent is payable monthly, with annual increases through 2030. Rent expense for the year ended September 30, 2023, was approximately $285,000.

(14) Multiemployer pension plans

The Company participates in various construction industry multiemployer pension plans in accordance with collective bargaining agreements. These plans cover all of the Company’s employees who are members of those bargaining units. The risks of participating in these multi- employer plans are different from single-employer plans. If a participating employer stops contributing to the plan, the unfunded obligations of the plan may be borne by the remaining participating employers. If the Company chooses to stop participating in some of the multi- employer plans, the Company may be required to pay those plans an amount based on the underfunded status of the plan, referred to as a withdrawal liability.

The following table presents the Company’s participation in multiemployer plans:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Most Recent | | | | | | | | Expiration |

| | Pension Plan | | Pension | | FIP/RP | | | | | | Date of |

| | Employer | | Protection | | Status | | Contributions | | | | Collective |

| | Identification | | Act ("PPA") | | Pending/ | | Year Ended | | Surcharge | | Bargaining |

| Pension Trust Fund | | Number | | Zone Status | | Implemented | | September 30, 2023 | | Imposed | | Agreement |

| | | | | | | | | | | | |

| Heavy and General Laborers Local Unions 472 and 172 of New Jersey Pension Fund | | 22-6032103 | | Green | | No | | $ | 478,848 | | | No | | 2/29/2024 |

| | | | | | | | | | | | |

| Operating Engineers 825 Pension Fund | | 22-6033380 | | Green | | No | | 450,706 | | | No | | 6/30/2026 |

| Total contributions | | | | | | | | $ | 929,554 | | | | | |

STAVOLA HOLDING CORPORATION AND SUBSIDIARIES AND AFFILIATES

NOTES TO FINANCIAL STATEMENTS

(14) Multiemployer pension plans (continued)

The most recent PPA zone status available is for the plan’s most recent year end prior to September 30, 2023. The zone status is based on information that the Company received from the plan and is certified by the plan’s actuary. Among other factors, plans in the red zone are generally less than 65 percent funded, plans in the orange zone are less than 80 percent funded and have an Accumulated Funding Deficiency in the current year or projected into the next six years, plans in the yellow zone are less than 80 percent funded, and plans in the green zone are at least 80 percent funded. The “FIP/RP status pending/implemented” column indicates plans for which a financial improvement plan (“FIP”) or a rehabilitation plan (“RP”) is either pending or has been implemented.

During the year ended September 30, 2023, the Company did not contribute more than 5% of total contributions to any plan, and the Company does not have any intentions of withdrawing from any of the multiemployer pension plans noted above. The Company will operate under the terms of expiring collective bargaining agreements at times while these agreements are being renegotiated. The Company does not expect work stoppages to occur during such renegotiations.

Nonunion employees are covered by a separate plan described in Note 12.

(15) Leases

Operating leases (lessor) - Nivek has an operating lease agreement with an unrelated party to lease its land. The lease calls for monthly receipts of approximately $23,000, subject to escalation every five years, through August 2026. In addition, CRCW has an agreement with an unrelated third party to lease land in Bridgewater Township, New Jersey. The lease calls for monthly receipts of $75,000, subject to certain escalations every five years, through April 2068.

The following is a schedule of future annual minimum rental payments to be received under these lease agreements as of September 30, 2023:

| | | | | | | | |

| Years Ending September 30, | | |

| | |

| 2024 | | $ | 1,216,000 | |

| 2025 | | 1,216,000 | |

| 2026 | | 1,191,000 | |

| 2027 | | 910,000 | |

| 2028 | | 910,000 | |

| Thereafter | | 37,745,000 | |

| | $ | 43,188,000 | |