false00013325510001332551us-gaap:SeriesCPreferredStockMember2023-11-012023-11-010001332551us-gaap:CommonStockMember2023-11-012023-11-0100013325512023-11-012023-11-010001332551us-gaap:SeriesDPreferredStockMember2023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 01, 2023 |

ACRES Commercial Realty Corp.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

1-32733 |

20-2287134 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

390 RXR Plaza |

|

Uniondale, New York |

|

11556 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 516 535-0015 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value per share |

|

ACR |

|

New York Stock Exchange |

8.625% Fixed-to-Floating Series C Cumulative Redeemable Preferred Stock |

|

ACRPrC |

|

New York Stock Exchange |

7.875% Series D Cumulative Redeemable Preferred Stock |

|

ACRPrD |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 1, 2023, ACRES Commercial Realty Corp. (the “Company”) issued a press release and detailed presentation regarding its operating results for the quarter ended September 30, 2023. A copy of this press release is furnished with this report as Exhibit 99.1 and a copy of the earnings presentation is furnished with this report as Exhibit 99.2 as well as made available on the Company’s website at www.acresreit.com.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

b) On November 1, 2023, David J. Bryant, Chief Financial Officer, Senior Vice President and Treasurer, informed the Company of his intention to retire effective December 31, 2023.

c) On November 1, 2023, Eldron C. Blackwell was appointed as the Company’s Chief Financial Officer, Senior Vice President and Treasurer, effective January 1, 2024. Mr. Blackwell, age 44, has been the Company’s Vice President and Chief Accounting Officer since March 2014. Mr. Blackwell was the Assistant Controller for New Penn Financial, LLC, a residential mortgage lender, from March 2013 to March 2014. From September 2001 to March 2013, he was a Senior Manager in the audit practice of the global accounting firm Grant Thornton LLP. Mr. Blackwell serves as board chair for Freire Schools Collaborative in Philadelphia, Pennsylvania and also serves on the board of Resources for Human Development in Philadelphia, Pennsylvania.

Additionally, on November 1, 2023, Linda M. Kilpatrick was appointed as the Company’s Chief Accounting Officer, Vice President and Controller, effective January 1, 2024. Ms. Kilpatrick, age 51, has been the Company’s Controller since October 2017 and before that, served as the Company’s Division Controller since 2010. Prior to joining the Company, Ms. Kilpatrick worked as an Accounting and Reporting Manager for Independence Blue Cross, a health insurance company, from December 2010 to December 2014. From October 2004 to December 2010, she was a Manager in the audit practice of the global accounting firm Grant Thornton LLP. Ms. Kilpatrick is a certified public accountant.

Neither Mr. Blackwell nor Ms. Kilpatrick have any family relationships with any current director, executive officer, or person nominated to become a director or executive officer, of the Company, and there are no transactions or proposed transactions, to which the Company is a party, or intended to be a party, in which Mr. Blackwell or Ms. Kilpatrick has, or will have, a material interest subject to disclosure under Item 404(a) of Regulation S-K.

Forward-Looking Statements

This Form 8-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “trend,” “will,” “continue,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “look forward” or other similar words or terms. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. Factors that can affect future results are discussed in the documents filed by the Company from time to time with the Securities and Exchange Commission. The Company undertakes no obligation to update or revise any forward-looking statement to reflect new or changing information or events after the date hereof or to reflect the occurrence of unanticipated events, except as may be required by law.

Item 7.01 Regulation FD Disclosure.

The information provided in Item 2.02 above is incorporated by reference into this Item 7.01.

The information set forth in Items 2.02 and 7.01 in this Current Report, and all of the exhibits hereto, is to be considered “furnished” pursuant to Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information set forth in Items 2.02 and 7.01 in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ACRES COMMERCIAL REALTY CORP. |

|

|

|

|

Date: |

November 1, 2023 |

By: |

/s/ David J. Bryant |

|

|

|

David J. Bryant

Chief Financial Officer |

Exhibit 99.1

ACRES COMMERCIAL REALTY CORP.

REPORTS RESULTS FOR

THIRD QUARTER 2023

Uniondale, NY, November 1, 2023 – ACRES Commercial Realty Corp. (NYSE: ACR) (“ACR” or the “Company”), a real estate investment trust that is primarily focused on originating, holding and managing commercial real estate mortgage loans and equity investments in commercial real estate property through direct ownership and joint ventures, today reported results for the quarter ended September 30, 2023. ACR’s GAAP net income allocable to common shares was $2.9 million, or $0.33 per share-diluted, for the quarter ended September 30, 2023.

“The ACRES team continually reviews and actively manages our investments to ensure that we maintain the highest quality portfolio. The Company has always maintained a strong commitment to an asset management infrastructure that is conditioned for challenging environments. Safeguarding and enhancing shareholder value remain our top priorities,” said ACRES Commercial Realty Corp. President & CEO Mark Fogel.

ACR issued a full, detailed presentation of its results for the quarter ended September 30, 2023 that can be viewed at www.acresreit.com.

Earnings Call Details

ACR will host a live conference call on November 2, 2023 at 11:00 a.m. Eastern Time to discuss its third quarter 2023 operating results. The conference call can be accessed by dialing 1-833-816-1421 (U.S. domestic) or 1-412-317-0514 (International) or from the investor relations section of the Company’s website at www.acresreit.com.

For those unable to listen to the live conference call, a replay will be available on the Company’s website and telephonically through November 16, 2023 by dialing 1-844-512-2921 (U.S. domestic) or 1-412-317-6671 (International), with the passcode 10182231.

About ACRES Commercial Realty Corp.

ACRES Commercial Realty Corp. is a real estate investment trust that is primarily focused on originating, holding and managing commercial real estate mortgage loans and equity investments in commercial real estate properties through direct ownership and joint ventures. The Company is externally managed by ACRES Capital, LLC, a subsidiary of ACRES Capital Corp., a private commercial real estate lender exclusively dedicated to nationwide middle market commercial real estate lending with a focus on multifamily, student housing, hospitality, industrial and office property in top U.S. markets. For more information, please visit the Company’s website at www.acresreit.com or contact investor relations at IR@acresreit.com.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “continue,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “look forward” or other similar words or terms. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. Factors that can affect future results are discussed in the documents filed by the Company from time to time with the Securities and Exchange Commission, including, without limitation, factors impacting whether we will be able to maintain our sources of liquidity and whether we will be able to identify sufficient suitable investments to increase our originations. The Company undertakes no obligation to update or revise any forward-looking statement to reflect new or changing information or events after the date hereof or to reflect the occurrence of unanticipated events, except as may be required by law.

THIRD Quarter 2023 �Earnings Presentation November 1, 2023 Exhibit 99.2

DISCLAIMER Forward-Looking Statements This presentation contains forward-looking statements within the meaning of federal securities laws. These forward-looking statements are not historical facts but rather are based on ACRES Commercial Realty Corp.’s (“ACR’s” or the “Company’s”) current beliefs, assumptions and expectations. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to ACR or are within its control. If a change occurs, its business, financial condition, liquidity and results of operations may vary materially from those expressed in the forward-looking statements. You should not place undue reliance on these forward-looking statements, which reflect ACR’s view only as of the date of this presentation. ACR uses words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” “target,” and variations of these words and similar expressions to identify forward-looking statements. Forward-looking statements are subject to various risks and uncertainties that could cause actual results to vary from its forward-looking statements, including, but not limited to: The adequacy of its cash reserves and working capital; The timing of cash flows, if any, from its investments; Unanticipated increases in financial and other costs, including a rise in interest rates; Its ability to maintain compliance with over-collateralization and interest coverage tests in its collateralized debt obligations (“CDOs”) and/or collateralized loan obligations (“CLOs”); Its dependence on ACRES Capital, LLC, its “manager”, and ability to find a suitable replacement in a timely manner, or at all, if its manager or the Company were to terminate the management agreement; Environmental and/or safety requirements; Its ability to satisfy complex rules in order for ACR to qualify as a real estate investment trust (“REIT”), for federal income tax purposes and qualify for its exemption under the investment company act of 1940, as amended, and its ability and the ability of its subsidiaries to operate effectively within the limitations imposed by these rules; Legislative and regulatory changes (including changes to laws governing the taxation of REITs or the exemptions from registration as an investment company); and Other factors discussed under item IA. Risk factors in its annual report on form 10-K for the year ended December 31, 2022 and those factors that may be contained in any subsequent filing ACR makes with the Securities and Exchange Commission. Changes in the industry, interest rates, the debt securities markets, real estate markets or the general economy; Increased rates of default and/or decreased recovery rates on its investments; The performance and financial condition of its borrowers; The cost and availability of its financings, which depend in part on its asset quality, the nature of its relationships with its lenders and other capital providers, its business prospects and outlook and general market conditions; The availability and attractiveness of terms of additional debt repurchases; Availability, terms and deployment of short-term and long-term capital; Availability of, and ability to retain, qualified personnel; Changes in its business strategy; Availability of investment opportunities in commercial real estate-related and commercial finance assets; The degree and nature of its competition; The resolution of its non-performing and sub-performing assets; The outbreak of widespread contagious disease, such as the novel coronavirus, COVID-19; The Company’s ability to comply with financial covenants in its debt instruments; ACRESREIT.COM

DISCLAIMER Forward-Looking Statements (continued) In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this presentation might not occur and actual results, performance or achievement could differ materially from those anticipated or implied in the forward-looking statements. The Company undertakes no obligation, and specifically disclaims any obligation, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Past Performance Past performance is not indicative of future results. There is no guarantee that any investment strategy referenced herein will work under all market conditions. Prior to making any investment decision, you should evaluate your ability to invest for the long-term, especially during periods of downturns in the market. You alone assume the responsibility of evaluating the merits and risks associated with any potential investment or investment strategy referenced herein. Notes on Presentation This presentation contains information regarding financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States (“GAAP”), which management believes is relevant to assessing ACR’s financial performance. Please refer to page 16 for the reconciliation of Net income (Loss), a GAAP financial measure, to Earnings Available for Distribution (“EAD”), a non-GAAP financial measure. Unless otherwise indicated, information included in this presentation is at or for the period ended September 30, 2023. Definitions Refer to page 19 for a description of certain terms not otherwise defined or footnoted, including EAD, Benchmark Rate, GAAP Book Value, and other key terms. This presentation is for informational purposes only and does not constitute an offer to sell or the solicitation of any offer to buy any securities of ACR or any other entity. Any offering of securities would be made pursuant to separate documentation and any such securities would not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. No Offer or Sale of Securities ACRESREIT.COM

Highlights Earnings and capital gains can be retained �through tax assets to increase book value Manager is focused on delivering shareholder value through EAD1 growth and share repurchases ACRESREIT.COM Percentage of Multifamily-focused �CRE in Loan Portfolio 76% Per Share-Diluted GAAP Net Income / EAD $0.33 / $0.73 3Q23 Net CRE Loan Payoffs $45.3M $25.07 Book Value Per Share at September 30, 2023 Total Liquidity at September 30, 2023 $104M 1 Refer to page 16 for the reconciliation of Net Income (Loss), a GAAP financial measure, to EAD, a non-GAAP financial measure

THIRD Quarter Results Financial Results Book Value CRE Loan Activity & CRE Portfolio Capitalization & Liquidity ACRESREIT.COM Total liquidity at September 30, 2023 $104M of asset-specific borrowings were comprised of non-recourse, �non-mark-to-market CLO financings 78% $168.7M of net investments in real estate �and properties held for sale 97% of the par value of the CRE loan �portfolio is current on payments of the par value of the CRE loan portfolio is rated 4 or 5 8% comprising 75 loans with a weighted average LTV of 75% $1.9B CRE loan portfolio $45.3M of net loan repayments Includes $(0.23) due to $2.0M provision for CECL reserves 12.8% annual increase since ACRES �acquisition in 3Q20 $25.07 GAAP book value up from $24.50 in 2Q23 and down from $25.08 in 3Q22 EAD 1 for 3Q23 $0.73 $0.33 GAAP net income per share-diluted 1 Refer to page 16 for the reconciliation of Net Income (Loss), a GAAP financial measure, to EAD, a non-GAAP financial measure

BALANCE SHEET Overview 3Q23 Balance Sheet Overview Summary of Changes to GAAP Book Value per Share 1,2 Total Assets ($B) $2.3 Total Liquidity ($M) $104.0 CRE Whole Loans, at par ($B) WA Spread $1.9 3.91% CECL Reserve – General ($M) Per BV Share / Basis Points $22.9 $2.72/1.19% CECL Reserve – Specific ($M) Per BV Share / Basis Points $4.7 $0.56/0.24% Investments in Real Estate ($M) Number of Investments $168.7 6 Total Borrowings ($B) Leverage Ratio $1.7 3.9x Asset Specific Borrowings ($B) WA Spread $1.5 1.93% Corporate Debt ($M) WA Coupon $201.5 6.72% Preferred and Common Equity3 ($M) Dividend %: Preferred / Common $226.5/$221.7 8.26% / NA ACRESREIT.COM 1 Per share adjustments are calculated based on the share count outstanding utilized in the calculation of book value at September 30, 2023 2 At September 30, 2023, $15.5 million, or 1.4 million shares, were repurchased under the board authorized plan 3 Includes $10.5 million of non-controlling interests Capitalization Total Capitalization $2.2B Stockholders’ equity 21% Term warehouse financing facilities (limited recourse) 11% Senior secured financing facility (limited recourse) 3% Mortgage Payable and Construction Loans (limited recourse) 1% Corporate Debt - TRUPS & 5.75% Notes (no guarantee) 9% Securitization notes payable (non-recourse) 55%

Loans held for investment, at amortized cost $1,920.2 CECL Reserves ($27.6) CRE whole loans, floating-rate WA 1M BR + 3.91% WA 1M BR Floor2 0.68% WA CRE loan portfolio LTV 75% Total number of CRE loans 75 Average CRE whole loan size, at par $26.0 WA Risk Rating, at par 2.6 CRE Loan Portfolio Overview CRE Loan Summary 1 Balance by Region 1,3 ACRESREIT.COM 1 All $ amounts are in millions and the percentages for region and property type disclosures are based on total carrying value of the CRE loans 2 At September 30, 2023, all CRE whole loans are now indexed only to SOFR and the WA benchmark rate was 5.37% 3 Texas (24.2%) and Florida (15.5%) were the states with the highest concentrations. Based on regions identified by the National Council of Real Estate Investment Fiduciaries (NCREIF) Total Loan Count 78 Total Loan Count 75 Loan Portfolio Activity, at par 1 Property Type 1 Multifamily 76.3% Office 13.1% Hotel 7.7% Self-storage 2.5% Retail 0.4% Pacific �9.1% Mountain�14.5% Southwest 24.2% West North Central �3.4% East North Central 4.6% Southeast 21.8% Mid Atlantic�12.8% Northeast 9.6%

Fully Extended Loan and Interest Rate Cap Maturities ($ in millions at par) CRE Loan Portfolio Maturity Profile ACRESREIT.COM 1 Excludes loans in default at September 30, 2023 2 Fully-extended maturity basis assumes borrower elects and qualifies for all extensions 3 Interest rate caps are contractually owned by the underlying borrower and supplement the property cash flows that collateralize the floating rate CRE loan portfolio 4 Our current interest rate caps have maturities from October 2023 through July 2026 Fully extended WA loan maturity 1,2 of the par value of the portfolio has interest rate caps in place at September 30, 2023 3,4 3.0 years 89%

CRE Loan Risk Ratings and CECL Reserves All but five of ACR’s 75 loans are current on contractual payments through September 30, 2023 CECL Reserve Overview ACRESREIT.COM 1 See page 20 for additional information on the risk rating definitions Risk Rating by Collateral Type, $ at par 3Q23 W.A. Risk Rating: 2.6 2Q23 W.A. Risk Rating: 2.4 of ACR’s loans have a risk rating of 2 or 3 that are performing in line with or near underwritten expectations 1 92% Specific CECL Reserve General CECL Reserve Total Reserve $25.7M Total Reserve $27.6M 100% Risk Rated 5 100% Risk Rated 5 8% Risk Rated 4 & 5 92% Risk Rated 2 & 3 10% Risk Rated 4 & 5 90% Risk Rated 2 & 3 3Q23 Risk Rating Overview $1.5B $1.5B $254.3M $261.7M $148.1M $148.6M $48.7M $70.1M $8.0M $8.0M Loan Count 5 42 3 25 0

Investments in Real Estate Properties $168.7 million �of net investments in real estate �and properties held for sale 1,2 Student Housing $13.0M 3 Existing structure and development of adjacent lot Equity investment in the southeast region Value add and development project Acquired in April 2022 Construction commenced in the first quarter of 2023 388-key hotel next to a convention center Equity investment in the east north central region Conversion to a Hilton hotel and stabilization Acquired in April 2022 279-key hotel next to a convention center Equity via lending activities in the northeast region Acquired the deed in November 2020 Reclassified to held for sale as of September 30, 2022 ACRESREIT.COM 1 Investments in real estate comprise six properties, four of which are held at depreciated/amortized cost basis and two of which are held for sale at lower of cost or fair value. Images exclude the $20.9M property held for sale acquired via deed-in-lieu of foreclosure in June 2023. 2 Depreciation and amortization expense is $933,000 for the 3rd quarter of 2023 3 Represents value on date of acquisition 99K SF Class A office / life science/ lab space Equity investment in the northeast region Lease up as life science / lab building Acquired in October 2021 Hotel $38.6M 3 Office $14.6M 3 Hotel $39.8M 3 Multifamily $14.2M 3 12-acre parcel of land for multifamily development Equity investment in the northeast region Development of a multifamily complex Acquired in November 2021

Capitalization Overview $ in Millions Capitalization Maximum Capacity Amount $ Avail. W. Avg. Coupon Leverage Ratio Term Warehouse Financing 2 $500.0 $250.5 $247.6 BR + 2.69% 0.6x Senior Secured Financing 2 500.0 61.4 435.5 BR + 3.78% 0.1x Mortgage Payable 2 20.4 18.5 1.5 BR + 3.80% 0.1x Construction Loans Oceanview Life and Annuity Company 3 48.0 (0.4) 46.7 BR + 6.00% - Florida Pace Funding Agency 15.5 5.4 10.1 7.26% - Total Construction Loans 63.5 5.0 56.8 Senior Unsecured Notes 150.0 148.0 - 5.75% 0.3x Trust Preferred Securities 51.5 51.5 - BR + 3.95% 0.1x Total Recourse Debt $1,285.4 $534.9 $741.4 1.2x Securitizations 2 1,203.9 1,203.9 - BR + 1.64% 2.7x Total Leverage 4 $2,489.3 $1,738.8 $741.4 3.9x Preferred Equity 226.5 8.26% Common Equity 5 221.7 Total Capitalization $2,187.0 7.39% 1 Total Capitalization $2,187.0 Corporate WACC 1 7.39% Total Asset Specific Financing $1,539.3 WA Asset Specific Cost BR + 1.93% Term/Senior Secured Avail. $683.1 Recourse Debt Leverage 1.2x Total Corporate Leverage 3.9x ACRESREIT.COM 1 Weighted average cost of capital (“WACC”) calculation excludes the impact of common equity in the denominator 2 Asset-specific borrowings total $1.5 billion, of which securitizations are 78% 3 Current balance includes capitalized deferred debt issuance costs 4 Includes $16.0 million of unamortized deferred debt issuance costs and discounts on borrowings 5 Includes $10.5 million of non-controlling interests Outstanding Financing 1% Mortgage Payable and Construction Loans 4% Senior Secured Financing 3% Trust Preferred Securities 9% Senior Unsecured Notes 69% Securitizations 14% Term Warehouse Financing 86% Non-Mark-to-Market

Leverage AND Liquidity Trend ACRESREIT.COM 1 Includes the projected amount of proceeds available to the Company if the unfinanced loans were financed with the applicable facilities $117.6 $130.6 $91.2 $ in millions Leverage Ratios Total Liquidity ($ in millions) $104.0

Appendix ACRESREIT.COM

Consolidated Balance Sheets ACRESREIT.COM (in thousands, except share and per share data) Sep. 30, 2023 Dec. 31, 2022 Assets (unaudited) Cash and cash equivalents $ 64,440 $ 66,232 Restricted cash 35,876 38,579 Accrued interest receivable 12,433 11,969 CRE loans 1,920,205 2,057,590 Less: allowance for credit losses (27,634) (18,803) CRE loans, net 1,892,571 2,038,787 Loan receivable - related party 11,050 11,275 Investments in unconsolidated entities 1,548 1,548 Properties held for sale 62,163 53,769 Investments in real estate 149,180 120,968 Right of use assets 19,970 20,281 Intangible assets 8,125 8,880 Other assets 4,140 4,364 Total Assets $ 2,261,496 $ 2,376,652 Liabilities Accounts payable and other liabilities $ 17,261 $ 10,391 Management fee payable - related party 1,022 898 Accrued interest payable 5,598 6,921 Borrowings 1,738,829 1,867,033 Lease liabilities 44,130 43,695 Distributions payable 3,262 3,262 Accrued tax liability 142 113 Liabilities held for sale 3,025 3,025 Total Liabilities 1,813,269 1,935,338 Equity Series C Preferred stock, par value $0.001 5 5 Series D Preferred stock, par value $0.001 5 5 Common stock, par value $0.001 8 9 Additional paid-in capital 1,173,975 1,174,202 Accumulated other comprehensive loss (5,202) (6,394) Distributions in excess of earnings (731,088) (732,359) Total Stockholders’ Equity 437,703 435,468 Non-controlling interests 10,524 5,846 Total Equity 448,227 441,314 Total Liabilities and Equity $ 2,261,496 $ 2,376,652

Consolidated Statements of Operations (Unaudited, in thousands, except share and per share data) For the Three Months Ended For the Nine Months Ended Sep. 30, 2023 Sep. 30, 2022 Sep. 30, 2023 Sep. 30, 2022 Revenues Interest income $ 48,208 $ 34,065 $ 140,685 $ 83,760 Interest expense 33,555 22,939 97,372 53,591 Net interest income 14,653 11,126 43,313 30,169 Real estate income 9,316 9,785 25,266 21,700 Other revenue 37 25 107 60 Total revenues 24,006 20,936 68,686 51,929 Operating Expenses General and administrative 2,246 2,128 7,573 7,938 Real estate expenses 9,706 10,099 29,058 24,055 Management fees - related party 2,113 1,669 5,776 5,023 Equity compensation - related party 482 913 2,095 2,648 Corporate depreciation and amortization 22 21 68 64 Provision for credit losses, net 1,983 2,620 9,779 1,342 Total operating expenses 16,552 17,450 54,349 41,070 Other Income (Expense) Loss on extinguishment of debt — — — (460) Gain on sale of real estate — 1,870 745 1,870 Other income 113 130 465 1,103 Total other income 113 2,000 1,210 2,513 Income before Taxes 7,567 5,486 15,547 13,372 Income tax expense — — (129) (280) Net Income 7,567 5,486 15,418 13,092 Net income allocated to preferred shares (4,855) (4,855) (14,566) (14,566) Net loss allocable to non-controlling interest, net of taxes 158 82 419 106 Net Income (Loss) Allocable to Common Shares $ 2,870 $ 713 $ 1,271 $ (1,368) Net Income (Loss) per Common Share - Basic $ 0.34 $ 0.08 $ 0.15 $ (0.15) Net Income (Loss) per Common Share - Diluted $ 0.33 $ 0.08 $ 0.15 $ (0.15) Weighted Average Number of Common Shares Outstanding - Basic 8,456,884 8,713,256 8,469,597 8,898,159 Weighted Average Number of Common Shares Outstanding - Diluted 8,592,556 8,758,718 8,609,679 8,898,159 ACRESREIT.COM

Earnings Available for Distribution The following table provides a reconciliation from GAAP net income (loss) allocable to common shares to Earnings Available for Distribution allocable to common shares, a non-GAAP measure, for the periods presented 1: ACRESREIT.COM 1 See page 19 for additional information (Unaudited, in thousands, except share and per share data) For the Three Months Ended For the Nine Months Ended Sep. 30, 2023 Sep. 30, 2022 Sep. 30, 2023 Sep. 30, 2022 Net Income (Loss) Allocable to Common Shares - GAAP $ 2,870 $ 713 $ 1,271 $ (1,368) Realized gain on sale of investment in real estate — (1,870) (745) (1,870) Net income (loss) allocable to common shares - GAAP, adjusted $ 2,870 $ (1,157) $ 526 $ (3,238) Reconciling Items from Continuing Operations: Non-cash equity compensation expense 482 913 2,095 2,648 Non-cash provision for (reversal of) CRE credit losses 1,983 2,620 9,779 1,342 Realized loss on sale of investment in real estate — (372) 745 (372) Real estate depreciation and amortization 933 1,347 2,833 4,302 Non-cash amortization of discounts or premiums associated with borrowings — 144 — 1,271 Net income from non-core assets 24 (28) (28) (760) Reconciling Items from Legacy CRE Assets: Net interest income on legacy CRE assets — — — (29) EAD Allocable to common shares $ 6,292 $ 3,467 $ 15,950 $ 5,164 EAD per Common Share - Diluted $ 0.73 $ 0.40 $ 1.85 $ 0.58 Weighted Average Number of Common Shares Outstanding - Diluted on EAD Allocable to Common Shares 8,592,556 8,758,718 8,609,679 8,898,159

CECL Trend Analysis Chart ACR’s CECL reserve as a percentage of the total CRE loan portfolio declined from 4Q21 until 3Q22 as ACR increased its percentage of multifamily loans1 ACRESREIT.COM 1 Percentages based on total CRE loans at par, except for the multifamily percentage, which is based on total carrying value of the CRE loans During the trailing 12 months, volatility in the commercial real estate sector and limited market liquidity have caused an increase in the CECL reserves to 1.43% at 3Q23

Benchmark Sensitivity Analysis Trend The recent increases to benchmark rates on net interest income have returned our match-financed investment portfolio to having a direct correlation to the rise or fall in interest rates BR Change Decreased 1.00% No Change Increased 0.25% Increased 0.50% Increased 0.75% Increased 1.00% BR: 3.14% BR Change Decreased 1.00% No Change Increased 0.25% Increased 0.50% Increased 0.75% Increased 1.00% BR: 5.32% ACRESREIT.COM September 30, 2022 September 30, 2023 Quarterly Net Interest Income per Share Sensitivity to Changes in BRs Change to a positive correlation to net interest income �assuming a 1.00% �increase to BRs

Key Definitions Earnings Available for Distribution: Earnings Available for Distribution (“EAD”) is a non-GAAP financial measure that the Company uses to evaluate its operating performance. EAD excludes the effects of certain transactions and GAAP adjustments that it believes are not necessarily indicative of its current CRE loan portfolio and other CRE-related investments and operations. EAD excludes income (loss) from all non-core assets comprising of investments and securities owned by the Company at the initial measurement date of December 31, 2016 in commercial finance, middle market lending, residential mortgage lending, certain legacy CRE loans and other non-CRE assets designated as assets held for sale. EAD, for reporting purposes, is defined as GAAP net income (loss) allocable to common shares, excluding (i) non-cash equity compensation expense, (ii) unrealized gains and losses, (iii) non-cash provisions for loan losses, (iv) non-cash impairments on securities, (v) non-cash amortization of discounts or premiums associated with borrowings, (vi) net income or loss from a limited partnership interest owned at the initial measurement date, (vii) net income or loss from non-core assets, (viii) real estate depreciation and amortization, (ix) foreign currency gains or losses and (x) income or loss from discontinued operations. EAD may also be adjusted periodically to exclude certain one-time events pursuant to changes in GAAP and certain non-cash items. Although pursuant to the Fourth Amended and Restated Management Agreement the Company calculates the Manager’s incentive compensation using EAD excluding incentive fees payable to the Manager, the Company includes incentive fees payable to the Manager in EAD for reporting purposes. Benchmark Rate: Benchmark Rate (“BR”) refers to the collective one-month Term Secured Overnight Finance Rate (“SOFR”) rates that are used as benchmarks on the originated loans during the associated period. GAAP Book Value: GAAP book value is presented per common share, excluding unvested restricted stock and including warrants to purchase common stock. The measure refers to common stock book value, which is calculated as total stockholders’ equity less preferred stock equity. Leverage ratio is calculated as the respective period ended borrowings over total equity. Asset-specific leverage ratio excludes corporate debt from the calculation. Leverage Ratio: ACRESREIT.COM Current Expected Credit Losses: Current Expected Credit Losses (‘CECL”) refers to the provision to earnings in order to estimate expected losses.

Other Disclosures Rating 1: Property performance has surpassed underwritten expectations Occupancy is stabilized, the property has had a history of consistently high occupancy, and the property has a diverse and high-quality tenant mix Rating 2: Property performance is consistent with underwritten expectations and covenants and performance criteria are being met or exceeded Occupancy is stabilized, near stabilized or is on track with underwriting Rating 3: Property performance lags behind underwritten expectations Occupancy is not stabilized and the property has some tenancy rollover Rating 4: Property performance significantly lags behind underwritten expectations. Performance criteria and loan covenants have required occasional waivers Occupancy is not stabilized and the property has a large amount of tenancy rollover Rating 5: Property performance is significantly worse than underwritten expectations. The loan is not in compliance with loan covenants and performance criteria and may be in default. Expected sale proceeds would not be sufficient to pay off the loan at maturity The property has a material vacancy rate and significant rollover of remaining tenants An updated appraisal is required upon designation and updated on an as-needed basis CRE loans are collateralized by a diversified mix of real estate properties and are assessed for credit quality based on the collective evaluation of several factors, including but not limited to: collateral performance relative to underwritten plan, time since origination, current implied and/or re-underwritten loan-to-collateral value ratios, loan structure and exit plan. Depending on the loan’s performance against these various factors, loans are rated on a scale from 1 to 5, with loans rated 1 representing loans with the highest credit quality and loans rated 5 representing loans with the lowest credit quality. The factors evaluated provide general criteria to monitor credit migration in the Company’s loan portfolio; as such, a loan’s rating may improve or worsen, depending on new information received. The criteria set forth below should be used as general guidelines, and therefore not every loan will have all of the characteristics described in each category below. Commercial Real Estate Loans Risk Ratings ACRESREIT.COM

Additional information is available at the Company’s website. Contact �Information Headquarters: 390 RXR Plaza Uniondale, NY 11556 Investor Relations: ir@acresreit.com 516-862-2385 New York Stock Exchange: Common Stock Symbol: ACR Pref. Stock Symbols: ACRPrC & ACRPrD ACRES Commercial Realty Corp. is a real estate investment trust that is primarily focused on originating, holding and managing commercial real estate mortgage loans and equity investments in commercial real estate property through direct ownership and joint ventures. www.acresreit.com

Exhibit 99.3

ACRES COMMERCIAL REALTY CORP.

ANNOUNCES RETIREMENT OF CHIEF FINANCIAL OFFICER DAVID J. BRYANT

AND NAMES ELDRON C. BLACKWELL AS SUCCESSOR

Uniondale, NY, November 1, 2023 – ACRES Commercial Realty Corp. (NYSE: ACR) (“ACR” or the “Company”), a real estate investment trust that is primarily focused on originating, holding and managing commercial real estate mortgage loans and equity investments in commercial real estate property through direct ownership and joint ventures, announced today that David J. Bryant, Senior Vice President, Chief Financial Officer and Treasurer, is retiring from ACR, effective December 31, 2023. Mr. Bryant has faithfully served the company for 17 years. Mr. Bryant joined ACR as Senior Vice President, Chief Financial Officer, Chief Accounting Officer and Treasurer in June 2006 and has played a significant role in the design and execution of the Company’s strategy.

“On behalf of the Board and entire Company, I want to congratulate Dave on his retirement and express our sincere gratitude for his significant contributions and expert counsel that have been invaluable since ACR’s inception and specifically since our acquisition in July of 2020,” said Chairman Andrew Fentress. “Dave helped navigate the Company during a challenging time in 2020 and his knowledge and expertise of our businesses combined with his leadership and contributions have been invaluable to ACR. On behalf of the many stakeholders at ACR, we thank Dave for his commitment to our shareholders and his positive impact on our people and our business."

Effective January 1, 2024, Eldron C. Blackwell will succeed Mr. Bryant as Senior Vice President, Chief Financial Officer and Treasurer. Mr. Blackwell has served as Vice President and Chief Accounting Officer of the Company since March 2014, leading the Company’s accounting and financial reporting functions. “This promotion recognizes Mr. Blackwell’s deep knowledge of, and invaluable experience at ACR and ensures a seamless transition as we remain committed to driving the Company's growth,” said President and Chief Executive Officer, Mark Fogel.

“It has been a privilege to be part of this talented team at ACR,” said Mr. Bryant. “I have no doubt the collective efforts of the ACR team will continue to propel the success of the Company well into the future. Having hired and worked with Eldron for nine years at the Company and collaborated with him for six years prior as the Company’s auditor, I'm pleased to see a knowledgeable and high-caliber leader like Eldron step in as the next CFO of the Company.”

About ACRES Commercial Realty Corp.

ACRES Commercial Realty Corp. is a real estate investment trust that is primarily focused on originating, holding and managing commercial real estate mortgage loans and equity investments in commercial real estate properties through direct ownership and joint ventures. The Company is externally managed by ACRES Capital, LLC, a subsidiary of ACRES Capital Corp., a private commercial real estate lender exclusively dedicated to nationwide middle market commercial real estate lending with a focus on multifamily, student housing, hospitality, industrial and office property in top U.S. markets. For more information, please visit the Company’s website at www.acresreit.com or contact investor relations at IR@acresreit.com.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “continue,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “look forward” or other similar words or terms. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. Factors that can affect future results are discussed in the documents filed by the Company from time to time with the Securities and Exchange Commission, including, without limitation, factors impacting whether we will be able to maintain our sources of liquidity and whether we will be able to identify sufficient suitable investments to increase our originations. The Company undertakes no obligation to update or revise any forward-looking statement to reflect new or changing information or events after the date hereof or to reflect the occurrence of unanticipated events, except as may be required by law.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesCPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

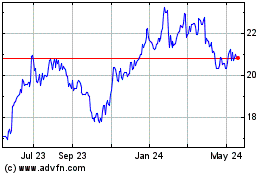

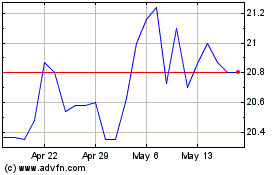

ACRES Commercial Realty (NYSE:ACR-D)

Historical Stock Chart

From Oct 2024 to Nov 2024

ACRES Commercial Realty (NYSE:ACR-D)

Historical Stock Chart

From Nov 2023 to Nov 2024