Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

August 05 2024 - 9:33AM

Edgar (US Regulatory)

AS FILED WITH THE SECURITIES

AND EXCHANGE COMMISSION

ON AUGUST 5, 2024

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

ISSUER TENDER OFFER STATEMENT

UNDER SECTION 13(e)(1) OF

THE

SECURITIES EXCHANGE ACT

OF 1934

(Amendment No. 1)

ADAMS DIVERSIFIED

EQUITY FUND, INC.

(Name of Subject Company)

ADAMS DIVERSIFIED

EQUITY FUND, INC.

(Name

of Filing Person (Issuer))

COMMON STOCK, $0.001

PAR VALUE

(Title of Class of

Securities)

006212104

(CUSIP Number of Class of

Securities)

Janis F. Kerns

Adams Diversified Equity Fund, Inc.

500 East Pratt Street, Suite 1300

Baltimore, Maryland 21202

(410) 752-5900

(Name,

Address and Telephone Number of Person Authorized to Receive

Notices and Communications

on Behalf of Filing Person)

¨ Check the box if the filing relates solely to preliminary communications

made before the commencement of a tender offer.

Check the appropriate boxes below to designate

any transactions to which the statement relates:

| ¨ |

third-party tender offer subject to Rule 14d-1. |

| |

|

| x |

issuer tender offer subject to Rule 13e-4. |

| |

|

| ¨ |

going-private transaction subject to Rule 13e-3. |

| |

|

| ¨ |

amendment to Schedule 13D under Rule 13d-2. |

| Check the following box if the filing is a final amendment reporting the results of the tender offer: ¨ |

|

EXPLANATORY NOTE

This Amendment No.1 to the Issuer Tender Offer

Statement on Schedule TO filed with the U.S. Securities and Exchange Commission on July 5, 2024, by Adams Diversified Equity Fund, Inc,.

a Maryland corporation (the “Fund”), relating to an offer to purchase for cash up to 12,405,174 shares of Common Stock, amends

such Issuer Tender Offer Statement on Schedule TO (“Statement”) to add and update exhibits in accordance with Rule 13e-4(c)(1) promulgated

under the Securities Exchange Act of 1934, as amended.

Except

as specifically provided herein, the information contained in the Statement, as amended, and the Transmittal Letter remains unchanged

and this Amendment does not modify any of the information previously reported on the Statement, as amended, or the Transmittal Letter.

ITEM 12. EXHIBITS

| (a)(5)(i) | Press Release dated August 5, 2024 |

| 107(i) | Calculation of Filing Fees Tables |

SIGNATURE

After due inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

ADAMS DIVERSIFIED EQUITY FUND, INC. |

| |

|

| |

/s/ Janis F. Kerns |

| |

Janis F. Kerns |

| |

V.P., General Counsel, Corporate Secretary, and Chief Compliance Officer |

| August 5, 2024 |

|

EXHIBIT INDEX

Exhibit (a)(5)(i)

Press Release

ADAMS DIVERSIFIED EQUITY FUND ANNOUNCES

PRELIMINARY TENDER OFFER RESULTS

BALTIMORE, MARYLAND, August 5, 2024 — Adams Diversified Equity Fund, Inc. (NYSE: ADX) announced today the preliminary results of its offer to purchase up to 12,405,174 of its common shares at $22.47, 98% of the $22.93 net asset value per share (“NAV”) at the close of regular trading on the New York Stock Exchange on August 2, 2024, the expiration date. The tender offer expired at 5:00 p.m. (ET) on August 2, 2024 and was not extended.

Based on the preliminary count by Equiniti Trust Company, LLC (“EQ”), the depositary for the tender offer, a total of 41,882,825 common shares of ADX were validly tendered and not withdrawn. The total amount of shares tendered exceeded the offer amount, and the Fund expects to purchase tendered shares on a pro rata basis.

In accordance with the terms and conditions of the tender offer and based on the preliminary count by EQ, ADX expects to accept for payment all 12,405,174 common shares subject to the tender offer.

The preliminary information contained in this press release is subject to confirmation by EQ. The final proration factor will be announced following completion by EQ of the confirmation process. Payment for the shares accepted for purchase under the tender offer and return of all other shares tendered and not purchased will occur promptly thereafter.

EQ Fund Solutions, LLC is the information agent for the Offer. Shareholders with questions may call EQ Fund Solutions, LLC at (888) 886-4425.

###

About Adams Funds

Since 1929, Adams Funds has consistently helped generations of investors reach their investment goals. Adams Funds is comprised of two closed-end funds, Adams Diversified Equity Fund, Inc. (NYSE: ADX) and Adams Natural Resources Fund, Inc. (NYSE: PEO). The Funds are actively managed by an experienced team with a disciplined approach and have paid dividends for more than 85 years across many market cycles. The Funds are committed to paying a minimum annual distribution rate of 8% of NAV or more, providing reliable income to long-term investors. Shares can be purchased through our transfer agent or through a broker. For more information about Adams Funds, please visit: adamsfunds.com.

For further information please contact: adamsfunds.com/about/contact or 800.638.2479

Statements in this press release that are not historical facts are “forward-looking statements” as defined by the U.S. securities laws. You should exercise caution in interpreting and relying on forward-looking statements because they are subject to uncertainties and other factors which are, in some cases, beyond the Fund’s control and could cause actual results to differ materially from those set forth in the forward-looking statements. All forward-looking statements are as of the date of this release only; the Fund undertakes no obligation to update or review any forward-looking statements.

EX-FILING

FEES

Calculation of

Filing Fee Table

SC TO-I

(Form Type)

Adams Diversified

Equity Fund, Inc.

(Name of Issuer)

Adams Diversified

Equity Fund, Inc.

(Name of Person(s)

Filing Statement)

Table 1: Transaction

Valuation

| |

|

Transaction

Valuation |

|

|

Fee

rate |

|

|

Amount

of

Filing Fee |

|

| Fees to Be

Paid |

|

|

|

|

|

|

--- |

|

|

|

--- |

|

| Fees Previously Paid |

|

$ |

288,048,140.00 |

(1) |

|

|

0.0001476 |

|

|

$ |

42,515.91 |

(2) |

| Total Transaction Valuation |

|

$ |

288,048,140.00 |

(1) |

|

|

|

|

|

|

|

|

| Total Fees Due for Filing |

|

|

|

|

|

|

|

|

|

$ |

0.00 |

|

| Total Fees Previously

Paid |

|

|

|

|

|

|

|

|

|

$ |

42,515.91 |

(2) |

| Total Fee Offsets |

|

|

|

|

|

|

|

|

|

$ |

0.00 |

|

| Net Fee Due |

|

|

|

|

|

|

|

|

|

$ |

0.00 |

|

| (1) |

The transaction value is calculated as the aggregate

maximum purchase price for common shares of beneficial interest (the “Shares”) of Adams Diversified Equity Fund, Inc.

(the “Fund”), based upon the offer price of 98% of the net asset value per share, as of June 28, 2024, of $23.22. This

amount is based upon the offer to purchase up to 12,405,174 Shares, par value $0.001 per share, of the Fund. |

| (2) |

Calculated at $147.60 per $1,000,000.00 of the Transaction

Valuation in accordance with Rule 0-11 under the Securities Exchange Act of 1934, as amended, as modified by Fee Rate Advisory No.

1 for fiscal year 2024. |

Table 2 –

Fee Offset Claims and Sources

| |

Registrant

or Filer

Name |

Form

or

Filing

Type |

File

Number |

Initial

Filing

Date |

Filing

Date |

Fee

Offset

Claimed |

Fee Paid with

Fee Offset Source |

| Fee Offset Claims |

Adams Diversified Equity Fund, Inc. |

SC TO-I |

811-00248 |

July 5, 2024 |

|

$42,515.91 |

|

| Fee Offset Sources |

|

|

|

|

July 5, 2024 |

|

$42,515.91 |

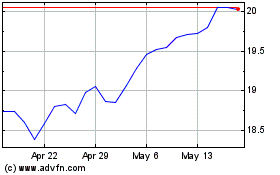

Adams Diversified Equity (NYSE:ADX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Adams Diversified Equity (NYSE:ADX)

Historical Stock Chart

From Dec 2023 to Dec 2024