Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

June 03 2024 - 3:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2024

Commission File Number: 001-38430

Meta Data Limited

Flat H 3/F, Haribest Industrial Building, 45-47

Au Pui Wan Street

Sha Tin New Territories

Hong Kong

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Receipt of Winding Up Petition

As previously disclosed by Meta Data Limited (the

“Company”), the Company is currently in default of certain banking facility agreement (the “Facility Agreement”)

dated March 27, 2019, as amended, by and among the Company, OneSmart Edu (HK) Limited, certain lenders named therein, and UBS AG Singapore

Branch as the Facility Agent (the “Facility Agent”). The term facility has a three-year term from the initial drawdown

date and should be repaid in installments. The Company drew down the $139 million term facility in full in March 2019 (the “Facility

Loan”). The proceeds from the Facility Loan were used for the Company’s share repurchase program, working capital, capital

expenditure, and other general corporate purposes.

On March 31, 2022, the Facility Agent issued an

acceleration notice and statutory demand to the Company, pursuant to which all of the outstanding balance on the Facility Loan of approximately

US$62 million became immediately due and payable.

On December 28, 2023, China Minsheng Banking Corp.,

Ltd. Hong Kong Branch (“CMBC”), one of the lenders under the Facility Agreement served a second statutory demand on

the Company demanding that the Company pay the outstanding balance on the Facility Loan of approximately US$15.6 million due to CMBC within

twenty-one (21) days of the date of the statutory demand, failing which CMBC may present a winding up petition against the Company.

On April 22, 2024, a winding up petition was presented

to the Grand Court of the Cayman Islands (the “Court”) against the Company by CMBC (the “Petition”)

on the basis that the Company is unable to pay its debts. The Petition is also seeking appointment by the Court that Simon Richard Conway

of PwC Corporate Finance & Recovery (Cayman) Limited and Ka Yee Annette Lee and Yat Kit Jong (Victor) of PricewaterhouseCoopers Limited,

be appointed as joint official liquidators. Management is currently exploring different options to address the Petition, which will be

subject to the Court’s decision which may grant, decline or modify the Petition as it sees fit. According to the notice of hearing,

the initial hearing of the Petition is scheduled to take place at the Court on June 11, 2024.

The ultimate resolution of the proceedings may

have a material adverse impact on the Company’s business, financial condition, results of operations or cash flows. Failure to settle

the proceedings or other unfavorable outcomes in the proceedings - including but not limited to the winding up of the Company or the appointment

of joint official liquidators - could result in significant damages, additional penalties or other remedies imposed against the Company.

Litigation of this kind could result in substantial costs and a diversion of the Company management’s attention and resources. It

could also result in the Company’s reputation being harmed and the Company’s stock price could decline as a result of allegations

made in the course of the proceedings, regardless of the truthfulness of the allegations.

Forward Looking Statement

This report contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Such forward-looking statements are made under the “safe harbor” provisions of the U.S. Private Securities

Litigation Reform Act of 1995. All statements other than statements of historical fact in this report are forward-looking statements,

including but not limited to, the results of the winding-up petition and application for appointment of provisional liquidators.

These forward-looking statements can be identified by terminology such as “will,” “expects,” “is expected

to,” “anticipates,” “aim,” “future,” “intends,” “plans,” “believes,”

“are likely to,” “estimates,” “may,” “should” and similar expressions, and include, without

limitation, statements regarding the Company’s future financial performance, revenue guidance, growth and growth rates, market position

and continued business transformation. Such statements are based upon management’s current expectations and current market and operating

conditions, and relate to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict

and many of which are beyond the Company’s control, which may cause its actual results, performance or achievements to differ materially

from those in the forward-looking statements. Further information regarding these and other risks, uncertainties or factors is included

in the Company’s filings with the U.S. Securities and Exchange Commission.

The Company does not undertake any obligation

to update any forward-looking statement as a result of new information, future events or otherwise, except as required under law.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Meta Data Limited |

| |

|

| |

By : |

/s/ Xiaoming Li |

| |

Name : |

Xiaoming Li |

| |

Title : |

Chairman of the Board of Directors and Chief Executive Officer |

Date: June 3, 2024

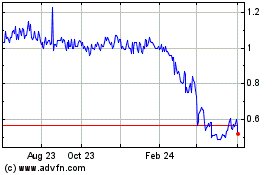

Meta Data (NYSE:AIU)

Historical Stock Chart

From Feb 2025 to Mar 2025

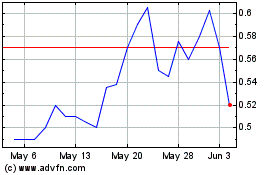

Meta Data (NYSE:AIU)

Historical Stock Chart

From Mar 2024 to Mar 2025