CORRECTING and REPLACING Acadia Realty Trust to Present at BofA Securities 2024 Global Real Estate Conference

September 10 2024 - 12:12PM

Business Wire

Please replace the release dated September 4, 2024, with the

following corrected version due to multiple revisions.

The updated release reads:

ACADIA REALTY TRUST TO PRESENT AT BOFA

SECURITIES 2024 GLOBAL REAL ESTATE CONFERENCE

Acadia Realty Trust (NYSE: AKR) (“Acadia” or the “Company”)

today announced that it will participate at the BofA Securities

2024 Global Real Estate Conference.

BofA Securities 2024 Global Real Estate

Conference

Acadia will participate at the BofA Securities 2024 Global Real

Estate Conference which will be held September 10-12, 2024. Kenneth

F. Bernstein, Acadia’s President and Chief Executive Officer, is

scheduled for a roundtable discussion on Wednesday, September 11,

2024, at 4:30 pm ET. The Company’s presentation materials will be

posted on its website under “Investors - Presentations &

Events.”

Acadia will also host individual meetings with investors during

the conference.

About Acadia

Acadia Realty Trust is an equity real estate investment trust

focused on delivering long-term, profitable growth. Acadia owns and

operates a high-quality core real estate portfolio ("Core" or "Core

Portfolio") of street and open-air retail properties in the

nation's most dynamic retail corridors, along with an investment

management platform that targets opportunistic and value-add

investments through its institutional co-investment vehicles

("Investment Management"). For further information, please visit

www.acadiarealty.com.

The Company uses, and intends to use, the Investors page of its

website, which can be found at www.acadiarealty.com/investors, as a

means of disclosing material nonpublic information and of complying

with its disclosure obligations under Regulation FD, including,

without limitation, through the posting of investor presentations

and certain portfolio updates. Additionally, the Company also uses

its LinkedIn profile to communicate with its investors and the

public. Accordingly, investors are encouraged to monitor the

Investors page of the Company's website and its LinkedIn profile,

in addition to following the Company’s press releases, SEC filings,

public conference calls, presentations and webcasts.

Safe Harbor Statement

Certain statements in this press release may contain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements, which are based on certain assumptions and describe the

Company's future plans, strategies and expectations are generally

identifiable by the use of words, such as “may,” “will,” “should,”

“expect,” “anticipate,” “estimate,” “believe,” “intend” or

“project,” or the negative thereof, or other variations thereon or

comparable terminology. Forward-looking statements involve known

and unknown risks, uncertainties and other factors that could cause

the Company's actual results and financial performance to be

materially different from future results and financial performance

expressed or implied by such forward-looking statements, including,

but not limited to: (i) macroeconomic conditions, including due to

geopolitical conditions and instability, which may lead to a

disruption of or lack of access to the capital markets, disruptions

and instability in the banking and financial services industries

and rising inflation; (ii) the Company’s success in implementing

its business strategy and its ability to identify, underwrite,

finance, consummate and integrate diversifying acquisitions and

investments; (including the potential acquisitions discussed in

this press release); (iii) changes in general economic conditions

or economic conditions in the markets in which the Company may,

from time to time, compete, and their effect on the Company’s

revenues, earnings and funding sources; (iv) increases in the

Company’s borrowing costs as a result of rising inflation, changes

in interest rates and other factors; (v) the Company’s ability to

pay down, refinance, restructure or extend its indebtedness as it

becomes due; (vi) the Company’s investments in joint ventures and

unconsolidated entities, including its lack of sole decision-making

authority and its reliance on its joint venture partners’ financial

condition; (vii) the Company’s ability to obtain the financial

results expected from its development and redevelopment projects;

(viii) the ability and willingness of the Company's tenants to

renew their leases with the Company upon expiration, the Company’s

ability to re-lease its properties on the same or better terms in

the event of nonrenewal or in the event the Company exercises its

right to replace an existing tenant, and obligations the Company

may incur in connection with the replacement of an existing tenant;

(ix) the Company’s potential liability for environmental matters;

(x) damage to the Company’s properties from catastrophic weather

and other natural events, and the physical effects of climate

change; (xi) the economic, political and social impact of, and

uncertainty surrounding, any public health crisis, such as the

COVID-19 Pandemic, which adversely affected the Company and its

tenants’ business, financial condition, results of operations and

liquidity; (xii) uninsured losses; (xiii) the Company’s ability and

willingness to maintain its qualification as a REIT in light of

economic, market, legal, tax and other considerations; (xiv)

information technology security breaches, including increased

cybersecurity risks relating to the use of remote technology; (xv)

the loss of key executives; and (xvi) the accuracy of the Company’s

methodologies and estimates regarding environmental, social and

governance (“ESG”) metrics, goals and targets, tenant willingness

and ability to collaborate towards reporting ESG metrics and

meeting ESG goals and targets, and the impact of governmental

regulation on its ESG efforts.

The factors described above are not exhaustive and additional

factors could adversely affect the Company’s future results and

financial performance, including the risk factors discussed under

the section captioned “Risk Factors” in the Company’s most recent

Annual Report on Form 10-K and other periodic or current reports

the Company files with the SEC. Any forward-looking statements in

this press release speak only as of the date hereof. The Company

expressly disclaims any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statements

to reflect any changes in the Company’s expectations with regard

thereto or changes in the events, conditions or circumstances on

which such forward-looking statements are based.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240904696093/en/

Sandra Liang (914) 288-3356

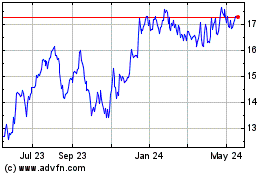

Acadia Realty (NYSE:AKR)

Historical Stock Chart

From Dec 2024 to Jan 2025

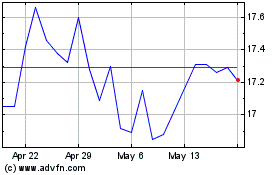

Acadia Realty (NYSE:AKR)

Historical Stock Chart

From Jan 2024 to Jan 2025