Form 8-K - Current report

November 26 2024 - 7:44AM

Edgar (US Regulatory)

false 0000040729 0000040729 2024-11-20 2024-11-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

(Date of report; date of earliest event reported)

November 20, 2024

(Date of report; date of earliest event reported)

Commission file number: 1-3754

ALLY FINANCIAL INC.

(Exact name of registrant as specified in its charter)

|

|

|

| Delaware |

|

38-0572512 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

Ally Detroit Center

500 Woodward Avenue, Floor 10,

Detroit, Michigan 48226

(Address of principal executive offices)

(Zip Code)

(866) 710-4623

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act (listed on the New York Stock Exchange):

|

|

|

|

|

| Title of each class |

|

Trading symbols |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

ALLY |

|

NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Jason E. Schugel transitioned from his position as Chief Risk Officer of Ally Financial Inc. (Ally) effective November 20, 2024, and into the role of Senior Operating Adviser. Stephanie N. Richard was appointed Chief Risk Officer effective that same time.

In connection with his transition, Mr. Schugel and Ally entered into a Transition Services and Release Agreement (Agreement) dated November 25, 2024. Subject to its terms and conditions, the Agreement provides for Mr. Schugel (1) to receive his current base salary and remain eligible for equivalent benefits and perquisites until his departure from Ally on or before March 31, 2025 (Transition End Date); (2) to remain eligible for the full-year discretionary 2024 cash and equity-based incentive-compensation awards commensurate with the position of Chief Risk Officer and his and Ally’s 2024 performance as determined by the Compensation, Nominating, and Governance Committee; provided however that if he has reasonably and in good faith satisfied the terms and conditions contained in the Agreement, such 2024 incentive-compensation awards will be no less than 80% of his 2024 target incentive compensation of $1.85 million, with 40% in the form of cash to be paid at the same time as that of other named executive officers (regardless of his earlier termination of employment) and 60% in the form of fully vested RSUs to be granted at the same time and shall settle one-third on each of the first, second, and third anniversaries of the grant date (without requirement of further employment); (3) to be reimbursed for outplacement assistance, executive network and/or executive coaching fees and/or legal or financial advice to a maximum of $20,000; (4) to receive as soon as reasonably practicable after the Transition End Date a lump-sum cash payment of $700,000; (5) to fully vest on the Transition End Date in his then unvested time-based equity awards, including restricted stock units and “Own It Awards,” with each such award settling as originally scheduled, and (6) to fully vest on the Transition End Date in his then unvested performance-based stock unit awards, with each such award settling as originally scheduled subject to (a) the achievement of the related performance goals and (b) if the achievement of the related performance goals exceeds the target, a proration of the number of shares distributable in excess of the target number of shares based on the number of calendar days during the performance period when he was employed by Ally. The Agreement also includes terms and conditions governing Mr. Schugel’s provision of services to Ally until his departure, his general release of claims subject to customary exceptions, his obligations of confidentiality and cooperation, and other customary provisions. A copy of the Agreement is attached as Exhibit 10.1 and incorporated by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

ALLY FINANCIAL INC. |

|

|

|

|

|

|

(Registrant) |

|

|

|

|

| Date: |

|

|

|

November 26, 2024 |

|

/s/ Jeffrey A. Belisle |

| |

|

|

|

|

|

Jeffrey A. Belisle |

| |

|

|

|

|

|

Corporate Secretary |

Ally Proprietary

EXHIBIT 10.1

TRANSITION SERVICES AND RELEASE AGREEMENT

Jason Schugel and the Company (as defined in the next sentence) have reached the following Transition Services and Release Agreement (the

“Agreement”). In this Agreement, “Employee” refers to Jason Schugel, “Company” refers to Ally Financial Inc. and its current affiliates (including Ally Bank) and divisions, and “Released Party” or

“Released Parties” refers to the Company and its shareholders, predecessors, successors, joint ventures, employee benefit plans, directors, officers, agents, employees, and assigns.

WHEREAS the Company and Employee have agreed that it is in their best interest to change Employee’s duties from the role of Chief Risk

Officer (“CRO”) to an interim role as Senior Operating Adviser and then to terminate their employment relationship, in each case, according to the terms set forth below, and THEREFORE, the parties agree as follows:

| |

1. |

Provided this signed document is received by Kathleen Patterson, Ally Chief Human Resources Officer, 500

Woodward Ave., Detroit, MI 48226, no later than December 11, 2024, and not revoked in accordance with Paragraph 17: |

| |

a. |

Effective at 12:01 am ET on November 20, 2024, Employee resigned from his position as CRO and all related

board and management committee positions and commence a transitional assignment reporting directly to the Company’s Chief Executive Officer in the role of Senior Operating Adviser. |

| |

b. |

As Senior Operating Adviser, Employee’s primary role will be to assist with the transition of CRO

responsibilities to the newly appointed CRO and to provide such other assistance to the Company, as reasonably requested by the Company from time to time. Employee is expected to work remotely and shall have flexibility in his working hours to seek

other employment opportunities. |

| |

c. |

From the date of this Agreement through the end of the transitional assignment, Employee will:

|

| |

i. |

receive the same base salary (i.e., $650,000 annually), payable in accordance with the Company’s standard

payroll practices; |

Ally Proprietary

| |

ii. |

remain eligible for the full-year discretionary 2024 cash and equity-based incentive-compensation awards

commensurate with the CRO role and his and the Company’s 2024 performance as determined by the Company’s Compensation, Nominating, and Governance Committee; provided however that if Employee has reasonably and in good faith satisfied the

terms and conditions contained in this Agreement, such 2024 incentive-compensation awards will be no less than 80% of Employee’s 2024 target incentive compensation of $1.85 million, with 40% in the form of cash to be paid in a lump sum

payment at the same time as that of other executive officers (regardless of Employee’s earlier termination of employment as CRO) and 60% in the form of fully vested restricted stock units (“RSUs”) to be granted at the same time as the

lump sum cash payment, which shall settle in shares of Company common stock one-third on each of the first, second, and third anniversaries of the grant date (without requirement of further employment) or as

soon as administratively possible after such anniversary dates (but in no event more than fifteen (15) days following the applicable anniversary date). If the Employee dies before the settlement of any portion of the RSUs, the Company will

transfer the stock payable with respect to the RSUs to the Employee’s estate); |

| |

iii. |

remain eligible for equivalent benefits and perquisites, including the broad-based benefits to which other

active Company employees are eligible (e.g., 401(k), medical coverage, life insurance, paid time off, etc.); |

| |

iv. |

be subject to all the same terms and conditions of employment to which other active Company employees are

subject; and |

| |

v. |

not be eligible to receive any 2025 incentive compensation. |

| |

d. |

Employee’s transitional assignment will end on March 31, 2025, or such earlier date as provided in

Paragraph 2 (the “Transition End Date”), at which point Employee’s employment will terminate by mutual consent. Provided Employee has satisfied the terms and conditions contained in this Agreement (including signing, returning, and

not revoking the Re-Acknowledgement appended to this Agreement as contemplated by Paragraph 17), Employee will receive: |

| |

i. |

as soon as reasonably practicable after the Transition End Date (but in no event more than fifteen

(15) days following the Transition End Date), a lump sum cash payment of $700,000, less applicable tax withholdings and any outstanding debts to the Company, including any corporate credit card balance; and |

Page 2 of 16

Ally Proprietary

| |

ii. |

reimbursement of outplacement assistance, executive network and/or executive coaching fees and/or legal or

financial advice through the vendor of Employee’s choosing, up to a maximum of $20,000, in accordance with the Company’s expense reimbursement policy. |

| |

2. |

Employee agrees that the elements of consideration referred to in Paragraph 1 are more than the Company is

required to provide under its normal policies and procedures. Employee agrees to remain actively employed and endeavor in good faith to meet the specific objectives required of his role as Senior Operating Adviser during the transitional assignment.

Notwithstanding the above, if Employee wishes to terminate his employment prior to March 31, 2025, other than as a result of the Company’s material breach of this Agreement, he will provide the Company with at least two-weeks advance written notice, at which point: |

| |

a. |

If his planned employment termination date is between January 1, 2025 and March 31, 2025, the Company

shall record the Transition End Date as occurring on the new date, provide Employee with his 2024 incentive-compensation awards on the terms and conditions (including the times) contained in Paragraph 1.c., pay Employee the separation allowance and

reimbursement of outplacement or other assistance as provided in Paragraph 1.d, and provide the favorable equity-award treatment described in Paragraph 5 but no salary, other compensation, or benefits or perquisites after the new employment

termination date (other than salary earned but not yet paid); or |

| |

b. |

If his planned termination date is on or before January 1, 2025, the Company may agree to a new Transition

End Date (such agreement not to be unreasonably withheld) or else afford Employee with a period of no less than three business days to withdraw his resignation, and if Employee does not withdraw his resignation within that period, deem

Employee’s separation as a voluntary resignation at the end of that period, meaning Employee will not receive further salary and other compensation after the end of that period (other than amounts earned but not yet paid), benefits and

perquisites will be terminated at the end of the month in which the employment termination occurs, Employee forfeits the separation allowance and reimbursement of outplacement or other assistance described in Paragraph 1.d, and Employee loses the

favorable equity award treatment described in Paragraph 5. |

Page 3 of 16

Ally Proprietary

Under either scenario described in Paragraphs 2.a or 2.b, the release language contained in

Paragraph 3 remains in full force and effect. The Company will not terminate Employee’s employment prior to the Transition End Date, other than for “Cause” as defined under the Ally Financial Inc. Incentive Compensation Plan

(“ICP”) (including a material breach by Employee of this Agreement). If Employee’s employment is so terminated for Cause, Paragraphs 1.c and 1.d will not apply.

| |

3. |

Employee for himself, family, heirs, insurers, assigns, and representatives further agrees to release the

Released Parties from all rights, claims, and demands he may have based on or related in any manner to his employment with the Company, this Agreement, or the termination of his employment, in each case, of any kind or nature whatsoever, whether

accrued or unaccrued or known or unknown, up to the effective date of this Agreement. This waiver and release specifically includes a waiver and release of any rights, claims, or demands Employee may have under: |

| |

• |

|

the Employee Retirement Income Security Act of 1974, as amended, which regulates employee benefit plans;

|

| |

• |

|

Title VII of the Civil Rights Act of 1964, as amended, the Civil Rights and Women’s Equity Act of 1991, as

amended, and the Equal Pay Act of 1963, as amended, which prohibit discrimination in employment based on race, color, national origin, religion, or sex; |

| |

• |

|

the Age Discrimination in Employment Act, which prohibits discrimination based on age; |

| |

• |

|

the Rehabilitation Act of 1973, as amended, and the Americans with Disabilities Act, as amended, which prohibit

discrimination based on disability; |

| |

• |

|

the Family and Medical Leave Act, as amended; |

| |

• |

|

the Worker Adjustment and Retraining Notification Act (WARN), as amended; |

Page 4 of 16

Ally Proprietary

| |

• |

|

the National Labor Relations Act, as amended; |

| |

• |

|

state fair employment practices or civil rights laws; and |

| |

• |

|

any other federal, state, or local laws or any common law actions relating to employment or employment

discrimination. |

This waiver and release includes any rights, claims, and demands arising under tort, contract, or

quasi-contract, such as breach of employment contract, either expressed or implied, violation of public policy, breach of implied covenant of good faith and fair dealing, intentional infliction of emotional distress, negligent infliction of

emotional distress, fraud, false imprisonment, invasion of privacy, commercial or trade defamation, defamation, slander, libel, tortious interference with contract or prospective business advantage, promissory estoppel, and wrongful discharge. This

waiver and release does not foreclose Employee’s ability to file an administrative charge with any administrative agency, including the Equal Employment Opportunity Commission (“EEOC”), but Employee expressly waives and releases to

the maximum extent permitted by law any right or claim to or demand for monetary relief in connection with any charge that he files should any administrative agency, including the EEOC, pursue any claim on his behalf. For the avoidance of doubt,

nothing herein shall be construed to prevent or limit Employee from recovering a bounty or award for providing truthful information to any governmental authority concerning any suspected violation of law. This waiver and release does not include any

claims: (a) to vested 401(k) benefits; (b) to unemployment compensation; or (c) under the express terms of this Agreement. If any right, claim, or demand is not subject to waiver or release, to the extent permitted by law, Employee

waives and releases any right or ability to be a class or collective action representative or to

Page 5 of 16

Ally Proprietary

otherwise participate in any putative or certified class, collective, or multi-party action or proceeding based on or related to such a right, claim, or demand in which any Released Party is

a party or may be liable. Employee promises not to consent to become a member of any class or collective in a case pertaining to private claims in which rights, claims, or demands are asserted against any Released Party that are related in any

way to his employment with the Company, this Agreement, or the termination of his employment with the Company. If Employee is made a member of a class or collective in such an action or proceeding, Employee will immediately opt out of the class or

collective.

| |

4. |

Employee understands and agrees that, by signing this Agreement, he expressly waives and releases any right,

claim, or demand to severance benefits under the Ally Financial Inc. Severance Plan. |

| |

5. |

Provided Employee has reasonably and in good faith satisfied the terms and conditions contained in this

Agreement (including signing, returning, and not revoking the Re-Acknowledgement appended to this Agreement as contemplated by Paragraph 17), Employee’s then unvested time-based equity awards, including

RSUs and “Own It Awards”, will fully vest on the Transition End Date, with each such award settling as originally scheduled. Additionally, Employee’s then unvested performance-based stock unit awards will fully vest on the Transition

End Date, with each such award settling as originally scheduled subject to (a) the achievement of the related performance goals and (b) if the achievement of the related performance goals exceeds the target, a proration of the number of

shares distributable in excess of the target number of shares based on the number of |

Page 6 of 16

Ally Proprietary

| |

calendar days during the performance period when Employee was employed by the Company. All other terms and conditions contained in the ICP and Employee’s award letters remain in full force

and effect. |

| |

6. |

The Company and Employee make this Agreement to avoid the cost of litigating against any possible lawsuit or

claims. By making this Agreement, neither the Company nor Employee admits that it or he has done anything wrong. |

| |

7. |

If the Company successfully asserts this Agreement as a defense against a future action, proceeding, claim, or

demand by or on behalf of Employee, Employee will pay for all fees and costs incurred by the Company in its defense, including all reasonable fees of attorneys and related costs. |

| |

8. |

Employee is advised to consult with an attorney before signing this Agreement. Employee understands that

whether or not he does so is his decision and that he will have until December 11, 2024, to accept or reject this Agreement. |

| |

9. |

Employee understands that, following the Transition End Date, he has no right to reemployment with the Company

and any reemployment decision is solely within the Company’s discretion. |

Employee understands and acknowledges

that, during the course of his employment with the Company, he had access and was privy to documents, materials, data, and other tangible and intangible information relating to the Company that are secret, confidential, or proprietary or that

constitute or contain trade secrets, privileged information, attorney work product, or matters subject to an attorney-client privilege, the disclosure of which will cause irreparable harm to the Company (the “Confidential Information”).

Employee affirms his duties and

Page 7 of 16

Ally Proprietary

obligations relating to the Confidential Information, including those under law and the Company’s policies and procedures, and promises (a) to promptly return to the Company all

Confidential Information that is in his possession or under his control or that he has directly or indirectly given to others outside the ordinary course of his employment and (b) not to discuss, disclose, or make available to any person or

entity any Confidential Information without the express permission of the Company. For clarity, Confidential Information does not include any information that is or becomes generally available to the public other than as a result of a breach of the

Employee’s duties and obligations to the Company, including under this Agreement.

Under current law, an individual cannot be held

criminally or civilly liable under any federal or state trade secret law for any disclosure of a trade secret that is made (i) in confidence to federal, state, or local government officials, either directly or indirectly, or to an attorney, and

is solely for the purpose of reporting or investigating a suspected violation of the law; (ii) under seal in a complaint or other document filed in a lawsuit or other proceeding; or (iii) to the individual’s attorney in connection

with a lawsuit for retaliation for reporting a suspected violation of law (and the trade secret may be used in the court proceedings for such lawsuit) as long as any document containing the trade secret is filed under seal and the trade secret is

not disclosed except pursuant to court order. Nothing in this Agreement prohibits Employee or his attorney from (a) initiating communications directly with, responding to any inquiry from, filing a charge with, participating in an investigation

conducted by, or providing testimony before the SEC, FINRA, or any other self-

Page 8 of 16

Ally Proprietary

regulatory organization or any other state or federal regulatory authority and Employee would not need the Company’s permission to do so, (b) obtaining any monetary award or other

payment to which Employee may be entitled from any federal or state governmental authority (including the SEC) or FINRA other than those that may be lawfully waived in accordance with Paragraph 3 and this Agreement shall not be read as requiring

Employee to waive any right Employee may have to receive an award for information provided to any governmental authority, or (c) disclosing any such information to the extent required by law or binding judicial or other governmental order or

process, provided that Employee gives prompt notice of such requirement to the Company, if legally permissible. In addition, it is understood that this Agreement shall not require Employee to notify the Company of a request for information from any

governmental authority or of Employee’s decision to file a charge with or participate in an investigation conducted by any governmental authority. Notwithstanding the foregoing, Employee recognizes that, in connection with the provision of

information to any governmental authority, Employee must inform such governmental authority that the information Employee is providing is confidential. Despite the foregoing, Employee is not permitted to reveal to any third party, including any

governmental authority, information Employee came to learn during Employee’s service to the Company that is protected from disclosure by any applicable privilege, including but not limited to the attorney-client privilege or attorney work

product doctrine. The Company does not waive any applicable privileges or the right to continue to protect its privileged attorney-client information, attorney work product, and other privileged information.

Page 9 of 16

Ally Proprietary

The Company may not retaliate against Employee for any of these activities. Employee acknowledges that a breach of this Paragraph 9 will entitle the Company to legal and equitable relief.

| |

10. |

Employee acknowledges that he is able to work and suffers from no disability that would preclude his from doing

his regularly assigned job. |

| |

11. |

Employee understands and agrees that (a) the existence and content of this Agreement may be publicly

disclosed in accordance with applicable law, (b) the negotiations, discussions, and proceedings leading up to this Agreement are confidential and (c) Employee, his attorney, and any person or entity acting on his or his attorney’s

behalf may not disclose any of the negotiations, discussions, or proceedings leading up to this Agreement or any other person or entity except as expressly required by law. |

| |

12. |

Employee must provide complete information to the Company and its legal counsel in connection with any claim,

demand, investigation, action or proceeding relating to the Company, including Employee’s knowledge and belief of any facts and circumstances arising during his employment with the Company. This does not mean that Employee must provide

information that is favorable to the Company; it means only that Employee will provide information within Employee’s knowledge and possession upon the Company’s request. The Company will provide reasonable advance notice of any requirement

for this information and will reimburse Employee for all reasonable and documented expenses incurred in providing it, including reimbursement for reasonable fees of attorneys and related costs if Employee in good faith believes independent counsel

to be necessary. |

Page 10 of 16

Ally Proprietary

Employee will not provide this information against his own legal interests or the legal interests of any subsequent employer or business partner, except to the extent required by law or binding

judicial or other governmental order or process.

| |

13. |

Employee will retain all rights to be indemnified by the Company under its governing documents, enterprise

policies, written agreements, and directors’ and officers’ liability insurance policies in connection with any third-party claim, demand, investigation, action or proceeding. |

| |

14. |

Employee affirms that he will or, as of his Transition End Date, he has returned all Company property,

including computers tablets, mobile phones and other devices, Company credit and telephone cards, ID cards, building passes, keys, and any other items that were issued or purchased by the Company. |

| |

15. |

Employee will be permitted to remove from Company premises and devices his personal papers and personal

electronic files, personal contact lists, files of nonproprietary third-party research and media articles, and personal effects, subject to oversight that the Company, in its sole discretion, judges to be necessary or appropriate.

|

| |

16. |

Employee understands that he has been given a period of at least

twenty-one (21) days to review and consider this Agreement before signing it. Employee further understands that he may use as much of this period as he wishes prior to signing. In order for this Agreement

to become effective, Employee must return a signed and original to Kathleen Patterson as per Paragraph 1 no later than December 11, 2024. If executed or returned after that date, the Company, in its sole discretion, may declare this Agreement

null and void. |

Page 11 of 16

Ally Proprietary

| |

17. |

The benefits described in Paragraphs 1.c, 1.d, and 5 are subject to Employee signing and returning the Re-Acknowledgement appended to this Agreement to Kathleen Patterson (or her designate) on his last day of employment and not revoking the Re-Acknowledgement in accordance with

this Paragraph 17. Employee may revoke this Agreement or the Re-Acknowledgement (as applicable) within seven (7) days of signing it. Revocation can be made by delivering a written notice to Kathleen

Patterson. For this revocation to be effective, written notice must be received by Kathleen Patterson no later than the seventh (7th) day after Employee signs this Agreement or the Re-Acknowledgement (as

applicable). If Employee revokes this Agreement in accordance with this Paragraph 17, it will not be effective or enforceable and he will not receive the benefits described in Paragraphs 1 and 5. If Employee revokes the Re-Acknowledgement in accordance with this Paragraph 17, he will not receive the benefits described in Paragraphs 1.c, 1.d, or 5. |

| |

18. |

Employee shall not be required to mitigate the amount of any payment provided pursuant to this Agreement or any

equity award agreement by seeking other employment or otherwise, and the amount of any payment provided for pursuant to this Agreement or any equity award agreement shall not be reduced by any compensation earned as a result of Employee’s other

employment after the Transition End Date or other income. |

| |

19. |

This Agreement will be governed by North Carolina law without regard to its conflict of laws provisions. For

purposes of enforcement of this Agreement, Employee agrees to submit to the jurisdiction of any federal or state court in North Carolina. Should any provision of this Agreement be declared illegal or

|

Page 12 of 16

Ally Proprietary

| |

unenforceable by any court of competent jurisdiction and cannot be modified to be enforceable, excluding the release language in Paragraph 3, only such provision will be affected, leaving the

remainder of this Agreement in full force and effect. However, if any portion of the release language in Paragraph 3 is declared unenforceable for any reason as a result of any lawsuit, claim, or demand by Employee, Employee will return to the

Company the payments paid in accordance with Paragraphs 1.c.ii and 1.d in addition to any amounts he must pay in accordance with Paragraph 7. |

| |

20. |

While Employee will not be subject to the Company’s Enterprise Insider Trading and Blackout Policy after

his departure from the Company, he acknowledges that he may continue to be aware of or otherwise possess material nonpublic information about the Company or its securities and will remain subject to all insider-trading and other securities laws.

|

| |

21. |

It is the intent of the parties that the payments and benefits under this Agreement comply with or be exempt

from Section 409A of the Internal Revenue Code, and the regulations and guidance thereunder (“Section 409A”), and, accordingly, to the maximum extent permitted, this Agreement shall be interpreted to be in compliance therewith.

Furthermore, notwithstanding anything in this Agreement to the contrary, any compensation or benefits payable under this Agreement that is considered nonqualified deferred compensation under Section 409A and is designated under this Agreement

as payable upon Employee’s termination of employment shall be payable only upon Employee’s “separation from service” with the Company within the meaning of Section 409A. |

Page 13 of 16

Ally Proprietary

| |

22. |

This Agreement, Employee’s award letters, and the ICP comprise the entire agreement between Employee and

the Company. The Company has made no promises to Employee other than those in this Agreement. |

INTENTIONALLY BLANK

Page 14 of 16

Ally Proprietary

EMPLOYEE ACKNOWLEDGES THAT HE HAS READ THIS AGREEMENT, UNDERSTANDS IT AND IS VOLUNTARILY ENTERING INTO IT.

PLEASE READ THIS AGREEMENT CAREFULLY. IT CONTAINS A RELEASE OF ALL KNOWN AND UNKNOWN CLAIMS.

Accepted:

|

|

|

|

|

| /s/ Jason Schugel |

|

|

|

11/24/2024 |

| Jason Schugel |

|

|

|

Dated |

Accepted:

|

|

|

|

|

| /s/ Kathleen Patterson |

|

|

|

11/25/2024 |

| Kathleen Patterson Ally Financial

Inc. |

|

|

|

Dated |

Page 15 of 16

Ally Proprietary

Re-Acknowledgement

EMPLOYEE RE-ACKNOWLEDGES THAT HE HAS READ THIS AGREEMENT, UNDERSTANDS IT AND IS VOLUNTARILY RE-ENTERING INTO IT AS OF THE LAST DATE OF HIS EMPLOYMENT. PLEASE READ THIS AGREEMENT CAREFULLY. IT CONTAINS A RELEASE OF ALL KNOWN AND UNKNOWN CLAIMS.

Re-Accepted as of Transition End Date:

Re-accepted as of Transition End Date:

|

|

|

|

|

| |

|

|

|

|

| Kathleen Patterson Ally Financial

Inc. |

|

|

|

Dated |

Page 16 of 16

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

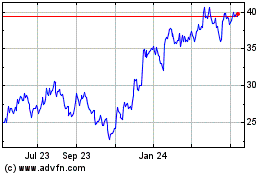

Ally Financial (NYSE:ALLY)

Historical Stock Chart

From Dec 2024 to Jan 2025

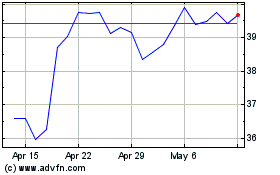

Ally Financial (NYSE:ALLY)

Historical Stock Chart

From Jan 2024 to Jan 2025