0000874501FALSE00008745012024-06-052024-06-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Amendment No. 1)

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): (June 5, 2024)

| | |

| Ambac Financial Group, Inc. |

| (Exact name of Registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 1-10777 | | 13-3621676 |

| (State of incorporation) | | (Commission

file number) | | (I.R.S. employer

identification no.) |

| | | | | | | | | | | |

| One World Trade Center | New York | NY | 10007 |

| (Address of principal executive offices) |

| | | | | | | | | | | |

| (212) | 658-7470 | |

| (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☒ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | AMBC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

| | | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to |

| Section 13(a) of the Exchange Act. | ☐ | |

Item 8.01. Other Events.

On June 5, 2024, Ambac Financial Group, Inc. made available the transcript from the investor conference call, which is filed as Exhibit 99.1 to this Current Report on Form 8-K.

Additional Information and Where to Find It

In connection with the AAC Transaction, the Company will file with the SEC and furnish to the Company’s stockholders a proxy statement. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE AAC TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT (IF ANY) BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE AAC TRANSACTION AND THE PARTIES TO THE AAC TRANSACTION. Investors and stockholders may obtain a copy of documents filed by the Company with the SEC at the SEC’s website at http://www.sec.gov. In addition, investors and stockholders may obtain a free copy of the Company’s filings with the SEC from the Company’s website at https://ambac.com/investor-relations.

Participants in the Solicitation

The Company and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the AAC Transaction. Information about the directors and executive officers of the Company is set forth in its definitive proxy statement, which AFG filed with the SEC on April 26, 2024. Investors may obtain additional information regarding the interests of such participants by reading the proxy statement and other relevant materials regarding the proposed transaction when they become available.

Forward-Looking Statements

In this report, there are statements that may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words such as “estimate,” “project,” “plan,” “believe,” “anticipate,” “intend,” “planned,” “potential” and similar expressions, or future or conditional verbs such as “will,” “should,” “would,” “could,” and “may,” or the negative of those expressions or verbs, identify forward-looking statements. We caution readers that these statements are not guarantees of future performance. Forward-looking statements are not historical facts but instead represent only our beliefs regarding future events, which may by their nature be inherently uncertain and some of which may be outside our control. These statements may relate to plans and objectives with respect to the future, among other things which may change. We are alerting you to the possibility that our actual results may differ, possibly materially, from the expected objectives or anticipated results that may be suggested, expressed or implied by these forward-looking statements. Important factors that could cause our results to differ, possibly materially, from those indicated in the forward-looking statements, include, among others, those discussed under “Risk Factors” in our most recent SEC filed quarterly or annual report, the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the AAC Transaction Purchase Agreement and the Beat Transaction Purchase Agreement (each a “Transaction” and together, the “Transactions”); the outcome of any legal proceedings that may be instituted against the parties to the Transactions; the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the Transactions), and the Company shareholder approval required in respect of the AAC Transaction or to satisfy any of the other conditions to the Transactions on a timely basis or at all; the possibility that either or both of the Transactions may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the Transactions; the ability of the parties to consummate one or both of the Transactions and the timing of each of the Transactions; and other factors that may affect future results of the Company. Furthermore, such forward-looking statements speak only as of the date of this report. Except as required by law, the parties undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. Risks or uncertainties (i) that are not currently known to the parties, (ii) that the parties currently deem to be immaterial, or (iii) that could apply to any company, could also materially adversely affect the future results of the Company.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. The following exhibit is filed as part of this Current Report on Form 8-K:

EXHIBIT INDEX

| | | | | | | | |

| Exhibit | | |

| Number | | Exhibit Description |

| 99.1 | | |

| 101.INS | | XBRL Instance Document - the instance document does not appear in the interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

| 101.SCH | | XBRL Taxonomy Extension Schema Document. |

| 101.CAL | | XBRL Taxonomy Extension Calculation Linkbase Document. |

| 101.LAB | | XBRL Taxonomy Extension Label Linkbase Document. |

| 101.PRE | | XBRL Taxonomy Extension Presentation Linkbase Document. |

| 101.DEF | | XBRL Taxonomy Extension Definition Linkbase Document. |

| 104 | | Cover Page Interactive Data File - The cover page interactive data file does not appear in the Interactive Data File because its XBRL tags or embedded within the Inline XBRL document |

* Certain schedules and other similar attachments to such agreement have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company will furnish a copy of such omitted documents to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | Ambac Financial Group, Inc. |

| | | (Registrant) |

| | | | | |

| Dated: | June 5, 2024 | | By: | | /s/ William J. White |

| | | | | William J. White |

| | | | | First Vice President, Secretary and Assistant General Counsel |

Filed by Ambac Financial Group, Inc.

pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Ambac Financial Group, Inc.

Commission File No.: 1-10777

Date: June 5,2024

| | |

Ambac Financial Group, Inc. – Strategic Update Call, June 5, 2024

|

C O R P O R A T E P A R T I C I P A N T S

Charles Sebaski, Head of Investor Relations

Claude LeBlanc, President, Chief Executive Officer

David Trick, Executive Vice President, Chief Financial Officer, Treasurer

John Cavanagh, Chairman, Beat Capital

Naveen Anand, President, Cirrata

C O N F E R E N C E C A L L P A R T I C I P A N T S

Giuliano Bologna, Compass Point

P R E S E N T A T I O N

Operator

Greetings and welcome to the Ambac Financial Group Incorporated Strategic Update Call.

At this time, all participants are in a listen-only mode. A question-and-answer session will follow the formal presentation. If anyone should require Operator assistance during the conference, please press star, zero on your telephone keypad. As a reminder, this conference is being recorded.

I would now like to turn the conference over to your host, Mr. Charles Sebaski, Head of Investor Relations for Ambac Financial Group. Thank you, sir, you may begin.

Charles Sebaski

Thank you. Good morning and welcome to Ambac’s strategic update investor call. To those of you following along on the webcast, during prepared remarks, we will be highlighting some slides from our investor presentation, which can be located on our website.

Our call today includes forward-looking statements. The Company cautions investors, any forward-looking statement involves risks and uncertainties and is not a guarantee of future performance. Actual results may differ materially from those expressed or implied in the forward-looking statements due to a variety of factors. These factors are described under the Forward-Looking Statements in our earnings press release

1

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Strategic Update Call, June 5, 2024

|

and our most recent 10-Q and 10-K filed with the SEC. We do not undertake any obligation to update forward-looking statements.

Also, in our prepared remarks or responses to questions, we may mention some non-GAAP financial measures. Reconciliations to those non-GAAP measures are included in our recent releases, operating supplements, and other materials available on the Investor Relations section of our website ambac.com.

Speaking today will be Claude LeBlanc, President and CEO of Ambac; David Trick, Chief Financial Officer of Ambac; Naveen Anand, President of Cirrata; and John Cavanagh, co-Founder and Chairman of Beat. The speakers are joined by Paul Raynor, Managing Partner of Beat, and Tim Shelley, Partner of Beat. We will share prepared remarks about the transactions we announced earlier this morning and afterwards take questions from our analysts.

If you are interested in scheduling time with Management after today’s call, please reach out to me and we are welcome to have a dialog with our shareholders.

With that, I would like to turn the call over to Mr. Claude LeBlanc, President and CEO of Ambac.

Claude LeBlanc

Thanks, Chuck, and thank you all for joining us this morning.

In short, this morning we announced two transactions that together significantly advance our strategy of transforming Ambac into a leading specialty P&C insurance platform. First, we announced that we will be selling 100% interest in AEC, our legacy financial guaranty business to Oak Tree for proceeds of $420 million. Second, we announced an agreement to acquire a majority stake in Beat Capital Partners, a leading London-based underwriting and MGA platform which will become part of our Cirrata insurance distribution platform. These transactions are transformational for Ambac as we position the Company for future growth and value creation.

In late 2020, we unveiled our specialty P&C insurance strategy, and we are pleased to meaningfully progress that strategy by both, one, enhancing our focus on our future vision through this sale; and two, achieving scale and expanded international footprint and enhanced diversification for our insurance distribution platform through this acquisition.

I’ll now provide some additional context on each of the two transactions and what they mean for Ambac and our shareholders. Let’s start with our sale of our legacy financial guaranty business.

As mentioned, we announced this morning that we signed a definitive agreement to sell our legacy financial guaranty business, Ambac Assurance Corporation and Ambac U.K. to investment firm, Oak Tree Capital Management, or Oak Tree. This transaction represents the realization of our objective to maximize the economic value of the legacy business, which has been in run-off since 2008. We believe this sale offers an optimal return on a time and risk-adjusted basis. Further, Oak Tree’s receipt of equity warrants in Ambac as part of this transaction is a vote of confidence in our go-forward specialty P&C strategy. This divestiture also clarifies the future of Ambac while reducing our earnings volatility and

2

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Strategic Update Call, June 5, 2024

|

uncertainty. We are now positioned as a pure play specialty P&C platform with a clear strategy for the future.

I’m now going to turn it over to David Trick, our CFO, to discuss the terms of the transaction. David?

David Trick

Thanks, Claude.

As Claude mentioned, this agreement involves the sale of 100% of AEC in Ambac U.K. to Oak Tree. As a result of the sale, Ambac will receive $420 million with potential upward performance adjustments. These proceeds include 100% cash consideration and 9.9% equity warrants at $18.50 strike price. The transaction is expected to close in the fourth quarter of this year.

As we’ve shared over the past few quarters, in exploring strategic alternatives for this business, the goal is to maximize its economic value for Ambac and our shareholders. We believe this transaction accomplishes that objective. The structure of the sale provides for material growth capital and financial flexibility while materially de-risking and simplifying Ambac’s profile and balance sheet. Upon the close of the sale, we expect Ambac to have an estimated pro forma first quarter book value of $857 million. The sale will eliminate nearly $1 billion of debt and reduce insured net par outstanding by $19 billion.

Importantly, AFG will obtain approximately $1.3 billion of NOLs subsequent to the sale of the legacy financial guaranty business, which will be used along with the proceeds to further drive value across our specialty platform.

The next slide details the pro forma financial impact of the sale. You will notice that this transaction significantly de-levers Ambac, eliminating long term debt and insured net par while preserving substantial book value. This is particularly compelling when combined with the potential value expansion that our acquisition of Beat brings to the table.

Looking forward, we are pleased to be able to continue to execute on our long-term strategy with a materially de-risked balance sheet.

I’ll now turn the call back to Claude to discuss our go-forward strategy.

Claude LeBlanc

Thanks, David.

If you’ve been following Ambac since late 2020, you’ll know the opportunity we see in establishing Ambac as a leading specialty P&C insurance platform. The sale of AEC is the final step in our transformation. It unencumbers our broader platform with a legal legacy strategy—legacy assets and liabilities and offers a more efficient capital structure as we look to the future. The proceeds from this transaction will be used to drive future value across our growth areas. Going forward, AFG has a clear path to creating value and we believe offers a compelling entry valuation point for investors.

3

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Strategic Update Call, June 5, 2024

|

Our focus is to grow and to create scaled offerings through profitable expansion. Slide 10 offers a glimpse of our future org chart, which we plan to dive deeper on in the next section of our presentation. As we part ways with our legacy business, we are simultaneously doubling down on our future, including with our transformational acquisition of Beat, which will join our Cirrata platform.

Now let’s turn to the details of the Beat transaction. The acquisition of Beat solidifies our position as the partner of choice for MGAs around the world. We are thrilled to enter into a partnership with both the founders of Beat and Bain Capital, both of whom will continue to hold a material stake in the business moving forward.

As we mentioned at the start of this call, one of the benefits of this acquisition is the immediate scale it offers. In 2024, Cirrata and Beat, on a pro forma basis, will deliver combined results for an estimated $155 million of revenue and $40 million of EBITDA. Importantly, our combined book will grow to over $1 billion of gross written premiums and is on track to achieve EBITDA margins in the mid to high 20s. Beyond scale, this transaction also gives us meaningful diversification and positions us for future growth.

With that, I’ll turn the call back to David Trick to walk us through the terms of the transaction.

David Trick

Thanks, Claude.

The next slides details the terms of the acquisition and sources of capital. This transaction values Beat at $460 million, and we estimate that the deal will close in the third quarter of this year. We are funding this transaction with a mix of cash, committed financing, and up to $40 million of AFG equity to Bain Capital and Beat management. In keeping with Ambac’s philosophy of shareholder alignment of interest, in addition to Bain and Beat’s management investment in Ambac, Beat’s management team will retain 20% equity in Beat and Bain will also retain a 20% equity stake in Beat. In place is a multi-year put-call structure that aligns this partnership for long term value creation.

We believe this structure is extremely attractive for Ambac shareholders, who will benefit immediately from the scale and profitability that Beat adds to the Ambac ecosystem, while being exceptionally aligned with the Beat operating team and previous ownership group. We are all going in the same direction as we build the global MGA platform of choice.

With that, I’d like to introduce John Cavanagh, co-Founder and Chairman of Beat to offer an overview of the Beat business and share some background on the exceptional Management team that he leads.

John Cavanagh

Thank you, David, and it’s a pleasure to be with you all today.

This is an extremely exciting time for Beat. Ambac brings stable ownership to our platform. We see Ambac’s well established MGA incubation and carrier capabilities and its outstanding leadership team, who we’ve known for a while, as a perfect fit with our existing operations and team.

4

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Strategic Update Call, June 5, 2024

|

I now want to take a moment to provide some more context on Beat. Beat was established in 2017 and we back leading specialty underwriters to establish their own underwriting franchises and MGAs. Since our inception, we’ve launched 13 MGAs, two Lloyd’s syndicates, and a Bermuda reinsurer. We’ve been very successful in our partnership model in which underwriting management holds a material interest in their business, much like the model that Ambac has built with Cirrata. Additionally, similar to Cirrata’s broad offering, Beat offers a full range of shared services to its underwriting franchisees.

Slide 15 on the chart illustrates the Beat ecosystem in three parts: the first of which is oversight of our agency platforms; the second of which is the underwriting management section of the business, which includes our two Lloyd’s syndicates and our Bermuda reinsurer; and the third section is our capital management platform, which manages the capital that feeds into our various underwriting transformer platforms.

Beat oversees MGA franchises across 22 lines of business in London, Bermuda, and the U.S. All of which we own a majority stake in. Additionally, we manage portfolios of underwriters that can back the MGA units via Lloyd’s, Bermuda or directly.

Lastly, we have established a network of long-term capital providers that provided approximately 80% of our 2023 capacity on a whole account or multi-cost basis. We believe these three pillars offer our MGAs a differentiated ecosystem as they look to propel the next chapter of their growth.

Additionally, we believe our greatest asset is our people. I’m pleased to lead an exceptional, proven Management team with a track record of profitable growth.

As Chuck mentioned at the top of the call, I’m joined by Tim Shelley and Paul Raynor, two of my partners today. We’ve been in discussions with Ambac for some time now, and the key takeaway we drove home in every meeting was that our firm’s success starts with its culture. Beat is a talent destination within the market it operates in. We have strong, prudent underwriting standards, and we are passionate about developing our own talent.

We are absolutely thrilled to join the Ambac team. We know that there’s immense value that our respective franchises can unlock, and we are ready to hit the ground running. I’m also appreciative that, along with my Management team and our existing supporters in Bain Capital, we’ll be able to participate in the Company’s future upside by retaining a 20% stake in the business.

I will now turn it back to Claude to offer more detail on the strategic rationale behind this partnership.

Claude LeBlanc

Thanks, John.

We are very excited to be partnering with the Beat team. Beat is not only a leading MGA platform but a perfect fit for our strategic vision for the future of Ambac as a specialty P&C platform that is scaling for profitable growth. We are thrilled to have John and his team onboard. During this process, I have had the opportunity to spend quite a bit of time with the Beat team, and it truly is the people and their entrepreneurial culture which I am most excited about.

5

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Strategic Update Call, June 5, 2024

|

Strategically, this transaction further accelerates our path towards the previously stated goal of more than $100 million of annual EBITDA. We believe it will also accelerate organic growth as Beat has an established track record of achieving growth and identifying attractive investments. This deal will scale Cirrata and most importantly diversify our operating footprint to key international markets.

Finally, we believe there will be key operational efficiencies as a result of these partnerships. I do want to note that we do not anticipate any reductions in force across Cirrata or Beat, however we do expect to achieve significant strategic and operational synergies which will drive growth and value.

I will now turn the call over to Naveen to review the combined Cirrata-Beat platform. Naveen?

Naveen Anand

Thank you, Claude. Good morning. What a terrific morning at Ambac today.

Slide 18 puts a final point on the strategic alignment between Beat and Cirrata. On a pro forma basis, we will achieve $1 billion in premium, $155 million in revenue, and EBITDA margin in the mid to high 20s. Cirrata and Beat both operate using a partnership model. As a reminder, Cirrata is focused on building a portfolio of specialty distribution businesses initially targeting specialty underwriting companies, MGAs and MGUs.

Today, Cirrata and Beat offer solutions to provide top tier underwriting and MGA management teams the tools, resources, and investment needed to grow and achieve superior returns to create long term value.

As we integrate this partnership into our day-to-day operations, there will be key data that we will track and significant insights that we will be able to share. We can see far more as a combined entity with international scale, and we are very excited to put these teams together.

Slide 19 shows the attractive diversification that this acquisition achieves. On a combined basis, we will not have a single product line in excess of 16% of our total portfolio. We are not necessarily beholden to that maximum percentage, but more importantly we are focused on the opportunities we have to go deeper into the areas we deem most attractive in the market. In addition, we are heavily weighted in the U.S. E&S markets, a segment of the overall P&C landscape, and we believe we’re set to continue to growing faster than the overall market, aided by a secular shift in risk complexity.

This is shown further on Slide 20, in which we illustrate how this transaction will significantly grow our top line and our bottom line performance for the year ahead. We are on track to achieve nearly $200 million of combined revenue and $60 million of combined EBITDA, and $31 million of EBITDA adjusted for non-controlling interest in 2025. This partnership positions Ambac for accelerated growth, increases margins, and supports the generation of mid-teens return on invested capital.

Now I’ll turn the call back over to Claude.

Claude LeBlanc

6

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Strategic Update Call, June 5, 2024

|

Thanks, Naveen.

Turning to our three-year financial targets, this partnership will accelerate our path to exceeding 100 in annual EBITDA, and it also offers a clear line of sight to $1.5 billion portfolio premiums across more than 50 MGA programs. In 2023, we achieved $12 million of P&C EBITDA through Cirrata and are on track to delivering strong organic growth across our existing platform. Now, across both Cirrata and Beat, the two businesses on a pro forma basis are expected to achieve $40 million in EBITDA this year.

I’d like to close with the benefits that Beat brings to Cirrata and to Ambac and its shareholders. One, it advances our specialty insurance strategy and accelerates margin expansion. Two, it furthers our shared strategic vision as a premier platform for strong underwriters for MGA formations. Three, it provides immediate scale and diversification to Cirrata while fueling future growth. Four, it aligns interest between Ambac and Beat Capital shareholders through ownership structure. Five, it presents a clear path to value creation across revenue opportunity, expense management, and capital structure. Six, it generates accretive returns in the first year with high margins and predictable cash flow generation.

Looking ahead, the acquisition of a majority stake in Beat represents the future of Ambac. Cirrata is positioned as a capital-light and growth-focused insurance distribution platform. Beyond Cirrata, we continue to work towards realizing our vision of transforming Ambac for the future. The sale of our legacy financial guaranty business is also a significant milestone in that transformation. With these two significant transactions in hand, we are confident that Ambac is poised to deliver significant incremental value for our shareholders in the years to come.

With that, I’d like to open the call up to our analysts for questions. Operator?

Operator

Thank you. At this time, we’d like to take questions from our analysts. If you would like to ask a question, please press star, one on your telephone keypad. A confirmation tone will indicate your line is in the question queue. You may press star, two if you’d like to remove your question from the queue. For participants using speaker equipment, it may be necessary to pick up your handset before pressing the star key. We ask that you each keep to one question and one follow-up. Thank you. One moment please while we poll for questions.

Our first question comes from the line of Giuliano Bologna with Compass Point. Please proceed with your question.

Giuliano Bologna

Congrats on the transaction. One thing I’d be curious about, we obviously have the proceeds, and there’s a note in the 8-K about the $150 million term loan. It looks like your pro form cash would be—if you use the term loan, it could be close to $540 million pro forma for all this, and without it to be, call it in the $390 million ballpark. I’m curious when you look at the long-term road map, that obviously gives you a lot of firepower for M&A and additional acquisitions. When we look at that $100 million-plus adjusted for three years, how much of that do you think comes from organic growth versus potential future M&A?

7

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Strategic Update Call, June 5, 2024

|

Claude LeBlanc

Thanks, Giuliano, for the question. A big portion now with our existing Cirrata platform, Everspan, and the Beat platform, at this point for those three combined, a significant portion of that $100 million over the next three years will come from organic growth. Some of the number estimates we’ve put out there in regards to this transaction alone has headline EBITDA as 24 to 25 for Cirrata alone, going up close to 40% or so. As you know, Everspan has been on track with three quarters now of continuous earnings growth. So, organically, we are very optimistic about a large portion of our objectives coming from the platform that we’ve built at this point going forward.

In terms of acquisitions and use of liquidity on the balance sheet, certainly we’re seeing a tremendous pipeline of opportunities in the marketplace to further build from a strategic standpoint and add additional acquisitions to the platform, and so I would say that we’re optimistic, both about the organic growth profile as well as the strategic opportunities. And now the additional synergies, I would say, that we could bring to additional acquisitions in the future with the combined firepower with Cirrata and Beat, and the operational and strategic benefits of those two combined platforms.

Giuliano Bologna

That’s very helpful. One thing I was curious about, in the presentation there’s a note about the 2024 pro forma EBITDA estimate for Beat of $27 million. Is that based on 100% interest or is that based on (inaudible) 60% interest?

Claude LeBlanc

That’s based on 100% interest, and as you know, based on our comments, we’re not closing on the Beat transaction for a few months, so that certainly adjusts for the fact that you only have partial year results in 2024. I like to think about and look at ’25 as a better profile, where gross EBITDA, as we said in our prepared comments, is about $60 million, and after minority interest looking north of $30 million.

Giuliano Bologna

When I look at Slide 20, there’s a kind of Cirrata core, 100% ownership (inaudible) $60 million, and then I switch over to AFG interest and it’s 13 just on the core Cirrata, then the total for both Cirrata and pro forma is 58, and that kind of implies $42 million of gross EBITDA for Beat in ’25, and my math on 60% is $25.2 million. Is that a rough sense of where you think it will be, $25.2 million on the 60% in ’25? Just because when you look at that chart over to the AFG interest, it looks like only $31 million total, but if it was $25 million, it should be in the higher 30s, close to 40. I’m just making sure I’m reading those numbers correctly.

David Trick

Slide 20, first of all, is Cirrata and Beat. It excludes the Everspan, which is part of the overall P&C numbers that we shared earlier. I’m not sure if that’s the difference you’re looking at.

8

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Strategic Update Call, June 5, 2024

|

Claude LeBlanc

Yes, I didn’t catch all your—the reconciliation, but we can take that offline. Like I said, we’re looking at a pro forma basis of about $60 million. You have to consider, of course, the pro forma EBITDA interest of the existing business as well, where we own on average 2.5% or so, the EBITDA of the existing Cirrata platforms. You have to factor that into your reconciliation.

Giuliano Bologna

Got it, that makes sense. Then when I think about the sale of the AEC platform, there’s obviously a fair amount of operation expense at the AEC level. I’m curious, are there any expenses that could be retained by Ambac from the AEC level post close, or should we assume that it all goes away? Then kind of on a related topic, I’m curious if there’s any expense saving opportunities outside of AEC post close.

David Trick

Yes, so with the sale of the legacy business, there will be a significant amount of employees that will be involved in that transaction. We obviously haven’t disclosed those details at this point, so that creates of course opportunities for expense reductions, given the cost of running the heavily regulated capital-intensive business. Of course, what will be happening going forward, the capital-light platform is certainly a more streamlined operating platform with AFG as a corporate entity being much more streamlined and overseeing the 22 degrees of Beat platform from an operational standpoint.

Working through a lot of the moving pieces and details of that as the legacy business was very integrated with Ambac over the years. We’re making some decisions about how to move certain pieces apart, and that process has begun. It could be a significant lift, and as we move through the process of closing on the transaction, we’ll have more information for you and shareholders about what the profile of the platform will be looking like further into the future.

Claude LeBlanc

Giuliano, I’d just like to add that a number of the people will be going with AEC and AUK. The Oak Tree purchase involves a large number of people and costs moving over with Oak Tree, just to clarify that point. We are also not expecting any headcount reductions specifically related to the Oak Tree transaction, and that is the plan that Oak Tree has in terms of how it wishes to manage the AEC and AUK businesses going forward.

Giuliano Bologna

That’s helpful. One thing I just wanted to make sure I was thinking about correctly, on the $100 million EBITDA target that you mentioned, is that kind of gross EBITDA or is that net to Ambac, and then related to that, does that include contribution from Everspan or not?

David Trick

That’s gross EBITDA.

9

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Strategic Update Call, June 5, 2024

|

Giuliano Bologna

Got it, that’s helpful. I appreciate it. Thanks for the time. Congrats on the deal, and I will jump back in the queue.

Claude LeBlanc

Thanks, Giuliano.

Operator

Thank you. Ladies and gentlemen, as a reminder, if you’d like to join the question queue, please press star, one on your telephone keypad. We’ll pause another moment to allow for any other questions.

Thank you. Ladies and gentlemen, this concludes our question-and-answer session and thus concludes our call today. We thank you for your interest and participation. You may now disconnect your lines.

Additional Information and Where to Find It

In connection with the AAC Transaction, the Company will file with the SEC and furnish to the Company’s stockholders a proxy statement. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE AAC TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT (IF ANY) BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE AAC TRANSACTION AND THE PARTIES TO THE AAC TRANSACTION. Investors and stockholders may obtain a copy of documents filed by the Company with the SEC at the SEC’s website at http://www.sec.gov. In addition, investors and stockholders may obtain a free copy of the Company’s filings with the SEC from the Company’s website at https://ambac.com/investor-relations.

Participants in the Solicitation

The Company and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the AAC Transaction. Information about the directors and executive officers of the Company is set forth in its definitive proxy statement, which AFG filed with the SEC on April 26, 2024. Investors may obtain additional information regarding the interests of such participants by reading the proxy statement and other relevant materials regarding the proposed transaction when they become available.

10

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

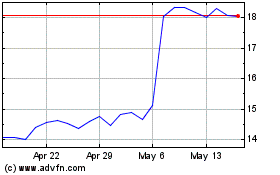

Ambac Financial (NYSE:AMBC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ambac Financial (NYSE:AMBC)

Historical Stock Chart

From Dec 2023 to Dec 2024