0001393584false00013935842025-02-122025-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 12, 2025 |

American Well Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39515 |

20-5009396 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

75 State Street 26th Floor |

|

Boston, Massachusetts |

|

02109 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 617 204-3500 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock, $0.01 Par Value |

|

AMWL |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 12, 2025, American Well Corporation (the "Company") announced its financial results for the fourth quarter and full year ended December 31, 2024. The Company's Earnings Report is furnished as Exhibit 99.1 to this Form 8-K and is incorporated by reference herein.

The Company will host a conference call to discuss its financial results today at 5 p.m. ET, Feb. 12. The call can be accessed via a live audio webcast at https://edge.media-server.com/mmc/p/zsp4abpw. A replay of the call will be available via webcast shortly after the completion of the call, at investors.amwell.com.

The information contained in this Item 2.02 and Exhibit 99.1 attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibit is being filed herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

AMERICAN WELL CORPORATION |

|

|

|

|

Date: |

February 12, 2025 |

By: |

/s/ Bradford Gay |

|

|

|

Bradford Gay

Senior Vice President, General Counsel |

Exhibit 99.1

AMWELL® ANNOUNCES RESULTS FOR Fourth QUARTER AND FULL YEAR 2024

BOSTON, Feb. 12, 2025 –Amwell® (NYSE: AMWL), a leading provider of a comprehensive SaaS-based technology-enabled healthcare platform, today announced financial results for the fourth quarter and full year ended Dec. 31, 2024.

“During 2024, we advanced our business in ways that put us much closer to unlocking the value of Amwell and advancing our mission to modernize healthcare with our unified platform,” said Ido Schoenberg, MD, chairman and CEO of Amwell. “Together with our partners at Leidos, we are successfully launching our full solution across the U.S. Military Health System, the most significant growth initiative in our history. We are also undertaking meaningful quality of revenue and margin initiatives that are resulting in steady, better-than-expected quarterly improvements in our adjusted EBITDA. We are successfully refining our business to deliver on the expectations of stakeholders, advancing us to generate positive cash flow during 2026, with a robust cash position.”

Amwell Fourth Quarter 2024 Highlights:

•Recorded Total Revenue of $71.0 million

oAchieved subscription revenue of $36.9 million

oRecorded Amwell Medical Group (“AMG”) visit revenue of $29.2 million

•Reported gross margin of 48%

•Net loss was ($44.6) million, compared to ($44.0) million in third quarter of 2024

•Adjusted EBITDA of ($22.8) million compared to ($31.0) million in the third quarter of 2024

•Total visits were 1.4 million;

Full Year 2024 Financial Highlights:

•Recorded Total Revenue of $254.4 million

oAchieved subscription revenue of $115.5 million

oRecorded AMG visit revenue of $116.5 million

•Reported gross margin of 39%

•Net loss was ($212.6) million compared to ($679.2) million (reflects non-cash goodwill impairment charges of $436.5 million) in 2023

•Adjusted EBITDA of ($134.4) million compared to ($165.4) million in 2023

•Total visits were 5.9 million

•Cash and short-term securities as of year-end were approximately $228.3 million.

Financial Outlook

The company provided 2025 financial guidance calls for:

•Revenue in the range of $250 to $260 million (this reflects the previously announced divestiture of Amwell Psychiatric Care)

•AMG visits between 1.3 and 1.35 million

•Adjusted EBITDA in the range of between ($55) million to ($45) million.

The company also provided financial guidance for Q1 2025 Revenue and EBITDA:

•Q1 revenue in the range of $59- $61 million

•Q1 adjusted EBITDA in the range of $($18) – ($20) million.

The Company also communicated its objective to achieve positive cash flow in 2026.

Amwell will host a conference call to discuss its financial results today at 5 p.m. ET, Feb. 12. The call can be accessed via a live audio webcast at https://edge.media-server.com/mmc/p/zsp4abpw. A replay of the call will be available via webcast shortly after the completion of the call, at investors.amwell.com.

Other than with respect to GAAP Revenue, the Company only provides guidance on a non-GAAP basis. The Company does not provide a reconciliation of forward-looking Adjusted EBITDA (non-GAAP) to GAAP net income (loss), due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. Because other deductions used to calculate projected net income (loss) vary dramatically based on actual events, the Company is not able to forecast on a GAAP basis with reasonable certainty all deductions needed in order to provide a GAAP calculation of projected net income (loss) at this time. The amount of these deductions may be material and, therefore, could result in projected GAAP net income (loss) being materially less than projected Adjusted EBITDA (non-GAAP).

About Amwell

Amwell is a leading hybrid care, delivery enablement platform in the United States and globally, connecting and enabling providers, payers, patients, and innovators to deliver greater access to more affordable, higher quality care. Amwell believes that hybrid care delivery will transform healthcare. We offer a single, comprehensive platform to support all digital health needs from urgent to acute and post-acute care, as well as chronic care management and healthy living. With nearly two decades of experience, Amwell powers the digital care of 50 health plans, which collectively represent more than 80 million covered lives, and many of the nation’s largest health systems. For more information, please visit https://business.amwell.com/.

©2025 American Well Corporation. All rights reserved. Amwell®, SilverCloud®, Amwell ConvergeTM, CarepointTM and the Amwell Logo are registered trademarks or trademarks of American Well Corporation.

Forward-Looking Statements

This press release contains forward-looking statements about us and our industry that involve substantial risks and uncertainties and are based on our beliefs and assumptions and on information currently available to us. All statements other than statements of historical facts contained in this press release, including statements regarding our future results of operations, financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” or “would,” or the negative of these words or other similar terms or expressions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent our beliefs and assumptions only as of the date of this release. These statements, and related risks, uncertainties, factors and assumptions, include, but are not limited to: our ability to successfully transition our clients to Converge without significant attrition; our ability to renew and upsell our client base; the election by the Defense Health Agency to deploy our solution across their entire enterprise; the continuation of the DHA relationship beyond July of 2025 with comparable financial terms; weak growth and increased volatility in the telehealth market; our ability to adapt to rapid technological changes; increased competition from existing and potential new participants in the healthcare industry; changes in healthcare laws, regulations or trends and our ability to operate in the heavily regulated healthcare industry; our ability to comply with federal and state privacy regulations; the significant liability that could result from a cybersecurity breach; our ability to commence and complete and strategic transformation initiatives and the impact of such initiatives; and other factors described under ‘Risk Factors’ in our most recent form 10-K filed with the SEC. These risks are not exhaustive. Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. Further information on factors that could cause actual results to differ materially from the results anticipated by our

forward-looking statements is included in the reports we have filed or will file with the Securities and Exchange Commission. These filings, when available, are available on the investor relations section of our website at investors.amwell.com and on the SEC’s website at www.sec.gov.

Contacts

Media:

Angela Vogen

Press@amwell.com

Investors:

Sue Dooley

sue.dooley@amwell.com

AMERICAN WELL CORPORATION

CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

As of December 31, |

|

|

|

2024 |

|

|

2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

228,316 |

|

|

$ |

372,038 |

|

Accounts receivable ($616 and $1,626, from related parties and net of

allowances of $7,236 and $2,291, respectively) |

|

|

71,885 |

|

|

|

54,146 |

|

Inventories |

|

|

2,858 |

|

|

|

6,652 |

|

Deferred contract acquisition costs |

|

|

2,513 |

|

|

|

2,262 |

|

Prepaid expenses and other current assets |

|

|

11,421 |

|

|

|

14,484 |

|

Total current assets |

|

|

316,993 |

|

|

|

449,582 |

|

Restricted cash |

|

|

795 |

|

|

|

795 |

|

Property and equipment, net |

|

|

376 |

|

|

|

572 |

|

Intangibles assets, net |

|

|

101,538 |

|

|

|

120,248 |

|

Operating lease right-of-use asset |

|

|

7,203 |

|

|

|

10,453 |

|

Deferred contract acquisition costs, net of current portion |

|

|

5,350 |

|

|

|

4,792 |

|

Other assets |

|

|

2,213 |

|

|

|

2,083 |

|

Investment in minority owned joint venture |

|

|

1,500 |

|

|

|

1,180 |

|

Total assets |

|

$ |

435,968 |

|

|

$ |

589,705 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

5,015 |

|

|

$ |

4,864 |

|

Accrued expenses and other current liabilities |

|

|

49,326 |

|

|

|

38,988 |

|

Operating lease liability, current |

|

|

3,690 |

|

|

|

3,580 |

|

Deferred revenue ($198 and $1,286 from related parties, respectively) |

|

|

53,232 |

|

|

|

46,365 |

|

Total current liabilities |

|

|

111,263 |

|

|

|

93,797 |

|

Other long-term liabilities |

|

|

1,170 |

|

|

|

1,425 |

|

Operating lease liability, net of current portion |

|

|

4,511 |

|

|

|

8,206 |

|

Deferred revenue, net of current portion ($10 and $0 from related

parties, respectively) |

|

|

2,780 |

|

|

|

6,091 |

|

Total liabilities |

|

|

119,724 |

|

|

|

109,519 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $0.01 par value; 100,000,000 shares authorized, no shares

issued or outstanding as of December 31, 2024 and as of December 31, 2023 |

|

|

— |

|

|

|

— |

|

Common stock, $0.01 par value; 1,000,000,000 Class A shares authorized, 13,922,877

and 12,776,608 shares issued and outstanding, respectively; 100,000,000 Class B

shares authorized, 1,369,518 shares issued and outstanding; 200,000,000 Class C

shares authorized 277,777 issued and outstanding as of December 31, 2024 and as of

December 31, 2023 |

|

|

156 |

|

|

|

145 |

|

Additional paid-in capital |

|

|

2,286,380 |

|

|

|

2,237,502 |

|

Accumulated other comprehensive income (loss) |

|

|

(15,840 |

) |

|

|

(15,650 |

) |

Accumulated deficit |

|

|

(1,965,924 |

) |

|

|

(1,757,778 |

) |

Total American Well Corporation stockholders’ equity |

|

|

304,772 |

|

|

|

464,219 |

|

Non-controlling interest |

|

|

11,472 |

|

|

|

15,967 |

|

Total stockholders’ equity |

|

|

316,244 |

|

|

|

480,186 |

|

Total liabilities and stockholders’ equity |

|

$ |

435,968 |

|

|

$ |

589,705 |

|

AMERICAN WELL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31 |

|

Years Ended December 31, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

Revenue |

|

$ 71,006 |

|

$ 70,677 |

|

$ 254,364 |

|

$ 259,047 |

Costs and operating expenses: |

|

|

|

|

|

|

|

|

Costs of revenue, excluding depreciation and amortization of intangible assets |

|

36,613 |

|

46,834 |

|

155,412 |

|

164,287 |

Research and development |

|

18,782 |

|

26,347 |

|

86,065 |

|

105,827 |

Sales and marketing |

|

15,389 |

|

21,801 |

|

76,272 |

|

86,460 |

General and administrative |

|

34,770 |

|

24,385 |

|

121,174 |

|

126,645 |

Depreciation and amortization expense |

|

8,208 |

|

8,265 |

|

32,975 |

|

31,492 |

Goodwill impairment |

|

— |

|

— |

|

— |

|

436,479 |

Total costs and operating expenses |

|

113,762 |

|

127,632 |

|

471,898 |

|

951,190 |

Loss from operations |

|

(42,756) |

|

(56,955) |

|

(217,534) |

|

(692,143) |

Interest income and other income (expense), net |

|

423 |

|

8,172 |

|

10,757 |

|

19,422 |

Loss before benefit (expense) from income taxes and loss from equity method investment |

|

(42,333) |

|

(48,783) |

|

(206,777) |

|

(672,721) |

Benefit (expense) from income taxes |

|

(1,528) |

|

(547) |

|

(2,751) |

|

(3,860) |

Loss from equity method investment |

|

(708) |

|

(713) |

|

(3,110) |

|

(2,590) |

Net loss |

|

(44,569) |

|

(50,043) |

|

(212,638) |

|

(679,171) |

Net (loss) income attributable to non-controlling interest |

|

(1,915) |

|

(1,456) |

|

(4,495) |

|

(4,007) |

Net loss attributable to American Well Corporation |

|

$ (42,654) |

|

$ (48,587) |

|

$ (208,143) |

|

$ (675,164) |

Net loss per share attributable to common stockholders, basic and diluted |

|

$ (2.77) |

|

$ (3.37) |

|

$ (13.88) |

|

$ (47.50) |

Weighted-average common shares outstanding, basic and diluted |

|

15,400,531 |

|

14,399,240 |

|

14,999,590 |

|

14,212,505 |

AMERICAN WELL CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2022 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(212,638 |

) |

|

$ |

(679,171 |

) |

|

$ |

(272,072 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Goodwill impairment |

|

|

— |

|

|

|

436,479 |

|

|

|

— |

|

Depreciation and amortization expense |

|

|

32,973 |

|

|

|

31,512 |

|

|

|

26,167 |

|

Provisions for credit losses |

|

|

7,090 |

|

|

|

1,057 |

|

|

|

806 |

|

Inventory write-off |

|

|

1,893 |

|

|

|

— |

|

|

|

— |

|

Amortization of deferred contract acquisition costs |

|

|

2,457 |

|

|

|

2,261 |

|

|

|

1,684 |

|

Amortization of deferred contract fulfillment costs |

|

|

459 |

|

|

|

432 |

|

|

|

620 |

|

Noncash compensation costs incurred by selling shareholders |

|

|

— |

|

|

|

— |

|

|

|

11,139 |

|

Accretion of discounts on debt securities |

|

|

— |

|

|

|

(10,010 |

) |

|

|

— |

|

Interest on debt securities |

|

|

— |

|

|

|

10,010 |

|

|

|

— |

|

Stock-based compensation expense |

|

|

47,542 |

|

|

|

72,246 |

|

|

|

67,675 |

|

Loss on equity method investment |

|

|

3,110 |

|

|

|

2,590 |

|

|

|

2,278 |

|

Deferred income taxes |

|

|

(243 |

) |

|

|

(242 |

) |

|

|

(2,524 |

) |

Changes in operating assets and liabilities, net of acquisition: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(25,012 |

) |

|

|

3,248 |

|

|

|

(8,140 |

) |

Inventories |

|

|

1,901 |

|

|

|

2,085 |

|

|

|

(1,207 |

) |

Deferred contract acquisition costs |

|

|

(3,287 |

) |

|

|

(4,499 |

) |

|

|

(2,771 |

) |

Prepaid expenses and other current assets |

|

|

2,601 |

|

|

|

4,694 |

|

|

|

(161 |

) |

Other assets |

|

|

(217 |

) |

|

|

(76 |

) |

|

|

(235 |

) |

Accounts payable |

|

|

159 |

|

|

|

(2,361 |

) |

|

|

(4,780 |

) |

Accrued expenses and other current liabilities |

|

|

10,118 |

|

|

|

(15,139 |

) |

|

|

8,962 |

|

Other long-term liabilities |

|

|

— |

|

|

|

— |

|

|

|

(25 |

) |

Deferred revenue |

|

|

3,756 |

|

|

|

(3,459 |

) |

|

|

(19,739 |

) |

Net cash used in operating activities |

|

|

(127,338 |

) |

|

|

(148,343 |

) |

|

|

(192,323 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(119 |

) |

|

|

(192 |

) |

|

|

(292 |

) |

Capitalized software development costs |

|

|

(15,103 |

) |

|

|

(15,056 |

) |

|

|

(10,155 |

) |

Investment in less than majority owned joint venture |

|

|

(3,430 |

) |

|

|

(3,920 |

) |

|

|

(1,960 |

) |

Purchases of investments |

|

|

— |

|

|

|

(389,990 |

) |

|

|

(499,223 |

) |

Proceeds from sales and maturities of investments |

|

|

— |

|

|

|

389,990 |

|

|

|

500,000 |

|

Net cash used in investing activities |

|

|

(18,652 |

) |

|

|

(19,168 |

) |

|

|

(11,630 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from exercise of common stock options |

|

|

— |

|

|

|

569 |

|

|

|

5,740 |

|

Proceeds from employee stock purchase plan |

|

|

1,384 |

|

|

|

2,164 |

|

|

|

2,503 |

|

Payments for the purchase of treasury stock |

|

|

(3 |

) |

|

|

(586 |

) |

|

|

(360 |

) |

Proceeds from Section 16(b) disgorgement |

|

|

— |

|

|

|

— |

|

|

|

295 |

|

Payment of contingent consideration |

|

|

— |

|

|

|

— |

|

|

|

(11,790 |

) |

Net cash provided by (used in) financing activities |

|

|

1,381 |

|

|

|

2,147 |

|

|

|

(3,612 |

) |

Effect of exchange rates changes on cash, cash equivalents, and restricted cash |

|

|

887 |

|

|

|

(1,144 |

) |

|

|

(305 |

) |

Net decrease in cash, cash equivalents, and restricted cash |

|

|

(143,722 |

) |

|

|

(166,508 |

) |

|

|

(207,870 |

) |

Cash, cash equivalents, and restricted cash at beginning of period |

|

|

372,833 |

|

|

|

539,341 |

|

|

|

747,211 |

|

Cash, cash equivalents, and restricted cash at end of period |

|

$ |

229,111 |

|

|

$ |

372,833 |

|

|

$ |

539,341 |

|

Cash, cash equivalents, and restricted cash at end of period: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

228,316 |

|

|

|

372,038 |

|

|

|

538,546 |

|

Restricted cash |

|

|

795 |

|

|

|

795 |

|

|

|

795 |

|

Total cash, cash equivalents, and restricted cash at end of period |

|

$ |

229,111 |

|

|

$ |

372,833 |

|

|

$ |

539,341 |

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

|

Cash paid for income taxes |

|

$ |

4,105 |

|

|

$ |

5,003 |

|

|

$ |

1,723 |

|

Supplemental disclosure of non-cash investing and financing

activities: |

|

|

|

|

|

|

|

|

|

Issuance of common stock in settlement of earnout |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

17,243 |

|

Non-GAAP Financial Measures:

To supplement our financial information presented in accordance with generally accepted accounting principles in the United States, of US GAAP, we use adjusted EBITDA, which is a non-U.S GAAP financial measure to clarify and enhance an understanding of past performance. We believe that the presentation of adjusted EBITDA enhances an investor’s understanding of our financial performance. We further believe that adjusted EBITDA is a useful financial metric to assess our operating performance from period-to-period by excluding certain items that we believe are not representative of our core business. We use certain financial measures for business planning purposes and in measuring our performance relative to that of our competitors. We utilize adjusted EBITDA as the primary measure of our performance.

We calculate adjusted EBITDA as net loss adjusted to exclude (i) interest income and other income, net, (ii) tax benefit and expense, (iii) depreciation and amortization, (iv) goodwill impairment, (v) stock-based compensation expense, (vi) severance and strategic transformation costs and (vii) capitalized software costs.

We believe adjusted EBITDA is commonly used by investors to evaluate our performance and that of our competitors. However, our use of the term adjusted EBITDA may vary from that of others in our industry. Adjusted EBITDA should not be considered as an alternative to net loss before taxes, net loss, loss per share or any other performance measures derived in accordance with U.S. GAAP as measures of performance.

Adjusted EBITDA has important limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Some of the limitations of adjusted EBITDA include (i) adjusted EBITDA does not properly reflect capital commitments to be paid in the future, and (ii) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and adjusted EBITDA does not reflect these capital expenditures. Our legal, accounting and other professional expenses reflect cash expenditures and we expect such expenditures to recur from time to time. Our adjusted EBITDA may not be comparable to similarly titled measures of other companies because they may not calculate adjusted EBITDA in the same manner as we calculate the measure, limiting its usefulness as a comparative measure.

In evaluating adjusted EBITDA, you should be aware that in the future we will incur expenses similar to the adjustments in this presentation. Our presentation of adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-recurring items. Adjusted EBITDA should not be considered as an alternative to loss before benefit from income taxes, net loss, earnings per share, or any other performance measures derived in accordance with U.S. GAAP. When evaluating our performance, you should consider adjusted EBITDA alongside other financial performance measures, including our net loss and other GAAP results.

The following table presents a reconciliation of adjusted EBITDA from the most comparable GAAP measure, net loss, for the three months and year ended December 31, 2024 and 2023 and the three months ended September 30, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31 |

|

Years Ended December 31, |

|

Three Months Ended September 2024 |

(in thousands) |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Net loss |

|

$ (44,569) |

|

$ (50,043) |

|

$ (212,638) |

|

$ (679,171) |

|

$ (44,041) |

Add: |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

8,208 |

|

8,265 |

|

32,975 |

|

31,492 |

|

8,313 |

Interest and other income, net |

|

(423) |

|

(8,172) |

|

(10,757) |

|

(19,422) |

|

(3,882) |

Benefit (expense) from income taxes |

|

1,528 |

|

547 |

|

2,751 |

|

3,860 |

|

(149) |

Goodwill impairment |

|

— |

|

— |

|

— |

|

436,479 |

|

— |

Stock-based compensation |

|

10,840 |

|

12,631 |

|

47,505 |

|

72,040 |

|

10,599 |

Severance and strategic transformation costs(1) |

|

4,071 |

|

1,074 |

|

20,892 |

|

4,414 |

|

2,865 |

Capitalized software development costs |

|

(2,412) |

|

(1,220) |

|

(15,102) |

|

(15,056) |

|

(4,718) |

Adjusted EBITDA |

|

$ (22,757) |

|

$ (36,918) |

|

$ (134,374) |

|

$ (165,364) |

|

$ (31,013) |

(1)Severance and strategic transformation costs include expenses associated with the termination of employees and expenses that focus on transforming the strategy of the Company’s sales and growth organization as well as our overall cost structure during the three months and year ended December 31, 2024 and 2023,and the three months ended September 30, 2024.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

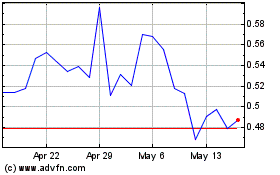

American Well (NYSE:AMWL)

Historical Stock Chart

From Jan 2025 to Feb 2025

American Well (NYSE:AMWL)

Historical Stock Chart

From Feb 2024 to Feb 2025