For the twelve months - Revenues Increase 29%, Net Income up 52%,

Earnings per Share Increased 52% and Backlog is up 30% FORT WORTH,

Texas, April 3 /PRNewswire-FirstCall/ -- AZZ incorporated

(NYSE:AZZ), a manufacturer of electrical products and a provider of

galvanizing services, today announced unaudited financial results

for the three and twelve-month periods ended February 28, 2009.

Revenues for the fourth quarter were $100.3 million, compared to

$76.6 million, an increase of 31 percent from the comparable period

last year. Net income rose 36 percent to $10 million, or $0.81 per

diluted share, compared to net income of $7.3 million or $0.60 per

diluted share, in last year's fiscal fourth quarter. Backlog at the

end of the fourth quarter was $174.8 million, compared to $195.2

million at the end of the previous quarter and $134.9 million for

the fourth quarter of last year. Incoming orders for the fourth

quarter totaled $79.9 million while shipments for the quarter

totaled $100.3 million, resulting in a book to ship ratio of 80

percent for the quarter. Incoming orders for the quarter increased

24 percent when compared to the fourth quarter of last year. Based

upon current customer requested delivery dates and our planned

production schedule, 94 percent of our backlog is expected to ship

in fiscal 2010. Of our $174.8 million backlog, 40 percent is to be

delivered outside of the U.S. For the fiscal year revenues

increased 29 percent to $412.4 million, compared to $320.2 million

for the prior year. Net income for the year was up 52 percent to

$42.2 million, or $3.43 per diluted share, compared to $27.7

million, or $2.26 per diluted share for the comparable twelve-month

period last year. Incoming orders for the twelve-month period were

$439.1 million, while fiscal year revenues totaled $412.4 million,

resulting in a book to ship ratio of 106 percent. Incoming orders

for the fiscal year of $439.1 million increased 31 percent when

compared to the prior fiscal year. Revenues for the Electrical and

Industrial Products Segment were $59.9 million for the fourth

quarter, compared to $41.7 million in the previous year's fourth

quarter, an increase of 44 percent. Operating income for this

segment increased 58 percent to $10.8 million, compared to $6.8

million in the fourth quarter of last year. Operating income

margins for the fourth quarter of 18 percent compare favorably to

the 16 percent in the prior year. For the fiscal year ended

February 28, 2009 revenues increased 26 percent to $225.8 million

and operating income rose 34 percent to $39.0 million, which

compared favorably to the $179.2 million and $29.2 million,

respectively, in the prior fiscal year. Operating income margins

for the fiscal year improved to 17 percent from the 16 percent in

the prior fiscal year. David H. Dingus, president and chief

executive officer, commented, "We are very pleased with the growth

and expansion of the Electrical and Industrial Products Segment for

fiscal 2009. The full year results reflected improvement in every

operating measurement. As we go forward, we continue to monitor

closely our market opportunities and our operating structure due to

the changing and challenging market conditions. Recently, incoming

orders have been slower than desired due to increased customer

deliberation on the release of new orders pertaining to projects

that are in process as well as those that are in the planning

phase. This combined with increased competitive pressure,

particularly on large international quotations, has had an adverse

impact on our incoming order rate. Our book to ship ratio for the

quarter was essentially the same as it has been in the fourth

quarter, three of the past four years. The fourth quarter continued

to be a difficult quarter for us in terms of incoming orders.

However, different than in prior years, we do not anticipate that

our backlog will increase in the second quarter or recover to the

record setting level of the third quarter of fiscal 2009 until we

see improvement in our markets. We remain optimistic that we will

see some leveling of our backlog after the second quarter and a

modest recovery as we enter our fiscal 2011. Margins were very

strong in the fourth quarter and fiscal year due to pricing

discipline, improved project management, and assisted by favorable

cost of key commodities. Our challenge is to continue to succeed in

our efforts to expand our served markets and product offerings,

while maintaining our strong operating performance and management

of our cost/price ratios consistent with our historical practices."

Revenues for the Company's Galvanizing Service Segment were $40.4

million for the fourth quarter, compared to $34.9 million in the

previous year's comparable quarter, an increase of 16 percent.

Operating income was up 26 percent to $11.2 million in the fourth

quarter as compared to $8.9 million in the same quarter last year.

Operating income margins for the fourth quarter were 28 percent

versus 26 percent in same period last year. For the fiscal year,

revenues increased 32 percent to $186.6 million, and operating

income rose 52 percent to $53.2 million compared to $141.0 million

and $35.1 million, respectively, for the prior fiscal year.

Operating margins were 29 percent for the fiscal year compared to

25 percent in the prior fiscal year. Mr. Dingus continued,

"Shipments for the fiscal year increased 37 percent, with 86

percent of the increase attributable to an acquisition made during

fiscal 2009. For the full fiscal year pricing was down 2 percent.

Demand for galvanizing services in the fourth quarter varied across

our served markets. Our infrastructure work related to electrical

and telecommunications, as well as the petrochemical remained at a

strong pace, while other markets did see deterioration due the

domestic economic conditions. Margins were extremely strong for

both the fourth quarter and fiscal year. We have seen additional

pricing deterioration since the first of calendar 2009 and do

believe that fiscal 2010 will reflect a continuation of these

conditions. Fortunately our cost structure is benefiting from lower

commodity cost partially offsetting the adverse impact of price

adjustments. The effective execution of our business strategies,

capitalizing on our market opportunities, and meeting or exceeding

our margin projections has very positively contributed to our

fiscal 2009 success. We anticipate that we will be able to retain

our strong market leadership position in the new fiscal year. "The

strength of our balance sheet, strong cash position, combined with

access to borrowings under our existing banking agreements, should

facilitate the execution of our business strategies." Mr. Dingus

concluded, "On January 16, 2009, the company issued projections for

Fiscal 2010 that revenues would be in the range of $420 to $440

million and that fully diluted earnings per share would be in the

range of $2.75 to $2.95. Based upon the evaluation of information

currently available to management, we are revising our guidance for

revenues to be in the range of $395 to $415 million. Our earnings

guidance remains unchanged from that previously issued. We continue

to strive to build upon the success we have been able to achieve,

and continually strive to maximize the performance of the Company.

Our estimates assume that we will not have any appreciable change

in our current market conditions, significant delays in the

delivery or timing in the receipt of orders of our electrical and

industrial products, and that the pricing and demand for our

galvanizing services will not significantly change from our current

outlook in fiscal 2010." AZZ incorporated will conduct a conference

call to discuss financial results for the fourth quarter and fiscal

2009, and the outlook for fiscal year 2010 at 11:00 A.M. Eastern on

Friday April 3, 2009. Interested parties can access the call at

(877) 356-5706 or (706) 643-0580 (international). The call will be

web cast via the Internet at http://www.azz.com/AZZinvest.htm. A

replay of the call will be available for three days at (800)

642-1687, or (706) 645-9291 (international) confirmation #91136736,

or for 30 days at http://www.azz.com/AZZinvest.htm. AZZ

incorporated is a specialty electrical equipment manufacturer

serving the global markets of industrial, power generation,

transmission and distribution, as well as a leading provider of hot

dip galvanizing services to the steel fabrication market

nationwide. Except for the statements of historical fact, this

release may contain forward-looking statements that involve risks

and uncertainties some of which are detailed from time to time in

documents filed by the Company with the SEC. Those risks and

uncertainties include, but are not limited to: changes in customer

demand and response to products and services offered by the

company, including demand by the electrical power generation

markets, electrical transmission and distribution markets, the

industrial markets, and the hot dip galvanizing markets; prices and

raw material costs, including zinc and natural gas which are used

in the hot dip galvanizing process; changes in the economic

conditions of the various markets the Company serves, foreign and

domestic, customer requested delays of shipments, acquisition

opportunities, currency exchange rates, adequacy of financing, and

availability of experienced management employees to implement the

Company's growth strategy. The Company can give no assurance that

such forward-looking statements will prove to be correct. We

undertake no obligation to affirm, publicly update or revise any

forward-looking statements, whether as a result of information,

future events or otherwise. Contact: Dana Perry, Senior Vice

President - Finance and CFO AZZ incorporated 817-810-0095 Internet:

http://www.azz.com/ Lytham Partners 602-889-9700 Joe Dorame or

Robert Blum Internet: http://www.lythampartners.com/ Condensed

financial tables on attached page AZZ incorporated Condensed

Consolidated Statement of Income (in thousands except per share

amounts) Three Months Ended Twelve Months Ended February February

February February 28, 2009 29, 2008 28, 2009 29, 2008 (unaudited)

(unaudited) (unaudited) (unaudited) =========== ===========

=========== =========== Net sales $100,286 $76,617 $412,364

$320,193 Costs and Expenses: Cost of Sales 72,167 56,708 299,012

239,651 Selling, General and Administrative 10,676 8,445 43,221

36,261 Interest Expense 1,685 233 6,170 1,495 Net (Gain) Loss on

Sales or Insurance Settlement of Property, Plant and Equipment

(373) 84 (1,509) 32 Other (Income) (61) (305) (1,440) (1,079)

$84,094 $65,165 $345,454 $276,360 Income before income taxes and

accounting change $16,192 $11,452 $66,910 $43,833 Income Tax

Expense 6,225 4,124 24,704 16,145 Income Before Cumulative Effect

of Changes in Accounting Principles 9,967 7,328 42,206 27,688

Cumulative Effect of Changes in Accounting Principles (Net of Tax)

- - - - Net income $9,967 $7,328 $42,206 $27,688 Net income per

share Basic $.82 $.60 $3.48 $2.30 Diluted $.81 $.60 $3.43 $2.26

Diluted Average Shares Outstanding 12,279 12,313 12,302 12,227

Segment Reporting (in thousands) Three Months Ended Twelve Months

Ended February February February February 28, 2009 29, 2008 28,

2009 29, 2008 (unaudited) (unaudited) (unaudited) (unaudited)

=========== =========== =========== =========== Net Sales:

Electrical and Industrial Products $59,872 $41,702 $225,797

$179,181 Galvanizing Services 40,414 34,914 186,567 141,012

$100,286 $76,616 $412,364 $320,193 Segment Operating Income(a):

Electrical and Industrial Products $10,811 $6,840 $38,951 $29,158

Galvanizing Services 11,223 8,909 53,184 35,087 Total Segment

Operating Income $22,034 $15,749 $92,135 $64,245 Condensed

Consolidated Balance Sheet (in thousands) February 28, 2009

February 29, 2008 (unaudited) (unaudited) =========== ===========

Assets: Current assets $182,023 $102,995 Net property, plant and

equipment 87,667 48,285 Other assets, net 85,025 42,039 ------

------ Total assets $354,715 $193,319 ======== ======== Liabilities

and shareholders' equity: Current liabilities $58,371 $42,696 Long

term debt due after one year 100,000 - Other liabilities 9,232

4,467 Shareholders' equity $187,112 $146,156 -------- --------

Total liabilities and shareholders' equity $354,715 $193,319

======== ======== Condensed Consolidated Statement of Cash Flows

(in thousands) Twelve Months Ended February 28, February 29, 2009

2008 (unaudited) (unaudited) =========== =========== Net cash

provided by (used in) operating activities $60,196 $38,926 Net cash

provided by (used in) investing activities ($112,811) ($9,706) Net

cash provided by (used in) financing activities $98,104 ($28,696)

Effect of exchange rate changes on cash ($158) - ------ --- Net

increase (decrease) in cash and cash equivalents $45,331 $524 Cash

and cash equivalents at beginning of period $2,227 $1,703 ------

------ Cash and cash equivalents at end of period $47,558 $2,227

======== ========= DATASOURCE: AZZ incorporated CONTACT: Dana

Perry, Senior Vice President - Finance and CFO of AZZ incorporated,

+1-817-810-0095; or Joe Dorame or Robert Blum of Lytham Partners,

+1-602-889-9700, for AZZ incorporated Web Site: http://www.azz.com/

Copyright

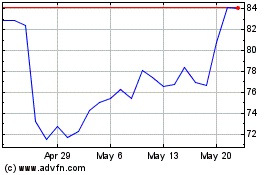

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jul 2024 to Aug 2024

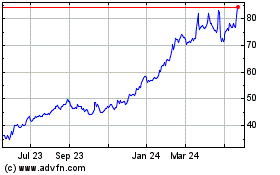

AZZ (NYSE:AZZ)

Historical Stock Chart

From Aug 2023 to Aug 2024