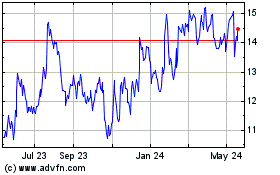

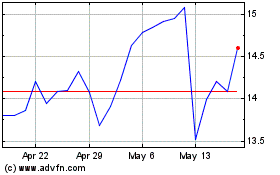

Banc of California, Inc. (NYSE: BANC):

$0.28

Earnings Per Share

$17.78

Book Value

Per Share

$15.72

Tangible Book Value

Per Share(1)

10.55%

CET1 Ratio

29.1%

Average Noninterest-

Bearing Deposits to

Average Total Deposits

Banc of California, Inc. (NYSE: BANC) (“Banc of California” or

the “Company”), the parent company of wholly-owned subsidiary Banc

of California (the “Bank”), today reported financial results for

the fourth quarter and year ended December 31, 2024. The Company

reported net earnings available to common and equivalent

stockholders of $47.0 million, or $0.28 per diluted common share,

for the fourth quarter of 2024. This compares to a net loss

available to common and equivalent stockholders of $1.2 million, or

a loss of $0.01 per diluted common share, for the third quarter of

2024. On an adjusted basis, net earnings available to common and

equivalent stockholders were $41.4 million, or $0.25 per diluted

common share for the third quarter.(1) The third quarter of 2024

included $60 million of pre-tax losses from repositioning a portion

of the securities portfolio. For the full year 2024, we reported

net income available to common and equivalent shareholders of $87.1

million, or $0.52 per diluted common share. On an adjusted basis,

net income available to common and equivalent shareholders was

$135.4 million, or $0.80 per diluted common shares.(1)

Update on Southern California

Wildfires

The recent wildfires in Southern California have been

devastating, severely impacting Los Angeles and the surrounding

areas – home to our headquarters and where many of our clients and

team members live and work. To support the recovery efforts, our

charitable foundation has launched the Banc of California Wildfire

Relief and Recovery Fund, which is dedicated to aiding relief

efforts and rebuilding our community. To further our commitment, we

have donated $1 million to the relief fund, standing in solidarity

with Angelenos as we work together to rebuild and restore what has

been lost. To date, we are not aware of any material impact on our

loan portfolio, collateral or any of our facilities due to the

Southern California wildfires. We are currently aware of four

commercial properties and three residential properties that have

been damaged or destroyed but all such collateral has insurance

coverage in place and will continue to monitor and assess for

potential exposure.

Financial Highlights for the Fourth

Quarter and 2024 Fiscal Year

- Net interest margin expansion of 11 basis points vs 3Q24

to 3.04% and 135 basis points year-over-year, driven by lower

funding costs

- Lowered funding costs by 27 basis points vs 3Q24 and 113

basis points year-over-year, reflecting benefits of prior balance

sheet repositioning actions and improved funding mix

- Average noninterest-bearing deposits grew to 29.1% of

average total deposits, up from 27.7% in 3Q24 and 22.6% in

4Q23, driven by relationship-focused deposit growth strategy

- Total loans of $23.8 billion grew 4.3% annualized or $254

million from 3Q24, driven by growth in warehouse lending,

equity funds, and residential mortgage loan portfolios

- Total noninterest expense declined 7.6% vs 3Q24 to

$181.4 million and 50.1% year-over-year, driven by strong

efficiency gains and achievement of our merger cost savings target.

This reflects a 35.7% decrease in adjusted noninterest expense(1)

year-over-year excluding acquisition, integration and

reorganization costs and normalizing 4Q23 to include combined

company expenses for a full quarter and incentive compensation

adjusted to target.

- Strengthened capital ratios with CET1 capital ratio(2)

up 9 basis points vs 3Q24 to 10.55% and 41 basis points

year-over year

- Growth in book value per share to $17.78 and tangible

book value per share(1) to $15.72

(1)

Non-GAAP measure; refer to section

'Non-GAAP Measures'

(2)

Capital ratio for 12/31/2024 is

preliminary

Jared Wolff, President & CEO of Banc of California,

commented, “Our strong fourth quarter results reflect continued

momentum and consistent execution by our team. During the quarter,

we achieved additional cost savings as well as a significant

decline in our funding costs driven by our targeted reduction in

deposit costs and the balance sheet repositioning actions that we

completed earlier in the year. These actions helped drive an

expansion in our net interest margin and increases in our net

income, earnings per share, and level of returns.”

Mr. Wolff continued, “During the course of 2024, we made

significant strides in strengthening our balance sheet and core

earnings power. We believe we are well positioned to continue

adding to our client base and expanding relationships with existing

clients. Given the positive economic outlook, and the solid gains

in loans and deposits generated by our teams in the fourth quarter,

we believe we are well positioned to generate further growth in the

balance sheet in 2025, expanding operating leverage and

profitability to create additional value for our shareholders.”

INCOME STATEMENT HIGHLIGHTS

Three Months Ended Year Ended December 31,

September 30, December 31, December 31,

Summary Income Statement

2024

2024

2023

2024

2023

(In thousands) Total interest income

$

424,519

$

446,893

$

467,240

$

1,812,705

$

1,971,000

Total interest expense

189,234

214,718

316,189

886,655

1,223,872

Net interest income

235,285

232,175

151,051

926,050

747,128

Provision for credit losses

12,801

9,000

47,000

42,801

52,000

Gain (loss) on sale of loans

20

(62

)

(3,526

)

645

(161,346

)

(Loss) gain on sale of securities

(454

)

(59,946

)

(442,413

)

(60,400

)

(442,413

)

Other noninterest income

29,423

44,556

45,537

136,900

155,474

Total noninterest income (loss)

28,989

(15,452

)

(400,402

)

77,145

(448,285

)

Total revenue

264,274

216,723

(249,351

)

1,003,195

298,843

Goodwill impairment

-

-

-

-

1,376,736

Acquisition, integration and reorganization costs

(1,023

)

(510

)

111,800

(14,183

)

142,633

Other noninterest expense

182,393

196,719

251,838

805,923

938,812

Total noninterest expense

181,370

196,209

363,638

791,740

2,458,181

Earnings (loss) before income taxes

70,103

11,514

(659,989

)

168,654

(2,211,338

)

Income tax expense (benefit)

13,184

2,730

(177,034

)

41,766

(312,201

)

Net earnings (loss)

56,919

8,784

(482,955

)

126,888

(1,899,137

)

Preferred stock dividends

9,947

9,947

9,947

39,788

39,788

Net earnings (loss) available to common and equivalent stockholders

$

46,972

$

(1,163

)

$

(492,902

)

$

87,100

$

(1,938,925

)

Net Interest Income

Q4-2024 vs Q3-2024

Net interest income increased by $3.1 million to $235.3 million

for the fourth quarter from $232.2 million for the third quarter

due to lower interest expense on interest-bearing liabilities,

offset partially by lower interest income on interest-earning

assets.

The net interest margin increased 11 basis points to 3.04% for

the fourth quarter as the cost of average total funding decreased

27 basis points and the average interest-earning assets yield

decreased 15 basis points.

The average yield on interest-earning assets decreased by 15

basis points to 5.48% for the fourth quarter from 5.63% for the

third quarter due mainly to the average yield on deposits in

financial institutions decreasing by 65 basis points and the

average yield on loans and leases decreasing by 17 basis points,

offset partially by the average yield on investment securities

increasing by 21 basis points. The decrease in the average yield on

deposits in financial institutions was due to lower market rates

attributable mainly to the Federal Reserve reducing the federal

funds rate by a total of 100 basis points since September 2024. The

average yield on loans and leases decreased by 17 basis points to

6.01% for the fourth quarter from 6.18% for the third quarter as a

result of lower market interest rates and lower loan discount

accretion. The average yield on investment securities increased by

21 basis points benefiting from the balance sheet repositioning

actions taken in the third quarter.

Average interest-earning assets decreased by $750.7 million to

$30.8 billion for the fourth quarter due mainly to the decreases of

$631.5 million in average deposits in financial institutions and

$154.4 million in average loans and leases.

The average total cost of funds decreased by 27 basis points to

2.55% for the fourth quarter from 2.82% for the third quarter due

mainly to lower market interest rates, lower rate on average

borrowings, and lower average balance of total deposits due to the

paydown of higher-cost brokered deposits in the third quarter. The

average cost of interest-bearing liabilities decreased by 32 basis

points to 3.48% for the fourth quarter from 3.80% for the third

quarter. The average cost of interest-bearing deposits decreased by

34 basis points to 3.18% for the fourth quarter from 3.52% for the

third quarter mainly due to deposit rate repricing driven by

federal funds rate cuts, while the average cost of borrowings

decreased by 95 basis points to 5.40% for the fourth quarter from

6.35% for the third quarter as the BTFP was paid off and partially

replaced with lower fixed rate FHLB advances in the third quarter.

Average noninterest-bearing deposits increased by $59.9 million for

the fourth quarter compared to the third quarter, average total

deposits decreased by $1.2 billion due to the aforementioned

paydown of brokered deposits, and average borrowings increased by

$335.5 million.

Full Year 2024 vs Full Year

2023

Net interest income increased by $178.9 million to $926.1

million for the year ended December 31, 2024 from $747.1 million

for the year ended December 31, 2023 due to lower interest expense

on interest-bearing liabilities, offset partially by lower interest

income on interest-earning assets.

The net interest margin increased by 87 basis points to 2.85%

for the year ended December 31, 2024 compared to 1.98% in 2023 due

to the average yield on interest-earning assets increasing by 37

basis points, while the average total cost of funds decreased by 50

basis points.

The average yield on interest-earning assets increased by 37

basis points to 5.58% for the year ended December 31, 2024 from

5.21% in 2023 due mainly to the change in the interest-earning

asset mix. This was driven by the increase in the balance of

average loans and leases as a percentage of average

interest-earning assets to 76% for the year ended December 31,2024

from 67% for the year ended December 31, 2023, the decrease in the

balance of average investment securities as a percentage of average

interest-earning assets to 14% for the year ended December 31, 2024

from 18% in 2023, and the decrease in the balance of average

deposits in financial institutions as a percentage of average

interest-earning assets to 10% for the year ended December 31, 2024

from 15% in 2023.

The average yield on loans and leases increased by 19 basis

points to 6.11% for the year ended December 31, 2024 from 5.92% in

2023 as a result of changes in portfolio mix and higher net

accretion of loan discounts. The average yield on investment

securities increased by 44 basis points benefiting from the balance

sheet repositioning actions taken in the third quarter of 2024.

Average interest-earning assets decreased by $5.4 billion to

$32.5 billion for the year ended December 31, 2024 due to lower

average balances in loans and leases, investments securities, and

deposits in financial institutions. Average loans and leases

decreased by $760.7 million primarily due to the sale in July 2024

of $1.95 billion of Civic loans, offset partially by the

acquisition of legacy Banc of California loans completed in the

fourth quarter of 2023. Average investment securities decreased by

$2.1 billion mostly due to securities sales completed in the fourth

quarter of 2023. Average deposits in financial institutions

decreased by $2.5 billion due to lower cash balances which were

used to pay down higher-cost funding including the full payoff of

$2.6 billion of the BTFP and $1.85 billion in brokered deposits as

part of the balance sheet repositioning actions taken during

2024.

The average total cost of funds decreased by 50 basis points to

2.84% for the year ended December 31, 2024 from 3.34% for the year

ended December 31, 2023 due mainly to changes in the total funding

mix. This was driven by the increase in the balance of lower-cost

average total deposits as a percentage of average total funds to

91% for the year ended December 31, 2024 from 78% in 2023, and the

decrease in the balance of higher-cost average borrowings as a

percentage of average total funds to 6% for the year ended December

31, 2024 from 19% in 2023. The average cost of interest-bearing

liabilities decreased by 35 basis points to 3.79% for the year

ended December 31, 2024 from 4.14% in 2023. The average total cost

of deposits decreased by 9 basis points to 2.52% for the year ended

December 31, 2024 compared to 2.61% for the year ended December 31,

2023. Average noninterest-bearing deposits increased by $757.6

million for the year ended December 31, 2024 compared to 2023 and

average total deposits decreased by $251.8 million. Average

borrowings decreased by $5.2 billion for the year ended December

31, 2024 compared to 2023 due to paydown of borrowings in

connection with the balance sheet repositioning completed due to

the merger.

Provision For Credit Losses

Q4-2024 vs Q3-2024

The provision for credit losses increased by $3.8 million to

$12.8 million for the fourth quarter compared to $9.0 million for

the third quarter. The fourth quarter provision included an $11.5

million provision for loan losses and a $1.5 million provision for

unfunded loan commitments, offset partially by a $0.2 million

reversal of the provision for credit losses related to

available-for-sale securities. The fourth quarter provision for

loans and unfunded loan commitments was driven primarily by net

charge-off activity during the quarter. The third quarter provision

was driven primarily by increases in qualitative reserves, for

loans secured by office properties and concentrations of credit,

and specific reserves for nonperforming loan downgrades.

Full Year 2024 vs Full Year

2023

The provision for credit losses decreased by $9.2 million to

$42.8 million for the year ended December 31, 2024 compared to

$52.0 million for the year ended December 31, 2023. The provision

for credit losses in 2024 included a $43.5 million provision for

loan losses, offset partially by a $0.5 million reversal of the

provision for credit losses related to unfunded loan commitments

and a $0.2 million reversal of the provision for credit losses

related to available-for-sale securities. The 2024 provision was

driven mainly by net charge-off activity during the year. The

provision for credit losses for 2023 included a $113.5 million

provision for loan losses, offset partially by a $61.5 million

reversal of the provision for credit losses related to lower

unfunded loan commitments. The 2023 provision for loan losses also

included an initial provision of $22.2 million for acquired legacy

Banc of California non-PCD loans.

Noninterest Income

Q4-2024 vs Q3-2024

Noninterest income increased by $44.4 million to $29.0 million

for the fourth quarter from a loss of $15.5 million for the third

quarter due mainly to a $59.5 million decrease in loss on sale of

securities, offset partially by decreases of $6.4 million in leased

equipment income, $5.4 million in other income and $3.7 million in

dividends and gains on equity investments. The decrease in loss on

sale of securities was mainly due to the sale of $741.8 million in

securities for a net loss of $59.9 million in the third quarter of

2024. The decrease in leased equipment was due mostly to lower

gains from early lease terminations and sale of leased assets. The

decrease in other income was due primarily to a $4.6 million

increase in the negative fair value mark on the credit-linked

notes. The decrease in dividends and gains on equity investments

was due to lower income distributions from the CRA equity

investments.

Full Year 2024 vs Full Year

2023

Noninterest income increased by $525.4 million to $77.1 million

for the year ended December 31, 2024 due mostly to a decrease in

the loss on sale of securities of $382.0 million and an increase in

the gain on sale of loans of $162.0 million. The Company sold

$753.7 million in securities for a net loss of $60.4 million in the

year ended December 31, 2024 and $2.7 billion in securities for a

net loss of $442.4 in the year ended December 31, 2023. The Company

sold $2.5 billion of loans for a net gain of $0.6 million in the

year ended December 31, 2024 and $8.7 billion of loans for a net

loss of $161.3 million in the year ended December 31, 2023.

Noninterest Expense

Q4-2024 vs Q3-2024

Noninterest expense decreased by $14.8 million to $181.4 million

for the fourth quarter due mainly to decreases of $7.9 million in

compensation expenses, $2.8 million in customer related expenses,

$1.5 million in insurance and assessments expense, and $1.2 million

in occupancy expense. The decrease in compensation expenses was

primarily due to lower headcount. The decrease in customer related

expenses was driven by lower earnings credit rate expenses which

were impacted by lower federal funds rate. The decrease in

insurance and assessments expense was due to lower FDIC assessment

rates. The decrease in occupancy expense was mostly attributable to

facility consolidations leading to cost savings.

Full Year 2024 vs Full Year

2023

Noninterest expense decreased by $1.7 billion to $791.7 million

for the year ended December 31, 2024 due mainly to a $1.4 billion

goodwill impairment recorded in 2023, a $156.8 million decrease in

acquisition, integration and reorganization costs related to our

merger with PacWest, and a $65.0 million decrease in insurance and

assessments expense for both the regular FDIC assessment and the

special assessment.

Income Taxes

Q4-2024 vs Q3-2024

Income tax expense of $13.2 million was recorded for the fourth

quarter resulting in an effective tax rate of 18.8% compared to

income tax expense of $2.7 million for the third quarter and an

effective tax rate of 23.7%. The lower fourth quarter effective tax

rate was due primarily to tax benefits resulted from recording

deferred tax assets at higher state tax rates.

Full Year 2024 vs Full Year

2023

Income tax expense of $41.8 million was recorded for the year

ended December 31, 2024 resulting in an effective tax rate of 24.8%

compared to an income tax benefit of $312.2 million for the year

ended December 31, 2023 and an effective tax rate of 14.1%. The

lower effective tax rate in 2023 was due primarily to

non-deductible goodwill impairment recorded in 2023. Excluding

non-deductible goodwill impairment of $1.0 billion, the effective

tax rate was 26.2% for the year ended December 31, 2023.

BALANCE SHEET HIGHLIGHTS

December 31, September 30, December 31,

Increase (Decrease) Selected

Balance Sheet Items

2024

2024

2023

QoQ YoY (In thousands) Cash and cash

equivalents

$

2,502,212

$

2,554,227

$

5,377,576

$

(52,015

)

$

(2,875,364

)

Securities available-for-sale

2,246,839

2,300,284

2,346,864

(53,445

)

(100,025

)

Securities held-to-maturity

2,306,149

2,301,263

2,287,291

4,886

18,858

Loans held for sale

26,331

28,639

122,757

(2,308

)

(96,426

)

Loans and leases held for investment, net of deferred fees

23,781,663

23,527,777

25,489,687

253,886

(1,708,024

)

Total assets

33,542,864

33,432,613

38,534,064

110,251

(4,991,200

)

Noninterest-bearing deposits

$

7,719,913

$

7,811,796

$

7,774,254

$

(91,883

)

$

(54,341

)

Total deposits

27,191,909

26,828,269

30,401,769

363,640

(3,209,860

)

Borrowings

1,391,814

1,591,833

2,911,322

(200,019

)

(1,519,508

)

Total liabilities

30,042,915

29,936,415

35,143,299

106,500

(5,100,384

)

Total stockholders' equity

3,499,949

3,496,198

3,390,765

3,751

109,184

Securities

The balance of securities held-to-maturity (“HTM”) remained

consistent through the fourth quarter and totaled $2.3 billion at

December 31, 2024. As of December 31, 2024, HTM securities had

aggregate unrealized net after-tax losses in accumulated other

comprehensive income (loss) (“AOCI”) of $157.9 million remaining

from the balance established at the time of transfer from

available-for-sale on June 1, 2022.

Securities available-for-sale (“AFS”) decreased by $53.4 million

during the fourth quarter to $2.2 billion at December 31, 2024. AFS

securities had aggregate unrealized net after-tax losses in AOCI of

$200.1 million. These AFS unrealized net losses related primarily

to changes in overall interest rates and spreads and the resulting

impact on valuations.

Loans and Leases

The following table sets forth the composition, by loan

category, of our loan and lease portfolio held for investment, net

of deferred fees, as of the dates indicated:

December 31, September 30, June 30, March

31, December 31, Composition of

Loans and Leases

2024

2024

2024

2024

2023

(Dollars in thousands) Real estate mortgage: Commercial

$

4,578,772

$

4,557,939

$

4,722,585

$

4,896,544

$

5,026,497

Multi-family

6,041,713

6,009,280

5,984,930

6,121,472

6,025,179

Other residential

2,807,174

2,767,187

2,866,085

4,949,383

5,060,309

Total real estate mortgage

13,427,659

13,334,406

13,573,600

15,967,399

16,111,985

Real estate construction and land: Commercial

799,131

836,902

784,166

775,021

759,585

Residential

2,373,162

2,622,507

2,573,431

2,470,333

2,399,684

Total real estate construction and land

3,172,293

3,459,409

3,357,597

3,245,354

3,159,269

Total real estate

16,599,952

16,793,815

16,931,197

19,212,753

19,271,254

Commercial: Asset-based

2,087,969

2,115,311

1,968,713

2,061,016

2,189,085

Venture capital

1,537,776

1,353,626

1,456,122

1,513,641

1,446,362

Other commercial

3,153,084

2,850,535

2,446,974

2,245,910

2,129,860

Total commercial

6,778,829

6,319,472

5,871,809

5,820,567

5,765,307

Consumer

402,882

414,490

425,903

439,702

453,126

Total loans and leases held for investment, net of deferred fees

$

23,781,663

$

23,527,777

$

23,228,909

$

25,473,022

$

25,489,687

Total unfunded loan commitments

$

4,887,690

$

5,008,449

$

5,256,473

$

5,482,672

$

5,578,907

Composition as % of Total December 31,

September 30, June 30, March 31, December

31, Loans and Leases

2024

2024

2024

2024

2023

Real estate mortgage: Commercial

19

%

19

%

20

%

19

%

20

%

Multi-family

26

%

25

%

26

%

24

%

23

%

Other residential

12

%

12

%

12

%

19

%

20

%

Total real estate mortgage

57

%

56

%

58

%

62

%

63

%

Real estate construction and land: Commercial

3

%

4

%

4

%

3

%

3

%

Residential

10

%

11

%

11

%

10

%

9

%

Total real estate construction and land

13

%

15

%

15

%

13

%

12

%

Total real estate

70

%

71

%

73

%

75

%

75

%

Commercial: Asset-based

9

%

9

%

8

%

8

%

9

%

Venture capital

6

%

6

%

6

%

6

%

6

%

Other commercial

13

%

12

%

11

%

9

%

8

%

Total commercial

28

%

27

%

25

%

23

%

23

%

Consumer

2

%

2

%

2

%

2

%

2

%

Total loans and leases held for investment, net of deferred fees

100

%

100

%

100

%

100

%

100

%

Total loans and leases held for investment, net of deferred

fees, increased by $253.9 million in the fourth quarter and totaled

$23.8 billion at December 31, 2024. The increase in loans and

leases held for investment was due primarily to increased balances

in the warehouse lending, equity funds, and residential mortgage

loan portfolios, offset partially by a decrease in the residential

real estate construction loan portfolio. Loan originations

including production, purchased loans, and unfunded new commitments

were $1.8 billion in the fourth quarter with rate on new production

at a weighted average interest rate of 7.02%.

Credit Quality

December 31, September 30, June 30, March

31, December 31, Asset Quality

Information and Ratios

2024

2024

2024

2024

2023

(Dollars in thousands) Delinquent loans and leases held

for investment: 30 to 89 days delinquent

$

91,347

$

52,927

$

27,962

$

178,421

$

113,307

90+ days delinquent

88,846

72,037

55,792

57,573

30,881

Total delinquent loans and leases

$

180,193

$

124,964

$

83,754

$

235,994

$

144,188

Total delinquent loans and leases to loans and leases held

for investment

0.76

%

0.53

%

0.36

%

0.93

%

0.57

%

Nonperforming assets, excluding loans held for sale:

Nonaccrual loans and leases

$

189,605

$

168,341

$

117,070

$

145,785

$

62,527

90+ days delinquent loans and still accruing

-

-

-

-

11,750

Total nonperforming loans and leases ("NPLs")

189,605

168,341

117,070

145,785

74,277

Foreclosed assets, net

9,734

8,661

13,302

12,488

7,394

Total nonperforming assets ("NPAs")

$

199,339

$

177,002

$

130,372

$

158,273

$

81,671

Classified loans and leases held for investment

$

563,502

$

533,591

$

415,498

$

366,729

$

228,417

Allowance for loan and lease losses

$

239,360

$

254,345

$

247,762

$

291,503

$

281,687

Allowance for loan and lease losses to NPLs

126.24

%

151.09

%

211.64

%

199.95

%

379.24

%

NPLs to loans and leases held for investment

0.80

%

0.72

%

0.50

%

0.57

%

0.29

%

NPAs to total assets

0.59

%

0.53

%

0.37

%

0.44

%

0.21

%

Classified loans and leases to loans and leases held for investment

2.37

%

2.27

%

1.79

%

1.44

%

0.90

%

We continued to remain conservative on risk rating of loans and

leases. Increases to classified loans and leases that remained on

accrual status resulted from downward migration for loans and

leases where performance metrics deteriorated but with no current

expectation of loss. Nonperforming, classified and delinquent loan

inflows were primarily driven by one customer relationship with two

loans with no expected loss due to collateral coverage. Our overall

loan portfolio continues to benefit from strong underwriting,

borrower strength and good credit metrics.

At December 31, 2024, total delinquent loans and leases were

$180.2 million, compared to $125.0 million at September 30, 2024.

The $55.2 million increase in total delinquent loans was due mainly

to increases in the 30 to 89 days delinquent category of $20.2

million in other residential real estate mortgage loans, $10.4

million in commercial real estate mortgage loans, and $10.3 million

in multi-family mortgage loans. In the 90 or more days delinquent

category, there was a $21.9 million increase in multi-family

mortgage loans, offset partially by a $6.9 million decrease in

commercial real estate mortgage loans. Total delinquent loans and

leases as a percentage of total loans and leases increased to 0.76%

at December 31, 2024, as compared to 0.53% at September 30,

2024.

At December 31, 2024, nonperforming assets were $199.3 million,

or 0.59% of total assets, compared to $177.0 million, or 0.53% of

total assets, as of September 30, 2024. At December 31, 2024,

nonperforming assets included $9.7 million of foreclosed assets,

consisting entirely of single-family residences.

At December 31, 2024, nonperforming loans were $189.6 million,

compared to $168.3 million at September 30, 2024. During the fourth

quarter, nonperforming loans increased by $21.3 million due to

additions of $56.9 million, offset partially by charge-offs of

$22.0 million and payoffs and paydowns of $13.6 million. The

addition to nonperforming loans was mainly related to

aforementioned two commercial loans from one customer

relationship.

Nonperforming loans and leases as a percentage of loans and

leases held for investment increased to 0.80% at December 31, 2024

compared to 0.72% at September 30, 2024.

Allowance for Credit Losses – Loans

Three Months Ended Year Ended December 31,

September 30, December 31, December 31,

Allowance for Credit Losses

– Loans

2024

2024

2023

2024

2023

(Dollars in thousands) Allowance for loan and lease

losses ("ALLL"): Balance at beginning of period

$

254,345

$

247,762

$

222,297

$

281,687

$

200,732

Initial ALLL on acquired PCD loans

-

-

25,623

-

25,623

Charge-offs

(27,696

)

(4,163

)

(14,628

)

(94,943

)

(63,428

)

Recoveries

1,211

1,746

1,395

9,116

5,260

Net charge-offs

(26,485

)

(2,417

)

(13,233

)

(85,827

)

(58,168

)

Provision for loan losses

11,500

9,000

47,000

43,500

113,500

Balance at end of period

$

239,360

$

254,345

$

281,687

$

239,360

$

281,687

Reserve for unfunded loan commitments ("RUC"):

Balance at beginning of period

$

27,571

$

27,571

$

29,571

$

29,571

$

91,071

(Negative provision) provision for credit losses

1,500

-

-

(500

)

(61,500

)

Balance at end of period

$

29,071

$

27,571

$

29,571

$

29,071

$

29,571

Allowance for credit losses ("ACL") – Loans:

Balance at beginning of period

$

281,916

$

275,333

$

251,868

$

311,258

$

291,803

Initial ALLL on acquired PCD loans

-

-

25,623

-

25,623

Charge-offs

(27,696

)

(4,163

)

(14,628

)

(94,943

)

(63,428

)

Recoveries

1,211

1,746

1,395

9,116

5,260

Net charge-offs

(26,485

)

(2,417

)

(13,233

)

(85,827

)

(58,168

)

Provision for credit losses

13,000

9,000

47,000

43,000

52,000

Balance at end of period

$

268,431

$

281,916

$

311,258

$

268,431

$

311,258

ALLL to loans and leases held for investment

1.01

%

1.08

%

1.11

%

1.01

%

1.11

%

ACL to loans and leases held for investment

1.13

%

1.20

%

1.22

%

1.13

%

1.22

%

ACL to NPLs

141.57

%

167.47

%

419.05

%

141.57

%

419.05

%

ACL to NPAs

134.66

%

159.27

%

381.11

%

134.66

%

381.11

%

Annualized net charge-offs to average loans and leases

0.45

%

0.04

%

0.22

%

0.35

%

0.23

%

The allowance for credit losses – loans, which includes the

reserve for unfunded loan commitments, totaled $268.4 million, or

1.13% of total loans and leases, at December 31, 2024, compared to

$281.9 million, or 1.20% of total loans and leases, at September

30, 2024. The $13.5 million decrease in the allowance was due to

net charge-offs of $26.5 million, offset partially by the $13.0

million provision. The ACL coverage ratio decreased from last

quarter driven by improvement in the economic forecast, a mix shift

towards loan categories with lower expected losses, and the impact

of charge-offs, offset partially by the impact of changes in risk

ratings.

Our ability to absorb credit losses is also bolstered by (i)

$117.0 million of loss coverage from the credit-linked notes,

pursuant to which the bank sold the first 5% of any losses on our

$2.3 billion single-family residential mortgage loan portfolio; and

(ii) unearned credit marks of $22.5 million on approximately $1.7

billion of purchased loans without credit deterioration that were

originated by Banc of California prior to the merger. When the loss

coverage from the credit-linked notes and unearned credit marks is

added to our allowance for credit losses, this provides additional

economic coverage on top of our ACL ratio. We refer to this

adjusted ACL ratio as our economic coverage ratio(1), which equaled

1.72% of total loans and leases at December 31, 2024.

The ACL coverage of nonperforming loans was 142% at December 31,

2024 compared to 167% at September 30, 2024.

Net charge-offs were 0.45% of average loans and leases

(annualized) for the fourth quarter, compared to 0.04% for the

third quarter. The increase in net charge-offs in the fourth

quarter was attributable primarily to a commercial loan exposure

with isolated risk and one Civic loan, both of which migrated to

nonperforming loan status in the third quarter.

(1)

Non-GAAP measures; refer to section

'Non-GAAP Measures'

Deposits and Client Investment Funds

The following table sets forth the composition of our deposits

at the dates indicated:

December 31, September 30, June 30, March

31, December 31, Composition of

Deposits

2024

2024

2024

2024

2023

(Dollars in thousands) Noninterest-bearing checking

$

7,719,913

$

7,811,796

$

7,825,007

$

7,833,608

$

7,774,254

Interest-bearing: Checking

7,610,705

7,539,899

7,309,833

7,836,097

7,808,764

Money market

5,361,635

5,039,607

4,837,025

5,020,110

6,187,889

Savings

1,933,232

1,992,364

2,040,461

2,016,398

1,997,989

Time deposits: Non-brokered

2,488,217

2,451,340

2,758,067

2,761,836

3,139,270

Brokered

2,078,207

1,993,263

4,034,057

3,424,358

3,493,603

Total time deposits

4,566,424

4,444,603

6,792,124

6,186,194

6,632,873

Total interest-bearing

19,471,996

19,016,473

20,979,443

21,058,799

22,627,515

Total deposits

$

27,191,909

$

26,828,269

$

28,804,450

$

28,892,407

$

30,401,769

December 31, September 30, June

30, March 31, December 31, Composition as % of Total Deposits

2024

2024

2024

2024

2023

Noninterest-bearing checking

28

%

29

%

27

%

27

%

26

%

Interest-bearing: Checking

28

%

28

%

25

%

27

%

26

%

Money market

20

%

19

%

17

%

17

%

20

%

Savings

7

%

7

%

7

%

7

%

6

%

Time deposits: Non-brokered

9

%

9

%

10

%

10

%

10

%

Brokered

8

%

8

%

14

%

12

%

12

%

Total time deposits

17

%

17

%

24

%

22

%

22

%

Total interest-bearing

72

%

71

%

73

%

73

%

74

%

Total deposits

100

%

100

%

100

%

100

%

100

%

Total deposits increased by $363.6 million during the fourth

quarter to $27.2 billion at December 31, 2024.

Noninterest-bearing checking totaled $7.72 billion and

represented 28% of total deposits at December 31, 2024, compared to

$7.81 billion, or 29% of total deposits, at September 30, 2024.

Uninsured and uncollateralized deposits of $7.2 billion

represented 26% of total deposits at December 31, 2024 compared to

uninsured and uncollateralized deposits of $6.7 billion or 25% of

total deposits at September 30, 2024.

In addition to deposit products, we also offer alternative,

non-depository corporate treasury solutions for select clients to

invest excess liquidity. These alternative options include

investments managed by BofCal Asset Management Inc. (“BAM”), our

registered investment advisor subsidiary, and third-party sweep

products. Total off-balance sheet client investment funds were $1.5

billion as of December 31, 2024, of which $0.7 billion was managed

by BAM.

Borrowings

Borrowings decreased $200.0 million to $1.4 billion at December

31, 2024 from $1.6 billion at September 30, 2024 due to lower

short-term borrowings.

Equity

During the fourth quarter, total stockholders’ equity increased

by $3.8 million to $3.5 billion and tangible common equity(1)

increased by $13.6 million to $2.7 billion at December 31, 2024.

The increase in total stockholders’ equity for the fourth quarter

resulted primarily from net earnings of $56.9 million, offset

partially by an increase in the unrealized after-tax net loss in

AOCI for AFS securities of $38.3 million and common and preferred

stock dividends of $27.9 million.

At December 31, 2024, book value per common share increased to

$17.78 compared to $17.75 at September 30, 2024, and tangible book

value per common share(1) increased to $15.72 compared to $15.63 at

September 30, 2024.

(1)

Non-GAAP measures; refer to section

'Non-GAAP Measures'

CAPITAL AND LIQUIDITY

Capital ratios remain strong with total risk-based capital at

17.05% and a tier 1 leverage ratio of 10.15% at December 31,

2024.

The following table sets forth our regulatory capital ratios as

of the dates indicated:

December 31, September 30, June 30, March

31, December 31, Capital

Ratios

2024 (1)

2024

2024

2024

2023

Banc of California, Inc. Total risk-based capital

ratio

17.05

%

17.00

%

16.57

%

16.40

%

16.43

%

Tier 1 risk-based capital ratio

12.97

%

12.88

%

12.62

%

12.38

%

12.44

%

Common equity tier 1 capital ratio

10.55

%

10.46

%

10.27

%

10.09

%

10.14

%

Tier 1 leverage capital ratio

10.15

%

9.83

%

9.51

%

9.12

%

9.00

%

Banc of California Total risk-based capital ratio

16.65

%

16.61

%

16.19

%

15.88

%

15.75

%

Tier 1 risk-based capital ratio

14.17

%

14.08

%

13.77

%

13.34

%

13.27

%

Common equity tier 1 capital ratio

14.17

%

14.08

%

13.77

%

13.34

%

13.27

%

Tier 1 leverage capital ratio

11.08

%

10.74

%

10.38

%

9.84

%

9.62

%

(1)

Capital information for December 31, 2024

is preliminary.

At December 31, 2024, immediately available cash and cash

equivalents were $2.3 billion, a decrease of $52.9 million from

September 30, 2024. Combined with total available borrowing

capacity of $11.5 billion and unpledged AFS securities of $2.0

billion, total available liquidity was $15.9 billion at the end of

the fourth quarter.

Conference Call

The Company will host a conference call to discuss its fourth

quarter 2024 financial results at 10:00 a.m. Pacific Time (PT) on

Thursday, January 23, 2025. Interested parties are welcome to

attend the conference call by dialing (888) 317-6003 and

referencing event code 4964279. A live audio webcast will also be

available, and the webcast link will be posted on the Company’s

Investor Relations website at www.bancofcal.com/investor. The slide

presentation for the call will also be available on the Company's

Investor Relations website prior to the call. A replay of the call

will be made available approximately one hour after the call has

ended on the Company’s Investor Relations website at

www.bancofcal.com/investor or by dialing (877) 344-7529 and

referencing event code 6452827.

About Banc of California, Inc.

Banc of California, Inc. (NYSE: BANC) is a bank holding company

with over $33 billion in assets and the parent company of Banc of

California. Banc of California is one of the nation’s premier

relationship-based business banks, providing banking and treasury

management services to small-, middle-market, and venture-backed

businesses. Banc of California is the largest independent bank

headquartered in Los Angeles and the third largest bank

headquartered in California and offers a broad range of loan and

deposit products and services through 80 full-service branches

located throughout California and in Denver, Colorado, and Durham,

North Carolina, as well as through regional offices nationwide. The

bank also provides full-stack payment processing solutions through

its subsidiary, Deepstack Technologies, and serves the Community

Association Management industry nationwide with its

technology-forward platform, SmartStreet™. The bank is committed to

its local communities through the Banc of California Charitable

Foundation, and by supporting organizations that provide financial

literacy and job training, small business support, affordable

housing, and more. For more information, please visit us at

www.bancofcal.com.

Forward-Looking Statements and Other Matters

This press release includes forward-looking statements within

the meaning of the “Safe-Harbor” provisions of the Private

Securities Litigation Reform Act of 1995. These statements include,

but are not limited to, statements related to our expectations

regarding the performance of our business, liquidity and capital

ratios and other non-historical statements. Words or phrases such

as “believe,” “will,” “should,” “will likely result,” “are expected

to,” “will continue,” “is anticipated,” “estimate,” “project,”

“plans,” “strategy,” or similar expressions are intended to

identify these forward-looking statements. You are cautioned not to

place undue reliance on any forward-looking statements. These

statements are necessarily subject to risk and uncertainty and

actual results could differ materially from those anticipated due

to various factors, including those set forth from time to time in

the documents filed or furnished by the Company with the Securities

and Exchange Commission (“SEC”). The Company undertakes no

obligation to revise or publicly release any revision or update to

these forward-looking statements to reflect events or circumstances

that occur after the date on which such statements were made,

except as required by law.

Factors that could cause actual results to differ materially

from the results anticipated or projected include, but are not

limited to: (i) changes in general economic conditions, either

nationally or in our market areas, including the impact of supply

chain disruptions, and the risk of recession or an economic

downturn; (ii) changes in the interest rate environment, including

the recent and potential future changes in the FRB benchmark rate,

which could adversely affect our revenue and expenses, the value of

assets and obligations, the realization of deferred tax assets, the

availability and cost of capital and liquidity, and the impacts of

continuing or renewed inflation; (iii) the credit risks of lending

activities, which may be affected by deterioration in real estate

markets and the financial condition of borrowers, and the

operational risk of lending activities, including the effectiveness

of our underwriting practices and the risk of fraud, any of which

may lead to increased loan delinquencies, losses, and

non-performing assets, and may result in our allowance for credit

losses not being adequate; (iv) fluctuations in the demand for

loans, and fluctuations in commercial and residential real estate

values in our market area; (v) the quality and composition of our

securities portfolio; (vi) our ability to develop and maintain a

strong core deposit base, including among our venture banking

clients, or other low cost funding sources necessary to fund our

activities particularly in a rising or high interest rate

environment; (vii) the rapid withdrawal of a significant amount of

demand deposits over a short period of time; (viii) the costs and

effects of litigation; (ix) risks related to the Company’s

acquisitions, including disruption to current plans and operations;

difficulties in customer and employee retention; fees, expenses and

charges related to these transactions being significantly higher

than anticipated; and our inability to achieve expected revenues,

cost savings, synergies, and other benefits; and in the case of our

recent acquisition of PacWest Bancorp (“PacWest”), reputational

risk, regulatory risk and potential adverse reactions of the

Company's or PacWest's customers, suppliers, vendors, employees or

other business partners; (x) results of examinations by regulatory

authorities of the Company and the possibility that any such

regulatory authority may, among other things, limit our business

activities, restrict our ability to invest in certain assets,

refrain from issuing an approval or non-objection to certain

capital or other actions, increase our allowance for credit losses,

result in write-downs of asset values, restrict our ability or that

of our bank subsidiary to pay dividends, or impose fines, penalties

or sanctions; (xi) legislative or regulatory changes that adversely

affect our business, including changes in tax laws and policies,

accounting policies and practices, privacy laws, and regulatory

capital or other rules; (xii) the risk that our enterprise risk

management framework may not be effective in mitigating risk and

reducing the potential for losses; (xiii) errors in estimates of

the fair values of certain of our assets and liabilities, which may

result in significant changes in valuation; (xiv) failures or

security breaches with respect to the network, applications,

vendors and computer systems on which we depend, including due to

cybersecurity threats; (xv) our ability to attract and retain key

members of our senior management team; (xvi) the effects of climate

change, severe weather events, natural disasters such as

earthquakes and wildfires, pandemics, epidemics and other public

health crises, acts of war or terrorism, and other external events

on our business; (xvii) the impact of bank failures or other

adverse developments at other banks on general depositor and

investor sentiment regarding the stability and liquidity of banks;

(xviii) the possibility that our recorded goodwill could become

impaired, which may have an adverse impact on our earnings and

capital; (xix) our existing indebtedness, together with any future

incurrence of additional indebtedness, could adversely affect our

ability to raise additional capital and to meet our debt

obligations; (xx) the risk that we may incur significant losses on

future asset sales; and (xxi) other economic, competitive,

governmental, regulatory, and technological factors affecting our

operations, pricing, products and services and the other risks

described in our Annual Report on Form 10-K for the fiscal year

ended December 31, 2023 and from time to time in other documents

that we file with or furnish to the SEC.

Non-GAAP Financial Measures

Included in this press release are certain non-GAAP financial

measures, such as tangible assets, tangible equity to tangible

assets, tangible book value per common share, return on average

tangible common equity, adjusted return on average tangible common

equity, adjusted net earnings (loss), adjusted noninterest expense,

and economic coverage ratio, designed to complement the financial

information presented in accordance with U.S. GAAP because

management believes such measures are useful to investors. These

non-GAAP financial measures should be considered only as

supplemental to, and not superior to, financial measures provided

in accordance with GAAP. Please refer to the “Non-GAAP Measures”

section of this release for additional detail including

reconciliations of the non-GAAP financial measures included in this

press release to the most directly comparable financial measures

prepared in accordance with GAAP.

BANC OF CALIFORNIA, INC. CONSOLIDATED STATEMENTS OF

FINANCIAL CONDITION (UNAUDITED) December 31,

September 30, June 30, March 31, December

31,

2024

2024

2024

2024

2023

(Dollars in thousands) ASSETS: Cash and due from

banks

$

192,006

$

251,869

$

203,467

$

199,922

$

202,427

Interest-earning deposits in financial institutions

2,310,206

2,302,358

2,495,343

2,885,306

5,175,149

Total cash and cash equivalents

2,502,212

2,554,227

2,698,810

3,085,228

5,377,576

Securities available-for-sale

2,246,839

2,300,284

2,244,031

2,286,682

2,346,864

Securities held-to-maturity

2,306,149

2,301,263

2,296,708

2,291,984

2,287,291

FRB and FHLB stock

147,773

145,123

132,380

129,314

126,346

Total investment securities

4,700,761

4,746,670

4,673,119

4,707,980

4,760,501

Loans held for sale

26,331

28,639

1,935,455

80,752

122,757

Gross loans and leases held for investment

23,808,205

23,553,534

23,255,297

25,517,028

25,534,730

Deferred fees, net

(26,542

)

(25,757

)

(26,388

)

(44,006

)

(45,043

)

Total loans and leases held for investment, net of deferred fees

23,781,663

23,527,777

23,228,909

25,473,022

25,489,687

Allowance for loan and lease losses

(239,360

)

(254,345

)

(247,762

)

(291,503

)

(281,687

)

Total loans and leases held for investment, net

23,542,303

23,273,432

22,981,147

25,181,519

25,208,000

Equipment leased to others under operating leases

307,188

314,998

335,968

339,925

344,325

Premises and equipment, net

142,546

143,200

145,734

144,912

146,798

Bank owned life insurance

339,517

343,212

341,779

341,806

339,643

Goodwill

214,521

216,770

215,925

198,627

198,627

Intangible assets, net

132,944

140,562

148,894

157,226

165,477

Deferred tax asset, net

720,587

706,849

738,534

741,158

739,111

Other assets

913,954

964,054

1,028,474

1,094,383

1,131,249

Total assets

$

33,542,864

$

33,432,613

$

35,243,839

$

36,073,516

$

38,534,064

LIABILITIES: Noninterest-bearing deposits

$

7,719,913

$

7,811,796

$

7,825,007

$

7,833,608

$

7,774,254

Interest-bearing deposits

19,471,996

19,016,473

20,979,443

21,058,799

22,627,515

Total deposits

27,191,909

26,828,269

28,804,450

28,892,407

30,401,769

Borrowings

1,391,814

1,591,833

1,440,875

2,139,498

2,911,322

Subordinated debt

941,923

942,151

939,287

937,717

936,599

Accrued interest payable and other liabilities

517,269

574,162

651,379

709,744

893,609

Total liabilities

30,042,915

29,936,415

31,835,991

32,679,366

35,143,299

STOCKHOLDERS' EQUITY: Preferred stock

498,516

498,516

498,516

498,516

498,516

Common stock

1,586

1,586

1,583

1,583

1,577

Class B non-voting common stock

5

5

5

5

5

Non-voting common stock equivalents

98

98

101

101

108

Additional paid-in-capital

3,785,725

3,802,314

3,813,312

3,827,777

3,840,974

Retained deficit

(431,201

)

(478,173

)

(477,010

)

(497,396

)

(518,301

)

Accumulated other comprehensive loss, net

(354,780

)

(328,148

)

(428,659

)

(436,436

)

(432,114

)

Total stockholders’ equity

3,499,949

3,496,198

3,407,848

3,394,150

3,390,765

Total liabilities and stockholders’ equity

$

33,542,864

$

33,432,613

$

35,243,839

$

36,073,516

$

38,534,064

Common shares outstanding (1)

168,825,656

168,879,566

168,875,712

169,013,629

168,959,063

(1)

Common shares outstanding include

non-voting common equivalents that are participating

securities.

BANC OF CALIFORNIA, INC. CONSOLIDATED STATEMENTS

OF EARNINGS (LOSS) (UNAUDITED) Three Months Ended

Year Ended December 31, September 30,

December 31, December 31,

2024

2024

2023

2024

2023

(In thousands, except per share amounts) Interest

income: Loans and leases

$

357,303

$

369,913

$

346,308

$

1,501,534

$

1,496,357

Investment securities

37,743

34,912

41,280

140,794

174,996

Deposits in financial institutions

29,473

42,068

79,652

170,377

299,647

Total interest income

424,519

446,893

467,240

1,812,705

1,971,000

Interest expense: Deposits

154,085

180,986

207,760

715,984

748,423

Borrowings

18,993

16,970

92,474

104,398

416,744

Subordinated debt

16,156

16,762

15,955

66,273

58,705

Total interest expense

189,234

214,718

316,189

886,655

1,223,872

Net interest income

235,285

232,175

151,051

926,050

747,128

Provision for credit losses

12,801

9,000

47,000

42,801

52,000

Net interest income after provision for credit losses

222,484

223,175

104,051

883,249

695,128

Noninterest income: Service charges on deposit accounts

4,770

4,568

4,562

18,583

16,468

Other commissions and fees

8,231

8,256

8,860

33,258

38,086

Leased equipment income

10,730

17,176

12,369

51,109

63,167

Gain (loss) on sale of loans and leases

20

(62

)

(3,526

)

645

(161,346

)

Loss on sale of securities

(454

)

(59,946

)

(442,413

)

(60,400

)

(442,413

)

Dividends and gains on equity investments

18

3,730

8,138

7,982

15,731

Warrant income (loss)

343

211

(173

)

408

(718

)

LOCOM HFS adjustment

(3

)

(74

)

3,175

215

(8,461

)

Other income

5,334

10,689

8,606

25,345

31,201

Total noninterest income (loss)

28,989

(15,452

)

(400,402

)

77,145

(448,285

)

Noninterest expense: Compensation

77,661

85,585

89,354

341,396

332,353

Occupancy

15,678

16,892

15,925

67,993

61,668

Information technology and data processing

14,546

14,995

13,099

60,418

51,805

Other professional services

5,498

5,101

2,980

20,857

24,623

Insurance and assessments

11,179

12,708

60,016

70,779

135,666

Intangible asset amortization

7,770

8,485

4,230

33,143

11,419

Leased equipment depreciation

7,096

7,144

7,447

29,271

34,243

Acquisition, integration and reorganization costs

(1,023

)

(510

)

111,800

(14,183

)

142,633

Customer related expense

31,672

34,475

45,826

129,471

124,104

Loan expense

4,489

3,994

4,446

17,306

20,458

Goodwill impairment

-

-

-

-

1,376,736

Other expense

6,804

7,340

8,515

35,289

142,473

Total noninterest expense

181,370

196,209

363,638

791,740

2,458,181

Earnings (loss) before income taxes

70,103

11,514

(659,989

)

168,654

(2,211,338

)

Income tax expense (benefit)

13,184

2,730

(177,034

)

41,766

(312,201

)

Net earnings (loss)

56,919

8,784

(482,955

)

126,888

(1,899,137

)

Preferred stock dividends

9,947

9,947

9,947

39,788

39,788

Net earnings (loss) available to common and equivalent

stockholders

$

46,972

$

(1,163

)

$

(492,902

)

$

87,100

$

(1,938,925

)

Basic and diluted earnings (loss) per common share (1)

$

0.28

$

(0.01

)

$

(4.55

)

$

0.52

$

(22.71

)

Weighted average number of common shares outstanding Basic

168,604

168,583

108,290

168,441

85,394

Diluted

169,732

168,583

108,290

168,684

85,394

(1)

Common shares include non-voting common

equivalents that are participating securities.

BANC OF CALIFORNIA, INC. SELECTED FINANCIAL

DATA (UNAUDITED) Three Months Ended

Year Ended December 31, September 30,

December 31, December 31, Profitability and Other Ratios

2024

2024

2023

2024

2023

Return on average assets (1)

0.67

%

0.10

%

(5.09

)%

0.36

%

(4.71

)%

Adjusted ROAA (1)(2)

0.67

%

0.59

%

(0.66

)%

0.50

%

0.13

%

Pre-tax, pre-provision, pre-goodwill impairment ROAA (1)(2)

0.98

%

0.24

%

(6.46

)%

0.60

%

(1.94

)%

Adjusted pre-tax, pre-provision, pre-goodwill impairment ROAA

(1)(2)

0.98

%

0.92

%

(0.27

)%

0.78

%

0.20

%

Return on average equity (1)

6.50

%

1.01

%

(68.49

)%

3.70

%

(63.42

)%

Return on average tangible common equity (1)(2)

7.35

%

0.70

%

(102.87

)%

4.35

%

(35.27

)%

Adjusted return on average tangible common equity (1)(2)

7.35

%

7.30

%

(12.39

)%

6.23

%

1.06

%

Dividend payout ratio (3)

35.71

%

(1000.00

)%

(2.64

)%

76.92

%

(2.33

)%

Average yield on loans and leases (1)

6.01

%

6.18

%

5.82

%

6.11

%

5.92

%

Average yield on interest-earning assets (1)

5.48

%

5.63

%

5.23

%

5.58

%

5.21

%

Average cost of interest-bearing deposits (1)

3.18

%

3.52

%

3.80

%

3.48

%

3.46

%

Average total cost of deposits (1)

2.26

%

2.54

%

2.94

%

2.52

%

2.61

%

Average cost of interest-bearing liabilities (1)

3.48

%

3.80

%

4.51

%

3.79

%

4.14

%

Average total cost of funds (1)

2.55

%

2.82

%

3.68

%

2.84

%

3.34

%

Net interest spread

2.00

%

1.83

%

0.72

%

1.79

%

1.07

%

Net interest margin (1)

3.04

%

2.93

%

1.69

%

2.85

%

1.98

%

Noninterest income to total revenue (4)

10.97

%

(7.13

)%

160.58

%

7.69

%

(150.01

)%

Adjusted noninterest income to adjusted total revenue (2)(4)

11.12

%

16.08

%

21.76

%

12.93

%

18.10

%

Noninterest expense to average total assets (1)

2.15

%

2.27

%

3.83

%

2.24

%

6.10

%

Adjusted noninterest expense to average total assets (1)(2)

2.16

%

2.26

%

2.31

%

2.28

%

2.06

%

Efficiency ratio (2)(5)

65.49

%

68.02

%

127.34

%

72.47

%

124.91

%

Adjusted efficiency ratio (2)(6)

65.49

%

68.02

%

110.38

%

72.02

%

86.20

%

Loans to deposits ratio

87.56

%

87.80

%

84.25

%

87.56

%

84.25

%

Average loans and leases to average deposits

87.05

%

84.05

%

84.34

%

86.42

%

88.32

%

Average investment securities to average total assets

14.01

%

13.55

%

16.01

%

13.26

%

16.94

%

Average stockholders' equity to average total assets

10.39

%

10.03

%

7.43

%

9.71

%

7.43

%

(1)

Annualized.

(2)

Non-GAAP measure.

(3)

Ratio calculated by dividing dividends declared per common and

equivalent share by basic earnings per common and equivalent share.

(4)

Total revenue equals the sum of net interest income and noninterest

income.

BANC OF CALIFORNIA, INC. AVERAGE BALANCE, AVERAGE YIELD

EARNED, AND AVERAGE COST PAID (UNAUDITED)

Three Months Ended December 31, 2024 September 30,

2024 December 31, 2023 Interest Average

Interest Average Interest Average

Average Income/ Yield/ Average

Income/ Yield/ Average Income/

Yield/ Balance Expense Cost

Balance Expense Cost Balance

Expense Cost (Dollars in thousands)

Assets: Loans and leases (1)

$

23,649,271

$

357,303

6.01

%

$

23,803,691

$

369,913

6.18

%

$

23,608,246

$

346,308

5.82

%

Investment securities

4,700,742

37,743

3.19

%

4,665,549

34,912

2.98

%

6,024,737

41,280

2.72

%

Deposits in financial institutions

2,474,732

29,473

4.74

%

3,106,227

42,068

5.39

%

5,791,739

79,652

5.46

%

Total interest-earning assets

30,824,745

424,519

5.48

%

31,575,467

446,893

5.63

%

35,424,722

467,240

5.23

%

Other assets

2,737,283

2,850,718

2,215,665

Total assets

$

33,562,028

$

34,426,185

$

37,640,387

Liabilities and Stockholders' Equity: Interest checking

$

7,659,320

56,408

2.93

%

$

7,644,515

61,880

3.22

%

$

7,296,234

60,743

3.30

%

Money market

5,003,118

31,688

2.52

%

4,958,777

32,361

2.60

%

5,758,074

44,279

3.05

%

Savings

1,954,625

14,255

2.90

%

2,028,931

17,140

3.36

%

1,696,222

16,446

3.85

%

Time

4,645,115

51,734

4.43

%

5,841,965

69,605

4.74

%

6,915,504

86,292

4.95

%

Total interest-bearing deposits

19,262,178

154,085

3.18

%

20,474,188

180,986

3.52

%

21,666,034

207,760

3.80

%

Borrowings

1,399,080

18,993

5.40

%

1,063,541

16,970

6.35

%

5,229,425

92,474

7.02

%

Subordinated debt

942,221

16,156

6.82

%

940,480

16,762

7.09

%

894,219

15,955

7.08

%

Total interest-bearing liabilities

21,603,479

189,234

3.48

%

22,478,209

214,718

3.80

%

27,789,678

316,189

4.51

%

Noninterest-bearing demand deposits

7,905,750

7,846,641

6,326,511

Other liabilities

566,635

648,760

726,414

Total liabilities

30,075,864

30,973,610

34,842,603

Stockholders' equity

3,486,164

3,452,575

2,797,784

Total liabilities and stockholders' equity

$

33,562,028

$

34,426,185

$

37,640,387

Net interest income (1)

$

235,285

$

232,175

$

151,051

Net interest spread

2.00

%

1.83

%

0.72

%

Net interest margin

3.04

%

2.93

%

1.69

%

Total deposits (2)

$

27,167,928

$

154,085

2.26

%

$

28,320,829

$

180,986

2.54

%

$

27,992,545

$

207,760

2.94

%

Total funds (3)

$

29,509,229

$

189,234

2.55

%

$

30,324,850

$

214,718

2.82

%

$

34,116,189

$

316,189

3.68

%

(1)

Includes net loan discount accretion of $20.7 million, $23.0

million and $15.7 million for the three months ended December 31,

2024, September 30, 2024, and December 31, 2023.

(2)

Total deposits is the sum of total interest-bearing deposits and

noninterest-bearing demand deposits. The cost of total deposits is

calculated as annualized interest expense on total deposits divided

by average total deposits.

(3)

Total funds is the sum of total interest-bearing liabilities and

noninterest-bearing demand deposits. The cost of total funds is

calculated as annualized total interest expense divided by average

total funds.

BANC OF CALIFORNIA, INC. AVERAGE

BALANCE, AVERAGE YIELD EARNED, AND AVERAGE COST PAID

(UNAUDITED) Year Ended December 31,

2024 December 31, 2023 Interest Average

Interest Average Average Income/

Yield/ Average Income/ Yield/

Balance Expense Cost Balance

Expense Cost (Dollars in thousands)

Assets: Loans and leases

(1)(2)(3)

$

24,569,650

$

1,501,534

6.11

%

$

25,330,351

$

1,498,701

5.92

%

Investment securities

4,686,615

140,794

3.00

%

6,827,059

174,996

2.56

%

Deposits in financial institutions

3,226,658

170,377

5.28

%

5,746,858

299,647

5.21

%

Total interest-earning assets (1)

32,482,923

1,812,705

5.58

%

37,904,268

1,973,344

5.21

%

Other assets

2,850,565

2,389,112

Total assets

$

35,333,488

$

40,293,380

Liabilities and Stockholders' Equity: Interest checking

$

7,714,920

240,913

3.12

%

$

6,992,888

220,735

3.16

%

Money market

5,164,566

138,176

2.68

%

6,724,296

190,027

2.83

%

Savings

2,005,513

66,421

3.31

%

1,051,117

30,978

2.95

%

Time

5,714,821

270,474

4.73

%

6,840,920

306,683

4.48

%

Total interest-bearing deposits

20,599,820

715,984

3.48

%

21,609,221

748,423

3.46

%

Borrowings

1,838,819

104,398

5.68

%

7,068,826

416,744

5.90

%

Subordinated debt

939,528

66,273

7.05

%

875,621

58,705

6.70

%

Total interest-bearing liabilities

23,378,167

886,655

3.79

%

29,553,668

1,223,872

4.14

%

Noninterest-bearing demand deposits

7,829,976

7,072,334

Other liabilities

693,981

672,950

Total liabilities

31,902,124

37,298,952

Stockholders' equity

3,431,364

2,994,428

Total liabilities and stockholders' equity

$

35,333,488

$

40,293,380

Net interest income (1)(2)

$

926,050

$

749,472

Net interest spread (1)

1.79

%

1.07

%

Net interest margin (1)

2.85

%

1.98

%

Total deposits (4)

$

28,429,796

$

715,984

2.52

%

$

28,681,555

$

748,423

2.61

%

Total funds (5)

$

31,208,143

$

886,655

2.84

%

$

36,626,002

$

1,223,872

3.34

%

(1)

Tax equivalent.

(2)

Includes net loan discount accretion of $88.0 million and $9.7

million for the year ended December 31, 2024 and 2023,

respectively.

(3)

Includes tax-equivalent adjustments of $0.0 million and $2.3

million for the year ended December 31, 2024 and 2023 related to

tax-exempt income on loans. The federal statutory tax rate utilized

was 21%.

(4)

Total deposits is the sum of total interest-bearing deposits and

noninterest-bearing demand deposits. The cost of total deposits is