Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

January 02 2024 - 6:26AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2024

Commission File Number 1-15250

BANCO BRADESCO S.A.

(Exact name of registrant as specified in its charter)

BANK BRADESCO

(Translation of Registrant's name into English)

Cidade de Deus, s/n, Vila Yara

06029-900 - Osasco - SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

.

COMMUNICATION ON RELATED-PARTY TRANSACTIONS

Banco Bradesco

S.A. (“Bradesco” or “Company”) informs its shareholders and the market in general, in accordance

with Article 33, item XXXII and Exhibit F of Securities and Exchange Commission (“CVM”) Resolution No. 80/22 and the

Company Related-Party Transactions Policy (“Internal Policy”), that celebrated a Contract for Provision of Intermediation,

Capture, Indication and Maintenance Services of Commercial Establishments on December 28, 2023 (“Contract” or “Transaction”)

with its affiliated, Cielo S.A. (“Cielo”).

The

information referring to the Transaction, provided in the aforementioned CVM Resolution, are listed in the chart below:

| Transaction |

| Related-Party’s Name |

Cielo |

| Relation between the Related-Party and the Company |

Bradesco composes, through controlled companies, Cielo's control group. |

| Transaction Subject and Main Terms and Conditions |

The Contract establishes the applicable

conditions to the services to be provided by Bradesco to Cielo regarding intermediation, capture, indication and maintenance of commercial

establishments (“Establishments”) for potential accreditation to Cielo System (“Services”).

The Services provided by Bradesco to

Cielo include, among others: (i) presentation to Cielo of the legal representatives and decision-makers associated with the Establishment,

provided that it is authorized by it; (ii) eventual participation in the initial meeting and subsequent meetings with the Establishment;

(iii) description of the profile and the main business of the Establishment; (iv) identification and forwarding to Cielo of the main necessities

and expectations appointed by the Establishment, for maintenance of the Establishments accredited in Cielo system; (v) identification

and transfer of the most recurring complaints and points of improvement in the commercial relationship for Cielo to evaluate them; and

(vi) collection of documents and information, as well as preparation of reports. All information related to the Contract will comply with

the applicable data protection legislation.

In return for the provision of services,

Bradesco will be entitled to (i) compensation for the payment transactions volume held in Establishments with banking domicile at Bradesco

and accredited to Cielo system, regardless of the channel and date of its accreditation to Cielo System, corresponding to 10 basis points

on the eligible volume. The eligible volume includes the amount captured only in domestic transactions, not including transactions in

which Cielo provides VAN services, and taking into account the minimum profitability criteria

of each Establishment, and (ii) additional compensation considering the increased penetration of term products by Establishments in the

Retail segment and Entrepreneurs with banking domicile at Bradesco and accredited to Cielo System, which will be calculated according

to the remuneration table provided for in the Contracts.

Signature date: 12.28.2023. Duration:

12 (twelve) months, effective from 01.01.2024.

|

| If, when, how and to what extend the counterparty in the transaction, its partners or managers participated in the process |

The Contract conclusion obtained the applicable internal approvals, following all the relevant norms. |

| Detailed justification of the reasons why the issuer's Management believes that the Transaction complied commutative conditions or provides for appropriate compensatory payment |

The Company’s Management understands that the Transaction complied commutative conditions and provides for appropriate compensatory payment, since was carried out in the best interest of the Company, observing Market Conditions (according to the Company's Internal Policy), good governance and conduct practices, ethics and transparency, not involving Conflicts of Interest (according to the Company's Internal Policy). |

The

documents referring to the Transaction are filed at the Company’s headquarters.

Cidade

de Deus, Osasco, SP, January 2, 2024.

Banco

Bradesco S.A.

Carlos

Wagner Firetti Investor Relations Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 2, 2024

|

BANCO BRADESCO S.A. |

|

|

By: |

|

/S/ Carlos Wagner Firetti

|

| |

|

Carlos Wagner Firetti

Department Officer and

Investor Relations Officer |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

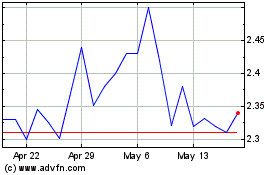

Banco Bradesco (NYSE:BBDO)

Historical Stock Chart

From Nov 2024 to Dec 2024

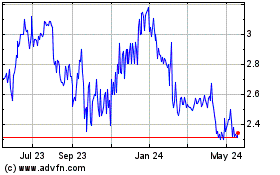

Banco Bradesco (NYSE:BBDO)

Historical Stock Chart

From Dec 2023 to Dec 2024