By Chip Cutter

A trash hauler, a liquor giant, a maker of hip replacements and

the company that brought us the iPhone all share one distinction:

They are among the most effectively run U.S. companies today.

Those are some of the revelations of this year's Management Top

250, a landmark ranking that uses the principles of the late

management guru Peter Drucker to identify the most effectively

managed companies.

Topping this year's list is Apple Inc., the world's most

valuable publicly traded company. The iPhone maker climbed to the

No. 1 spot in the 2018 ranking, dethroning Amazon.com Inc., by

performing consistently well across each of the five main

components of the overall ranking. Amazon places second this year,

followed by Microsoft Corp. and chip makers Nvidia Corp. and Intel

Corp. Other management highfliers include Google parent Alphabet

Inc., consulting firm Accenture PLC and Johnson & Johnson, Nos.

6, 7 and 8, respectively. Rounding out the top 10 are Procter &

Gamble Co. and International Business Machines Corp.

What sets this effort apart from other "best companies" lists is

its holistic approach. Researchers at Claremont Graduate

University's Drucker Institute, which compiles the list, evaluate

companies on five dimensions of performance: customer satisfaction,

employee engagement and development, innovation, social

responsibility and financial strength.

Those pillars represent core values of Mr. Drucker, who wrote

more than 30 books over his more than six-decade career and, to

many in the world of business, defined the field of modern

management. Mr. Drucker long believed companies should exist for

purposes beyond profits, stressing that they should care for

workers and benefit society. The Management Top 250 attempts to

model Mr. Drucker's thinking, using dozens of inputs -- from

employee ratings on Glassdoor to five-year shareholder returns and

trademark filings -- to arrive at its management scorecard. The

result is an unmatched look at how companies balance the often

competing pressures confronting executives today.

While tech companies account for seven of the top 10 most

effectively managed firms, the list also spotlights plenty of

unsung management successes. These include garbage-collection

company Waste Management Inc., cleaning-products giant Ecolab Inc.,

Jack Daniel's whiskey maker Brown-Forman Corp., and Stryker Corp.,

which produces everything from replacement hips to hospital bed

frames.

"Good management is a series of practices," says Rick Wartzman,

director of the KH Moon Center for a Functioning Society, a part of

the Drucker Institute. "That doesn't come from any one sector or

any one type of company. Good management and bad management, for

that matter, can be found anywhere."

In this year's ranking, the Drucker Institute expanded the

universe of firms it analyzed to 752 from 693 previously, and added

new components to its mix of 37 indicators, which contributed to

some of the movement among the companies. For example, to measure

innovation, the institute considered the number of cutting-edge

jobs a company posted, such as drone operators, and incorporated

how the stock market values a company's patents, calculated by

professors at Northwestern University and Stanford University. To

be eligible for inclusion, a company needed to be part of the Dow

Jones U.S. Total Stock Market Index or the S&P Composite 1500

Index, and meet other benchmarks pertaining to market value and

annual revenue.

A financial all-star

Apple rose to the top of the list by getting high marks in every

one of the Drucker Institute's categories, a consistency shared by

only a handful of companies. A foundation of the company's success

-- and a rallying point of pride for many of its employees -- is

the beauty and simplicity of its products, investors and analysts

say. Apple reported record profits and revenue for its fiscal year

that ended in September, helped by raising prices for its iPhones

and selling more subscription services. Earlier this year, it

became the first company to achieve a trillion-dollar market

valuation, although its market value has since fallen.

On Drucker's measure of financial strength, Apple outperforms

every other company. It commands a premium price for its iPhones,

outsources much of its manufacturing to suppliers and sells devices

used by millions of consumers. "Those are the ingredients for

outrageous returns on capital," says Toni Sacconaghi, an analyst at

AllianceBernstein, and "outrageous cash generation."

Apple also improved from last year in Drucker's measure of

social responsibility, which Mr. Drucker saw as an important driver

of a company's innovative spirit. After facing criticism years ago

for working conditions at its suppliers' factories in China, Apple

has worked to introduce more-responsible working practices into its

supply chain, increasing the training and education of workers.

This year it also launched a $300 million fund in China to support

clean-energy initiatives to power operations for its suppliers, and

introduced a proprietary process to recycle aluminum for the newest

editions of its MacBook Air and Mac mini.

"If there's a knock" on Apple, Mr. Sacconaghi says, it's in the

realm of innovation. Apple faces questions over how it will

navigate the second decade of the smartphone era, when people may

be waiting longer to replace their iPhones. Despite introducing its

Watch and HomePod smart speaker, the company has failed to produce

a new blockbuster device to rival sales of the iPhone. Apple's

latest revenue projections also disappointed Wall Street investors,

and the share prices of some of its suppliers have fallen after

they reported cuts in iPhone production.

"We just launched an incredible range of new products for the

holidays and couldn't be more excited about what we have in the

pipeline," says Luca Maestri, Apple's chief financial officer. "We

manage our company for the long term and are investing

significantly in game-changing services and technologies that we

believe our customers will love."

Innovation standouts

Amazon, second on the Management Top 250 list, is a more uneven

performer. It is the ranking's highest scorer in innovation, yet it

rates in the bottom quarter on measures of corporate social

responsibility.

Ardine Williams, a vice president of people operations at

Amazon, says the company is able to be innovative because it makes

"lots and lots of small bets." Employees come up with new products

and services by working backward -- writing an internal press

release of a new product feature and then gaining buy-in from

company leaders to build it. "This is a seniority-agnostic

process," Ms. Williams says. "Anyone with a good idea can put

forward their own document to senior leaders."

Critics, though, say the e-commerce juggernaut has done too

little to help the communities in which it operates. Amazon faced

fierce backlash after the company won billions in tax incentives to

open planned new hubs in New York and near Washington, D.C.,

raising worries about gentrification. "They have demonstrated zero

regard" for communities' general welfare, says Scott Galloway, a

professor of marketing at New York University, who has been

critical of Amazon's selection process for its additional

headquarters locations.

Amazon's Ms. Williams says the company is focused on making a

"uniquely Amazonian impact in the communities where our employees

live and work." She points to Amazon's support of efforts to fight

homelessness near its Seattle headquarters and its work using its

vast logistics network to help communities recover from disasters

like hurricanes and wildfires. The company also supports science

and technology education for underrepresented communities, she

says.

Other innovation standouts include Allstate Corp., a top-10

company in the category. Allstate is a rising star in the

Management Top 250, climbing to No. 39 overall this year from No.

109 last year.

The company has introduced improvements such as a quick photo

claims feature for customers involved in an auto accident, reducing

the need for an adjuster to verify damages in person. Allstate also

now uses drones to assess home damage after hurricanes or natural

disasters. It is working on longer-range bets, too. Chief Executive

Thomas J. Wilson describes a new model it is developing for

car-sharing as "Airbnb with cars."

Mr. Wilson says a greater focus on innovation in the company

comes, in part, from employees better understanding their purpose.

More than 27,000 Allstate employees have attended a day-and-a-half

workshop the company hosts called Energy for Life, which includes

everything from body-composition tests to assess employees'

physical health to activities on what motivates them. The result,

Mr. Wilson says, is employees with a clearer sense of who they are

and how they can contribute to the company. "Our belief is we have

to give to get," he says. "You can make people do stuff, but that's

not the point, particularly when you're trying to be

innovative."

At Johnson & Johnson, also in the top 10 for innovation,

Chief Financial Officer Joe Wolk says the company looks for ways to

reinvent products even in markets where it is the No. 1 or No. 2

player. "We can't come out with simply me-too ideas and me-too

products," Mr. Wolk says. One example: This year the company took

the step of relaunching its baby wash and shampoos to be more

transparent about those products' ingredients after sales dipped,

despite maintaining a market-share lead over rivals.

How values work together

The Management Top 250 is meant to show that the principles of

good management work together. Greater employee engagement, for

instance, leads to greater innovation, customer satisfaction,

social responsibility and financial strength. "These five areas all

seem to be interrelated and mutually reinforcing," the Drucker

Institute's Mr. Wartzman says.

Still, no model is perfect. General Electric Co. has had a

tumultuous year, marked by about a 55% drop in its share price and,

in October, the replacement of its CEO of 14 months. GE's overall

score in the Management Top 250 ranking fell from last year, but

the industrial conglomerate is still ranked No. 18. A deeper look

at the numbers shows GE posted declines in financial strength and

employee engagement, but saw an increase in its innovation

score.

"For all of GE's very real financial and operational problems,

they remain in many respects a cutting-edge engineering

organization," Mr. Wartzman says, noting that a rapid decline in

the company's fortunes may not yet be reflected in the available

data. "GE was the paradigm of management for decades," Mr. Wartzman

adds. "It does take a long time for those things to unwind."

GE says the company continues to build important technology.

"While this is a time of great change at the company, curiosity,

ingenuity and invention -- essential traits of our founder Thomas

Edison -- continue to be core to who we are and the products we

deliver to our customers," says Vic Abate, GE's chief technology

officer.

Those who have studied Mr. Drucker's thinking say he valued a

long-term perspective. "The reason he became the father of modern

management is not to help organizations function better, although

that's important," says Bernie Jaworski, a professor who teaches a

class on Mr. Drucker to incoming graduate students at the Peter F.

Drucker and Masatoshi Ito Graduate School of Management, a separate

institution from the Drucker Institute. Mr. Drucker's management

teachings were "a tool to get to an end, and the end was having

better societies," he says.

Mr. Cutter is a Wall Street Journal reporter in New York. Email:

chip.cutter@wsj.com.

(END) Dow Jones Newswires

November 30, 2018 08:36 ET (13:36 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

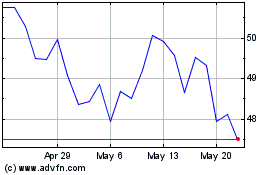

Brown Forman (NYSE:BF.A)

Historical Stock Chart

From Oct 2024 to Nov 2024

Brown Forman (NYSE:BF.A)

Historical Stock Chart

From Nov 2023 to Nov 2024