false

0001278027

0001278027

2024-09-09

2024-09-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

As filed with the

Securities and Exchange Commission on September 9, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

September 9, 2024

| |

B&G Foods, Inc. |

|

|

(Exact name of Registrant as specified in its charter) |

| Delaware |

|

001-32316 |

|

13-3918742 |

| (State or Other Jurisdiction |

|

(Commission |

|

(IRS Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

| Four Gatehall Drive, Parsippany, New Jersey |

|

07054 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (973) 401-6500

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

BGS |

New York Stock Exchange |

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure

On September 9, 2024, B&G Foods issued a notice

of full redemption for all $265,392,000 remaining aggregate principal amount of our outstanding 5.25% senior notes due 2025 at a cash

redemption price of 100.0% of the principal amount of the notes being redeemed, plus accrued and unpaid interest on such amount, to, but

excluding, the redemption date of October 9, 2024. B&G Foods plans to fund the redemption with revolving loans under our existing

credit facility together with cash on hand.

Interest on the redeemed notes will cease to accrue

on and after October 9, 2024. The only remaining right of the holders of the redeemed notes will be to receive payment of the redemption

price (together with the accrued and unpaid interest on such amount).

A copy of the press release announcing the foregoing,

which is attached to this report as Exhibit 99.1, is incorporated by reference herein and furnished pursuant to Item 7.01, “Regulation

FD Disclosure.”

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

B&G FOODS, INC. |

| |

|

| Dated: September 9, 2024 |

By: |

/s/ Scott E. Lerner |

| |

|

Scott E. Lerner |

| |

|

Executive Vice President, |

| |

|

General Counsel and Secretary |

Exhibit 99.1

B&G Foods

Issues Notice of Full Redemption of Remaining

5.25% Senior Notes due 2025

Parsippany, N.J., September 9, 2024—B&G

Foods, Inc. (NYSE: BGS), announced today that it has issued a notice of redemption for all $265,392,000 remaining aggregate principal

amount of its outstanding 5.25% senior notes due 2025 at a cash redemption price of 100.0% of the principal amount of the notes being

redeemed, plus accrued and unpaid interest on such amount, to, but excluding, the redemption date of October 9, 2024. B&G Foods

plans to fund the redemption with revolving loans under its existing credit facility together with cash on hand.

Interest on the redeemed notes will

cease to accrue on and after October 9, 2024. The only remaining right of the holders of the redeemed notes will be to receive payment

of the redemption price (together with the accrued and unpaid interest on such amount).

A notice of redemption will be sent

by The Bank of New York Mellon Trust Company, N.A., the trustee for the notes, to the registered holders of the notes. Copies of the

notice of redemption and additional information relating to the procedure for redemption may be obtained from The Bank of New York Mellon

Trust Company at 1.800.254.2826.

About B&G Foods, Inc.

Based in Parsippany, New Jersey, B&G Foods

and its subsidiaries manufacture, sell and distribute high-quality, branded shelf-stable and frozen foods across the United States, Canada

and Puerto Rico. With B&G Foods’ diverse portfolio of more than 50 brands you know and love, including B&G,

B&M, Bear Creek, Cream of Wheat, Crisco, Dash, Green Giant, Las Palmas,

Le Sueur, Mama Mary’s, Maple Grove Farms, New York Style, Ortega,

Polaner, Spice Islands and Victoria, there’s a little something for everyone. For more information about

B&G Foods and its brands, please visit www.bgfoods.com.

Forward-Looking Statements

Statements in this press release

that are not statements of historical or current fact, including, without limitation, statements about the planned funding and completion

of the redemption, constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks,

uncertainties and other unknown factors that could cause the actual results of B&G Foods to be materially different from the

historical results or from any future results expressed or implied by such forward-looking statements. In addition to statements that

explicitly describe such risks and uncertainties, readers are urged to consider statements labeled with the terms “believes,”

“belief,” “expects,” “projects,” “intends,” “anticipates,” “assumes,”

“could,” “should,” “estimates,” “potential,” “seek,” “predict,”

“may,” “will” or “plans” and similar references to future periods to be uncertain and forward-looking.

Factors that may affect actual results include, without limitation: B&G Foods’ substantial leverage; the effects of rising

costs for and/or decreases in the supply of commodities, ingredients, packaging, other raw materials, distribution and labor; crude oil

prices and their impact on distribution, packaging and energy costs; B&G Foods’ ability to successfully implement sales

price increases and cost saving measures to offset any cost increases; intense competition, changes in consumer preferences, demand for

B&G Foods’ products and local economic and market conditions; B&G Foods’ continued ability to promote brand

equity successfully, to anticipate and respond to new consumer trends, to develop new products and markets, to broaden brand portfolios

in order to compete effectively with lower priced products and in markets that are consolidating at the retail and manufacturing levels

and to improve productivity; the ability of B&G Foods and its supply chain partners to continue to operate manufacturing facilities,

distribution centers and other work locations without material disruption, and to procure ingredients, packaging and other raw materials

when needed despite disruptions in the supply chain or labor shortages; the impact pandemics or disease outbreaks, such as the COVID-19

pandemic, may have on B&G Foods’ business, including among other things, B&G Foods’ supply chain, manufacturing

operations or workforce and customer and consumer demand for B&G Foods’ products; B&G Foods’ ability to

recruit and retain senior management and a highly skilled and diverse workforce at B&G Foods’ corporate offices, manufacturing

facilities and other locations despite a very tight labor market and changing employee expectations as to fair compensation, an inclusive

and diverse workplace, flexible working and other matters; the risks associated with the expansion of B&G Foods’ business;

B&G Foods’ possible inability to identify new acquisitions or to integrate recent or future acquisitions or B&G Foods’

failure to realize anticipated revenue enhancements, cost savings or other synergies from recent or future acquisitions; B&G Foods’

ability to successfully complete the integration of recent or future acquisitions into B&G Foods’ enterprise resource

planning (ERP) system; tax reform and legislation, including the effects of the Infrastructure Investment and Jobs Act, U.S. Tax Cuts

and Jobs Act; and the U.S. CARES Act, the Inflation Reduction Act, and future tax reform or legislation; B&G Foods’ ability

to access the credit markets and B&G Foods’ borrowing costs and credit ratings, which may be influenced by credit markets

generally and the credit ratings of B&G Foods’ competitors; unanticipated expenses, including, without limitation, litigation

or legal settlement expenses; the effects of currency movements of the Canadian dollar and the Mexican peso as compared to the U.S. dollar;

the effects of international trade disputes, tariffs, quotas, and other import or export restrictions on B&G Foods’ international

procurement, sales and operations; future impairments of B&G Foods’ goodwill and intangible assets; B&G Foods’

ability to protect information systems against, or effectively respond to, a cybersecurity incident, other disruption or data leak; B&G Foods’

ability to successfully implement B&G Foods’ sustainability initiatives and achieve B&G Foods’ sustainability

goals, and changes to environmental laws and regulations; and other factors that affect the food industry generally, including recalls

if products become adulterated or misbranded, liability if product consumption causes injury, ingredient disclosure and labeling laws

and regulations and the possibility that consumers could lose confidence in the safety and quality of certain food products; competitors’

pricing practices and promotional spending levels; fluctuations in the level of B&G Foods’ customers’ inventories

and credit and other business risks related to B&G Foods’ customers operating in a challenging economic and competitive

environment; and the risks associated with third-party suppliers and co-packers, including the risk that any failure by one or more of

B&G Foods’ third-party suppliers or co-packers to comply with food safety or other laws and regulations may disrupt B&G Foods’

supply of raw materials or certain finished goods products or injure B&G Foods’ reputation. The forward-looking statements

contained herein are also subject generally to other risks and uncertainties that are described from time to time in B&G Foods’

filings with the Securities and Exchange Commission, including under Item 1A, “Risk Factors” in B&G Foods’

most recent Annual Report on Form 10-K and in its subsequent reports on Forms 10-Q and 8-K. Investors are cautioned not to place undue

reliance on any such forward-looking statements, which speak only as of the date they are made. B&G Foods undertakes no obligation

to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Contacts:

Investor

Relations:

ICR, Inc.

Anna Kate Heller

bgfoodsIR@icrinc.com |

Media

Relations:

ICR, Inc.

Matt Lindberg

203.682.8214 |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

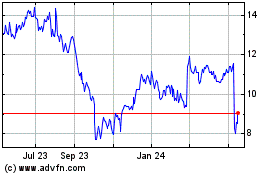

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Mar 2025 to Apr 2025

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Apr 2024 to Apr 2025