B&G Foods, Inc. (NYSE: BGS) today announced financial

results for the fourth quarter and full year 2024. Financial

results for the fourth quarter and full year 2024 reflect the

impact of the Green Giant U.S. shelf-stable divestiture during the

fourth quarter of 2023.

Summary

Fourth Quarter of 2024

Fiscal Year 2024

(In millions, except per share

data)

Change vs.

Change vs.

Amount

Q4 2023

Amount

FY 2023

Net Sales

$

551.6

(4.6

)%

$

1,932.5

(6.3

)%

Base Business Net Sales (1)

$

551.6

(1.9

)%

$

1,932.6

(3.3

)%

Diluted EPS

$

(2.81

)

NM

$

(3.18

)

257.3

%

Adj. Diluted EPS (1)

$

0.31

3.3

%

$

0.70

(29.3

)%

Net Loss

$

(222.4

)

NM

$

(251.3

)

279.5

%

Adj. Net Income (1)

$

24.6

4.6

%

$

55.7

(24.6

)%

Adj. EBITDA (1)

$

86.1

(0.8

)%

$

295.4

(7.1

)%

Guidance for Full Year Fiscal 2025

- Net sales range of $1.890 billion to $1.950 billion.

- Adjusted EBITDA range of $290.0 million to $300.0 million.

- Adjusted diluted earnings per share range of $0.65 to

$0.75.

Commenting on the results, Casey Keller, President and Chief

Executive Officer of B&G Foods, stated, “B&G Foods’ fourth

quarter results were in line or slightly above expectations, with

some improvement versus prior quarters. We expect first half fiscal

2025 trends to continue to be soft, with sequential improvement in

the second half of the year as we lap consumer purchasing changes

following high inflation across the packaged foods industry.”

Financial Results for the Fourth Quarter of 2024

Net sales for the fourth quarter of 2024 decreased $26.5

million, or 4.6%, to $551.6 million from $578.1 million for the

fourth quarter of 2023. The decrease was primarily attributable to

the Green Giant U.S. shelf-stable divestiture, a decrease in unit

volume, and the negative impact of foreign currency, partially

offset by an increase in net pricing and the impact of product mix.

Net sales of the Green Giant U.S. shelf-stable product line, which

the Company divested on November 8, 2023, were $15.9 million in the

fourth quarter of 2023.

Base business net sales for the fourth quarter of 2024 decreased

$10.7 million, or 1.9%, to $551.6 million from $562.3 million for

the fourth quarter of 2023. The decrease in base business net sales

was driven by a decrease in unit volume of $12.4 million, or 2.2%,

and the negative impact of foreign currency of $0.4 million,

partially offset by an increase in net pricing and the impact of

product mix of $2.1 million, or 0.4% of base business net

sales.

Gross profit was $118.7 million for the fourth quarter of 2024,

or 21.5% of net sales. Adjusted gross profit(1), which excludes the

negative impact of $3.7 million of acquisition/divestiture-related

expenses and non-recurring expenses included in cost of goods sold

during the fourth quarter of 2024, was $122.3 million, or 22.2% of

net sales. Gross profit was $125.2 million for the fourth quarter

of 2023, or 21.7% of net sales. Adjusted gross profit, which

excludes the negative impact of $1.6 million of

acquisition/divestiture-related expenses and non-recurring expenses

included in cost of goods sold during the fourth quarter of 2023,

was $126.7 million, or 21.9% of net sales.

Selling, general and administrative expenses decreased $2.9

million, or 5.5%, to $50.3 million for the fourth quarter of 2024

from $53.2 million for the fourth quarter of 2023. The decrease was

composed of decreases in consumer marketing expenses of $1.7

million, general and administrative expenses of $1.1 million,

warehousing expenses of $0.7 million, and selling expenses of $0.2

million, partially offset by an increase in

acquisition/divestiture-related and non-recurring expenses of $0.8

million. Expressed as a percentage of net sales, selling, general

and administrative expenses improved by 0.1 percentage points to

9.1% for the fourth quarter of 2024, as compared to 9.2% for the

fourth quarter of 2023.

During the fourth quarter of 2024, the Company recorded pre-tax,

non-cash impairment charges of $320.0 million related to intangible

trademark assets for the Green Giant, Victoria, Static Guard and

McCann’s brands. See “Impairment of Intangible Assets” below.

During the fourth quarter of 2023, the Company recorded pre-tax,

non-cash impairment charges of $20.5 million related to intangible

trademark assets for the Baker’s Joy, Molly McButter, Sugar Twin

and New York Flatbreads brands.

Net interest expense decreased $0.6 million, or 1.4%, to $39.6

million for the fourth quarter of 2024 from $40.2 million for the

fourth quarter of 2023. The decrease was primarily attributable to

a reduction in average long-term debt outstanding during the fourth

quarter of 2024 as compared to the fourth quarter of 2023,

partially offset by higher blended interest rates on the Company’s

long-term debt during the fourth quarter of 2024 compared to the

fourth quarter of 2023, as well as a non-cash loss on

extinguishment of debt during the fourth quarter of 2024 of $0.2

million, net of the accelerated amortization of deferred debt

financing costs, related to the Company’s redemption in full of its

then remaining outstanding 5.25% senior notes due 2025.

The Company had a net loss of $222.4 million, or $2.81 per

diluted share, for the fourth quarter of 2024, compared to net

income of $2.6 million, or $0.03 per diluted share, for the fourth

quarter of 2023. The decrease in net income and diluted earnings

per share were primarily attributable to the pre-tax, non-cash

impairment charges of $320.0 million related to intangible

trademark assets in the fourth quarter of 2024, and a reduction in

base business net sales for the fourth quarter of 2024 compared to

the fourth quarter of 2023, partially offset by the pre-tax,

non-cash impairment charges of $20.5 million related to intangible

trademark assets, and an additional net loss on sale of assets

relating to the Green Giant U.S. shelf-stable divestiture of $4.8

million, each recorded in the fourth quarter of 2023.

The Company’s adjusted net income for the fourth quarter of 2024

was $24.6 million, or $0.31 per adjusted diluted share, compared to

adjusted net income of $23.5 million, or $0.30 per adjusted diluted

share, for the fourth quarter of 2023.

For the fourth quarter of 2024, adjusted EBITDA was $86.1

million, a decrease of $0.7 million, or 0.8%, compared to $86.8

million for the fourth quarter of 2023. The decrease in adjusted

EBITDA was primarily attributable to the reduction of base business

net sales in the fourth quarter of 2024, the impact of the Green

Giant U.S. shelf-stable divestiture and the negative impact of

foreign currency on the cost of goods sold for products

manufactured at the Company’s Green Giant manufacturing facility in

Mexico, partially offset by a decrease in selling, general and

administrative expenses. Adjusted EBITDA as a percentage of net

sales was 15.6% for the fourth quarter of 2024, compared to 15.0%

for the fourth quarter of 2023.

Financial Results for Full Year Fiscal 2024

Net sales for fiscal 2024 decreased $129.8 million, or 6.3%, to

$1,932.5 million from $2,062.3 million for fiscal 2023. The

decrease was primarily attributable to a decrease in base business

net sales and the Green Giant U.S. shelf-stable divestiture. Net

sales of the Green Giant U.S. shelf-stable product line, which the

Company divested on November 8, 2023, were $64.4 million in fiscal

2023.

Base business net sales for fiscal 2024 decreased $65.4 million,

or 3.3%, to $1,932.6 million from $1,998.0 million for fiscal 2023.

The decrease in base business net sales was driven by a decrease in

unit volume of $51.1 million, or 2.6%, a decrease in net pricing

and the impact of product mix of $13.4 million, or 0.7% of base

business net sales, and the negative impact of foreign currency of

$0.9 million.

Gross profit was $422.0 million for fiscal 2024, or 21.8% of net

sales. Adjusted gross profit, which excludes the negative impact of

$6.0 million of acquisition/divestiture-related expenses and

non-recurring expenses included in cost of goods sold during fiscal

2024, was $427.9 million, or 22.1% of net sales. Gross profit was

$455.5 million for fiscal 2023, or 22.1% of net sales. Adjusted

gross profit, which excludes the negative impact of $2.9 million of

acquisition/divestiture-related expenses and non-recurring expenses

included in cost of goods sold during fiscal 2023, was $458.4

million, or 22.2% of net sales.

Selling, general and administrative expenses decreased $7.9

million, or 4.1%, to $188.1 million for fiscal 2024 from $196.0

million for fiscal 2023. The decrease was composed of decreases in

consumer marketing expenses of $4.7 million, selling expenses of

$3.9 million and warehousing expenses of $2.3 million, partially

offset by increases in general and administrative expenses of $2.8

million and acquisition/divestiture-related and non-recurring

expenses of $0.2 million. Expressed as a percentage of net sales,

selling, general and administrative expenses increased by 0.2

percentage points to 9.7% for fiscal 2024, as compared to 9.5% for

fiscal 2023.

During fiscal 2024, the Company recorded pre-tax, non-cash

impairment charges of $320.0 million related to intangible

trademark assets for the Green Giant, Victoria, Static Guard and

McCann’s brands in the fourth quarter, and $70.6 million related to

goodwill for the Company’s Frozen & Vegetables reporting unit

in the first quarter. See “Impairment of Intangible Assets” below.

During fiscal 2023, the Company recorded pre-tax, non-cash

impairment charges of $20.5 million related to intangible trademark

assets for the Baker’s Joy, Molly McButter, Sugar Twin and New York

Flatbreads brands.

Net interest expense increased $6.1 million, or 4.0%, to $157.4

million for fiscal 2024 from $151.3 million for fiscal 2023. The

increase was primarily attributable to higher blended interest

rates on the Company’s long-term debt during fiscal 2024 compared

to fiscal 2023, partially offset by a reduction in average

long-term debt outstanding during fiscal 2024 compared to fiscal

2023. Net interest expense during fiscal 2024 was negatively

impacted by a non-cash loss on extinguishment of debt of $2.1

million and debt refinancing costs of $1.1 million related to the

Company’s refinancing of its senior secured credit facility, and

the accelerated amortization of deferred debt financing costs of

$0.5 million resulting from the retirement of long-term debt during

fiscal 2024. In addition, net interest expense for fiscal 2023 was

reduced by $0.9 million as a result of a net gain on extinguishment

of debt, net of the accelerated amortization of deferred debt

financing costs, related to the Company’s repurchase of a portion

of its then outstanding 5.25% senior notes due 2025.

The Company had a net loss of $251.3 million, or $3.18 per

diluted share, for fiscal 2024, compared to a net loss of $66.2

million, or $0.89 per diluted share, for fiscal 2023. The Company’s

net loss for fiscal 2024 was primarily attributable to the pre-tax,

non-cash impairment charges of $320.0 million related to intangible

trademark assets in the fourth quarter of 2024, pre-tax, non-cash

impairment charges of $70.6 million recorded during the first

quarter of 2024 for the impairment of goodwill within the Company’s

Frozen & Vegetables reporting unit, the reduction of base

business net sales in fiscal 2024, and the impact of the Green

Giant U.S. shelf-stable divestiture. The Company’s net loss for

fiscal 2023 was primarily attributable to a loss on sale of assets

relating to the Green Giant U.S. shelf-stable divestiture of $137.7

million, of which $132.9 million was recorded during the third

quarter and $4.8 million was recorded during the fourth

quarter.

The Company’s adjusted net income for fiscal 2024 was $55.7

million, or $0.70 per adjusted diluted share, compared to adjusted

net income of $73.9 million, or $0.99 per adjusted diluted share,

for fiscal 2023. The reduction in adjusted net income and adjusted

diluted earnings per share in fiscal 2024 was primarily

attributable to the reduction in base business net sales in fiscal

2024, the impact of the Green Giant U.S. shelf-stable divestiture,

and the negative impact of foreign currency on the cost of goods

sold for products manufactured at the Company’s Green Giant

manufacturing facility in Mexico. The Company’s adjusted diluted

earnings per share for fiscal 2024 was also negatively impacted by

an increase to the weighted average shares outstanding in fiscal

2024 compared to fiscal 2023.

For fiscal 2024, adjusted EBITDA was $295.4 million, a decrease

of $22.6 million, or 7.1%, compared to $318.0 million for fiscal

2023. Adjusted EBITDA as a percentage of net sales was 15.3% for

fiscal 2024, compared to 15.4% for fiscal 2023.

Segment Results(2)

Historically, the Company operated in a single industry segment.

However, beginning with the first quarter of 2024, the Company now

operates in, and has begun reporting results by, four business

segments. This change stemmed from the Company’s recent formation

and the evolution of the Company’s four business units: Specialty,

Meals, Frozen & Vegetables and Spices & Flavor Solutions,

which are further described below. Prior period segment results in

this earnings press release have been recast to reflect the change

from one single business segment to four business segments.

Specialty — includes, among others, the

Crisco, Clabber Girl, Bear Creek, Polaner, Underwood, B&G,

Grandma’s, New York Style, Don Pepino, Sclafani, B&M, Baker’s

Joy, Regina, TrueNorth, Static Guard, SugarTwin and Brer Rabbit

brands.

Meals — includes, among others, the Ortega,

Maple Grove Farms, Cream of Wheat, Las Palmas, Victoria, Mama

Mary’s, Spring Tree, McCann’s, Carey’s and Vermont Maid brands.

Frozen & Vegetables — includes the Green

Giant and Le Sueur brands.

Spices & Flavor Solutions — includes,

among others, the Dash, Spice Islands, Weber, Ac’cent, Tone’s,

Trappey’s, Durkee and Wright’s brands.

Specialty Segment Results

Specialty segment results were as follows (dollars in

thousands):

Fourth Quarter

Fiscal Year

Ended

Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

$ Change

% Change

2024

2023

$ Change

% Change

Specialty segment net sales

$

216,732

$

227,263

$

(10,531

)

(4.6

)%

$

679,076

$

722,429

$

(43,353

)

(6.0

)%

Specialty segment adjusted expenses

156,786

170,059

(13,273

)

(7.8

)%

508,939

552,016

(43,077

)

(7.8

)%

Specialty segment adjusted EBITDA

$

59,946

$

57,204

$

2,742

4.8

%

$

170,137

$

170,413

$

(276

)

(0.2

)%

For the fourth quarter and full year 2024, the decrease in

Specialty segment net sales was primarily due to lower Crisco

pricing, driven by decreased commodity costs, coupled with modest

declines in volumes across the Specialty business unit in the

aggregate. The increase in Specialty segment adjusted EBITDA for

the fourth quarter of 2024 was primarily due to decreased costs in

certain raw materials, partially offset by a decrease in net sales.

Specialty segment adjusted EBITDA was essentially flat for fiscal

year 2024 primarily due to lower net sales, mostly offset by

decreased costs in certain raw materials and favorable product

mix.

Meals Segment Results

Meals segment results were as follows (dollars in

thousands):

Fourth Quarter

Fiscal Year

Ended

Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

$ Change

% Change

2024

2023

$ Change

% Change

Meals segment net sales

$

122,895

$

125,327

$

(2,432

)

(1.9

)%

$

462,397

$

477,567

$

(15,170

)

(3.2

)%

Meals segment adjusted expenses

94,635

97,239

(2,604

)

(2.7

)%

361,344

374,521

(13,177

)

(3.5

)%

Meals segment adjusted EBITDA

$

28,260

$

28,088

$

172

0.6

%

$

101,053

$

103,046

$

(1,993

)

(1.9

)%

For the fourth quarter and full year 2024, the decrease in Meals

segment net sales was primarily due to a decrease in volumes across

the Meals business unit in the aggregate, partially offset by an

increase in net pricing and product mix. Meals segment adjusted

EBITDA was essentially flat for the fourth quarter of 2024. The

decrease in Meals segment adjusted EBITDA for fiscal 2024 was

primarily due to a decrease in net sales.

Frozen & Vegetables Segment Results

Frozen & Vegetables segment results were as follows (dollars

in thousands):

Fourth Quarter

Fiscal Year

Ended

Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

$ Change

% Change

2024

2023

$ Change

% Change

Frozen & Vegetables segment net

sales

$

110,137

$

128,546

$

(18,409

)

(14.3

)%

$

395,785

$

473,570

$

(77,785

)

(16.4

)%

Frozen & Vegetables segment adjusted

expenses

113,412

127,117

(13,705

)

(10.8

)%

386,263

446,482

(60,219

)

(13.5

)%

Frozen & Vegetables segment adjusted

EBITDA

$

(3,275

)

$

1,429

$

(4,704

)

(329.2

)%

$

9,522

$

27,088

$

(17,566

)

(64.8

)%

For the fourth quarter and full year 2024, the decrease in

Frozen & Vegetables segment net sales was primarily due to the

Green Giant U.S. shelf-stable divestiture (which negatively

impacted net sales versus the prior year period by $15.9 million

and $64.5 million, respectively), a decrease in net pricing and a

decline in volumes. The decrease in Frozen & Vegetables segment

adjusted EBITDA was primarily due to the negative impact of foreign

currency on Green Giant raw material and manufacturing costs, an

increase in raw material costs, the Green Giant U.S. shelf-stable

divestiture and a decrease in net sales.

Spices & Flavor Solutions Segment Results

Spices & Flavor Solutions segment results were as follows

(dollars in thousands):

Fourth Quarter

Fiscal Year

Ended

Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

$ Change

% Change

2024

2023

$ Change

% Change

Spices & Flavor Solutions segment net

sales

$

101,804

$

96,992

$

4,812

5.0

%

$

395,196

$

388,747

$

6,449

1.7

%

Spices & Flavor Solutions segment

adjusted expenses

75,781

71,612

4,169

5.8

%

284,348

276,502

7,846

2.8

%

Spices & Flavor Solutions segment

adjusted EBITDA

$

26,023

$

25,380

$

643

2.5

%

$

110,848

$

112,245

$

(1,397

)

(1.2

)%

For the fourth quarter and full year 2024, the increase in

Spices & Flavor Solutions segment net sales was primarily due

to increased volumes across the Spices & Flavor Solutions

business unit in the aggregate. Fourth quarter 2024 Spices &

Flavor Solutions segment net sales also benefited from higher net

pricing and product mix. Fiscal year 2024 Spices & Flavor

Solutions net sales were negatively impacted by lower net pricing

and product mix. The increase in Spices & Flavor Solutions

segment adjusted EBITDA for the fourth quarter of 2024 was

primarily due to the increase in net sales, partially offset by

increases in raw material costs. The decrease in Spices &

Flavor Solutions segment adjusted EBITDA for fiscal 2024 was

primarily due to increases in trade spending, the impact of product

mix and increases in raw material costs, partially offset by an

increase in net sales.

Impairment of Intangible Assets

The Company annually tests its indefinite-lived intangible

assets at least annually and whenever events or circumstances occur

indicating that goodwill or indefinite-lived intangible assets

might be impaired. The Company tests indefinite-lived intangible

assets by comparing the fair values with the carrying values and

recognize a loss for the difference. Estimating the fair value for

these purposes requires significant estimates and assumptions by

management, including future cash flows consistent with

management’s expectations, annual sales growth rates, and certain

assumptions underlying a discount rate based on available market

data. Significant management judgment is necessary to estimate the

impact of competitive operating, macroeconomic and other factors to

estimate the future levels of sales and cash flows.

Our annual impairment testing during the fourth quarter of 2024

resulted in the Company recording pre-tax, non-cash impairment

charges of $320.0 million related to intangible trademark assets

for the Green Giant, Victoria, Static Guard and McCann’s brands.

Green Giant is part of the Frozen & Vegetables segment;

Victoria and McCann’s are part of the Meals segment; and Static

Guard is part of the Specialty segment. These charges reflect

partial impairments of each brand as net sales and contributions to

the Company’s operating results for each of these brands have not

met the Company’s expectations.

As previously reported, in connection with the Company’s

transition from one reportable segment to four reportable segments

during the first quarter of 2024, the Company reassigned assets and

liabilities, including goodwill, between four reporting units

(which are the same as the Company’s reportable segments) and

completed a goodwill impairment test, both prior to and subsequent

to the change, comparing the fair values of the reporting units to

the carrying values. The goodwill impairment test resulted in the

Company recognizing pre-tax, non-cash goodwill impairment charges

of $70.6 million within its Frozen & Vegetables reporting unit

during the first quarter of 2024.

Full Year Fiscal 2025 Guidance

For fiscal 2025, net sales are expected to be $1.890 billion to

$1.950 billion, adjusted EBITDA is expected to be $290.0 million to

$300.0 million, and adjusted diluted earnings per share are

expected to be $0.65 to $0.75.

B&G Foods provides earnings guidance only on a non-GAAP

basis and does not provide a reconciliation of the Company’s

forward-looking adjusted EBITDA and adjusted diluted earnings per

share guidance to the most directly comparable GAAP financial

measures because of the inherent difficulty in forecasting and

quantifying certain amounts that are necessary for such

reconciliations, including adjustments that could be made for

deferred taxes; acquisition/divestiture-related expenses, gains and

losses (which may include third-party fees and expenses,

integration, restructuring and consolidation expenses, amortization

of acquired inventory fair value step-up and gains and losses on

the sale of certain assets); gains and losses on extinguishment of

debt; impairment of assets held for sale; impairment of intangible

assets; non-recurring expenses, gains and losses; and other charges

reflected in the Company’s reconciliation of historic non-GAAP

financial measures, the amounts of which, based on past experience,

could be material. For additional information regarding B&G

Foods’ non-GAAP financial measures, see “About Non-GAAP Financial

Measures and Items Affecting Comparability” below.

Conference Call

B&G Foods will hold a conference call at 4:30 p.m. ET today,

February 25, 2025 to discuss fourth quarter 2024 financial results.

The live audio webcast of the conference call can be accessed at

www.bgfoods.com/investor-relations. A replay of the webcast will be

available following the conference call through the same link.

About Non-GAAP Financial Measures and Items Affecting

Comparability

“Adjusted net income” (net income (loss) adjusted for certain

items that affect comparability), “adjusted diluted earnings per

share” (diluted earnings (loss) per share adjusted for certain

items that affect comparability), “base business net sales” (net

sales without the impact of acquisitions until the acquisitions are

included in both comparable periods and without the impact of

discontinued or divested brands), “EBITDA” (net income (loss)

before net interest expense, income taxes, and depreciation and

amortization), “adjusted EBITDA” (EBITDA as adjusted for cash and

non-cash acquisition/divestiture-related expenses, gains and losses

(which may include third-party fees and expenses, integration,

restructuring and consolidation expenses, amortization of acquired

inventory fair value step-up and gains and losses on the sale of

certain assets), gains and losses on extinguishment of debt,

impairment of assets held for sale, impairment of intangible

assets, and non-recurring expenses, gains and losses), “segment

adjusted EBITDA” (adjusted EBITDA for business segments), “segment

adjusted expenses” (primarily includes cost of goods sold and other

expenses incurred by the Company’s business segments to run

day-to-day operations, excluding unallocated corporate items,

depreciation and amortization, acquisition/divestiture-related and

non-recurring expenses, impairment of intangible assets, goodwill

and assets held for sale, gains and losses on sales of assets,

interest expense, and income tax expense or benefit), “adjusted

gross profit” (gross profit adjusted for

acquisition/divestiture-related expenses and non-recurring expenses

included in cost of goods sold) and “adjusted gross profit

percentage” (gross profit as a percentage of net sales adjusted for

acquisition/divestiture-related expenses and non-recurring expenses

included in cost of goods sold) are “non-GAAP financial measures.”

A non-GAAP financial measure is a numerical measure of financial

performance that excludes or includes amounts so as to be different

than the most directly comparable measure calculated and presented

in accordance with generally accepted accounting principles in the

United States (GAAP) in B&G Foods’ consolidated balance sheets

and related consolidated statements of operations, comprehensive

income (loss), changes in stockholders’ equity and cash flows.

Non-GAAP financial measures should not be considered in isolation

or as a substitute for the most directly comparable GAAP measures.

The Company’s non-GAAP financial measures may be different from

non-GAAP financial measures used by other companies.

The Company uses non-GAAP financial measures to adjust for

certain items that affect comparability. This information is

provided in order to allow investors to make meaningful comparisons

of the Company’s operating performance between periods and to view

the Company’s business from the same perspective as the Company’s

management. Because the Company cannot predict the timing and

amount of these items that affect comparability, management does

not consider these items when evaluating the Company’s performance

or when making decisions regarding allocation of resources.

Additional information regarding EBITDA, adjusted EBITDA,

segment adjusted EBITDA and reconciliations of EBITDA, adjusted

EBITDA and segment adjusted EBITDA to net (loss) income and, in the

case of EBITDA and adjusted EBITDA, to net cash provided by

operating activities, is included below for the fourth quarter and

full year 2024 and 2023, along with the components of EBITDA,

adjusted EBITDA and segment adjusted EBITDA. Also included below

are reconciliations of the non-GAAP terms adjusted net income,

adjusted diluted earnings per share and base business net sales to

the most directly comparable measure calculated and presented in

accordance with GAAP in the Company’s consolidated balance sheets

and related consolidated statements of operations, comprehensive

loss, changes in stockholders’ equity and cash flows.

End Notes

(1)

Please see “About Non-GAAP

Financial Measures and Items Affecting Comparability” above for the

definition of the non-GAAP financial measures “base business net

sales,” “adjusted diluted earnings per share,” “adjusted net income

,” “EBITDA,” “adjusted EBITDA,” “segment adjusted EBITDA,” “segment

adjusted expenses,” “adjusted gross profit” and “adjusted gross

profit percentage,” as well as information concerning certain items

affecting comparability and reconciliations of the non-GAAP terms

to the most comparable GAAP financial measures.

(2)

Segment net sales, segment

adjusted expenses and segment adjusted EBITDA are the primary

measures used by the Company’s chief operating decision maker

(CODM) to evaluate segment operating performance and to decide how

to allocate resources to segments. The Company’s CODM is the

Company’s chief executive officer. Segment adjusted expenses and

segment adjusted EBITDA exclude unallocated corporate items,

depreciation and amortization, acquisition/divestiture-related and

non-recurring expenses, impairment of intangible assets, gains and

losses on sales of assets, interest expense, and income tax expense

or benefit. Unallocated corporate items consist of centrally

managed corporate functions, including selling, marketing,

procurement, centralized administrative functions, insurance, and

other similar expenses not directly tied to segment operating

performance. Depreciation and amortization expenses are neither

maintained nor available by business segment, as the Company’s

manufacturing, warehouse, and distribution activities are centrally

managed. These items that are centrally managed at the corporate

level, and therefore excluded from the measures of segment adjusted

expenses and segment adjusted EBITDA, are reviewed by the CODM.

Expenses that are managed centrally but can be attributed to a

segment, such as warehousing and transportation expenses, are

generally allocated to segments based on net sales.

NM – Not meaningful.

About B&G Foods, Inc.

Based in Parsippany, New Jersey, B&G Foods and its

subsidiaries manufacture, sell and distribute high-quality, branded

shelf-stable and frozen foods across the United States, Canada and

Puerto Rico. With B&G Foods’ diverse portfolio of more than 50

brands you know and love, including B&G, B&M, Bear Creek,

Cream of Wheat, Crisco, Dash, Green Giant, Las Palmas, Le Sueur,

Mama Mary’s, Maple Grove Farms, New York Style, Ortega, Polaner,

Spice Islands and Victoria, there’s a little something for

everyone. For more information about B&G Foods and its brands,

please visit www.bgfoods.com.

Forward-Looking Statements

Statements in this press release that are not statements of

historical or current fact constitute “forward-looking statements.”

The forward-looking statements contained in this press release

include, without limitation, statements related to B&G Foods’

expectations regarding net sales, adjusted EBITDA and adjusted

diluted earnings per share and B&G Foods’ overall expectations

for fiscal 2025 and beyond, including our expectations as to first

half fiscal 2025 trends and sequential improvement in the second

half of the year. Such forward-looking statements involve known and

unknown risks, uncertainties and other unknown factors that could

cause the actual results of B&G Foods to be materially

different from the historical results or from any future results

expressed or implied by such forward-looking statements. In

addition to statements that explicitly describe such risks and

uncertainties, readers are urged to consider statements labeled

with the terms “believes,” “belief,” “expects,” “projects,”

“intends,” “anticipates,” “assumes,” “could,” “should,”

“estimates,” “potential,” “seek,” “predict,” “may,” “will” or

“plans” and similar references to future periods to be uncertain

and forward-looking. Factors that may affect actual results

include, without limitation: the Company’s substantial leverage;

the effects of rising costs for and/or decreases in supply of the

Company’s commodities, ingredients, packaging, other raw materials,

distribution and labor; crude oil prices and their impact on

distribution, packaging and energy costs; the Company’s ability to

successfully implement sales price increases and cost saving

measures to offset any cost increases; intense competition, changes

in consumer preferences, demand for the Company’s products and

local economic and market conditions; the Company’s continued

ability to promote brand equity successfully, to anticipate and

respond to new consumer trends, to develop new products and

markets, to broaden brand portfolios in order to compete

effectively with lower priced products and in markets that are

consolidating at the retail and manufacturing levels and to improve

productivity; the ability of the Company and its supply chain

partners to continue to operate manufacturing facilities,

distribution centers and other work locations without material

disruption, and to procure ingredients, packaging and other raw

materials when needed despite disruptions in the supply chain or

labor shortages; the impact pandemics or disease outbreaks, may

have on the Company’s business, including among other things, the

Company’s supply chain, manufacturing operations or workforce and

customer and consumer demand for the Company’s products; the

Company’s ability to recruit and retain senior management and a

highly skilled and diverse workforce at the Company’s corporate

offices, manufacturing facilities and other locations despite a

very tight labor market and changing employee expectations as to

fair compensation, an inclusive and diverse workplace, flexible

working and other matters; the risks associated with the expansion

of the Company’s business; the Company’s possible inability to

identify new acquisitions or to integrate recent or future

acquisitions or the Company’s failure to realize anticipated

revenue enhancements, cost savings or other synergies from recent

or future acquisitions; the Company’s ability to successfully

complete the integration of recent or future acquisitions into the

Company’s enterprise resource planning (ERP) system; tax reform and

legislation, including the effects of the Infrastructure Investment

and Jobs Act, U.S. Tax Cuts and Jobs Act and the U.S. CARES Act,

and future tax reform or legislation; the Company’s ability to

access the credit markets and the Company’s borrowing costs and

credit ratings, which may be influenced by credit markets generally

and the credit ratings of the Company’s competitors; unanticipated

expenses, including, without limitation, litigation or legal

settlement expenses; the effects of currency movements of the

Canadian dollar and the Mexican peso as compared to the U.S.

dollar; the effects of international trade disputes, tariffs,

quotas, and other import or export restrictions on the Company’s

international procurement, sales and operations; future impairments

of the Company’s goodwill and intangible assets; the Company’s

ability to protect information systems against, or effectively

respond to, a cybersecurity incident, other disruption or data

leak; the Company’s ability to successfully implement the Company’s

sustainability initiatives and achieve the Company’s sustainability

goals, and changes to environmental laws and regulations; and other

factors that affect the food industry generally, including: recalls

if products become adulterated or misbranded, liability if product

consumption causes injury, ingredient disclosure and labeling laws

and regulations and the possibility that consumers could lose

confidence in the safety and quality of certain food products;

competitors’ pricing practices and promotional spending levels;

fluctuations in the level of the Company’s customers’ inventories

and credit and other business risks related to the Company’s

customers operating in a challenging economic and competitive

environment; and the risks associated with third-party suppliers

and co-packers, including the risk that any failure by one or more

of the Company’s third-party suppliers or co-packers to comply with

food safety or other laws and regulations may disrupt the Company’s

supply of raw materials or certain finished goods products or

injure the Company’s reputation. The forward-looking statements

contained herein are also subject generally to other risks and

uncertainties that are described from time to time in B&G

Foods’ filings with the Securities and Exchange Commission,

including under Item 1A, “Risk Factors” in the Company’s most

recent Annual Report on Form 10-K and in its subsequent reports on

Forms 10-Q and 8-K. Investors are cautioned not to place undue

reliance on any such forward-looking statements, which speak only

as of the date they are made. B&G Foods undertakes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

B&G Foods, Inc. and Subsidiaries

Consolidated Balance Sheets (In thousands, except share

and per share data) (Unaudited)

December 28,

December 30,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

50,583

$

41,094

Trade accounts receivable, net

172,260

143,015

Inventories

511,232

568,980

Prepaid expenses and other current

assets

38,301

41,747

Income tax receivable

9,068

7,988

Total current assets

781,444

802,824

Property, plant and equipment, net

278,119

302,288

Operating lease right-of-use assets

55,431

70,046

Finance lease right-of-use assets

773

1,832

Goodwill

548,231

619,399

Other intangible assets, net

1,285,946

1,627,836

Other assets

34,788

23,484

Deferred income taxes

9,320

15,581

Total assets

$

2,994,052

$

3,463,290

Liabilities and Stockholders’

Equity

Current liabilities:

Trade accounts payable

$

113,209

$

123,778

Accrued expenses

83,960

83,217

Current portion of operating lease

liabilities

17,963

16,939

Current portion of finance lease

liabilities

726

1,070

Current portion of long-term debt

5,625

22,000

Income tax payable

344

475

Dividends payable

15,038

14,939

Total current liabilities

236,865

262,418

Long-term debt, net of current portion

2,014,823

2,023,088

Deferred income taxes

168,027

267,053

Long-term operating lease liabilities, net

of current portion

37,697

53,724

Long-term finance lease liabilities, net

of current portion

—

726

Other liabilities

11,833

20,818

Total liabilities

2,469,245

2,627,827

Stockholders’ equity:

Preferred stock, $0.01 par value per

share. Authorized 1,000,000 shares; no shares issued or

outstanding

—

—

Common stock, $0.01 par value per share.

Authorized 125,000,000 shares; 79,144,800 and 78,624,419 shares

issued and outstanding as of December 28, 2024 and December 30,

2023, respectively

791

786

Additional paid-in capital

—

46,990

Accumulated other comprehensive (loss)

income

(4,743

)

2,597

Retained earnings

528,759

785,090

Total stockholders’ equity

524,807

835,463

Total liabilities and stockholders’

equity

$

2,994,052

$

3,463,290

B&G Foods, Inc. and Subsidiaries

Consolidated Statements of Operations (In thousands,

except per share data) (Unaudited)

Fourth Quarter Ended

Fiscal Year Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

2024

2023

Net sales

$

551,568

$

578,128

$

1,932,454

$

2,062,313

Cost of goods sold

432,881

452,957

1,510,504

1,606,792

Gross profit

118,687

125,171

421,950

455,521

Operating expenses:

Selling, general and administrative

expenses

50,340

53,246

188,068

196,044

Amortization expense

5,111

5,111

20,444

20,760

Impairment of goodwill

—

—

70,580

—

Loss on sales of assets

—

4,764

135

137,798

Impairment of intangible assets

320,000

20,500

320,000

20,500

Operating (loss) income

(256,764

)

41,550

(177,277

)

80,419

Other expenses (income):

Interest expense, net

39,648

40,225

157,447

151,333

Other income

(1,081

)

(962

)

(4,215

)

(3,781

)

(Loss) income before income tax

benefit

(295,331

)

2,287

(330,509

)

(67,133

)

Income tax benefit

(72,917

)

(288

)

(79,258

)

(935

)

Net (loss) income

$

(222,414

)

$

2,575

$

(251,251

)

$

(66,198

)

Weighted average shares outstanding:

Basic

79,152

78,624

79,012

74,267

Diluted

79,152

78,624

79,012

74,267

(Loss) earnings per share:

Basic

$

(2.81

)

$

0.03

$

(3.18

)

$

(0.89

)

Diluted

$

(2.81

)

$

0.03

$

(3.18

)

$

(0.89

)

Cash dividends declared per share

$

0.190

$

0.190

$

0.760

$

0.760

B&G Foods, Inc. and Subsidiaries

Net Sales, Expenses and Adjusted EBITDA by Segment and

Reconciliation of Segment Adjusted EBITDA to Net (Loss)

Income (In thousands) (Unaudited)

Fourth Quarter Ended

Fiscal Year Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

2024

2023

Segment net sales:

Specialty

$

216,732

$

227,263

$

679,076

$

722,429

Meals

122,895

125,327

462,397

477,567

Frozen & Vegetables

110,137

128,546

395,785

473,570

Spices & Flavor Solutions

101,804

96,992

395,196

388,747

Total segment net sales

551,568

578,128

1,932,454

2,062,313

Segment adjusted expenses:

Specialty

156,786

170,059

508,939

552,016

Meals

94,635

97,239

361,344

374,521

Frozen & Vegetables

113,412

127,117

386,263

446,482

Spices & Flavor Solutions

75,781

71,612

284,348

276,502

Total segment adjusted expenses

440,614

466,027

1,540,894

1,649,521

Segment adjusted EBITDA:

Specialty

59,946

57,204

170,137

170,413

Meals

28,260

28,088

101,053

103,046

Frozen & Vegetables

(3,275

)

1,429

9,522

27,088

Spices & Flavor Solutions

26,023

25,380

110,848

112,245

Total segment adjusted EBITDA

110,954

112,101

391,560

412,792

Unallocated corporate expenses

24,875

25,326

96,147

94,797

Adjusted EBITDA

$

86,079

$

86,775

$

295,413

$

317,995

Depreciation and amortization

$

16,905

$

17,034

$

68,614

$

69,620

Acquisition/divestiture-related and

non-recurring expenses

4,649

1,965

8,938

5,877

Impairment of goodwill

—

—

70,580

—

Loss on sales of assets

—

4,764

135

137,798

Impairment of intangible assets

320,000

20,500

320,000

20,500

Impairment of property, plant and

equipment, net

208

—

208

—

Interest expense, net

39,648

40,225

157,447

151,333

Income tax benefit

(72,917

)

(288

)

(79,258

)

(935

)

Net (loss) income

$

(222,414

)

$

2,575

$

(251,251

)

$

(66,198

)

B&G Foods, Inc. and Subsidiaries

Items Affecting Comparability Reconciliation of Net

(Loss) Income to EBITDA(1) and Adjusted EBITDA(1) (In

thousands) (Unaudited)

Fourth Quarter Ended

Fiscal Year Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

2024

2023

Net (loss) income

$

(222,414

)

$

2,575

$

(251,251

)

$

(66,198

)

Income tax benefit

(72,917

)

(288

)

(79,258

)

(935

)

Interest expense, net(2)

39,648

40,225

157,447

151,333

Depreciation and amortization

16,905

17,034

68,614

69,620

EBITDA(1)

(238,778

)

59,546

(104,448

)

153,820

Acquisition/divestiture-related and

non-recurring expenses(3)

4,649

1,965

8,938

5,877

Impairment of goodwill(4)

—

—

70,580

—

Loss on sales of assets(5)

—

4,764

135

137,798

Impairment of property, plant and

equipment, net

208

—

208

—

Impairment of intangible assets(6)

320,000

20,500

320,000

20,500

Adjusted EBITDA(1)

$

86,079

$

86,775

$

295,413

$

317,995

B&G Foods, Inc. and Subsidiaries

Items Affecting Comparability Reconciliation of Net Cash

Provided by Operating Activities to EBITDA(1) and Adjusted

EBITDA(1) (In thousands) (Unaudited)

Fourth Quarter Ended

Fiscal Year Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

2024

2023

Net cash provided by operating

activities

$

80,348

$

92,078

$

130,914

$

247,759

Income tax benefit

(72,917

)

(288

)

(79,258

)

(935

)

Interest expense, net(2)

39,648

40,225

157,447

151,333

Impairment of goodwill(4)

—

—

(70,580

)

—

(Loss) gain on extinguishment of

debt(2)

(188

)

(457

)

(2,126

)

911

Loss on sales of assets and impairment of

property, plant and equipment(5)

(300

)

(4,799

)

(558

)

(138,523

)

Deferred income taxes

82,139

7,455

99,107

26,395

Amortization of deferred debt financing

costs and bond discount/premium

(1,391

)

(1,819

)

(5,928

)

(7,510

)

Share-based compensation expense

(1,869

)

(1,739

)

(8,664

)

(7,191

)

Changes in assets and liabilities, net of

effects of business combinations

(44,248

)

(50,610

)

(4,802

)

(97,919

)

Impairment of intangible assets(7)

(320,000

)

(20,500

)

(320,000

)

(20,500

)

EBITDA(1)

(238,778

)

59,546

(104,448

)

153,820

Acquisition/divestiture-related and

non-recurring expenses(3)

4,649

1,965

8,938

5,877

Impairment of goodwill

—

—

70,580

—

Loss on sales of assets(5)

—

4,764

135

137,798

Impairment of property, plant and

equipment, net

208

—

208

—

Impairment of intangible assets(7)

320,000

20,500

320,000

20,500

Adjusted EBITDA(1)

$

86,079

$

86,775

$

295,413

$

317,995

B&G Foods, Inc. and Subsidiaries

Items Affecting Comparability Reconciliation of Net

(Loss) Income to Adjusted Net Income(8) and Adjusted Diluted

Earnings per Share(8) (In thousands, except per share

data) (Unaudited)

Fourth Quarter Ended

Fiscal Year Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

2024

2023

Net (loss) income

$

(222,414

)

$

2,575

$

(251,251

)

$

(66,198

)

Loss (gain) on extinguishment of

debt(2)

188

457

2,126

(911

)

Debt financing costs(8)

—

—

1,140

—

Acquisition/divestiture-related and

non-recurring expenses(3)

4,649

1,965

8,938

5,877

Impairment of goodwill(4)

—

—

70,580

—

Loss on sales of assets(5)

—

4,764

135

137,798

Accelerated amortization of deferred debt

financing costs(9)

—

—

456

—

Impairment of intangible assets(6)

320,000

20,500

320,000

20,500

Impairment of property, plant and

equipment, net

208

—

208

—

Tax adjustment related to Back to Nature

divestiture(10)

—

—

—

14,736

Tax true-up(11)

1,636

—

2,282

—

Tax effects of non-GAAP

adjustments(12)

(79,636

)

(6,712

)

(98,876

)

(37,925

)

Adjusted net income(7)

$

24,631

$

23,549

$

55,738

$

73,877

Adjusted diluted earnings per share(7)

$

0.31

$

0.30

$

0.70

$

0.99

__________________________

(1)

EBITDA and adjusted EBITDA are

non-GAAP financial measures used by management to measure operating

performance. A non-GAAP financial measure is defined as a numerical

measure of the Company’s financial performance that excludes or

includes amounts so as to be different from the most directly

comparable measure calculated and presented in accordance with GAAP

in the Company’s consolidated balance sheets and related

consolidated statements of operations, comprehensive loss, changes

in stockholders’ equity and cash flows. The Company defines EBITDA

as net income (loss) before net interest expense, income taxes, and

depreciation and amortization. The Company defines adjusted EBITDA

as EBITDA adjusted for cash and non-cash

acquisition/divestiture-related expenses, gains and losses (which

may include third-party fees and expenses, integration,

restructuring and consolidation expenses, amortization of acquired

inventory fair value step-up, and gains and losses on the sale of

certain assets); gains and losses on extinguishment of debt;

impairment of assets held for sale; impairment of intangible

assets; and non-recurring expenses, gains and losses.

Management believes that it is

useful to eliminate these items because it allows management to

focus on what it deems to be a more reliable indicator of ongoing

operating performance and the Company’s ability to generate cash

flow from operations. The Company uses EBITDA and adjusted EBITDA

in the Company’s business operations to, among other things,

evaluate the Company’s operating performance, develop budgets and

measure the Company’s performance against those budgets, determine

employee bonuses and evaluate the Company’s cash flows in terms of

cash needs. The Company also presents EBITDA and adjusted EBITDA

because the Company believes they are useful indicators of the

Company’s historical debt capacity and ability to service debt and

because covenants in the Company’s credit agreement, the Company’s

senior secured notes indenture and the Company’s senior notes

indenture contain ratios based on these measures. As a result,

reports used by internal management during monthly operating

reviews feature the EBITDA and adjusted EBITDA metrics. However,

management uses these metrics in conjunction with traditional GAAP

operating performance and liquidity measures as part of its overall

assessment of company performance and liquidity, and therefore does

not place undue reliance on these measures as its only measures of

operating performance and liquidity.

EBITDA and adjusted EBITDA are

not recognized terms under GAAP and do not purport to be

alternatives to operating income (loss), net income (loss) or any

other GAAP measure as an indicator of operating performance. EBITDA

and adjusted EBITDA are not complete net cash flow measures because

EBITDA and adjusted EBITDA are measures of liquidity that do not

include reductions for cash payments for an entity’s obligation to

service its debt, fund its working capital, capital expenditures

and acquisitions and pay its income taxes and dividends. Rather,

EBITDA and adjusted EBITDA are potential indicators of an entity’s

ability to fund these cash requirements. EBITDA and adjusted EBITDA

are not complete measures of an entity’s profitability because they

do not include certain costs and expenses and gains and losses

described above. Because not all companies use identical

calculations, this presentation of EBITDA and adjusted EBITDA may

not be comparable to other similarly titled measures of other

companies. However, EBITDA and adjusted EBITDA can still be useful

in evaluating the Company’s performance against the Company’s peer

companies because management believes these measures provide users

with valuable insight into key components of GAAP amounts.

(2)

Net interest expense for fiscal

2024 includes a loss on extinguishment of debt of $2.1 million (or

$1.6 million, net of tax), $1.3 million of which relates to the

refinancing of tranche B term loans and $0.6 million of which

relates to the refinancing of revolving credit loans during the

third quarter of 2024, and $0.2 million of which relates to the

Company’s redemption in full of its then remaining outstanding

5.25% senior notes due 2025 during the fourth quarter of 2024.

Net interest expense for fiscal

2023 was reduced by $0.9 million (or $0.7 million, net of tax), as

a result of a net gain on extinguishment of debt related to the

Company’s 5.25% senior notes due 2025. During fiscal 2023, the

Company repurchased $79.2 million aggregate principal amount of its

5.25% senior notes due 2025 in the open market at discounted

repurchase prices and recorded a gain of $1.9 million, net of the

accelerated amortization of deferred debt financing costs of $0.3

million. In addition, in October 2023, the Company redeemed $555.4

million aggregate principal amount of its 5.25% senior notes due

2025 at par and recorded a loss resulting from the accelerated

amortization of deferred debt financing costs of $1.0 million.

(3)

Acquisition/divestiture-related

and non-recurring expenses primarily include acquisition,

integration and divestiture-related expenses for prior and

potential future acquisitions and divestitures, and non-recurring

expenses.

(4)

In connection with the Company’s

transition from one reportable segment to four reportable segments

during the first quarter of 2024, the Company reassigned assets and

liabilities, including goodwill, between four reporting units

(which are the same as the Company’s reportable segments). The

Company completed a goodwill impairment test, both prior to and

subsequent to the change in reporting structure, comparing the fair

values of the reporting units to the carrying values. The goodwill

impairment test resulted in the Company recognizing pre-tax,

non-cash goodwill impairment charges of $70.6 million (or $53.4

million, net of tax) within its Frozen & Vegetables reporting

unit during the first quarter of 2024.

(5)

In connection with the

divestiture of the Company’s Green Giant U.S. shelf-stable product

line during the fourth quarter of 2023, the Company recorded

pre-tax, non-cash impairment charges of $132.9 million (or $100.4

million, net of tax) relating to the assets held for sale during

the third quarter of 2023. During the fourth quarter of 2023, the

Company completed the Green Giant U.S. shelf-stable divestiture and

recorded a loss on sale of $4.8 million (or $3.6 million, net of

tax) during the quarter, resulting in a total loss on sale during

fiscal 2023 of $137.7 million (or $104.0 million, net of tax) and

an additional $0.1 million during the first quarter of fiscal

2024.

On the first business day of

fiscal 2023, the Company completed the Back to Nature divestiture

and recorded a loss on the sale of $0.1 million.

(6)

During the fourth quarter of

2024, the Company recorded pre-tax, non-cash impairment charges of

$320.0 million (or $241.6 million, net of tax) related to

intangible trademark assets for the Green Giant, Victoria, Static

Guard and McCann’s brands.

During the fourth quarter of

2023, the Company recorded pre-tax, non-cash impairment charges of

$20.5 million (or $15.5 million, net of tax) related to intangible

trademark assets for the Baker’s Joy, Molly McButter, Sugar Twin,

and New York Flatbreads brands. The Company partially impaired the

Baker’s Joy and Sugar Twin brands, and the Company fully impaired

the Molly McButter and New York Flatbreads brands.

(7)

Adjusted net income and adjusted

diluted earnings per share are non-GAAP financial measures used by

management to measure operating performance. The Company defines

adjusted net income and adjusted diluted earnings per share as net

income (loss) and diluted earnings (loss) per share adjusted for

certain items that affect comparability. These non-GAAP financial

measures reflect adjustments to net income (loss) and diluted

earnings (loss) per share to eliminate the items identified in the

reconciliation above. This information is provided in order to

allow investors to make meaningful comparisons of the Company’s

operating performance between periods and to view the Company’s

business from the same perspective as the Company’s management.

Because the Company cannot predict the timing and amount of these

items, management does not consider these items when evaluating the

Company’s performance or when making decisions regarding allocation

of resources.

(8)

Debt financing costs for fiscal

2024 reflects the portion of debt financing costs incurred in

connection with the Company’s refinancing of the Company’s senior

secured credit facility that is included in net interest expense

for fiscal 2024. Of the $1.1 million (or $0.9 million, net of tax)

included in net interest expense for fiscal 2024, $0.7 million

relates to the refinancing of revolving credit loans and $0.4

million relates to the refinancing of tranche B term loans.

(9)

Net interest expense for fiscal

2024 includes the accelerated amortization of deferred debt

financing costs of $0.5 million (or $0.3 million, net of tax),

resulting from the Company’s prepayment of $21.3 million aggregate

principal amount of tranche B term loans and repurchase of $0.7

million aggregate principal amount of 8.00% senior secured notes

due 2028 during the second quarter of 2024.

(10)

As a result of the Back to Nature

divestiture, the Company incurred a capital loss for tax purposes,

for which the Company recorded a deferred tax asset during the

first quarter of 2023. A valuation allowance has been recorded

against this deferred tax asset, which negatively impacted the

Company’s first quarter of 2023 income taxes by $14.7 million, or

$0.21 per share.

(11)

Tax true-up for the fourth

quarter and full year 2024 relates to return to provision

adjustments in the U.S., Mexico and Canada.

(12)

Represents the tax effects of the

non-GAAP adjustments listed above, assuming a tax rate of

24.5%.

B&G Foods, Inc. and Subsidiaries

Items Affecting Comparability Reconciliation of Net Sales

to Base Business Net Sales(1) (In thousands)

(Unaudited)

Fourth Quarter Ended

Fiscal Year Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

2024

2023

Net sales

$

551,568

$

578,128

$

1,932,454

$

2,062,313

Net sales from discontinued or divested

brands(2)

—

(15,813

)

106

(64,333

)

Base business net sales

$

551,568

$

562,315

$

1,932,560

$

1,997,980

__________________________

(1)

Base business net sales is a

non-GAAP financial measure used by management to measure operating

performance. The Company defines base business net sales as the

Company’s net sales excluding (1) the net sales of acquisitions

until the net sales from such acquisitions are included in both

comparable periods and (2) net sales of discontinued or divested

brands. The portion of current period net sales attributable to

recent acquisitions for which there is no corresponding period in

the comparable period of the prior year is excluded. For each

acquisition, the excluded period starts at the beginning of the

most recent fiscal period being compared and ends on the first

anniversary of the acquisition date. For discontinued or divested

brands, the entire amount of net sales is excluded from each fiscal

period being compared. The Company has included this financial

measure because management believes it provides useful and

comparable trend information regarding the results of the Company’s

business without the effect of the timing of acquisitions and the

effect of discontinued or divested brands.

(2)

For the fourth quarter and fiscal

2023, reflects net sales of the Green Giant U.S. shelf-stable

product line, which was divested on November 8, 2023, partially

offset by a net credit paid to customers relating to discontinued

brands. For fiscal 2024, reflects a net credit paid to customers

relating to discontinued and divested brands.

B&G Foods, Inc. and Subsidiaries

Items Affecting Comparability Reconciliation of Gross

Profit to Adjusted Gross Profit(1) and Gross Profit

Percentage to Adjusted Gross Profit Percentage(1) (In

thousands, except percentages) (Unaudited)

Fourth Quarter Ended

Fiscal Year Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

2024

2023

Gross profit

$

118,687

$

125,171

$

421,950

$

455,521

Acquisition/divestiture-related expenses

and non-recurring expenses included in cost of goods sold(2)

3,658

1,568

5,979

2,921

Adjusted gross profit(1)

$

122,345

$

126,739

$

427,929

$

458,442

Gross profit percentage

21.5

%

21.7

%

21.8

%

22.1

%

Acquisition/divestiture-related expenses

and non-recurring expenses included in cost of goods sold as a

percentage of net sales

0.7

%

0.3

%

0.3

%

0.1

%

Adjusted gross profit percentage(1)

22.2

%

21.9

%

22.1

%

22.2

%

__________________________

(1)

Adjusted gross profit and

adjusted gross profit percentage are non-GAAP financial measures

used by management to measure operating performance. The Company

defines adjusted gross profit as gross profit adjusted for

acquisition/divestiture-related expenses and non-recurring expenses

included in cost of goods sold and adjusted gross profit percentage

as gross profit percentage (i.e., gross profit as a percentage of

net sales) adjusted for acquisition/divestiture-related expenses

and non-recurring expenses included in cost of goods sold. These

non-GAAP financial measures reflect adjustments to gross profit and

gross profit percentage to eliminate the items identified in the

reconciliation above. This information is provided in order to

allow investors to make meaningful comparisons of the Company’s

operating performance between periods and to view the Company’s

business from the same perspective as the Company’s management.

Because the Company cannot predict the timing and amount of these

items, management does not consider these items when evaluating the

Company’s performance or when making decisions regarding allocation

of resources.

(2)

Acquisition/divestiture-related

expenses and non-recurring expenses included in cost of goods sold

primarily include acquisition, integration and divestiture-related

expenses for prior and potential future acquisitions and

divestitures, and non-recurring expenses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225864429/en/

Investor Relations: ICR, Inc. Anna Kate Heller

bgfoodsIR@icrinc.com

Media Relations: ICR, Inc. Matt Lindberg 203.682.8214

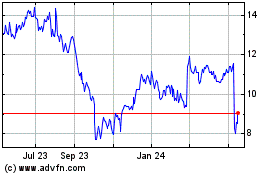

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Feb 2025 to Mar 2025

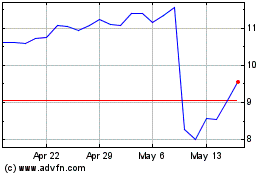

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Mar 2024 to Mar 2025