Benchmark Electronics, Inc. (NYSE: BHE) today announced

financial results for the fourth quarter and year ended December

31, 2024.

Fourth quarter 2024 results(1):

- Revenue of $657 million with year-over-year growth in Semi-Cap,

A&D and Industrials offset by anticipated weakness in Medical

and AC&C

- GAAP and non-GAAP gross margin of 10.3% and 10.4%

- GAAP and Non-GAAP operating margin of 4.3% and 5.1%

- GAAP and non-GAAP earnings per share of $0.50 and $0.61

- Delivered 7th consecutive quarter of positive Free Cash

Flow

Full year 2024 results(1):

- Revenue of $2.7 billion driven by strength in Semi-Cap and

A&D

- GAAP and non-GAAP gross margin of 10.2%, up 70 and 60 basis

points year-over-year

- GAAP and non-GAAP operating margin of 4.1% and 5.1%

- GAAP earnings per share of $1.72, with non-GAAP earnings of

$2.29

- Delivered $156 million in Free Cash Flow

Three Months Ended

December 31,

September 30,

December 31,

(Amounts in millions, except per share

data)

2024

2024

2023

Sales

$

657

$

658

$

691

Net income

$

18

$

15

$

18

Income from operations

$

29

$

28

$

32

Net income – non-GAAP(1)

$

22

$

21

$

23

Income from operations – non-GAAP(1)

$

33

$

35

$

38

Diluted earnings per share

$

0.50

$

0.42

$

0.49

Diluted earnings per share –

non-GAAP(1)

$

0.61

$

0.57

$

0.65

Operating margin

4.3

%

4.3

%

4.6

%

Operating margin – non-GAAP(1)

5.1

%

5.3

%

5.5

%

Year Ended

December 31,

(Amounts in millions, except per share

data)

2024

2023

Sales

$

2,656

$

2,839

Net income

$

63

$

64

Income from operations

$

109

$

110

Net income – non-GAAP(1)

$

84

$

85

Income from operations – non-GAAP(1)

$

135

$

139

Diluted earnings per share

$

1.72

$

1.79

Diluted earnings per share –

non-GAAP(1)

$

2.29

$

2.38

Operating margin

4.1

%

3.9

%

Operating margin – non-GAAP(1)

5.1

%

4.9

%

(1)

A reconciliation of non-GAAP results to

the most directly comparable GAAP measures and a discussion of why

management believes these non-GAAP results are useful are included

below.

“The past year has reinforced that our strategy is working, as

we have continued to drive margin expansion and free cash flow

generation. Our demonstrated execution across cycles gives me

confidence in our ability to continue to drive value for our

stakeholders,” said Jeff Benck, Benchmark’s President and CEO.

Benck continued: “We will continue to focus on maintaining

financial discipline during this dynamic environment, while

strategically investing in our future growth. To that end, we are

breaking ground on our fourth building in Penang, Malaysia in

support of our ongoing momentum in the Semiconductor Capital

Equipment sector.”

Cash Conversion Cycle

December 31,

September 30,

December 31,

2024

2024

2023

Accounts receivable days

57

51

59

Contract asset days

23

26

23

Inventory days

85

89

99

Accounts payable days

(54

)

(54

)

(53

)

Advance payments from customers days

(22

)

(22

)

(30

)

Cash conversion cycle days

89

90

98

Fourth Quarter 2024 Industry Sector Update

Revenue and percentage of sales by industry sector were as

follows.

December 31,

September 30,

December 31,

(In millions)

2024

2024

2023

Semi-Cap

$

198

30

%

$

188

28

%

$

168

24

%

Complex Industrials

140

21

151

23

132

19

Medical

117

18

107

16

126

18

A&D

117

18

102

16

102

15

AC&C

85

13

110

17

163

24

Total

$

657

100

%

$

658

100

%

$

691

100

%

Revenue decreased quarter over quarter primarily due to

decreases in Advanced Computing and Communications (AC&C)

sales, which were partially offset by increases in Semi-Cap and

A&D sales. Revenue decreased year-over-year primarily due to

decreases in Medical and AC&C sales, which were partially

offset by increases in Semi-Cap and A&D sales.

First Quarter 2025 Guidance

- Revenue between $620 million - $660 million

- Diluted GAAP earnings per share between $0.34 - $0.40

- Diluted non-GAAP earnings per share between $0.48 - $0.54

- Non-GAAP earnings per share guidance excludes stock-based

compensation expense of approximately $4.5 million and other

non-operating expenses of $2.6 million to $2.8 million which

includes restructuring, amortization of intangibles and other

expenses.

Fourth Quarter 2024 Earnings Conference Call

The Company will host a conference call to discuss the results

today at 5:00 p.m. Eastern Time. The live webcast of the call and

accompanying reference materials will be accessible by logging on

to the Company’s website at www.bench.com. A replay of the

broadcast will also be available on the Company’s website.

About Benchmark Electronics, Inc.

Benchmark provides comprehensive solutions across the entire

product life cycle by leading through its innovative technology and

engineering design services, leveraging its optimized global supply

chain and delivering world-class manufacturing services in the

following industries: semiconductor capital equipment, complex

industrials, medical, commercial aerospace, defense, and advanced

computing and communications. Benchmark’s global operations include

facilities in seven countries and its common shares trade on the

New York Stock Exchange under the symbol BHE.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements are identified as any

statement that does not relate strictly to historical or current

facts and may include words such as “anticipate,” “believe,”

“intend,” “plan,” “project,” “forecast,” “strategy,” “position,”

“continue,” “estimate,” “expect,” “may,” “will,” “could,”

“predict,” and similar expressions of the negative or other

variations thereof. In particular, statements, express or implied,

concerning the Company’s outlook and guidance for first quarter and

fiscal year 2025 results, future operating results or margins, the

ability to generate sales and income or cash flow, expected revenue

mix, the Company’s business strategy and strategic initiatives, the

Company’s repurchases of shares of its common stock, the Company’s

expectations regarding restructuring charges, stock-based

compensation expense, amortization of intangibles, award of any tax

incentives and capital expenditures, and the Company’s intentions

concerning the payment of dividends, among others, are

forward-looking statements. Although the Company believes these

statements are based on and derived from reasonable assumptions,

they involve risks, uncertainties and assumptions that are beyond

the Company’s ability to control or predict, relating to

operations, markets and the business environment generally,

including those discussed under Part I, Item 1A of the Company's

Annual Report on Form 10-K for the year ended December 31, 2023,

and in any of the Company’s subsequent reports filed with the

Securities and Exchange Commission. Events relating to the

possibility of customer demand fluctuations, supply chain

constraints, continuing inflationary pressures, the effects of

foreign currency fluctuations and high interest rates, geopolitical

uncertainties including continuing hostilities and tensions, trade

restrictions and sanctions, or the ability to utilize the Company’s

manufacturing facilities at sufficient levels to cover its fixed

operating costs, may have resulting impacts on the Company’s

business, financial condition, results of operations, and the

Company’s ability (or inability) to execute on its plans. Should

one or more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual outcomes, including

the future results of the Company’s operations, may vary materially

from those indicated. Undue reliance should not be placed on any

forward-looking statements. Forward-looking statements are not

guarantees of performance. All forward-looking statements included

in this document are based upon information available to the

Company as of the date of this document, and the Company assumes no

obligation to update.

Non-GAAP Financial Measures

Management discloses certain non-GAAP information to provide

investors with additional information to analyze the Company’s

performance and underlying trends. These non-GAAP financial

measures exclude restructuring charges, stock-based compensation

expense, amortization of intangible assets acquired in business

combinations, certain legal and other settlement losses (gains),

customer insolvency losses (recoveries), asset impairments, other

significant non-recurring costs and the related tax impacts of all

of the above. A detailed reconciliation between GAAP results and

results excluding certain items (“non-GAAP”) is included in the

following tables attached to this document. In situations where a

non-GAAP reconciliation has not been provided, the Company was

unable to provide such a reconciliation without unreasonable effort

due to the uncertainty and inherent difficulty predicting the

occurrence, the financial impact and the periods in which the

non-GAAP adjustments may be recognized. Management uses non-GAAP

measures that exclude certain items in order to better assess

operating performance and help investors compare results with our

previous guidance. This document also references “free cash flow”,

a non-GAAP measure, which the Company defines as cash flow from

operations less additions to property, plant and equipment and

purchased software. The Company’s non-GAAP information is not

necessarily comparable to the non-GAAP information used by other

companies. Non-GAAP information should not be viewed as a

substitute for, or superior to, net income or other data prepared

in accordance with GAAP as a measure of the Company’s profitability

or liquidity. Readers should consider the types of events and

transactions for which adjustments have been made.

Benchmark Electronics, Inc.

and Subsidiaries

Condensed Consolidated Statements

of Income

(Amounts in Thousands, Except Per

Share Data)

(UNAUDITED)

Three Months Ended

Year Ended

December 31,

December 31,

2024

2023

2024

2023

Sales

$

656,887

$

691,354

$

2,656,105

$

2,838,976

Cost of sales

588,962

620,350

2,386,081

2,567,906

Gross profit

67,925

71,004

270,024

271,070

Selling, general and administrative

expenses

37,470

35,646

149,460

147,025

Amortization of intangible assets

1,204

1,204

4,817

5,979

Restructuring charges and other costs

727

2,054

6,336

8,402

Income from operations

28,524

32,100

109,411

109,664

Interest expense

(6,175

)

(8,692

)

(26,922

)

(31,875

)

Interest income

2,879

2,033

10,208

6,256

Other expense, net

(1,350

)

(3,105

)

(8,802

)

(2,825

)

Income before income taxes

23,878

22,336

83,895

81,220

Income tax expense

5,455

4,784

20,568

16,905

Net income

$

18,423

$

17,552

$

63,327

$

64,315

Earnings per share:

Basic

$

0.51

$

0.49

$

1.76

$

1.81

Diluted

$

0.50

$

0.49

$

1.72

$

1.79

Weighted-average number of shares used in

calculating earnings per share:

Basic

35,973

35,658

35,970

35,566

Diluted

36,659

35,956

36,759

35,973

Benchmark Electronics, Inc.

and Subsidiaries

Condensed Consolidated Balance

Sheets

(In Thousands)

(UNAUDITED)

December 31,

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

315,152

$

277,391

Restricted cash

12,875

5,822

Accounts receivable, net

412,458

449,404

Contract assets

167,578

174,979

Inventories

553,654

683,801

Prepaid expenses and other current

assets

42,512

44,350

Total current assets

1,504,229

1,635,747

Property, plant and equipment, net

225,097

227,698

Operating lease right-of-use assets

117,995

130,830

Goodwill and other long-term assets

292,143

280,480

Total assets

$

2,139,464

$

2,274,755

Liabilities and Shareholders’ Equity

Current liabilities:

Current installments of long-term debt

$

6,737

$

4,283

Accounts payable

354,218

367,480

Advance payments from customers

143,614

204,883

Accrued liabilities

144,530

136,901

Total current liabilities

649,099

713,547

Long-term debt, net of current

installments

250,457

326,674

Operating lease liabilities

108,997

123,385

Other long-term liabilities

17,598

32,064

Total liabilities

1,026,151

1,195,670

Shareholders’ equity

1,113,313

1,079,085

Total liabilities and shareholders’

equity

$

2,139,464

$

2,274,755

Benchmark Electronics, Inc.

and Subsidiaries

Condensed Consolidated Statements

of Cash Flows

(In Thousands)

(UNAUDITED)

Year Ended

December 31,

2024

2023

Cash flows from operating activities:

Net income

$

63,327

$

64,315

Depreciation and amortization

46,144

45,410

Stock-based compensation expense

13,366

15,286

Accounts receivable

33,953

42,050

Contract assets

7,401

8,634

Inventories

127,840

45,071

Accounts payable

(18,283

)

(35,320

)

Advance payments from customers

(61,269

)

6,946

Other changes in working capital and

other, net

(23,254

)

(18,098

)

Net cash provided by operating

activities

189,225

174,294

Cash flows from investing activities:

Additions to property, plant and equipment

and software

(33,253

)

(77,739

)

Other investing activities, net

486

601

Net cash used in investing activities

(32,767

)

(77,138

)

Cash flows from financing activities:

Share repurchases

(5,100

)

—

Net debt activity

(74,283

)

5,509

Other financing activities, net

(29,723

)

(29,087

)

Net cash used in financing activities

(109,106

)

(23,578

)

Effect of exchange rate changes

(2,538

)

2,205

Net increase in cash and cash equivalents

and restricted cash

44,814

75,783

Cash and cash equivalents and restricted

cash at beginning of year

283,213

207,430

Cash and cash equivalents and restricted

cash at end of year

$

328,027

$

283,213

Benchmark Electronics, Inc.

and Subsidiaries

Reconciliation of GAAP to

Non-GAAP Financial Results

(Amounts in Thousands, Except Per

Share Data)

(UNAUDITED)

Three Months Ended

Year Ended

Dec 31,

Sep 30,

Jun 30,

Mar 31,

Dec 31,

Sep 30,

Jun 30,

Dec 31,

2024

2024

2024

2024

2023

2023

2023

2024

2023

Income from operations (GAAP)

$

28,524

$

28,105

$

27,253

$

25,529

$

32,100

$

30,341

$

24,481

$

109,411

$

109,664

Restructuring charges and other costs

727

795

1,471

3,343

2,054

1,437

2,364

6,336

7,281

Stock-based compensation expense

2,626

4,379

4,185

2,176

2,955

3,674

3,867

13,366

15,286

Amortization of intangible assets

1,204

1,205

1,204

1,204

1,204

1,592

1,591

4,817

5,979

Asset impairment

—

—

—

—

—

198

923

—

1,121

Legal and other settlement loss

239

367

317

855

—

—

—

1,778

—

Customer insolvency (recovery)

—

—

(316

)

—

—

—

—

(316

)

—

Non-GAAP income from operations

$

33,320

$

34,851

$

34,114

$

33,107

$

38,313

$

37,242

$

33,226

$

135,392

$

139,331

GAAP operating margin

4.3

%

4.3

%

4.1

%

3.8

%

4.6

%

4.2

%

3.3

%

4.1

%

3.9

%

Non-GAAP operating margin

5.1

%

5.3

%

5.1

%

4.9

%

5.5

%

5.2

%

4.5

%

5.1

%

4.9

%

Gross profit (GAAP)

$

67,925

$

66,741

$

67,950

$

67,408

$

71,004

$

69,077

$

67,031

$

270,024

$

271,070

Stock-based compensation expense

503

413

326

426

416

420

423

1,668

1,655

Customer insolvency (recovery)

—

—

(316

)

—

—

—

—

(316

)

—

Non-GAAP gross profit

$

68,428

$

67,154

$

67,960

$

67,834

$

71,420

$

69,497

$

67,454

$

271,376

$

272,725

GAAP gross margin

10.3

%

10.1

%

10.2

%

10.0

%

10.3

%

9.6

%

9.1

%

10.2

%

9.5

%

Non-GAAP gross margin

10.4

%

10.2

%

10.2

%

10.0

%

10.3

%

9.7

%

9.2

%

10.2

%

9.6

%

Selling, general and administrative

expenses

$

37,470

$

36,636

$

38,022

$

37,332

$

35,646

$

35,509

$

37,672

$

149,460

$

147,025

Stock-based compensation expense

(2,123

)

(3,966

)

(3,859

)

(1,750

)

(2,539

)

(3,254

)

(3,444

)

(11,698

)

(13,631

)

Legal and other settlement loss

(239

)

(367

)

(317

)

(855

)

—

—

—

(1,778

)

—

Non-GAAP selling, general and

administrative expenses

$

35,108

$

32,303

$

33,847

$

34,727

$

33,107

$

32,255

$

34,228

$

135,984

$

133,394

Net income (GAAP)

$

18,423

$

15,374

$

15,528

$

14,002

$

17,552

$

20,412

$

13,991

$

63,327

$

64,315

Restructuring charges and other costs

727

795

1,471

3,343

2,899

1,437

2,364

6,336

8,126

Stock-based compensation expense

2,626

4,379

4,185

2,176

2,955

3,674

3,867

13,366

15,286

Amortization of intangible assets

1,204

1,205

1,204

1,204

1,204

1,592

1,591

4,817

5,979

Asset impairment

—

—

—

—

—

198

923

—

1,121

Legal and other settlement loss (gain)

239

367

317

855

(37

)

(3,375

)

(1,155

)

1,778

(4,567

)

Customer insolvency (recovery)

—

—

(316

)

—

—

—

—

(316

)

—

Income tax adjustments(1)

(971

)

(1,406

)

(1,437

)

(1,393

)

(1,280

)

(529

)

(1,484

)

(5,207

)

(4,816

)

Non-GAAP net income

$

22,248

$

20,714

$

20,952

$

20,187

$

23,293

$

23,409

$

20,097

$

84,101

$

85,444

Diluted earnings per share:

Diluted (GAAP)

$

0.50

$

0.42

$

0.43

$

0.38

$

0.49

$

0.57

$

0.39

$

1.72

$

1.79

Diluted (Non-GAAP)

$

0.61

$

0.57

$

0.57

$

0.55

$

0.65

$

0.65

$

0.56

$

2.29

$

2.38

Weighted-average number of shares used in

calculating diluted earnings per share:

Diluted (GAAP)

36,659

36,629

36,497

36,401

35,956

35,876

35,676

36,759

35,973

Diluted (Non-GAAP)

36,659

36,629

36,497

36,401

35,956

35,876

35,676

36,759

35,973

Net cash provided by operations

$

45,916

$

39,036

$

55,816

$

48,457

$

137,079

$

37,583

$

24,538

$

189,225

$

174,294

Additions to property, plant and equipment

and software

(9,032

)

(9,814

)

(8,504

)

(5,903

)

(11,026

)

(19,664

)

(8,318

)

(33,253

)

(77,739

)

Free cash flow

$

36,884

$

29,222

$

47,312

$

42,554

$

126,053

$

17,919

$

16,220

$

155,972

$

96,555

(1)

This amount represents the tax impact of

the non-GAAP adjustments using the applicable effective tax

rates.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250129984018/en/

For More Information, Please Contact: Paul Mansky,

Investor Relations and Corporate Development 1-623-300-7052 or

paul.mansky@bench.com

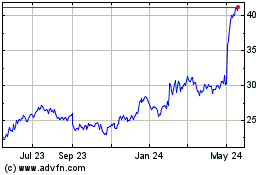

Benchmark Electronics (NYSE:BHE)

Historical Stock Chart

From Jan 2025 to Feb 2025

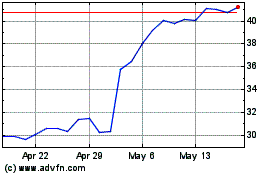

Benchmark Electronics (NYSE:BHE)

Historical Stock Chart

From Feb 2024 to Feb 2025