UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed

by the Registrant ☐

Filed

by a Party other than the Registrant ☒

Check

the appropriate box:

| ☐ | Preliminary

Proxy Statement |

| ☐ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive

Proxy Statement |

| ☒ | Definitive

Additional Materials |

| ☐ | Soliciting

Material under §240.14a-12 |

Braemar

Hotels and Resorts Inc.

(Name of Registrant as Specified In Its Charter)

Blackwells

Capital LLC

Blackwells Onshore I LLC

Jason Aintabi

Michael Cricenti

Jennifer M. Hill

Betsy L. McCoy

Steven J. Pully

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☐ | Fee

paid previously with preliminary materials |

| ☐ | Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On May 20, 2024, Blackwells Capital LLC (“Blackwells”)

issued a press release, a copy of which is attached hereto as Exhibit 1. Also on May 20, 2024, Blackwells issued a presentation

regarding Braemar Hotels and Resorts Inc.’s (the “Corporation”) statements about Blackwells and its campaign, a copy

of which is attached hereto as Exhibit 2. A copy of each of the press release and the presentation is available on Blackwells’

website, www.NoMoreMonty.com.

IMPORTANT ADDITIONAL INFORMATION

Blackwells, Blackwells Onshore I LLC, Jason Aintabi, Michael Cricenti,

Jennifer M. Hill, Betsy L. McCoy and Steven J. Pully (collectively, the “Participants”) are participants in the solicitation

of proxies from the stockholders of the Corporation for the Corporation’s 2024 annual meeting of stockholders. On April 3, 2024,

the Participants filed with the Securities and Exchange Commission (the “SEC”) their definitive proxy statement and accompanying

WHITE universal proxy card in connection with their solicitation of proxies from the stockholders of the Corporation.

ALL STOCKHOLDERS OF THE CORPORATION ARE ADVISED TO READ THE DEFINITIVE

PROXY STATEMENT, THE ACCOMPANYING WHITE UNIVERSAL PROXY CARD AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY THE

PARTICIPANTS, AS THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS AND THEIR DIRECT OR

INDIRECT INTERESTS IN THE CORPORATION, BY SECURITY HOLDINGS OR OTHERWISE.

The definitive proxy statement and an accompanying WHITE

universal proxy card will be furnished to some or all of the Corporation’s stockholders and are, along with other relevant documents,

available at no charge on the SEC’s website at http://www.sec.gov/. In addition, the Participants will provide copies of the definitive

proxy statement without charge, upon request. Requests for copies should be directed to Blackwells.

The Corporation’s board of directors has purported to reject

as invalid our nominations to elect each of Blackwells’ nominees and determined that our notice is purportedly non-compliant with

the Corporation’s Fifth Amended and Restated Bylaws, as amended (the “Bylaws”) and defective. On March 24, 2024, the

Corporation brought suit against each of the Participants, Blackwells Holding Co. LLC, Vandewater Capital Holdings, LLC, Blackwells Asset

Management LLC and BW Coinvest Management I LLC in the United States District Court for the Northern District of Texas (the “District

Court”), seeking injunctive relief against solicitation of proxies by Blackwells and a declaratory judgment that Blackwells’

nomination is invalid due to Blackwells’ alleged violations of the Bylaws, and, as a result, Blackwells’ slate of purported

nominees is invalid and ineligible to stand for election by the Corporation’s stockholders. Ultimately, Blackwells believes the

Corporation’s claims have no merit. On April 11, 2024, Blackwells filed a Complaint in the District Court against the Corporation

and the Corporation’s directors. Blackwells alleges, among other things, that the Corporation improperly rejected Blackwells’

nomination notice, breached the Bylaws, and violated Section 14(a) of the Securities Exchange Act of 1934 by issuing false and misleading

statements and failing to disclose The Dallas Express as a proxy participant. The action filed by the Corporation on March 24, 2024 and

the action filed by Blackwells on April 11, 2024 have been consolidated (the “Consolidated Litigation”). The Consolidated

Litigation is currently stayed. The outcome of the Consolidated Litigation and any related litigation may affect our ability to deliver

proxies submitted to us on the WHITE universal proxy card.

Exhibit 1

Blackwells Releases Presentation Exposing Monty

Bennett’s Buffoonery

Warns That Blackwells Will Seek to Recover All Improper

Expenditures by Mr. Bennett and the Board

Invites Shareholders to Visit www.NoMoreMonty.com

for More Information on Blackwells’ Campaign

NEW YORK, May 20, 2024 – Blackwells

Capital LLC (“Blackwells”), a shareholder of Braemar Hotels & Resorts Inc. (“Braemar” or the “Company”)

(NYSE: BHR), today released a presentation entitled “The Buffoonery of Monty Bennett”, which may be found at https://nomoremonty.com/letters-presentations/.

Jason Aintabi, Chief Investment Officer of Blackwells,

said:

“Last week, Mr. Bennett expanded his comically

inept smear campaign (“#ExpelBlackwells”) designed to keep independent directors out of Braemar’s boardroom. Following

Blackwells’ report that Mr. Bennett’s social media account had a mere four followers, it would appear that Mr. Bennett

scrambled to direct the purchase of over 3,000 fake followers for his account.

Blackwells will fight to ensure that all monies, great

and small, that are spent to satisfy Mr. Bennett’s buffoonery are recovered and returned to shareholders. We continue to pursue

the termination of Braemar and Mr. Bennett’s shady Advisory Agreement for cause, and will hold the Company’s

board accountable for abetting what we believe is one of the most grotesque examples of corporate piracy in the public markets today.”

Mr. Aintabi continued:

“Independent directors must be installed

on the Braemar board, and a thorough examination of the Company’s external Advisory Agreement must be expediently pursued. We remind

the current directors again, that enabling Mr. Bennett’s buffoonery creates a substantial risk of liability, litigation, and

reputational harm for each of them. Until the job is done, we will continue with our refrain: No More Monty.”

Blackwells encourages all shareholders to review Blackwells’

materials, the details of its engagement with the Company, information about Blackwells’ nominees, and other important information

at www.NoMoreMonty.com.

Shareholders are also invited to follow Blackwells’

campaign on X at @nomoremonty and Instagram at @no_more_monty.

About Blackwells Capital

Blackwells is a multi-strategy

investment manager with a public markets focus on currencies, equities, credit and commodities. When necessary, we engage with public

boards to drive value for all stakeholders. Our private equity portfolio includes investments in space, clean energy, infrastructure,

real estate and technology. Further information is available at www.blackwellscap.com.

Contacts

Stockholders

MacKenzie Partners, Inc.

Toll Free: +1 (800) 322-2885

proxy@mackenziepartners.com

Media

Gagnier Communications

Dan Gagnier & Riyaz Lalani

646-569-5897

blackwells@gagnierfc.com

IMPORTANT ADDITIONAL INFORMATION

Blackwells, Blackwells Onshore

I LLC, Jason Aintabi, Michael Cricenti, Jennifer M. Hill, Betsy L. McCoy and Steven J. Pully (collectively, the “Participants”)

are participants in the solicitation of proxies from the stockholders of Braemar Hotels & Resorts Inc. (the “Company”)

for the Company’s 2024 annual meeting of stockholders. On April 3, 2024, the Participants filed with the Securities and Exchange

Commission (the “SEC”) their definitive proxy statement and accompanying WHITE universal proxy card in connection with their

solicitation of proxies from the stockholders of the Company.

ALL STOCKHOLDERS OF THE COMPANY

ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT, THE ACCOMPANYING WHITE UNIVERSAL PROXY CARD AND OTHER DOCUMENTS RELATED TO THE SOLICITATION

OF PROXIES BY THE PARTICIPANTS, AS THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS AND

THEIR DIRECT OR INDIRECT INTERESTS IN THE COMPANY, BY SECURITY HOLDINGS OR OTHERWISE.

The definitive proxy statement

and an accompanying WHITE universal proxy card will be furnished to some or all of the Company’s stockholders and are, along with

other relevant documents, available at no charge on the SEC’s website at http://www.sec.gov/. In addition, the Participants

will provide copies of the definitive proxy statement without charge, upon request. Requests for copies should be directed to Blackwells.

The Company’s board

of directors has purported to reject as invalid our nominations to elect each of Blackwells’ nominees and determined that our notice

is purportedly non-compliant with the Company’s Fifth Amended and Restated Bylaws, as amended (the “Bylaws”) and defective.

On March 24, 2024, the Company brought suit against each of the Participants, Blackwells Holding Co. LLC, Vandewater Capital Holdings,

LLC, Blackwells Asset Management LLC and BW Coinvest Management I LLC in the United States District Court for the Northern District of

Texas (the “District Court”), seeking injunctive relief against solicitation of proxies by Blackwells and a declaratory judgment

that Blackwells’ nomination is invalid due to Blackwells’ alleged violations of the Bylaws, and, as a result, Blackwells’

slate of purported nominees is invalid and ineligible to stand for election by the Company’s stockholders. Ultimately, Blackwells

believes the Company’s claims have no merit. On April 11, 2024, Blackwells filed a Complaint in the District Court against the Company

and the Company’s directors. Blackwells alleges, among other things, that the Company improperly rejected Blackwells’ nomination

notice, breached the Bylaws, and violated Section 14(a) of the Securities Exchange Act of 1934 by issuing false and misleading statements

and failing to disclose The Dallas Express as a proxy participant. The action filed by the Company on March 24, 2024 and the action filed

by Blackwells on April 11, 2024 have been consolidated (the “Consolidated Litigation”). The Consolidated Litigation is currently

stayed. The outcome of the Consolidated Litigation and any related litigation may affect our ability to deliver proxies submitted to us

on the WHITE universal proxy card.

Exhibit 2

THE BUFFOONERY OF MONTY BENNETT Braemar Hotels & Resorts Inc. (NYSE:BHR 1 ) MAY 2024 NOMOREMONTY.COM PRESENTED BY BLACKWELLS CAPITAL

DISC L A IMER 2 The views expressed in this presentation (the “Presentation”) represent the opinions of Blackwells Capital LLC and/or certain of its affiliates (“Blackwells”) and the investment funds it manages that hold shares in Braemar Hotels & Resorts Inc . (the “Company”, “Braemar” or “BHR”) . The Presentation is for informational purposes only, and it does not have regard to the specific investment objective, financial situation, suitability or particular need of any specific person who may receive the Presentation and should not be taken as advice on the merits of any investment decision . The views expressed in the Presentation represent the opinions of Blackwells and are based on publicly available information with respect to the Company and from other third - party reports . Blackwells recognizes that there may be confidential information in the possession of the Company that could lead it or others to disagree with Blackwells’ conclusions . Blackwells reserves the right to change any of its opinions expressed herein at any time as it deems appropriate and disclaims any obligation to notify the market or any other party of any such change, except as required by law . The information contained herein is current only as of the date of this Presentation . Blackwells disclaims any obligation to update the information or opinions contained herein . Certain financial projections and statements made herein have been derived or obtained from filings made with the U . S . Securities and Exchange Commission (“SEC”) or other regulatory authorities and from other third - party reports . Neither Blackwells nor any of its affiliates shall be responsible or have any liability for any misinformation contained in any SEC or other regulatory filing or third - party report . Select figures included in this Presentation have not been calculated using generally accepted accounting principles (“GAAP”) and have not been audited by independent accountants . Such figures may vary from GAAP accounting in material respects and there can be no assurance that the unrealized values reflected within such materials will be realized . This Presentation does not recommend the purchase or sale of any security, and should not be construed as legal, tax, investment or financial advice, and the information contained herein should not be taken as advice on the merits of any investment decision . The information contained in this Presentation is provided merely as information, and this Presentation is not intended to be, nor should it be construed as, an offer to sell or a solicitation of an offer to buy any security . Funds, investment vehicles, and accounts managed by Blackwells currently beneficially own shares of common stock, par value $ 0 . 01 per share, of the Company (“Shares”) . These funds, investment vehicles, and accounts are in the business of trading – buying and selling – securities and intend to continue trading in the securities of the Company . You should assume such funds, investment vehicles, and accounts will from time to time sell all or a portion of their holdings of the Company in open market transactions or otherwise, buy additional Shares (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls, swaps or other derivative instruments relating to such Shares, regardless of the views expressed in this Presentation . Blackwells reserves the right to take any actions with respect to investments in the Company as it may deem appropriate, including, but not limited to, communicating with the Company’s management, the Company’s board of directors, other investors and shareholders, stakeholders, industry participants, and/or interested or relevant parties about the Company or seeking representation on the Company’s board of directors, and to change its intentions with respect to its investments in the Company at any time and disclaims any obligation to notify the market or any other party of any such changes or actions, except as required by law . Although Blackwells believes the statements made in this Presentation are substantially accurate in all material respects and do not omit to state material facts necessary to make those statements not misleading, Blackwells makes no representation or warranty, express or implied, as to the accuracy or completeness of those statements or any other written or oral communication it makes with respect to the Company and any other companies mentioned, and each of Blackwells, the other Participants (as defined below) and their respective affiliates expressly disclaim any liability relating to those statements or communications (or any inaccuracies or omissions therein) . Thus, shareholders and others should conduct their own independent investigation and analysis of those statements and communications and of the Company and any other companies to which those statements or communications may be relevant . This Presentation contains forward - looking statements . All statements contained herein that are not clearly historical in nature or that necessarily depend on future events are forward - looking, and the words “anticipate,” “believe,” “expect,” “potential,” “could,” “intend,” “project,” “will,” “may,” “would,” “opportunity,” “estimate,” “plan,” and similar expressions are generally intended to identify forward - looking statements . The projected results and statements contained herein that are not historical facts are based on current expectations, speak only as of the date of these materials and involve risks, uncertainties and other factors that may cause actual results, performances or achievements to be materially different from any future results, performances or achievements expressed or implied by such projected results and statements . Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which entail risks and uncertainties and are beyond the control of Blackwells . Though this Presentation may contain projections, nothing in this Presentation is, or is intended to be, a prediction of the future trading price or market value of securities of the Company . Accordingly, there is no assurance or guarantee with respect to the prices at which any securities of the Company will trade, and such securities may not trade at prices that may be implied herein . The estimates, projections and potential impact of the opportunities identified by Blackwells herein are based on assumptions that Blackwells believes to be reasonable as of the date of the Presentation, but there can be no assurance or guarantee that (i) any of the proposed actions set forth in this Presentation will be completed, (ii) the actual results or performance of the Company will not differ, and such differences may be material, or (iii) any of the assumptions provided in this Presentation are accurate . There can be no assurance that the projected results or forward - looking statements included herein will prove to be accurate, and therefore actual results could differ materially from those set forth in, contemplated by, or underlying these forward - looking statements . In light of the significant uncertainties inherent in the projected results and forward - looking statements included herein, the inclusion of such information should not be regarded as a representation as to future results or that the objectives and strategic initiatives expressed or implied by such projected results and forward - looking statements will be achieved . Blackwells will not undertake and specifically declines any obligation to disclose the results of any revisions that may be made to any projected results or forward - looking statements herein to reflect events or circumstances after the date of such projected results or statements or to reflect the occurrence of anticipated or unanticipated events . Blackwells has neither sought nor obtained the consent from any other third party to use any statements or information contained herein that have been obtained or derived from statements made or published by such third parties, nor has it paid for any such statements . Any such statements or information should not be viewed as indicating the support of such third parties for the views expressed herein . Blackwells does not endorse third - party estimates or research which are used in this Presentation, and such use is solely for illustrative purposes . No warranty is made that data or information, whether derived or obtained from filings made with the SEC or any other regulatory agency or from any third party, are accurate . Past performance is not an indication of future results . This Presentation may contain citations or links to articles and/or videos (collectively, “Media”) . The views and opinions expressed in such Media or those of the author(s)/speaker(s) referenced or quoted in such Media, unless specifically noted otherwise, do not necessarily represent the opinions of Blackwells . All registered or unregistered service marks, trademarks and trade names referred to in this Presentation are the property of their respective owners, and Blackwells’ use herein does not imply an affiliation with or endorsement by, the owners of these service marks, trademarks and trade names . Some of the materials in this Presentation are copyrighted by Blackwells and portions are copyrighted by others and are used with their permission . Blackwells Capital LLC, Blackwells Onshore I LLC, Jason Aintabi, Michael Cricenti, Jennifer M . Hill, Betsy L . McCoy and Steven J . Pully (collectively, the “Participants”) are participants in the solicitation of proxies from the shareholders of the Company for the 2024 Annual Meeting of Shareholders (the “Annual Meeting”) . On April 3 , 2024 , the Participants filed with the SEC their definitive proxy statement and accompanying WHITE Proxy Card in connection with their solicitation of proxies from the shareholders of the Company for the 2024 Annual Meeting . All shareholders of the Company are advised to read the definitive proxy statement, the accompanying WHITE proxy card and other documents related to the solicitation of proxies by the Participants, as they contain important information, including additional information related to the Participants and their direct or indirect interests in the Company, by security holdings or otherwise . The definitive proxy statement and an accompanying WHITE proxy card will be furnished to some or all of the Company’s shareholders and are, along with other relevant documents, publicly available at no charge on the SEC’s website at http : //www . sec . gov / . In addition, the Participants will provide copies of the definitive proxy statement without charge, when available, upon request . Requests for copies should be directed to Blackwells Capital LLC . The Company’s board of directors has purported to reject as invalid Blackwells’ nominations to elect each of Blackwells’ nominees and determined that our notice is purportedly non - compliant with the Bylaws and defective . On March 24 , 2024 , Braemar brought suit against Blackwells Capital, Blackwells Onshore I LLC, Blackwells Holding Co . LLC, Vandewater Capital Holdings, LLC, Blackwells Asset Management LLC, BW Coinvest Management I LLC, Mr . Aintabi and each of Blackwells’ nominees in the United States District Court for the Northern District of Texas (the “District Court”), seeking injunctive relief against solicitation of proxies by Blackwells and a declaratory judgment that Blackwells’ nomination is invalid due to Blackwells’ alleged violations of the Company’s Bylaws, and, as a result, Blackwells’ slate of purported nominees is invalid and ineligible to stand for election by the Company’s stockholders . Ultimately, Blackwells believe the Company’s claims have no merit . The outcome of the Company’s lawsuit and any related litigation may affect our ability to deliver proxies submitted to us on the WHITE Universal Proxy Card .

Bu ff o on e r y R ea li ty THE BUFFOONERY OF MONTY BENNETT In a piece about Mr . Bennett, written by Mr . Bennett , he claims : “As the CEO of Ashford, Bennett embodies a relentless commitment to achieving exceptional results ” Montgomery Bennett took over his daddy's hotel business and here are the results: • AHT – stock is down (99%) all time (1) • BHR – stock is down (91%) all time (2) • A I N C – st ock i s do w n (95 % ) a l l t i m e ( 3 ) Are these the “exceptional results” Mr. Bennett speaks of? Source: Medium.com and Capital IQ. Note: Data has been split adjusted by Capital IQ. (1) Calculated from IPO date, August 26, 2003, to unaffected date March 28, 2024. (2) Calculated from November 20, 2013, to unaffected date March 28, 2024. (3) Calculated from November 7, 2014 to unaffected date March 28, 2024. 3

Bu ff o on e r y R ea li ty THE BUFFOONERY OF MONTY BENNETT “committed to corporate governance practices that promote the long - term interests of our stockholders” Source: Braemar proxy statement, filed on April 25, 2024. Capital IQ. $ 2 . 5 0 $22.50 $ 2 0 . 0 0 $17.50 $ 1 5 . 0 0 $ 1 2 . 5 0 $ 1 0 . 0 0 $ 7 . 5 0 $ 5 . 0 0 $ - Nov - 13 M a y - 1 5 N o v - 1 6 M a y - 1 8 N o v - 1 9 M a y - 2 1 N o v - 2 2 4

Bu ff o on e r y R ea li ty THE BUFFOONERY OF MONTY BENNETT “honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest” Sources: Braemar proxy statement, filed on April 25, 2024 and 2023 Form 10 - K. The web that has enabled a near 600% increase in fees to Archibald and Montgomery Bennett entities 5

Bu ff o on e r y R ea li ty THE BUFFOONERY OF MONTY BENNETT “lifelong advocate of civic engagement… [Bennett] takes pride in giving back to the Dallas - Fort Worth community.” Monty “was cast as a face of corporate greed in the COVID - 19 era after applying” for the PPP loans (1) Braemar, Ashford and their affiliates collectively “laid off or furloughed 95% of their 7,000 employees” Source: Company website, The Wall Street Journal, (1) The Dallas Morning News. 6

Bu ff o on e r y R ea li ty THE BUFFOONERY OF MONTY BENNETT On websites created by Monty Bennett he claims to have “sagacious leadership” and be a “visionary” It appears Mr. Bennett has a pattern of burning company resources on pet projects Source: https://monty - bennett.jimdosite.com/. 7

Bu ff o on e r y R ea li ty THE BUFFOONERY OF MONTY BENNETT The Dallas Express, Mr. Bennett’s media outlet, claims to “ follow ethical standards in order to maintain the integrity of the publication ” Mr. Bennett uses his rag to publish articles smearing Blackwells Why has Braemar failed to disclose The Dallas Express, a purported 501(c)(3) not - for - profit corporation, as a participant in its solicitation? Sources: The Dallas Express. 8

Bu ff o on e r y R ea li ty THE BUFFOONERY OF MONTY BENNETT Mr. Bennett: “truth has become a casualty in today’s media world”, “somewhere journalism lost its way” Somewhere journalism has lost its way, says Mr. Bennett… readers need look no further to see where that somewhere is… Sources: The Dallas Express: https://dallasexpress.com/opinion/a - letter - from - the - publisher/, https://dallasexpress.com/opinion/the - southwest - airlines - gestapo/. 9

Bu ff o on e r y R ea li ty THE BUFFOONERY OF MONTY BENNETT Braemar comically suggests Blackwells does not provide value to shareholders through its engagement Blackwells has unlocked tens of billions of dollars of value at other companies in need of major governance overhauls Mr. Bennett’s track record, on the other hand, is one of turning companies he ‘runs’ into near penny stocks AHT – stock is down (99%) all time (1) BHR – stock is down (91%) all time (2) A I N C – st ock i s do w n (95 % ) a l l t i m e ( 3 ) Source: Expel Blackwells Twitter and Capital IQ. Note: Data has been split adjusted by Capital IQ. (1) Calculated from IPO date, August 26, 2003, to unaffected date March 28, 2024. (2) Calculated from November 20, 2013, to unaffected date March 28, 2024. (3) Calculated from November 7, 2014 to unaffected date March 28, 2024. 10

Bu ff o on e r y R ea li ty THE BUFFOONERY OF MONTY BENNETT BHR Stock P e r f o r m a n c e v s S& P 500 since start date B r ae m a r S t o c k P e r f o r m a n c e s i n c e start date Role Name (285.6%) (90.63%) Chairman of the Board Monty Bennett (285.6%) (90.63%) Lead Director Stefani Carter (154.4%) (78.07%) Director Candace Evans (228.1%) (87.26%) Director Kenneth Fearn (98.0%) (64.48%) Director Rebeca Odino - Johnson (285.6%) (90.63%) Director Matthew Rinaldi (81.6%) (18.37%) CEO & Director Richard Stockton (187.5%) (78.95%) Director Abteen Vaziri Source: Expel Blackwells Twitter, Bloomberg and Company Filings. Note: Market date as of the unaffected date March 28, 2024. ( 1 ) 11

Bu ff o on e r y R ea li ty THE BUFFOONERY OF MONTY BENNETT Blackwells has nominated four highly - qualified candidates , including Jennifer Hill, the former CFO of Bank of America Merrill Lynch, and Betsy McCoy, the General Counsel of The Related Group B la ck w e l l s ’ no m in ee s : x are independent of Monty Bennett x are independent of Blackwells x have extensive leadership experience in capital allocation, real property law and real estate x support proper corporate governance S ou rc e : E x pe l B l a c k w e ll s T w i tte r . 12

Bu ff o on e r y R ea li ty THE BUFFOONERY OF MONTY BENNETT B rae m ar : “ B la ck w el l s ’ a tt e m p t e d w i t hhol d pro x y campaign at AHT was a FAILURE ” Following Blackwells' withhold campaign at Ashford Hospitality Trust, Inc., both Chairman Monty Bennett and director Kamal Jafarnia were forced to RESIGN S ou rc e : E x pe l B l a c k w e ll s T w i tte r . 13

Bu ff o on e r y R ea li ty THE BUFFOONERY OF MONTY BENNETT Mr. Bennett and Ashford suggesting anyone has a history of petty litigation is like the ocean calling the sand ‘wet’ Braemar suggests that Mr. Aintabi has a history of petty litigious behavior citing a case from 15 years ago from a dispute against a company that Mr. Bennett happened to acquire years later! S ou rc e : E x pe l B l a c k w e ll s T w i tte r . 14

Bu ff o on e r y R ea li ty THE BUFFOONERY OF MONTY BENNETT Bennett again suggests that Mr. Aintabi has a history of petty litigious behavior… S ou r c e : E x pe l B l a c k we ll s T w i t te r . (1) Email sent from Mr. Bennett’s account. “You guys may very well be involved in child abuse… What do you think your liability will be 10 or more years from now… I suggest you look at the financial implications … You all may very well become bankrupted, regardless of how much insurance your organization carries. Is it wrong that I will volunteer to testify”… (1) - Montgomery Bennett 15

Bu ff o on e r y R ea li ty THE BUFFOONERY OF MONTY BENNETT “As always, we will continue to look at ways to fulfill our mission to create and protect stockholder value” - Monty J. Bennett (1) Blackwells submitted a 454 - page nomination notice… only for Braemar to sue to keep our independent director candidates out of the boardroom Attempting to silence and suppress opposition is the antithesis to protecting shareholder value Source: Expel Blackwells Twitter; (1) Braemar proxy statement, filed on April 25, 2024. 16

Bu ff o on e r y R ea li ty THE BUFFOONERY OF MONTY BENNETT [… ] BRAEMAR HAS BURNED SHAREHOLDER DOLLARS TO ACQUIRE FAKE INSTAGRAM FOLLOWERS ON AN ACCOUNT CREATED TO SMEAR A SHAREHOLDER Bef or e : A fte r: Source: Expel Blackwells Instagram and Blackwells’ Press Release as of May 16, 2024. 17

VOTING INFORMATION Braemar's 2024 Annual Meeting of Shareholders will be held on July 30 , 2024 , and all shareholders of record as of the close of business on May 2 , 2024 are entitled to vote at the meeting Braemar Shareholders – Please vote your proxy today on the WHITE universal proxy card “FOR” each of the Blackwells nominees and the Blackwells proposals Blackwells recommends shareholders vote "AGAINST" Braemar’s executive compensation resolution If you have any questions about voting your proxy or need replacement proxy materials, contact: MacKenzie Partners, Inc. 1 - 800 - 322 - 2885 (call toll free:) proxy@mackenziepartners.com 18

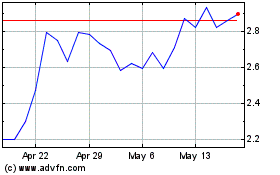

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From May 2024 to Jun 2024

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From Jun 2023 to Jun 2024