UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by

the Registrant ☐

Filed by

a Party other than the Registrant ☒

Check the

appropriate box:

| ☐ | Preliminary

Proxy Statement |

| ☐ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive

Proxy Statement |

| ☒ | Definitive

Additional Materials |

| ☐ | Soliciting

Material under §240.14a-12 |

Braemar Hotels and Resorts Inc.

(Name of Registrant as Specified In Its Charter)

Blackwells Capital LLC

Blackwells Onshore I LLC

Jason Aintabi

Michael Cricenti

Jennifer M. Hill

Betsy L. McCoy

Steven J. Pully

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of

Filing Fee (Check all boxes that apply):

| ☐ | Fee

paid previously with preliminary materials |

| ☐ | Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On June 10, 2024, Blackwells Capital LLC (“Blackwells”)

issued a press release, which included a letter from Brancous LPI, one of Braemar Hotels and Resorts Inc.’s (the “Corporation”)

largest stockholders, expressing support

for Blackwells’ campaign and criticizing the Corporation’s governance. A copy of the press release is attached hereto as Exhibit 1. Also on June 10, 2024, Blackwells issued a presentation regarding the Corporation’s

statements about Blackwells and its campaign, a copy of which is attached hereto as Exhibit 2. A copy of each of the press release

and the presentation is available on Blackwells’ website, www.NoMoreMonty.com.

IMPORTANT ADDITIONAL INFORMATION

Blackwells, Blackwells Onshore I LLC, Jason Aintabi,

Michael Cricenti, Jennifer M. Hill, Betsy L. McCoy and Steven J. Pully (collectively, the “Participants”) are participants

in the solicitation of proxies from the stockholders of the Corporation for the Corporation’s 2024 annual meeting of stockholders.

On April 3, 2024, the Participants filed with the Securities and Exchange Commission (the “SEC”) their definitive proxy statement

and accompanying WHITE universal proxy card in connection with their solicitation of proxies from the stockholders of the

Corporation.

ALL STOCKHOLDERS OF THE CORPORATION ARE ADVISED

TO READ THE DEFINITIVE PROXY STATEMENT, THE ACCOMPANYING WHITE UNIVERSAL PROXY CARD AND OTHER DOCUMENTS RELATED TO THE SOLICITATION

OF PROXIES BY THE PARTICIPANTS, AS THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS AND

THEIR DIRECT OR INDIRECT INTERESTS IN THE CORPORATION, BY SECURITY HOLDINGS OR OTHERWISE.

The definitive proxy statement and an accompanying

WHITE universal proxy card will be furnished to some or all of the Corporation’s stockholders and are, along with

other relevant documents, available at no charge on the SEC’s website at http://www.sec.gov/. In addition, the Participants will

provide copies of the definitive proxy statement without charge, upon request. Requests for copies should be directed to Blackwells.

The Corporation’s board of directors has

purported to reject as invalid our nominations to elect each of Blackwells’ nominees and determined that our notice is purportedly

non-compliant with the Corporation’s Fifth Amended and Restated Bylaws, as amended (the “Bylaws”) and defective. On

March 24, 2024, the Corporation brought suit against each of the Participants, Blackwells Holding Co. LLC, Vandewater Capital Holdings,

LLC, Blackwells Asset Management LLC and BW Coinvest Management I LLC in the United States District Court for the Northern District of

Texas (the “District Court”), seeking injunctive relief against solicitation of proxies by Blackwells and a declaratory judgment

that Blackwells’ nomination is invalid due to Blackwells’ alleged violations of the Bylaws, and, as a result, Blackwells’

slate of purported nominees is invalid and ineligible to stand for election by the Corporation’s stockholders. Ultimately, Blackwells

believes the Corporation’s claims have no merit. On April 11, 2024, Blackwells filed a Complaint in the District Court against the

Corporation and the Corporation’s directors. Blackwells alleges, among other things, that the Corporation improperly rejected Blackwells’

nomination notice, breached the Bylaws and violated Section 14(a) of the Securities Exchange Act of 1934 by issuing false and misleading

statements and failing to disclose The Dallas Express as a proxy participant. The action filed by the Corporation on March 24, 2024 and

the action filed by Blackwells on April 11, 2024 have been consolidated (the “Consolidated Litigation”). The Consolidated

Litigation is currently stayed. The outcome of the Consolidated Litigation and any related litigation may affect our ability to deliver

proxies submitted to us on the WHITE universal proxy card.

Exhibit 1

Blackwells Capital Releases Presentation Detailing

Continued Buffoonery of Monty Bennett

Applauds Support for Blackwells’ Campaign

from Other Braemar Shareholders

Urges Shareholders to Vote FOR Blackwells’

Nominees and Proposals

NEW YORK, June 10, 2024 (GLOBE NEWSWIRE) --

Blackwells Capital LLC (“Blackwells”), a shareholder of Braemar Hotels & Resorts Inc. (“Braemar” or the “Company”)

(NYSE: BHR), today released a presentation titled, “The Continued Buffoonery of Monty Bennett.”

Additionally, Blackwells is pleased to announce

that independent shareholders of Braemar are speaking out and concurring with Blackwells’ campaign aims: to terminate the egregious

external management agreement with Ashford Inc. (“Ashford”) and to reconstitute Braemar’s entrenched Board.

Brancous LP1 (“Brancous”), a large

Braemar shareholder, wrote to Blackwells commending Blackwells’ campaign. Brancous wrote: “we share Blackwells’ concerns…” and

that “[t]he reappointment of Monty Bennett and Kamal Jafarnia by Ashford Hospitality board…reinforces our concerns

about the governance integrity of Braemar.” Brancous further commented on “the lackluster performance under

the current board’s leadership” and stated that “it’s troubling to see board members enriching themselves

at the expense of shareholder value.” A complete copy of the Brancous letter can be found at the end of this press release.

In addition, Braemar’s second largest

shareholder recently disclosed a June 3, 2024 email that it sent to Monty Bennett. The email calls for the termination of the external

management agreement with Ashford and for the replacement of members of the Board. A copy of this letter can be found at https://www.sec.gov/Archives/edgar/data/1574085/000139834424011207/fp0088636-1_ex3.htm.

Jason Aintabi, Chief Investment Officer

of Blackwells, said:

“We are not surprised to see other shareholders

speaking out. We are only surprised that Monty Bennett has remained in his position as long as he has. He may have his conflicted board

to thank for that, but both he and they are facing a ticking clock until independent, qualified individuals make their way onto the Board

so Braemar can return value to its rightful owners once and for all. It’s time to put Monty’s Advisory Agreement where it

belongs: in the trash can.”

Blackwells urges all

Braemar shareholders to vote their proxy on the WHITE universal proxy card “FOR” each of the Blackwells nominees and the Blackwells

proposals. Blackwells recommends shareholders vote “AGAINST” Braemar’s executive compensation resolution.

If you have any questions

about voting your proxy or need replacement proxy materials, contact:

MacKenzie Partners, Inc.

+1 (800) 322-2885 (toll free for shareholders)

proxy@mackenziepartners.com

Blackwells also encourages shareholders to

review Blackwells’ materials, the details of its engagement with the Company, information about Blackwells’ nominees, and

other important information at www.NoMoreMonty.com. Shareholders are also invited to follow Blackwells’ campaign on X at @nomoremonty and

Instagram at @no_more_monty.

Brancous’ letter to Blackwells is copied

in full below:

May 16th, 2024

Dear Mr. Aintabi,

I am writing to express our support for Blackwells in its proxy battle with Braemar Hotel & Resorts board.

The recent developments at Ashford Hospitality

Trust have raised significant concerns. The reappointment of Monty Bennett and Kamal Jafarnia by Ashford Hospitality board, despite their

prior defeat, highlights entrenched directorship and reinforces our concerns about the governance integrity of Braemar. These actions

at Ashford Hospitality not only question the independence and accountability of its board but also raises serious questions about governance

integrity within Braemar. It is crucial for Braemar’s board to recognize these warning signs and prioritize transparency, accountability,

and shareholder interests to regain investor trust and foster sustainable growth.

We share Blackwells’ concerns regarding the

intertwined relationship between Braemar Hotels & Resorts and Ashford Inc., especially the conflict of interest arising from Monty

Bennett’s dual roles. This situation not only undermines shareholder interests but also hampers the company’s potential for growth and

value creation.

Furthermore, we agree with your assessment

of the lackluster performance under the current board’s leadership. While the company has struggled, it’s troubling to see board members

enriching themselves at the expense of shareholder value. Immediate action is needed to address governance issues and restore shareholder

confidence.

In line with Blackwells’ conviction, we support

the call for separation between Braemar Hotels & Resorts and Ashford Inc. This critical step is imperative not only to safeguard shareholder

interests but also to guarantee unbiased decision-making within Braemar.

We affirm our commitment to vote in favor

of the directors nominated by Blackwells to the Braemar Hotel & Resorts board.

Sincerely,

Alejandro Malbran

Managing Director

Brancous LP1

About Blackwells Capital

Blackwells is a multi-strategy alternative

asset management firm that invests in public and private markets globally. Our public markets portfolio focuses on currencies, equities,

credit and commodities. When necessary, we engage with public company boards to drive value for all stakeholders. Our private markets

portfolio includes investments in space, clean energy, infrastructure, real estate and technology. Further information is available at www.blackwellscap.com.

Contacts

Stockholders

MacKenzie Partners, Inc.

Toll Free: +1 (800) 322-2885

proxy@mackenziepartners.com

Media

Gagnier Communications

Dan Gagnier & Riyaz Lalani

646-569-5897

blackwells@gagnierfc.com

IMPORTANT ADDITIONAL INFORMATION

Blackwells, Blackwells Onshore I LLC, Jason

Aintabi, Michael Cricenti, Jennifer M. Hill, Betsy L. McCoy and Steven J. Pully (collectively, the “Participants”) are participants

in the solicitation of proxies from the stockholders of the Company for the Company’s 2024 annual meeting of stockholders. On April

3, 2024, the Participants filed with the Securities and Exchange Commission (the “SEC”) their definitive proxy statement and

accompanying WHITE universal proxy card in connection with their solicitation of proxies from the stockholders of the Company.

ALL STOCKHOLDERS OF THE COMPANY ARE ADVISED

TO READ THE DEFINITIVE PROXY STATEMENT, THE ACCOMPANYING WHITE UNIVERSAL PROXY CARD AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF

PROXIES BY THE PARTICIPANTS, AS THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS AND THEIR

DIRECT OR INDIRECT INTERESTS IN THE COMPANY, BY SECURITY HOLDINGS OR OTHERWISE.

The definitive proxy statement and an accompanying

WHITE universal proxy card will be furnished to some or all of the Company’s stockholders and are, along with other relevant documents,

available at no charge on the SEC’s website at http://www.sec.gov/. In addition, the Participants will provide copies of the

definitive proxy statement without charge, upon request. Requests for copies should be directed to Blackwells.

The Company’s board of directors has

purported to reject as invalid our nominations to elect each of Blackwells’ nominees and determined that our notice is purportedly

non-compliant with the Company’s Fifth Amended and Restated Bylaws, as amended (the “Bylaws”) and defective. On March

24, 2024, the Company brought suit against each of the Participants, Blackwells Holding Co. LLC, Vandewater Capital Holdings, LLC, Blackwells

Asset Management LLC and BW Coinvest Management I LLC in the United States District Court for the Northern District of Texas (the “District

Court”), seeking injunctive relief against solicitation of proxies by Blackwells and a declaratory judgment that Blackwells’

nomination is invalid due to Blackwells’ alleged violations of the Bylaws, and, as a result, Blackwells’ slate of purported

nominees is invalid and ineligible to stand for election by the Company’s stockholders. Ultimately, Blackwells believes the Company’s

claims have no merit. On April 11, 2024, Blackwells filed a Complaint in the District Court against the Company and the Company’s

directors. Blackwells alleges, among other things, that the Company improperly rejected Blackwells’ nomination notice, breached

the Bylaws, and violated Section 14(a) of the Securities Exchange Act of 1934 by issuing false and misleading statements and failing to

disclose The Dallas Express as a proxy participant. The action filed by the Company on March 24, 2024 and the action filed by Blackwells

on April 11, 2024 have been consolidated (the “Consolidated Litigation”). The Consolidated Litigation is currently stayed.

The outcome of the Consolidated Litigation and any related litigation may affect our ability to deliver proxies submitted to us on the

WHITE universal proxy card.

Exhibit 2

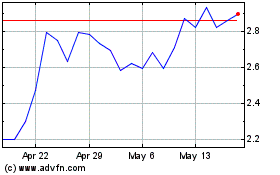

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From May 2024 to Jun 2024

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From Jun 2023 to Jun 2024