Current Report Filing (8-k)

June 24 2022 - 3:46PM

Edgar (US Regulatory)

false000163411700016341172022-06-182022-06-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 18, 2022

| | | | | | | | | | | | | | | | | |

| BARNES & NOBLE EDUCATION, INC. |

| (Exact name of registrant as specified in its charter) |

| |

| Delaware | | 1-37499 | | 46-0599018 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | |

120 Mountainview Blvd., Basking Ridge, NJ 07920 |

| (Address of principal executive offices)(Zip Code) |

| |

| Registrant’s telephone number, including area code: | | (908) 991-2665 |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

□ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

□ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

□ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

□ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Class | | Trading Symbol | | Name of Exchange on which registered |

| Common Stock, $0.01 par value per share | | BNED | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company □

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. □

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

On June 18, 2022, Barnes & Noble Education, Inc. (the “Company”) provided notice of its intent to propose new terms for the employment agreement with Michael P. Huseby, the Company’s chief executive officer. On June 23, 2022, the parties agreed to amend Mr. Huseby’s employment agreement to:

(i) extend the term of the agreement to September 20, 2023;

(ii) reduce Mr. Huseby’s annual target bonus from 125% to 100% of his base salary;

(iii) with respect to severance payable other than in connection with a “change of control” of the Company, (A) provide that in addition to the Company’s termination of Mr. Huseby’s employment without cause or his resignation for good reason, this severance will be payable if the Company elects not to renew the agreement, (B) reduce the amount of cash severance payable from two times the sum of his annual base salary, annual target bonus for the fiscal year in which the termination occurs and the cost of his benefits, to one times the sum of such amounts, (C) provide for the acceleration of vesting of shares subject to his equity awards that would vest subject solely to his continued employment during the twelve months following the date of his termination, (D) provide that his release of claims must become irrevocable within 60 days following termination and if the time period he has to consider whether to execute such release spans two calendar years, the cash severance will not be paid prior to the first payroll date after January 1 of the second calendar year and (E) provide that if this severance will be subject to Section 409A of the Internal Revenue Code of 1986, as amended, (“Section 409A”), the severance will not be paid until he has incurred a “separation from service” for purposes of Section 409A;

(iv) reduce the amount of cash severance that Mr. Huseby is entitled to if the Company terminates his employment without cause or he resigns for good reason within two years (or the remainder of his term of employment under his employment agreement, whichever is longer) following a “change of control” of the Company, from three times the sum of his annual base salary, annual target bonus for the fiscal year in which the termination occurs and the cost of his benefits, to one times the sum of such amounts; and

(v) agree that if the Company separates the positions of Chief Executive Officer and Chairman of the Board while Mr. Huseby is serving in both roles, he will continue as Chief Executive Officer, and the removal of his authority, duties, responsibilities, and title relating to the Chairman of the Board role will not result in a potential “good reason” event for purposes of the agreement.

The foregoing description of the amendment is subject to and qualified in its entirety by reference to the full text of the amendment, a copy of which is included with this filing as Exhibit 10.1.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: June 24, 2022

BARNES & NOBLE EDUCATION, INC.

By: /s/ Michael C. Miller

Name: Michael C. Miller

Title: Executive Vice President, Corporate Development & Affairs and Chief Legal Officer

BARNES & NOBLE EDUCATION, INC.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

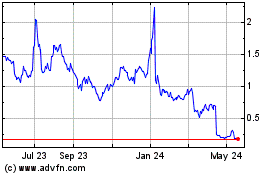

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Jun 2024 to Jul 2024

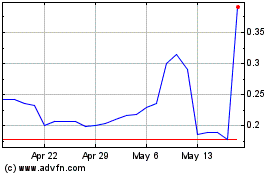

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Jul 2023 to Jul 2024