Form 8-K - Current report

August 30 2023 - 7:57AM

Edgar (US Regulatory)

false000001484600000148462023-08-292023-08-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 29, 2023

BRT APARTMENTS CORP.

(Exact name of Registrant as specified in charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-07172 | | 13-2755856 |

| (State or other jurisdiction of incorporation) | | (Commission file No.) | | (IRS Employer I.D. No.) |

60 Cutter Mill Road, Suite 303, Great Neck, New York 11021

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code: 516-466-3100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | BRT | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off- Balance Sheet

Arrangement of a Registrant.

The information set forth in Item 8.01 in incorporated herein by reference to the extent responsive to the

disclosures called for by Items 1.01 and 2.03.

Item 8.01 Other Information

On August 29, 2023, we and VNB New York, LLC (the "Lender") entered into the second amendment dated August 22, 2023 (the "Amendment") to the Amended and Restated Loan Agreement made as of November 18, 2021, as amended, by and between us and the Lender (the "Initial Credit Facility"; the Initial Credit Facility as amended by the Amendment, the "Credit Facility"). The Amendment converted the index on which interest on the credit facility is calculated from the prime rate to SOFR. After giving effect to the Amendment, the interest rate on the Credit Facility, which adjusts monthly and is subject to a floor of 6.0%, equals one-month SOFR plus 250 basis points. As of August 29, 2023, the annual interest rate on the Credit Facility was 7.82%.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

In reviewing the Amendment included as exhibit 10.1 to this Current Report on Form 8-K, please remember it is included to provide you with information regarding its terms and is not intended to provide any other factual or disclosure information about us or the other party to the agreement. The agreement contains representations and warranties by one or more of the parties thereto. These representations and warranties have been made solely for the benefit of the other party to the agreement and:

•should not in all instances be treated as categorical statements of fact, but rather as a way of allocating the risk to one of the parties if those statements prove to be inaccurate;

•have been qualified by disclosures that were made to the other party in connection with the negotiation of the agreement, which disclosures are not necessarily reflected in the agreement;

•may apply standards of materiality in a way that is different from what may be viewed as material to you or other investors; and

•and are subject to more recent developments. Accordingly, these representations and warranties may not describe the actual state of affairs as of the date they were made or at any other time.

| | | | | | | | |

| Exhibit No. | | Description |

| | Second amendment dated as of August 22, 2023 to the Amended and Restated Loan Agreement made as of November 18, 2021, as amended, by and between us and VNB New York, LLC. |

| 101 | | Cover Page Interactive Data File - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | BRT APARTMENTS CORP. |

| | |

| August 29, 2023 | | /s/ George Zweier |

| | George Zweier, Vice President |

| | and Chief Financial Officer |

| | |

| | |

SECOND AMENDMENT TO AMENDED AND RESTATED LOAN AGREEMENT THIS SECOND AMENDMENT TO AMENDED AND RESTATED LOAN AGREEMENT (this "Amendment") is dated as of August 22, 2023 between VNB New York, LLC, having an office at 350 Madison Avenue, 5th Floor, New York, New York 10017 (hereinafter referred to as "Lender") and BRT Apartments Corp., having an office at 60 Cutter Mill Road, Suite 303, Great Neck, New York 11021 (hereinafter referred to as "Borrower"). WI TNES SETH: WHEREAS, Borrower executed and delivered to Lender a $60,000,000 Replacement Revolving Credit Note dated September 14, 2022 (as the same may be amended, modified or replaced from time to time, the "Note"); and WHEREAS, Borrower and Lender executed an. Amended and Restated Loan Agreement dated November 18, 2021, as modified by that certain Letter Agreement dated as of November 19, 2021 and further modified by that certain Amendment to Loan Agreement dated as of September 14, 2022 (as the same may be further amended, modified or replaced from time to time, collectively, the "Loan Agreement"); and WHEREAS, Borrower has requested that Lender modify the terms of the Loan Agreement to, among other things, change the interest rate applicable to Revolving Credit Loans; and WHEREAS, Borrower and Lender now agree to make further certain changes to the Loan Agreement and the terms thereof, all as set forth in the succeeding provisions of this Amendment; and NOW, THEREFORE, in consideration of the premises and of the mutual promises and covenants contained herein, the receipt and sufficiency are hereby acknowledged, Borrower and Lender hereby agree as follows: 1. DEFINITIONS. Capitalized terms used but not defined in this Amendment shall have the meaning given to them in the Loan Agreement. 2. REPRESENTATIONS. Borrower represents and warrants to Lender and its successors and assigns that: (i) that there is currently an outstanding principal balance under the Loan Documents of$0.00, (ii) the Loan Agreement and the Note are the valid and binding obligations of Borrower, (iii) except as may have been disclosed to Lender in writing prior to the date hereof, any and all representations and warranties and schedules contained in the Note, Loan Agreement or Loan Documents are true and correct in all material aspects on and as of the date hereof as though made on and as of such date, (v) no event has occurred and is continuing which constitutes an Event of Default under the Note, Loan Agreement or under any of the other Loan Documents or which upon the giving of notice or the lapse of time or both would constitute an Event of Default, and (vi) it has no defenses, set-offs, or counterclaims of any kind or nature whatsoever against Lender with respect to the Note, Loan Agreement or Loan Documents or obligations thereunder, or any action previously taken by Lender with respect thereto. Exhibit 10.1

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

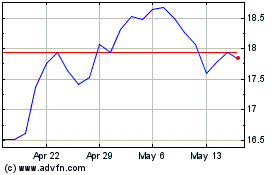

BRT Apartments (NYSE:BRT)

Historical Stock Chart

From Apr 2024 to May 2024

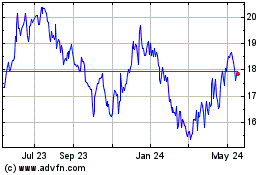

BRT Apartments (NYSE:BRT)

Historical Stock Chart

From May 2023 to May 2024