Black Stone Minerals, L.P. (NYSE: BSM) (“Black Stone Minerals,”

“Black Stone,” or “the Company”) today announces its financial and

operating results for the fourth quarter and full year of 2023 and

provides guidance for 2024.

Fourth Quarter 2023 Highlights

- Mineral and royalty production for the fourth quarter of 2023

equaled 38.9 MBoe/d, a decrease of 3% over the prior quarter; total

production, including working interest volumes, was 41.1 MBoe/d for

the quarter

- Net income for the quarter was $147.6 million. Adjusted EBITDA

for the quarter totaled $125.5 million

- Distributable cash flow was $119.1 million for the fourth

quarter, which represents a 4% decrease relative to the third

quarter of 2023, making the seventh consecutive quarter above $100

million

- Black Stone announced a distribution of $0.475 per unit with

respect to the fourth quarter of 2023. Distribution coverage for

all units was 1.19x

- Total debt at the end of the quarter was zero; as of February

16, 2024, total debt remained at zero with $102.9 million of

cash

Full Year Financial and Operational Highlights

- Mineral and royalty volumes in 2023 increased 9% over the prior

year to average 37.4 MBoe/d; average full year 2023 production was

39.8 MBoe/d

- Reported 2023 net income and Adjusted EBITDA of $422.5 million

and $474.7 million, respectively

- Increased cash distributions by 9% from $1.745 per unit

attributable to the full year 2022 to $1.90 per unit attributable

to the full year 2023

- Eliminated outstanding debt during 2023

Management Commentary

Thomas L. Carter, Jr., Black Stone Minerals’ Chairman, Chief

Executive Officer, and President, commented, “We finished the year

with a strong quarter. We were able to maintain our highest

distribution without any outstanding debt despite a challenging

natural gas market. We expect headwinds in 2024 as natural gas

prices remain depressed, but we remain encouraged by the long-term

prospects for liquefied natural gas export growth and an asset base

with significant inventory life that will benefit unitholders

through the next decade.”

Quarterly Financial and Operating Results

Production

Black Stone Minerals reported mineral and royalty volumes of

38.9 MBoe/d (95% natural gas) for the fourth quarter of 2023,

compared to 40.3 MBoe/d for the third quarter of 2023. Mineral and

royalty production was 40.0 MBoe/d for the fourth quarter of 2022.

Mineral and royalty production in the fourth quarter of 2023

benefited from new wells coming online in the Permian and Shelby

Trough.

Working interest production for the fourth quarter of 2023 was

2.2 MBoe/d, a decrease of 4% from the 2.3 MBoe/d for the quarter

ended September 30, 2023, and an increase of 5% from the 2.1 MBoe/d

for the quarter ended December 31, 2022. The continued overall

decline in working interest production volumes is consistent with

the Company's decision to farm out its working-interest

participation to third-party capital providers.

Total reported production averaged 41.1 MBoe/d (95% mineral and

royalty, 73% natural gas) for the fourth quarter of 2023. Average

total production was 42.6 MBoe/d and 42.1 MBoe/d for the quarters

ended September 30, 2023 and December 31, 2022, respectively.

Realized Prices, Revenues, and Net Income

The Company’s average realized price per Boe, excluding the

effect of derivative settlements, was $35.03 for the quarter ended

December 31, 2023. This is an increase of 2% from $34.30 per Boe

for the third quarter of 2023 and a 31% decrease compared to $50.67

for the fourth quarter of 2022.

Black Stone reported oil and gas revenue of $132.6 million (60%

oil and condensate) for the fourth quarter of 2023, a decrease of

1% from $134.5 million in the third quarter of 2023. Oil and gas

revenue in the fourth quarter of 2022 was $196.2 million.

The Company reported a gain on commodity derivative instruments

of $54.5 million for the fourth quarter of 2023, composed of a

$17.1 million gain from realized settlements and a non-cash $37.4

million unrealized gain due to the change in value of Black Stone’s

derivative positions during the quarter. Black Stone reported a

loss on commodity derivative instruments of $26.9 million and a

gain of $31.4 million for the quarters ended September 30, 2023 and

December 31, 2022, respectively.

Lease bonus and other income was $3.8 million for the fourth

quarter of 2023, primarily related to leasing activity in the

Granite Wash, Gulf Coast, and Haynesville plays. Lease bonus and

other income for the quarters ended September 30, 2023 and December

31, 2022 was $2.2 million and $2.8 million, respectively.

There was no impairment for the quarters ended December 31,

2023, September 30, 2023, and December 31, 2022.

The Company reported net income of $147.6 million for the

quarter ended December 31, 2023, compared to net income of $62.1

million in the preceding quarter. For the quarter ended December

31, 2022, net income was $183.2 million.

Adjusted EBITDA and Distributable Cash Flow

Adjusted EBITDA for the fourth quarter of 2023 was $125.5

million, which compares to $130.0 million in the third quarter of

2023 and $131.7 million in the fourth quarter of 2022.

Distributable cash flow for the quarter ended December 31, 2023 was

$119.1 million. For the quarters ended September 30, 2023 and

December 31, 2022, Distributable cash flow was $124.4 million and

$125.3 million, respectively.

2023 Proved Reserves

Estimated proved oil and natural gas reserves at year-end 2023

were 64.5 MMBoe, an increase of 1% from 64.1 MMBoe at year-end

2022, and were approximately 70% natural gas and 89% proved

developed producing. The standardized measure of discounted future

net cash flows was $1,019.5 million at the end of 2023, as compared

to $1,665.0 million at year-end 2022.

Netherland, Sewell and Associates, Inc., an independent,

third-party petroleum engineering firm, evaluated Black Stone

Minerals’ estimate of its proved reserves and PV-10 at December 31,

2023. These estimates were prepared using reference prices of

$78.21 per barrel of oil and $2.64 per MMBTU of natural gas in

accordance with the applicable rules of the Securities and Exchange

Commission (as compared to prompt month prices of $76.81 per barrel

of oil and $1.61 per MMBTU of natural gas as of February 16, 2024).

These prices were adjusted for quality and market differentials,

transportation fees, and, in the case of natural gas, the value of

natural gas liquids. A reconciliation of proved reserves is

presented in the summary financial tables following this press

release.

Financial Position and Activities

As of December 31, 2023, Black Stone Minerals had $70.3 million

in cash, with nothing drawn under its credit facility. The

Company’s borrowing base at December 31, 2023 was $580 million, and

total commitments under the credit facility were $375 million. The

Company's next regularly scheduled borrowing base redetermination

is set for April 2024. Black Stone is in compliance with all

financial covenants associated with its credit facility.

As of February 16, 2024, no debt was outstanding under the

credit facility and the Company had $102.9 million in cash.

During the fourth quarter of 2023, the Company made no

repurchases of units under the Board-approved $150 million unit

repurchase program.

Fourth Quarter 2023 Distributions

As previously announced, the Board approved a cash distribution

of $0.475 for each common unit attributable to the fourth quarter

of 2023. The quarterly distribution coverage ratio attributable to

the fourth quarter of 2023 was approximately 1.19x. These

distributions will be paid on February 23, 2024 to unitholders of

record as of the close of business on February 16, 2024.

Activity Update

Rig Activity

As of December 31, 2023, Black Stone had 63 rigs operating

across its acreage position, a 17% decrease from rig activity on

the Company's acreage as of September 30, 2023 and 42% lower as

compared to the 108 rigs operating on the Company's acreage as of

December 31, 2022. The decrease is primarily driven by reduced rig

activity in the Haynesville and Permian.

Shelby Trough Development Update

A significant portion of Shelby Trough development in recent

years has been performed by Aethon Energy (“Aethon”) under the

Company’s two Joint Exploration Agreements (“JEA” or “JEAs”) with

Aethon, one JEA each covering development in San Augustine County,

Texas, and the other in Angelina County, Texas.

As announced on December 22, 2023, BSM received notice that

Aethon was exercising the “time-out” provisions under its joint

exploration agreements with the Company in Angelina and San

Augustine counties in East Texas. When natural-gas prices fall

below specified thresholds, Aethon may elect to temporarily suspend

its drilling obligations for up to nine consecutive months and a

maximum of 18 total months in any 48-month period. Aethon has not

previously invoked the time-out provisions under the

agreements.

The time-out provisions apply only to drilling obligations and

associated development activity occurring after December 2023.

Based on ongoing discussions with Aethon, we do not expect material

changes for wells on which drilling operations had begun prior to

the invocation of the time-out in December 2023. We continue

working closely with Aethon to finalize development plans going

forward and assess the effect of the temporary suspension of

drilling obligations and any potential longer-term impacts.

Austin Chalk Update

The Company owns a large mineral position in the Brookeland

Austin Chalk play in East Texas.

Black Stone has entered into agreements with multiple operators

to drill wells in the areas of the Austin Chalk in East Texas,

where the Company has significant acreage positions. The results of

the test program in the Brookeland Field demonstrated that modern

completion technology has the potential to improve production rates

and increase reserves when compared to the vintage, unstimulated

wells in the Austin Chalk formation. To date, 29 wells with modern

completions are now producing in the field.

Acquisition Activity

Black Stone’s commercial strategy since 2021 has been focused on

attracting capital and securing drilling commitments on minerals

already owned by the Company. Management made the decision to

expand this growth strategy by adding to the Company’s mineral

portfolio through strategic, targeted efforts primarily in the Gulf

Coast region. To that end, in 2023 Black Stone acquired additional,

non-producing mineral and royalty interests totaling $14.6 million.

Black Stone’s commercial strategy going forward includes the

continuation of meaningful, targeted mineral and royalty

acquisitions to complement our existing positions.

Summary 2024 Guidance

Following are the key assumptions in Black Stone Minerals’ 2024

guidance, as well as comparable results for 2023:

FY 2023

Actual

FY 2024

Est.

Mineral and royalty production

(MBoe/d)

37.4

39 – 40

Working interest production (MBoe/d)

2.4

1 – 2

Total production (MBoe/d)

39.8

40 – 42

Percentage natural gas

74%

76%

Percentage royalty interest

94%

96%

Lease bonus and other income ($MM)

$12.5

$10 - $15

Lease operating expense ($MM)

$11.4

$10 - $12

Production costs and ad valorem taxes (as

% of total pre-derivative O&G revenue)

12%

11% - 13%

G&A - cash ($MM)

$40.6

$44 - $45

G&A - non-cash ($MM)

$10.9

$10 - $12

G&A - TOTAL ($MM)

$51.5

$54 - $57

DD&A ($/Boe)

$3.14

$3.00 - $3.25

Black Stone expects royalty production to increase by

approximately 4% in 2024 relative to full year 2023 levels,

primarily due to Aethon turning on-line the 24 wells in various

stages of development in the Shelby Trough and continued

development in the Austin Chalk. This is partially offset by an

expected moderation of activity in Louisiana Haynesville due to

lower commodity prices.

Working interest production is expected to decline in 2024 as a

result of Black Stone's decision in 2017 to farm out participation

in its working interest opportunities.

The Partnership expects general and administrative expenses to

be slightly higher in 2024 as a result of inflationary costs and

selective hires made to support Black Stone’s ability to evaluate,

market and manage its undeveloped acreage positions to potential

operators.

Hedge Position

Black Stone has commodity derivative contracts in place covering

portions of its anticipated production for 2024 and 2025, including

derivative contracts put in place after the end of the year. The

Company's hedge position as of February 16, 2024, is summarized in

the following tables:

Oil Hedge Position

Oil Swap Volume

Oil Swap Price

MBbl

$/Bbl

1Q24

570

$71.45

2Q24

570

$71.45

3Q24

570

$71.45

4Q24

570

$71.45

1Q25

210

$70.50

2Q25

210

$70.50

3Q25

210

$70.50

4Q25

210

$70.50

Natural Gas Hedge Position

Gas Swap Volume

Gas Swap Price

BBtu

$/MMbtu

1Q24

10,310

$3.56

2Q24

10,465

$3.55

3Q24

10,580

$3.55

4Q24

10,580

$3.55

1Q25

900

$3.65

2Q25

910

$3.65

3Q25

920

$3.65

4Q25

920

$3.65

More detailed information about the Company's existing hedging

program can be found in the Annual Report on Form 10-K, which is

expected to be filed on or around February 20, 2024.

Conference Call

Black Stone Minerals will host a conference call and webcast for

investors and analysts to discuss its results for the fourth

quarter and full year of 2023 on Tuesday, February 20, 2024 at 9:00

a.m. Central Time. Black Stone recommends participants who do not

anticipate asking questions to listen to the call via the live

broadcast available at http://investor.blackstoneminerals.com.

Analysts and investors who wish to ask questions should dial (800)

245-3047 for domestic participants and (203) 518-9765 for

international participants. The conference ID for the call is

BSMQ423. A recording of the conference call will be available on

Black Stone's website.

About Black Stone Minerals, L.P.

Black Stone Minerals is one of the largest owners and managers

of oil and natural gas mineral interests in the United States. The

Company owns mineral interests and royalty interests in 41 states

in the continental United States. Black Stone believes its large,

diversified asset base and long-lived, non-cost-bearing mineral and

royalty interests provide for stable production and reserves over

time, allowing the majority of generated cash flow to be

distributed to unitholders.

Forward-Looking Statements

This news release includes forward-looking statements. All

statements, other than statements of historical facts, included in

this news release that address activities, events or developments

that the Company expects, believes or anticipates will or may occur

in the future are forward-looking statements. Terminology such as

“will,” “may,” “should,” “expect,” “anticipate,” “plan,” “project,”

“intend,” “estimate,” “believe,” “target,” “continue,” “potential,”

the negative of such terms, or other comparable terminology often

identify forward-looking statements. Except as required by law,

Black Stone Minerals undertakes no obligation and does not intend

to update these forward-looking statements to reflect events or

circumstances occurring after this news release. You are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date of this news release. All

forward-looking statements are qualified in their entirety by these

cautionary statements. These forward-looking statements involve

risks and uncertainties, many of which are beyond the control of

Black Stone Minerals, which may cause the Company’s actual results

to differ materially from those implied or expressed by the

forward-looking statements. Important factors that could cause

actual results to differ materially from those in the

forward-looking statements include, but are not limited to, those

summarized below, as wells as the Risk Factors section in our most

recent annual report on Form 10-K:

- the Company’s ability to execute its business strategies;

- the volatility of realized oil and natural gas prices;

- the level of production on the Company’s properties;

- overall supply and demand for oil and natural gas, and regional

supply and demand factors, delays, or interruptions of

production;

- conservation measures and general concern about the

environmental impact of the production and use of fossil

fuels;

- the Company’s ability to replace its oil and natural gas

reserves;

- general economic, business, or industry conditions including

slowdowns, domestically and internationally, and volatility in the

securities, capital, or credit markets;

- cybersecurity incidents, including data security breaches or

computer viruses;

- competition in the oil and natural gas industry;

- the availability or cost of rigs, equipment, raw materials,

supplies, oilfield services or personnel; and

- the level of drilling activity by the Company's operators,

particularly in areas such as the Shelby Trough where the Company

has concentrated acreage positions.

BLACK STONE MINERALS,

L.P.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

(In thousands, except per unit

amounts)

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

REVENUE

Oil and condensate sales

$

80,112

$

85,920

$

288,296

$

336,287

Natural gas and natural gas liquids

sales

52,440

110,254

200,297

434,945

Lease bonus and other income

3,824

2,790

12,506

13,052

Revenue from contracts with customers

136,376

198,964

501,099

784,284

Gain (loss) on commodity derivative

instruments

54,465

31,415

91,117

(120,680

)

TOTAL REVENUE

190,841

230,379

592,216

663,604

OPERATING (INCOME) EXPENSE

Lease operating expense

3,237

3,124

11,386

12,380

Production costs and ad valorem taxes

15,027

14,924

56,979

66,233

Exploration expense

429

1

2,148

193

Depreciation, depletion, and

amortization

11,748

12,786

45,683

47,804

General and administrative

12,505

14,326

51,455

53,652

Accretion of asset retirement

obligations

293

245

1,042

861

(Gain) loss on sale of assets, net

—

—

(73

)

(17

)

TOTAL OPERATING EXPENSE

43,239

45,406

168,620

181,106

INCOME (LOSS) FROM OPERATIONS

147,602

184,973

423,596

482,498

OTHER INCOME (EXPENSE)

Interest and investment income

826

31

1,867

53

Interest expense

(674

)

(2,022

)

(2,754

)

(6,286

)

Other income (expense)

(107

)

237

(160

)

215

TOTAL OTHER EXPENSE

45

(1,754

)

(1,047

)

(6,018

)

NET INCOME (LOSS)

147,647

183,219

422,549

476,480

Distributions on Series B cumulative

convertible preferred units

(6,026

)

(5,250

)

(21,776

)

(21,000

)

NET INCOME (LOSS) ATTRIBUTABLE TO THE

GENERAL PARTNER AND COMMON UNITS

$

141,621

$

177,969

$

400,773

$

455,480

ALLOCATION OF NET INCOME (LOSS):

General partner interest

$

—

$

—

$

—

$

—

Common units

141,621

177,969

400,773

455,480

$

141,621

$

177,969

$

400,773

$

455,480

NET INCOME (LOSS) ATTRIBUTABLE TO LIMITED

PARTNERS PER COMMON UNIT:

Per common unit (basic)

$

0.67

$

0.85

$

1.91

$

2.18

Per common unit (diluted)

$

0.65

$

0.82

$

1.88

$

2.12

WEIGHTED AVERAGE COMMON UNITS

OUTSTANDING:

Weighted average common units outstanding

(basic)

209,991

209,406

209,970

209,382

Weighted average common units outstanding

(diluted)

225,511

224,756

225,105

224,446

The following table shows the Company’s production, revenues,

realized prices, and expenses for the periods presented.

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

(Unaudited)

(Dollars in thousands, except

for realized prices)

Production:

Oil and condensate (MBbls)

1,026

1,017

3,757

3,591

Natural gas (MMcf)1

16,546

17,130

64,647

59,778

Equivalents (MBoe)

3,784

3,872

14,532

13,554

Equivalents/day (MBoe)

41.1

42.1

39.8

37.1

Realized prices, without

derivatives:

Oil and condensate ($/Bbl)

$

78.08

$

84.48

$

76.74

$

93.65

Natural gas ($/Mcf)1

3.17

6.44

3.10

7.28

Equivalents ($/Boe)

$

35.03

$

50.66

$

33.62

$

56.90

Revenue:

Oil and condensate sales

$

80,112

$

85,920

$

288,296

$

336,287

Natural gas and natural gas liquids

sales1

52,440

110,254

200,297

434,945

Lease bonus and other income

3,824

2,790

12,506

13,052

Revenue from contracts with customers

136,376

198,964

501,099

784,284

Gain (loss) on commodity derivative

instruments

54,465

31,415

91,117

(120,680

)

Total revenue

$

190,841

$

230,379

$

592,216

$

663,604

Operating expenses:

Lease operating expense

$

3,237

$

3,124

$

11,386

$

12,380

Production costs and ad valorem taxes

15,027

14,924

56,979

66,233

Exploration expense

429

1

2,148

193

Depreciation, depletion, and

amortization

11,748

12,786

45,683

47,804

General and administrative

12,505

14,326

51,455

53,652

Other expense:

Interest expense

674

2,022

2,754

6,286

Per Boe:

Lease operating expense (per working

interest Boe)

$

16.02

$

16.02

$

13.13

$

12.13

Production costs and ad valorem taxes

3.97

3.85

3.92

4.89

Depreciation, depletion, and

amortization

3.10

3.30

3.14

3.53

General and administrative

3.30

3.70

3.54

3.96

1 As a mineral-and-royalty-interest owner, Black Stone Minerals

is often provided insufficient and inconsistent data on natural gas

liquid ("NGL") volumes by its operators. As a result, the Company

is unable to reliably determine the total volumes of NGLs

associated with the production of natural gas on its acreage.

Accordingly, no NGL volumes are included in our reported

production; however, revenue attributable to NGLs is included in

natural gas revenue and the calculation of realized prices for

natural gas.

Non-GAAP Financial Measures

Adjusted EBITDA and Distributable cash flow are supplemental

non-GAAP financial measures used by Black Stone's management and

external users of the Company's financial statements such as

investors, research analysts, and others, to assess the financial

performance of its assets and its ability to sustain distributions

over the long term without regard to financing methods, capital

structure, or historical cost basis.

The Company defines Adjusted EBITDA as net income (loss) before

interest expense, income taxes, and depreciation, depletion, and

amortization adjusted for impairment of oil and natural gas

properties, if any, accretion of asset retirement obligations,

unrealized gains and losses on commodity derivative instruments,

non-cash equity-based compensation, and gains and losses on sales

of assets, if any. Black Stone defines Distributable cash flow as

Adjusted EBITDA plus or minus amounts for certain non-cash

operating activities, cash interest expense, distributions to

preferred unitholders, and restructuring charges, if any.

Adjusted EBITDA and Distributable cash flow should not be

considered an alternative to, or more meaningful than, net income

(loss), income (loss) from operations, cash flows from operating

activities, or any other measure of financial performance presented

in accordance with generally accepted accounting principles

("GAAP") in the United States as measures of the Company's

financial performance.

Adjusted EBITDA and Distributable cash flow have important

limitations as analytical tools because they exclude some but not

all items that affect net income (loss), the most directly

comparable U.S. GAAP financial measure. The Company's computation

of Adjusted EBITDA and Distributable cash flow may differ from

computations of similarly titled measures of other companies.

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

(Unaudited)

(In thousands, except per unit

amounts)

Net income (loss)

$

147,647

$

183,219

$

422,549

$

476,480

Adjustments to reconcile to Adjusted

EBITDA:

Depreciation, depletion, and

amortization

11,748

12,786

45,683

47,804

Interest expense

674

2,022

2,754

6,286

Income tax expense (benefit)

143

(171

)

320

58

Accretion of asset retirement

obligations

293

245

1,042

861

Equity-based compensation

2,417

5,579

10,829

17,388

Unrealized (gain) loss on commodity

derivative instruments

(37,400

)

(72,014

)

(8,394

)

(82,486

)

(Gain) loss on sale of assets, net

—

—

(73

)

(17

)

Adjusted EBITDA

125,522

131,666

474,710

466,374

Adjustments to reconcile to Distributable

cash flow:

Change in deferred revenue

(1

)

(7

)

(9

)

(30

)

Cash interest expense

(410

)

(1,059

)

(1,715

)

(4,282

)

Preferred unit distributions

(6,026

)

(5,250

)

(21,776

)

(21,000

)

Distributable cash flow

$

119,085

$

125,350

$

451,210

$

441,062

Total units outstanding1

210,313

209,684

Distributable cash flow per unit

0.566

0.598

1 The distribution attributable to the quarter ended December

31, 2023 is calculated using 210,313,477 common units as of the

record date of February 16, 2024. Distributions attributable to the

quarter ended December 31, 2022 were calculated using 209,683,640

common units as of the record date of February 17, 2023.

Proved Oil & Gas Reserve Quantities

A reconciliation of proved reserves is presented in the

following table:

Crude Oil

(MBbl)

Natural Gas

(MMcf)

Total

(MBoe)

Net proved reserves at December 31,

2022

19,184

269,586

64,115

Revisions of previous estimates

675

(20,578

)

(2,754

)

Extensions, discoveries, and other

additions

2,989

87,935

17,645

Production

(3,757

)

(64,647

)

(14,532

)

Net proved reserves at December 31,

2023

19,091

272,296

64,474

Net Proved Developed Reserves

December 31, 2022

19,184

236,529

58,606

December 31, 2023

19,091

228,061

57,101

Net Proved Undeveloped Reserves

December 31, 2022

—

33,057

5,509

December 31, 2023

—

44,235

7,373

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240219650505/en/

Evan Kiefer Senior Vice President, Chief Financial Officer, and

Treasurer Telephone: (713) 445-3200

investorrelations@blackstoneminerals.com

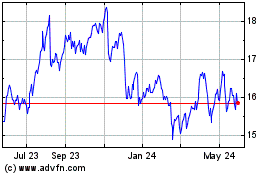

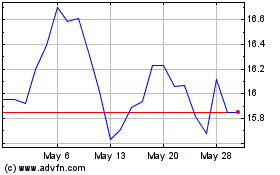

Black Stone Minerals (NYSE:BSM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Black Stone Minerals (NYSE:BSM)

Historical Stock Chart

From Nov 2023 to Nov 2024