UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign

Issuer

Pursuant to Rule 13a-16

or 15d-16

of the Securities

Exchange Act of 1934

For the month

of February 2025

Commission File

Number: 001-14370

COMPANIA DE MINAS

BUENAVENTURA S.A.A.

(Exact name of registrant

as specified in its charter)

BUENAVENTURA

MINING COMPANY INC.

(Translation of

registrant’s name into English)

AV. BEGONIAS

NO. 415, 19TH FLOOR,

SAN

ISIDRO, LIMA, PERU

(Address of principal

executive office)

Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

Buenaventura

Announces Fourth Quarter 2024 Results for Production and Volume Sold per Metal

Lima,

Peru, February 11, 2024 – Compañía de Minas Buenaventura S.A.A. (“Buenaventura” or “the

Company”) (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s largest publicly-traded precious metals mining company, today

announced 4Q24 results for production and volume sold.

Production

per Metal

| | |

Three

Months

Ended December 31,

2024 | | |

Year

Ended

December 31,

2024 | | |

Year

Ended

December 31, 2025

Guidance(1) | |

| Gold ounces

produced | |

| | | |

| | | |

| | |

| El

Brocal | |

| 6,317 | | |

| 23,646 | | |

| 15.5k

- 18.5k | |

| Orcopampa | |

| 16,466 | | |

| 70,892 | | |

| 45.0k

- 50.0k | |

| Tambomayo | |

| 7,823 | | |

| 33,896 | | |

| 12.5k

- 15.5k | |

| Julcani | |

| 1,664 | | |

| 4,504 | | |

| 7.5k

- 9.5k | |

| La Zanja | |

| 7,091 | | |

| 15,746 | | |

| 18.0k

– 21.0k | |

| San

Gabriel (4) | |

| 0 | | |

| 0 | | |

| 10.0k

– 15.0k | |

| Total

Direct Operations (2) | |

| 39,362 | | |

| 148,683 | | |

| 108.5k

– 129.5k | |

| Coimolache | |

| 9,566 | | |

| 48,120 | | |

| 50.0k

- 55.0k | |

| Total

incl. Associated (3) | |

| 40,761 | | |

| 158,856 | | |

| 122.6k

– 144.4k | |

| | |

| | | |

| | | |

| | |

| Silver

ounces produced | |

| | | |

| | | |

| | |

| El Brocal | |

| 420,802 | | |

| 2,122,742 | | |

| 1.1M

- 1.4M | |

| Uchucchacua | |

| 839,090 | | |

| 2,364,035 | | |

| 2.7M

- 3.2M | |

| Yumpag

(5) | |

| 2,105,606 | | |

| 8,123,445 | | |

| 7.3M

- 7.8M | |

| Orcopampa | |

| 6,636 | | |

| 29,493 | | |

| - | |

| Tambomayo | |

| 268,602 | | |

| 1,412,092 | | |

| 1.2M

- 1.5M | |

| Julcani | |

| 312,554 | | |

| 1,402,786 | | |

| 1.5M

- 1.8M | |

| La

Zanja | |

| 8,733 | | |

| 23,637 | | |

| - | |

| Total

Direct Operations (2) | |

| 3,962,024 | | |

| 15,478,231 | | |

| 13.8M

- 15.7M | |

| Coimolache | |

| 57,741 | | |

| 236,082 | | |

| 0.2M

- 0.3M | |

| Total

incl. Associated (3) | |

| 3,822,871 | | |

| 14,754,144 | | |

| 13.5M

- 15.3M | |

| | |

| | | |

| | | |

| | |

| Lead metric

tons produced | |

| | | |

| | | |

| | |

| Uchucchacua | |

| 2,939 | | |

| 13,751 | | |

| 16.0k

- 18.0k | |

| Tambomayo | |

| 965 | | |

| 4,058 | | |

| - | |

| Julcani | |

| 108 | | |

| 727 | | |

| 0.8k

- 1.0k | |

| Total

Direct Operations (2) | |

| 4,013 | | |

| 18,536 | | |

| 16.8k

- 19.0k | |

| | |

| | | |

| | | |

| | |

| Zinc metric

tons produced | |

| | | |

| | | |

| | |

| El Brocal | |

| 0 | | |

| 1,985 | | |

| - | |

| Uchucchacua | |

| 4,684 | | |

| 21,205 | | |

| 23.0k

- 26.0k | |

| Tambomayo | |

| 1,228 | | |

| 5,262 | | |

| 1.0k

- 1.3k | |

| Total

Direct Operations (2) | |

| 5,913 | | |

| 28,452 | | |

| 24.0k

- 27.3k | |

| | |

| | | |

| | | |

| | |

| Copper

metric tons produced | |

| | | |

| | | |

| | |

| El

Brocal | |

| 14,191 | | |

| 56,525 | | |

| 55.0k

- 60.0k | |

| Total

Direct Operations (2) | |

| 14,191 | | |

| 56,525 | | |

| 55.0k

- 60.0k | |

| 1. | 2025 projections

are considered to be forward-looking statements and represent management’s good faith

estimates or expectations of future production results as of February 2025. |

| 2. | Considers 100%

of Buenaventura’s operating units, 100% of La Zanja and 100% of El Brocal. |

| 3. | Considers 100%

of Buenaventura’s operating units, 100% of La Zanja, 61.43% of El Brocal and 40.094%

of Coimolache. |

| 4. | 4Q25 targeted

production initiation remains unchanged, subject to final permitting and required approvals. |

| 5. | Considers ore

from the pilot stope approved within Yumpag EIA-sd. |

Volume Sold per Metal

| | |

Three Months Ended

December 31, 2024 | | |

Year Ended

December 31, 2024 | |

| Gold ounces sold | |

| | | |

| | |

| El Brocal | |

| 3,825 | | |

| 14,501 | |

| Orcopampa | |

| 16,403 | | |

| 70,626 | |

| Tambomayo | |

| 7,129 | | |

| 31,328 | |

| Julcani | |

| 1,460 | | |

| 3,987 | |

| La Zanja | |

| 6,798 | | |

| 15,323 | |

| Total Direct Operations (1) | |

| 35,615 | | |

| 135,766 | |

| Coimolache | |

| 10,414 | | |

| 48,941 | |

| Total incl. Associated (2) | |

| 38,315 | | |

| 149,795 | |

| | |

| | | |

| | |

| Silver ounces sold | |

| | | |

| | |

| El Brocal | |

| 336,635 | | |

| 1,739,941 | |

| Uchucchacua | |

| 734,812 | | |

| 2,080,541 | |

| Yumpag (3) | |

| 2,062,192 | | |

| 7,847,952 | |

| Orcopampa | |

| 4,947 | | |

| 27,121 | |

| Tambomayo | |

| 232,468 | | |

| 1,268,157 | |

| Julcani | |

| 290,618 | | |

| 1,342,669 | |

| La Zanja | |

| 25,694 | | |

| 57,835 | |

| Total Direct Operations (1) | |

| 3,687,366 | | |

| 14,364,215 | |

| Coimolache | |

| 61,500 | | |

| 238,893 | |

| Total incl. Associated (2) | |

| 3,582,184 | | |

| 13,788,902 | |

| | |

| | | |

| | |

| Lead metric tons sold | |

| | | |

| | |

| El Brocal | |

| 0 | | |

| 72 | |

| Uchucchacua | |

| 2,515 | | |

| 12,267 | |

| Yumpag (3) | |

| 8 | | |

| 63 | |

| Tambomayo | |

| 821 | | |

| 3,513 | |

| Julcani | |

| 91 | | |

| 649 | |

| Total Direct Operations (1) | |

| 3,435 | | |

| 16,564 | |

| | |

| | | |

| | |

| Zinc metric tons sold | |

| | | |

| | |

| El Brocal | |

| 0 | | |

| 1,592 | |

| Uchucchacua | |

| 3,858 | | |

| 17,451 | |

| Tambomayo | |

| 978 | | |

| 4,209 | |

| Total Direct Operations (1) | |

| 4,835 | | |

| 23,252 | |

| | |

| | | |

| | |

| Copper metric tons sold | |

| | | |

| | |

| El Brocal | |

| 13,398 | | |

| 53,107 | |

| Tambomayo | |

| 63 | | |

| 158 | |

| Julcani | |

| 8 | | |

| 87 | |

| Total Direct Operations (1) | |

| 13,469 | | |

| 53,353 | |

| 1. | Considers 100%

of Buenaventura’s operating units, 100% of La Zanja and 100% of El Brocal. |

| 2. | Considers 100%

of Buenaventura’s operating units, 100% of La Zanja, 61.43% of El Brocal and 40.094%

of Coimolache. |

| 3. | Considers ore

from the pilot stope approved within Yumpag EIA-sd. |

Average realized

prices(1)(2)

| | |

Three Months Ended

December 31, 2024 | | |

Year Ended

December 31, 2024 | |

| Gold (US$/Oz) | |

| 2,641 | | |

| 2,407 | |

| Silver (US$/Oz) | |

| 31.17 | | |

| 28.92 | |

| Lead (US$/MT) | |

| 1,890 | | |

| 2,039 | |

| Zinc (US$/MT) | |

| 3,084 | | |

| 2,715 | |

| Copper (US$/MT) | |

| 8,883 | | |

| 9,063 | |

| 1. | Considers Buenaventura

consolidated figures. |

| 2. | Realized prices

include both provisional sales and final adjustments for price changes. |

Commentary on Operations

Tambomayo:

2024 gold production exceeded revised guidance, primarily due to an increase in processed ore.

2024 lead and zinc production were in line with expectations. 2024 silver production underperformed slightly relative to adjusted guidance,

primarily due to delays related to poor ground conditions at the high silver grade ore stopes which made extraction more challenging.

2025

Guidance: Buenaventura anticipates a decrease in gold, lead, and zinc production at its Tambomayo

operations relative to 2024. The Company expects an approximately 40% decrease in throughput for the year, as well as lower gold, lead,

and zinc grades as the mining sequence progresses into lower-grade areas. However, higher silver grades in the scheduled 2025 mining

areas are expected to offset the decrease in volume processed, resulting in stable silver production, year-on-year.

Orcopampa:

2024 gold and silver production was in line with expectations.

2025

Guidance: Guidance reflects a year-on-year decrease in gold production as well as an approximately

45% reduction in annual throughput, partially offset by higher gold grades expected in the scheduled 2025 mining areas as some stopes

from Pucarina and Nazareno veins come into production.

Coimolache:

2024 Gold production exceeded projections due to an accelerated percolation rate at the leach

pad and to higher grades than was previously expected.

2025

Guidance: The Company expects a year-on-year increase in gold production due to the expansion

of the leach pad, which will be ready to receive fresh ore starting in 2H25. Buenaventura expects to obtain the necessary permits in

1Q25 with expected construction in 2Q25 and the resulting resumption of fresh ore leaching in 3Q25. The Coimolache production plan combines

fresh ore with low-grade stockpile ore for leaching on the Tantahuatay pad to offset the decreased production planned for the 1H25.

Julcani:

2024 silver production underperformed slightly relative to adjusted guidance, primarily due

to the transition from silver into copper-gold stopes. 2024 gold production therefore exceeded revised guidance slightly, gradually increasing

as the operation transitions to zones richer in copper-gold.

2025

Guidance: The Company expects a year-on-year increase in silver and gold production due to an

approximately 20% increase in expected throughput for the year, driven by an increased contribution of ore extracted from the Socorro

sector.

Uchucchacua:

2024 silver and zinc production was in line with expectations. 2024 lead production underperformed

slightly relative to adjusted guidance due to lower than expected grades.

2025

Guidance: Buenaventura anticipates a year-on-year increase in silver, lead, and zinc production

resulting from an approximately 20% increase in throughput for 2025. This is due to optimized operations at Uchucchacua, which is projected

to increase to 2,000 tpd by year-end 2025 from 1,500 tpd currently.

Yumpag:

2024 Silver production exceeded projections mainly due to higher than expected grades.

2025

Guidance: Buenaventura expects a decrease in silver production year-over-year, primarily due

to lower silver grades. However, this will be partially mitigated by increased ore volume processed, as 2025 represents Yumpag’s

first full 12-months of production at 1,000 tpd; the operations’ maximum allowable throughput based on the environmental permit

currently in place. Buenaventura has planned to apply in 2025 for mining extraction rate expansion, enabling these operations to achieve

1,200 tpd during 2026.

El

Brocal: 2024 copper and zinc production was in line with expectations. 2024 gold and silver

production exceeded expectations primarily due to better than expected by-product recovery from copper concentrate extracted from the

underground mine.

2025

Guidance: Buenaventura expects copper production to remain consistent with 2024 levels as underground

mine production ramp-up continues, partially offset by lower copper grades. The targeted underground mine exploitation rate at El Brocal

exceeded the original 11,500tpd target, reaching 12,500 tpd in 4Q24. A significant decrease in El Brocal silver and gold production is

expected in 2025 due to the full depletion of the remaining ore inventory from Colquijirca’s Tajo Norte Mine in 2024, as well as

ongoing temporary suspension of mining activities at Tajo Norte Mine. There are no plans for lead and zinc production for 2025.

San

Gabriel:

2025

Guidance: Construction and mine development at San Gabriel will continue as planned during 1H25.

In 3Q25, Buenaventura will focus on ensuring the processing plant's operational readiness for commercial production. 4Q25 targeted production

initiation remains unchanged, subject to final permitting and required approvals.

Company Description

Compañía

de Minas Buenaventura S.A.A. is Peru’s largest, publicly traded precious and base metals Company and a major holder of mining rights

in Peru. The Company is engaged in the exploration, mining development, processing and trade of gold, silver and other base metals via

wholly-owned mines and through its participation in joint venture projects. Buenaventura currently

operates several mines in Peru (Orcopampa*, Uchucchacua*, Julcani*, Tambomayo*, La Zanja*, El Brocal and Coimolache).

The

Company owns 19.58% of Sociedad Minera Cerro Verde, an important Peruvian copper producer (a partnership with Freeport-McMorRan Inc.

and Sumitomo Corporation).

(*)

Operations wholly owned by Buenaventura.

Note

on Forward-Looking Statements

This

press release may contain forward-looking information (as defined in the U.S. Private Securities Litigation Reform Act of 1995) that

involve risks and uncertainties, including those concerning Cerro Verde’s costs and expenses, results of exploration, the continued

improving efficiency of operations, prevailing market prices of gold, silver, copper and other metals mined, the success of joint ventures,

estimates of future explorations, development and production, subsidiaries’ plans for capital expenditures, estimates of reserves

and Peruvian political, economic, social and legal developments. These forward-looking statements reflect the Company’s view with

respect to Cerro Verde’s future financial performance. Actual results could differ materially from those projected in the forward-looking

statements as a result of a variety of factors discussed elsewhere in this Press Release.

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

COMPAÑÍA

DE MINAS BUENAVENTURA S.A.A. |

| |

|

|

| Date: February 11,

2025 |

By: |

/s/

DANIEL DOMÍNGUEZ VERA |

| |

Name: |

Daniel Domínguez

Vera |

| |

Title: |

Market Relations Officer |

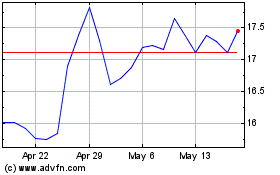

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Jan 2025 to Feb 2025

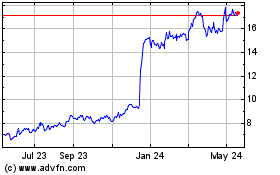

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Feb 2024 to Feb 2025