Lear Reaches 52-Week High - Analyst Blog

July 02 2013 - 8:40AM

Zacks

Shares of Lear Corp. (LEA) hit a new 52-week

high of $62.29 on Jul 1, which is above its previous level of

$61.51 on May 22, and closed at $61.55 on the same date. The

closing price represented a strong one-year return of 65.2% and

year-to-date return of 30.5%.

Lear Corporation designs, manufactures, assembles and supplies

automotive seat systems, electrical distribution systems, and

related components primarily to automotive original equipment

manufacturers mainly in North America, South America, Europe and

Asia. It has a market cap of $5.6 billion. Average volume of shares

traded over the last three months stood at approximately

1,011.6K.

Shares of LEA started escalating due to improving fundamentals in

the automobile parts market. However, the company failed to impress

investors with its first-quarter results on Apr 25.

Lear posted a 5.8% fall in adjusted earnings per share to $1.30 in

the first quarter of 2013 from $1.38 in the corresponding quarter

last year. However, earnings per share comfortably outpaced the

Zacks Consensus Estimate of $1.09. Net income declined 11.1% to

$124.4 million from $140.0 million in the year-ago quarter.

Revenues increased 8.3% to $3.9 million in the reported quarter,

surpassing the Zacks Consensus Estimate of $3.7 million. However,

global industry production decreased 1% year over year, with an 8%

fall in Europe. Production improved 12% in China and 1% in North

America.

Not only Lear, shares of other auto parts maker such as

Magna International Inc. (MGA), Johnson

Controls Inc. (JCI) and BorgWarner Inc.

(BWA) are also reaching 52-week highs due to continuous

improvements in the market. Investors believe that the recessionary

conditions in the industry no longer exist.

Two of the company’s biggest markets, North America (which

contributed 39.2% to its 2012 revenues) and Europe (35.0%) are

expected to rebound significantly in the coming years. Further,

Lear’s three largest customers – GM, Ford and BMW, together

accounting for more than 50% of revenues – are expected to perform

well in the near-term

Currently, LEA retains a Zacks Rank #2 (Buy).

BORG WARNER INC (BWA): Free Stock Analysis Report

JOHNSON CONTROL (JCI): Free Stock Analysis Report

LEAR CORPORATN (LEA): Free Stock Analysis Report

MAGNA INTL CL A (MGA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

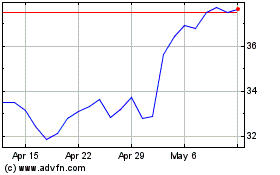

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Jun 2024 to Jul 2024

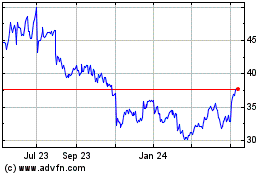

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Jul 2023 to Jul 2024