Citigroup Chief Risk Officer to Depart

November 02 2020 - 5:56PM

Dow Jones News

By Dylan Tokar

Citigroup Inc.'s chief risk officer will depart as the bank

works to overhaul its risk-management systems, the nation's

third-largest bank said Monday.

Brad Hu, a 12-year veteran of Citigroup, will remain in his

position until the end of the year to ensure a smooth transition,

according to an internal memo by Chief Executive Michael Corbat and

Jane Fraser, the firm's president and head of global consumer

banking.

News of Mr. Hu's departure arrives a month after federal

financial regulators fined Citigroup $400 million and ordered the

bank to fix its risk-management systems, citing "significant

ongoing deficiencies."

The decision to leave was Mr. Hu's, according to Citigroup. Mr.

Hu, through a Citigroup spokeswoman, declined to comment.

Ms. Fraser is set to take over as CEO of Citigroup after Mr.

Corbat retires in February.

"We respect his decision to align his own timing with the [chief

executive officer] transition and his desire for the function to

reset as Jane leads the management team on the firm-wide

transformation that lies ahead," Mr. Corbat and Ms. Fraser said in

the memo, which was viewed by The Wall Street Journal.

Ms. Fraser's role as head of global consumer banking will be

filled by one of her top lieutenants, Anand Selva, according to the

memo.

Citigroup said it will conduct a search for its next chief risk

officer and that it will consider both internal and external

candidates.

The bank praised Mr. Hu's accomplishments as chief risk officer,

saying he helped reduce Citigroup's risk profile and guide the firm

through geopolitical and economic disruptions. Mr. Hu also helped

the bank respond to emerging risk areas such as climate change and

cybersecurity, Citigroup said.

The Federal Reserve and the Office of the Comptroller of the

Currency in October said Citigroup failed in various areas of

internal controls and risk management, including data management,

regulatory reporting and capital planning.

Longstanding concerns about Citigroup's internal risk systems

were stoked when the firm inadvertently made a $900 million payment

to creditors of cosmetics company Revlon Inc.

The OCC and the Fed have ordered Citigroup to form a new board

committee to oversee the risk overhaul.

Write to Dylan Tokar at dylan.tokar@wsj.com

(END) Dow Jones Newswires

November 02, 2020 18:41 ET (23:41 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

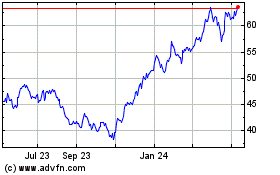

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2024 to May 2024

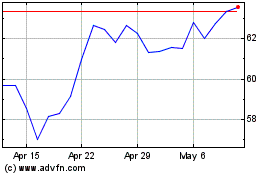

Citigroup (NYSE:C)

Historical Stock Chart

From May 2023 to May 2024