Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

May 22 2024 - 3:58PM

Edgar (US Regulatory)

Hypothetical Interim Payment per Security* Preliminary Terms This summary of terms is not complete and should be read with the pricing supplement below Citigroup Global Markets Holdings Inc. Issuer: Citigroup Inc. Guarantor: U.S. Bancorp (ticker: “USB”) Underlying: May 31, 2024 Pricing date: June 3, 2025, June 1, 2026 and June 1, 2027 (the “final valuation date”), each subject to postponement if such date is not a scheduled trading day or certain market disruption events occur Valuation dates: Unless earlier redeemed, June 4, 2027 Maturity date: If on any valuation date prior to the final valuation date, the closing value of the underlying is greater than or equal to the initial underlying value, the securities will be automatically called for an amount equal to the principal plus the applicable premium Automatic early redemption: $1,000 × the underlying return × the upside participation rate Upside return amount: 200% Upside participation rate: 60.00% Maximum return at maturity: $1,000 × the absolute value of the underlying return Absolute return amount: 65% of the initial underlying value Final barrier value: The stated principal amount divided by the initial underlying value Equity ratio: 17331AMV0 / US17331AMV07 CUSIP / ISIN: T he closing value of the underlying on the pricing date Initial underlying value: The closing value of the underlying on the final valuation date Final underlying value: (Final underlying value - initial underlying value) / initial underlying value Underlying return: • If the final underlying value is greater than or equal to the initial underlying value: $1,000 + the upside return amount, subject to the maximum return at maturity • If the final underlying value is less than the initial underlying value but greater than or equal to the final barrier value: $1,000 + the absolute return amount • If the final underlying value is less than the final barrier value: a fixed number of underlying shares of the underlying equal to the equity ratio (or, if we elect, the cash value of those shares based on the final underlying value) If the securities are not automatically redeemed prior to maturity and the final underlying value is less than the final barrier value, you will receive underlying shares (or, in our sole discretion, cash) expected to be worth significantly less than the stated principal amount of your securities, and possibly nothing, at maturity. Payment at Maturity: $1,000 per security Stated principal amount: Preliminary Pricing Supplement dated May 22, 2024 Pricing Supplement: Citigroup Global Markets Holdings Inc. Guaranteed by Citigroup Inc. 3 Year Autocallable Dual Directional Barrier Securities Linked to USB Hypothetical Payment at Maturity Hypothetical Security Return Hypothetical Underlying Return $1,600.00 60.00% 100.00% $1,600.00 60.00% 75.00% $1,600.00 60.00% 50.00% D $1,600.00 60.00% 30.00% $1,500.00 50.00% 25.00% C $1,200.00 20.00% 10.00% $1,000.00 0.00% 0.00% $1,050.00 5.00% - 5.00% B $1,350.00 35.00% - 35.00% $649.90**** - 35.01% - 35.01% $250.00**** - 75.00% - 75.00% A $0.00**** - 100.00% - 100.00% *Assumes that the premium for each valuation date prior to the final valuation date will be set at the lowest value indicated in this offering summary **The actual premium for each valuation date prior the final valuation date will be determined on the pricing date ***Assumes the securities have not been automatically redeemed prior to maturity ****A number of underlying shares of the underlying on the final valuation date (or, in our sole discretion, cash) worth appr oxi mately this value based on the final underlying value A B C Hypothetical Redemption Premium ** Valuation Date on which Closing Value Exceeds Initial Underlying Value $1,160.00 16.00% June 3, 2025 $1,320.00 32.00% June 1, 2026 If the closing value of the underlying is greater than or equal to its initial underlying value on any valuation date prior to the final valuation date , then the securities will be automatically redeemed prior to maturity and you will receive a premium following that valuation date. Hypothetical Payment at Maturity*** D

Selected Risk Considerations • You may lose a significant portion or all of your investment. Unlike conventional debt securities, the securities do not repay a fixed amount of principal at maturity. If the securities are not automatically redeemed prior to maturity, your payment at maturity will depend on the performance of the underlying. If the final underlying value is less than the final barrier value, the absolute return feature will no longer be available and, instead, you will receive underlying shares of the underlying (or, in our sole discretion, cash based on the value thereof) expected to be worth significantly less than the stated principal amount and possibly nothing. There is no minimum payment at maturity on the securities, and you may lose up to all of your investment. • If the securities are automatically redeemed, the appreciation potential of the securities is limited by the premium specified for each valuation date prior to the final valuation date. • The securities may be automatically redeemed prior to maturity, limiting the term of the securities. • Your potential return on the securities is limited to the maximum return at maturity. • Your potential for positive return from depreciation of the underlying is limited. • The securities do not pay interest. • You will not receive dividends or have any other rights with respect to the underlying unless and until you receive underlying shares of the underlying at maturity. • The performance of the securities will depend on the closing values of the underlying solely on the valuation dates, which makes the securities particularly sensitive to volatility in the closing values of the underlying on or near the valuation dates. • The securities are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. If Citigroup Global Markets Holdings Inc. defaults on its obligations under the securities and Citigroup Inc. defaults on its guarantee obligations, you may not receive anything owed to you under the securities. • The securities will not be listed on any securities exchange and you may not be able to sell them prior to maturity. • The estimated value of the securities on the pricing date will be less than the issue price. For more information about the estimated value of the securities, see the accompanying preliminary pricing supplement. • The value of the securities prior to maturity will fluctuate based on many unpredictable factors. • Even if the underlying pays a dividend that it identifies as special or extraordinary, no adjustment will be required under the securities for that dividend unless it meets the criteria specified in the accompanying product supplement. • The securities will not be adjusted for all events that may have a dilutive effect on or otherwise adversely affect the closing value of the underlying. • The securities may become linked to an underlying other than the original underlying upon the occurrence of a reorganization event or upon the delisting of the underlying shares. • If the underlying shares are delisted, we may call the securities prior to maturity for an amount that may be less than the stated principal amount. • The issuer and its affiliates may have conflicts of interest with you. • The U.S. federal tax consequences of an investment in the securities are unclear. The above summary of selected risks does not describe all of the risks associated with an investment in the securities. You should read the accompanying preliminary pricing supplement and product supplement for a more complete description of risks relating to the securities. Additional Information Citigroup Global Markets Holdings Inc. and Citigroup Inc. have filed registration statements (including the accompanying preliminary pricing supplement, product supplement, underlying supplement, prospectus supplement and prospectus) with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the accompanying preliminary pricing supplement, product supplement, underlying supplement, prospectus supplement and prospectus in those registration statements (File Nos. 333 - 270327 and 333 - 270327 - 01) and the other documents Citigroup Global Markets Holdings Inc. and Citigroup Inc. have filed with the SEC for more complete information about Citigroup Global Markets Holdings Inc., Citigroup Inc. and this offering. You may obtain these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, you can request these documents by calling toll - free 1 - 800 - 831 - 9146. Filed pursuant to Rule 433 This offering summary does not contain all of the material information an investor should consider before investing in the securities. This offering summary is not for distribution in isolation and must be read together with the accompanying preliminary pricing supplement and the other documents referred to therein, which can be accessed via the link on the first page. Citigroup Global Markets Holdings Inc. Guaranteed by Citigroup Inc.

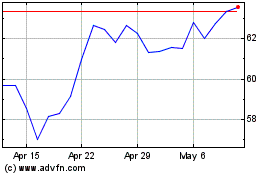

Citigroup (NYSE:C)

Historical Stock Chart

From May 2024 to Jun 2024

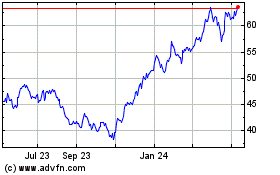

Citigroup (NYSE:C)

Historical Stock Chart

From Jun 2023 to Jun 2024