Same-center NOI in 2024 increased 0.2% over the

prior-year period

CBL Properties (NYSE: CBL) announced results for the fourth

quarter and year ended December 31, 2024. Results of operations as

reported in the consolidated financial statements for these periods

are prepared in accordance with GAAP. A description of each

supplemental non-GAAP financial measure and the related

reconciliation to the comparable GAAP financial measure is located

at the end of this news release.

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Net income attributable to common

shareholders

$

1.22

$

0.37

$

1.87

$

0.17

Funds from Operations ("FFO")

$

2.42

$

1.80

$

6.40

$

6.59

FFO, as adjusted (1)

$

1.92

$

1.94

$

6.69

$

6.66

(1)

For a reconciliation of FFO to FFO, as

adjusted, for the periods presented, please refer to the footnotes

to the Company’s reconciliation of net income (loss) attributable

to common shareholders to FFO allocable to Operating Partnership

common unitholders on page 8 of this news release.

KEY TAKEAWAYS:

- In January 2025, CBL closed on the sale of Monroeville Mall in

Monroeville, PA, for $34.0 million, all cash.

- In December 2024, CBL closed on the acquisition of its

partner’s 50% joint venture interests in three high-performing

centers, CoolSprings Galleria in Nashville, TN, Oak Park Mall in

Kansas City, KC, and West County Center in St. Louis, MO. The

interests were acquired for a total cash consideration of $22.5

million. CBL also assumed its former partner's share of three

non-recourse loans, secured individually by each of the assets,

totaling $266.7 million.

- Same-center NOI for 2024 increased 0.2% compared with the

prior-year period, and FFO, as adjusted, per share increased to

$6.69, compared with $6.66 for the prior-year period. CBL reported

a decline in same-center NOI of 1.6% for the fourth quarter 2024

compared with the prior-year period, and FFO, as adjusted, per

share of $1.92, compared with $1.94 for fourth quarter 2023.

Results were in-line with the previously issued guidance range for

2024.

- Nearly 4.5 million square feet of leases were executed in 2024,

including nearly 1.4 million executed in the fourth quarter. Fourth

quarter 2024 leasing results included comparable leases of

approximately 859,000 square feet signed at roughly flat average

rents versus the prior leases.

- Portfolio occupancy was 90.3% as of December 31, 2024, a

100-basis-point-increase sequentially from September 30, 2024, and

a 60-bps decline compared with portfolio occupancy of 90.9% as of

December 31, 2023. Same-center occupancy for malls, lifestyle

centers and outlet centers was 88.7% as of December 31, 2024, a

110-basis-point decline from 89.8% as of December 31, 2023.

Anticipated bankruptcy related store closures representing over

290,000-square-feet negatively impacted mall occupancy by 184 basis

points, compared with the prior-year quarter.

- Same-center tenant sales per square foot for the fourth quarter

2024 increased approximately 1% as compared with the prior-year

period. Same-center tenant sales per square foot for the 12-months

ended December 31, 2024, of $418, were flat compared with the prior

period.

- As of December 31, 2024, the Company had $283.9 million of

unrestricted cash and marketable securities.

- CBL's Board of Directors declared a regular cash dividend of

$0.40 per common share for the quarter ending March 31, 2025, and a

special cash dividend of $0.80 per common share.

"2024 was an outstanding year for CBL," said CBL's chief

executive officer, Stephen D. Lebovitz. "Financial results were

strong, highlighted by the achievement of positive same-center NOI

growth. We also completed significant financing and transactional

activity that strengthened both our balance sheet and portfolio.

Same-center NOI growth for the year benefited from overall positive

rent spreads and new leasing activity as well as lower operating

expenses and tax savings, partially offset by an unfavorable

variance in uncollectable revenues and declines in percentage

rent.

"Leasing volumes were healthy in 2024, with 1.4 million square

feet of new and renewal leases signed in the fourth quarter,

bringing the full year total to nearly 4.5 million square feet.

Comparable shop leases were signed at positive lease spreads of

5.8% for both new and renewal leases. We added exciting new brands

and restaurants to our properties, signing new deals in the fourth

quarter with Kendra Scott, J. Crew Factory, Barnes & Noble,

Drybar, and Cooper's Hawk Winery & Restaurant. Our leasing

efforts through the year resulted in a 100 bps increase in

occupancy sequentially and a narrowing of the decline from the

prior-year period to 60 basis points. We are focused on making

additional progress in occupancy in 2025. Sales improved over the

course of the year with the holiday sales season driving a 1%

increase in the fourth quarter.

"In 2024, we were active on the transaction front, generating

$85 million in proceeds from asset sales. In late December, we were

excited to complete the acquisition of our joint venture partner's

interest in three of our top properties, which paves the way to

unlock future value creation opportunities. We are pursuing

numerous growth opportunities at these high-performing properties

and will now benefit 100% from the results of these efforts.

"We made tremendous improvements to our balance sheet during the

fourth quarter with more than $500 million in financing activity

completed. In concert with the acquisition noted above, we

completed the extension of the non-recourse loans secured by West

County Center, (to December 2026, at the existing interest rate)

and Oak Park Mall, (to October 2030, at a 5% fixed interest rate).

We also closed on two favorable new non-recourse loans secured by

our open-air center in Melbourne, FL and our outlet center in

Louisville, KY.

"With more than $37 million in share repurchase activity

completed, we are actively pursuing opportunities to return capital

to shareholders. We increased our regular dividend rate at the

start of 2024, and now our Board has approved our regular quarterly

dividend as well as a significant special dividend totaling $1.20

per share, to be paid in all cash.

"While uncertainty and certain headwinds remain a factor in

2025, we are focused on driving additional operational improvements

across our portfolio through strategic leasing and redevelopment

efforts. We will continue to pursue opportunities to utilize our

portfolio and strong balance sheet position to generate cash flow

improvements and enhanced shareholder returns. We are excited to

hit the ground running this year and build off the strong momentum

created in 2024."

Same-center Net Operating Income (“NOI”) (1):

Three Months Ended December

31,

2024

2023

Total Revenues

$

177,826

$

180,571

Total Expenses

$

(56,103

)

$

(56,867

)

Total portfolio same-center NOI

$

121,723

$

123,704

Total same-center NOI percentage

change

(1.6

)%

Estimate for uncollectable revenues

(recovery)

$

1,039

$

(285

)

(1)

CBL’s definition of same-center NOI

excludes the impact of lease termination fees and certain non-cash

items such as straight-line rents and reimbursements, write-offs of

landlord inducements and net amortization of above and below market

leases.

Same-center NOI for the fourth quarter 2024 declined $2.0

million. Fourth quarter 2024 results were impacted by a $0.6

million decline in percentage rents. Total operating expense

declined $0.8 million, primarily driven by lower thirdparty

contract expense and lower maintenance and repair projects expense

as compared with the prior period. The estimate for uncollectable

revenues unfavorably impacted the quarter by approximately $1.3

million.

Year Ended December

31,

2024

2023

Total Revenues

$

675,468

$

681,425

Total Expenses

$

(219,901

)

$

(226,934

)

Total portfolio same-center NOI

$

455,568

$

454,492

Total same-center NOI percentage

change

0.2

%

Estimate for uncollectable revenues

(recovery)

$

3,667

$

1,211

Same-center NOI for the twelve months ended December 31, 2024

increased $1.1 million. Results included real estate and other tax

expense savings and improved operating expenses from lower

third-party contract expense. Percentage rents in 2024 were $2.3

million lower. The estimate for uncollectable revenues unfavorably

impacted 2024 by $2.5 million.

PORTFOLIO OPERATIONAL RESULTS Occupancy(1):

As of December 31,

2024

2023

Total portfolio

90.3%

90.9%

Malls, lifestyle centers and outlet

centers:

Total malls

87.8%

89.3%

Total lifestyle centers

92.2%

91.5%

Total outlet centers

92.3%

91.9%

Total same-center malls, lifestyle centers

and outlet centers

88.7%

89.8%

Open-air centers

95.6%

95.5%

All Other Properties

89.5%

78.2%

(1)

Occupancy for malls, lifestyle centers and

outlet centers represent percentage of in-line gross leasable area

under 20,000 square feet occupied. Occupancy for open-air

centers represents percentage of gross leasable area

occupied.

New and Renewal Leasing Activity of Same Small Shop Space

Less Than 10,000 Square Feet:

% Change in Average Gross Rent Per

Square Foot:

Three Months Ended December

31,

Year Ended December

31,

2024

2024

All Property Types

(0.6)%

5.8%

Stabilized Malls, Lifestyle Centers and

Outlet Centers

(0.8)%

5.5%

New leases

36.4%

56.5%

Renewal leases

(2.2)%

1.1%

Open Air Centers

8.9%

15.7%

Same-Center Sales Per Square Foot for In-line Tenants 10,000

Square Feet or Less:

Sales Per Square Foot for the

Trailing Twelve Months Ended December 31,

2024

2023

% Change

Malls, lifestyle centers and outlet

centers same-center sales per square foot

$

418

$

418

0.0%

DIVIDEND

On February 12, 2025, CBL announced that its Board of Directors

declared a regular cash dividend of $0.40 per common share for the

quarter ending March 31, 2025. The dividend, which equates to an

annual dividend payment of $1.60 per common share, is payable on

March 31, 2025, to shareholders of record as of March 13, 2025.

CBL’s Board of Directors also declared a special cash dividend

of $0.80 per common share. The special dividend is required to

remain in compliance with U.S. federal income tax rules for real

estate investment trusts (“REITs”). The special dividend is payable

on March 31, 2025, to shareholders of record as of March 13,

2025.

FINANCING ACTIVITY

During the fourth quarter 2024, CBL completed approximately

$513.7 million in financing activity.

In December 2024, CBL completed the extension of the $251.4

million non-recourse loan secured by Oak Park Mall in Kansas City,

KS. The maturity was extended to October 2030. The fixed interest

rate will increase to 5% beginning in October 2025. CBL also

exercised a two-year extension of the $144.7 million loan secured

by West County Center in St. Louis, MO. The maturity was extended

to December 2026. CBL closed on an extension of the $6.6 million

loan ($3.3 million at CBL's share) secured by Coastal Grand-Dick's

Sporting Goods in Myrtle Beach, SC. The loan now matures in

November 2025, with an option to extend the maturity to May

2026.

In November, CBL and its 50% joint venture partner took

advantage of improved financing terms and closed on new

non-recourse ten-year loans totaling $45.0 million, secured by

Hammock Landing in West Melbourne, FL. The loans bear a fixed

interest rate of 5.86% and replace two existing partially

guaranteed loans totaling $44.5 million, which bore a floating

interest rate (8.2% as of September 30, 2024). The loans had a

maturity of February 2025.

In October, CBL and its joint venture partner closed on a new

$66.0 million loan secured by The Outlet Shoppes of the Bluegrass.

The new non-recourse loan bears a fixed interest rate of 6.84% and

matures in November 2034. Proceeds were used to retire the $61.6

million existing loan that was set to mature in December 2024.

CBL and its 50% joint venture partner are continuing

discussions, which began in August, with the lender regarding a

loan modification/extension of the $98.8 million in loans secured

by Coastal Grand Mall and Coastal Grand Crossing in Myrtle Beach,

SC.

In July 2024, CBL and its 50% joint venture partner closed on a

new $14.5 million five-year loan secured by the Aloft Hotel at

Hamilton Place in Chattanooga, TN. The loan bears a fixed interest

rate of 7.2% and is non-recourse to CBL and replaced the existing

$16.0 million loan that was set to mature in November 2024.

In May 2024, CBL transferred the title to Westgate Mall in

Spartanburg, SC, to the mortgage holder in satisfaction of the

$28.7 million non-recourse loan secured by the property.

In February 2024, CBL retired the $15.3 million recourse loan

secured by Brookfield Square Anchor Redevelopment in Brookfield,

WI.

CBL is cooperating with the foreclosure or conveyance of

Alamance Crossing East in Burlington, NC, ($41.1 million).

ACQUISITION ACTIVITY

In December 2024, CBL closed on the acquisition of its partner’s

50% joint venture interests in three high-performing centers,

CoolSprings Galleria in Nashville, TN, Oak Park Mall in Kansas

City, KS, and West County Center in St. Louis, MO. The interests

were acquired for a total cash consideration of $22.5 million. CBL

also assumed its former partner's share of three non-recourse

loans, secured individually by each of the assets, totaling $266.7

million.

DISPOSITION ACTIVITY

In January 2025, CBL completed the sale of Monroeville Mall and

Annex in Monroeville PA, for $34.0 million.

In 2024, CBL completed more than $85.0 million in disposition

activity, at CBL's share. Major transactions included the sale of

Layton Hills Mall in Layton, UT, in August for $37.125 million. In

September, CBL closed on the sale of Layton Hills Convenience

Center, Layton Hills Plaza and nine related outparcels in Layton

(Salt Lake City), UT, to an unaffiliated third party for $28.5

million, all cash.

During the fourth quarter, CBL completed the sale of three

outparcels, generating aggregate proceeds at its share of $10.8

million.

DEVELOPMENT AND REDEVELOPMENT ACTIVITY

Detailed project information is available in CBL’s Financial

Supplement for Q4 2024, which can be found in the Invest –

Financial Reports section of CBL’s website at cblproperties.com

OUTLOOK AND GUIDANCE

Based on Management's expectations, CBL is initiating FFO, as

adjusted, guidance for 2025 in the range of $6.98 - $7.34 per

share. Management anticipates same-center NOI for full-year 2025 in

the range of (2.0)% to 0.5%.

Low

High

2025 FFO, as adjusted (in millions)

$

213.0

$

224.0

2025 WA Share Count

30.5

30.5

2025 FFO, as adjusted, per share

$

6.98

$

7.34

2025 Same-Center NOI ("SC NOI") (in

millions)

$

427.0

$

438.0

2025 change in same-center NOI

(2.0

)%

0.5

%

2024 vs. 2025 Same-center NOI guidance bridge:

2025 SC NOI Low End

2025 SC NOI High End

Category Explanation

2024 same-center NOI

$

435.7

$

435.7

Non-core assets excluded from same center

pool include Harford Mall, Imperial Valley Mall, Laurel Park Mall

and Brookfield Square.

Net impact from new and renewal leasing

activity

6.5

11.0

Net impact of new leases, renewal leases

and contractual rent bumps for permanent and specialty leasing.

Percentage rent

(3.0

)

(2.0

)

Represents impact of flat to down sales

expectations for the year, higher breakpoints upon lease renewal

and conversion of percentage rent to base rent on renewal.

Operating expense

(7.0

)

(4.0

)

Represents potential increase in operating

expenses.

Credit loss

(5.2

)

(3.7

)

Unbudgeted reserve for tenants that may

file for bankruptcy/close stores.

Uncollectable revenue variance

-

1.0

Represents the estimated impact of a

variance in the estimate for uncollectable revenues.

2025 SC NOI Guidance

$

427.0

$

438.0

% change

(2.0

)%

0.5

%

Reconciliation of GAAP Earnings Per Share to 2025 FFO, as

Adjusted, Per Share:

Low

High

Expected diluted earnings per common

share

$

1.07

$

1.43

Depreciation and amortization

4.61

4.61

Expected FFO, per diluted, fully converted

common share

5.68

6.04

Debt discount accretion, net of

noncontrolling interests' share

0.60

0.60

Adjustment for unconsolidated affiliates

with negative investment

0.70

0.70

Expected FFO, as adjusted, per diluted,

fully converted common share

$

6.98

$

7.34

2025 Estimate of Capital Items (in millions):

Low

High

2025 Estimated maintenance capital/tenant

allowances (1)

$

40.0

$

55.0

2025 Estimated development/redevelopment

expenditures

5.0

10.0

2025 Estimated principal amortization

(including est. term loan ECF)

85.0

95.0

Total Estimate

$

130.0

$

160.0

(1) Excludes amounts related to properties

which have 100% of the cash flows from such properties restricted

under the terms of the respective loan agreements as further

described on page 12 of the Financial Supplement.

ABOUT CBL PROPERTIES

Headquartered in Chattanooga, TN, CBL Properties owns and

manages a national portfolio of market-dominant properties located

in dynamic and growing communities. CBL’s owned and managed

portfolio is comprised of 89 properties totaling 56.2 million

square feet across 21 states, including 54 high-quality enclosed

malls, outlet centers and lifestyle retail centers as well as more

than 30 open-air centers and other assets. CBL seeks to

continuously strengthen its company and portfolio through active

management, aggressive leasing and profitable reinvestment in its

properties. For more information visit cblproperties.com.

NON-GAAP FINANCIAL MEASURES

Funds From Operations

FFO is a widely used non-GAAP measure of the operating

performance of real estate companies that supplements net income

(loss) determined in accordance with GAAP. The National Association

of Real Estate Investment Trusts ("NAREIT") defines FFO as net

income (loss) (computed in accordance with GAAP) excluding gains or

losses on sales of depreciable operating properties and impairment

losses of depreciable properties, plus depreciation and

amortization, and after adjustments for unconsolidated partnerships

and joint ventures and noncontrolling interests. Adjustments for

unconsolidated partnerships and joint ventures and noncontrolling

interests are calculated on the same basis. We define FFO as

defined above by NAREIT. The Company’s method of calculating FFO

may be different from methods used by other REITs and, accordingly,

may not be comparable to such other REITs.

The Company believes that FFO provides an additional indicator

of the operating performance of its properties without giving

effect to real estate depreciation and amortization, which assumes

the value of real estate assets declines predictably over time.

Since values of well-maintained real estate assets have

historically risen with market conditions, the Company believes

that FFO enhances investors’ understanding of its operating

performance. The use of FFO as an indicator of financial

performance is influenced not only by the operations of the

Company’s properties and interest rates, but also by its capital

structure.

The Company believes FFO allocable to Operating Partnership

common unitholders is a useful performance measure since it

conducts substantially all of its business through its Operating

Partnership and, therefore, it reflects the performance of the

properties in absolute terms regardless of the ratio of ownership

interests of the Company’s common shareholders and the

noncontrolling interest in the Operating Partnership.

In the reconciliation of net income (loss) attributable to the

Company’s common shareholders to FFO allocable to Operating

Partnership common unitholders, located in this earnings release,

the Company makes an adjustment to add back noncontrolling interest

in income (loss) of its Operating Partnership in order to arrive at

FFO of the Operating Partnership common unitholders.

FFO does not represent cash flows from operations as defined by

GAAP, is not necessarily indicative of cash available to fund all

cash flow needs and should not be considered as an alternative to

net income (loss) for purposes of evaluating the Company’s

operating performance or to cash flow as a measure of

liquidity.

The Company believes that it is important to identify the impact

of certain significant items on its FFO measures for a reader to

have a complete understanding of the Company’s results of

operations. Therefore, the Company has also presented adjusted FFO

measures excluding these items from the applicable periods. Please

refer to the reconciliation of net income (loss) attributable to

common shareholders to FFO allocable to Operating Partnership

common unitholders on page 8 of this news release for a description

of these adjustments.

Same-center Net Operating Income

NOI is a supplemental non-GAAP measure of the operating

performance of the Company’s shopping centers and other properties.

The Company defines NOI as property operating revenues (rental

revenues, tenant reimbursements and other income) less property

operating expenses (property operating, real estate taxes and

maintenance and repairs).

The Company computes NOI based on the Operating Partnership’s

pro rata share of both consolidated and unconsolidated properties.

The Company believes that presenting NOI and same-center NOI

(described below) based on its Operating Partnership’s pro rata

share of both consolidated and unconsolidated properties is useful

since the Company conducts substantially all of its business

through its Operating Partnership and, therefore, it reflects the

performance of the properties in absolute terms regardless of the

ratio of ownership interests of the Company’s common shareholders

and the noncontrolling interest in the Operating Partnership. The

Company's definition of NOI may be different than that used by

other companies and, accordingly, the Company's calculation of NOI

may not be comparable to that of other companies.

Since NOI includes only those revenues and expenses related to

the operations of the Company’s shopping center properties, the

Company believes that same-center NOI provides a measure that

reflects trends in occupancy rates, rental rates, sales at the

malls and operating costs and the impact of those trends on the

Company’s results of operations. The Company’s calculation of

same-center NOI excludes lease termination income, straight-line

rent adjustments, amortization of above and below market lease

intangibles and write-off of landlord inducement assets in order to

enhance the comparability of results from one period to another. A

reconciliation of same-center NOI to net income (loss) is located

at the end of this earnings release.

Pro Rata Share of Debt

The Company presents debt based on the carrying value of its pro

rata ownership share (including the carrying value of the Company’s

pro rata share of unconsolidated affiliates and excluding

noncontrolling interests’ share of consolidated properties) because

it believes this provides investors a clearer understanding of the

Company’s total debt obligations which affect the Company’s

liquidity. A reconciliation of the Company’s pro rata share of debt

to the amount of debt on the Company’s condensed consolidated

balance sheet is located at the end of this earnings release.

Information included herein contains “forward-looking

statements” within the meaning of the federal securities laws. Such

statements are inherently subject to risks and uncertainties, many

of which cannot be predicted with accuracy and some of which might

not even be anticipated. Future events and actual events, financial

and otherwise, may differ materially from the events and results

discussed in the forward-looking statements. The reader is directed

to the Company’s various filings with the Securities and Exchange

Commission, including without limitation the Company’s Annual

Report on Form 10-K, and the “Management's Discussion and Analysis

of Financial Condition and Results of Operations” included therein,

for a discussion of such risks and uncertainties.

Consolidated Statements of

Operations

(Unaudited; in thousands, except per share

amounts)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

REVENUES:

Rental revenues

$

125,786

$

134,008

$

493,876

$

513,957

Management, development and leasing

fees

1,897

1,821

7,609

7,917

Other

4,007

3,880

14,076

13,412

Total revenues

131,690

139,709

515,561

535,286

EXPENSES:

Property operating

(22,149

)

(22,254

)

(90,052

)

(90,996

)

Depreciation and amortization

(31,561

)

(42,376

)

(140,591

)

(190,505

)

Real estate taxes

(11,797

)

(11,744

)

(47,365

)

(54,807

)

Maintenance and repairs

(9,725

)

(11,334

)

(37,732

)

(41,336

)

General and administrative

(16,607

)

(14,283

)

(67,254

)

(64,066

)

Loss on impairment

(625

)

—

(1,461

)

—

Litigation settlement

400

132

553

2,310

Other

(88

)

(23

)

(230

)

(221

)

Total expenses

(92,152

)

(101,882

)

(384,132

)

(439,621

)

OTHER INCOME (EXPENSES):

Interest and other income

3,604

3,939

15,713

13,199

Interest expense

(36,418

)

(42,317

)

(154,486

)

(172,905

)

Gain (loss) on extinguishment of debt

—

3,270

(819

)

3,270

Gain on deconsolidation

—

—

—

47,879

Gain on consolidation

26,727

—

26,727

—

Gain on sales of real estate assets

189

229

16,676

5,125

Income tax (provision) benefit

(199

)

487

(1,055

)

(894

)

Equity in earnings of unconsolidated

affiliates

4,106

9,043

22,932

11,865

Total other expenses

(1,991

)

(25,349

)

(74,312

)

(92,461

)

Net income

37,547

12,478

57,117

3,204

Net (income) loss attributable to

noncontrolling interests in:

Operating Partnership

(3

)

(8

)

(4

)

(2

)

Other consolidated subsidiaries

434

(657

)

1,857

3,344

Net income attributable to the

Company

37,978

11,813

58,970

6,546

Earnings allocable to unvested restricted

stock

(770

)

(276

)

(1,206

)

(1,113

)

Net income attributable to common

shareholders

$

37,208

$

11,537

$

57,764

$

5,433

Basic and diluted per share data

attributable to common shareholders:

Basic earnings per share

$

1.23

$

0.37

$

1.87

$

0.17

Diluted earnings per share

1.22

0.37

1.87

0.17

Weighted-average basic shares

30,178

31,291

30,905

31,303

Weighted-average diluted shares

30,400

31,291

30,962

31,303

The Company's reconciliation of net

income attributable to common shareholders to FFO allocable to

Operating Partnership common unitholders is as follows:

(in thousands, except per share data)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Net income attributable to common

shareholders

$

37,208

$

11,537

$

57,764

$

5,433

Noncontrolling interest in income of

Operating Partnership

3

8

4

2

Earnings allocable to unvested restricted

stock

770

276

1,206

1,113

Depreciation and amortization expense

of:

Consolidated properties

31,561

42,376

140,591

190,505

Unconsolidated affiliates

4,141

4,145

16,137

17,408

Non-real estate assets

(418

)

(232

)

(1,187

)

(905

)

Noncontrolling interests' share of

depreciation and amortization in other consolidated

subsidiaries

(446

)

(507

)

(1,916

)

(2,442

)

Loss on impairment, net of taxes

625

—

1,244

—

Gain on depreciable property

—

—

(15,651

)

—

FFO allocable to Operating Partnership

common unitholders

73,444

57,603

198,192

211,114

Debt discount accretion, including our

share of unconsolidated affiliates and net of noncontrolling

interests' share (1)

10,327

13,909

44,929

61,788

Adjustment for unconsolidated affiliates

with negative investment (2)

1,494

(6,062

)

(9,974

)

(7,242

)

Litigation settlement (3)

(400

)

(132

)

(553

)

(2,310

)

Non-cash default interest expense (4)

374

—

606

972

Gain on deconsolidation (5)

—

—

—

(47,879

)

Gain on consolidation (6)

(26,727

)

—

(26,727

)

—

(Gain) loss on extinguishment of debt

(7)

—

(3,270

)

819

(3,270

)

FFO allocable to Operating Partnership

common unitholders, as adjusted

$

58,512

$

62,048

$

207,292

$

213,173

FFO per diluted share

$

2.42

$

1.80

$

6.40

$

6.59

FFO, as adjusted, per diluted

share

$

1.92

$

1.94

$

6.69

$

6.66

Weighted-average common and potential

dilutive common units outstanding

30,406

32,007

30,967

32,015

(1)

In conjunction with fresh start accounting

upon emergence from bankruptcy, the Company recognized debt

discounts equal to the difference between the outstanding balance

of mortgage notes payable and the estimated fair value of such

mortgage notes payable. The debt discounts are accreted as

additional interest expense over the terms of the respective

mortgage notes payable using the effective interest method.

(2)

Represents the Company’s share of the

earnings (losses) before depreciation and amortization expense of

unconsolidated affiliates where the Company is not recognizing

equity in earnings (losses) because its investment in the

unconsolidated affiliate is below zero.

(3)

Represents a credit to litigation

settlement expense, in each respective period, related to claim

amounts that were released pursuant to the terms of the settlement

agreement related to the settlement of a class action lawsuit.

(4)

The three months and year ended December

31, 2024 includes default interest on loans past their maturity

dates. The year ended December 31, 2023 includes default interest

on loans past their maturity dates.

(5)

For the year ended December 31, 2023, the

Company deconsolidated Alamance Crossing East and WestGate Mall due

to a loss of control when the properties were placed into

receivership in connection with the foreclosure process.

(6)

For the year ended December 31, 2024, the

Company closed on the acquisition of its partners' 50% joint

venture interests in CoolSprings Galleria, Oak Park Mall and West

County Center and recognized gain on consolidation.

(7)

During the year ended December 31, 2024,

the Company made a partial paydown on the open-air centers and

outparcels loan and recognized loss on extinguishment of debt

related to a prepayment fee. The three months and year ended

December 31, 2023 includes a gain on extinguishment of debt related

to the loan secured by The Outlet Shoppes at Laredo.

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Diluted EPS attributable to common

shareholders

$

1.22

$

0.37

$

1.87

$

0.17

Add amounts per share included in FFO:

Unvested restricted stock

0.03

0.01

0.03

0.03

Eliminate amounts per share excluded from

FFO:

Depreciation and amortization expense,

including amounts from consolidated properties, unconsolidated

affiliates, non-real estate assets and excluding amounts allocated

to noncontrolling interests

1.15

1.42

4.96

6.39

Loss on impairment, net of taxes

0.02

—

0.04

—

Gain on depreciable property

—

—

(0.50

)

—

FFO per diluted share

$

2.42

$

1.80

$

6.40

$

6.59

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

SUPPLEMENTAL FFO INFORMATION:

Lease termination fees

$

144

$

1,423

$

2,357

$

3,504

Straight-line rental income adjustment

$

804

$

1,432

$

974

$

6,840

Gain on outparcel sales, net of taxes

$

257

$

229

$

951

$

5,607

Net amortization of acquired above- and

below-market leases

$

(5,134

)

$

(5,626

)

$

(15,616

)

$

(20,736

)

Income tax (provision) benefit

$

(199

)

$

487

$

(1,055

)

$

(894

)

Abandoned projects expense

$

(88

)

$

(22

)

$

(230

)

$

(39

)

Interest capitalized

$

134

$

111

$

562

$

453

Estimate of uncollectable revenues

$

(870

)

$

1,081

$

(5,085

)

$

(1,493

)

As of December 31,

2024

2023

Straight-line rent receivable

$

23,789

$

22,649

Same-center Net Operating

Income

(Dollars in thousands)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Net income

$

37,547

$

12,478

$

57,117

$

3,204

Adjustments:

Depreciation and amortization

31,561

42,376

140,591

190,505

Depreciation and amortization from

unconsolidated affiliates

4,141

4,145

16,137

17,408

Noncontrolling interests' share of

depreciation and amortization in other consolidated

subsidiaries

(446

)

(507

)

(1,916

)

(2,442

)

Interest expense

36,418

42,317

154,486

172,905

Interest expense from unconsolidated

affiliates

16,070

17,753

67,108

71,867

Noncontrolling interests' share of

interest expense in other consolidated subsidiaries

(1,044

)

(1,089

)

(4,240

)

(6,156

)

Abandoned projects expense

88

22

230

39

Gain on sales of real estate assets, net

of taxes and noncontrolling interests' share

(189

)

(229

)

(16,676

)

(4,839

)

Gain on sales of real estate assets of

unconsolidated affiliates

(68

)

—

(68

)

(768

)

Adjustment for unconsolidated affiliates

with negative investment

1,494

(6,062

)

(9,974

)

(7,242

)

(Gain) loss on extinguishment of debt

—

(3,270

)

819

(3,270

)

Gain on deconsolidation

—

—

—

(47,879

)

Gain on consolidation

(26,727

)

—

(26,727

)

—

Loss on impairment

625

—

1,461

—

Litigation settlement

(400

)

(132

)

(553

)

(2,310

)

Income tax provision (benefit)

199

(487

)

1,055

894

Lease termination fees

(144

)

(1,423

)

(2,357

)

(3,504

)

Straight-line rent and above- and

below-market lease amortization

4,330

4,194

14,642

13,896

Net loss (income) attributable to

noncontrolling interests in other consolidated subsidiaries

434

(657

)

1,857

3,344

General and administrative expenses

16,607

14,283

67,254

64,066

Management fees and non-property level

revenues

(5,979

)

(4,360

)

(25,049

)

(19,087

)

Operating Partnership's share of

property NOI

114,517

119,352

435,197

440,631

Non-comparable NOI

7,206

4,352

20,371

13,861

Total same-center NOI (1)(2)

$

121,723

$

123,704

$

455,568

$

454,492

Total same-center NOI percentage

change

(1.6

)%

0.2

%

(1)

CBL defines NOI as property operating

revenues (rental revenues, tenant reimbursements and other income),

less property operating expenses (property operating, real estate

taxes and maintenance and repairs). NOI excludes lease termination

income, straight-line rent adjustments, amortization of above and

below market lease intangibles and write-offs of landlord

inducement assets. We include a property in our same-center pool

when we own all or a portion of the property as of December 31,

2024, and we owned it and it was in operation for both the entire

preceding calendar year and the current year-to-date reporting

period ending December 31, 2024. New properties are excluded from

same-center NOI, until they meet these criteria. Properties

excluded from the same-center pool that would otherwise meet these

criteria are properties which are under major redevelopment or

being considered for repositioning, where we intend to renegotiate

the terms of the debt secured by the related property or return the

property to the lender.

(2)

Due to the purchase of the Company's joint

venture partner's 50% interest in CoolSprings Galleria, Oak Park

Mall and West County Center during December 2024, same-center NOI

is reflected at 100% for those properties for all periods.

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Malls

$

86,968

$

89,941

$

318,288

$

322,534

Outlet centers

5,927

5,505

22,202

21,044

Lifestyle centers

9,190

9,126

36,089

35,849

Open-air centers

13,882

13,604

56,517

53,971

Outparcels and other

5,756

5,528

22,472

21,094

Total same-center NOI

$

121,723

$

123,704

$

455,568

$

454,492

Percentage Change:

Malls

(3.3

)%

(1.3

)%

Outlet centers

7.7

%

5.5

%

Lifestyle centers

0.7

%

0.7

%

Open-air centers

2.0

%

4.7

%

Outparcels and other

4.1

%

6.5

%

Total same-center NOI

(1.6

)%

0.2

%

Company's Share of Consolidated and

Unconsolidated Debt

(Dollars in thousands)

As of December 31,

2024

Fixed Rate

Variable Rate

Total Debt

Unamortized Deferred Financing

Costs

Unamortized Debt Discounts

(1)

Total, net

Consolidated debt (2)

$

1,403,798

$

928,106

$

2,331,904

$

(8,688

)

$

(110,536

)

$

2,212,680

Noncontrolling interests' share of

consolidated debt

(24,392

)

(11,403

)

(35,795

)

168

1,803

(33,824

)

Company's share of unconsolidated

affiliates' debt

372,939

26,989

399,928

(2,613

)

—

397,315

Other debt (3)

41,122

—

41,122

—

—

41,122

Company's share of consolidated,

unconsolidated and other debt

$

1,793,467

$

943,692

$

2,737,159

$

(11,133

)

$

(108,733

)

$

2,617,293

Weighted-average interest rate

5.18

%

7.66

%

6.03

%

As of December 31,

2023

Fixed Rate

Variable Rate

Total Debt

Unamortized Deferred Financing

Costs

Unamortized Debt Discounts

(1)

Total, net

Consolidated debt (2)

$

915,753

$

1,028,213

$

1,943,966

$

(13,221

)

$

(41,942

)

$

1,888,803

Noncontrolling interests' share of

consolidated debt

(25,021

)

(11,823

)

(36,844

)

249

3,706

(32,889

)

Company's share of unconsolidated

affiliates' debt

622,169

57,274

679,443

(3,197

)

—

676,246

Other debt (3)

69,783

—

69,783

—

—

69,783

Company's share of consolidated,

unconsolidated and other debt

$

1,582,684

$

1,073,664

$

2,656,348

$

(16,169

)

$

(38,236

)

$

2,601,943

Weighted-average interest rate

5.26

%

8.42

%

6.54

%

(1)

In conjunction with the acquisition of the

Company's partners' 50% joint venture interests in CoolSprings

Galleria, Oak Park Mall and West County Center and the

implementation of fresh start accounting upon emergence from

bankruptcy, the Company recognized debt discounts equal to the

difference between the outstanding balance of mortgage notes

payable and the estimated fair value of such mortgage notes

payable. The debt discounts are accreted as additional interest

expense over the terms of the respective mortgage notes payable

using the effective interest method.

(2)

At December 31, 2024, includes $533,377 of

debt and $87,022 of unamortized debt discounts related to three

properties in which the Company acquired its joint venture

partner's 50% interest and now consolidates the properties. At

December 31, 2023, $274,879 of debt represented the Company's 50%

interest of such debt, which was included in the Company's share of

unconsolidated affiliates' debt.

(3)

Represents the outstanding loan balance

for Alamance Crossing East, which was deconsolidated due to a loss

of control when the property was placed into receivership in

connection with the foreclosure process. Additionally, WestGate

Mall was deconsolidated in September 2023 when the property was

placed into receivership in connection with the foreclosure

process, which was completed in May 2024.

Consolidated Balance Sheets

(Unaudited; in thousands, except share

data)

December 31,

December 31,

2024

2023

ASSETS

Real estate assets:

Land

$

588,153

$

585,191

Buildings and improvements

1,505,232

1,216,054

2,093,385

1,801,245

Accumulated depreciation

(283,785

)

(228,034

)

1,809,600

1,573,211

Held-for-sale

56,075

—

Developments in progress

5,817

8,900

Net investment in real estate assets

1,871,492

1,582,111

Cash and cash equivalents

40,791

34,188

Restricted cash

112,938

88,888

Available-for-sale securities - at fair

value (amortized cost of $242,881 and $261,869 as of December 31,

2024 and December 31, 2023, respectively)

243,148

262,142

Receivables:

Tenant

45,594

43,436

Other

2,356

2,752

Investments in unconsolidated

affiliates

83,465

76,458

In-place leases, net

186,561

157,639

Intangible lease assets and other

assets

160,846

158,291

$

2,747,191

$

2,405,905

LIABILITIES AND EQUITY

Mortgage and other indebtedness, net

$

2,212,680

$

1,888,803

Accounts payable and accrued

liabilities

221,647

186,485

Total liabilities

2,434,327

2,075,288

Shareholders' equity:

Common stock, $.001 par value, 200,000,000

shares authorized, 30,711,227 and 31,975,645 issued and outstanding

as of December 31, 2024 and December 31, 2023, respectively (in

each case, excluding 34 treasury shares)

31

32

Additional paid-in capital

694,566

719,125

Accumulated other comprehensive income

782

610

Accumulated deficit

(371,833

)

(380,446

)

Total shareholders' equity

323,546

339,321

Noncontrolling interests

(10,682

)

(8,704

)

Total equity

312,864

330,617

$

2,747,191

$

2,405,905

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250214103239/en/

Katie Reinsmidt, Executive Vice President - Chief Operating

Officer, 423.490.8301, katie.reinsmidt@cblproperties.com

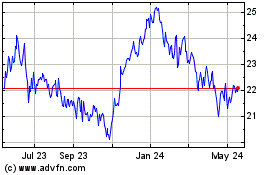

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Jan 2025 to Feb 2025

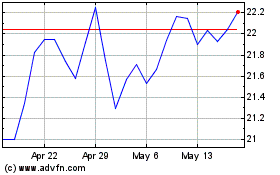

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Feb 2024 to Feb 2025