CBRE Group, Inc. (NYSE:CBRE) today announced that the company

plans to combine its Project Management business with Turner &

Townsend, its majority-owned subsidiary that provides program

management, cost consultancy and project management services

globally.

Upon closing the transaction, CBRE will own 70% of the combined

Turner & Townsend/CBRE Project Management business, with the

Turner & Townsend partners holding the remaining 30%. CBRE

acquired a 60% ownership interest in Turner & Townsend in

November 2021. Since then, Turner & Townsend has grown revenue

at a compound rate of more than 20%.

CBRE’s entire Project Management business, including Turner

& Townsend, produced net revenue of approximately $3 billion in

2023(1). Since 2021, combined net revenue has grown at a

double-digit annual rate with an approximately 15% net profit

margin(2). The net synergies derived from bringing the two

businesses together are expected to generate approximately $0.15 of

incremental run-rate core EPS(3) by the end of 2027, an amount that

is expected to grow over time. The cost of the incremental

investment in Turner & Townsend/CBRE Project Management is

approximately $70 million, exclusive of deal costs.

Bob Sulentic, CBRE’s chair and chief executive officer, said:

“Unifying our Project Management business will create an offering

that is unmatched for its scale and breadth of capabilities, with

more than 20,000 employees serving clients in over 60 countries.

Powerful secular trends, particularly increased spending on

infrastructure, green energy, and employee experience, are growth

catalysts for this business and we are well positioned to

capitalize on this significant opportunity.”

The combined business will be led by Vincent Clancy, Turner

& Townsend’s chief executive officer, who will continue to

report to a Board controlled by CBRE and comprised of senior

executives from both CBRE and Turner & Townsend.

“Vince is an exemplary leader who has guided Turner &

Townsend to great success,” Mr. Sulentic said. “Putting CBRE’s

extensive global Project Management resources and capabilities

under Vince will strengthen our value proposition for clients and

advance our growth ambitions.”

Mr. Clancy said: “Our ambition since joining forces with CBRE in

2021 has been to create the premier, differentiated program,

project and cost management capability globally. We have made

exceptional progress towards this goal and our revenue and profit

have grown significantly in the last three years. Turner &

Townsend’s momentum will continue to grow with the combining of two

great businesses into one integrated, pure play project management

capability. Our combined depth of talent and resources, global

footprint, sector expertise and commitment to excellence will be

second to none in project and program management.”

The CBRE Board of Directors intends to appoint Mr. Clancy to the

CBRE Board upon closing the transaction. “Vince will bring a global

perspective and deep experience in key growth areas like renewable

energy and infrastructure to our Board. We look forward to his

insights and contributions,” Mr. Sulentic said.

Beginning in 2025, CBRE intends to report Project Management

results in a new segment separate from Global Workplace Solutions

in order to provide increased transparency for investors.

Turner & Townsend operates across three business segments

globally, Real Estate – serving investors and occupiers across all

property types, including data centers and life sciences;

Infrastructure – notably transport and aviation; and Energy and

Natural Resources – including renewable energy, alternative fuels

and liquified natural gas.

The transaction is expected to close around year-end, subject to

satisfaction of regulatory and other customary conditions and

completion of required consultations with employee Works Councils

in certain jurisdictions.

About CBRE Group,

Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500

company headquartered in Dallas, is the world’s largest commercial

real estate services and investment firm (based on 2023 revenue).

The company has more than 130,000 employees (including Turner &

Townsend employees) serving clients in more than 100 countries.

CBRE serves a diverse range of clients with an integrated suite of

services, including facilities, transaction and project management;

property management; investment management; appraisal and

valuation; property leasing; strategic consulting; property sales;

mortgage services and development services. Please visit our

website at www.cbre.com. We routinely post important

information on our website, including corporate and investor

presentations and financial information. We intend to use our

website as a means of disclosing material, non-public information

and for complying with our disclosure obligations under Regulation

FD. Such disclosures will be included in the Investor Relations

section of our website at https://ir.cbre.com. Accordingly,

investors should monitor such portion of our website, in addition

to following our press releases, Securities and Exchange Commission

filings and public conference calls and webcasts.

About Turner &

Townsend

Turner & Townsend is a global professional services company

with over 10,000 people in 48 countries. Collaborating with our

clients across real estate, infrastructure and natural resources

sectors, the company specializes in major programs, program

management, cost and commercial management, net zero and digital

solutions. Turner & Townsend is majority-owned by CBRE Group,

Inc., the world’s largest commercial real estate services and

investment firm, with its partners holding a significant

non-controlling interest. www.turnerandtownsend.com

Forward-Looking

Statements

Certain of the statements in this release regarding the

combining of CBRE’s Project Management business with Turner &

Townsend and the performance of the combined business that do not

concern purely historical data are forward-looking statements

within the meaning of the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. The words

“anticipate,” “expect,” “intends,” “plan,” “will” and similar terms

and phrases are used in this release to identify forward-looking

statements. Forward-looking statements are made based on our

management’s expectations and beliefs concerning future events

affecting us, including the expected closing of the transaction and

the expected related net synergies, and are subject to

uncertainties and factors relating to our operations and business

environment, all of which are difficult to predict and many of

which are beyond our control. Accordingly, actual performance,

results and events may vary materially from those indicated in

forward-looking statements, and you should not rely on

forward-looking statements as predictions of future performance,

results or events. Numerous factors could cause actual future

performance, results and events to differ materially from those

indicated in forward-looking statements, including, but not limited

to, the ability to combine CBRE Project Management people and

capabilities with Turner & Townsend and successfully operate

the combined business, future demand for Project Management

services, as well as other risks and uncertainties discussed in our

filings with the U.S. Securities and Exchange Commission (SEC). Any

forward-looking statements speak only as of the date of this

release. We assume no obligation to update forward-looking

statements to reflect actual results, changes in assumptions or

changes in other factors affecting forward-looking information,

except to the extent required by applicable securities laws. If we

do update one or more forward-looking statements, no inference

should be drawn that we will make additional updates with respect

to those or other forward-looking statements. For additional

information concerning factors that may cause actual results to

differ from those anticipated in the forward-looking statements and

other risks and uncertainties to our business in general, please

refer to our SEC filings, including our Form 10-K for the fiscal

year ended December 31, 2023 and Form 10-Q for the quarter ended

March 31, 2024. Such filings are available publicly and may be

obtained from our website at www.cbre.com or upon request from the

CBRE Investor Relations Department at

investorrelations@cbre.com.

(1)

Reconciliation of Project Management revenue to net revenue is

shown below (dollars in millions):

Years ending December

31,

Project Management Revenue

2023

2022

2021

Revenue

$

7,310

$

4,650

$

2,932

Less: Pass through costs also recognized as revenue

4,186

1,915

1,395

Net revenue

$

3,124

$

2,735

$

1,537

Fiscal 2021 includes two months of

activity for Turner & Townsend since the acquisition closed on

November 1, 2021.

(2)

Represents management’s best

estimate of Project Management line of business’ contribution to

overall Global Workplace Solutions operating profit on a net

revenue basis.

(3)

CBRE has not reconciled the

(non-GAAP) Core EPS forward-looking guidance included in this

release to the most directly comparable GAAP measure because this

cannot be done without unreasonable effort due to the variability

and low visibility with respect to potential adjustments to future

earnings, such as acquisition related charges.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240624021635/en/

Chandni Luthra - Investors 212.984.8113 Chandni.Luthra@cbre.com

Steve Iaco – Media 212.984.6535 Steven.Iaco@cbre.com

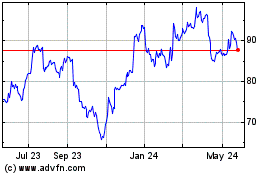

CBRE (NYSE:CBRE)

Historical Stock Chart

From Dec 2024 to Jan 2025

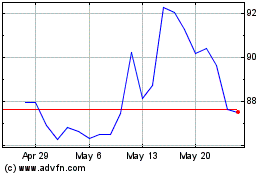

CBRE (NYSE:CBRE)

Historical Stock Chart

From Jan 2024 to Jan 2025