CBRE Group, Inc. (NYSE:CBRE) today reported financial results

for the second quarter ended June 30, 2024.

Key Highlights:

- Revenue up 9%; net revenue up 11%

- Resilient Business(1) net revenue increased 14%, bolstered by

Turner & Townsend’s 18% growth

- Advisory transaction revenue - leasing and capital markets -

rose 5%, supported by growth of 13% in U.S. leasing revenue and 20%

in mortgage origination fees

- GAAP EPS down 34% to $0.42; Core EPS down 2% to $0.81

- Deployed $1.3 billion of capital year-to-date across M&A

and REI co-investments

- Both net cash flow from operations and free cash flow improved

by approximately $300 million; free cash flow conversion was nearly

90%

- Now expect slightly over $1 billion of free cash flow for the

full year

- Increased full-year Core EPS outlook to a range of $4.70 to

$4.90 – up from $4.25 to $4.65

“CBRE had a successful second quarter for three reasons. First,

revenue, profitability and cash flow exceeded our expectations,

with outperformance across all three business segments. Second, we

made several sizable capital investments consistent with our

strategy to invest in cyclically resilient or secularly favored

elements of our business. And third, we made quick, material

progress on the cost challenges we identified last quarter,” said

Bob Sulentic, chair and chief executive officer of CBRE.

Consolidated Financial Results

Overview

The following table presents highlights of CBRE performance

(dollars in millions, except per share data; totals may not add due

to rounding):

% Change

Q2 2024

Q2 2023

USD

LC (2)

Operating Results

Revenue

$

8,391

$

7,720

8.7

%

9.4

%

Net revenue (3)

4,971

4,478

11.0

%

11.7

%

GAAP net income

130

201

(35.5

)%

(31.8

)%

GAAP EPS

0.42

0.64

(34.2

)%

(30.4

)%

Core adjusted net income (4)

248

258

(3.8

)%

(1.0

)%

Core EBITDA (5)

505

504

0.3

%

1.7

%

Core EPS (4)

0.81

0.82

(1.9

)%

1.0

%

Cash Flow Results

Cash flow provided by (used in)

operations

$

287

$

(11

)

N/M

Less: Capital expenditures

67

75

(10.6

)%

Free cash flow (6)

$

220

$

(86

)

N/M

Advisory Services

Segment

The following table presents highlights of the Advisory Services

segment performance (dollars in millions; totals may not add due to

rounding):

% Change

Q2 2024

Q2 2023

USD

LC

Revenue

$

2,218

$

2,042

8.6

%

9.3

%

Net revenue

2,195

2,021

8.6

%

9.3

%

Segment operating profit (7)

344

315

9.2

%

10.4

%

Segment operating profit on revenue margin

(8)

15.5

%

15.5

%

— pts

0.1 pts

Segment operating profit on net revenue

margin (8)

15.7

%

15.6

%

0.1 pts

0.2 pts

Note: all percent changes cited are vs. second-quarter 2023,

except where noted.

Property Leasing

- Global leasing revenue rose 9% (same local currency), exceeding

expectations.

- Growth was driven by the Americas, with leasing revenue up 12%

(13% local currency), including 13% in the United States.

- Asia-Pacific (APAC) leasing revenue rose 3% (7% local

currency), with solid growth across most of the region.

- In Europe, the Middle East & Africa (EMEA), leasing revenue

fell 3% (4% local currency) with growth in the Netherlands, Poland

and Spain offset by weakness elsewhere in the region.

- Globally, office leasing once again increased by double digits,

led by the United States. New York office leasing was a key driver

in the quarter.

- U.S. leasing showed continued momentum in July.

Capital Markets

- Property sales revenue began to stabilize. Global sales revenue

declined 3% (2% local currency), less pronounced than

expected.

- EMEA once again paced global activity with sales revenue up 3%

(same local currency), led by double-digit growth in the United

Kingdom, where property values have largely reset.

- In contrast, sales revenue fell 4% (same local currency) in the

Americas and 5% (up 1% local currency) in APAC. Greater China,

India and Singapore showed solid growth in the quarter.

- Among property types, industrial and multifamily sales showed

global growth.

- Mortgage origination revenue jumped 38% (same local currency),

led by a 20% increase in loan origination fees reflecting

refinancing activity with debt funds, as well as higher interest

earnings on escrow balances.

Other Advisory Business Lines

- Loan servicing revenue rose 7% (6% local currency). The

servicing portfolio increased to more than $425 billion, up 3% for

the quarter and 7% from a year ago.

- Property management net revenue increased 16% (same local

currency), fueled by the onboarding of the Brookfield 65 million

sq. ft. U.S. office portfolio.

- Valuations revenue edged up 2% (3% local currency). Growth was

strongest in Continental Europe.

Global Workplace Solutions

(GWS) Segment

The following table presents highlights of the GWS segment

performance (dollars in millions; totals may not add due to

rounding):

% Change

Q2 2024

Q2 2023

USD

LC

Revenue

$

5,944

$

5,426

9.5

%

10.3

%

Net revenue

2,547

2,205

15.5

%

16.3

%

Segment operating profit

258

233

10.8

%

12.0

%

Segment operating profit on revenue

margin

4.3

%

4.3

%

— pts

0.1 pts

Segment operating profit on net revenue

margin

10.1

%

10.6

%

(0.4 pts)

(0.4 pts)

Note: all percent changes cited are vs. second-quarter 2023,

except where noted.

- Facilities management net revenue increased 18% (19% local

currency), paced by strength in the Local business. Organic net

revenue, which excludes contributions from companies acquired since

July 1, 2023, was also up by double digits.

- Project management net revenue rose 11% (12% local currency),

with continued strong growth from Turner & Townsend.

- Net operating margin improved 20 basis points compared with

first-quarter 2024 reflecting the early benefit of recent cost

actions but was below the prior-year second quarter level.

Real Estate Investments (REI)

Segment

The following table presents highlights of the REI segment

performance (dollars in millions):

% Change

Q2 2024

Q2 2023

USD

LC

Revenue

$

232

$

256

(9.2

)%

(9.2

)%

Segment operating profit

10

33

(69.8

)%

(68.4

)%

Note: all percent changes cited are vs. second-quarter 2023,

except where noted.

Investment Management

- Total revenue slipped 2% (1% local currency).

- Operating profit increased 4% (5% local currency) to

approximately $39 million, largely due to higher co-investment

returns.

- Assets Under Management (AUM) totaled $142.5 billion, a

decrease of $1.5 billion from first-quarter 2024. The decrease was

primarily driven by lower asset values as well as adverse foreign

currency movement.

Real Estate Development

- Global development operating loss(9) totaled approximately $26

million. As expected, asset sales activity was limited in the

period.

- The in-process portfolio ended second-quarter 2024 at $18.8

billion, unchanged from first-quarter 2024. The pipeline increased

$0.3 billion during the quarter to $13.1 billion.

Corporate and Other

Segment

- Non-core operating loss totaled $13 million, primarily due to

the lower value of the company’s investment in Altus Power, Inc.

(NYSE:AMPS), reflecting a decline in its share price during the

quarter.

- Core corporate operating loss increased by approximately $29

million, primarily due to a resetting of incentive compensation,

which had been reduced in last year’s second quarter.

Capital Allocation

Overview

- Free Cash Flow – During the second quarter of 2024, free

cash flow was $220 million. This reflected cash provided by

operating activities of $287 million, adjusted for total capital

expenditures of $67 million.(10) Cash flow conversion improved to

64% on a trailing 12-month basis, the third consecutive

increase.

- Stock Repurchase Program – The company repurchased

approximately 0.6 million shares for $48.4 million ($87.25 average

price per share) during the second quarter. There was approximately

$1.4 billion of capacity remaining under the company’s authorized

stock repurchase program as of June 30, 2024.

- Acquisitions and Investments – During the second

quarter, CBRE made acquisitions totaling approximately $290.9

million in cash and non-cash consideration, primarily for Direct

Line Global, a leading provider of technical facilities management

services for data center owners and operators. Direct Line Global

serves the world’s largest global technology companies across the

hyperscale, co-location and enterprise markets. CBRE also acquired

a provider of local facilities management technical services in

Canada. During the quarter, CBRE also announced plans to combine

its project management business with its Turner & Townsend

subsidiary. The combined business, which will be reported as a

separate business segment beginning in 2025, will create a premier

project, program and cost management business with more than 20,000

employees serving clients in over 60 countries.

Leverage and Financing

Overview

- Leverage – CBRE’s net leverage ratio (net debt(11) to

trailing twelve-month core EBITDA) was 1.58x as of June 30, 2024,

which is substantially below the company’s primary debt covenant of

4.25x. The net leverage ratio is computed as follows (dollars in

millions):

As of

June 30, 2024

Total debt

$

4,247

Less: Cash (12)

928

Net debt (11)

$

3,319

Divided by: Trailing twelve-month Core

EBITDA

$

2,103

Net leverage ratio

1.58x

- Liquidity – As of June 30, 2024, the company had

approximately $3.7 billion of total liquidity, consisting of $927.7

million in cash, plus the ability to borrow an aggregate of

approximately $2.7 billion under its revolving credit facilities,

net of any outstanding letters of credit.

Conference Call Details

The company’s second quarter earnings webcast and conference

call will be held today, Thursday, July 25, 2024 at 8:30 a.m.

Eastern Time. Investors are encouraged to access the webcast via

this link or they can click this link beginning at

8:15 a.m. Eastern Time for automated access to the conference

call.

Alternatively, investors may dial into the conference call using

these operator-assisted phone numbers: 877.407.8037 (U.S.) or

201.689.8037 (International). A replay of the call will be

available starting at 1:00 p.m. Eastern Time on July 25, 2024. The

replay is accessible by dialing 877.660.6853 (U.S.) or 201.612.7415

(International) and using the access code: 13747576#. A transcript

of the call will be available on the company's Investor Relations

website at https://ir.cbre.com.

About CBRE Group,

Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500

company headquartered in Dallas, is the world’s largest commercial

real estate services and investment firm (based on 2023 revenue).

The company has more than 130,000 employees (including Turner &

Townsend employees) serving clients in more than 100 countries.

CBRE serves a diverse range of clients with an integrated suite of

services, including facilities, transaction and project management;

property management; investment management; appraisal and

valuation; property leasing; strategic consulting; property sales;

mortgage services and development services. Please visit our

website at www.cbre.com. We routinely post important

information on our website, including corporate and investor

presentations and financial information. We intend to use our

website as a means of disclosing material, non-public information

and for complying with our disclosure obligations under Regulation

FD. Such disclosures will be included in the Investor Relations

section of our website at https://ir.cbre.com. Accordingly,

investors should monitor such portion of our website, in addition

to following our press releases, Securities and Exchange Commission

filings and public conference calls and webcasts.

Safe Harbor and

Footnotes

This press release contains forward-looking statements within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including statements

regarding the economic outlook, the company’s future growth

momentum, operations and business outlook. These forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause the company’s actual results and performance

in future periods to be materially different from any future

results or performance suggested in forward-looking statements in

this press release. Any forward-looking statements speak only as of

the date of this press release and, except to the extent required

by applicable securities laws, the company expressly disclaims any

obligation to update or revise any of them to reflect actual

results, any changes in expectations or any change in events. If

the company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with

respect to those or other forward-looking statements. Factors that

could cause results to differ materially include, but are not

limited to: disruptions in general economic, political and

regulatory conditions and significant public health events,

particularly in geographies or industry sectors where our business

may be concentrated; volatility or adverse developments in the

securities, capital or credit markets, interest rate increases and

conditions affecting the value of real estate assets, inside and

outside the United States; poor performance of real estate

investments or other conditions that negatively impact clients’

willingness to make real estate or long-term contractual

commitments and the cost and availability of capital for investment

in real estate; foreign currency fluctuations and changes in

currency restrictions, trade sanctions and import/export and

transfer pricing rules; our ability to compete globally, or in

specific geographic markets or business segments that are material

to us; our ability to identify, acquire and integrate accretive

companies; costs and potential future capital requirements relating

to companies we may acquire; integration challenges arising out of

companies we may acquire; increases in unemployment and general

slowdowns in commercial activity; trends in pricing and risk

assumption for commercial real estate services; the effect of

significant changes in capitalization rates across different

property types; a reduction by companies in their reliance on

outsourcing for their commercial real estate needs, which would

affect our revenues and operating performance; client actions to

restrain project spending and reduce outsourced staffing levels;

our ability to further diversify our revenue model to offset

cyclical economic trends in the commercial real estate industry;

our ability to attract new occupier and investor clients; our

ability to retain major clients and renew related contracts; our

ability to leverage our global services platform to maximize and

sustain long-term cash flow; our ability to continue investing in

our platform and client service offerings; our ability to maintain

expense discipline; the emergence of disruptive business models and

technologies; negative publicity or harm to our brand and

reputation; the failure by third parties we do business with to

comply with service level agreements or regulatory or legal

requirements; the ability of our investment management business to

maintain and grow assets under management and achieve desired

investment returns for our investors, and any potential related

litigation, liabilities or reputational harm possible if we fail to

do so; our ability to manage fluctuations in net earnings and cash

flow, which could result from poor performance in our investment

programs, including our participation as a principal in real estate

investments; the ability of our indirect subsidiary, CBRE Capital

Markets, Inc., to periodically amend, or replace, on satisfactory

terms, the agreements for its warehouse lines of credit; declines

in lending activity of U.S. GSEs, regulatory oversight of such

activity and our mortgage servicing revenue from the commercial

real estate mortgage market; changes in U.S. and international law

and regulatory environments (including relating to anti-corruption,

anti-money laundering, trade sanctions, tariffs, currency controls

and other trade control laws), particularly in Asia, Africa,

Russia, Eastern Europe and the Middle East, due to the level of

political instability in those regions; litigation and its

financial and reputational risks to us; our exposure to liabilities

in connection with real estate advisory and property management

activities and our ability to procure sufficient insurance coverage

on acceptable terms; our ability to retain, attract and incentivize

key personnel; our ability to manage organizational challenges

associated with our size; liabilities under guarantees, or for

construction defects, that we incur in our development services

business; variations in historically customary seasonal patterns

that cause our business not to perform as expected; our leverage

under our debt instruments as well as the limited restrictions

therein on our ability to incur additional debt, and the potential

increased borrowing costs to us from a credit-ratings downgrade;

our and our employees’ ability to execute on, and adapt to,

information technology strategies and trends; cybersecurity threats

or other threats to our information technology networks, including

the potential misappropriation of assets or sensitive information,

corruption of data or operational disruption; our ability to comply

with laws and regulations related to our global operations,

including real estate licensure, tax, labor and employment laws and

regulations, fire and safety building requirements and regulations,

as well as data privacy and protection regulations and ESG matters,

and the anti-corruption laws and trade sanctions of the U.S. and

other countries; changes in applicable tax or accounting

requirements; any inability for us to implement and maintain

effective internal controls over financial reporting; the effect of

implementation of new accounting rules and standards or the

impairment of our goodwill and intangible assets; and the

performance of our equity investments in companies that we do not

control.

Additional information concerning factors that may influence the

company’s financial information is discussed under “Risk Factors,”

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations,” “Quantitative and Qualitative Disclosures

About Market Risk” and “Cautionary Note on Forward-Looking

Statements” in our Annual Report on Form 10-K for the year ended

December 31, 2023, our latest quarterly report on Form 10-Q, as

well as in the company’s press releases and other periodic filings

with the Securities and Exchange Commission (SEC). Such filings are

available publicly and may be obtained on the company’s website at

www.cbre.com or upon written request from CBRE’s Investor Relations

Department at investorrelations@cbre.com.

The terms “net revenue,” “core adjusted net income,” “core

EBITDA,” “core EPS,” “business line operating profit (loss),”

“segment operating profit on revenue margin,” “segment operating

profit on net revenue margin,” “net debt” and “free cash flow,” all

of which CBRE uses in this press release, are non-GAAP financial

measures under SEC guidelines, and you should refer to the

footnotes below as well as the “Non-GAAP Financial Measures”

section in this press release for a further explanation of these

measures. We have also included in that section reconciliations of

these measures in specific periods to their most directly

comparable financial measure calculated and presented in accordance

with GAAP for those periods.

Totals may not sum in tables in millions included in this

release due to rounding.

Note: We have not reconciled the (non-GAAP) core earnings per

share forward-looking guidance included in this release to the most

directly comparable GAAP measure because this cannot be done

without unreasonable effort due to the variability and low

visibility with respect to costs related to acquisitions, carried

interest incentive compensation and financing costs, which are

potential adjustments to future earnings. We expect the variability

of these items to have a potentially unpredictable, and a

potentially significant, impact on our future GAAP financial

results.

(1)

Net revenue from Resilient Businesses

includes facilities management, project management, property

management, loan servicing, valuations and investment management

business fees. Net revenue from Transactional Businesses includes

sales, leasing, mortgage origination, carried interest and

incentive fees in the investment management business, and

development fees.

(2)

Local currency percentage change is

calculated by comparing current-period results at prior-period

exchange rates versus prior-period results.

(3)

Net revenue is gross revenue less costs

largely associated with subcontracted vendor work performed for

clients. These costs are reimbursable by clients and generally have

no margin.

(4)

Core adjusted net income and core earnings

per diluted share (or core EPS) exclude the effect of select items

from GAAP net income and GAAP earnings per diluted share as well as

adjust the provision for (benefit from) income taxes and impact on

non-controlling interest for such charges. Adjustments during the

periods presented included non-cash depreciation and amortization

expense related to certain assets attributable to acquisitions and

restructuring activities, interest expense related to indirect tax

settlement, certain carried interest incentive compensation expense

(reversal) to align with the timing of associated revenue, costs

incurred related to legal entity restructuring, write-off of

financing costs on extinguished debt, integration and other costs

related to acquisitions, asset impairments, costs associated with

efficiency and cost-reduction initiatives, and charges related to

indirect tax settlement. It also removes the fair value changes and

related tax impact of certain strategic non-core non-controlling

equity investments that are not directly related to our business

segments (including venture capital “VC” related investments).

(5)

Core EBITDA represents earnings, inclusive

of non-controlling interest, before net interest expense, write-off

of financing costs on extinguished debt, income taxes, depreciation

and amortization, asset impairments, adjustments related to certain

carried interest incentive compensation expense (reversal) to align

with the timing of associated revenue, costs incurred related to

legal entity restructuring, integration and other costs related to

acquisitions, costs associated with efficiency and cost-reduction

initiatives, charges related to indirect tax settlement. It also

removes the fair value changes, on a pre-tax basis, of certain

strategic non-core non-controlling equity investments that are not

directly related to our business segments (including venture

capital “VC” related investments).

(6)

Free cash flow is calculated as cash flow

provided by operations, less capital expenditures (reflected in the

investing section of the consolidated statement of cash flows).

(7)

Segment operating profit (loss) is the

measure reported to the chief operating decision maker (CODM) for

purposes of making decisions about allocating resources to each

segment and assessing performance of each segment. Segment

operating profit represents earnings, inclusive of non-controlling

interest, before net interest expense, write-off of financing costs

on extinguished debt, income taxes, depreciation and amortization

and asset impairments, as well as adjustments related to the

following: certain carried interest incentive compensation expense

(reversal) to align with the timing of associated revenue, costs

incurred related to legal entity restructuring, integration and

other costs related to acquisitions, costs associated with

efficiency and cost-reduction initiatives, and charges related to

indirect tax settlement.

(8)

Segment operating profit on revenue and

net revenue margins represent segment operating profit divided by

revenue and net revenue, respectively.

(9)

Represents line of business

profitability/losses, as adjusted.

(10)

For the three months ended June 30, 2024,

the company incurred capital expenditures of $66.8 million

(reflected in the investing section of the condensed consolidated

statement of cash flows) and received tenant concessions from

landlords of $5.9 million (reflected in the operating section of

the condensed consolidated statement of cash flows).

(11)

Net debt is calculated as total debt

(excluding non-recourse debt) less cash and cash equivalents.

(12)

Cash represents cash and cash equivalents

(excluding restricted cash).

CBRE GROUP, INC.

OPERATING RESULTS

FOR THE THREE AND SIX MONTHS

ENDED JUNE 30, 2024 AND 2023

(in millions, except share and

per share data)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenue:

Net revenue

$

4,971

$

4,478

$

9,415

$

8,658

Pass-through costs also recognized as

revenue

3,420

3,242

6,911

6,473

Total revenue

8,391

7,720

16,326

15,131

Costs and expenses:

Cost of revenue

6,793

6,179

13,268

12,186

Operating, administrative and other

1,191

1,089

2,302

2,297

Depreciation and amortization

161

155

319

316

Total costs and expenses

8,145

7,423

15,889

14,799

Gain on disposition of real estate

—

9

13

12

Operating income

246

306

450

344

Equity (loss) income from unconsolidated

subsidiaries

(15

)

(8

)

(73

)

134

Other income

6

6

15

8

Interest expense, net of interest

income

63

43

99

71

Income before provision for income

taxes

174

261

293

415

Provision for income taxes

32

55

3

84

Net income

142

206

290

331

Less: Net income attributable to

non-controlling interests

12

5

34

13

Net income attributable to CBRE Group,

Inc.

$

130

$

201

$

256

$

318

Basic income per share:

Net income per share attributable to CBRE

Group, Inc.

$

0.42

$

0.65

$

0.84

$

1.02

Weighted average shares outstanding for

basic income per share

306,745,116

310,857,203

306,276,871

310,662,324

Diluted income per share:

Net income per share attributable to CBRE

Group, Inc.

$

0.42

$

0.64

$

0.83

$

1.01

Weighted average shares outstanding for

diluted income per share

308,035,211

314,282,247

308,269,040

314,821,615

Core EBITDA

$

505

$

504

$

930

$

1,036

CBRE GROUP, INC.

SEGMENT RESULTS

FOR THE THREE MONTHS ENDED

JUNE 30, 2024

(in millions, totals may not

add due to rounding)

(Unaudited)

Three Months Ended June 30,

2024

Advisory

Services

Global Workplace

Solutions

Real Estate

Investments

Corporate (1)

Total Core

Other

Total

Consolidated

Revenue:

Net revenue

$

2,195

$

2,547

$

232

$

(3

)

$

4,971

$

—

$

4,971

Pass-through costs also recognized as

revenue

23

3,397

—

—

3,420

—

3,420

Total revenue

2,218

5,944

232

(3

)

8,391

—

8,391

Costs and expenses:

Cost of revenue

1,359

5,377

57

—

6,793

—

6,793

Operating, administrative and other

515

354

169

153

1,191

—

1,191

Depreciation and amortization

63

81

3

14

161

—

161

Total costs and expenses

1,937

5,812

229

167

8,145

—

8,145

Operating income (loss)

281

132

3

(170

)

246

—

246

Equity income (loss) from unconsolidated

subsidiaries

—

3

4

—

7

(22

)

(15

)

Other (loss) income

—

(1

)

(1

)

(1

)

(3

)

9

6

Add-back: Depreciation and

amortization

63

81

3

14

161

—

161

Adjustments:

Costs associated with efficiency and

cost-reduction initiatives

—

30

—

37

67

—

67

Charges related to indirect tax

settlement

—

—

—

13

13

—

13

Carried interest incentive compensation

expense to align with the timing of associated revenue

—

—

1

—

1

—

1

Integration and other costs related to

acquisitions

—

13

—

—

13

—

13

Total segment operating profit (loss)

$

344

$

258

$

10

$

(107

)

$

(13

)

$

492

Core EBITDA

$

505

_______________

(1)

Includes elimination of inter-segment

revenue.

CBRE GROUP, INC.

SEGMENT

RESULTS—(CONTINUED)

FOR THE THREE MONTHS ENDED

JUNE 30, 2023

(in millions, totals may not

add due to rounding)

(Unaudited)

Three Months Ended June 30,

2023

Advisory

Services

Global Workplace

Solutions

Real Estate

Investments

Corporate (1)

Total Core

Other

Total

Consolidated

Revenue:

Net revenue

$

2,021

$

2,205

$

256

$

(4

)

$

4,478

$

—

$

4,478

Pass-through costs also recognized as

revenue

21

3,221

—

—

3,242

—

3,242

Total revenue

2,042

5,426

256

(4

)

7,720

—

7,720

Costs and expenses:

Cost of revenue

1,234

4,897

51

(3

)

6,179

—

6,179

Operating, administrative and other

498

307

177

107

1,089

—

1,089

Depreciation and amortization

72

65

3

15

155

—

155

Total costs and expenses

1,804

5,269

231

119

7,423

—

7,423

Gain on disposition of real estate

—

—

9

—

9

—

9

Operating income (loss)

238

157

34

(123

)

306

—

306

Equity income (loss) from unconsolidated

subsidiaries

1

—

(3

)

—

(2

)

(6

)

(8

)

Other income (loss)

2

2

—

3

7

(1

)

6

Add-back: Depreciation and

amortization

72

65

3

15

155

—

155

Adjustments:

Costs associated with efficiency and

cost-reduction initiatives

2

1

—

—

3

—

3

Integration and other costs related to

acquisitions

—

8

—

28

36

—

36

Carried interest incentive compensation

reversal to align with the timing of associated revenue

—

—

(1

)

—

(1

)

—

(1

)

Total segment operating profit (loss)

$

315

$

233

$

33

$

(77

)

$

(7

)

$

497

Core EBITDA

$

504

_______________

(1)

Includes elimination of inter-segment

revenue.

CBRE GROUP, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in millions)

(Unaudited)

June 30, 2024

December 31, 2023

ASSETS

Current Assets:

Cash and cash equivalents

$

928

$

1,265

Restricted cash

105

106

Receivables, net

6,304

6,370

Warehouse receivables (1)

973

675

Contract assets

454

443

Prepaid expenses

342

333

Income taxes receivable

190

159

Other current assets

357

315

Total Current Assets

9,653

9,666

Property and equipment, net

895

907

Goodwill

5,667

5,129

Other intangible assets, net

2,385

2,081

Operating lease assets

1,032

1,030

Investments in unconsolidated

subsidiaries

1,309

1,374

Non-current contract assets

92

75

Real estate under development

380

300

Non-current income taxes receivable

77

78

Deferred tax assets, net

338

361

Other assets, net

1,634

1,547

Total Assets

$

23,462

$

22,548

LIABILITIES AND EQUITY

Current Liabilities:

Accounts payable and accrued expenses

$

3,568

$

3,562

Compensation and employee benefits

payable

1,230

1,459

Accrued bonus and profit sharing

974

1,556

Operating lease liabilities

244

242

Contract liabilities

311

298

Income taxes payable

128

217

Warehouse lines of credit (which fund

loans that U.S. Government Sponsored Enterprises have committed to

purchase) (1)

961

666

Revolving credit facility

940

—

Other short-term borrowings

7

16

Current maturities of long-term debt

28

9

Other current liabilities

238

218

Total Current Liabilities

8,629

8,243

Long-term debt, net of current

maturities

3,272

2,804

Non-current operating lease

liabilities

1,091

1,089

Non-current income taxes payable

—

30

Non-current tax liabilities

148

157

Deferred tax liabilities, net

248

255

Other liabilities

885

903

Total Liabilities

14,273

13,481

Equity:

CBRE Group, Inc. Stockholders’ Equity:

Class A common stock

3

3

Additional paid-in capital

—

—

Accumulated earnings

9,384

9,188

Accumulated other comprehensive loss

(1,031

)

(924

)

Total CBRE Group, Inc. Stockholders’

Equity

8,356

8,267

Non-controlling interests

833

800

Total Equity

9,189

9,067

Total Liabilities and Equity

$

23,462

$

22,548

(1)

Represents loan receivables, the majority

of which are offset by borrowings under related warehouse line of

credit facilities.

CBRE GROUP, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in millions)

(Unaudited)

Six Months Ended June

30,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net income

$

290

$

331

Adjustments to reconcile net income to net

cash used in operating activities:

Depreciation and amortization

319

316

Amortization of financing costs

3

2

Gains related to mortgage servicing

rights, premiums on loan sales and sales of other assets

(60

)

(45

)

Gain on disposition of real estate

assets

(13

)

—

Net realized and unrealized gains,

primarily from investments

(2

)

(3

)

Provision for doubtful accounts

9

6

Net compensation expense for equity

awards

69

39

Equity loss (income) from unconsolidated

subsidiaries

73

(134

)

Distribution of earnings from

unconsolidated subsidiaries

30

183

Proceeds from sale of mortgage loans

4,129

4,356

Origination of mortgage loans

(4,408

)

(4,894

)

Increase in warehouse lines of credit

295

549

Tenant concessions received

13

7

Purchase of equity securities

(28

)

(8

)

Proceeds from sale of equity

securities

46

8

Increase in real estate under

development

(6

)

(37

)

Decrease (increase) in receivables,

prepaid expenses and other assets (including contract and lease

assets)

110

(101

)

Decrease in accounts payable and accrued

expenses and other liabilities (including contract and lease

liabilities)

(77

)

(313

)

Decrease in compensation and employee

benefits payable and accrued bonus and profit sharing

(788

)

(811

)

Increase in net income taxes

receivable/payable

(153

)

(157

)

Other operating activities, net

(56

)

(50

)

Net cash used in operating activities

(205

)

(756

)

CASH FLOWS FROM INVESTING

ACTIVITIES:

Capital expenditures

(135

)

(135

)

Acquisition of businesses, including net

assets acquired and goodwill, net of cash acquired

(1,051

)

(166

)

Contributions to unconsolidated

subsidiaries

(73

)

(60

)

Distributions from unconsolidated

subsidiaries

29

21

Acquisition and development of real estate

assets

(136

)

—

Proceeds from disposition of real estate

assets

6

—

Other investing activities, net

53

(30

)

Net cash used in investing activities

(1,307

)

(370

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Proceeds from revolving credit

facility

2,505

3,206

Repayment of revolving credit facility

(1,565

)

(2,801

)

Proceeds from notes payable on real

estate

12

—

Proceeds from issuance of 5.500% senior

notes

495

—

Proceeds from issuance of 5.950% senior

notes

—

975

Repurchase of common stock

(47

)

(130

)

Acquisition of businesses (cash paid for

acquisitions more than three months after purchase date)

(16

)

(68

)

Units repurchased for payment of taxes on

equity awards

(97

)

(50

)

Non-controlling interest contributions

17

2

Non-controlling interest distributions

(30

)

(1

)

Other financing activities, net

(32

)

(58

)

Net cash provided by financing

activities

1,242

1,075

Effect of currency exchange rate changes

on cash and cash equivalents and restricted cash

(68

)

3

NET DECREASE IN CASH AND CASH

EQUIVALENTS AND RESTRICTED CASH

(338

)

(48

)

CASH AND CASH EQUIVALENTS AND

RESTRICTED CASH, AT BEGINNING OF PERIOD

1,371

1,405

CASH AND CASH EQUIVALENTS AND

RESTRICTED CASH, AT END OF PERIOD

$

1,033

$

1,357

SUPPLEMENTAL DISCLOSURES OF CASH FLOW

INFORMATION:

Cash paid during the period

for:

Interest

$

170

$

91

Income tax payments, net

$

244

$

303

Non-cash investing and financing

activities:

Deferred and/or contingent

consideration

$

15

$

—

Non-GAAP Financial

Measures

The following measures are considered “non-GAAP financial

measures” under SEC guidelines:

(i)

Net revenue

(ii)

Core EBITDA

(iii)

Business line operating profit/loss

(iv)

Segment operating profit on revenue and

net revenue margins

(v)

Free cash flow

(vi)

Net debt

(vii)

Core net income attributable to CBRE

Group, Inc. stockholders, as adjusted (which we also refer to as

“core adjusted net income”)

(viii)

Core EPS

These measures are not recognized measurements under United

States generally accepted accounting principles (GAAP). When

analyzing our operating performance, investors should use these

measures in addition to, and not as an alternative for, their most

directly comparable financial measure calculated and presented in

accordance with GAAP. Because not all companies use identical

calculations, our presentation of these measures may not be

comparable to similarly titled measures of other companies.

Our management generally uses these non-GAAP financial measures

to evaluate operating performance and for other discretionary

purposes. The company believes these measures provide a more

complete understanding of ongoing operations, enhance comparability

of current results to prior periods and may be useful for investors

to analyze our financial performance because they eliminate the

impact of selected charges that may obscure trends in the

underlying performance of our business. The company further uses

certain of these measures, and believes that they are useful to

investors, for purposes described below.

With respect to net revenue, net revenue is gross revenue less

costs largely associated with subcontracted vendor work performed

for clients. We believe that investors may find this measure useful

to analyze the company’s overall financial performance because it

excludes costs reimbursable by clients that generally have no

margin, and as such provides greater visibility into the underlying

performance of our business.

With respect to Core EBITDA, business line operating

profit/loss, and segment operating profit on revenue and net

revenue margins, the company believes that investors may find these

measures useful in evaluating our operating performance compared to

that of other companies in our industry because their calculations

generally eliminate the accounting effects of strategic

acquisitions, which would include impairment charges of goodwill

and intangibles created from such acquisitions, the effects of

financings and income tax and the accounting effects of capital

spending. All of these measures may vary for different companies

for reasons unrelated to overall operating performance. In the case

of Core EBITDA, this measure is not intended to be a measure of

free cash flow for our management’s discretionary use because it

does not consider cash requirements such as tax and debt service

payments. The Core EBITDA measure calculated herein may also differ

from the amounts calculated under similarly titled definitions in

our credit facilities and debt instruments, which amounts are

further adjusted to reflect certain other cash and non-cash charges

and are used by us to determine compliance with financial covenants

therein and our ability to engage in certain activities, such as

incurring additional debt. The company also uses segment operating

profit and core EPS as significant components when measuring our

operating performance under our employee incentive compensation

programs.

With respect to free cash flow, the company believes that

investors may find this measure useful to analyze the cash flow

generated from operations after accounting for cash outflows to

support operations and capital expenditures. With respect to net

debt, the company believes that investors use this measure when

calculating the company’s net leverage ratio.

With respect to core EBITDA, core EPS and core adjusted net

income, the company believes that investors may find these measures

useful to analyze the underlying performance of operations without

the impact of strategic non-core equity investments (Altus Power,

Inc. and certain other investments) that are not directly related

to our business segments. These can be volatile and are often

non-cash in nature.

Core net income attributable to CBRE Group, Inc. stockholders,

as adjusted (or core adjusted net income), and core EPS, are

calculated as follows (in millions, except share and per share

data):

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income attributable to CBRE Group,

Inc.

$

130

$

201

$

256

$

318

Adjustments:

Non-cash depreciation and amortization

expense related to certain assets attributable to acquisitions and

restructuring activities

47

40

87

90

Interest expense related to indirect tax

settlement

8

—

8

—

Impact of adjustments on non-controlling

interest

(6

)

(8

)

(6

)

(18

)

Net fair value adjustments on strategic

non-core investments

13

7

84

33

Costs associated with efficiency and

cost-reduction initiatives

67

3

97

141

Charges related to indirect tax

settlement

13

—

13

—

Carried interest incentive compensation

expense (reversal) to align with the timing of associated

revenue

1

(1

)

15

6

Costs incurred related to legal entity

restructuring

—

—

2

—

Integration and other costs related to

acquisitions (1)

13

36

8

54

Tax impact of adjusted items and strategic

non-core investments

(38

)

(20

)

(75

)

(76

)

Core net income attributable to CBRE

Group, Inc., as adjusted

$

248

$

258

$

489

$

548

Core diluted income per share attributable

to CBRE Group, Inc., as adjusted

$

0.81

$

0.82

$

1.59

$

1.74

Weighted average shares outstanding for

diluted income per share

308,035,211

314,282,247

308,269,040

314,821,615

Core EBITDA is calculated as follows (in millions, totals may

not add due to rounding):

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income attributable to CBRE Group,

Inc.

$

130

$

201

$

256

$

318

Net income attributable to non-controlling

interests

12

5

34

13

Net income

142

206

290

331

Adjustments:

Depreciation and amortization

161

155

319

316

Interest expense, net of interest

income

63

43

99

71

Provision for income taxes

32

55

3

84

Costs associated with efficiency and

cost-reduction initiatives

67

3

97

141

Charges related to indirect tax

settlement

13

—

13

—

Carried interest incentive compensation

expense (reversal) to align with the timing of associated

revenue

1

(1

)

15

6

Costs incurred related to legal entity

restructuring

—

—

2

—

Integration and other costs related to

acquisitions (1)

13

36

8

54

Net fair value adjustments on strategic

non-core investments

13

7

84

33

Core EBITDA

$

505

$

504

$

930

$

1,036

(1)

During the first quarter of 2024, we

incurred integration and other costs related to acquisitions of

$17.5 million in deal and integration costs, offset by reversal of

$21.7 million in previously recognized transaction-related bonus

expense due to change in estimate.

Core EBITDA for the trailing twelve months ended June 30, 2024

is calculated as follows (in millions):

Trailing Twelve Months

Ended June 30, 2024

Net income attributable to CBRE Group,

Inc.

$

924

Net income attributable to non-controlling

interests

62

Net income

986

Adjustments:

Depreciation and amortization

625

Interest expense, net of interest

income

177

Provision for income taxes

169

Costs incurred related to legal entity

restructuring

15

Integration and other costs related to

acquisitions (1)

16

Carried interest incentive compensation

expense to align with the timing of associated revenue

2

Costs associated with efficiency and

cost-reduction initiatives

115

Charges related to indirect tax

settlement

13

One-time gain associated with remeasuring

an investment in an unconsolidated subsidiary to fair value as of

the date the remaining controlling interest was acquired

(34

)

Net fair value adjustments on strategic

non-core investments

19

Core EBITDA

$

2,103

_______________

(1)

During the first quarter of 2024, we

incurred integration and other costs related to acquisitions of

$17.5 million in deal and integration costs, offset by reversal of

$21.7 million in previously recognized transaction-related bonus

expense due to change in estimate.

Revenue includes client reimbursed pass-through costs largely

associated with employees that are dedicated to client facilities

and subcontracted vendor work performed for clients. Reimbursement

related to subcontracted vendor work generally has no margin and

has been excluded from net revenue. Reconciliations are shown below

(dollars in millions):

Three Months Ended June

30,

2024

2023

Consolidated

Revenue

$

8,391

$

7,720

Less: Pass-through costs also recognized

as revenue

3,420

3,242

Net revenue

$

4,971

$

4,478

Three Months Ended June

30,

2024

2023

Property

Management Revenue

Revenue

$

555

$

481

Less: Pass-through costs also recognized

as revenue

23

21

Net revenue

$

532

$

460

Three Months Ended June

30,

2024

2023

GWS

Revenue

Revenue

$

5,944

$

5,426

Less: Pass-through costs also recognized

as revenue

3,397

3,221

Net revenue

$

2,547

$

2,205

Three Months Ended June

30,

2024

2023

Facilities

Management Revenue

Revenue

$

4,127

$

3,686

Less: Pass-through costs also recognized

as revenue

2,430

2,247

Net revenue

$

1,697

$

1,439

Three Months Ended June

30,

2024

Facilities

Management Revenue from acquisitions since July 1,

2023

Revenue

$

106

Less: Pass-through costs also recognized

as revenue

8

Net revenue

$

98

Three Months Ended June

30,

2024

2023

Project

Management Revenue

Revenue

$

1,817

$

1,740

Less: Pass-through costs also recognized

as revenue

967

974

Net revenue

$

850

$

766

Three Months Ended June

30,

2024

2023

Turner &

Townsend

Revenue

$

528

$

442

Less: Pass-through costs also recognized

as revenue

84

65

Net revenue

$

444

$

377

Three Months Ended June

30,

2024

2023

Net revenue from

Resilient Business lines (1)

Revenue

$

6,898

$

6,302

Less: Pass-through costs also recognized

as revenue

3,420

3,242

Net revenue

$

3,478

$

3,060

Below represents a reconciliation of REI business line operating

profitability/loss to REI segment operating profit (in

millions):

Three Months Ended June

30,

Real Estate

Investments

2024

2023

Investment management operating profit

$

39

$

38

Global real estate development operating

loss

(26

)

(9

)

Segment overhead (and related

adjustments)

(3

)

4

Real estate investments segment operating

profit

$

10

$

33

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725574112/en/

Chandni Luthra - Investors 212.984.8113

Chandni.Luthra@cbre.com

Steve Iaco - Media 212.984.6535 Steven.Iaco@cbre.com

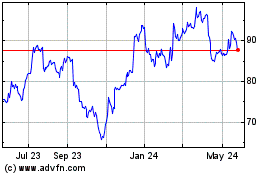

CBRE (NYSE:CBRE)

Historical Stock Chart

From Dec 2024 to Jan 2025

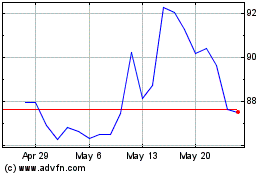

CBRE (NYSE:CBRE)

Historical Stock Chart

From Jan 2024 to Jan 2025