Form SD - Specialized disclosure report

September 25 2024 - 2:50PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

Cameco

Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Canada |

|

1-14228 |

|

98-0113090 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

| 2121-11th Street West

Saskatoon, Saskatchewan, Canada |

|

S7M 1J3 |

| (Address of principal executive offices) |

|

(Zip code) |

Heidi Shockey 306-956-6200

(Name and telephone number, including area code, of the person to contact in connection with this report)

Check the appropriate box to indicate the rule pursuant to which this form is being filed.

| ☐ |

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31,_________. |

| ☒ |

Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended December 31, 2023. |

SECTION 1 - CONFLICT MINERALS DISCLOSURE

Item 1.01 - Conflict Minerals Disclosure and Report

Not applicable.

Item 1.02 – Exhibit

Not applicable

SECTION 2 -

RESOURCE EXTRACTION ISSUER DISCLOSURE

Item 2.01 Resource Extraction Issuer Disclosure and Report

Cameco Corporation (the “Company”) is subject to Canada’s Extractive Sector Transparency Measures Act

(“ESTMA”). The Company is relying on the alternative reporting provision of Item 2.01 and providing its ESTMA report for the year ended December 31, 2023 to satisfy the requirements of Item 2.01. The Company’s ESTMA report is

available on the Company’s website at https://www.cameco.com/sites/default/files/documents/cameco-2023-estma-reporting.pdf and on the Government of Canada’s website at

https://natural-resources.canada.ca/our-natural-resources/minerals-mining/

services-for-the-mining-industry/extractive-sector-transparency-measures-act/links-estma-reports/18198.

Except as set forth herein, information on the Company’s and the Government of Canada’s websites is not part of or incorporated by reference in this Form SD.

The payment disclosure required by Form SD is included as Exhibit 2.01 to this Form SD.

SECTION 3 – EXHIBITS

Item 3.01. Exhibits

The following exhibit is filed as part of this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned.

|

|

|

| CAMECO CORPORATION |

|

September 25, 2024 |

|

|

| (Registrant) |

|

(Date) |

|

|

|

| By: |

|

/s/ Heidi Shockey |

| Name: |

|

Heidi Shockey |

| Title: |

|

Senior Vice-President and Deputy Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| Extractive Sector Transparency Measures Act - Annual Report |

|

|

| |

|

|

|

|

|

| Reporting Entity Name |

|

|

|

|

|

|

|

|

Cameco Corporation |

|

|

|

|

| |

|

|

|

|

|

|

|

| Reporting Year |

|

|

From |

|

|

1/1/2023 |

|

|

To: |

|

|

12/31/2023 |

|

Date submitted |

|

6/13/2024 |

|

Reporting Entities May

Insert Their Brand/Logo here |

| |

|

|

|

|

|

|

| Reporting Entity ESTMA Identification Number |

|

|

E886600 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Other Subsidiaries Included

(optional field) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Not Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Not Substituted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Attestation by Reporting Entity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

In accordance with the requirements of the ESTMA, and in particular section 9 thereof, I attest I have reviewed the information

contained in the ESTMA report for the entity(ies) listed above. Based on my knowledge, and having exercised reasonable diligence, the information in the ESTMA report is true, accurate and complete in all material respects for the purposes of the

Act, for the reporting year listed above. |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| Full Name of Director or Officer of Reporting

Entity |

|

|

Heidi Shockey |

|

Date |

|

6/13/2024 |

|

|

| Position Title |

|

|

Senior Vice-President and Deputy Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Extractive Sector Transparency Measures Act - Annual Report |

| Reporting Year |

|

|

From: |

|

|

1/1/2023 |

|

|

To: |

|

|

|

12/31/2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reporting Entity Name |

|

|

|

|

|

Cameco Corporation |

|

|

|

|

|

|

|

Currency of the Report |

|

|

|

CAD |

|

|

|

|

|

|

|

| Reporting Entity ESTMA

Identification Number |

|

|

|

|

|

|

|

|

E886600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subsidiary Reporting Entities (if necessary) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Payments by Payee |

| Country |

|

Payee Name1 |

|

|

Departments, Agency, etc...

within Payee

that Received

Payments2 |

|

Taxes |

|

|

Royalties |

|

|

Fees |

|

|

Production

Entitlements |

|

|

Bonuses |

|

|

Dividends |

|

|

Infrastructure

Improvement

Payments |

|

|

Total Amount

paid to Payee |

|

|

Notes3,4

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Canada |

|

|

national

government of

Canada |

|

|

|

|

|

|

|

|

|

|

|

|

|

3,970,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,970,000 |

|

|

Payments for regulatory oversight, and radio licenses. Departments include Canadian Nuclear Safety

Commission (CNSC), Industry Canada, Environment Canada. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Canada -Saskatchewan |

|

|

the province

of

Saskatchewan |

|

|

|

|

|

7,830,000 |

|

|

|

69,100,000 |

|

|

|

4,420,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

81,350,000 |

|

|

Payments for property taxes, royalties, highway maintenance, and regulatory oversight. Departments include Ministry

of Economy, Ministry of Finance, Ministry of Government Relations, Ministry of Environment, Ministry of Highways & Infrastructure. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Canada -Ontario |

|

|

the province

of Ontario |

|

|

Ministry

of

Finance |

|

|

|

|

|

|

|

|

|

|

50,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50,000 |

|

|

Payments for mandatory hoist rope testing |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Canada -Saskatchewan |

|

|

Athabasca

Community

Trust |

|

|

|

|

|

|

|

|

|

|

|

|

|

1,820,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,820,000 |

|

|

Payments to the trust are attributed to Black Lake Denesuline First Nation, Fond du Lac Denesuline First Nation,

Hatchet Lake Denesuline First Nation, northern hamlet of Stony Rapids, northern settlement of Wollaston Lake, northern settlement of Uranium City, and northern settlement of Camsell Portage. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Canada -Saskatchewan |

|

|

English River

First Nation |

|

|

|

|

|

|

|

|

|

|

|

|

|

500,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20,000 |

|

|

|

520,000 |

|

|

Payments are comprised of contributions stipulated in collaboration agreements with the community. These include

payments directly to the community and to a community-owned contractor and consultant. Some payments are made to support the building and maintenance of community facilities |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Canada -Saskatchewan |

|

|

Lac La Ronge

Indian Band

Community

Trust |

|

|

|

|

|

|

|

|

|

|

|

|

|

510,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

510,000 |

|

|

Payments based on the collaboration agreement, including funding for education and community liaison. The trust is

attributed to the communities of Grandmother’s Bay, Hall Lake, La Ronge, Little Red River, Stanley Mission, and Sucker River |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Canada -Saskatchewan |

|

|

northern

village of

Pinehouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

1,230,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,230,000 |

|

|

Payments are mostly comprised of contributions stipulated in collaboration agreements with the community. These

include payments directly to the community and to a community-owned contractor. Some payments are made to support the building and maintenance of community facilities |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Canada -Saskatchewan |

|

|

Six Rivers

Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

100,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100,000 |

|

|

Trust fund to benefit indigenous communities in Northern Saskatchewan. Money is granted to projects to support youth, education, health &

wellness, and sports & recreaction. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Extractive Sector Transparency Measures Act - Annual Report |

| Reporting Year |

|

|

From: |

|

|

1/1/2023 |

|

|

To: |

|

|

|

12/31/2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reporting Entity Name |

|

|

|

|

|

Cameco Corporation |

|

|

|

|

|

|

|

Currency of the Report |

|

|

|

CAD |

|

|

|

|

|

|

|

| Reporting Entity ESTMA

Identification Number |

|

|

|

|

|

|

|

|

E886600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subsidiary Reporting Entities (if necessary) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Payments by Payee |

| |

|

|

|

|

|

|

|

|

|

|

|

| Country |

|

Payee

Name1 |

|

|

Departments,

Agency, etc...

within Payee

that Received

Payments2 |

|

Taxes |

|

|

Royalties |

|

|

Fees |

|

|

Production Entitlements |

|

|

Bonuses |

|

|

Dividends |

|

|

Infrastructure

Improvement

Payments |

|

|

Total Amount paid to

Payee |

|

|

Notes3,4 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Canada -Saskatchewan |

|

|

Peter

Ballantyne

Cree Nation |

|

|

|

|

|

|

|

|

|

|

|

|

|

700,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

700,000 |

|

|

Payments based on the participation agreement, including community investment funding and business

development. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

United States of America |

|

|

national

government

of United

States of

America |

|

|

|

|

|

|

|

|

|

|

|

|

|

880,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

880,000 |

|

|

Departments include Nuclear Regulatory Commission, Bureau of Land Management, Department of Agriculture.

Transaction occurred in USD$, converted to CAD$ at the exchange rate existing at time of payments (Avg. $1.30 CAD/USD). |

| |

|

|

|

|

|

|

|

|

|

|

|

|

United States of America |

|

|

the state of

Wyoming |

|

|

|

|

|

70,000 |

|

|

|

10,000 |

|

|

|

300,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

380,000 |

|

|

Departments include Department of Environmental Quality,Office of State Lands and Investments, Department of

Revenue, Secretary of State. Transaction occurred in USD$, converted to CAD$ at the exchange rate existing at time of payments (Avg. $1.30 CAD/USD) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

United States of America |

|

|

the state of

Nebraska |

|

|

|

|

|

|

|

|

|

|

|

|

|

180,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

180,000 |

|

|

Departments include Department of Environmental Quality, Board of Education, Department of Health & Human

Services. Transaction occurred in USD$, converted to CAD$ at the exchange rate existing at time of payments (Avg. $1.30 CAD/USD) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

United States of America |

|

|

the

municipality

of Campbell

County |

|

|

|

|

|

250,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

250,000 |

|

|

Transaction occurred in USD$, converted to CAD$ at the exchange rate existing at time of payments (Avg. $1.30

CAD/USD) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

United States of America |

|

|

the

municipality

of Converse

County |

|

|

|

|

|

540,000 |

|

|

|

|

|

|

|

30,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

570,000 |

|

|

Transaction occurred in USD$, converted to CAD$ at the exchange rate existing at time of payments (Avg. $1.30

CAD/USD) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

United States of America |

|

|

the

municipality

of Dawes

County |

|

|

|

|

|

80,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80,000 |

|

|

Transaction occurred in USD$, converted to CAD$ at the exchange rate existing at time of payments (Avg. $1.30

CAD/USD) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

United States of America |

|

|

the

municipality

of Fremont

County |

|

|

|

|

|

10,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,000 |

|

|

Transaction occurred in USD$, converted to CAD$ at the exchange rate existing at time of payments (Avg. $1.30

CAD/USD) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Australia |

|

|

Government

of Western

Australia |

|

|

Department

of Mines &

Petroleum |

|

|

|

|

|

|

|

|

|

|

310,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

310,000 |

|

|

Transaction occurred in AUD$, converted to CAD$ at the exchange rate existing at time of payments ($0.90

CAD/AUD) |

| Additional Notes: |

|

|

As required by Canada’s Extractive Sector Transparency Measures Act (ESTMA), Cameco has reported to the Canadian government payments made

to

governments in Canada, the United States, and Australia. These payments include royalties, taxes and fees paid during a year by Cameco and its subsidiaries to

various levels of government related to commercial development. Under ESTMA

commercial development captures the exploration and extraction of minerals

and does not include post-extraction activities, such as refining, processing, marketing, distribution, transportation or export. With the exception of payments

made to

Indigenous Payees, the amounts reported are on a 100% basis with no adjustment to reflect the minority ownership interest of other entities in the

commercial development of minerals undertaken by Cameco and its subsidiaries. Payments made to

Indigenous Payees in Canada are reported at Cameco’s

share. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Extractive Sector Transparency Measures Act - Annual Report |

| Reporting Year |

|

|

From: |

|

|

|

1/1/2023 |

|

|

|

To: |

|

|

|

12/31/2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reporting Entity Name |

|

|

|

|

|

|

|

|

|

|

Cameco Corporation |

|

|

|

|

|

|

|

|

Currency of the Report |

|

CAD |

|

|

|

|

|

|

|

|

|

|

| Reporting Entity ESTMA

Identification Number |

|

|

|

|

|

|

|

|

|

|

E886600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subsidiary Reporting Entities (if

necessary) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Payments by Project |

| |

|

|

|

|

|

|

|

|

|

|

| Country |

|

Project Name1 |

|

|

Taxes |

|

|

Royalties |

|

|

Fees |

|

|

Production Entitlements |

|

Bonuses |

|

Dividends |

|

Infrastructure

Improvement Payments |

|

|

Total Amount paid

by Project |

|

|

Notes2,3 |

| |

|

|

|

|

|

|

|

|

|

|

|

Canada -Saskatchewan |

|

|

Cameco Corporation |

|

|

|

|

|

|

|

69,100,000 |

|

|

|

4,860,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

73,960,000 |

|

|

corporate royalties & colloboration agreements that are not assigned/attributed to a specific

project |

| |

|

|

|

|

|

|

|

|

|

|

|

Canada -Saskatchewan |

|

|

Key Lake |

|

|

|

1,500,000 |

|

|

|

|

|

|

|

3,860,000 |

|

|

|

|

|

|

|

|

|

10,000 |

|

|

|

5,370,000 |

|

|

property taxes &

regulatory fees (100% of payments reported, Cameco ownership 83.3%) |

| |

|

|

|

|

|

|

|

|

|

|

|

Canada -Saskatchewan |

|

|

McArthur River |

|

|

|

1,320,000 |

|

|

|

|

|

|

|

1,600,000 |

|

|

|

|

|

|

|

|

|

10,000 |

|

|

|

2,930,000 |

|

|

property taxes &

regulatory fees (100% of payments reported, Cameco ownership 69.8%) |

| |

|

|

|

|

|

|

|

|

|

|

|

Canada -Saskatchewan |

|

|

Cigar Lake |

|

|

|

4,630,000 |

|

|

|

|

|

|

|

2,040,000 |

|

|

|

|

|

|

|

|

|

10,000 |

|

|

|

6,680,000 |

|

|

property taxes &

regulatory fees (100% of payments reported, Cameco ownership 54.5%) |

| |

|

|

|

|

|

|

|

|

|

|

|

Canada -Saskatchewan |

|

|

Rabbit Lake |

|

|

|

380,000 |

|

|

|

|

|

|

|

860,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1,240,000 |

|

|

property taxes & regulatory fees |

| |

|

|

|

|

|

|

|

|

|

|

|

Canada -Saskatchewan |

|

|

Exploration |

|

|

|

|

|

|

|

|

|

|

|

90,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

90,000 |

|

|

Claim staking and maintenance fees |

| |

|

|

|

|

|

|

|

|

|

|

|

United States of America |

|

|

Crow Butte

Resources |

|

|

|

80,000 |

|

|

|

|

|

|

|

370,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

450,000 |

|

|

Transaction occurred in USD$, converted to CAD$ at the exchange rate existing at time of payment (Avg. $1.30

CAD/USD) |

| |

|

|

|

|

|

|

|

|

|

|

|

United States of America |

|

|

Power Resources

Inc |

|

|

|

870,000 |

|

|

|

10,000 |

|

|

|

1,030,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1,910,000 |

|

|

Transaction occurred in USD$, converted to CAD$ at the exchange rate existing at time of payment (Avg. $1.30

CAD/USD) |

| |

|

|

|

|

|

|

|

|

|

|

|

Australia |

|

|

Cameco Australia |

|

|

|

|

|

|

|

|

|

|

|

310,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

310,000 |

|

|

Transaction occurred in AUD$, converted to CAD$ at the exchange rate existing at time of payment (Avg. $0.90 CAD/AUD) |

| |

|

| Additional Notes3: |

|

|

As required by Canada’s Extractive Sector Transparency Measures Act (ESTMA), Cameco has reported to

the Canadian government payments made to governments in Canada, the United States, and Australia.

These payments include royalties, taxes and fees paid during a year by Cameco and its subsidiaries to various levels of government related to

commercial development. Under ESTMA commercial development

captures the exploration and extraction of minerals and does not include post-extraction activities, such as refining, processing, marketing, distribution, transportation or export. With

the exception of payments

made to Indigenous Payees, the amounts reported are on a 100% basis with no adjustment to reflect the minority ownership interest of other entities in the commercial development of minerals undertaken by

Cameco and

its subsidiaries. Payments made to Indigenous Payees in Canada are reported at Cameco’s share. |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe three character ISO 4217 code for the currency used for reporting purposes. Example: 'USD'.

| Name: |

dei_EntityReportingCurrencyISOCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:currencyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

Payments, by Project - 12 months ended Dec. 31, 2023 - CAD ($)

|

Taxes |

Royalties |

Fees |

Infrastructure |

Total Payments |

| Cameco Corporation [Member] |

|

|

|

|

|

| Total |

|

$ 69,100,000

|

$ 4,860,000

|

|

$ 73,960,000

|

| Key Lake [Member] |

|

|

|

|

|

| Total |

$ 1,500,000

|

|

3,860,000

|

$ 10,000

|

5,370,000

|

| McArthur River [Member] |

|

|

|

|

|

| Total |

1,320,000

|

|

1,600,000

|

10,000

|

2,930,000

|

| Cigar Lake [Member] |

|

|

|

|

|

| Total |

4,630,000

|

|

2,040,000

|

$ 10,000

|

6,680,000

|

| Rabbit Lake [Member] |

|

|

|

|

|

| Total |

380,000

|

|

860,000

|

|

1,240,000

|

| Exploration [Member] |

|

|

|

|

|

| Total |

|

|

90,000

|

|

90,000

|

| Crow Butte Resources [Member] |

|

|

|

|

|

| Total |

80,000

|

|

370,000

|

|

450,000

|

| Power Resources Inc [Member] |

|

|

|

|

|

| Total |

$ 870,000

|

$ 10,000

|

1,030,000

|

|

1,910,000

|

| Cameco Australia [Member] |

|

|

|

|

|

| Total |

|

|

$ 310,000

|

|

$ 310,000

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ccj_CamecoCorporationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ccj_KeyLakeMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ccj_McArthurRiverMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ccj_CigarLakeMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ccj_RabbitLakeMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ccj_ExplorationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ccj_CrowButteResourcesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ccj_PowerResourcesIncMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ccj_CamecoAustraliaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.3

Payments, by Government - 12 months ended Dec. 31, 2023 - CAD ($)

|

Taxes |

Royalties |

Fees |

Infrastructure |

Total Payments |

| Canada -Saskatchewan | National Government Of Canada [Member] |

|

|

|

|

|

| Total |

|

|

$ 3,970,000

|

|

$ 3,970,000

|

| Canada -Saskatchewan | The Province Of Saskatchewan [Member] |

|

|

|

|

|

| Total |

$ 7,830,000

|

$ 69,100,000

|

4,420,000

|

|

81,350,000

|

| Canada -Saskatchewan | The Province Of Ontario [Member] |

|

|

|

|

|

| Total |

|

|

50,000

|

|

50,000

|

| Canada -Saskatchewan | Athabasca Community Trust [Member] |

|

|

|

|

|

| Total |

|

|

1,820,000

|

|

1,820,000

|

| Canada -Saskatchewan | English River First Nation [Member] |

|

|

|

|

|

| Total |

|

|

500,000

|

$ 20,000

|

520,000

|

| Canada -Saskatchewan | Lac La Ronge Indian Band Community Trust [Member] |

|

|

|

|

|

| Total |

|

|

510,000

|

|

510,000

|

| Canada -Saskatchewan | Northern Village Of Pinehouse [Member] |

|

|

|

|

|

| Total |

|

|

1,230,000

|

|

1,230,000

|

| Canada -Saskatchewan | Six Rivers Fund [Member] |

|

|

|

|

|

| Total |

|

|

100,000

|

|

100,000

|

| Canada -Saskatchewan | Peter Ballantyne Cree Nation [Member] |

|

|

|

|

|

| Total |

|

|

700,000

|

|

700,000

|

| United States of America | National Government Of United States Of America [Member] |

|

|

|

|

|

| Total |

|

|

880,000

|

|

880,000

|

| United States of America | The State Of Wyoming [Member] |

|

|

|

|

|

| Total |

70,000

|

$ 10,000

|

300,000

|

|

380,000

|

| United States of America | The State Of Nebraska [Member] |

|

|

|

|

|

| Total |

|

|

180,000

|

|

180,000

|

| United States of America | The Municipality Of Campbell County [Member] |

|

|

|

|

|

| Total |

250,000

|

|

|

|

250,000

|

| United States of America | The Municipality Of Converse County [Member] |

|

|

|

|

|

| Total |

540,000

|

|

30,000

|

|

570,000

|

| United States of America | The Municipality Of Dawes County [Member] |

|

|

|

|

|

| Total |

80,000

|

|

|

|

80,000

|

| United States of America | The Municipality Of Fremont County [Member] |

|

|

|

|

|

| Total |

$ 10,000

|

|

|

|

10,000

|

| Australia | Government of Western Australia [Member] |

|

|

|

|

|

| Total |

|

|

$ 310,000

|

|

$ 310,000

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_CA |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_NationalGovernmentOfCanadaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_TheProvinceOfSaskatchewanMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_TheProvinceOfOntarioMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_EnglishRiverFirstNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_LacLaRongeIndianBandCommunityTrustMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_NorthernVillageOfPinehouseMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_SixRiversFundMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_PeterBallantyneCreeNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_US |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_NationalGovernmentOfUnitedStatesOfAmericaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_TheStateOfWyomingMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_TheStateOfNebraskaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_TheMunicipalityOfCampbellCountyMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_TheMunicipalityOfConverseCountyMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_TheMunicipalityOfDawesCountyMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_TheMunicipalityOfFremontCountyMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_AU |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ccj_GovernmentOfWesternAustraliaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

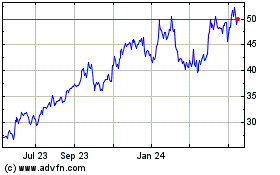

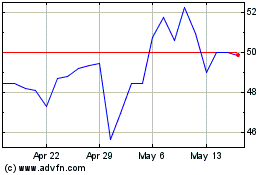

Cameco (NYSE:CCJ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cameco (NYSE:CCJ)

Historical Stock Chart

From Dec 2023 to Dec 2024