true--12-310001725057Q200017250572023-01-012023-06-3000017250572023-07-26xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q/A

(Amendment No. 1)

☒ Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly reporting period ended June 30, 2023

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission file number 001-38467

Ceridian HCM Holding Inc.

(Exact name of registrant as specified in its charter)

|

|

Delaware |

46-3231686 |

(State or Other Jurisdiction of

Incorporation or Organization) |

(I.R.S. Employer Identification Number) |

3311 East Old Shakopee Road

Minneapolis, Minnesota 55425

(952) 853-8100

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, $0.01 par value |

|

CDAY |

|

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as the latest practicable date: 155,612,552 shares of common stock, $0.01 par value per share, as of July 26, 2023.

Explanatory Note

Ceridian HCM Holding Inc. (the “Company”) is filing this Amendment No. 1 on Form 10-Q/A (this “Amendment” or “Form 10-Q/A”) to our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, which was filed with the U.S. Securities and Exchange Commission (the “SEC”) on August 2, 2023 (the “Original Form 10-Q”) to make certain changes as described below.

Background

As previously disclosed in the Company’s earnings press release furnished as an exhibit to the Current Report on Form 8-K furnished with the SEC on November 1, 2023, the Company recently discovered an error in the presentation of one Canadian bank account balance within “customer funds” and “customer funds obligations” and related items on the Company’s condensed consolidated balance sheets as of June 30, 2023 and December 31, 2022 and in the Company’s net cash provided by financing activities within its condensed consolidated statements of cash flows for the six months ended June 30, 2023 and 2022. There was an understatement of customer funds within current assets and a corresponding understatement of customer funds obligations within current liabilities on the Company’s condensed consolidated balance sheets. As a result, the Company also erroneously presented certain changes related to customer funds and customer funds obligations on the Company’s condensed consolidated statements of cash flows.

However, the Company determined that the incorrect presentation did not result in a material misstatement of the Company’s financial statements and, accordingly, it does not need to restate its previously issued financial statements contained in the Original Form 10-Q, in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 or in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023.

Considering the foregoing, management reassessed the effectiveness of the Company’s internal control over financial reporting (“ICFR”) as of December 31, 2022, based on the framework established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. As a result of that reassessment, management identified a material weakness in its ICFR as the Company has determined that its control designed to assess the proper presentation of cash and cash equivalents for its Canada customer funds for financial reporting purposes was ineffective (“Canada Trust Material Weakness”).

With regard to the Canada Trust Material Weakness, the Company has implemented an additional control and training to ensure proper classification and presentation of cash and cash equivalents for its Canada customer funds. The Company expects the Canada Trust Material Weakness will be fully remediated before December 31, 2023, but remediation will not be considered complete until the applicable controls operate for a sufficient period of time subsequent to the additional training to enable management to test and to conclude on the operating effectiveness of the control.

Further, while reassessing the effectiveness of the Company’s ICFR, management identified, in the aggregate, a material weakness related to controls over certain Professional Services and Powerpay revenue accounts as of December 31, 2022 (the "Risk Assessment Material Weakness"). The Company has enhanced its risk assessment process and information technology general controls to prevent misstatements in Professional Services revenue accounts. The Company also expects to implement additional controls to prevent misstatements in Powerpay revenue accounts. The Company expects the Risk Assessment Material Weakness will be fully remediated before December 31, 2023, but remediation will not be considered complete until the applicable controls operate for a sufficient period of time to enable management to test and to conclude on the operating effectiveness of the controls.

In light of the Canada Trust Material Weakness and the Risk Assessment Material Weakness, which continue to exist as of June 30, 2023, the Company has performed additional analyses and other procedures to enable management to conclude that the existence of the material weaknesses did not result in a material misstatement of the Company’s previously issued financial statements.

As a result of the Canada Trust Material Weakness and the Risk Assessment Material Weakness, the Company concluded that its disclosure controls and procedures and ICFR were ineffective as of June 30, 2023. As a result, the Company is amending and restating Part I, Item 4 Controls and Procedures in this Form 10-Q/A to update its conclusions regarding the effectiveness of its disclosure controls and procedures and its internal control over financial reporting as of June 30, 2023 a result of the material weaknesses.

2 |  Q2 2023 Form 10-Q/A

Q2 2023 Form 10-Q/A

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company is also including with this Form 10-Q/A certifications of the Company’s principal executive officer and principal financial officer (included in Part II, Item 6. “Exhibits” and attached as Exhibits 31.1, 31.2, 32.1, and 32.2). This Form 10-Q/A should be read in conjunction with the Original Form 10-Q, which continues to speak as of the date of the Original Form 10-Q. Except as specifically noted above, this Form 10-Q/A does not modify or update disclosures in the Original Form 10-Q. Accordingly, this Form 10-Q/A does not reflect events occurring after the filing of the Original Form 10-Q or modify or update any related or other disclosures, other than those discussed above. No other portions of the Original Form 10-Q were changed.

Amendments of 2022 Annual Report on Form 10-K and 2023 Quarterly Report on Form 10-Q

In addition to this Form 10-Q/A, the Company is concurrently filing amendments to its Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the period ended March 31, 2023.

3 |  Q2 2023 Form 10-Q/A

Q2 2023 Form 10-Q/A

PART I

ITEM 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Management, under the supervision and with the participation of the Chief Executive Officer and Chief Financial Officer, have conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act). Disclosure controls and procedures are designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is accumulated and communicated to our management, including our principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure.

Based on that evaluation, our Chief Executive Officer and our Chief Financial Officer concluded that as of June 30, 2023, our disclosure controls and procedures were not effective due to the material weaknesses in internal control over financial reporting described below. We have in place and are executing a remediation plan to address the material weaknesses described below.

As discussed in our Annual Report on Form 10-K/A, we identified a material weakness in our internal control over financial reporting as we have determined that our control was not operating effectively to assess the proper presentation of cash and cash equivalents for our Canada customer funds for financial reporting purposes, including the corresponding customer funds and customer funds obligations and related statements of cash flows presentation as of December 31, 2022, which continues to exist as of June 30, 2023. This material weakness was the result of the control operator not appropriately detecting and correcting the error, as a result of insufficient training.

Further, while reassessing the effectiveness of the Company’s internal control over financial reporting, management identified, in the aggregate, a material weakness related to controls over certain Professional Services and Powerpay revenue accounts as of December 31, 2022, which continues to exist as of June 30, 2023, resulting from an ineffective risk assessment process to properly design and implement controls over (1) certain process level activities related to Powerpay revenue, and (2) information technology access pertaining to a system implemented in September 2022 that adversely impacted the accuracy and completeness of information that is used to measure a component of its Professional Services revenue.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis.

In light of the material weaknesses, management performed additional analyses and other procedures to ensure that our consolidated financial statements were prepared in accordance with U.S. Generally Accepted Accounting Principles ("U.S. GAAP"). Accordingly, management believes that the condensed consolidated financial statements included in the Original Form 10-Q fairly present, in all material respects, our financial position, results of operations, and cash flows as of and for the periods presented, in accordance with U.S. GAAP.

Management’s Plan to Remediate the Identified Material Weaknesses

With regard to the Canada Trust Material Weakness, the Company has implemented an additional control and training to ensure proper classification and presentation of cash and cash equivalents for its Canada customer funds.

In addition, we have enhanced our revenue risk assessment process and information technology general controls to prevent misstatements in Professional Services revenue accounts. We will also implement additional controls to prevent misstatements in Powerpay revenue accounts. We anticipate that the two material weaknesses will be fully remediated before December 31, 2023, but the material weaknesses cannot be considered fully remediated until the improved controls have been in place and operate for a sufficient period of time to enable management to test and to conclude on the operating effectiveness of the controls.

4 |  Q2 2023 Form 10-Q/A

Q2 2023 Form 10-Q/A

Changes in Internal Control over Financial Reporting

With the exception of the controls implemented in response to the material weaknesses identified above, there were no changes to our internal control over financial reporting during the three months ended June 30, 2023 that have materially affected, or that are reasonably likely to materially affect, our internal controls over financial reporting.

5 |  Q2 2023 Form 10-Q/A

Q2 2023 Form 10-Q/A

ITEM 6. EXHIBITS

(a) Exhibits

The following exhibits are filed or furnished as a part of this report:

* Filed herewith.

# In accordance with Item 601(b)(32)(ii) of Regulation S-K and SEC Release Nos. 33-8238 and 34-47986, Final Rule: Management’s Reports on Internal Control Over Financial Reporting and Certification of Disclosure in Exchange Act Periodic Reports, the certifications furnished in Exhibits 32.1 and 32.2 hereto are deemed to accompany this Quarterly Report on Form 10-Q/A and will not be deemed “filed” for purpose of Section 18 of the Exchange Act. Such certifications will not be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act, except to the extent that the registrant specifically incorporates it by reference.

6 |  Q2 2023 Form 10-Q/A

Q2 2023 Form 10-Q/A

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

CERIDIAN HCM HOLDING INC. |

|

|

|

Date: November 13, 2023 |

By: |

/s/ David D. Ossip |

|

|

Name: |

David D. Ossip |

|

|

Title: |

Chief Executive Officer |

|

|

|

(Principal Executive Officer) |

|

|

|

Date: November 13, 2023 |

By: |

/s/ Noémie C. Heuland |

|

|

Name: |

Noémie C. Heuland |

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

(Principal Financial Officer) |

|

|

|

|

7 |  Q2 2023 Form 10-Q/A

Q2 2023 Form 10-Q/A

Exhibit 31.1

CERTIFICATIONS

I, David D. Ossip, certify that:

1.I have reviewed this quarterly report on Form 10-Q/A of Ceridian HCM Holding Inc.;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4.The registrant’s other certifying officers and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a)designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b)designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c)evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d)disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5.The registrant’s other certifying officers and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of registrant’s board of directors (or persons performing the equivalent functions):

(a)all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

(b)any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

Date: November 13, 2023

|

|

|

By: |

|

/s/ David D. Ossip |

|

|

David D. Ossip

Chief Executive Officer |

Exhibit 31.2

CERTIFICATIONS

I, Noémie C. Heuland, certify that:

1.I have reviewed this quarterly report on Form 10-Q/A of Ceridian HCM Holding Inc.;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4.The registrant’s other certifying officers and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a)designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b)designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c)evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d)disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant’s other certifying officers and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of registrant’s board of directors (or persons performing the equivalent functions):

(a)all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

(b)any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

Date: November 13, 2023

|

|

|

By: |

|

/s/ Noémie C. Heuland |

|

|

Noémie C. Heuland

Executive Vice President and Chief Financial Officer |

Exhibit 32.1

CERTIFICATION OF PERIODIC FINANCIAL REPORTS PURSUANT TO 18 U.S.C. §1350

The undersigned hereby certifies that he is the duly appointed and acting Chief Executive Officer of Ceridian HCM Holding Inc., a Delaware corporation (the “Company”), and hereby further certifies to the best of his knowledge as follows.

1.The periodic report containing financial statements to which this certificate is an exhibit fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934.

2.The information contained in the periodic report to which this certificate is an exhibit fairly presents, in all material respects, the financial condition and results of operations of the Company.

In witness whereof, the undersigned has executed and delivered this certificate as of the date set forth opposite his signature below.

Date: November 13, 2023

|

|

|

By: |

|

/s/ David D. Ossip |

|

|

David D. Ossip |

|

|

Chief Executive Officer |

This certification accompanies the Form 10-Q/A to which it relates, is not deemed filed with the Securities and Exchange Commission and is not to be incorporated by reference into any filing of Ceridian HCM Holding Inc. under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (whether made before or after the date of the Form 10-Q/A), irrespective of any general incorporation language contained in such filing.

Exhibit 32.2

CERTIFICATION OF PERIODIC FINANCIAL REPORTS PURSUANT TO 18 U.S.C. §1350

The undersigned hereby certifies that she is the duly appointed and acting Executive Vice President and Chief Financial Officer of Ceridian HCM Holding Inc., a Delaware corporation (the “Company”), and hereby further certifies as follows.

1.The periodic report containing financial statements to which this certificate is an exhibit fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934.

2.The information contained in the periodic report to which this certificate is an exhibit fairly presents, in all material respects, the financial condition and results of operations of the Company.

In witness whereof, the undersigned has executed and delivered this certificate as of the date set forth opposite her signature below.

Date: November 13, 2023

|

|

|

By: |

|

/s/ Noémie C. Heuland |

|

|

Noémie C. Heuland |

|

|

Executive Vice President and Chief Financial Officer |

This certification accompanies the Form 10-Q/A to which it relates, is not deemed filed with the Securities and Exchange Commission and is not to be incorporated by reference into any filing of Ceridian HCM Holding Inc. under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (whether made before or after the date of the Form 10-Q/A), irrespective of any general incorporation language contained in such filing.

v3.23.3

Document and Entity Information - shares

|

6 Months Ended |

|

Jun. 30, 2023 |

Jul. 26, 2023 |

| Cover [Abstract] |

|

|

| Document Type |

10-Q/A

|

|

| Amendment Flag |

true

|

|

| Document Period End Date |

Jun. 30, 2023

|

|

| Document Fiscal Year Focus |

2023

|

|

| Document Fiscal Period Focus |

Q2

|

|

| Trading Symbol |

CDAY

|

|

| Title of 12(b) Security |

Common stock, $0.01 par value

|

|

| Security Exchange Name |

NYSE

|

|

| Entity Registrant Name |

Ceridian HCM Holding Inc.

|

|

| Entity Central Index Key |

0001725057

|

|

| Entity Current Reporting Status |

Yes

|

|

| Current Fiscal Year End Date |

--12-31

|

|

| Entity Filer Category |

Large Accelerated Filer

|

|

| Entity Shell Company |

false

|

|

| Entity Interactive Data Current |

Yes

|

|

| Document Quarterly Report |

true

|

|

| Document Transition Report |

false

|

|

| Entity File Number |

001-38467

|

|

| Entity Incorporation State Country Code |

DE

|

|

| Entity Tax Identification Number |

46-3231686

|

|

| Entity Address Address Line1 |

3311 East Old Shakopee Road

|

|

| Entity Address City Or Town |

Minneapolis

|

|

| Entity Address State Or Province |

MN

|

|

| Entity Address Postal Zip Code |

55425

|

|

| City Area Code |

952

|

|

| Local Phone Number |

853-8100

|

|

| Entity Small Business |

false

|

|

| Entity Emerging Growth Company |

false

|

|

| Entity Common Stock, Shares Outstanding |

|

155,612,552

|

| Amendment Description |

Ceridian HCM Holding Inc. (the “Company”) is filing this Amendment No. 1 on Form 10-Q/A (this “Amendment” or “Form 10-Q/A”) to our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, which was filed with the U.S. Securities and Exchange Commission (the “SEC”) on August 2, 2023 (the “Original Form 10-Q”) to make certain changes as described below. BackgroundAs previously disclosed in the Company’s earnings press release furnished as an exhibit to the Current Report on Form 8-K furnished with the SEC on November 1, 2023, the Company recently discovered an error in the presentation of one Canadian bank account balance within “customer funds” and “customer funds obligations” and related items on the Company’s condensed consolidated balance sheets as of June 30, 2023 and December 31, 2022 and in the Company’s net cash provided by financing activities within its condensed consolidated statements of cash flows for the six months ended June 30, 2023 and 2022. There was an understatement of customer funds within current assets and a corresponding understatement of customer funds obligations within current liabilities on the Company’s condensed consolidated balance sheets. As a result, the Company also erroneously presented certain changes related to customer funds and customer funds obligations on the Company’s condensed consolidated statements of cash flows.However, the Company determined that the incorrect presentation did not result in a material misstatement of the Company’s financial statements and, accordingly, it does not need to restate its previously issued financial statements contained in the Original Form 10-Q, in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 or in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023. Considering the foregoing, management reassessed the effectiveness of the Company’s internal control over financial reporting (“ICFR”) as of December 31, 2022, based on the framework established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. As a result of that reassessment, management identified a material weakness in its ICFR as the Company has determined that its control designed to assess the proper presentation of cash and cash equivalents for its Canada customer funds for financial reporting purposes was ineffective (“Canada Trust Material Weakness”). With regard to the Canada Trust Material Weakness, the Company has implemented an additional control and training to ensure proper classification and presentation of cash and cash equivalents for its Canada customer funds. The Company expects the Canada Trust Material Weakness will be fully remediated before December 31, 2023, but remediation will not be considered complete until the applicable controls operate for a sufficient period of time subsequent to the additional training to enable management to test and to conclude on the operating effectiveness of the control.Further, while reassessing the effectiveness of the Company’s ICFR, management identified, in the aggregate, a material weakness related to controls over certain Professional Services and Powerpay revenue accounts as of December 31, 2022 (the "Risk Assessment Material Weakness"). The Company has enhanced its risk assessment process and information technology general controls to prevent misstatements in Professional Services revenue accounts. The Company also expects to implement additional controls to prevent misstatements in Powerpay revenue accounts. The Company expects the Risk Assessment Material Weakness will be fully remediated before December 31, 2023, but remediation will not be considered complete until the applicable controls operate for a sufficient period of time to enable management to test and to conclude on the operating effectiveness of the controls.In light of the Canada Trust Material Weakness and the Risk Assessment Material Weakness, which continue to exist as of June 30, 2023, the Company has performed additional analyses and other procedures to enable management to conclude that the existence of the material weaknesses did not result in a material misstatement of the Company’s previously issued financial statements.As a result of the Canada Trust Material Weakness and the Risk Assessment Material Weakness, the Company concluded that its disclosure controls and procedures and ICFR were ineffective as of June 30, 2023. As a result, the Company is amending and restating Part I, Item 4 Controls and Procedures in this Form 10-Q/A to update its conclusions regarding the effectiveness of its disclosure controls and procedures and its internal control over financial reporting as of June 30, 2023 a result of the material weaknesses. In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company is also including with this Form 10-Q/A certifications of the Company’s principal executive officer and principal financial officer (included in Part II, Item 6. “Exhibits” and attached as Exhibits 31.1, 31.2, 32.1, and 32.2). This Form 10-Q/A should be read in conjunction with the Original Form 10-Q, which continues to speak as of the date of the Original Form 10-Q. Except as specifically noted above, this Form 10-Q/A does not modify or update disclosures in the Original Form 10-Q. Accordingly, this Form 10-Q/A does not reflect events occurring after the filing of the Original Form 10-Q or modify or update any related or other disclosures, other than those discussed above. No other portions of the Original Form 10-Q were changed.Amendments of 2022 Annual Report on Form 10-K and 2023 Quarterly Report on Form 10-Q In addition to this Form 10-Q/A, the Company is concurrently filing amendments to its Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the period ended March 31, 2023.

|

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an quarterly report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-Q

-Number 240

-Section 308

-Subsection a

| Name: |

dei_DocumentQuarterlyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

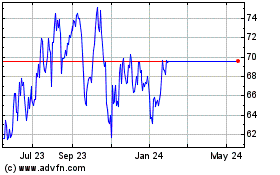

Ceridian HCM (NYSE:CDAY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ceridian HCM (NYSE:CDAY)

Historical Stock Chart

From Feb 2024 to Feb 2025