Centerra Gold Inc. (“Centerra” or the “Company”) (TSX: CG) (NYSE:

CGAU) announces the results from its Thompson Creek feasibility

study, including a strategic, integrated business plan for its

Molybdenum Business Unit (“MBU”) consisting of a restart of the

Thompson Creek Mine (“Thompson Creek”) and a commercially optimized

plan for the Langeloth Metallurgical Facility (“Langeloth”),

collectively the US Molybdenum Operations (“US Moly”). Centerra

will host a conference call and webcast to discuss the strategic

plan for US Moly on Friday, September 13, 2024, at 9:00 am Eastern

Time. Details for the conference call and webcast are included at

the end of the news release.

President and CEO, Paul Tomory, commented, “Over

the last year, we have developed a value-enhancing strategy for

Centerra’s US molybdenum operations, centered around the vertical

integration of Thompson Creek and Langeloth, and supported by

strong molybdenum market fundamentals. The combined US Moly

business is expected to produce an after-tax net present value (8%)

(“NPV8%”) of $472 million. A key contributor to this value is

Langeloth, which at full capacity, integrated with Thompson Creek,

has the potential to generate robust annual EBITDA. Today, we

announce the decision to unlock significant value through the

restart of operations at Thompson Creek and a progressive ramp-up

of production at Langeloth. When Thompson Creek begins production,

currently targeted for the second half of 2027, it will provide

additional high-grade, high-quality feed to Langeloth, enabling a

ramp-up of production towards Langeloth’s full annual capacity of

40 million pounds while improving operational flexibility to meet

market demand.”

Paul Tomory continued, “We completed a

feasibility study at Thompson Creek that has confirmed the capital

estimate from the pre-feasibility study, while adding another year

of production. Following significant progress on permitting efforts

in the second quarter 2024, we have pivoted from a two-phased

approval to a single-phase capital investment of $397 million over

three years, from now through mid-2027. Our total project costs

guidance at Thompson Creek for the second half of 2024 is expected

to be $55 to $65 million. We will provide 2025 guidance for

Thompson Creek with our annual guidance that is expected to be

published early next year.”

Paul Tomory concluded, “We are continuing to

explore strategic options to unlock the full potential of our

molybdenum business, in line with Centerra’s strategy to maximize

the value of each asset in our portfolio. While Centerra expects to

remain a gold-focused company, we acknowledge the significant value

of our base metal assets.”

Integrated US Moly

Highlights

- Robust integrated economics

of Thompson Creek and Langeloth: Strong project economics

due to synergies with the high-quality concentrate blend that could

be achieved when Thompson Creek is vertically integrated with

Langeloth. Once Thompson Creek resumes full production, the US Moly

business is expected to generate sustainable strong annual cash

flows.

|

|

US

Moly(1)(Thompson

Creek +Langeloth) |

Thompson CreekOnly(3) |

Langeloth Only |

|

NPV8% |

$472M |

$185M |

$258M |

|

Internal Rate of Return (“IRR”) |

22% |

15% |

n.m. |

|

Additions to PP&E / Non-sustaining capital

expendituresNG(2) |

$397M |

$397M |

- |

|

(1) |

US

Moly includes an additional $29M of unattributed tax

synergies. |

| (2) |

Additions to Property, Plant, and

Equipment (“PP&E”) are the same as Capital ExpendituresNG. |

| (3) |

The economic assessment for

Thompson Creek in the FS (as defined below) has been prepared on a

stand-alone basis and does not include integration with Langeloth.

The economics for integrating Thompson Creek and Langeloth are

extrapolated from the Thompson Creek feasibility study.NOTE: See

“Assumptions” at the end of this news release. “n.m.” stand for not

meaningful. |

- Improved integrated economics compared to the

pre-feasibility study (“PFS”) in September 2023:

Integrated economics based on the FS have improved as compared to

the PFS, specifically the Thompson Creek updated life of mine

(“LOM”) plan has an additional 12 million pounds of molybdenum

being produced, one year of additional mine life, more concentrate

produced in the first four years, and a de-risked capital

estimate.

|

|

US Moly: Thompson Creek + Langeloth |

|

FS(1) |

PFS |

|

NPV8% |

$472M |

$218M |

|

NPV5% |

$692M |

$373M |

|

IRR |

22% |

16% |

|

LOM |

12 years |

11 years |

|

Thompson Creek Molybdenum Production |

146M lbs |

134M lbs |

|

Additions to PP&E / Non-sustaining capital

expendituresNG(2,3) |

$397M |

$350M - $400M |

|

(1) |

The economics for integrating Thompson Creek and Langeloth are

extrapolated from the Thompson Creek feasibility study. |

| (2) |

Additions to PP&E are the

same as Capital ExpendituresNG. |

| (3) |

Thompson Creek only; Langeloth

additions to PP&E are in the range of $3 to $4 million per year

and are considered sustaining capital. |

Langeloth Highlights

-

Phased ramp-up to full capacity: Langeloth plans

to ramp up production progressively over the next few years to

increase production towards its full capacity of 40 million pounds

per annum by 2028, which aligns with Thompson Creek’s first full

year of production. At full capacity, the molybdenum feed to

Langeloth is expected to consist of approximately one third

supplied by Thompson Creek and two thirds purchased from third

parties.

-

At full capacity, Langeloth is expected to generate

approximately $45 million in earnings from operations and $50

million of earnings before interest, taxes, depreciation and

amortization (“EBITDA”)NG annually.

Significant synergies and margin improvements are expected to

result from increased capacity utilization at Langeloth, including

improved blending flexibility and more higher margin molybdenum

products enabled by the high-quality feed from Thompson Creek.

-

Strategic geographic location: Langeloth is

strategically connected to the North American steel supply and

sales markets via efficient transportation networks and reliable

infrastructure. Being close to several major US east coast ports,

Langeloth is also well located for importing molybdenum

concentrates and exporting molybdenum products.

-

Flexible and agile operations: With six roasters,

the ability to produce a variety of finished molybdenum products

and a potential total capacity of approximately 40 million pounds,

Langeloth has flexibility to adapt to changing market and

commercial conditions. Langeloth has value-added production

capabilities, namely for ferromolybdenum and pure molybdenum oxide,

positioning the business for opportunities and growth.

-

Strong leadership and people: The Langeloth

management team and staff are highly experienced, dedicated and

committed to a strong culture of operational excellence and

innovation. With 100 years of experience in processing molybdenum,

the team at Langeloth has developed a strong commercial network and

constructive engagement with local regulators.

Thompson Creek FS

Highlights

-

Robust project economics: NPV8% of $185

million and after-tax IRR of 15% using an assumed flat

molybdenum price of $20 per pound for the LOM. The economic

assessment for Thompson Creek in the FS has been prepared on a

stand-alone basis and does not include the benefits of integration

with Langeloth.

-

De-risked capital costs: Initial capital

investment of approximately $397 million. The capital

expenditures needed to restart Thompson Creek are significantly

de-risked due to an existing pit, significantly advanced equipment

rebuilds and purchases and an existing process plant that requires

minimal upgrades and refurbishment. A majority of the anticipated

capital expenditures are focused on capitalized stripping, plant

refurbishment and mine mobile fleet upgrades.

-

Initial mine life of 12 years: Average annual

molybdenum production is estimated to be approximately 13 million

pounds after initial ramp-up. The average LOM operating costs are

$9.66 per molybdenum pound sold and LOM all-in sustaining costs

(“AISC”)NG are $12.46 per molybdenum pound sold.

-

Strong Reserve Base: The FS includes proven

and probable molybdenum reserves of 161 million pounds, measured

and indicated molybdenum resources of 63 million pounds and

inferred molybdenum resources of 17 million pounds, as of September

1, 2024. The average reserve grade is 0.065% molybdenum.

The Company expects to file a technical report

for Thompson Creek on its website at www.centerragold.com, on

SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar.

US Moly Overview

US Moly, consisting of the Langeloth

metallurgical facility near Pittsburgh, Pennsylvania, and the

Thompson Creek mine in Idaho, is part of Centerra’s MBU. The

molybdenum assets were acquired by Centerra in 2016, along with the

Mount Milligan gold-copper mine.

Langeloth

Langeloth is one of three molybdenum conversion

facilities in the United States. Its facility and existing permits

make it a unique and strategic asset, given its proximity to the

North American steel market. Langeloth began commercial molybdenum

conversion operations in 1924 and has historically operated at

levels significantly higher than today. Over a two-year period

prior to the suspension of the Thompson Creek mine in December

2014, the volume of molybdenum roasted at Langeloth was around 37

million pounds per year.

Langeloth operates as a conversion facility of

molybdenum concentrate into metallurgical and chemical grade

products. These products are sold to steel, other metallurgical,

and chemical producers globally. Technical oxide is the main

product manufactured by Langeloth due to its role as a key input in

the manufacturing of high-performance steels. It can potentially be

further processed into value-added products that command a higher

margin. Langeloth can also produce ferromolybdenum and pure

molybdenum oxide, and it has the capability to produce byproducts

such as rhenium, with flexibility to adjust the product mix

depending on market demand and the quality of concentrates sourced.

The availability of high-quality Thompson Creek concentrate

provides significant commercial flexibility to the MBU.

Commercial Optimization of

Langeloth

Centerra has completed a commercial optimization

plan at Langeloth, geared at increasing profitability and

maximizing its future potential by increasing production levels,

achieved by a ramp-up in the purchase of third-party concentrates

and the restart of the Thompson Creek primary molybdenum mine.

Langeloth is well-positioned to capitalize on

the current supply deficit in the molybdenum market and grow the

business to meet the market demand. In the recent past Langeloth

has operated slightly below its annual breakeven capacity of

approximately 14 million pounds. The operation can be ramped up to

full capacity to enable production of approximately 40 million

pounds per year in a straightforward manner.

At full capacity, significant synergies and

margin improvements that will enhance future cash flow generation

and profitability from US Moly are expected to result from: (1)

ability to leverage fixed costs, related to increased capacity

utilization at Langeloth from the current level of approximately

one third; (2) ability to blend the high-quality Thompson Creek

concentrate with lower quality third-party concentrates; and (3)

the ability, enabled by the quality of the Thompson Creek

concentrate, to produce an increased volume of higher margin final

molybdenum products.

At full production capacity, integrated with

Thompson Creek, the molybdenum conversion facility at Langeloth has

the potential to generate annually approximately $50 million of

EBITDANG, $40 million in cash flow from operations and free cash

flowNG of $35 million.

As a result of the compelling value opportunity,

Centerra is initiating a progressive ramp-up at Langeloth to allow

for commercial optimization. Langeloth is expected to ramp up

production progressively towards its full capacity of 40 million

pounds per annum by 2028, which aligns with Thompson Creek’s

expected first full year of production. At full capacity, the

molybdenum feed processed at the Langeloth facility is expected to

consist of approximately one third supplied by Thompson Creek and

approximately two thirds purchased from third-party providers.

Further details on the restart of Thompson Creek are provided

below.

Based on an assumed flat price of $20 per pound

molybdenum, a working capital investment will be required over the

period from 2025 to 2028 to support the ramp-up to full capacity.

On a cash flow basis, this increase in working capital is expected

to be largely offset by cash flow generated by Langeloth during the

same period. The structure of commercial contracts at Langeloth

helps to mitigate molybdenum price volatility. Concentrates are

purchased at a discount to the prevailing market molybdenum price,

while final products are generally sold at prices at or above this

benchmark. As a result, the integrated operations of US Moly will

be better positioned to withstand future fluctuations in molybdenum

prices.

Reaching higher capacity utilization will depend

on several factors which are not fully in Centerra’s control,

including the ability to acquire third-party concentrates on

favourable commercial terms over a significant period of time.

Thompson Creek

The Thompson Creek mine is a large open-pit

primary molybdenum mine. It was a producing mine until it was

placed on care and maintenance in December 2014. It has an existing

open pit, as well as established site infrastructure, processing

facilities and equipment fleet.

Feasibility Study

The Company has completed a FS on the restart of

mining at Thompson Creek, with the objective of realizing value for

the US Moly business. A restart of Thompson Creek, on a stand-alone

basis, is expected to result in NPV8% of $185 million and IRR of

15%, based on an assumed flat molybdenum price of $20 per pound.

The FS includes an optimized mine plan with a 12-year mine life. A

summary of the FS production profile is included in the table

below.

Thompson Creek FS Production

Profile

|

|

Total Mined(M tons) |

Grade of Ore Processed(% Mo) |

Molybdenum

Production(3)(Mlb) |

|

2024(1) |

4.9 |

- |

- |

|

2025 |

50.0 |

- |

- |

|

2026 |

48.0 |

- |

- |

|

2027(2) |

52.0 |

0.05 |

4.7 |

|

2028 |

56.9 |

0.07 |

12.4 |

|

2029 |

51.0 |

0.08 |

14.5 |

|

2030 |

45.0 |

0.08 |

14.7 |

|

2031 |

37.0 |

0.07 |

13.7 |

|

2032 |

57.0 |

0.05 |

9.7 |

|

2033 |

40.0 |

0.04 |

7.8 |

|

2034 |

36.7 |

0.08 |

15.9 |

|

2035 |

24.2 |

0.10 |

19.3 |

|

2036 |

8.0 |

0.06 |

12.2 |

|

2037 |

- |

0.05 |

9.1 |

|

2038 |

- |

0.05 |

9.1 |

|

2039(2) |

- |

0.03 |

2.4 |

|

Total LOM |

510.7 |

0.06 |

145.6 |

| (1) |

2024 figures

for the period from September 1, 2024 to December 31, 2024. |

| (2) |

Production is expected for a part of this year. |

| (3) |

It is estimated that approximately 4.7% of the recovered

molybdenum pounds will be further refined at Thompson Creek and

sold as high-performance molybdenum. |

| NOTE: “Mo” stands for molybdenum, “M tons” stands

for millions of short (US) tons, “Mlb” stands for millions of

molybdenum pounds. Totals may not sum precisely due to

rounding. |

The cost profile associated with the FS is

largely driven by the grade profile. AISCNG per pound from 2028 to

2031 are expected to be lower than the LOM average due to higher

grades and more ore tons mined, which is expected to result in

stronger cash flows in these years. The average operating costs

over the LOM are detailed in the table below. These operating costs

exclude capitalized pre-production costs, which are included in

capital costs. Processing costs cover mill, tailings and water

management costs.

|

LOM average operating costs |

|

|

Mining |

$2.03 per ton mined |

|

Processing |

$4.85 per ton processed |

|

General and administrative (“G&A”) |

$1.67 per ton processed |

Capital

ExpendituresNG

Centerra is proceeding with a restart of

Thompson Creek, which is expected to require an investment of

approximately $397 million in total initial, non-sustaining capital

expendituresNG over three years, from September 2024 through

mid-2027. In the second quarter of 2024, following environmental

studies and regulatory reviews, Centerra obtained mine permit

authorizations for additional lands at Thompson Creek, which will

enable the proposed pit highwall layback included in the FS. As a

result of receiving these mine permit authorizations, a key first

step in the overall permitting process, the Company is moving away

from a two-phased capital approval previously disclosed to a

single-phase capital investment over three years. Thompson Creek is

proactively advancing environmental studies which should support

future permitting, which will not be required until several years

after first production.

Centerra’s capital investment at the Thompson

Creek mine is significantly de-risked due to an existing pit,

significantly advanced equipment rebuilds and purchases, and an

existing process plant that requires some refurbishment. Early

works to support the restart of operations at Thompson Creek are

underway, progressing on budget and on schedule. The majority of

the capital expenditures going forward are expected to be focused

on pre-stripping activities and mill refurbishment. Over the first

six months of 2024, capital spending at Thompson Creek was

primarily related to refurbishment of existing mining mobile

equipment and the purchase of additional mobile equipment,

stripping activities and technical studies.

Updated 2024 Guidance at Thompson

Creek

For the second half of 2024, total project costs

at Thompson Creek are expected to be $55 to $65 million, primarily

related to pre-production stripping and mine mobile fleet upgrades.

Approximately $10 million of these costs will be expensed for

accounting purposes, with the remainder treated as capital

expenditures. Including the actual amounts spent in the first six

months of 2024 of $20.9 million, full year 2024 project development

costs guidance at Thompson Creek is $75 to $85 million.

Sensitivity to Molybdenum

Prices

The Thompson Creek FS and integration of

Langeloth demonstrate strong economics at assumed flat molybdenum

prices of $20 per pound. Langeloth provides resilience to low

molybdenum prices in the cycle. The sensitivity to changes in

molybdenum prices is illustrated in the table below.

FS Economics (Thompson Creek

only)

|

|

Molybdenum Price ($/pound) |

|

$17.50 |

$20.00 (FS price) |

$22.50 |

$25.00 |

|

NPV8% |

($7M) |

$185M |

$370M |

$542M |

|

NPV5% |

$70M |

$307M |

$535M |

$744M |

|

IRR |

8% |

15% |

21% |

26% |

US Moly Integrated Economics (Thompson

Creek plus Langeloth)

|

|

Molybdenum Price ($/pound) |

|

$17.50 |

$20.00 (FS price) |

$22.50 |

$25.00 |

|

NPV8% |

$313M |

$472M |

$628M |

$782M |

|

NPV5% |

$496M |

$692M |

$885M |

$1,076M |

|

IRR |

18% |

22% |

26% |

29% |

Mineral Reserve and Mineral Resource

Estimates

Thompson Creek is an open pit operation that was

active until 2014 when management made the decision to cease

operations due to falling molybdenum prices. After approximately 10

years on care and maintenance, the historical mineral resource

model needed to be updated. The tables below outline the mineral

reserve and resources at Thompson Creek as of September 1,

2024.

Thompson Creek Mineral Molybdenum

Reserve and Resource Estimate (September 1, 2024)

|

|

Tons(M) |

MolybdenumGrade(%) |

Contained Molybdenum(Mlbs) |

|

Proven |

49 |

0.076 |

75 |

|

Probable |

75 |

0.057 |

86 |

|

Proven and Probable |

125 |

0.065 |

161 |

|

Measured |

6 |

0.059 |

7 |

|

Indicated |

50 |

0.057 |

57 |

|

Measured and Indicated |

55 |

0.057 |

63 |

|

Inferred |

12 |

0.072 |

17 |

NOTE: See “Reserve and Resource Notes” at the

end of this news release. Totals may not sum precisely due to

rounding.

Endako Project

Centerra has a 75% interest in the Endako mine

in northern British Columbia, Canada, which is part of the MBU. The

remaining 25% interest is held by Moon River Capital Ltd. Endako is

expected to remain in care and maintenance while the Company

focuses on the Thompson Creek restart. Endako is an important

primary molybdenum asset with a large defined resource in a

top-tier jurisdiction, with a modern processing plant, providing

longer-term optionality. Should Endako be restarted in the future,

it has the potential to provide approximately one third of the

molybdenum feed supplied to Langeloth, which could either

complement or replace the Thompson Creek feed.

Molybdenum Market

Molybdenum is an industrial metal principally

used for metallurgical applications such as a ferro-alloy in

engineered, stainless, and other speciality steels where high

strength, temperature-resistant or corrosion-resistant properties

are sought. The addition of molybdenum enhances the strength,

toughness and wear and corrosion-resistance in steels. Molybdenum

is used in major industries including chemical and petrochemical

processing, oil and gas for drilling and pipelines, power

generation, automotive and aerospace. It is also required for

several green energy applications, especially wind, geothermal and

nuclear. Higher purity molybdenum is also widely used in

non-metallurgical applications such as petroleum refining

catalysts, lubricants, flame-retardants in plastics, water

treatment and as a pigment.

According to the World Bank report “Minerals for

Climate Action: The Mineral Intensity of the Clean Energy

Transition” (2020), molybdenum is named one of the cross-cutting

minerals, like copper, needed across a range of low-carbon

technologies, especially wind and geothermal. The report estimates

that the cumulative molybdenum demand under the renewable energy

roadmap scenario from the International Renewable Energy Agency may

grow by 119% through 2050 from green technologies only. Based on

data from the International Molybdenum Association, the world used

around 630 million pounds of molybdenum in 2023, with the most used

in engineered steels (38%), stainless steels (25%) and chemicals

(13%). A variety of end uses and limited substitution ensures that

molybdenum is not dependent on specific industries, making the

demand for it relatively stable.

Conference Call to Discuss the Strategic

Plan for US Moly

Centerra will host a conference call and webcast

to discuss the strategic plan for US Moly on Friday, September 13,

2024, at 9:00 am Eastern Time. Details for the conference call and

webcast are included below.

Webcast

- Participants can access the webcast

at the following link.

- An archive of the webcast will be

available for until end of day December 13, 2024.

Conference Call

- Participants can register for the

conference call at the following registration link. Upon

registering, you will receive the dial-in details and a unique PIN

to access the call. This process will by-pass the live operator and

avoid the queue. Registration will remain open until the end of the

live conference call.

- Participants who prefer to dial-in

and speak with a live operator, can access the call by dialing

1-844-763-8274 or 647-484-8814. It is recommended that you call 10

minutes before the scheduled start time.

- After the call, an audio recording

will be made available via telephone for one month, until end of

day October 13, 2024. The recording can be accessed by dialing

412-317-0088 or 1-877-344-7529 and using the passcode 1752426. In

addition, the webcast will be archived on Centerra’s website at:

www.centerragold.com.

About Centerra Gold

Centerra Gold Inc. is a Canadian-based gold

mining company focused on operating, developing, exploring and

acquiring gold and copper properties in North America, Türkiye, and

other markets worldwide. Centerra operates two mines: the Mount

Milligan Mine in British Columbia, Canada, and the Öksüt Mine in

Türkiye. The Company also owns the Goldfield District Project in

Nevada, United States, the Kemess Project in British Columbia,

Canada, and owns and operates the Molybdenum Business Unit in the

United States and Canada. Centerra’s shares trade on the Toronto

Stock Exchange (“TSX”) under the symbol CG and on the New York

Stock Exchange (“NYSE”) under the symbol CGAU. The Company is based

in Toronto, Ontario, Canada.

For more information:

Lisa Wilkinson Vice President, Investor

Relations & Corporate Communications (416)

204-3780 lisa.wilkinson@centerragold.com

Lana Pisarenko Senior Manager, Investor

Relations (416)

204-1957lana.pisarenko@centerragold.com

Additional information on Centerra is available

on the Company’s website at www.centerragold.com, on SEDAR+ at

www.sedarplus.ca and EDGAR at www.sec.gov/edgar.

Reserve and Resource Notes

- Mineral Reserves

stated in the table above are the economic portion of the Measured

and Indicated Mineral Resource contained within the engineered pit

design following the selected ultimate Pseudoflow pit shell.

- Mineral Reserves

are stated in terms of in situ tons and grade before process

recovery is applied.

- Modifying

factors such as dilution and mining loss have been accounted

for.

- The economic

assumptions used for the Mineral Reserve estimate include: ore

mining cost of $2.17/ton; waste mining cost of $1.77/ton; mining

sustaining cost of $0.06/ton; G&A, processing, and sustaining

costs of $7.33/ton ore; and selling cost of $1,460/ton metal in

concentrate.

- Mineral Reserves

are based upon a 0.030% Mo internal cut-off grade with some

marginal material included, using a $16.00/lb Mo price with a

variable molybdenum recovery.

- Mineral

Resources are reported exclusive of Mineral Reserves; Mineral

Resources that are not Mineral Reserves do not have demonstrated

economic viability.

- Mineral

Resources are considered for open pit extraction.

- Resources are

reported using a 0.025% Mo cut-off grade within a conceptual pit

shell and are exclusive of Mineral Reserves. Economic parameters

for the determination of the resource cut-off grade include: (i)

Molybdenum price of US$18.50/lb; (ii) Mining cost of

$1.77-$2.17/ton and G&A and processing cost of $6.75/ton

processed. Sustaining costs were not included in the resource

cut-off grade calculation; (iii) At the cut-off grade an 82%

recovery was assumed.

- Mineral

Resources are classified and have been estimated in accordance with

CIM Definition Standards.

- As required by

reporting guidelines, rounding may result in apparent summation

differences between tons, grade, and metal content.

- Refer to the

full technical report for the Thompson Creek mine at

www.centerragold.com, on SEDAR+ at www.sedarplus.ca and EDGAR at

www.sec.gov/edgar.

Feasibility Study Qualified Persons

(“QPs”)

Lars Weiershäuser, PhD, P.Geo, and Centerra’s

Director, Geology, has reviewed and approved the scientific and

technical information included in this news release related to

mineral resource estimates. Dr. Weiershäuser is a Qualified Person

within the meaning of the Canadian Securities Administrators’

National Instrument 43-101, Standards of Disclosure for Mineral

Projects (“NI 43-101”).

Jean-Francois St-Onge, Professional Engineer,

member of the Professional Engineers of Ontario (PEO), has reviewed

and approved the scientific and technical information in this news

release related to mineral reserve estimates, operating and capital

costs. Mr. St-Onge is a Qualified Person within the meaning of NI

43-101. Mr. St-Onge was Centerra’s Senior Director, Technical

Services until May 31, 2024, and is now providing services to the

Company as an external consultant.

All other scientific and technical information

presented in this news release was reviewed and approved by

Centerra’s geological and mining staff under the supervision of W.

Paul Chawrun, Professional Engineer, member of the Professional

Engineers of Ontario (PEO) and Centerra’s Executive Vice President

and Chief Operating Officer. Mr. Chawrun is a Qualified Person

within the meaning of NI 43-101.

For more information on the FS and the full list

of QPs, please refer to the full technical report for the Thompson

Creek mine at www.centerragold.com, on SEDAR+ at www.sedarplus.ca

and EDGAR at www.sec.gov/edgar.

Assumptions

The economic analysis of the project was

performed using the following assumptions and basis:

- Economic

assessment for Thompson Creek is prepared on a stand-alone basis

and does not include any integration with Langeloth.

- Pre-tax net cash

flows for Thompson Creek include all operating, transport,

treatment, capital and reclamation costs.

- Economic

assessment of the project uses a discounted cash flow approach.

Cash flows are taken to occur at the mid-year of each period. NPV

is calculated by applying no discounting to 2024 cash flows and by

discounting LOM cash flows from the year 2025 to the end of mine

life to January 1, 2025, using 8% discount rate.

- Project

economics are based on a valuation date of September 1, 2024.

- A price of

$20/lb of molybdenum is assumed throughout the LOM.

- All costs

presented are in constant US dollars as of Q2 2024 with no price

inflation or escalation factors applied.

- Ore production

is scheduled to begin in Q3 2027.

- Mine life is 16

years, including an initial four years of construction and waste

stripping from years 2024 to 2027 and 12 years of production

activities.

- Average annual

molybdenum production during production years is 12 million pounds

per year. All molybdenum produced by the mine is assumed to be sold

in the same year it is produced.

- Working capital

for Thompson Creek is assumed not to change significantly over the

LOM and is not modeled in this economic analysis.

- No salvage

values are assumed for the capital equipment at the end of mine

life.

- Reclamation and

closure costs for the site were estimated by an external consultant

at a total of $202 million. Reclamation and closure activities will

start progressively after the end of production in 2039, with the

bulk of reclamation work to be completed by 2045, followed by

ongoing tailings management costs and monitoring thereafter.

- Transportation

costs for molybdenite concentrate shipments to Langeloth are

estimated at $29 million over the LOM. Treatment costs at Langeloth

are estimated at $118 million over the LOM. These costs include all

processing and refining expenses necessary to convert the

molybdenite concentrate into molybdenum oxide and other marketable

products. The estimated costs for transportation to and treatment

at Langeloth are based on current trucking quotes and current

treatment costs at the facility, respectively.

Caution Regarding Forward-Looking

InformationInformation contained in this document which is

not a statement of historical fact, and the documents incorporated

by reference herein, may be “forward-looking information” for the

purposes of Canadian securities laws and within the meaning of the

United States Private Securities Litigation Reform Act of 1995.

Such forward-looking information involves risks, uncertainties and

other factors that could cause actual results, performance,

prospects and opportunities to differ materially from those

expressed or implied by such forward-looking information. The words

"achieve", “advance”, “assume”, “anticipate”, “approach”,

“believe”, “budget”, “could”, “de-risk”, “develop”, “enhance”,

“estimate”, “expect”, “explore”, “focus”, “forecast”, “future”,

“generate”, “growth”, “in line”, “improve”, “may”, “maximize”,

“offset”, “optimize”, “plan”, "potential", “remaining”, “restart”,

“result”, “schedule”, “strategy”, “subject to”, “target”,

“understand”, “update”, “will”, and similar expressions identify

forward-looking information.

These forward-looking statements relate to,

among other things: statements regarding the Company’s strategic

plan; any synergies which may arise from, or are expected to arise

from, the vertical integration of Thompson Creek and Langeloth

including the Company’s ability to source and blend the concentrate

from Thompson Creek or third-parties at Langeloth; the proposed pit

highwall layback included in the Thompson Creek feasibility study;

projections regarding earnings, cash flow from operations, free

cash flow, internal rates of return and after-tax net present

values for Thompson Creek, Langeloth or US Moly; the 2024 guidance

for project spending at Thompson Creek related to capitalized

stripping, plant refurbishment, mine mobile fleet upgrades and

capital expenditure guidance; fluctuation of, sensitivity to, and

assumptions of molybdenum prices and the impact it may have on the

future supply and demand of molybdenum and steel; the expected

profile of US Moly’s future production and costs; updates to the

life of mine plan for Thompson Creek; the expected filing of a

technical report for Thompson Creek; Langeloth’s ability to

capitalize on growing demand in the molybdenum market; strategic

options for the entire MBU and US Moly; future cash flow generation

and profitability from Thompson Creek, Langeloth or US Moly;

evaluating external opportunities for growth; ongoing evaluations

of a restart of Thompson Creek, including integrating Langeloth,

its operating capacities and the use of the concentrate from

Thompson Creek or third-parties, the ability of the Company

successfully advance environmental studies that support future

permitting; the Company receiving all necessary permits and

authorizations required during the restart and production at

Thompson Creek; mineral reserve and mineral resource estimates from

Thompson Creek; the ability to ramp-up operations at Langeloth and

realizing its full annual capacity; the ability of the Company to

obtain the requisite supply to support full capacity at Langeloth

from third-parties; future prices of molybdenum including the

ability of the Company to purchase concentrate at a discount to the

market and being able to sell final products at or above this

benchmark; the future of Endako, its ability to supply Langeloth

with molybdenum feed if restarted and whether or not this

molybdenum feed could complement or replace that feed from Thompson

Creek; and the future exploration plans for the Company.

Forward-looking information is necessarily based

upon a number of estimates and assumptions that, while considered

reasonable by Centerra, are inherently subject to significant

technical, political, business, economic and competitive

uncertainties and contingencies. Known and unknown factors could

cause actual results to differ materially from those projected in

the forward- looking information. Factors and assumptions that

could cause actual results or events to differ materially from

current expectations include, among other things: (A) strategic,

legal, planning and other risks associated with the Company’s

operations, including; the management of external stakeholder

expectations; the impact of changes in, or to the more aggressive

enforcement of, laws, regulations and government practices; risks

that community activism may result in increased contributory

demands or business interruptions; potential defects of title in

the Company’s properties that are not known as of the date hereof;

the imprecision of the Company’s mineral reserves and resources

estimates and the assumptions they rely on, including

environmental, processing permitting, taxation, socioeconomic,

infill and exploration drilling and other factors; key assumptions,

parameters and methods used to estimate the mineral reserve and

mineral resource estimate in the Thompson Creek feasibility study;

Indigenous claims and consultative issues relating to the Company’s

properties which are in proximity to Indigenous communities; and

(B) risks related to operational matters and geotechnical issues

and the Company’s continued ability to successfully manage such

matters, including: the ability of the Company to achieve pit slope

design angles at Thompson Creek, particularly in the North Wall,

which will be based on future drilling and may be impacted by

stronger/weaker rock characteristics, favorable/unfavorable

geologic structure, and/or variations in pore pressures that could

result in an increase or decrease in required depressurization to

achieve these slope design angles; the ability of the Company to

achieve historical throughput rates at Thompson Creek; the Company

receiving the required authorizations and permits for the restart

of Thompson Creek; the ability of the Company to source and blend

concentrate from Thompson Creek or third-parties at Langeloth; the

stability of the pit walls at the Company’s operations, including

Thompson Creek; the integrity of tailings storage facilities and

the management thereof, including as to stability, seismic

activity, compliance with laws, regulations, licenses and permits,

controlling seepages and storage of water, where applicable and any

future capital expenditures required for active reclamation and

tailings storage facilities issues; changes to current remediation

plans due to tailings storage facilities structures; the ability of

the Company to achieve its commercial optimization plan at

Langeloth; changes to, or delays in the Company’s supply chain and

transportation routes, including cessation or disruption in rail

and shipping networks, whether caused by decisions of third-party

providers or force majeure events (including, but not limited to:

labour action, flooding, wildfires, earthquakes, pandemics, or

other global events such as wars); risks related to future price of

molybdenum, inflation and interest rates; the adequacy of the

Company’s insurance to mitigate operational and corporate risks;

mechanical breakdowns; the occurrence of any labour unrest or

disturbance and the ability of the Company to successfully

renegotiate collective agreements when required; reliance on a

limited number of suppliers for certain consumables, equipment and

components; the ability of the Company to address physical and

transition risks from climate change; the Company’s ability to

accurately predict decommissioning and reclamation costs and the

assumptions they rely upon; the Company’s ability to attract and

retain qualified personnel; . For additional risk factors, please

see section titled “Risks Factors” in the Company’s most recently

filed Annual Information Form (“AIF”) available on SEDAR+ at

www.sedarplus.com and EDGAR at www.sec.gov/edgar and the “Capital

and Operating Costs – Material Assumptions”, “Economic Analysis –

Assumptions”, “Interpretation and Conclusions - Risks and

Opportunities” sections of the technical report for Thompson Creek

which will be available on SEDAR+ at www.sedarplus.com and

EDGAR at www.sec.gov/edgar.

There can be no assurances that forward-looking

information and statements will prove to be accurate, as many

factors and future events, both known and unknown could cause

actual results, performance or achievements to vary or differ

materially from the results, performance or achievements that are

or may be expressed or implied by such forward-looking statements

contained herein or incorporated by reference. Accordingly, all

such factors should be considered carefully when making decisions

with respect to Centerra, and prospective investors should not

place undue reliance on forward-looking information.

Forward-looking information is as of September 12, 2024. Centerra

assumes no obligation to update or revise forward-looking

information to reflect changes in assumptions, changes in

circumstances or any other events affecting such forward-looking

information, except as required by applicable law.

Non-GAAP Financial Measures

This document contains “specified financial

measures” within the meaning of NI 52-112, specifically the

non-GAAP financial measures and non-GAAP ratios described below.

Management believes that the use of these measures assists

analysts, investors and other stakeholders of the Company in

understanding the costs associated with producing molybdenum,

understanding the economics of molybdenum mining, assessing

operating performance, the Company’s ability to generate free cash

flow from current operations and on an overall Company basis and

for planning and forecasting of future periods. However, the

measures have limitations as analytical tools as they may be

influenced by the point in the life cycle of a specific mine and

the level of additional exploration or other expenditures a company

has to make to fully develop its properties. The specified

financial measures used in this document do not have any

standardized meaning prescribed by IFRS and may not be comparable

to similar measures presented by other issuers, even as compared to

other issuers who may be applying the World Gold Council (“WGC”)

guidelines. Accordingly, these specified financial measures should

not be considered in isolation, or as a substitute for, analysis of

the Company’s recognized measures presented in accordance with

IFRS.

Definitions

The following is a description of the non-GAAP

financial measures and non-GAAP ratios used in this document:

- EBITDA is a non-GAAP financial

measure that represents earnings before interest, taxes,

depreciation, and amortization. It is calculated by adjusting

earnings from operations as recorded in the consolidated statements

of earnings by depreciation and amortization. Management uses this

measure to monitor and plan for the operating performance of the

Company in conjunction with other data prepared in accordance with

IFRS.

- Free cash flow (deficit) is a

non-GAAP financial measure calculated as cash provided by operating

activities from continuing operations less property, plant and

equipment additions. A reconciliation of free cash flow to the

nearest IFRS measures is set out below. Management uses this

measure to monitor the amount of cash available to reinvest in the

Company and allocate for shareholder returns.

- Sustaining capital expenditures and

Non-sustaining capital expenditures are non-GAAP financial

measures. Sustaining capital expenditures are defined as those

expenditures required to sustain current operations and exclude all

expenditures incurred at new operations or major projects at

existing operations where these projects will materially benefit

the operation. Non-sustaining capital expenditures are primarily

costs incurred at ‘new operations’ and costs related to ‘major

projects at existing operations’ where these projects will

materially benefit the operation. A material benefit to an existing

operation is considered to be at least a 10% increase in annual or

life of mine production, net present value, or reserves compared to

the remaining life of mine of the operation. A reconciliation of

sustaining capital expenditures and non-sustaining capital

expenditures to the nearest IFRS measures is set out below.

Management uses the distinction of the sustaining and

non-sustaining capital expenditures as an input into the

calculation of all-in sustaining costs per ounce and all-in costs

per ounce.

- All-in sustaining costs per

molybdenum pound sold is a non-GAAP financial measure that includes

all operating costs, comprising of all stripping costs, capital

costs and treatment costs. This measure incorporates costs incurred

during the production phase. Management uses this measure to

monitor and plan for the operating performance of the Company in

conjunction with other data prepared in accordance with IFRS.

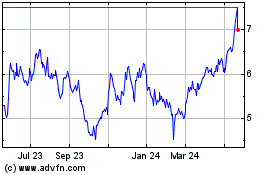

Centerra Gold (NYSE:CGAU)

Historical Stock Chart

From Oct 2024 to Nov 2024

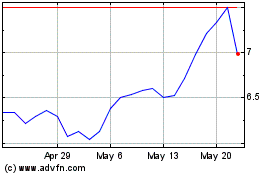

Centerra Gold (NYSE:CGAU)

Historical Stock Chart

From Nov 2023 to Nov 2024