Clipper Realty Inc. (NYSE: CLPR) (the “Company”), a leading

owner and operator of multifamily residential and commercial

properties in the New York metropolitan area, today announced

financial and operating results for the three months ended March

31, 2023.

Highlights for the Three Months Ended March 31, 2023

- Record quarterly revenues of $33.7 million for the first

quarter of 2023

- Quarterly income from operations of $6.9 million for the first

quarter of 2023

- Net operating income (“NOI”)1 of $17.1 million for the first

quarter of 2023

- Quarterly net loss of $7.1 million for the first quarter of

2023

- Quarterly adjusted funds from operations (“AFFO”)1 of $4.5

million for the first quarter of 2023

- Declared a dividend of $0.095 per share for the first quarter

of 2023

David Bistricer, Co-Chairman and Chief Executive Officer,

commented,

“In the first quarter the Company has built on its momentum from

the prior year. New leases continue to rent at higher levels than

the previous ones. This has resulted in record revenue for the

quarter. In the first quarter, we recorded record revenue of $33.7

million, NOI of $17.1 million, leased occupancy of 98.9% and our

overall collection rate remains high at 98.7%. We have

substantially completed our development of the 1010 Pacific Street

building, branded “Pacific House”, including obtaining a temporary

certificate of occupancy for a majority of the building at the end

of the first quarter, well ahead of schedule and on budget. As a

result, we were able to refinance the building early to a fixed

rate mortgage that will substantially decrease our interest costs

compared to the construction loan. As occupancy increases, we will

have access to additional borrowings on the loan and we will see

the rate we pay on the loan decrease by up to 25 additional basis

points. This new loan increases the percentage of our

non-development portfolio with fixed rates loans to over 90% and

with none of the loans maturing until 2027. This puts us in a

strong position as it relates to the current interest rate

environment. We remain committed to executing our strategic

initiatives, including the development of our Dean Street project,

to create long-term value.”

Financial Results

For the first quarter of 2023, revenues increased by $1.6

million, or 5.0%, to $33.7 million and $2.7 million, or 8.8%

excluding a net $1.1 million recovery of a bad debt reserve at a

commercial tenant in the first quarter of 2022. This compares to

revenue of $32.1 million or $31.0 million, excluding this one-time

bad debt recovery where we reached an agreement with a commercial

tenant whose arrears were included in bad debt under the new

accounting standard first implemented on January 1, 2022.

Residential revenue increased by $2.5 million, or 11.5%, driven by

higher rental rates and occupancy at all our residential

properties. Commercial income decreased $0.9 million as reported,

or 8.1%, but increased by $0.2 million, or 2.5%, excluding the

one-time recovery of a bad debt reserve. The adjusted increase was

due to new commercial leases signed during 2022.

For the first quarter of 2023, net loss was $7.1 million, or

$0.19 per share compared to net loss of $3.5 million, or $0.09 per

share, for the first quarter of 2022, or $4.6 million, or $0.12 per

share excluding the one-time bad debt recovery. The adjusted change

was primarily attributable to the $3.9 million loss on

extinguishment of debt discussed below (see Pacific House

Refinance) partially offset by the increased rental revenue

discussed above net of higher utilities costs, real estate taxes

and general and administrative costs.

For the first quarter of 2023, AFFO was $4.5 million, or $0.11

per share, compared to $4.4 million, or $0.10 per share, for the

first quarter of 2022, or $3.3 million excluding the one-time bad

debt recovery mentioned above. The adjusted increase was primarily

attributable to the increased revenue discussed above, net of

higher utilities, real estate taxes, and general and administrative

costs.

Balance Sheet

At March 31, 2023, notes payable (excluding unamortized loan

costs) was $1,187.3 million, compared to $1,171.2 million at

December 31, 2022. The increase was primarily due to the

refinancing of the Pacific House loan described below.

Pacific House Refinance

On February 10, 2023, the Company refinanced its Pacific House

construction loan with a mortgage loan with Valley National Bank

providing for maximum borrowings of $80 million. The loan provided

initial funding of $60 million and a further $20 million subject to

the achievement of certain financial targets. The loan has a term

of five years and an initial annual interest rate of 5.7% subject

to reduction by up to 25 basis points upon achievement of certain

financial targets. The loan is interest only for the first two

years and principal and interest thereafter based on a 30-year

amortization schedule. The refinancing with fixed rate debt took

advantage of the prompt and on-budget completion of construction by

which the Company avoided the higher cost of continued variable

rate interest, including a related interest rate cap, in return for

the recorded early termination fee.

Dividend

The Company today declared a first quarter dividend of $0.095

per share, the same amount as last quarter, to shareholders of

record on May 15, 2023, payable May 24, 2023.

Conference Call and Supplemental Material

The Company will host a conference call on May 4, 2023, at 5:00

PM Eastern Time to discuss the first quarter 2023 results and

provide a business update. The conference call can be accessed by

dialing (800) 346-7359 or (973) 528-0008, conference entry code

313340. A replay of the call will be available from May 4, 2023,

following the call, through May 18, 2023, by dialing (800) 332-6854

or (973) 528-0005, replay conference ID 313340. Supplemental data

to this press release can be found under the “Quarterly Earnings”

navigation tab on the “Investors” page of our website at

www.clipperrealty.com. The Company’s filings with the Securities

and Exchange Commission (the “SEC”) are filed at www.sec.gov under

Clipper Realty Inc.

About Clipper Realty Inc.

Clipper Realty Inc. (NYSE: CLPR) is a self-administered and

self-managed real estate company that acquires, owns, manages,

operates and repositions multifamily residential and commercial

properties in the New York metropolitan area, with a portfolio in

Manhattan and Brooklyn. For more information on the Company, please

visit www.clipperrealty.com.

Forward-Looking Statements

Various statements contained in this press release, including

those that express a belief, expectation or intention, as well as

those that are not statements of historical fact, are

forward-looking statements. These forward-looking statements may

include estimates concerning capital projects and the success of

specific properties. Our forward-looking statements are generally

accompanied by words such as "estimate," "project," "predict,"

"believe," "expect," "intend," "anticipate," "potential," "plan" or

other words that convey the uncertainty of future events or

outcomes. The forward-looking statements in this press release

speak only as of the date of this press release.

We disclaim any obligation to update these statements unless

required by law, and we caution you not to rely on them unduly. We

have based these forward-looking statements on our current

expectations and assumptions about future events. While our

management considers these expectations and assumptions to be

reasonable, they are inherently subject to significant business,

economic, competitive, regulatory and other risks, contingencies

and uncertainties (including uncertainties regarding the ongoing

impact of the COVID-19 pandemic, and measures intended to curb its

spread, on our business, our tenants and the economy generally),

most of which are difficult to predict and many of which are beyond

our control and which may cause our actual results, performance or

achievements to differ materially from any future results,

performance or achievements expressed or implied by these

forward-looking statements. For a discussion of these and other

important factors that could affect our actual results, please

refer to our filings with the SEC, including the "Risk Factors"

section of our Annual Report on Form 10-K for the year ended

December 31, 2022, and other reports filed from time to time with

the SEC.

___________________________ 1 NOI and AFFO are non-GAAP

financial measures. For a definition of these financial measures

and a reconciliation of such measures to the most comparable GAAP

measures, see “Reconciliation of Non-GAAP Measures” at the end of

this release.

Clipper Realty Inc. Consolidated Balance Sheets

(In thousands, except for share and per share data)

March 31, 2023 December 31, 2022 (unaudited)

ASSETS Investment in real estate Land and improvements

$

540,859

$

540,859

Building and improvements

659,109

656,460

Tenant improvements

3,406

3,406

Furniture, fixtures and equipment

12,964

12,878

Real estate under development

150,719

142,287

Total investment in real estate

1,367,057

1,355,890

Accumulated depreciation

(191,580

)

(184,781

)

Investment in real estate, net

1,175,477

1,171,109

Cash and cash equivalents

18,801

18,152

Restricted cash

19,023

12,514

Tenant and other receivables, net of allowance for doubtful

accounts

4,768

5,005

of $200 and $321, respectively Deferred rent

2,138

2,573

Deferred costs and intangible assets, net

6,532

6,624

Prepaid expenses and other assets

10,659

13,654

TOTAL ASSETS

$

1,237,398

$

1,229,631

LIABILITIES AND EQUITY Liabilities: Notes payable,

net of unamortized loan costs

$

1,178,027

$

1,161,588

of $9,240 and $9,650, respectively Accounts payable and accrued

liabilities

13,938

17,094

Security deposits

8,230

7,940

Below-market leases, net

10

18

Other liabilities

10,803

5,812

TOTAL LIABILITIES

1,211,008

1,192,452

Equity: Preferred stock, $0.01 par value; 100,000 shares

authorized (including 140 shares

-

-

of 12.5% Series A cumulative non-voting preferred stock), zero

shares issued and outstanding Common stock, $0.01 par value;

500,000,000 shares authorized,

160

160

16,063,228 shares issued and outstanding Additional paid-in-capital

88,952

88,829

Accumulated deficit

(79,108

)

(74,895

)

Total stockholders' equity

10,004

14,094

Non-controlling interests

16,386

23,085

TOTAL EQUITY

26,390

37,179

TOTAL LIABILITIES AND EQUITY

$

1,237,398

$

1,229,631

Clipper Realty Inc. Consolidated Statements of

Operations (In thousands, except per share data)

(Unaudited) Three Months Ended March 31,

2023

2022

REVENUES Residential rental income

$

23,940

$

21,462

Commercial rental income

9,727

10,588

TOTAL REVENUES

33,667

32,050

OPERATING EXPENSES Property operating expenses

8,099

7,539

Real estate taxes and insurance

8,536

7,931

General and administrative

3,293

2,942

Transaction pursuit costs

-

424

Depreciation and amortization

6,825

6,705

TOTAL OPERATING EXPENSES

26,753

25,541

INCOME FROM OPERATIONS

6,914

6,509

Interest expense, net

(10,135

)

(9,985

)

Loss on extinguishment of debt

(3,868

)

-

Net loss

(7,089

)

(3,476

)

Net loss attributable to non-controlling interests

4,402

2,158

Net loss attributable to common stockholders

$

(2,687

)

$

(1,318

)

Basic and diluted net loss per share

$

(0.19

)

$

(0.09

)

Weighted average common shares / OP units Common shares

outstanding

16,063

16,063

OP units outstanding

26,317

26,317

Diluted shares outstanding

42,380

42,380

Clipper Realty Inc. Consolidated Statements of

Cash Flows (In thousands) (Unaudited)

Three Months Ended March 31, .

2023

2022

CASH FLOWS FROM OPERATING ACTIVITIES Net loss

$

(7,089

)

$

(3,476

)

Adjustments to reconcile net loss to net cash provided by

operating activities: Depreciation

6,799

6,646

Amortization of deferred financing costs

313

313

Amortization of deferred costs and intangible assets

146

179

Amortization of above- and below-market leases

(9

)

(9

)

Loss on extinguishment of debt

3,868

-

Deferred rent

435

(189

)

Stock-based compensation

648

495

Bad debt expense

(121

)

(379

)

Changes in operating assets and liabilities: Tenant and other

receivables

358

(237

)

Prepaid expenses, other assets and deferred costs

2,941

3,122

Accounts payable and accrued liabilities

(1,801

)

(668

)

Security deposits

290

89

Other liabilities

643

701

Net cash provided by operating activities

7,421

6,587

CASH FLOWS FROM INVESTING ACTIVITIES Additions to

land, buildings and improvements

(12,494

)

(13,885

)

Acquisition deposit

-

(265

)

Cash paid in connection with acquisition of real estate

-

(3,701

)

Net cash used in investing activities

(12,494

)

(17,851

)

CASH FLOWS FROM FINANCING ACTIVITIES Payments of

mortgage notes

(46,301

)

(554

)

Proceeds from mortgage notes

62,330

7,617

Dividends and distributions

-

(4,188

)

Loan issuance and extinguishment costs

(3,798

)

-

Net cash provided by financing activities

12,231

2,875

Net increase (decrease) in cash and cash equivalents and

restricted cash

7,158

(8,389

)

Cash and cash equivalents and restricted cash - beginning of period

30,666

52,224

Cash and cash equivalents and restricted cash - end of

period

$

37,824

$

43,835

Cash and cash equivalents and restricted cash - beginning of

period: Cash and cash equivalents

$

18,152

$

34,524

Restricted cash

12,514

17,700

Total cash and cash equivalents and restricted cash - beginning of

period

$

30,666

$

52,224

Cash and cash equivalents and restricted cash - end of

period: Cash and cash equivalents

$

18,801

$

25,342

Restricted cash

19,023

18,493

Total cash and cash equivalents and restricted cash - end of period

$

37,824

$

43,835

Supplemental cash flow information: Cash paid for interest,

net of capitalized interest of $2,382 and $607 in 2023 and 2022,

respectively

$

9,863

$

10,351

Non-cash interest capitalized to real estate under development

27

508

Additions to investment in real estate included in accounts payable

and accrued liabilities

3,527

6,906

Non-cash dividend declared

4,348

-

Clipper Realty Inc. Reconciliation of

Non-GAAP Measures (In thousands, except per share data)

(Unaudited)

Non-GAAP Financial Measures

We disclose and discuss funds from operations (“FFO”), adjusted

funds from operations (“AFFO”), adjusted earnings before interest,

income taxes, depreciation and amortization (“Adjusted EBITDA”) and

net operating income (“NOI”), all of which meet the definition of

“non-GAAP financial measures” set forth in Item 10(e) of Regulation

S-K promulgated by the SEC.

While management and the investment community in general believe

that presentation of these measures provides useful information to

investors, neither FFO, AFFO, Adjusted EBITDA, nor NOI should be

considered as an alternative to net income (loss) or income from

operations as an indication of our performance. We believe that to

understand our performance further, FFO, AFFO, Adjusted EBITDA, and

NOI should be compared with our reported net income (loss) or

income from operations and considered in addition to cash flows

computed in accordance with GAAP, as presented in our consolidated

financial statements.

Funds From Operations and Adjusted Funds From

Operations

FFO is defined by the National Association of Real Estate

Investment Trusts (“NAREIT”) as net income (computed in accordance

with GAAP), excluding gains (or losses) from sales of property and

impairment adjustments, plus depreciation and amortization, and

after adjustments for unconsolidated partnerships and joint

ventures. Our calculation of FFO is consistent with FFO as defined

by NAREIT.

AFFO is defined by us as FFO excluding amortization of

identifiable intangibles incurred in property acquisitions,

straight-line rent adjustments to revenue from long-term leases,

amortization costs incurred in originating debt, interest rate cap

mark-to-market adjustments, amortization of non-cash equity

compensation, acquisition and other costs, transaction pursuit

costs, loss on modification/extinguishment of debt, gain on

involuntary conversion, gain on termination of lease and

non-recurring litigation-related expenses, less recurring capital

spending.

Historical cost accounting for real estate assets implicitly

assumes that the value of real estate assets diminishes predictably

over time. In fact, real estate values have historically risen or

fallen with market conditions. FFO is intended to be a standard

supplemental measure of operating performance that excludes

historical cost depreciation and valuation adjustments from net

income. We consider FFO useful in evaluating potential property

acquisitions and measuring operating performance. We further

consider AFFO useful in determining funds available for payment of

distributions. Neither FFO nor AFFO represent net income or cash

flows from operations computed in accordance with GAAP. You should

not consider FFO and AFFO to be alternatives to net income (loss)

as reliable measures of our operating performance; nor should you

consider FFO and AFFO to be alternatives to cash flows from

operating, investing or financing activities (computed in

accordance with GAAP) as measures of liquidity.

Neither FFO nor AFFO measure whether cash flow is sufficient to

fund all of our cash needs, including loan principal amortization,

capital improvements and distributions to stockholders. FFO and

AFFO do not represent cash flows from operating, investing or

financing activities computed in accordance with GAAP. Further, FFO

and AFFO as disclosed by other REITs might not be comparable to our

calculations of FFO and AFFO.

The following table sets forth a reconciliation of FFO and AFFO

for the periods presented to net loss, computed in accordance with

GAAP (amounts in thousands):

Three Months Ended March 31,

2023

2022

FFO Net loss

$

(7,089

)

$

(3,476

)

Real estate depreciation and amortization

6,825

6,705

FFO

$

(264

)

$

3,229

AFFO FFO

$

(264

)

$

3,229

Amortization of real estate tax intangible

120

120

Amortization of above- and below-market leases

(9

)

(9

)

Straight-line rent adjustments

(5

)

(189

)

Amortization of debt origination costs

313

313

Amortization of LTIP awards

648

495

Transaction pursuit costs

-

424

Loss on extinguishment of debt

3,868

-

Certain litigation-related expenses

-

86

Recurring capital spending

(195

)

(49

)

AFFO

$

4,476

$

4,420

AFFO Per Share/Unit

$

0.11

$

0.10

Adjusted Earnings Before Interest, Income Taxes, Depreciation

and Amortization

We believe that Adjusted EBITDA is a useful measure of our

operating performance. We define Adjusted EBITDA as net income

(loss) before allocation to non-controlling interests, plus real

estate depreciation and amortization, amortization of identifiable

intangibles, straight-line rent adjustments to revenue from

long-term leases, amortization of non-cash equity compensation,

interest expense (net), acquisition and other costs, transaction

pursuit costs, loss on modification/extinguishment of debt and

non-recurring litigation-related expenses, less gain on involuntary

conversion and gain on termination of lease.

We believe that this measure provides an operating perspective

not immediately apparent from GAAP income from operations or net

income (loss). We consider Adjusted EBITDA to be a meaningful

financial measure of our core operating performance.

However, Adjusted EBITDA should only be used as an alternative

measure of our financial performance. Further, other REITs may use

different methodologies for calculating Adjusted EBITDA, and

accordingly, our Adjusted EBITDA may not be comparable to that of

other REITs.

The following table sets forth a reconciliation of Adjusted

EBITDA for the periods presented to net loss, computed in

accordance with GAAP (amounts in thousands):

Three Months Ended March 31,

2023

2022

Adjusted EBITDA Net loss

$

(7,089

)

$

(3,476

)

Real estate depreciation and amortization

6,825

6,705

Amortization of real estate tax intangible

120

120

Amortization of above- and below-market leases

(9

)

(9

)

Straight-line rent adjustments

(5

)

(189

)

Amortization of LTIP awards

648

495

Interest expense, net

10,135

9,985

Transaction pursuit costs

-

424

Loss on extinguishment of debt

3,868

-

Certain litigation-related expenses

-

86

Adjusted EBITDA

$

14,493

$

14,141

Net Operating Income

We believe that NOI is a useful measure of our operating

performance. We define NOI as income from operations plus real

estate depreciation and amortization, general and administrative

expenses, acquisition and other costs, transaction pursuit costs,

amortization of identifiable intangibles and straight-line rent

adjustments to revenue from long-term leases, less gain on

termination of lease. We believe that this measure is widely

recognized and provides an operating perspective not immediately

apparent from GAAP income from operations or net income (loss). We

use NOI to evaluate our performance because NOI allows us to

evaluate the operating performance of our company by measuring the

core operations of property performance and capturing trends in

rental housing and property operating expenses. NOI is also a

widely used metric in valuation of properties.

However, NOI should only be used as an alternative measure of

our financial performance. Further, other REITs may use different

methodologies for calculating NOI, and accordingly, our NOI may not

be comparable to that of other REITs.

The following table sets forth a reconciliation of NOI for the

periods presented to income from operations, computed in accordance

with GAAP (amounts in thousands):

Three Months Ended March 31,

2023

2022

NOI Income from operations

$

6,914

$

6,509

Real estate depreciation and amortization

6,825

6,705

General and administrative expenses

3,293

2,942

Transaction pursuit costs

-

424

Amortization of real estate tax intangible

120

120

Amortization of above- and below-market leases

(9

)

(9

)

Straight-line rent adjustments

(5

)

(189

)

NOI

$

17,138

$

16,502

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230504005153/en/

Lawrence Kreider Chief Financial Officer (718) 438-2804 x2231

larry@clipperrealty.com

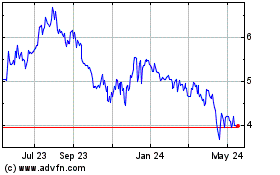

Clipper Realty (NYSE:CLPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

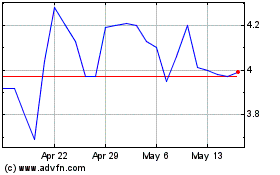

Clipper Realty (NYSE:CLPR)

Historical Stock Chart

From Jan 2024 to Jan 2025