false

0001030894

A6

00-0000000

0001030894

2025-01-29

2025-01-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 29, 2025

Celestica Inc.

(Exact name of registrant as specified in its charter)

| Ontario |

001-14832 |

N/A |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 5140

Yonge Street, Suite 1900, Toronto, Ontario, Canada |

M2N 6L7 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s

Telephone Number, Including Area Code: (416) 448-5800

Check the appropriate box below if the Form 8-K is intended to

simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class |

|

Trading |

|

Name of each exchange on which registered |

| Common Shares without par value |

|

CLS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

As previously disclosed, Celestica Inc. (the "Company")

will hold a conference call on January 30, 2025 regarding its financial results for the quarter and full year ended December 31, 2024.

On January 29, 2025, the Company posted an earnings presentation on its website to be used in connection with the related conference call.

A copy of the earnings presentation is included in this Report as Exhibit 99.1.

The information furnished with this Item 7.01,

including Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference

in such a filing.

| Item 9.01. | Financial Statements and Exhibits. |

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Earnings Presentation |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Celestica Inc. |

| |

|

|

| Date: January 29, 2025 |

|

|

| |

By: |

/s/ Douglas Parker |

| |

|

Name: Douglas Parker |

| |

|

Title: Chief Legal Officer and Corporate Secretary |

Exhibit 99.1

Fourth Quarter 2024 Financial Results January 30, 2025 1

Cautionary Note Regarding Forward - Looking Statements 2 This presentation contains forward - looking statements, including, without limitation, those related to : strengthening demand in our CCS segment, demand environment and customer forecasts, our anticipated financial and/or operational results, guidance and outlook, including statements under the headings "Q 1 2025 Guidance", “Q 1 2025 Non - GAAP Tax Rate Estimate”, “Q 1 2025 End Market Revenue Outlook”, “ 2025 Annual Outlook” and "Business Outlook", developments related to new customer wins, program inclusions, timing of production ramps, advancements in the AI and machine learning industries, anticipated economic conditions, industry trends, customer demand, prospects and opportunities, and strategic initiatives . Such forward - looking statements may, without limitation, be preceded by, followed by, or include words such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “continues,” “project,” "target," "outlook," "goal," "guidance", “potential,” “possible,” “contemplate,” “seek,” or similar expressions, or may employ such future or conditional verbs as “may,” “might,” “will,” “could,” “should,” or “would,” or may otherwise be indicated as forward - looking statements by grammatical construction, phrasing or context . For those statements, we claim the protection of the safe harbor for forward - looking statements contained in the U . S . Private Securities Litigation Reform Act of 1995 , where applicable, and for forward - looking information under applicable Canadian securities laws . Forward - looking statements are provided to assist readers in understanding management’s current expectations and plans relating to the future . Forward - looking statements reflect our current estimates, beliefs and assumptions, which are based on management’s perception of historic trends, current conditions and expected future developments, as well as other factors it believes are appropriate in the circumstances, including certain assumptions about anticipated CCS and ATS revenue growth ; anticipated demand levels across our businesses ; continuing operating leverage and improving mix ; the impact of anticipated market conditions on our businesses including the developing AI and machine learning industries ; tax and interest rates ; continued advancement and commercialization of AI technologies and cloud computing ; supporting sustained high levels of capital expenditure investments by leading hyperscaler ; AI, and data center customers ; the economy ; our customers ; our suppliers ; our ability to achieve our strategic goals ; the number of outstanding shares ; as well as other market, financial and operational assumptions . Readers are cautioned that such information may not be appropriate for other purposes . Readers should not place undue reliance on such forward - looking information . Forward - looking statements are not guarantees of future performance and are subject to risks that could cause actual results to differ materially from those expressed or implied in such forward - looking statements, including, among others, risks related to : customer and segment concentration ; reduction in customer revenue ; erosion in customer market competitiveness ; changing revenue mix and margins ; uncertain market, industry, political and economic conditions ; changes to policies or legislation ; operational challenges such as inventory management and materials and supply chain constraints ; and program ramps ; the cyclical nature and/or volatility of certain of our businesses ; talent management and inefficient employee utilization ; risks related to the expansion or consolidation of our operations ; cash flow, revenue, and operating results, and tax and interest variability ; technology and IT disruption ; increasing legal, tax and regulatory complexity and uncertainty (including in relation to our or our customers' businesses) ; integrating and achieving the anticipated benefits from acquisitions ; and the potential adverse impacts of events outside of our control . For more exhaustive information on the foregoing and other material risks, uncertainties and assumptions readers should refer to our public filings at www . sedarplus . ca and www . sec . gov , including in our most recent Management's Discussion and Analysis of Financial Condition and Results of Operations, Annual Report on Form 20 - F, and subsequent reports on Form 10 - K, Quarterly Reports on Form 10 - Q, Current Reports on Form 8 - K and other documents filed with or furnished to, the U . S . Securities and Exchange Commission, and the Canadian Securities Administrators, as applicable . Forward - looking statements speak only as of the date on which they are made, and we disclaim any intention or obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable law . All forward - looking statements attributable to us are expressly qualified by these cautionary statements . Note Regarding Non - GAAP Financial Measures In addition to disclosing detailed operating results in accordance with Generally Accepted Accounting Principles (GAAP), this presentation refers to non - GAAP financial measures (including ratios) to consider in evaluating the Company’s operating performance . Management uses adjusted net earnings and other non - GAAP financial measures to assess operating performance, financial leverage and the effective use and allocation of resources ; to provide more normalized period - to - period comparisons of operating results ; to enhance investors’ understanding of the core operating results of Celestica’s business ; and to set management incentive targets . We believe investors use both GAAP and non - GAAP financial measures to assess management's decisions associated with our priorities and capital allocation, as well as to analyze how our business operates in, or responds to, macroeconomic trends or other events that impact our core operations . Non - GAAP financial measures do not have any standardized meaning prescribed by GAAP and may not be comparable to similar measures presented by other public companies that report under GAAP and use non - GAAP financial measures to describe similar operating metrics . Non - GAAP financial measures are not measures of performance under GAAP and should not be considered in isolation or as a substitute for any GAAP financial measure . We do not provide reconciliations for forward - looking non - GAAP financial measures, as the items that we exclude from GAAP to calculate the comparable non - GAAP measure are dependent on future events that are not able to be reliably predicted by management and are not part of our routine operating activities . We are unable to provide such a reconciliation without unreasonable effort due to the uncertainty and inherent difficulty in predicting the occurrence, the financial impact and the periods in which the adjustments may be recognized . The occurrence, timing and amount of any of the items excluded from GAAP to calculate non - GAAP could significantly impact our forward - looking GAAP results . Forward - looking non - GAAP financial measures may vary materially from the corresponding GAAP financial measures . All of our financial results, including historical comparisons, will now be reported on a US GAAP basis, having transitioned from reporting under IFRS previously . Please note that our guidance for Q 4 2024 was issued on an IFRS basis, and has not been restated, due to our assessment that the impact of the transition to US GAAP standards did not have a material impact on these figures . Currency Unless otherwise specified, all references to dollars in this presentation are to U . S . dollars .

3 CEO Remarks

1.94 2.46 3.88 1.46 2.03 3.61 2022 2023 2024 4.9% 5.5% 6.5% 4.0% 4.2% 6.2% 2022 2023 2024 7.3 8.0 9.6 2022 2023 2024 EMS HPS 4 2024 Annual Results Revenue ($B) GAAP Earnings from Operations as a Percentage of Revenue Adjusted Operating Margin (Non - GAAP) 1 GAAP EPS ($) Adjusted EPS (Non - GAAP) 1 ($) 1 See “Note Regarding Non - GAAP Financial Measures”. Also see the Appendix for, among other things, the definition and use of this non - GAAP financial measure, and a reconciliation of historic non - GAAP Adjusted Operating Margin to GAAP Earnings from Operations as a Percentage of Revenue and of non - GAAP Adjusted EPS to GAAP EPS. GAAP Non - GAAP GAAP Non - GAAP

5 1 See “Note Regarding Non - GAAP Financial Measures”. Also see the Appendix for , among other things, definitions and uses of non - GAAP financial measures (including ratios based on non - GAAP financial measures) set forth in the ta ble and a reconciliation of these non - GAAP financial measures (or, in the case of ratios, the non - GAAP financial measure used in calculati ng such ratio) to the most directly comparable GAAP financial measures. 2 “QTQ” reflects change vs. Q3 2024 figures and “YTY” reflects change vs. Q4 2023 figures. B/(W) YTY 2 B/(W) QTQ 2 Q4 2024 Non - GAAP financial measures 0.5% 0.3% 11.0% Adjusted Gross Margin (non - GAAP) $45.3 $4.8 $173.6 Adjusted Operating Earnings (adjusted EBIAT) (non - GAAP) 0.8% Flat 6.8% Adjusted Operating Margin (non - GAAP) 1% 2% 19% Adjusted Effective Tax Rate (non - GAAP) $0.34 $0.07 $1.11 Adjusted EPS (non - GAAP) 5.5% 0.1% 29.1% Adjusted ROIC % (non - GAAP) B/(W) YTY 2 B/(W) QTQ 2 Q4 2024 GAAP financial measures $US Millions (Except for per share amounts and %) $405 $46 $2,546 Revenue 1.3% 1.3% 11.7% Gross Margin $93.4 $64.6 $202.6 Earnings from Operations 2.9% 2.5% 8.0% Earnings from Operations as a % of Revenue Flat 8% 20% Effective Tax Rate $0.52 $0.54 $1.29 EPS 13.9% 10.3% 34.0% ROIC % Q4 2024 Highlights¹

ATS 29% CCS 71% Q4 2023 % of Total Segment Income ATS 32% CCS 68% Q4 2024 Revenue 4 6 1 Our ATS segment consists of our ATS end market, and is comprised of our Aerospace & Defense (A&D), Industrial, HealthTech, an d C apital Equipment businesses. 2 Our CCS segment consists of our Communications and Enterprise end markets. 3 Our Enterprise end market consists of our Servers and Storage businesses. 4 In Q4 2024, Communications represented 46 % of total revenue and Enterprise represented 22% of total revenue. 5 In Q4 2023, Communications represented 33% of total revenue and Enterprise represented 29% of total revenue. 6 See footnote 1 on slide 18 for the definition of segment income and segment margin. Year over Year Sequential Q4 2024 Revenue Flat Down 1% ATS Up 30% Up 3% CCS Up 64% Up 11% Communications Down 10% Down 9% Enterprise 3 Q4 2023 Q4 2024 Segment Margin 6 4.7 % 4.6% ATS 6.8% 7.9% CCS ATS 38% CCS 62% Q4 2023 Revenue 5 ATS 21% CCS 79% Q4 2024 % of Total Segment Income Q4 2023 Q4 2024 Segment Income 6 $ 37.7M 37.0M ATS 90.6 M 136.6M CCS ATS 1 and CCS 2 Segment Revenue and Profitability

1 Inventory turns are determined by dividing 365 by the number of days in inventory. Days in inventory are calculated by dividi ng the average inventory balance for the quarter by the average daily cost of sales. 2 Celestica receives cash deposits from certain customers to alleviate the impact of inventory purchases on our cash flows, and t o reduce risks related to excess and/or obsolete inventory. 3 Days in A/R is defined as the average A/R for the quarter divided by the average daily revenue. Days in inventory, days in A/ P a nd days in cash deposits are calculated by dividing the average balance for each item for the quarter by the average daily cost of sales. Cash cycle days is defined as the sum of days in A/R and days in inventory minus the days in A/P an d days in cash deposits. 4 “QTQ” reflects change vs. Q3 2024 figures and “YTY” reflects change vs. Q4 2023 figures. Working Capital 7 Cash Cycle Days B/(W) YTY 4 B/(W) QTQ 4 Q4 2024 $US Millions 1.5x 0.1x 5.0x Inventory Turns 1 $344 $60 $1,761 Inventory ($393) ($9) $512 Customer Cash Deposits for Inventory 2 Q4 2023 Q3 2024 Q4 2024 72 71 73 Days in A/R 3 104 75 73 Days in Inventory 3 (62) (56) (55) Days in A/P 3 (42) (24) (22) Days in Cash Deposits 2,3 72 66 69 Cash Cycle Days

Generated Free Cash Flow (Non - GAAP) 1 of $306M in 2024 (+50% YTY 2 ) 45 100 63 118 108 100 123 143 12 69 36 86 68 66 77 96 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Free Cash Flow (Non - GAAP) 1 Cash Provided by Operations ($M) 8 1 See “Note Regarding Non - GAAP Financial Measures”. Also see the Appendix for, among other things, the definition and use of this non - GAAP financial measure, and a reconciliation of historic non - GAAP free cash flow to GAAP cash provided by operations. 2 “QTQ” reflects change vs. Q3 2024 figures, 4Q 2024 “YTY” reflects change vs. Q4 2023 figures and FY 2024 “YTY” reflects chang e vs. FY 2023 figures. YTY 2 Increase/(Decrease) QTQ 2 Increase/(Decrease) Q4 2024 $US $15M $2M $48M Capex 0.4% 0.1% 1.9% Capex as a % of revenue Free Cash Flow (Non - GAAP) 1

Balance Sheet 9 1 See “Note Regarding Non - GAAP Financial Measures”. See slide 21 for a calculation of GAAP TTM debt leverage ratio and non - GAAP ad justed TTM debt leverage ratio. 2 Total liquidity is defined as cash and cash equivalents as of December 31, 2024, plus the total availability under Celestica’ s R evolver. Balance Sheet (as of December 31, 2024) $423M Cash and cash equivalents - Revolver (excluding L/Cs) $741M Term Loans $318M Net Debt 1.2x GAAP TTM Debt Leverage Ratio 1 1.0x Non - GAAP Adjusted TTM Debt Leverage Ratio 1 ~$1.2B Total Liquidity 2 Reduced share count by 2.4% in 2024 Repurchased 0.3M shares for $25.5M in Q4 2024 Repurchased 3.2M shares for $152.0M in 2024

$US $2.475B - $2.625B Revenue 6.8% at the mid - point of revenue and non - GAAP adjusted EPS guidance ranges Adjusted Operating Margin (Non - GAAP) $1.06 - $1.16 Adjusted EPS (Non - GAAP) Q1 2025 Guidance 1 10 Q1 2025 Non - GAAP Tax Rate Estimate 1 Adjusted Effective Tax Rate (Non - GAAP) of approximately 20% 1 See “Note Regarding Non - GAAP Financial Measures.” Also see the Appendix for, among other things, definitions and uses of these n on - GAAP financial measures (including ratios based on non - GAAP financial measures) set forth in the table. Guidance reflects management’s expectations as of the date provided and will only be updated through a public announcement. W e d o not provide reconciliations for our forward - looking non - GAAP financial measures, as we are unable to reasonably estimate the items that we exclude from GAAP to calculate comparable non - GAAP measures without unreasonable effort. T his is due to the inherent difficulty of forecasting the timing or amount of various events that have not yet occurred, are out of our control and/or cannot be reasonably predicted, and that would impact the most directly comparable fo rwa rd - looking GAAP financial measure. For these same reasons, we are unable to address the probable significance of the unavailable information. Forward - looking non - GAAP financial measures may vary materially from the corresponding GAAP fina ncial measures.

Q1 2025 End Market Revenue Outlook 1 11 Year - over - Year Revenue % Change Flat ATS 2 Increase low - eighties Communications Decrease mid - forties Enterprise 3 1 Outlook reflects management’s expectations as of the date provided. 2 ATS consists of A&D, Industrial, HealthTech, and Capital Equipment. 3 Enterprise consists of Servers and Storage.

2025 Annual Outlook 1 12 1 See “Note Regarding Non - GAAP Financial Measures”. Outlook reflects management’s expectations as of the date provided and will on ly be updated through a public announcement. We do not provide reconciliations for our forward - looking non - GAAP financial measures, as we are unable to reasonably estimate the items that we exclude from GAAP to calculate comparable no n - GAAP measures without unreasonable effort. This is due to the inherent difficulty of forecasting the timing or amount of various events that have not yet occurred, are out of our control and/or cannot be reasonably predicted, and that w oul d impact the most directly comparable forward - looking GAAP financial measure. For these same reasons, we are unable to address the probable significance of the unavailable information. Forward - looking non - GAAP financial measures may vary materially from the corresponding GAAP financial measures. Previous 2025 Outlook 2025 Outlook $US $10.4B $10.7B Revenue Outlook 6.7% 6.9% Adjusted Operating Margin (Non - GAAP) $4.42 $4.75 Adjusted EPS (Non - GAAP) $325M $350M Free Cash Flow (Non - GAAP) 2025 Non - GAAP Tax Rate Estimate 1 Adjusted Effective Tax Rate (Non - GAAP) of approximately 19%

13 Business Outlook 1 Industrial Stabilizing demand with recovery expected in 2H 2025 Aerospace & Defense Healthy demand supported by new program ramps and customer wins; Decision to not renew a dilutive margin program driving lower revenues Capital Equipment Solid demand and new program ramps driving growth 1 The information on this slide reflects management’s expectations as of the date provided. Connectivity & Cloud Solutions Mid - double digit percentage revenue growth expected in 2025 Enterprise Reacceleration in 2H 2025, supported by ramp of next - gen sole - sourced AI/ML compute program and ramps with a new customer Communications Growth driven by 800G ramps and continued strong demand for 400G Hyperscaler Portfolio Growth driven by networking demand from 800G ramps through 2025, coupled with reacceleration in AI/ML compute in 2H 2025 Advanced Technology Solutions Revenues expected to be ~flat in 2025

14 Concluding Remarks

Q&A

Fourth Quarter 2024 Financial Results January 30, 2025

Appendix

Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 FY 2024 FY 2023 FY 2022 Revenue by segment: ATS segment revenue 792.2$ 865.3$ 859.4$ 802.9$ 767.9$ 767.7$ 814.1$ 805.8$ 3,155.5$ 3,319.8$ 2,979.0$ ATS segment revenue as a % of total revenue 43% 45% 42% 38% 35% 32% 33% 32% 33% 42% 41% CCS segment revenue 1,045.6$ 1,074.1$ 1,183.9$ 1,337.6$ 1,441.0$ 1,624.2$ 1,685.4$ 1,739.9$ 6,490.5$ 4,641.2$ 4,271.0$ CCS segment revenue as a % of total revenue 57% 55% 58% 62% 65% 68% 67% 68% 67% 58% 59% Communications end market revenue as a % of total revenue 36% 29% 36% 33% 34% 39% 42% 46% 41% 33% 40% Enterprise end market revenue as a % of total revenue 21% 26% 22% 29% 31% 29% 25% 22% 26% 25% 19% Total revenue 1,837.8$ 1,939.4$ 2,043.3$ 2,140.5$ 2,208.9$ 2,391.9$ 2,499.5$ 2,545.7$ 9,646.0$ 7,961.0$ 7,250.0$ Segment income, segment margin, and reconciliation of segment income to GAAP earnings before income taxes: ATS segment income 33.7$ 41.6$ 42.0$ 37.7$ 31.9$ 35.1$ 40.1$ 37.0$ 144.1$ 155.0$ 140.3$ ATS segment margin 4.3% 4.8% 4.9% 4.7% 4.2% 4.6% 4.9% 4.6% 4.6% 4.7% 4.7% CCS segment income 58.6$ 64.5$ 72.9$ 90.6$ 98.7$ 114.5$ 128.7$ 136.6$ 478.5$ 286.6$ 217.6$ CCS segment margin 5.6% 6.0% 6.2% 6.8% 6.8% 7.0% 7.6% 7.9% 7.4% 6.2% 5.1% Total segment income 92.3$ 106.1$ 114.9$ 128.3$ 130.6$ 149.6$ 168.8$ 173.6$ 622.6$ 441.6$ 357.9$ Total segment margin 5.0% 5.5% 5.6% 6.0% 5.9% 6.3% 6.8% 6.8% 6.5% 5.5% 4.9% Reconciling items 2 : Finance costs 21.9 22.6 18.9 15.5 14.0 15.0 11.2 11.9 52.1 78.9 51.7 Miscellaneous Expense (Income) 0.8 (5.2) (21.2) (21.0) 6.6 4.4 2.8 1.2 15.0 (46.6) (1.5) FCC Transitional ADJ 0.6 (0.4) - (1.4) (0.5) (0.7) (0.5) 0.4 (1.3) (1.2) (26.1) Employee SBC expense 22.0 10.9 12.9 9.8 22.7 11.9 12.7 10.1 57.4 55.6 51.0 TRS FVAs - - - - (31.5) (15.7) 7.7 (51.5) (91.0) - - Amortization of intangible assets (excluding computer software) 9.2 9.2 9.2 9.2 9.3 9.7 9.9 9.9 38.8 36.8 37.0 Restructuring and other charges, net of recoveries 4.6 3.5 2.5 1.5 4.8 11.5 1.0 2.1 19.4 12.1 6.7 Earnings before income taxes 33.2$ 65.5$ 92.6$ 114.7$ 105.2$ 113.5$ 124.0$ 189.5$ 532.2$ 306.0$ 239.1$ Segment Income and Margin 1 18 1 Segment margin is segment income as a percentage of segment revenue. Segment income is defined as a segment’s revenue less it s c ost of sales and its allocatable portion of SG&A expenses and research and development expenses. Segment income excludes Miscellaneous Expense (Income), FCC Transitional ADJ, employee SBC expense, TRS FVAs, amortization of intangi ble assets (excluding computer software), restructuring and other charges, net of recoveries (each defined in slides 19 and 20) and finance costs. 2 See slides 19 and 20 for, among other things, the definitions and uses of certain non - GAAP financial measures and adjustments.

Non - GAAP Supplementary Information 19 The non - GAAP financial measures included in this presentation are: adjusted gross profit, adjusted gross margin (adjusted gross profit as a percentage of revenue), adjusted selling, general and administrative expenses (SG&A), adjusted SG&A as a percentage of revenue, adjusted operating earnings (or adjusted EBIAT), adjusted EBITDA, adjusted TTM EBITDA, TTM earnings fr om operations, adjusted operating margin (non - GAAP operating earnings or adjusted EBIAT as a percentage of revenue), adjusted EBITDA as a percentage of revenue, adjusted net earnings, adjusted EPS, adjusted return on invested capita l ( adjusted ROIC), free cash flow, adjusted tax expense, adjusted effective tax rate and adjusted TTM debt leverage ratio are further described in the tables in the following slides. We believe the non - GAAP financial measures herein enable investors to evaluate and compare our results from operations by exclud ing specific items that we do not consider to be reflective of our core operations, to evaluate cash resources that we generate from our business each period, to analyze operating results using the same measures our chief operating decision mak ers use to measure performance, and to help compare our results with those of our competitors. In addition, management believes that the use of adjusted tax expense and adjusted effective tax rate provides additional transparency into the tax e ffe cts of our core operations, and are useful to management and investors for historical comparisons and forecasting. These non - GAAP financial measures reflect management’s belief that the excluded items are not indicative of our core operations. Non - GAAP financial measures do not have any standardized meaning prescribed by GAAP and therefore may not be directly comparable to similar measures presented by other companies. Non - GAAP financial measures are not measures of performance under GAAP and should not be considered in isolation or as a substitute for any GAAP financial measure. Reconcili ati ons of the non - GAAP financial measures to the most directly comparable GAAP financial measures are provided in the following slides. We do not provide reconciliations for our forward - looking non - GAAP financial measures, as we are unable to reasonably estimate t he items that we exclude from GAAP to calculate comparable non - GAAP measures without unreasonable effort. This is due to the inherent difficulty of forecasting the timing or amount of various events that have not yet occurred, are out of o ur control and/or cannot be reasonably predicted, and that would impact the most directly comparable forward - looking GAAP financial measure. For these same reasons, we are unable to address the probable significance of the unavailable information. Fo rward - looking non - GAAP financial measures may vary materially from the corresponding GAAP financial measures. Our non - GAAP financial measures are calculated by making the following adjustments (as applicable) to our GAAP financial measure s: Employee SBC expense , which represents the estimated fair value of stock options, restricted share units and performance share units granted to e mpl oyees, is excluded because grant activities vary significantly from quarter - to - quarter in both quantity and fair value. We believe excluding this expense allows us to compare core operating results with those of our competitors, who also generally exclude employee SBC expense in assessing operating performance, and may have different granting patterns, equity awards and valuation assumptions. Total return swap fair value adjustments (TRS FVAs) represent mark - to - market adjustments to our TRS Agreement, as the TRS Agreement is re - measured at fair value at each quarter en d. We exclude the impact of these non - cash fair value adjustments (which reflect fluctuations in the market price of our common shares recorded in cost of sales, SG&A, or Miscella neo us Expenses (Income)) from period to period as such fluctuations do not represent our ongoing operating performance. In addition, we believe that excluding these non - cash adjustments permits a helpful comparison of our core operating results to our competitors. In accordance with GAAP, TRS FVAs prior to 2024 were recorded in Miscellaneous Expense (Income). Commencing in 2024, the TRS Agreement was treated as an economic hedge with the TRS FVAs recorded in cost of sales and SG&A. Transitional hedge reclassifications and adjustments related to foreign currency forward exchange contracts (FCC Transitional AD J) and interest rate swaps (IRS Transitional ADJ) were both specifically driven by our transition from IFRS to GAAP. For the purpose of determining our non - GAAP measures, FCC Transitional ADJ were made to cost of sales and SG&A and IRS Transitional ADJ are made to finance costs. Our foreign currency forward exchange contracts and interest rate swaps that we entered prior to 2024 were accounted for as either cash flow hedges (qualified for hedge accounting) or economic hedges under IF RS. However, those contracts were not accounted for as such under GAAP until January 1, 2024, resulting in FCC Transitional ADJ and IRS Transitional ADJ. Had we been able to designate those foreign currency forward exchange contracts an d i nterest rate swaps under GAAP from their inception, they would have qualified as cash flow or economic hedges under GAAP, and no FCC Transitional ADJ or IRS Transitional ADJ would have been required under GAAP. FCC Transitional ADJ and IRS t ran sitional ADJ are not reflective of the on - going operational impacts of our hedging activities and are excluded in assessing operating performance. Amortization of intangible assets (excluding computer software) consist of non - cash charges for intangible assets that are impacted by the timing and magnitude of acquired businesses. Amortiz ation of intangible assets varies among our competitors, and we believe that excluding these charges permits a helpful comparison of core operating results to our competitors who als o g enerally exclude amortization charges in assessing operating performance.

Non - GAAP Supplementary Information…continued 20 Restructuring and Other Charges (Recoveries) consist of, when applicable: Restructuring Charges (Recoveries) (defined below); Transition Costs (Recoveries) (defined below ); consulting, transaction and integration costs related to potential and completed acquisitions; legal settlements (recoveries); in Q2 2023 and Q3 2023, costs associated with the conversion and unde rwr itten public sale of our shares by Onex Corporation (Onex), our then - controlling shareholder, and commencing in Q2 2023, related costs pertaining to our transition as a US domestic filer. We exclude these charges and recoveries because we b eli eve that they are not directly related to ongoing operating results and do not reflect our expected future operating expenses after completion of the relevant actions. Our competitors may record similar items at different times, and we believ e t hese exclusions permit a helpful comparison of our core operating results with those of our competitors who also generally exclude these items in assessing operating performance. Restructuring Charges (Recoveries) , consist of costs or recoveries relating to: employee severance, lease terminations, site closings and consolidations, accel era ted depreciation of owned property and equipment which are no longer used and are available for sale, and reductions in infrastructure. Transition Costs (Recoveries) consist of costs and recoveries in connection with: ( i ) the transfer of manufacturing lines from closed sites to other sites within our global network; (ii) the sale of real prope rti es unrelated to restructuring actions (Property Dispositions); and (iii) specified charges or recoveries related to the Purchaser Lease (defined below). Transition Costs con sis t of direct relocation and duplicate costs (such as rent expense, utility costs, depreciation charges, and personnel costs) incurred during the transition periods, as well as cease - use and other costs incurred in connection with idle or vacated portion s of the relevant premises that we would not have incurred but for these relocations, transfers and dispositions. As part of our 2019 Toronto real property sale, we entered into a related 10 - year lease for our then - anticipated headquarters (Purchaser Lease) . In November 2022, we extended the lease (on a long - term basis) on our current corporate headquarters due to several Purchaser Lease commencement date delays. In Q3 2023, we executed a sublease for a portion of the leased space under the Purc has er Lease. We record charges related to the sublet of the Purchaser Lease (which commenced in June 2024) as Transition Costs. We believe that excluding Transition Costs and Recoveries permits a helpful comparison of our core operatin g r esults from period - to - period, as they do not reflect our ongoing operations once these specified events are complete. Miscellaneous Expense (Income) consists primarily of: ( i ) certain net periodic benefit costs (credits) related to our pension and post - employment benefit plans consisting of interest c osts and expected returns on pension balances, and amortization of actuarial gains or losses; and (ii) gains or losses related to our TRS Agreement and foreign currency forward exchange contra cts and interest rate swaps that we entered into prior to 2024. Those derivative instruments were accounted for as either cash flow hedges (qualifying for hedge accounting) or economic hedges under IFRS. However, those contracts were not accounted for as such under GAAP until January 1, 2024. Certain gains and losses related to those contracts were recorded in Miscellaneous Expense (Income). See FCC Transitional ADJ, IRS Transitional ADJ and TRS FVAs above. We exclude such items beca use we believe they are not directly related to our ongoing operating results. Non - core tax impacts are excluded, as we do not believe these costs or recoveries reflect our core operating performance and var y significantly among our competitors who also generally exclude such items in assessing operating performance. In addition, in calculating adjusted net earnings, adjusted EPS, adjusted tax expense and adjusted effective tax rate for the 20 24 periods, management also excluded the one - time Q1 2024 portion of the negative tax impact arising from the enactment of Pillar Two (global minimum tax) legislation in Canada recorded in Q2 2024 and incremental withholding tax accrued in such qua rte r to minimize its impact (Pillar Two Tax Adjustments), as such portion is not attributable to our on - going operations for subsequent periods. Our non - GAAP financial measures include the following: Adjusted operating earnings (Adjusted EBIAT) is defined as GAAP earnings from operations excluding the impact of Employee SBC expense, TRS FVAs, FCC Transitional ADJ, Amo rt ization of intangible assets (excluding computer software), and Restructuring and Other Charges (Recoveries). Adjusted operating margin is adjusted operating earnings as a percentage of GAA P r evenue. Management uses adjusted operating earnings (adjusted EBIAT) as a measure to assess performance related to our core operations. Adjusted net earnings is defined as GAAP net earnings before the impact of Employee SBC expense, TRS FVAs, FCC Transitional ADJ, amortization of in ta ngible assets (excluding computer software), Restructuring and Other Charges (Recoveries), IRS Transitional ADJ, Miscellaneous Expense (Income) and adjustment for taxes. Adjusted net earnings per share is calculated by dividing adjusted net earnings by the number of diluted weighted average shares outstanding. Management uses adjusted net earnings as a measure to assess performance related to our core operations. Free cash flow is defined as cash provided by (used in) operations after the purchase of property, plant and equipment (net of proceeds from t he sale of certain surplus equipment and property, when applicable). Free cash flow does not represent residual cash flow available to Celestica for discretionary expenditures. Management uses free cash flow as a measure, in add iti on to GAAP cash provided by (used in) operations, to assess our operational cash flow performance. We believe free cash flow provides another level of transparency to our ability to generate cash from normal business operations. Adjusted ROIC is calculated by dividing annualized adjusted EBIAT by average net invested capital for the period. Net invested capital (cal cu lated in the tables in the following slides) is derived from GAAP financial measures, and is defined as total assets less: cash, ROU assets (operating and finance leases), accounts payable, accrued and other current liabilities (exclud ing finance and operating lease liabilities), provisions, and income taxes payable. Management uses adjusted ROIC as a measure to assess the effectiveness of the invested capital we employ to build products or provide services to our customers, by quantifying how well we generate earnings relative to the capital we have invested in our business.

Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 FY 2024 FY 2023 FY 2022 GAAP Revenue 1,837.8$ 1,939.4$ 2,043.3$ 2,140.5$ 2,208.9$ 2,391.9$ 2,499.5$ 2,545.7$ 9,646.0$ 7,961.0$ 7,250.0$ Net earnings 20.6 57.1 75.1 91.6 91.8 95.0 89.5 151.7 428.0 244.4 180.1 Earnings per share - diluted 0.17$ 0.47$ 0.63$ 0.77$ 0.77$ 0.80$ 0.75$ 1.29$ 3.61$ 2.03$ 1.46$ W.A. # of shares (in millions), on a basic basis 121.5 120.3 119.3 119.3 119.0 118.8 118.2 116.3 118.1 120.1 123.5 W.A. # of shares (in millions), on a diluted basis 121.6 120.3 119.6 119.5 119.3 119.4 118.9 117.3 118.7 120.3 123.6 Actual # of shares o/s (in millions) as of period end 120.7 119.3 119.4 119.0 118.8 118.6 116.4 116.1 116.1 119.0 121.6 GAAP gross profit 157.3$ 181.3$ 192.3$ 223.2$ 222.1$ 253.8$ 260.6$ 297.2$ 1,033.7$ 754.1$ 649.7$ As a percentage of revenue 8.6% 9.3% 9.4% 10.4% 10.1% 10.6% 10.4% 11.7% 10.7% 9.5% 9.0% Employee SBC expense 8.5 4.8 5.1 4.2 8.9 5.7 5.6 4.6 24.8 22.6 20.3 TRS FVAs - - - - (12.8) (7.1) 2.7 (22.4) (39.6) - - FCC Transitional ADJ 3.8 1.4 2.0 (3.6) - - (0.3) 0.4 0.1 3.6 (15.1) Non-GAAP adjusted gross profit 169.6$ 187.5$ 199.4$ 223.8$ 218.2$ 252.4$ 268.6$ 279.8$ 1,019.0$ 780.3$ 654.9$ As a percentage of revenue 9.2% 9.7% 9.8% 10.5% 9.9% 10.6% 10.7% 11.0% 10.6% 9.8% 9.0% GAAP SG&A 74.7$ 70.7$ 72.7$ 85.1$ 64.8$ 79.3$ 91.8$ 57.6$ 293.5$ 303.2$ 267.3$ As a percentage of revenue 4.1% 3.6% 3.6% 4.0% 2.9% 3.3% 3.7% 2.3% 3.0% 3.8% 3.7% Employee SBC expense (13.5) (6.1) (7.8) (5.6) (13.8) (6.2) (7.1) (5.5) (32.6) (33.0) (30.7) TRS FVAs - - - - 18.7 8.6 (5.0) 29.1 51.4 - - FCC Transitional ADJ 3.2 1.8 2.0 (2.2) 0.5 0.7 0.2 - 1.4 4.8 11.0 Non-GAAP gross profit 64.4$ 66.4$ 66.9$ 77.3$ 70.2$ 82.4$ 79.9$ 81.2$ 313.7$ 275.0$ 247.6$ As a percentage of revenue 3.5% 3.4% 3.3% 3.6% 3.2% 3.4% 3.2% 3.2% 3.3% 3.5% 3.4% GAAP Earnings from operations 55.9$ 82.9$ 90.3$ 109.2$ 125.8$ 132.9$ 138.0$ 202.6$ 599.3$ 338.3$ 289.3$ As a percentage of revenue 3.0% 4.3% 4.4% 5.1% 5.7% 5.6% 5.5% 8.0% 6.2% 4.2% 4.0% Restructuring and other charges, net of recoveries 4.6 3.5 2.5 1.5 4.8 11.5 1.0 2.1 19.4 12.1 6.7 Employee SBC expense 22.0 10.9 12.9 9.8 22.7 11.9 12.7 10.1 57.4 55.6 51.0 TRS FVAs - - - - (31.5) (15.7) 7.7 (51.5) (91.0) - - FCC Transitional ADJ 0.6 (0.4) - (1.4) (0.5) (0.7) (0.5) 0.4 (1.3) (1.2) (26.1) Amortization of intangible assets (excluding computer software) 9.2 9.2 9.2 9.2 9.3 9.7 9.9 9.9 38.8 36.8 37.0 Non-GAAP adjusted EBIAT 92.3$ 106.1$ 114.9$ 128.3$ 130.6$ 149.6$ 168.8$ 173.6$ 622.6$ 441.6$ 357.9$ Non-GAAP adjusted operating margin 5.0% 5.5% 5.6% 6.0% 5.9% 6.3% 6.8% 6.8% 6.5% 5.5% 4.9% Depreciation expense - finance leases 1.8 1.8 1.9 1.9 1.8 1.9 1.9 2.0 7.6 7.4 6.6 Depreciation expense - property, plant and equipment, software 20.0 20.7 20.9 24.9 24.1 25.7 27.5 28.1 105.4 86.5 72.3 Non-GAAP adjusted EBITDA 114.1$ 128.6$ 137.7$ 155.1$ 156.5$ 177.2$ 198.2$ 203.7$ 735.6$ 535.5$ 436.8$ As a percentage of revenue 6.2% 6.6% 6.7% 7.2% 7.1% 7.4% 7.9% 8.0% 7.6% 6.7% 6.0% Borrowings under the Revolver 2 -$ 28.0$ -$ -$ -$ Borrowings under the Term Loans 608.9 604.3 750.0 745.6 741.2 Gross Debt 608.9$ 632.3$ 750.0$ 745.6$ 741.2$ TTM earnings from operations 338.3$ 408.2$ 458.2$ 505.9$ 599.3$ Gross debt to TTM earnings from operations (GAAP TTM debt leverage ratio) 1.8x 1.5x 1.6x 1.5x 1.2x Non-GAAP adjusted TTM EBITDA 535.5$ 577.9$ 626.5$ 687.0$ 735.6$ Gross debt to non-GAAP adjusted TTM EBITDA (non-GAAP adjusted TTM debt leverage ratio) 1.1x 1.1x 1.2x 1.1x 1.0x Non-GAAP gross profit Non-GAAP SG&A Non-GAAP operating earnings (adjusted EBIAT) and non-GAAP adjusted EBITDA Non-GAAP Adjusted Trailing Twelve Month (TTM) Debt Leverage Ratio Reconciliation 21 GAAP to non - GAAP Reconciliation 1 1 See “Note Regarding Non - GAAP Financial Measures” . Also see slides 19 and 20 for, among other things, the definitions and uses of certain non - GAAP financial measures . 2 Excluding ordinary course letters of credit .

Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 FY 2024 FY 2023 FY 2022 GAAP Net earnings 20.6$ 57.1$ 75.1$ 91.6$ 91.8$ 95.0$ 89.5$ 151.7$ 428.0$ 244.4$ 180.1$ As a percentage of revenue 1.1% 2.9% 3.7% 4.3% 4.2% 4.0% 3.6% 6.0% 4.4% 3.1% 2.5% Employee SBC expense 22.0 10.9 12.9 9.8 22.7 11.9 12.7 10.1 57.4 55.6 51.0 Amortization of intangible assets (excluding computer software) 9.2 9.2 9.2 9.2 9.3 9.7 9.9 9.9 38.8 36.8 37.0 Restructuring and other charges, net of recoveries 4.6 3.5 2.5 1.5 4.8 11.5 1.0 2.1 19.4 12.1 6.7 IRS Transitional ADJ 1.6 2.1 2.4 2.9 - - - - - 9.0 (2.5) Miscellaneous Expense (Income) 0.8 (5.2) (21.2) (21.0) 6.6 4.4 2.8 1.2 15.0 (46.6) (1.5) TRS FVAs - - - - (31.5) (15.7) 7.7 (51.5) (91.0) - - FCC Transitional ADJ 0.6 (0.4) - (1.4) (0.5) (0.7) (0.5) 0.4 (1.3) (1.2) (26.1) Adjustments for taxes (4.2) (8.5) (1.1) (0.5) (4.4) (8.1) 0.7 6.3 (5.5) (14.3) (4.6) Non-GAAP adjusted net earnings 55.2$ 68.7$ 79.8$ 92.1$ 98.8$ 108.0$ 123.8$ 130.2$ 460.8$ 295.8$ 240.1$ As a percentage of revenue 3.0% 3.5% 3.9% 4.3% 4.5% 4.5% 5.0% 5.1% 4.8% 3.7% 3.3% Non-GAAP adjusted earnings per share - diluted 0.45$ 0.57$ 0.67$ 0.77$ 0.83$ 0.90$ 1.04$ 1.11$ 3.88$ 2.46$ 1.94$ GAAP Earnings from operations 55.9$ 82.9$ 90.3$ 109.2$ 125.8$ 132.9$ 138.0$ 202.6$ 599.3$ 338.3$ 289.3$ Multiplier to annualize earnings 4 4 4 4 4 4 4 4 1 1 1 Annualized GAAP earnings from operations 223.6$ 331.6$ 361.2$ 436.8$ 503.2$ 531.6$ 552.0$ 810.4$ 599.3$ 338.3$ 289.3$ Average Net Invested Capital for the period 2,103.4$ 2,109.9$ 2,137.0$ 2,176.9$ 2,198.2$ 2,253.6$ 2,325.5$ 2,386.7$ 2,292.4$ 2,132.5$ 2,011.4$ GAAP ROIC % 10.6% 15.7% 16.9% 20.1% 22.9% 23.6% 23.7% 34.0% 26.1% 15.9% 14.4% Non-GAAP adjusted EBIAT 92.3$ 106.1$ 114.9$ 128.3$ 130.6$ 149.6$ 168.8$ 173.6$ 622.6$ 441.6$ 357.9$ Non-GAAP adjusted ROIC Multiplier to annualize earnings 4 4 4 4 4 4 4 4 1 1 1 Annualized non-GAAP adjusted EBIAT 369.2$ 424.4$ 459.6$ 513.2$ 522.4$ 598.4$ 675.2$ 694.4$ 622.6$ 441.6$ 357.9$ Average Net Invested Capital for the period 2,103.4$ 2,109.9$ 2,137.0$ 2,176.9$ 2,198.2$ 2,253.6$ 2,325.5$ 2,386.7$ 2,292.4$ 2,132.5$ 2,011.4$ Non-GAAP adjusted ROIC % 17.6% 20.1% 21.5% 23.6% 23.8% 26.6% 29.0% 29.1% 27.2% 20.7% 17.8% Net invested capital consists of: Total assets 5,464.2$ 5,499.6$ 5,744.8$ 5,890.5$ 5,711.5$ 5,872.8$ 5,924.8$ 5,988.2$ 5,988.2$ 5,890.5$ 5,625.5$ Less: cash (318.7) (360.7) (353.1) (370.4) (308.1) (434.0) (398.5) (423.3) (423.3) (370.4) (374.5) Less: ROU assets (operating and finance leases) (150.6) (163.2) (174.0) (170.0) (196.1) (200.1) (186.3) (180.8) (180.8) (170.0) (157.1) Less: accounts payable, accrued and other liabilities, provisions (2,877.0)$ (2,873.9)$ (3,045.6)$ (3,168.4)$ (2,992.6)$ (2,946.2)$ (2,981.6)$ (2,969.2)$ (2,969.2) (3,168.4) (3,005.0) and income tax payable (excluding finance and operating lease liabilities) Net invested capital at period end 2,117.9$ 2,101.8$ 2,172.1$ 2,181.7$ 2,214.7$ 2,292.5$ 2,358.4$ 2,414.9$ 2,414.9$ 2,181.7$ 2,088.9$ GAAP cash provided by operations 45.2$ 100.4$ 62.6$ 118.0$ 108.1$ 99.6$ 122.8$ 143.4$ 473.9$ 326.2$ 211.1$ Non-GAAP free cash flow Purchase of property, plant, and equipment, net of sales proceeds (33.1) (31.2) (26.2) (31.9) (40.4) (34.0) (46.0) (47.6) (168.0)$ (122.4)$ (108.9)$ Non-GAAP free cash flow 12.1$ 69.2$ 36.4$ 86.1$ 67.7$ 65.6$ 76.8$ 95.8$ 305.9$ 203.8$ 102.2$ Non-GAAP adjusted net earnings and non-GAAP adjusted EPS 1 See “Note Regarding Non - GAAP Financial Measures” . Also see slides 19 and 20 for, among other things, the definitions and uses of certain non - GAAP financial measures . 22 GAAP to non - GAAP Reconciliation…continued 1

$US millions Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 FY 2024 FY2023 FY 2022 GAAP tax expense 12.6$ 8.4$ 17.5$ 23.1$ 13.4$ 18.5$ 34.5$ 37.8$ 104.2$ 61.6$ 59.0$ Tax costs (benefits) of the following items excluded from GAAP tax expense: Employee SBC expense and TRS FVAs 2.3 6.4 (1.1) 2.4 3.6 6.8 (1.4) (5.5) 3.5 10.0 2.5 Amortization of intangible assets (excluding computer software) 0.8 0.7 0.7 0.8 0.8 0.8 0.7 0.7 3.0 3.0 3.0 Restructuring and other charges 0.4 0.4 0.7 (0.2) 0.3 0.4 (0.1) 0.5 1.1 1.3 0.3 Non-core tax adjustment for NCS acquisition - - - - - 7.5 - - 7.5 - - Prior Period Pillar Two Tax Adjustments - - - - - (8.1) - - (8.1) - - Miscellaneous Expense (Income) 0.7 1.0 0.8 (2.5) (0.3) 0.7 0.1 (2.0) (1.5) - (1.2) Adjusted tax expense (non-GAAP) 16.8$ 16.9$ 18.6$ 23.6$ 17.8$ 26.6$ 33.8$ 31.5$ 109.7$ 75.9$ 63.6$ GAAP tax expense 12.6$ 8.4$ 17.5$ 23.1$ 13.4$ 18.5$ 34.5$ 37.8$ 104.2$ 61.6$ 59.0$ Earnings from operations 55.9 82.9 90.3 109.2 125.8 132.9 138.0 202.6 599.3 338.3 289.3 Finance Costs (21.9) (22.6) (18.9) (15.5) (14.0) (15.0) (11.2) (11.9) (52.1) (78.9) (51.7) Miscellaneous Expense (Income) (0.8) 5.2 21.2 21.0 (6.6) (4.4) (2.8) (1.2) (15.0) 46.6 1.5 33.2$ 65.5$ 92.6$ 114.7$ 105.2$ 113.5$ 124.0$ 189.5$ 532.2$ 306.0$ 239.1$ GAAP effective tax rate 2 38% 13% 19% 20% 13% 16% 28% 20% 20% 20% 25% Adjusted tax expense (non-GAAP) 16.8$ 16.9$ 18.6$ 23.6$ 17.8$ 26.6$ 33.8$ 31.5$ 109.7$ 75.9$ 63.6$ Adjusted operating earnings (non-GAAP) 92.3 106.1 114.9 128.3 130.6 149.6 168.8 173.6 622.6 441.6 357.9 Finance Costs (21.9) (22.6) (18.9) (15.5) (14.0) (15.0) (11.2) (11.9) (52.1) (78.9) (51.7) IRS Transitional ADJ 1.6 2.1 2.4 2.9 - - - - - 9.0 (2.5) 72.0$ 85.6$ 98.4$ 115.7$ 116.6$ 134.6$ 157.6$ 161.7$ 570.5$ 371.7$ 303.7$ Adjusted effective tax rate (non-GAAP) 3 23% 20% 19% 20% 15% 20% 21% 19% 19% 20% 21% Non - GAAP Supplementary Information…continued 1 23 The following table sets forth a reconciliation of our non - GAAP adjusted tax expense and our non - GAAP adjusted effective tax rat e to our GAAP tax expense and GAAP effective tax rate for the periods indicated, in each case determined by excluding the tax benefits or costs associated with the listed items (in millio ns, except percentages) from our GAAP tax expense for such periods: 1 See “Note Regarding Non - GAAP Financial Measures” . Also see slides 19 and 20 for, among other things, the definitions and uses of certain non - GAAP financial measures . 2 Our GAAP effective tax rate is determined by dividing ( i ) tax expense by (ii) earnings from operations minus Finance Costs and Miscellaneous Expense (Income) . 3 Our Adjusted effective tax rate (non - GAAP) is determined by dividing ( i ) adjusted tax expense (non - GAAP) by (ii) adjusted operating earnings (non - GAAP) minus finance costs and IRS Transitional ADJ .

Fourth Quarter 2024 Financial Results January 30, 2025

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

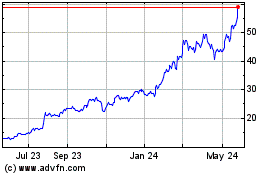

Celestica (NYSE:CLS)

Historical Stock Chart

From Jan 2025 to Feb 2025

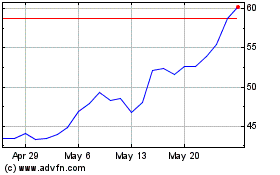

Celestica (NYSE:CLS)

Historical Stock Chart

From Feb 2024 to Feb 2025