First quarter sales of $900.1 million, a

6.4% year-over-year increase

GAAP EPS of $0.81, up 8.1% versus prior

year; adjusted EPS of $0.83

Reaffirming fiscal 2025 outlook

Donaldson Company, Inc. (NYSE: DCI) (Donaldson or the Company),

a global leader in technology-led filtration products and

solutions, today reported first quarter fiscal 2025 generally

accepted accounting principles (GAAP) net earnings of $99.0

million, compared with $92.1 million in fiscal 2024. First quarter

2025 GAAP earnings per share (EPS)1 were $0.81 compared with 2024

EPS of $0.75. First quarter 2025 adjusted EPS2,3 was $0.83. The

tables attached to this press release include a reconciliation of

GAAP to non-GAAP measures.

“Donaldson’s record first quarter earnings, driven by robust

sales growth and continued margin strength, mark a strong start to

fiscal 2025,” said Tod Carpenter, chairman, president and chief

executive officer. “We gained share in several of our key

businesses while continuing the footprint and cost optimization

initiatives we began last quarter, strengthening our foundation for

higher profitability.

“For the balance of the year, our focus is on delivery to

customers, execution of optimization initiatives, and shareholder

value creation through another year of record sales and earnings.

We are committed to maintaining our position as the leader in

technology-led filtration with disciplined investments in key

strategic areas, including in our Life Sciences segment and

bioprocessing businesses.”

First Quarter Operating

Results

Sales of $900.1 million were up 6.4% compared with 2024, mainly

as a result of volume growth in all segments.

Three Months Ended

October 31, 2024

Reported % Change

Constant Currency %

Change

Mobile Solutions segment

Off-Road

(5.9

)%

(6.7

)%

On-Road

(15.0

)

(15.2

)

Aftermarket

10.7

10.1

Total Mobile Solutions segment

6.0

5.4

Industrial Solutions segment

Industrial Filtration Solutions

0.8

(0.1

)

Aerospace and Defense

26.8

26.0

Total Industrial Solutions segment

4.6

3.7

Life Sciences segment

Total Life Sciences segment

16.6

13.9

Total Company

6.4

%

5.5

%

Mobile Solutions segment (Mobile) sales rose 6.0%. Aftermarket

sales increased 10.7% from continued market share gains and

customer destocking in the prior year period. On-Road and Off-Road

sales decreased 15.0% and 5.9%, respectively, due to declines in

global equipment production, including in agriculture and

transportation.

Industrial Solutions segment (Industrial) sales increased 4.6%

from strength in Aerospace and Defense sales, which grew 26.8% as a

result of robust end-market conditions. Industrial Filtration

Solutions (IFS) sales grew 0.8% driven by Power Generation project

timing.

Life Sciences segment (Life Sciences) sales increased 16.6% from

share gains and improved market conditions in Disk Drive and a

double-digit increase in Food & Beverage sales.

Gross margin was 35.5%, down 10 basis points from 35.6% in 2024,

due to higher costs, including for footprint optimization and

distribution. Adjusted gross margin, which excludes the impact from

restructuring and other charges, was 35.6%, flat to prior year.

Operating expenses as a percentage of sales were 21.0%, an

increase from 20.8% in the prior year, as a result of restructuring

and other charges. Adjusted operating expenses as a percentage of

sales were 20.7%, down 10 basis points from prior year.

Operating income as a percentage of sales (operating margin) of

14.5% decreased 20 basis points from 14.7% in 2024 driven primarily

by restructuring and other charges. Adjusted operating income was

14.9%, a 20 basis point increase from 14.7% in 2024.

Interest expense was $5.5 million, flat compared with prior

year. Other income, net increased to $5.2 million compared with

$3.8 million in 2024, primarily due to higher joint venture income.

The Company’s effective tax rate was 24.2% versus 25.1% a year ago

driven by an increase in net discrete tax benefits.

During the first quarter, Donaldson paid $32.4 million in

dividends and repurchased 0.8% of its outstanding shares for $74.9

million.

Reaffirming Fiscal 2025

Outlook

Adjusted full-year EPS, which excludes $0.02 of first quarter

restructuring and other charges, is forecast to be between $3.56

and $3.72, consistent with previous guidance. 2024 GAAP and

adjusted4 EPS were $3.38 and $3.42, respectively. Sales are

expected to increase between 2% and 6% year over year, with a

pricing benefit of approximately 1%.

Mobile sales are projected to be flat to up 4% versus prior

year. Off-Road sales are forecast to grow low-single digits from

market share gains. On-Road sales are expected to decrease

low-double digits due to an exit from non-strategic product sales

combined with unfavorable end-market conditions. Aftermarket sales

are projected to increase low-single digits, driven by high vehicle

utilization rates and market share gains.

Industrial sales are forecast to grow between 4% and 8% versus

2024. IFS sales are projected to increase high-single digits with

strength across most businesses, including dust collection,

Industrial Hydraulics and Industrial Gases. Aerospace and Defense

sales are expected to be flat after cycling against double-digit

growth in the prior year.

Life Sciences sales are forecast to increase low-double digits

compared with prior year driven by growth in Disk Drive and Food

& Beverage.

Adjusted operating margin, driven by continued gross margin

strength and operating expense leverage, is expected to be between

15.3% and 15.9% versus 15.2%, or 15.4% on an adjusted basis, in

2024.

Interest expense is estimated to be approximately $21 million

and other income is forecast to be between $16 million and $20

million. Donaldson projects a fiscal 2025 effective income tax rate

of between 23% and 25%.

Capital expenditures are forecast to be between $85 million and

$105 million and free cash flow conversion is expected to be

between 85% and 95%. For the full year, Donaldson anticipates

repurchasing 2% to 3% of its shares outstanding.

_________________________________

1 All EPS figures refer to diluted

EPS.

2 Adjusted EPS is a non-GAAP financial

measure that excludes the impact of certain items not related to

ongoing operations.

3 First quarter fiscal 2025 adjusted

results exclude $3.3 million of pre-tax restructuring and other

charges, primarily related to targeted cost reduction initiatives

in the Life Sciences segment and global footprint optimization

actions.

4 Fiscal 2024 adjusted results exclude

$6.4 million of pre-tax restructuring and other charges largely

related to footprint optimization and cost reduction

initiatives.

Miscellaneous

The Company will webcast its first quarter fiscal 2025 earnings

conference call today at 9:00 a.m. CT. To listen to the webcast,

visit the “Events & Presentations” section of Donaldson’s

Investor Relations website (IR.Donaldson.com), and click on the

“listen to webcast” option. The webcast replay will be available at

approximately 12:00 p.m. CT today. Also available on the website is

the Company’s supplemental quarterly earnings presentation.

Statements in this release regarding future events and

expectations, such as forecasts, plans, trends and projections

relating to the Company’s business and financial performance, are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995 and are identified by

words or phrases such as “will likely result,” “are expected to,”

“will continue,” “will allow,” “estimate,” “project,” “believe,”

“expect,” “anticipate,” “forecast,” “plan” and similar expressions.

These forward-looking statements speak only as of the date such

statements are made and are subject to risks and uncertainties that

could affect the Company’s performance and could cause the

Company’s actual results for future periods to differ materially

from any opinions or statements expressed. These factors include,

but are not limited to, challenges in global operations; impacts of

global economic, industrial and political conditions on product

demand; impacts from unexpected events, including natural

disasters; effects of unavailable raw materials or material cost

inflation; inability to attract and retain qualified personnel;

inability to meet customer demand; inability to maintain

competitive advantages; threats from disruptive technologies;

effects of highly competitive markets with pricing pressure;

exposure to customer concentration in certain cyclical industries;

inability to manage productivity improvements; inability to achieve

commitments to ESG; results of execution of any acquisition,

divestiture and other strategic transactions; vulnerabilities

associated with information technology systems and security;

inability to protect and enforce intellectual property rights;

costs associated with governmental laws and regulations; impacts of

foreign currency fluctuations; and effects of changes in capital

and credit markets. These and other factors are described in Part

I, Item 1A, “Risk Factors” of the Company’s Annual Report on Form

10-K for the fiscal year ended July 31, 2024. The Company

undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, unless required by law. The results

presented herein are preliminary, unaudited and subject to revision

until the Company files its results with the United States

Securities and Exchange Commission on Form 10-Q.

About Donaldson Company,

Inc.

Founded in 1915, Donaldson (NYSE: DCI) is a global leader in

technology-led filtration products and solutions, serving a broad

range of industries and advanced markets. Diverse, skilled

employees at over 140 locations on six continents partner with

customers – from small business owners to R&D organizations and

the world’s biggest OEM brands. Donaldson solves complex filtration

challenges through three primary segments: Mobile Solutions,

Industrial Solutions and Life Sciences. Additional information is

available at www.Donaldson.com.

DONALDSON COMPANY, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS

(In millions, except per share

amounts)

(Unaudited)

Three Months Ended

October 31,

2024

2023

Change

Net sales

$

900.1

$

846.3

6.4

%

Cost of sales

580.5

545.4

6.4

Gross profit

319.6

300.9

6.2

Selling, general and administrative

166.1

155.0

7.2

Research and development

22.7

21.3

6.4

Operating expenses

188.8

176.3

7.1

Operating income

130.8

124.6

4.9

Interest expense

5.5

5.5

—

Other income, net

(5.2

)

(3.8

)

38.8

Earnings before income taxes

130.5

122.9

6.2

Income taxes

31.5

30.8

2.3

Net earnings

$

99.0

$

92.1

7.5

%

Weighted average shares – basic

119.9

120.9

(0.8

)%

Weighted average shares – diluted

121.9

122.6

(0.5

)%

Net EPS – basic

$

0.83

$

0.76

8.4

%

Net EPS – diluted

$

0.81

$

0.75

8.1

%

Dividends paid per share

$

0.27

$

0.25

8.0

%

Note: Amounts may not foot due to

rounding.

DONALDSON COMPANY, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In millions)

(Unaudited)

October 31,

July 31,

2024

2024

Assets

Current assets:

Cash and cash equivalents

$

221.2

$

232.7

Accounts receivable, net

631.3

629.7

Inventories, net

520.0

476.7

Prepaid expenses and other current

assets

106.9

99.0

Total current assets

1,479.4

1,438.1

Property, plant and equipment, net

647.4

645.5

Goodwill

479.9

478.4

Intangible assets, net

168.3

171.9

Other long-term assets

268.6

180.4

Total assets

$

3,043.6

$

2,914.3

Liabilities and Stockholders’

Equity

Current liabilities:

Short-term borrowings

$

78.2

$

28.3

Current maturities of long-term debt

25.0

25.0

Accounts payable

373.5

379.4

Accrued employee compensation and related

taxes

135.3

140.9

Deferred revenue

24.8

19.7

Income taxes payable

60.5

42.6

Dividends payable

—

32.5

Other current liabilities

103.3

114.1

Total current liabilities

800.6

782.5

Long-term debt

538.6

483.4

Non-current income taxes payable

40.4

39.8

Deferred income taxes

15.3

16.1

Other long-term liabilities

105.7

103.4

Total liabilities

1,500.6

1,425.2

Total stockholders’ equity

1,543.0

1,489.1

Total liabilities and stockholders’

equity

$

3,043.6

$

2,914.3

DONALDSON COMPANY, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

Three Months Ended

October 31,

2024

2023

Operating Activities

Net earnings

$

99.0

$

92.1

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Depreciation and amortization

25.5

24.3

Deferred income taxes

(4.7

)

(4.6

)

Stock-based compensation expense

12.2

10.5

Other, net

(2.4

)

(0.2

)

Changes in operating assets and

liabilities

(56.7

)

15.9

Net cash provided by operating

activities

72.9

138.0

Investing Activities

Purchases of property, plant and

equipment

(25.0

)

(23.2

)

Equity investment

(71.0

)

—

Net cash used in investing activities

(96.0

)

(23.2

)

Financing Activities

Proceeds from long-term debt

55.0

35.0

Repayments of long-term debt

—

(73.8

)

Change in short-term borrowings

50.1

41.5

Purchase of treasury stock

(74.4

)

(53.3

)

Dividends paid

(32.4

)

(30.2

)

Exercise of stock options and other

11.5

1.9

Net cash provided by (used in) in

financing activities

9.8

(78.9

)

Effect of exchange rate changes on

cash

1.8

(5.2

)

(Decrease) increase in cash and cash

equivalents

(11.5

)

30.7

Cash and cash equivalents, beginning of

period

232.7

187.1

Cash and cash equivalents, end of

period

$

221.2

$

217.8

CONSOLIDATED RATE

ANALYSIS

(Unaudited)

Three Months Ended

October 31,

2024

2023

Gross margin

35.5

%

35.6

%

Operating expenses

21.0

%

20.8

%

Operating margin

14.5

%

14.7

%

Other income, net

(0.6

)%

(0.4

)%

Depreciation and amortization

2.8

%

2.9

%

EBITDA

17.9

%

18.0

%

Effective tax rate

24.2

%

25.1

%

Earnings before income taxes - Mobile

Solutions

18.3

%

17.1

%

Earnings before income taxes - Industrial

Solutions

15.9

%

17.6

%

Loss before income taxes - Life

Sciences

(7.6

)%

(7.0

)%

Cash conversion ratio

48.4

%

124.6

%

Three Months Ended

October 31,

2024

2023

Adjusted Rates

Gross margin

35.6

%

35.6

%

Operating expenses

20.7

%

20.8

%

Operating margin

14.9

%

14.7

%

Other income, net

(0.6

)%

(0.4

)%

Depreciation and amortization

2.8

%

2.9

%

EBITDA

18.3

%

18.0

%

Effective tax rate

24.2

%

25.1

%

Earnings before income taxes - Mobile

Solutions

18.3

%

17.1

%

Earnings before income taxes - Industrial

Solutions

15.9

%

17.6

%

Loss before income taxes - Life

Sciences

(7.6

)%

(7.0

)%

Cash conversion ratio

47.2

%

124.6

%

Note: Rate analysis metrics are computed

by dividing the applicable amount by net sales, and cash conversion

ratio reflects free cash flow divided by net earnings. Adjusted

rates exclude the impact of certain items not related to ongoing

operations. Adjusted rates are non-GAAP measures; see the

Reconciliation of Non-GAAP Financial Measures schedule for

additional information.

SEGMENT DETAIL

(In millions)

(Unaudited)

Three Months Ended October

31,

2024

2023

Change

Net sales

Mobile Solutions segment

Off-Road

$

89.1

$

94.7

(5.9

)%

On-Road

32.1

37.8

(15.0

)

Aftermarket

451.2

407.5

10.7

Total Mobile Solutions segment

572.4

540.0

6.0

Industrial Solutions segment

Industrial Filtration Solutions

212.4

210.6

0.8

Aerospace and Defense

45.2

35.6

26.8

Total Industrial Solutions segment

257.6

246.2

4.6

Life Sciences segment

Total Life Sciences segment

70.1

60.1

16.6

Total Company

$

900.1

$

846.3

6.4

%

Earnings (loss) before income

taxes

Mobile Solutions segment

$

104.7

$

92.2

13.6

%

Industrial Solutions segment

41.0

43.3

(5.3

)

Life Sciences segment

(5.3

)

(4.2

)

(26.2

)

Corporate and unallocated

(9.9

)

(8.4

)

(17.9

)

Total Company

$

130.5

$

122.9

6.2

%

Earnings (loss) before income taxes

percentage

Mobile Solutions segment

18.3

%

17.1

%

1.2

%

Industrial Solutions segment

15.9

%

17.6

%

(1.7

)%

Life Sciences segment

(7.6

)%

(7.0

)%

(0.6

)%

Note: Earnings before income taxes

percentage is calculated by dividing earnings before income taxes

by net sales. Amounts may not foot due to rounding.

SEGMENT SALES PERCENT CHANGE

FROM PRIOR PERIODS BY GEOGRAPHY, AS REPORTED

(Unaudited)

Three Months Ended October 31,

2024

TOTAL

U.S.(1)/CA(2)

EMEA(3)

APAC(4)

LATAM(5)

Mobile Solutions segment

Off-Road

(5.9

)%

2.2

%

(20.1

)%

5.8

%

8.8

%

On-Road

(15.0

)

(14.3

)

4.0

(27.9

)

8.7

Aftermarket

10.7

10.1

14.7

12.1

6.1

Total Mobile Solutions segment

6.0

6.6

4.7

6.5

6.2

Industrial Solutions segment

Industrial Filtration Solutions

0.8

1.6

0.3

4.2

(12.0

)

Aerospace and Defense

26.8

41.0

(11.8

)

9.0

N/A

Total Industrial Solutions segment

4.6

9.0

(1.2

)

4.3

(12.0

)

Life Sciences segment

Total Life Sciences segment

16.6

5.1

4.4

36.1

12.0

Total Company

6.4

%

7.4

%

2.8

%

10.8

%

4.2

%

Note: Amounts may not foot due to

rounding.

(1) United States (U.S.)

(2) Canada (CA)

(3) Europe, Middle East and Africa

(EMEA)

(4) Asia Pacific (APAC)

(5) Latin America (LATAM)

SEGMENT SALES PERCENT CHANGE

FROM PRIOR PERIODS BY GEOGRAPHY, CONSTANT CURRENCY

(Unaudited)

Three Months Ended October 31,

2024

TOTAL

U.S./CA

EMEA

APAC

LATAM

Mobile Solutions segment

Off-Road

(6.7

)%

2.2

%

(22.5

)%

5.4

%

13.4

%

On-Road

(15.2

)

(14.3

)

2.3

(29.0

)

18.4

Aftermarket

10.1

10.1

11.0

10.4

9.0

Total Mobile Solutions segment

5.4

6.6

1.4

5.1

9.4

Industrial Solutions segment

Industrial Filtration Solutions

(0.1

)

1.6

(2.5

)

2.9

(10.1

)

Aerospace and Defense

26.0

41.0

(14.9

)

9.1

N/A

Total Industrial Solutions segment

3.7

9.0

(4.1

)

3.1

(10.1

)

Life Sciences segment

Total Life Sciences segment

13.9

5.1

1.0

32.3

16.4

Total Company

5.5

%

7.4

%

(0.3

)%

9.1

%

7.2

%

Note: The constant currency presentation,

which is a non-GAAP measure, excludes the impact of fluctuations in

foreign currency exchange rates. The Company believes providing

constant currency information provides valuable supplemental

information regarding its results of operations. The Company

calculates constant currency percentages by converting its current

period local currency financial results using the prior period

exchange rates and compares these adjusted amounts to its prior

period reported results. Amounts may not foot due to rounding.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

(In millions)

(Unaudited)

Three Months Ended

October 31,

2024

2023

Net cash provided by operating

activities

$

72.9

$

138.0

Net capital expenditures

(25.0

)

(23.2

)

Free cash flow

$

47.9

$

114.8

Net earnings

$

99.0

$

92.1

Income taxes

31.5

30.8

Interest expense

5.5

5.5

Depreciation and amortization

25.5

24.3

EBITDA

$

161.5

$

152.7

Adjusted net earnings

$

101.5

$

92.1

Adjusted income taxes

32.3

30.8

Interest expense

5.5

5.5

Depreciation and amortization

25.5

24.3

Adjusted EBITDA

$

164.8

$

152.7

Gross profit

$

319.6

$

300.9

Restructuring and other charges

1.1

—

Adjusted gross profit

$

320.7

$

300.9

Operating expense

$

188.8

$

176.3

Restructuring and other charges

(2.2

)

—

Adjusted operating expense

$

186.6

$

176.3

Operating income

$

130.8

$

124.6

Restructuring and other charges

3.3

—

Adjusted operating income

$

134.1

$

124.6

Net earnings

$

99.0

$

92.1

Restructuring and other charges, net of

tax

2.5

—

Adjusted net earnings

$

101.5

$

92.1

Diluted EPS

$

0.81

$

0.75

Restructuring and other charges per

share

0.02

—

Adjusted diluted EPS

$

0.83

$

0.75

2025 Adjusted EPS Guidance

A reconciliation of the Company’s fiscal 2025 adjusted EPS

guidance to fiscal 2025 GAAP EPS guidance is not included in this

release due to the number of variables in the projected GAAP EPS

range and the Company’s current inability to reasonably quantify

certain amounts, such as restructuring or other charges, that would

be included in the GAAP measure or the individual adjustments for

such reconciliation.

Note: Although free cash flow, EBITDA, adjusted EBITDA, adjusted

gross profit, adjusted operating expense, adjusted operating

income, adjusted net earnings and adjusted diluted EPS are not

measures of financial performance under GAAP, the Company believes

they are useful in understanding its financial results. Free cash

flow is a commonly used measure of a company’s ability to generate

cash in excess of its operating needs. EBITDA is a commonly used

measure of operating earnings less non-cash expenses. The adjusted

basis presentation excludes the impact of certain matters not

related to the Company’s ongoing operations. Management believes

that the adjusted basis presentation reflects management’s

performance in operating the Company and provides a meaningful

representation of the performance of the Company’s core business

and is useful to understanding its financial results. A shortcoming

of these financial measures is that they do not reflect the

Company’s actual results under GAAP. Management does not intend

these items to be considered in isolation or as a substitute for

the related GAAP measures. Amounts may not foot due to

rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241203084792/en/

Sarika Dhadwal (952) 887-3753 Sarika.Dhadwal@Donaldson.com

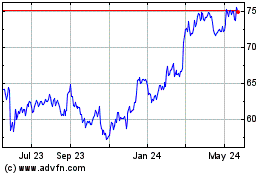

Donaldson (NYSE:DCI)

Historical Stock Chart

From Dec 2024 to Jan 2025

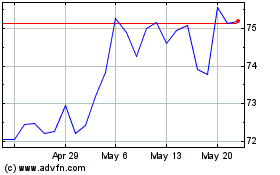

Donaldson (NYSE:DCI)

Historical Stock Chart

From Jan 2024 to Jan 2025