Successfully Executed Initiatives to Grow

Volume, Reduce Costs and Manage Working Capital Levels

Completed Financing Transactions to Bolster

Liquidity and Extend Debt Maturities

Announcing Further Initiatives to Improve

Profitability Levels

GrafTech International Ltd. (NYSE: EAF) ("GrafTech," the

"Company," "we," or "our") today announced financial results for

the quarter and year ended December 31, 2024.

Fourth Quarter 2024 Highlights

- Exceeded cost reduction guidance, achieving a 25%

year-over-year reduction in cash costs per metric ton ("MT") for

the fourth quarter and a 23% reduction on a full-year basis

- Grew sales volume 13% year-over-year to 27.2 thousand MT

- Achieved fourth consecutive quarter of sequential sales volume

growth

- Completed financing transactions, ending 2024 with total

liquidity of $464 million

Fourth Quarter 2024 Summary

- Net sales of $134 million

- Net loss of $49 million, or $0.19 per share(1)

- Adjusted EBITDA(2) of negative $7 million

- Net cash used in operating activities of $26 million

- Adjusted free cash flow(2) of negative $21 million

CEO Comments

"We successfully delivered on our stated initiatives for 2024 to

grow volume and market share, to cut costs and to manage our

working capital and capital expenditure levels," said Timothy

Flanagan, Chief Executive Officer and President. “For the full

year, we grew sales volume 13% and reduced our cash costs on a per

metric ton basis by 23%. In addition, with the successful

completion of our previously announced financing transactions, we

ended the year with $464 million of liquidity, which will support

our ability to manage through the near-term, industry-wide

challenges facing GrafTech."

"As we enter 2025, we remain relentlessly focused on managing

what is within our control," continued Mr. Flanagan. "However, as

graphite electrode demand remains muted and competitive pressures

have persisted in many of our key regions, the pricing environment

remains unsustainably low. As a result, we are taking further

actions to accelerate our path to normalized levels of

profitability and support our ability to invest in our business.

These include initiatives to optimize our order book and actively

shift the geographic mix of our business to regions where there is

an opportunity to capture higher average selling prices. In

addition, we have informed our customers of our intention to

increase prices by 15% on volume that is not yet committed for

2025. These actions reflect our ongoing commitment to protect

GrafTech's position as the steel industry's preeminent supplier of

graphite electrodes, leading-edge technical support and

high-quality petroleum needle coke."

Fourth Quarter and Full Year 2024

Financial Performance

(dollars in thousands, except per share

amounts)

Year Ended

December 31,

Q4 2024

Q3 2024

Q4 2023

2024

2023

Net sales

$

134,217

$

130,654

$

137,145

$

538,782

$

620,500

Net loss

$

(49,476

)

$

(36,068

)

$

(217,409

)

$

(131,165

)

$

(255,250

)

Loss per share(1)

$

(0.19

)

$

(0.14

)

$

(0.85

)

$

(0.51

)

$

(0.99

)

Net cash (used in) provided by operating

activities

$

(26,417

)

$

23,709

$

9,292

$

(40,093

)

$

76,561

Adjusted net loss(2)

$

(33,143

)

$

(34,276

)

$

(68,569

)

$

(106,144

)

$

(100,752

)

Adjusted loss per share(1)(2)

$

(0.13

)

$

(0.13

)

$

(0.27

)

$

(0.41

)

$

(0.39

)

Adjusted EBITDA(2)

$

(6,859

)

$

(6,196

)

$

(21,572

)

$

1,632

$

20,484

Adjusted free cash flow(2)

$

(20,960

)

$

19,682

$

3,539

$

(56,153

)

$

49,974

For the fourth quarter of 2024, sales volume increased 13%

compared to the fourth quarter of 2023. Net sales for the fourth

quarter of 2024 were $134 million, a decrease of 2% compared to

$137 million in the fourth quarter of 2023 as the higher sales

volume was offset by a decrease in the weighted-average realized

price for volume derived from short-term agreements and spot sales

("non-LTA") and a shift in the mix of our business from volume

derived from our take-or-pay agreements that had initial terms of

three-to-five years ("LTA") to non-LTA volume.

Net loss for the fourth quarter of 2024 was $49 million, or

$0.19 per share, compared to a net loss of $217 million, or $0.85

per share, in the fourth quarter of 2023. Included in net loss for

the fourth quarter of 2023 was a goodwill impairment charge of $171

million.

Adjusted EBITDA(2) was negative $7 million in the fourth quarter

of 2024, compared to negative $22 million in the fourth quarter of

2023. The year-over-year improvement reflected a 25% reduction in

cash costs on a per MT basis for the fourth quarter of 2024,

compared to the same period in 2023. This was partially offset by

the impact of lower weighted-average realized prices and a shift in

the mix of our business from LTA volume to non-LTA volume.

In the fourth quarter of 2024, net cash used in operating

activities was $26 million and adjusted free cash flow(2) was a use

of $21 million, compared to net cash provided by operating

activities of $9 million and adjusted free cash flow(2) of $4

million in the fourth quarter of 2023. The year-over-year change

primarily reflected a lower benefit from the net change in working

capital in the fourth quarter of 2024 compared to the same period

in 2023.

For the year ended December 31, 2024, sales volume increased 13%

compared to the prior year. Net sales for the year ended December

31, 2024 decreased 13% compared to the prior year as the higher

sales volume was offset by a decrease in the weighted-average

realized price for non-LTA volume and a shift in the mix of our

business from LTA volume to non-LTA volume.

Net loss for the year ended December 31, 2024 was $131 million,

or $0.51 per share, compared to a net loss of $255 million, or

$0.99 per share, for the year ended December 31, 2023. Included in

net loss for the year ended December 31, 2023 was a goodwill

impairment charge of $171 million.

Adjusted EBITDA(2) for 2024 was $2 million, compared to adjusted

EBITDA of $20 million in the prior year. The year-over-year decline

primarily reflected the impact of lower weighted-average realized

prices and a shift in the mix of our business from LTA volume to

non-LTA volume, with these factors partially offset by a 23%

reduction in cash costs on a per MT basis for the year ended

December 31, 2024 compared to 2023.

Net cash used in operating activities for the year ended

December 31, 2024 was $40 million and adjusted free cash flow(2)

was a use of $56 million, compared to net cash provided by

operating activities of $77 million and adjusted free cash flow(2)

of $50 million for the year ended December 31, 2023. The

year-over-year change primarily reflected a lower benefit from the

net change in working capital for the year ended December 31, 2024

compared to 2023. Adjusted free cash flow(2) for the year ended

December 31, 2023 also included a $27 million benefit from the

settlement of interest rate swaps.

Operational and Commercial

Update

Key Operating Metrics

Year Ended

December 31,

(in thousands, except

percentages)

Q4 2024

Q3 2024

Q4 2023

2024

2023

Sales volume (MT)

27.2

26.4

24.1

103.2

91.6

Production volume (MT)(3)

25.1

19.4

24.4

97.3

88.1

Production capacity (MT)(4)(5)

46.0

42.0

52.0

178.0

202.0

Capacity utilization(6)

55

%

46

%

47

%

55

%

44

%

Sales volume for the fourth quarter of 2024 was 27.2 thousand

MT, consisting of 23.9 thousand MT of non-LTA volume and 3.2

thousand MT of LTA volume.

For the fourth quarter of 2024, the weighted-average realized

price for our non-LTA volume was approximately $3,900 per MT, a

decrease of approximately 19% compared to the fourth quarter of

2023, with the decline reflecting the persistent competitive

pressures in our principal commercial regions. For our LTA volume,

the weighted-average realized price was approximately $7,700 per MT

for the fourth quarter of 2024.

Production volume was 25.1 thousand MT in the fourth quarter of

2024, an increase of 3% compared to the fourth quarter of 2023.

Capital Structure and Liquidity

During the fourth quarter of 2024, we completed the previously

announced capital transactions which provided incremental liquidity

and extended our debt maturities. As of December 31, 2024, we had

liquidity of $464 million, consisting of cash and cash equivalents

of $256 million, $108 million of availability under our amended

revolving credit facility and $100 million of availability under

our new senior secured first lien delayed draw term loans. As of

December 31, 2024, we had gross debt(7) of $1,125 million and net

debt(8) of approximately $869 million.

Outlook

In 2024, steel industry production remained constrained by

global economic and geopolitical uncertainty. As we enter 2025,

industry analyst projections indicate a modest recovery in global

steel demand is expected for the year. However, significant

geopolitical uncertainty remains, including the potential impact of

policymaking on the interest rate environment, global trade and

decarbonization policies. As we closely monitor all of these

developments and assess their potential impact on the commercial

environment for graphite electrodes, our current outlook is that

demand for graphite electrodes in the near term will remain

relatively flat in the key regions in which we operate.

For GrafTech, despite the industry-wide headwinds, we anticipate

a low double-digit percentage point year-over-year increase in our

sales volume for 2025 on a full-year basis as we continue to regain

market share. This reflects our compelling customer value

proposition and our ongoing focus on delivering on the needs of our

customers. Of our anticipated 2025 sales volume, to date, we have

over 60% committed in our order book following the successful

completion of the customer negotiations that occur in the fourth

quarter of each year.

As it relates to price, challenging pricing dynamics have

persisted in most regions and the pricing environment remains

unsustainably low. As a result, we are taking further actions to

accelerate our path to normalized levels of profitability and

support our ability to invest in our business. These include

initiatives to optimize our order book and actively shift the

geographic mix of our business to regions where there is an

opportunity to capture higher average selling prices. In addition,

we have informed our customers of our intention to increase prices

by 15% on volume that is not yet committed for 2025.

As it relates to costs, we will continue to execute our

initiatives to improve our cost structure. Reflecting these actions

and the benefit of the anticipated increase in our sales and

production volume levels, we expect a mid-single digit percentage

point decline in our cash cost of goods sold per MT for 2025

compared to 2024.

In addition, we will continue to closely manage our working

capital levels and capital expenditures. For 2025, we expect the

net impact of working capital will be favorable to our full year

cash flow performance, although to a lesser extent than in each of

the previous two years which reflected our efforts to align

inventory levels with our view on demand. We anticipate our full

year 2025 capital expenditures will be approximately $40

million.

Longer term, we remain confident that the steel industry’s

efforts to decarbonize will lead to increased adoption of the

electric arc furnace method of steelmaking, driving long-term

demand growth for graphite electrodes. We also anticipate the

demand for petroleum needle coke, the key raw material we use to

produce graphite electrodes, to accelerate driven by its

utilization in producing synthetic graphite for use in lithium-ion

batteries for the growing electric vehicle market. We believe that

the near-term actions we are taking, supported by an

industry-leading position and our sustainable competitive

advantages, including our substantial vertical integration into

petroleum needle coke via our Seadrift facility, will optimally

position GrafTech to benefit from that long-term growth.

Conference Call Information

In connection with this earnings release, you are invited to

listen to our earnings call being held on February 7, 2025 at 10:00

a.m. (EST). The webcast and accompanying slide presentation will be

available on our investor relations website at:

http://ir.graftech.com. The earnings call dial-in number is +1

(800) 717-1738 toll-free in North America or +1 (289) 514-5100 for

overseas calls, conference ID: 51544. Archived replays of the

conference call and webcast will be made available on our investor

relations website at: http://ir.graftech.com. GrafTech also makes

its complete financial reports that have been filed with the

Securities and Exchange Commission ("SEC") and other information

available at: www.GrafTech.com. The information on our website is

not part of this release or any report we file with or furnish to

the SEC.

About GrafTech

GrafTech International Ltd. is a leading manufacturer of

high-quality graphite electrode products essential to the

production of electric arc furnace steel and other ferrous and

non-ferrous metals. The Company has a competitive portfolio of

low-cost, ultra-high power graphite electrode manufacturing

facilities, with some of the highest capacity facilities in the

world. We are the only large-scale graphite electrode producer that

is substantially vertically integrated into petroleum needle coke,

our key raw material for graphite electrode manufacturing. This

unique position provides us with competitive advantages in product

quality and cost.

________________________

(1)

Loss per share represents diluted loss per

share. Adjusted loss per share represents diluted adjusted loss per

share.

(2)

A non-GAAP financial measure, see below

for more information and reconciliations to the most directly

comparable financial measures calculated and presented in

accordance with accounting principles generally accepted in the

United States of America ("GAAP").

(3)

Production volume reflects graphite

electrodes we produced during the period.

(4)

Production capacity reflects expected

maximum production volume during the period depending on product

mix and expected maintenance outage. Actual production may

vary.

(5)

Includes graphite electrode facilities in

Calais, France; Monterrey, Mexico; and Pamplona, Spain. While

maintaining the capability to produce up to 28,000 MT of graphite

electrodes and pins on an annual basis at our St. Marys,

Pennsylvania facility, most production activities at St. Marys have

been suspended. The wind down of these production activities was

completed in the second quarter of 2024. Remaining activities at

St. Marys are limited to machining graphite electrodes and pins

sourced from our other plants.

(6)

Capacity utilization reflects production

volume as a percentage of production capacity.

(7)

Gross debt reflects the notional value of

our outstanding debt and excludes unamortized debt discount and

issuance costs.

(8)

A non-GAAP financial measure, net debt is

calculated as gross debt minus cash and cash equivalents (December

31, 2024 gross debt of $1.1 billion less December 31, 2024 cash and

cash equivalents of $256 million).

Cautionary Note Regarding Forward-Looking Statements

This press release and related discussions may contain

forward-looking statements within the meaning of the safe harbor

provisions of the U.S. Private Securities Litigation Reform Act of

1995. Forward-looking statements reflect our current views with

respect to, among other things, financial projections, plans and

objectives of management for future operations, future economic

performance and short-term and long-term liquidity. Examples of

forward-looking statements include, among others, statements we

make regarding future estimated volume, pricing and revenue,

anticipated levels of capital expenditures and cost of goods sold.

You can identify these forward-looking statements by the use of

forward-looking words such as “will,” “may,” “plan,” “estimate,”

“project,” “believe,” “anticipate,” “expect,” “foresee,” “intend,”

“should,” “would,” “could,” “target,” “goal,” “continue to,”

“positioned to,” “are confident,” or the negative versions of those

words or other comparable words. Any forward-looking statements

contained in this press release are based upon our historical

performance and on our current plans, estimates and expectations

considering information currently available to us. The inclusion of

this forward-looking information should not be regarded as a

representation by us that the future plans, estimates, or

expectations contemplated by us will be achieved. Our expectations

and targets are not predictions of actual performance and

historically our performance has deviated, often significantly,

from our expectations and targets. These forward-looking statements

are subject to various risks and uncertainties and assumptions

relating to our operations, financial results, financial condition,

business, prospects, growth strategy and liquidity. Accordingly,

there are or will be important factors that could cause our actual

results to differ materially from those indicated in these

statements. We believe that these factors include, but are not

limited to: our dependence on the global steel industry generally

and the electric arc furnace steel industry, in particular; the

cyclical nature of our business and the selling prices of our

products, which may continue to decline in the future, and may lead

to prolonged periods of reduced profitability and net losses or

adversely impact liquidity; the sensitivity of our business and

operating results to economic conditions, including any recession,

and the possibility others may not be able to fulfill their

obligations to us in a timely fashion or at all; the possibility

that we may be unable to implement our business strategies in an

effective manner; the possibility that global graphite electrode

overcapacity may adversely affect graphite electrode prices; the

competitiveness of the graphite electrode industry; our dependence

on the supply of raw materials, including decant oil and petroleum

needle coke, and disruptions in supply chains for these materials;

our primary reliance on one facility in Monterrey, Mexico for the

manufacturing of connecting pins; the cost of electric power and

natural gas, particularly in Europe; our manufacturing operations

are subject to hazards; the legal, compliance, economic, social and

political risks associated with our substantial operations in

multiple countries; the possibility that fluctuation of foreign

currency exchange rates could materially harm our financial

results; the possibility that our results of operations could

further deteriorate if our manufacturing operations were

substantially disrupted for an extended period, including as a

result of equipment failure, climate change, regulatory issues,

natural disasters, public health crises, such as a global pandemic,

political crises or other catastrophic events; the risks and

uncertainties associated with litigation, arbitration, and like

disputes, including disputes related to contractual commitments;

our dependence on third parties for certain construction,

maintenance, engineering, transportation, warehousing and logistics

services; the possibility that we are subject to information

technology systems failures, cybersecurity incidents, network

disruptions and breaches of data security, including with respect

to our third-party suppliers and business partners; the possibility

that we are unable to recruit or retain key management and plant

operating personnel or successfully negotiate with the

representatives of our employees, including labor unions; the

sensitivity of long-lived assets on our balance sheet to changes in

the market; our dependence on protecting our intellectual property

and the possibility that third parties may claim that our products

or processes infringe their intellectual property rights; the

impact of inflation and our ability to mitigate the effect on our

costs; the impact of macroeconomic and geopolitical events on our

business, results of operations, financial condition and cash

flows, and the disruptions and inefficiencies in our supply chain

that may occur as a result of such events; the possibility that the

imposition of new or increase of existing custom duties and other

tariffs in the countries in which we, our customers and our

suppliers operate could adversely affect our operations; the

possibility that our indebtedness could limit our financial and

operating activities or that our cash flows may not be sufficient

to service our indebtedness; past increases in benchmark interest

rates and the fact that any future borrowings may subject us to

interest rate risk; risks and uncertainties associated with our

ability to access the capital and credit markets could adversely

affect our results of operations, cash flows and financial

condition; the possibility that disruptions in the capital and

credit markets could adversely affect our customers and suppliers;

the possibility that restrictive covenants in our financing

agreements could restrict or limit our operations; changes in, or

more stringent enforcement of, health, safety and environmental

regulations applicable to our manufacturing operations and

facilities; and our ability to continue to meet the New York Stock

Exchange listing standards.

These factors should not be construed as exhaustive and should

be read in conjunction with the Risk Factors and other cautionary

statements that are included in our most recent Annual Report on

Form 10-K and other filings with the SEC. The forward-looking

statements made in this press release relate only to events as of

the date on which the statements are made. Except as required by

law, we do not undertake any obligation to publicly update or

review any forward-looking statement, whether as a result of new

information, future developments or otherwise.

If one or more of these or other risks or uncertainties

materialize, or if our underlying assumptions prove to be

incorrect, our actual results may vary materially from what we may

have expressed or implied by these forward-looking statements. We

caution that you should not place undue reliance on any of our

forward-looking statements. You should specifically consider the

factors identified in this press release that could cause actual

results to differ before making an investment decision to purchase

our common stock. Furthermore, new risks and uncertainties arise

from time to time, and it is impossible for us to predict those

events or how they may affect us.

Non‑GAAP Financial Measures

In addition to providing results that are determined in

accordance with GAAP, we have provided certain financial measures

that are not in accordance with GAAP. EBITDA, adjusted EBITDA,

adjusted net loss, adjusted loss per share, free cash flow,

adjusted free cash flow, net debt and cash cost of goods sold per

MT are non-GAAP financial measures.

We define EBITDA, a non‑GAAP financial measure, as net loss plus

interest expense, minus interest income, plus income taxes and

depreciation and amortization. We define adjusted EBITDA, a

non-GAAP financial measure, as EBITDA adjusted by any pension and

other post-employment benefit ("OPEB") expenses, rationalization

and rationalization-related expenses, non‑cash gains or losses from

foreign currency remeasurement of non‑operating assets and

liabilities in our foreign subsidiaries where the functional

currency is the U.S. dollar, stock-based compensation expense,

proxy contest expenses, Tax Receivable Agreement adjustments and

goodwill impairment charges. Adjusted EBITDA is the primary metric

used by our management and our Board of Directors to establish

budgets and operational goals for managing our business and

evaluating our performance.

We monitor adjusted EBITDA as a supplement to our GAAP measures,

and believe it is useful to present to investors, because we

believe that it facilitates evaluation of our period‑to‑period

operating performance by eliminating items that are not operational

in nature, allowing comparison of our recurring core business

operating results over multiple periods unaffected by differences

in capital structure, capital investment cycles and fixed asset

base. In addition, we believe adjusted EBITDA and similar measures

are widely used by investors, securities analysts, ratings

agencies, and other parties in evaluating companies in our industry

as a measure of financial performance and debt‑service

capabilities.

Our use of adjusted EBITDA has limitations as an analytical

tool, and you should not consider it in isolation or as a

substitute for analysis of our results as reported under GAAP. Some

of these limitations are:

- adjusted EBITDA does not reflect changes in, or cash

requirements for, our working capital needs;

- adjusted EBITDA does not reflect our cash expenditures for

capital equipment or other contractual commitments, including any

capital expenditure requirements to augment or replace our capital

assets;

- adjusted EBITDA does not reflect the interest expense or the

cash requirements necessary to service interest or principal

payments on our indebtedness;

- adjusted EBITDA does not reflect tax payments or the income tax

benefit that may represent a reduction in cash available to

us;

- adjusted EBITDA does not reflect expenses relating to our

pension and OPEB plans;

- adjusted EBITDA does not reflect rationalization or

rationalization-related expenses;

- adjusted EBITDA does not reflect the non‑cash gains or losses

from foreign currency remeasurement of non‑operating assets and

liabilities in our foreign subsidiaries where the functional

currency is the U.S. dollar;

- adjusted EBITDA does not reflect stock-based compensation

expense;

- adjusted EBITDA does not reflect proxy contest expenses;

- adjusted EBITDA does not reflect Tax Receivable Agreement

adjustments;

- adjusted EBITDA does not reflect goodwill impairment charges;

and

- other companies, including companies in our industry, may

calculate EBITDA and adjusted EBITDA differently, which reduces its

usefulness as a comparative measure.

We define adjusted net loss, a non‑GAAP financial measure, as

net loss, excluding the items used to calculate adjusted EBITDA and

further excluding debt modification costs, less the tax effect of

those adjustments. We define adjusted loss per share, a non‑GAAP

financial measure, as adjusted net loss divided by the weighted

average diluted common shares outstanding during the period. We

believe adjusted net loss and adjusted loss per share are useful to

present to investors because we believe that they assist investors’

understanding of the underlying operational profitability of the

Company.

We define free cash flow, a non-GAAP financial measure, as net

cash provided by or used in operating activities less capital

expenditures. We define adjusted free cash flow, a non-GAAP

financial measure, as free cash flow adjusted by payments made or

received from the settlement of interest rate swap contracts and

payments made for debt modification costs. We use free cash flow

and adjusted free cash flow as critical measures in the evaluation

of liquidity in conjunction with related GAAP amounts. We also use

these measures when considering available cash, including for

decision-making purposes related to dividends, debt servicing and

discretionary investments. Further, these measures help management,

the Board of Directors, and investors evaluate the Company's

ability to generate liquidity from operating activities.

We define net debt, a non-GAAP financial measure, as gross debt

minus cash and cash equivalents. We believe this is an important

measure as it is more representative of our financial position.

We define cash cost of goods sold per MT, a non-GAAP financial

measure, as cost of goods sold less depreciation and amortization,

less cost of goods sold associated with the portion of our sales

that consists of deliveries of by-products of the manufacturing

processes and less rationalization-related expenses, with this

total divided by our sales volume measured in MT. We believe this

is an important measure as it is used by our management and Board

of Directors to evaluate our costs on a per MT basis.

In evaluating these non-GAAP financial measures, you should be

aware that in the future, we may incur expenses similar to the

adjustments in the reconciliations presented below. Our

presentations of these non-GAAP financial measures should not be

construed as suggesting that our future results will be unaffected

by these expenses or any unusual or non‑recurring items. When

evaluating our performance, you should consider these non-GAAP

financial measures alongside other measures of financial

performance and liquidity, including our net loss, loss per share,

cash flow from operating activities, cost of goods sold and other

GAAP measures.

GRAFTECH INTERNATIONAL LTD.

AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (Dollars in

thousands, except per share data) (Unaudited)

December 31,

2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

256,248

$

176,878

Accounts and notes receivable, net of

allowance for doubtful accounts of $7,114 as of December 31, 2024

and $7,708 as of December 31, 2023

93,576

101,387

Inventories

231,241

330,146

Prepaid expenses and other current

assets

55,732

66,382

Total current assets

636,797

674,793

Property, plant and equipment

910,247

920,444

Less: accumulated depreciation

427,548

398,330

Net property, plant and equipment

482,699

522,114

Deferred income taxes

53,139

31,542

Other assets

51,639

60,440

Total assets

$

1,224,274

$

1,288,889

LIABILITIES AND STOCKHOLDERS’

(DEFICIT) EQUITY

Current liabilities:

Accounts payable

$

72,833

$

83,268

Long-term debt, current maturities

—

134

Accrued income and other taxes

9,642

10,022

Other accrued liabilities

55,432

91,702

Tax Receivable Agreement

2,022

5,417

Total current liabilities

139,929

190,543

Long-term debt

1,086,915

925,511

Other long-term obligations

48,559

55,645

Deferred income taxes

23,971

33,206

Tax Receivable Agreement long-term

3,802

5,737

Stockholders’ (deficit) equity:

Preferred stock, par value $0.01,

300,000,000 shares authorized, none issued

—

—

Common stock, par value $0.01,

3,000,000,000 shares authorized, 257,263,710 and 256,831,870 shares

issued and outstanding as of December 31, 2024 and December 31,

2023, respectively

2,572

2,568

Additional paid-in capital

755,338

749,527

Accumulated other comprehensive loss

(43,359

)

(11,458

)

Accumulated deficit

(793,453

)

(662,390

)

Total stockholders’ (deficit) equity

(78,902

)

78,247

Total liabilities and stockholders’

(deficit) equity

$

1,224,274

$

1,288,889

GRAFTECH INTERNATIONAL LTD.

AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (Dollars

in thousands, except per share data) (Unaudited)

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

Net sales

$

134,217

$

137,145

$

538,782

$

620,500

Cost of goods sold

131,698

144,393

533,757

571,857

Lower of cost or market inventory

valuation adjustment

12,962

12,431

24,878

12,431

Gross (loss) profit

(10,443

)

(19,679

)

(19,853

)

36,212

Research and development

1,387

1,837

5,706

5,520

Selling and administrative expenses

13,075

15,079

46,510

74,012

Rationalization expenses

—

—

3,156

—

Goodwill impairment charges

—

171,117

—

171,117

Operating loss

(24,905

)

(207,712

)

(75,225

)

(214,437

)

Other expense (income), net

200

3,418

(1,569

)

4,679

Interest expense

37,575

15,655

85,313

58,087

Interest income

(1,226

)

(1,681

)

(5,701

)

(3,439

)

Loss before income taxes

(61,454

)

(225,104

)

(153,268

)

(273,764

)

Income tax benefit

(11,978

)

(7,695

)

(22,103

)

(18,514

)

Net loss

$

(49,476

)

$

(217,409

)

$

(131,165

)

$

(255,250

)

Basic loss per common share:

Net loss per share

$

(0.19

)

$

(0.85

)

$

(0.51

)

$

(0.99

)

Weighted average common shares

outstanding

257,967,374

257,205,583

257,667,125

257,042,843

Diluted loss per common share:

Net loss per share

$

(0.19

)

$

(0.85

)

$

(0.51

)

$

(0.99

)

Weighted average common shares

outstanding

257,967,374

257,205,583

257,667,125

257,042,843

GRAFTECH INTERNATIONAL LTD.

AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (Dollars

in thousands) (Unaudited)

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

Cash flow from operating activities:

Net loss

$

(49,476

)

$

(217,409

)

$

(131,165

)

$

(255,250

)

Adjustments to reconcile net loss to cash

(used in) provided by operations:

Depreciation and amortization

16,110

13,836

62,245

56,889

Deferred income tax benefit

(15,891

)

(17,826

)

(27,634

)

(28,123

)

Non-cash stock-based compensation

expense

1,589

624

6,035

4,433

Non-cash interest expense

1,550

(1,463

)

(2,028

)

8,786

Goodwill impairment charges

—

171,117

—

171,117

Lower of cost or market inventory

valuation adjustment

12,962

12,431

24,878

12,431

Other adjustments

1,302

8,355

6,283

5,077

Net change in working capital*

10,543

42,729

40,254

107,562

Change in Tax Receivable Agreement

87

233

(5,330

)

(4,398

)

Change in long-term assets and

liabilities

(5,193

)

(3,335

)

(13,631

)

(1,963

)

Net cash (used in) provided by operating

activities

(26,417

)

9,292

(40,093

)

76,561

Cash flow from investing activities:

Capital expenditures

(12,792

)

(5,753

)

(34,309

)

(54,040

)

Proceeds from the sale of fixed assets

—

—

100

220

Net cash used in investing activities

(12,792

)

(5,753

)

(34,209

)

(53,820

)

Cash flow from financing activities:

Proceeds from term loan

175,000

—

175,000

—

Proceeds from issuance of long-term debt,

net of original issuance discount

—

—

—

438,552

Principal payments on long-term debt

(137

)

(133

)

(137

)

(433,841

)

Debt issuance costs

(18,945

)

(19

)

(18,945

)

(8,152

)

Interest rate swap settlements

—

—

—

27,453

Payments for taxes related to net share

settlement of equity awards

(36

)

—

(118

)

(129

)

Dividends paid

—

—

—

(5,134

)

Principal payments under finance lease

obligations

(24

)

(16

)

(82

)

(36

)

Net cash provided by (used in) financing

activities

155,858

(168

)

155,718

18,713

Net change in cash and cash

equivalents

116,649

3,371

81,416

41,454

Effect of exchange rate changes on cash

and cash equivalents

(1,807

)

700

(2,046

)

783

Cash and cash equivalents at beginning of

period

141,406

172,807

176,878

134,641

Cash and cash equivalents at end of

period

$

256,248

$

176,878

$

256,248

$

176,878

* Net change in working capital due to

changes in the following components:

Accounts and notes receivable, net

$

(6,682

)

$

(2,327

)

$

4,519

$

45,680

Inventories

18,727

38,538

68,832

107,796

Prepaid expenses and other current

assets

6,296

(1,622

)

9,106

3,352

Income taxes payable

1,067

4,158

(1,549

)

(27,198

)

Accounts payable and accruals

9,165

19,515

(39,501

)

(23,876

)

Interest payable

(18,030

)

(15,533

)

(1,153

)

1,808

Net change in working capital

$

10,543

$

42,729

$

40,254

$

107,562

NON-GAAP RECONCILIATIONS

(Dollars in thousands, except per share and per MT data)

(Unaudited) The following tables reconcile our non-GAAP financial

measures to the most directly comparable GAAP measures:

Reconciliation of Net Loss to Adjusted

Net Loss

Year Ended

December 31,

Q4 2024

Q3 2024

Q4 2023

2024

2023

Net loss

$

(49,476

)

$

(36,068

)

$

(217,409

)

$

(131,165

)

$

(255,250

)

Diluted loss per common share:

Net loss per share

$

(0.19

)

$

(0.14

)

$

(0.85

)

$

(0.51

)

$

(0.99

)

Weighted average shares outstanding

257,967,374

257,694,799

257,205,583

257,667,125

257,042,843

Adjustments, pre-tax:

Pension and OPEB expenses(1)

967

479

3,578

2,270

6,309

Rationalization expenses(2)

—

(99

)

—

3,156

—

Rationalization-related expenses(3)

—

—

—

2,655

—

Non-cash (gains) losses on foreign

currency remeasurement(4)

(507

)

(352

)

170

(1,949

)

603

Stock-based compensation expense(5)

1,589

1,838

624

6,035

4,433

Proxy contest expenses(6)

—

—

—

752

—

Tax Receivable Agreement adjustment(7)

87

—

233

124

249

Debt modification costs(8)

18,369

—

—

18,369

—

Goodwill impairment charges(9)

—

—

171,117

—

171,117

Total non-GAAP adjustments pre-tax

20,505

1,866

175,722

31,412

182,711

Income tax impact on non-GAAP

adjustments(10)

4,172

74

26,882

6,391

28,213

Adjusted net loss

$

(33,143

)

$

(34,276

)

$

(68,569

)

$

(106,144

)

$

(100,752

)

Reconciliation of Loss Per Share to

Adjusted Loss Per Share

Year Ended

December 31,

Q4 2024

Q3 2024

Q4 2023

2024

2023

Loss per share

$

(0.19

)

$

(0.14

)

$

(0.85

)

$

(0.51

)

$

(0.99

)

Adjustments per share:

Pension and OPEB expenses(1)

—

—

0.01

0.01

0.02

Rationalization expenses(2)

—

—

—

0.01

—

Rationalization-related expenses(3)

—

—

—

0.01

—

Non-cash (gains) losses on foreign

currency remeasurement(4)

—

—

—

—

—

Stock-based compensation expense(5)

0.01

0.01

—

0.02

0.02

Proxy contest expenses(6)

—

—

—

—

—

Tax Receivable Agreement adjustment(7)

—

—

—

—

—

Debt modification costs(8)

0.07

—

—

0.07

—

Goodwill impairment charges(9)

—

—

0.67

—

0.67

Total non-GAAP adjustments pre-tax per

share

0.08

0.01

0.68

0.12

0.71

Income tax impact on non-GAAP adjustments

per share(10)

0.02

—

0.10

0.02

0.11

Adjusted loss per share

$

(0.13

)

$

(0.13

)

$

(0.27

)

$

(0.41

)

$

(0.39

)

Reconciliation of Net Loss to Adjusted

EBITDA

Year Ended

December 31,

Q4 2024

Q3 2024

Q4 2023

2024

2023

Net loss

$

(49,476

)

$

(36,068

)

$

(217,409

)

$

(131,165

)

$

(255,250

)

Add:

Depreciation and amortization

16,110

17,933

13,836

62,245

56,889

Interest expense

37,575

16,503

15,655

85,313

58,087

Interest income

(1,226

)

(1,098

)

(1,681

)

(5,701

)

(3,439

)

Income taxes

(11,978

)

(5,332

)

(7,695

)

(22,103

)

(18,514

)

EBITDA

(8,995

)

(8,062

)

(197,294

)

(11,411

)

(162,227

)

Adjustments:

Pension and OPEB expenses(1)

967

479

3,578

2,270

6,309

Rationalization expenses(2)

—

(99

)

—

3,156

—

Rationalization-related expenses(3)

—

—

—

2,655

—

Non-cash (gains) losses on foreign

currency remeasurement(4)

(507

)

(352

)

170

(1,949

)

603

Stock-based compensation expense(5)

1,589

1,838

624

6,035

4,433

Proxy contest expenses(6)

—

—

—

752

—

Tax Receivable Agreement adjustment(7)

87

—

233

124

249

Goodwill impairment charges(9)

—

—

171,117

—

171,117

Adjusted EBITDA

$

(6,859

)

$

(6,196

)

$

(21,572

)

$

1,632

$

20,484

Reconciliation of

Net Cash (Used in) Provided by Operating Activities to Free Cash

Flow and Adjusted Free Cash Flow

Year Ended

December 31,

Q4 2024

Q3 2024

Q4 2023

2024

2023

Net cash (used in) provided by

operating activities

$

(26,417

)

$

23,709

$

9,292

$

(40,093

)

$

76,561

Capital expenditures

(12,792

)

(4,027

)

(5,753

)

(34,309

)

(54,040

)

Free cash flow

(39,209

)

19,682

3,539

(74,402

)

22,521

Debt modification costs(11)

18,249

—

—

18,249

—

Interest rate swap settlements(12)

—

—

—

—

27,453

Adjusted free cash flow

$

(20,960

)

$

19,682

$

3,539

$

(56,153

)

$

49,974

Reconciliation of

Cost of Goods Sold to Cash Cost of Goods Sold per MT

Year Ended

December 31,

Q4 2024

Q3 2024

Q4 2023

2024

2023

Cost of goods sold

$

131,698

$

134,885

$

144,393

$

533,757

$

571,857

Less:

Depreciation and amortization(13)

14,466

16,281

12,163

55,602

50,124

Cost of goods sold - by-products and

other(14)

6,094

7,806

780

32,801

14,500

Rationalization-related expenses(3)

—

—

—

2,655

—

Cash cost of goods sold

111,138

110,798

131,450

442,699

507,233

Sales volume (in thousands of MT)

27.2

26.4

24.1

103.2

91.6

Cash cost of goods sold per MT

$

4,086

$

4,197

$

5,454

$

4,290

$

5,537

(1)

Net periodic benefit cost for our pension

and OPEB plans, including a mark-to-market adjustment, representing

actuarial gains and losses that result from the remeasurement of

plan assets and obligations due to changes in assumptions or

experience. We recognize the actuarial gains and losses in

connection with the annual remeasurement in earnings in the fourth

quarter of each year.

(2)

Severance and contract termination costs

associated with the cost rationalization and footprint optimization

plan announced in February 2024.

(3)

Other non-cash costs, primarily inventory

and fixed asset write-offs, associated with the cost

rationalization and footprint optimization plan announced in

February 2024.

(4)

Non-cash (gains) losses from foreign

currency remeasurement of non-operating assets and liabilities of

our non-U.S. subsidiaries where the functional currency is the U.S.

dollar.

(5)

Non-cash expense for stock-based

compensation awards.

(6)

Expenses associated with our proxy

contest.

(7)

Non-cash expense adjustment for future

payment to our sole pre-initial public offering stockholder for tax

assets that have been utilized.

(8)

Debt modification costs related to the

December 2024 debt transactions, which are recognized in interest

expense on the Consolidated Statements of Operations.

(9)

Non-cash goodwill impairment

charges.

(10)

The tax impact on the non-GAAP adjustments

is affected by their tax deductibility and the applicable

jurisdictional tax rates.

(11)

Cash payments of debt modification costs

related to the December 2024 debt transactions, which are

recognized in interest expense on the Consolidated Statements of

Operations and recognized in net cash (used in) provided by

operating activities on the Consolidated Statements of Cash

Flows.

(12)

Receipt of cash related to the monthly

settlement of our interest rate swap contracts prior to their

termination in the second quarter of 2023, as well as receipt of

cash related to the termination of the interest rate swap

contracts.

(13)

Reflects the portion of depreciation and

amortization that is recognized in cost of goods sold.

(14)

Primarily reflects cost of goods sold

associated with the portion of our sales that consists of

deliveries of by-products of the manufacturing processes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206173148/en/

Michael Dillon 216-676-2000 investor.relations@graftech.com

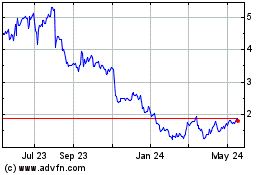

GrafTech (NYSE:EAF)

Historical Stock Chart

From Feb 2025 to Mar 2025

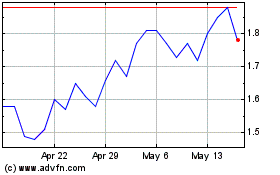

GrafTech (NYSE:EAF)

Historical Stock Chart

From Mar 2024 to Mar 2025