Virtus Stone Harbor Emerging Markets Income Fund Announces Distributions

March 01 2023 - 3:15PM

Business Wire

Virtus Stone Harbor Emerging Markets Income Fund (NYSE: EDF),

today announced the following monthly distributions:

Amount of Distribution

Ex-Date

Record Date

Payable Date

$0.06

March 10, 2023

March 13, 2023

March 23, 2023

$0.06

April 12, 2023

April 13, 2023

April 25, 2023

$0.06

May 10, 2023

May 11, 2023

May 23, 2023

The amounts of distributions reported in this notice are

estimates only and are not being provided for tax reporting

purposes. The actual amounts and sources of the distributions for

tax purposes will depend on the Fund’s investment experience during

the remainder of its fiscal year and may be subject to changes

based on tax regulations. The Fund or your broker will send you a

Form 1099-DIV for the calendar year that will tell you what

distributions to report for federal income tax purposes.

About the Fund

Virtus Stone Harbor Emerging Markets Income Fund is a

non-diversified, closed-end management investment company that is

managed by Stone Harbor Investment Partners. The Fund's primary

investment objective is to maximize total return, which consists of

income and capital appreciation on its investments in emerging

markets securities. There is no assurance that the Fund will

achieve its investment objective.

For more information on the Fund, contact shareholder services

at (866) 270-7788, by email at closedendfunds@virtus.com, or

through the Closed-End Funds section of virtus.com.

Fund Risks

An investment in a fund is subject to risk, including the risk

of possible loss of principal. A fund’s shares may be worth less

upon their sale than what an investor paid for them. Shares of

closed-end funds may trade at a premium or discount to their net

asset value. For more information about the Fund’s investment

objective and risks, please see the Fund’s annual report. A copy of

the Fund’s most recent annual report may be obtained free of charge

by contacting “Shareholder Services” as set forth at the end of

this press release.

About Stone Harbor

Stone Harbor Investment Partners is a global institutional

fixed-income investment manager specializing in credit and asset

allocation strategies. The firm manages institutional clients’

assets in a range of investment strategies including emerging

markets debt, global high yield, bank loans, as well as

multi-sector credit products including unconstrained and total

return approaches. The firm’s investment strategies are based on

fundamental insights, derived from a combination of proprietary

research and the in-depth knowledge and specialized experience of

the firm’s team. Founded in 2006, it is based in New York City with

additional offices in London and Singapore. Stone Harbor Investment

Partners is a division of Virtus Fixed Income Advisers, LLC, a

registered investment adviser affiliated with Virtus Investment

Partners. For more information, visit shipemd.com.

About Virtus Investment Partners, Inc.

Virtus Investment Partners (NASDAQ: VRTS) is a distinctive

partnership of boutique investment managers singularly committed to

the long-term success of individual and institutional investors.

The company provides investment management products and services

through its affiliated managers and select subadvisers, each with a

distinct investment style, autonomous investment process, and

individual brand. For more information, visit virtus.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230301006085/en/

For Further Information:

Shareholder Services (866) 270-7788 closedendfunds@virtus.com

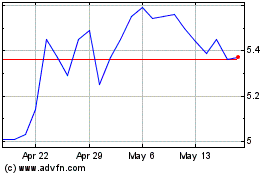

Virtus Stone Harbor Emer... (NYSE:EDF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Virtus Stone Harbor Emer... (NYSE:EDF)

Historical Stock Chart

From Nov 2023 to Nov 2024