Reorganization of Virtus Stone Harbor Closed-End Funds Completed

December 18 2023 - 7:30AM

Business Wire

The reorganization of Virtus Stone Harbor Emerging Markets Total

Income Fund (NYSE: EDI) with and into Virtus Stone Harbor Emerging

Markets Income Fund (NYSE: EDF) has been completed. EDI ceased

trading and dissolved as of the close of business on Friday,

December 15, 2023. The surviving fund continues to have the EDF

ticker symbol and CUSIP 86164T107.

Prior to the open of trading on the NYSE today, each share of

EDI common stock converted into an equivalent dollar amount (to the

nearest $0.0001) of shares of common stock of EDF. The conversion

price was based on each fund’s net asset value (NAV) per share

calculated at the close of business on Friday, December 15,

2023:

EDF

$4.4018

EDI

$5.0785

Based upon those prices, former EDI shareholders were credited

1.153733 shares of common stock of EDF for every share of EDI

common stock they held, though cash will be paid in lieu of partial

shares.

About the Fund

Virtus Stone Harbor Emerging Markets Income Fund is a

non-diversified, closed-end management investment company that is

managed by Stone Harbor Investment Partners. The Fund's primary

investment objective is to maximize total return, which consists of

income and capital appreciation on its investments in emerging

markets securities. There is no assurance that the Fund will

achieve its investment objective.

For more information on the Fund, contact shareholder services

at (866) 270-7788, by email at closedendfunds@virtus.com, or

through the Closed-End Funds section of virtus.com.

Fund Risks

An investment in a fund is subject to risk, including the risk

of possible loss of principal. A fund’s shares may be worth less

upon their sale than what an investor paid for them. Shares of

closed-end funds may trade at a premium or discount to their net

asset value. For more information about the Fund’s investment

objective and risks, please see the Fund’s annual report. A copy of

the Fund’s most recent annual report may be obtained free of charge

by contacting “Shareholder Services” as set forth at the end of

this press release.

About Stone Harbor

Stone Harbor Investment Partners is a global institutional

fixed-income investment manager specializing in credit and asset

allocation strategies. The firm manages institutional clients’

assets in a range of investment strategies including emerging

markets debt, global high yield, bank loans, as well as

multi-sector credit products including unconstrained and total

return approaches. The firm’s investment strategies are based on

fundamental insights, derived from a combination of proprietary

research and the in-depth knowledge and specialized experience of

the firm’s team. Founded in 2006, it is based in New York City with

additional offices in London and Singapore. Stone Harbor Investment

Partners is a division of Virtus Fixed Income Advisers, LLC, a

registered investment adviser affiliated with Virtus Investment

Partners. For more information, visit shipemd.com.

About Virtus Investment Partners, Inc.

Virtus Investment Partners (NASDAQ: VRTS) is a distinctive

partnership of boutique investment managers singularly committed to

the long-term success of individual and institutional investors.

The company provides investment management products and services

through its affiliated managers and select subadvisers, each with a

distinct investment style, autonomous investment process, and

individual brand. For more information, visit virtus.com.

Additional Information

The information in this press release is for informational

purposes only and shall not constitute an offer to sell, the

solicitation of an offer to sell, the solicitation of an offer to

buy any securities, or the solicitation of any vote or approval in

any jurisdiction pursuant to or in connection with the transaction

or otherwise, nor shall there be any sale, issuance or transfer of

securities in any jurisdiction in contravention of applicable law.

No offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231218964891/en/

For Further Information:

Shareholder Services (866) 270-7788 closedendfunds@virtus.com

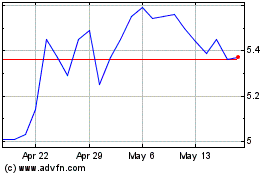

Virtus Stone Harbor Emer... (NYSE:EDF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Virtus Stone Harbor Emer... (NYSE:EDF)

Historical Stock Chart

From Jan 2024 to Jan 2025