Amended Tender Offer Statement by Third Party (sc To-t/a)

November 16 2021 - 3:21PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

AMENDMENT NO. 1 (RULE 14D-100)

Tender Offer Statement under Section 14(d)(1)

or 13(e)(1) of the Securities Exchange Act of 1934

EMPRESA

DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(Name of Subject Company (Issuer))

EMPRESA DE ENERGÍA DEL CONO SUR

S.A.

And

SOUTH AMERICAN ENERGY LLP

(Names of Filing Persons (Offerors))

CLASS B

COMMON SHARES, par value 1 Peso per share (ISIN: ARENOR010020), including Class B Shares represented by American Depositary

Shares

(Title of Class of Securities)

29244A102

(CUSIP Number of Class of Securities)

SCHEDULE 13E-3

RULE 13E-3 TRANSACTION STATEMENT UNDER SECTION 13(E) OF THE SECURITIES EXCHANGE ACT OF 1934

EMPRESA DE ENERGÍA

DEL CONO SUR S.A.

And

SOUTH AMERICAN ENERGY

LLP

(Names of Filing Persons (Offerors))

CLASS B

COMMON SHARES, par value 1 Peso per share (ISIN: ARENOR010020), including

Class B Shares represented by American Depositary Shares

(Title of Class of Securities)

29244A102

(CUSIP Number of Class of Securities)

Nicolas Mallo Huergo

c/o Maipú 1252, 12th floor,

City of Buenos Aires, (CP1006),

Argentina

With a copy to:

Christopher C. Paci, Esq.

J.A. Glaccum, Esq.

Nicolas Teijeiro, Esq.

DLA Piper LLP (US)

1251 6th Ave.

New York, NY 10020

(212) 225-2000

(Name, Address and

Telephone Number of Person Authorized to Receive Notices and Communications on behalf of the Filing Persons)

CALCULATION OF FILING FEE

|

Transaction

Valuation(1)

|

Amount of Filing Fee

|

|

U.S.$114,594,527

|

U.S.$10,622.82

|

|

|

☒

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2)

and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number,

or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Estimated for purposes of calculating the filing fee pursuant to Rule 0-11(d)

only. The Transaction Valuation was calculated assuming the purchase of all outstanding Class B Shares (including Class B shares underlying

the American Depositary Shares), other than Class B Shares and ADSs owned directly or indirectly by the Filing Person or its affiliates

(including shares held as treasury shares) at a purchase price of 29.34 Argentine pesos (“Ps.”) per Class B Share and converted

into U.S. dollars based on the official selling exchange rate of Ps. 105.25 per U.S.$1.00 as reported by Banco de la Nación Argentina

on November 10, 2021. As of November 10, 2021, there were 411,075,965 issued and outstanding Class B Shares (including Class B Shares

underlying the American Depositary Shares) but excluding shares owned by the Filing Person or its affiliates (including shares held as

treasury shares).

|

Amount Previously Paid: US$10,622.82 Filing

Party: Empresa de Energía del Cono Sur S.A. and South American Energy LLP

Form or Registration No.: Schedule TO-T Date Filed: November

12, 2021

☐ Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions

to which the statement relates:

☒ third

party tender offer subject to Rule 14d-1.

☐ issuer

tender offer subject to 13e-4.

☒ going-private

transaction subject to Rule 13e-3.

☐ amendment

to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting

the results of the tender offer:

If applicable, check the appropriate box(es) below to designate

the appropriate rule provision(s) relied upon:

☐ Rule

13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

☒

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

This Amendment No. 1 (this “Amendment”)

amends and supplements the Tender Offer Statement on a combined Schedule TO and Schedule 13E-3 under cover of Schedule TO originally filed

on November 12, 2021, (together with any subsequent amendments and supplements thereto, the “Schedule TO”) by Empresa

de Energía del Cono Sur S.A. (“Edelcos”) and South American Energy LLP (“SAE”, and together with Edelcos

the “Bidders”) and relates to the offer by the Bidders to purchase any and all outstanding Class B shares, par value Ps. 1.00

per share (the “Class B Shares”), including Class B Shares represented by American Depositary Shares (“ADSs”),

of Empresa Distribuidora y Comercializadora Norte S.A., a corporation organized under the laws of the Republic of Argentina (“Edenor”).

The offer is being made on the terms and subject

to the conditions set forth in the offer to purchase dated November 12, 2021 (the "U.S. Offer to Purchase") incorporated

herein by reference and in the related documents (which, together with any amendments or supplements thereto, collectively constitute

the "U.S. Offer"). The U.S. Offer is being made in conjunction with an offer by Edelcos in Argentina for all outstanding

Class B Shares (the "Argentine Offer," and together with the U.S. Offer, the "Offers"). The price offered

in the Argentine Offer is the same on a per Class B Share basis as the Offer Price in the U.S. Offer. This Schedule TO is intended solely

for (i) holders of Class B Shares that are U.S. residents (under the meaning of Rule 14d-1(d) under the U.S. Securities Exchange Act

of 1934, as amended) and (ii) holders of Class B Shares represented by American Depositary Shares (each representing rights to 20 Class

B Shares). The information set forth in the U.S. Offer to Purchase is incorporated herein by reference with respect to Items 1 through

11 of this Schedule TO. This Schedule TO is being filed on behalf of the Bidders.

Except as otherwise set forth in this

Amendment, the information set forth in the Schedule TO remains unchanged.

Exhibit (a)(1)(v) to Item 12 is hereby replaced with Exhibit

99(a)(1)(v).

None.

* Previously

filed with Schedule TO.

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: November 16, 2021

|

|

EMPRESA DE ENERGÍA DEL CONO SUR S.A.

|

|

|

|

|

|

/s/ Ricardo Nicolás Mallo Huergo

|

|

|

Name: Ricardo Nicolás Mallo Huergo

|

|

|

Title: Authorized Signatory

|

|

|

|

|

|

SOUTH AMERICAN ENERGY LLP

|

|

|

|

|

|

/s/ Ricardo Nicolás Mallo Huergo

|

|

|

Name: Ricardo Nicolás Mallo Huergo

|

|

|

Title: Authorized Signatory

|

|

|

|

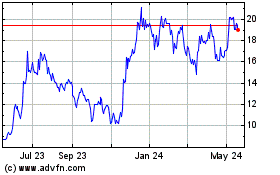

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

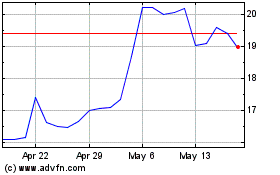

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jul 2023 to Jul 2024