0000915389false00009153892024-10-312024-10-310000915389us-gaap:CommonStockMember2024-10-312024-10-310000915389emn:A1.875notesdueNovember2026Member2024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

October 31, 2024

EASTMAN CHEMICAL COMPANY

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-12626 | | 62-1539359 |

(State or Other Jurisdiction

of Incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | |

| | | | | | | | |

| 200 South Wilcox Drive | |

| Kingsport | Tennessee | 37662 |

| (Address of Principal Executive Offices) | (Zip Code) |

(423) 229-2000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | | | | |

| | ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | |

| | ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | |

| | ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | |

| | ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | EMN | | New York Stock Exchange |

| 1.875% Notes Due 2026 | | EMN26 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | | | | |

| EASTMAN CHEMICAL COMPANY - EMN | | |

Item 2.02 Results of Operations and Financial Condition

On October 31, 2024, the registrant publicly released its financial results for third quarter 2024. The full text of the release is furnished as Exhibit 99.01 to this Current Report on Form 8-K, and is incorporated herein by reference. This information shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits:

(d) Exhibits

The following exhibits are furnished pursuant to Item 9.01:

99.01 Public release by Eastman on October 31, 2024 of third quarter 2024 financial results

104 Cover Page Interactive Data File

| | | | | | | | |

| EASTMAN CHEMICAL COMPANY - EMN | | |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | | Eastman Chemical Company |

| | By: | /s/ Michelle R. Stewart |

| | Michelle R. Stewart |

| | Vice President, Chief Accounting Officer and Corporate Controller |

| | | Date: October 31, 2024 |

Exhibit 99.01

Eastman Announces Third Quarter 2024 Financial Results

KINGSPORT, Tenn., October 31, 2024 – Eastman Chemical Company (NYSE:EMN) announced its third quarter 2024 financial results.

•Strong year-over-year sales volume/mix growth with improvement in all operating segments

•Adjusted EBIT margin increased 360 basis points compared to last year through volume/mix growth, operating leverage, and commercial excellence

•Continued to make good progress on Kingsport methanolysis operations and the build of our sales funnel for 2025

•Made investment decision to move forward with the Longview, Texas, methanolysis facility

•Returned $195 million of cash to shareholders, including $100 million of share repurchases

| | | | | | | | | | |

| (In millions, except per share amounts; unaudited) | 3Q2024 | 3Q2023 | | |

| Sales revenue | $2,464 | $2,267 | | |

| Earnings before interest and taxes ("EBIT") | 329 | 256 | | |

| Adjusted EBIT* | 366 | 256 | | |

| Earnings per diluted share | 1.53 | 1.49 | | |

| Adjusted earnings per diluted share* | 2.26 | 1.47 | | |

| Net cash provided by operating activities | 396 | 514 | | |

| | | | |

*For non-core and unusual items excluded from adjusted earnings and for adjusted provision for income taxes, segment adjusted EBIT margins, and net debt, reconciliations to reported company and segment earnings and total borrowings for all periods presented in this release, see Tables 3A, 3B, 4A, and 6.

“Our third-quarter results were driven by strong sales volume/mix growth, operating leverage, and continued commercial excellence,” said Mark Costa, Board Chair and CEO. “Underlying end-market trends remained largely unchanged from the second quarter, consistent with our expectations. In many of our specialty product lines, we continue to grow above underlying end markets, including automotive. During this prolonged period of muted demand, I am proud of the way the Eastman team has worked to find ways to deliver on our earnings and cash commitments this year. In the circular economy, I am excited to announce that we have made an investment decision and will be moving forward with the construction of a second methanolysis facility in Longview, Texas. We continue to make good progress on ramping up our Kingsport methanolysis facility, although we had more downtime than expected.”

Corporate Results 3Q 2024 versus 3Q 2023

Sales revenue increased 9 percent primarily due to 8 percent higher sales volume/mix.

Higher sales volume/mix across all segments was driven by the end of customer inventory destocking across most key end markets and innovation driving growth above underlying market trends.

EBIT increased primarily due to higher sales volume/mix, higher spreads in Chemical Intermediates, and improved asset utilization. This was partially offset by higher variable compensation and by operating costs for the Kingsport methanolysis facility.

Segment Results 3Q 2024 versus 3Q 2023

Advanced Materials – Sales revenue increased 5 percent due to 8 percent higher sales volume/mix partially offset by 3 percent lower selling prices.

Higher sales volume/mix was driven by the end of customer inventory destocking across key end markets as well as continued growth of premium interlayers products in the automotive end market. This growth was partially offset by lower selling prices.

EBIT increased primarily due to higher sales volume/mix and improved asset utilization that was partially offset by higher costs associated with the Kingsport methanolysis facility.

Additives & Functional Products – Sales revenue increased 11 percent due to 11 percent higher sales volume/mix.

Higher sales volume/mix was driven primarily by the end of customer inventory destocking across key end markets and heat transfer fluid project fulfillments.

EBIT increased primarily due to higher sales volume/mix.

Fibers – Sales revenue increased 4 percent due to 2 percent higher sales volume/mix and 2 percent higher selling prices.

Higher selling prices were driven by acetate tow price increases. Sales volume/mix increased primarily due to textiles.

EBIT was slightly up primarily due to improved price-cost.

Chemical Intermediates – Sales revenue increased 13 percent due to 7 percent higher sales volume/mix and 6 percent higher selling prices.

Higher sales volume/mix and higher selling prices were driven by the end of customer inventory destocking and improved market conditions compared to the prior year period.

EBIT increased primarily due to improved olefin and derivative spreads.

Cash Flow

In third quarter 2024, cash provided by operating activities was $396 million. The company returned $195 million to stockholders through share repurchases and dividends. See Table 5. Priorities for uses of available cash for 2024 include organic growth investments, payment of the quarterly dividend, and share repurchases.

2024 Outlook

Commenting on the outlook for full-year 2024, Costa said, “We are proud to have delivered another strong quarter in this period of prolonged macroeconomic weakness. As expected, sales volume improved from last year mostly due to the lack of customer inventory destocking. With destocking over, our demand has reconnected to our end markets, which remain stable. In the fourth quarter, we expect to see normal seasonal volume declines across most of our markets. We also expect to continue to leverage our innovation-driven growth model to drive growth above our markets. We expect to benefit from commercial excellence and the continued flow through of lower raw material and energy costs in our specialty businesses. While we have made significant progress achieving consistent production rates at the Kingsport methanolysis facility, it has taken us longer than expected to achieve those rates. Despite these challenges, the strong results we have delivered in our base business enable us to keep the midpoint of our full-year adjusted EPS

guidance unchanged. Taking these factors together, we expect 2024 EPS to be between $7.50 and $7.70 and for 2024 cash from operations to approach $1.3 billion, reflecting a targeted increase in working capital to support growth in 2025. I remain confident in our ability to deliver earnings growth and strong cash flow going forward.”

The full-year 2024 projected adjusted diluted EPS and Earnings Before Interest, Taxes, Depreciation, and Amortization (“EBITDA”) exclude any non-core, unusual, or nonrecurring items. Our financial results forecasts do not include non-core items (such as mark-to-market pension and other postretirement benefit gain or loss, and asset impairments and restructuring charges) or any unusual or non-recurring items because we are unable to predict with reasonable certainty the financial impact of such items. These items are uncertain and depend on various factors, and we are unable to reconcile projected adjusted diluted EPS and EBITDA excluding non-core and any unusual or non-recurring items to reported GAAP diluted EPS or net earnings without unreasonable efforts.

Forward-Looking Statements

The information in this release and other statements by the company may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act with respect to, among other items: projections and estimates of earnings, revenues, volumes, pricing, margins, cost reductions, expenses, taxes, liquidity, capital expenditures, cash flow, dividends, share repurchases or other financial items, statements of management’s plans, strategies and objectives for future operations, and statements regarding future economic, industry or market conditions or performance. Such projections and estimates are based upon certain preliminary information, internal estimates, and management assumptions, expectations, and plans. Forward-looking statements are subject to a number of risks and uncertainties, and actual performance or results could differ materially from that anticipated by any forward-looking statements. Forward-looking statements speak only as of the date they are made, and the company undertakes no obligation to update or revise any forward-looking statement. Other important assumptions and factors that could cause actual results to differ materially from those in the forward-looking statements are detailed in the company’s filings with the Securities and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at www.sec.gov and the company’s website at www.eastman.com.

Conference Call and Webcast Information

Eastman will host a conference call with industry analysts on Nov. 1, 2024, at 8:00 a.m. ET. To listen to the live webcast of the conference call and view the accompanying slides and prepared remarks, go to investors.eastman.com, Events & Presentations. The slides and prepared remarks to be discussed during the call and webcast will be available at investors.eastman.com at approximately 4:15 p.m. ET on Oct. 31, 2024. To listen via telephone, the dial-in number is +1 (833) 470-1428, passcode: 170609. A web replay, a replay in downloadable MP3 format, and the accompanying slides and prepared remarks will be available at investors.eastman.com, Events & Presentations. A telephone replay will be available continuously beginning at approximately 1:00 p.m. Eastern Time, Nov. 1, 2024, through 11:59 p.m. Eastern Time, Nov. 11, 2024, Toll Free at +1 (866) 813-9403, passcode 986486.

Founded in 1920, Eastman is a global specialty materials company that produces a broad range of products found in items people use every day. With the purpose of enhancing the quality of life in a material way, Eastman works with customers to deliver innovative products and solutions while maintaining a commitment to safety and sustainability. The company’s innovation-driven growth model takes advantage of world-class technology platforms, deep customer engagement, and differentiated application development to grow its leading positions in attractive end markets such as transportation, building and construction, and consumables. As a globally inclusive and diverse company, Eastman employs approximately 14,000 people around the world and serves customers in more than 100 countries. The company had 2023 revenue of approximately $9.2 billion and is headquartered in Kingsport, Tennessee, USA. For more information, visit www.eastman.com.

# # #

Contacts:

Media: Tracy Kilgore Addington

423-224-0498 / tracy@eastman.com

Investors: Greg Riddle

212-835-1620 / griddle@eastman.com

FINANCIAL INFORMATION

October 31, 2024

For Eastman Chemical Company Third Quarter 2024 Financial Results Release

Table 1 – Statements of Earnings | | | | | | | | | | | | | | | | | | | | | | | |

| Third Quarter | | First Nine Months |

| (Dollars in millions, except per share amounts; unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Sales | $ | 2,464 | | | $ | 2,267 | | | $ | 7,137 | | | $ | 7,003 | |

Cost of sales (1)(2)(3) | 1,859 | | | 1,783 | | | 5,401 | | | 5,406 | |

| Gross profit | 605 | | | 484 | | | 1,736 | | | 1,597 | |

| Selling, general and administrative expenses | 183 | | | 160 | | | 554 | | | 536 | |

| Research and development expenses | 65 | | | 60 | | | 184 | | | 182 | |

| Asset impairments, restructuring, and other charges, net | 30 | | | — | | | 41 | | | 22 | |

| Other components of post-employment (benefit) cost, net | (5) | | | (2) | | | (14) | | | (8) | |

| Other (income) charges, net | 3 | | | 10 | | | 42 | | | 40 | |

| | | | | | | |

| Earnings before interest and taxes | 329 | | | 256 | | | 929 | | | 825 | |

| Net interest expense | 49 | | | 57 | | | 148 | | | 163 | |

| | | | | | | |

| Earnings before income taxes | 280 | | | 199 | | | 781 | | | 662 | |

Provision for income taxes | 99 | | | 20 | | | 204 | | | 77 | |

| Net earnings | 181 | | | 179 | | | 577 | | | 585 | |

| Less: Net earnings attributable to noncontrolling interest | 1 | | | 1 | | | 2 | | | 1 | |

| Net earnings attributable to Eastman | $ | 180 | | | $ | 178 | | | $ | 575 | | | $ | 584 | |

| | | | | | | |

| Basic earnings per share attributable to Eastman | $ | 1.55 | | | $ | 1.50 | | | $ | 4.91 | | | $ | 4.92 | |

| Diluted earnings per share attributable to Eastman | $ | 1.53 | | | $ | 1.49 | | | $ | 4.86 | | | $ | 4.89 | |

| | | | | | | |

| Shares (in millions) outstanding at end of period | 115.9 | | | 118.6 | | | 115.9 | | | 118.6 | |

| Shares (in millions) used for earnings per share calculation | | | | | | | |

| Basic | 116.4 | | | 118.5 | | | 117.0 | | | 118.7 | |

| Diluted | 117.8 | | | 119.0 | | | 118.3 | | | 119.5 | |

(1)Third quarter and first nine months 2024 includes inventory adjustment charges of $7 million related to the planned closure of a solvent-based resins production line at an advanced interlayers facility in North America.

(2)First nine months 2023 includes $8 million insurance proceeds, net of costs, from the previously reported operational incident at the Kingsport site as a result of a steam line failure (the "steam line incident").

(3)First nine months 2023 includes $23 million accelerated depreciation related to the closure of an acetate yarn manufacturing facility in Europe.

Table 2A – Segment Sales Information | | | | | | | | | | | | | | | | | | | | | | | |

| | Third Quarter | | First Nine Months |

| (Dollars in millions, unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Sales by Segment | | | | | | | |

| Advanced Materials | $ | 787 | | | $ | 746 | | | $ | 2,330 | | | $ | 2,227 | |

Additives & Functional Products | 744 | | | 670 | | | 2,166 | | | 2,194 | |

Chemical Intermediates | 593 | | | 527 | | | 1,631 | | | 1,630 | |

| Fibers | 336 | | | 323 | | | 997 | | | 949 | |

| Total Sales by Segment | 2,460 | | | 2,266 | | | 7,124 | | | 7,000 | |

Other | 4 | | | 1 | | | 13 | | | 3 | |

| Total Eastman Chemical Company | $ | 2,464 | | | $ | 2,267 | | | $ | 7,137 | | | $ | 7,003 | |

| | | | | |

| | Second Quarter |

| (Dollars in millions, unaudited) | 2024 |

| Sales by Segment | |

| Advanced Materials | $ | 795 | |

Additives & Functional Products | 718 | |

Chemical Intermediates | 515 | |

| Fibers | 330 | |

| Total Sales by Segment | 2,358 | |

Other | 5 | |

| Total Eastman Chemical Company | $ | 2,363 | |

Table 2B – Sales Revenue Change | | | | | | | | | | | | | | | |

| | Third Quarter 2024 Compared to Third Quarter 2023 |

| | Change in Sales Revenue Due To |

| (Unaudited) | Revenue

% Change | Volume / Product Mix Effect | Price Effect | Exchange

Rate

Effect | |

| Advanced Materials | 5 | % | 8 | % | (3) | % | — | % | |

| Additives & Functional Products | 11 | % | 11 | % | — | % | — | % | |

| Chemical Intermediates | 13 | % | 7 | % | 6 | % | — | % | |

| Fibers | 4 | % | 2 | % | 2 | % | — | % | |

Total Eastman Chemical Company | 9 | % | 8 | % | 1 | % | — | % | |

| | First Nine Months 2024 Compared to First Nine Months 2023 |

| | Change in Sales Revenue Due To |

| (Unaudited) | Revenue

% Change | Volume / Product Mix Effect | Price Effect | Exchange

Rate

Effect | |

| Advanced Materials | 5 | % | 9 | % | (4) | % | — | % | |

| Additives & Functional Products | (1) | % | 4 | % | (5) | % | — | % | |

| Chemical Intermediates | — | % | 5 | % | (5) | % | — | % | |

| Fibers | 5 | % | 3 | % | 3 | % | (1) | % | |

| Total Eastman Chemical Company | 2 | % | 6 | % | (4) | % | — | % | |

| | | | | | | | | | | | | | |

| | Third Quarter 2024 Compared to Second Quarter 2024 |

| | Change in Sales Revenue Due To |

| (Unaudited) | Revenue

% Change | Volume / Product Mix Effect | Price Effect | Exchange

Rate

Effect |

| Advanced Materials | (1) | % | (1) | % | — | % | — | % |

| Additives & Functional Products | 4 | % | 4 | % | — | % | — | % |

| Chemical Intermediates | 15 | % | 13 | % | 2 | % | — | % |

| Fibers | 2 | % | 2 | % | — | % | — | % |

| | | | |

| Total Eastman Chemical Company | 4 | % | 4 | % | — | % | — | % |

Table 2C – Sales by Customer Location | | | | | | | | | | | | | | | | | | | | | | | |

| | Third Quarter | | First Nine Months |

| (Dollars in millions, unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Sales by Customer Location | | | | | | | |

| United States and Canada | $ | 1,032 | | | $ | 966 | | | $ | 2,995 | | | $ | 3,031 | |

| Europe, Middle East, and Africa | 640 | | | 602 | | | 1,949 | | | 1,946 | |

| Asia Pacific | 653 | | | 576 | | | 1,807 | | | 1,654 | |

| Latin America | 139 | | | 123 | | | 386 | | | 372 | |

| Total Eastman Chemical Company | $ | 2,464 | | | $ | 2,267 | | | $ | 7,137 | | | $ | 7,003 | |

| | | | | | | |

Table 3A - Segment, Other, and Company

Non-GAAP Earnings (Loss) Before Interest and Taxes Reconciliations (1) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Third Quarter | | First Nine Months |

| (Dollars in millions, unaudited) | | 2024 | | 2023 | | 2024 | | 2023 |

| Advanced Materials | | | | | | | | |

| Earnings before interest and taxes | | $ | 100 | | | $ | 93 | | | $ | 335 | | | $ | 278 | |

Asset impairments, restructuring, and other charges, net (2) | | 18 | | | — | | | 18 | | | — | |

Cost of sales impact of restructuring activities (2) | | 4 | | | — | | | 4 | | | — | |

| | | | | | | | |

| Excluding non-core item | | 122 | | | 93 | | | 357 | | | 278 | |

| Additives & Functional Products | | | | | | | | |

| Earnings before interest and taxes | | 127 | | | 105 | | | 359 | | | 369 | |

| | | | | | | | |

Cost of sales impact of restructuring activities (2) | | 3 | | | — | | | 3 | | | — | |

| | | | | | | | |

| Excluding non-core item | | 130 | | | 105 | | | 362 | | | 369 | |

| Chemical Intermediates | | | | | | | | |

| Earnings before interest and taxes | | 43 | | | 6 | | | 81 | | | 87 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Fibers | | | | | | | | |

| Earnings before interest and taxes | | 112 | | | 109 | | | 351 | | | 280 | |

| Asset impairments, restructuring, and other charges, net | | — | | | — | | | — | | | 6 | |

Cost of sales impact of restructuring activities (3) | | — | | | — | | | — | | | 23 | |

| Excluding non-core items | | 112 | | | 109 | | | 351 | | | 309 | |

| Other | | | | | | | | |

| Loss before interest and taxes | | (53) | | | (57) | | | (197) | | | (189) | |

| | | | | | | | |

Asset impairments, restructuring, and other charges net (4) | | 12 | | | — | | | 23 | | | 16 | |

Steam line incident (insurance proceeds) costs, net | | — | | | — | | | — | | | (8) | |

| | | | | | | | |

| | | | | | | | |

Environmental and other costs (5) | | — | | | — | | | 16 | | | 13 | |

| | | | | | | | |

| Excluding non-core and unusual items | | (41) | | | (57) | | | (158) | | | (168) | |

| | | | | | | | |

| Total Eastman Chemical Company | | | | | | | | |

| Earnings before interest and taxes | | 329 | | | 256 | | | 929 | | | 825 | |

| | | | | | | | |

Asset impairments, restructuring, and other charges, net | | 30 | | | — | | | 41 | | | 22 | |

Cost of sales impact of restructuring activities | | 7 | | | — | | | 7 | | | 23 | |

Steam line incident (insurance proceeds) costs, net | | — | | | — | | | — | | | (8) | |

| | | | | | | | |

| Environmental and other costs | | — | | | — | | | 16 | | | 13 | |

| | | | | | | | |

| Total earnings before interest and taxes excluding non-core and unusual items | | $ | 366 | | | $ | 256 | | | $ | 993 | | | $ | 875 | |

(1)See "Management's Discussion and Analysis of Financial Condition and Results of Operations" of the Quarterly Report on Form 10-Q for third quarter 2023 for description of third quarter and first nine months 2023 non-core and unusual items. (2)Third quarter and first nine months 2024 includes asset impairment charges of $5 million, severance charges of $4 million, and site closure costs of $9 million related to the planned closure of a solvent-based resins production line at an advanced interlayers facility in North America. In addition, third quarter and first nine months 2024 includes inventory adjustment charges of $4 million and $3 million in the Advanced Materials ("AM") segment and the Additives and Functional Products ("AFP") segment, respectively, related to this planned closure.

(3)First nine months 2023 includes $23 million accelerated depreciation related to the closure of an acetate yarn manufacturing facility in Europe.

(4)Third quarter and first nine months 2024 includes charges of $6 million related to growth and profitability improvement initiatives. Additionally, third quarter and first nine months 2024 includes severance charges of $6 million and $17 million, respectively, as part of corporate cost reduction initiatives.

(5)Environmental and other costs from previously divested or non-operational sites and product lines.

Table 3A - Segment, Other, and Company

Non-GAAP Earnings (Loss) Before Interest and Taxes Reconciliations (continued) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Third Quarter | | First Nine Months |

| (Dollars in millions, unaudited) | | 2024 | | 2023 | | 2024 | | 2023 |

| Company Non-GAAP Earnings Before Interest and Taxes Reconciliations by Line Items | | | | | | | | |

| Earnings before interest and taxes | | $ | 329 | | | $ | 256 | | | $ | 929 | | | $ | 825 | |

Cost of sales | | 7 | | | — | | | 7 | | | 15 | |

| | | | | | | | |

| | | | | | | | |

Asset impairments, restructuring, and other charges, net | | 30 | | | — | | | 41 | | | 22 | |

| | | | | | | | |

| Other (income) charges, net | | — | | | — | | | 16 | | | 13 | |

| | | | | | | | |

| Total earnings before interest and taxes excluding non-core and unusual items | | $ | 366 | | | $ | 256 | | | $ | 993 | | | $ | 875 | |

Table 3A - Segment, Other, and Company

Non-GAAP Earnings (Loss) Before Interest and Taxes Reconciliations (continued) (1)

| | | | | | | | |

| | Second Quarter |

| (Dollars in millions, unaudited) | | 2024 |

| Advanced Materials | | |

| Earnings before interest and taxes | | $ | 131 | |

| | |

| | |

| | |

| | |

| Additives & Functional Products | | |

| Earnings before interest and taxes | | 123 | |

| | |

| | |

| | |

| Chemical Intermediates | | |

| Earnings before interest and taxes | | 22 | |

| | |

| | |

| | |

| Fibers | | |

| Earnings before interest and taxes | | 122 | |

| | |

| | |

| | |

| Other | | |

| Loss before interest and taxes | | (61) | |

| | |

| Environmental and other costs | | 16 | |

| | |

| | |

| | |

| | |

| | |

| Excluding non-core and unusual items | | (45) | |

| | |

| Total Eastman Chemical Company | | |

| Earnings before interest and taxes | | 337 | |

| | |

| | |

| | |

| | |

| | |

| Environmental and other costs | | 16 | |

| | |

| Total earnings before interest and taxes excluding non-core and unusual items | | $ | 353 | |

| | | | | | | | |

| Company Non-GAAP Earnings Before Interest and Taxes Reconciliations by Line Items | | |

| Earnings before interest and taxes | | 337 | |

| | |

| | |

| | |

| | |

| | |

| Other (income) charges, net | | 16 | |

| | |

| Total earnings before interest and taxes excluding non-core and unusual items | | $ | 353 | |

(1)See "Management's Discussion and Analysis of Financial Condition and Results of Operations" of the Quarterly Report on Form 10-Q for second quarter 2024 for description of second quarter 2024 non-core and unusual items.

Table 3B - Segment Non-GAAP Earnings (Loss) Before Interest and Taxes Margins(1)(2)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Third Quarter | | First Nine Months |

| (Dollars in millions, unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Adjusted EBIT | Adjusted EBIT Margin | | Adjusted EBIT | Adjusted EBIT Margin | | Adjusted EBIT | Adjusted EBIT Margin | | Adjusted EBIT | Adjusted EBIT Margin |

| Advanced Materials | $ | 122 | | 15.5 | % | | $ | 93 | | 12.5 | % | | $ | 357 | | 15.3 | % | | $ | 278 | | 12.5 | % |

Additives & Functional Products | 130 | | 17.5 | % | | 105 | | 15.7 | % | | 362 | | 16.7 | % | | 369 | | 16.8 | % |

Chemical Intermediates | 43 | | 7.3 | % | | 6 | | 1.1 | % | | 81 | | 5.0 | % | | 87 | | 5.3 | % |

| Fibers | 112 | | 33.3 | % | | 109 | | 33.7 | % | | 351 | | 35.2 | % | | 309 | | 32.6 | % |

| Total segment EBIT excluding non-core and unusual items | 407 | | 16.5 | % | | 313 | | 13.8 | % | | 1,151 | | 16.2 | % | | 1,043 | | 14.9 | % |

Other | (41) | | | | (57) | | | | (158) | | | | (168) | | |

| Total EBIT excluding non-core and unusual items | $ | 366 | | 14.9 | % | | $ | 256 | | 11.3 | % | | $ | 993 | | 13.9 | % | | $ | 875 | | 12.5 | % |

| | | | | | | | |

| | Second Quarter |

| (Dollars in millions, unaudited) | 2024 |

| Adjusted EBIT | Adjusted EBIT Margin |

| Advanced Materials | $ | 131 | | 16.5 | % |

Additives & Functional Products | 123 | | 17.1 | % |

Chemical Intermediates | 22 | | 4.3 | % |

| Fibers | 122 | | 37.0 | % |

| Total segment EBIT excluding non-core and unusual items | 398 | | 16.9 | % |

Other | (45) | | |

| Total EBIT excluding non-core and unusual items | $ | 353 | | 14.9 | % |

(1)For identification of excluded non-core and unusual items and reconciliations to GAAP EBIT, see Table 3A. (2)Adjusted EBIT margin is non-GAAP EBIT divided by GAAP sales. See Table 2A for sales.

Table 4A – Non-GAAP Earnings Before Interest and Taxes, Net Earnings,

and Earnings Per Share Reconciliations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Third Quarter 2024 |

| | Earnings Before Interest and Taxes | | Earnings Before Income Taxes | | Provision for Income Taxes | | Effective Income Tax Rate | | Net Earnings

Attributable to Eastman |

| (Dollars in millions, except per share amounts, unaudited) | | After Tax | | Per Diluted Share |

| As reported (GAAP) | | $ | 329 | | | $ | 280 | | | $ | 99 | | | 35 | % | | $ | 180 | | | $ | 1.53 | |

Non-Core and Unusual Items: (1) | | | | | | | | | | | | |

Asset impairments, restructuring, and other charges, net | | 30 | | | 30 | | | 8 | | | | | 22 | | | 0.19 | |

| Cost of sales impact of restructuring activities | | 7 | | | 7 | | | 2 | | | | | 5 | | | 0.04 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Interim adjustment to tax provision (2) | | — | | | — | | | (59) | | | | | 59 | | | 0.50 | |

| Non-GAAP (Excluding non-core and unusual items and with adjusted provision for income taxes) | | $ | 366 | | | $ | 317 | | | $ | 50 | | | 16 | % | | $ | 266 | | | $ | 2.26 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Third Quarter 2023 |

| | | Earnings Before Interest and Taxes | | Earnings Before Income Taxes | | Provision for (Benefit from) Income Taxes | | Effective Income Tax Rate | | Net Earnings

Attributable to Eastman |

| (Dollars in millions, except per share amounts, unaudited) | | After Tax | | Per Diluted Share |

| As reported (GAAP) | | $ | 256 | | | $ | 199 | | | $ | 20 | | | 10 | % | | $ | 178 | | | $ | 1.49 | |

Non-Core and Unusual Items: (1) | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Interim adjustment to tax provision (2) | | — | | | — | | | 3 | | | | | (3) | | | (0.02) | |

| Non-GAAP (Excluding non-core and unusual items and with adjusted provision for income taxes) | | $ | 256 | | | $ | 199 | | | $ | 23 | | | 12 | % | | $ | 175 | | | $ | 1.47 | |

(1)See Table 3A for description of third quarter 2024 and 2023 non-core and unusual items excluded from non-GAAP EBIT. Provision for income taxes for non-core and unusual items is calculated using the tax rate for the jurisdiction where the gains are taxable and the expenses are deductible. (2)The adjusted provision for income taxes for third quarter 2024 and 2023 is calculated applying the forecasted full year effective tax rate as shown in Table 4B.

Table 4A – Non-GAAP Earnings Before Interest and Taxes, Net Earnings,

and Earnings Per Share Reconciliations (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | First Nine Months 2024 |

| | | Earnings Before Interest and Taxes | | Earnings Before Income Taxes | | Provision for Income Taxes | | Effective Income Tax Rate | | Net Earnings

Attributable to Eastman |

| (Dollars in millions, except per share amounts, unaudited) | | After Tax | | Per Diluted Share |

| As reported (GAAP) | | $ | 929 | | | $ | 781 | | | $ | 204 | | | 26 | % | | $ | 575 | | | $ | 4.86 | |

Non-Core or Unusual Items: (1) | | | | | | | | | | | | |

Asset impairments, restructuring, and other charges, net | | 41 | | | 41 | | | 11 | | | | | 30 | | | 0.27 | |

| | | | | | | | | | | | |

| Cost of sales impact of restructuring activities | | 7 | | | 7 | | | 2 | | | | | 5 | | | 0.04 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Environmental and other costs | | 16 | | | 16 | | | 3 | | | | | 13 | | | 0.10 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Interim adjustment to tax provision (2) | | — | | | — | | | (89) | | | | | 89 | | | 0.75 | |

Non-GAAP (Excluding non-core and unusual items) | | $ | 993 | | | $ | 845 | | | $ | 131 | | | 16 | % | | $ | 712 | | | $ | 6.02 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | First Nine Months 2023 |

| | | Earnings Before Interest and Taxes | | Earnings Before Income Taxes | | Provision for Income Taxes | | Effective Income Tax Rate | | Net Earnings

Attributable to Eastman |

| (Dollars in millions, except per share amounts, unaudited) | | After Tax | | Per Diluted Share |

| As reported (GAAP) | | $ | 825 | | | $ | 662 | | | $ | 77 | | | 12 | % | | $ | 584 | | | $ | 4.89 | |

Non-Core or Unusual Items: (1) | | | | | | | | | | | | |

Asset impairments, restructuring, and other charges, net | | 22 | | | 22 | | | 4 | | | | | 18 | | | 0.14 | |

| | | | | | | | | | | | |

| Cost of sales impact of restructuring activities | | 23 | | | 23 | | | 3 | | | | | 20 | | | 0.17 | |

| | | | | | | | | | | | |

| Steam line incident costs (insurance proceeds), net | | (8) | | | (8) | | | (2) | | | | | (6) | | | (0.05) | |

| Environmental and other costs | | 13 | | | 13 | | | 4 | | | | | 9 | | | 0.08 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Interim adjustment to tax provision (2) | | — | | | — | | | 17 | | | | | (17) | | | (0.14) | |

| Non-GAAP (Excluding non-core and unusual items) | | $ | 875 | | | $ | 712 | | | $ | 103 | | | 15 | % | | $ | 608 | | | $ | 5.09 | |

(1)See Table 3A for description of first nine months 2024 and 2023 non-core and unusual items excluded from non-GAAP EBIT. Provision for income taxes for non-core and unusual items is calculated using the tax rate for the jurisdiction where the gains are taxable and the expenses are deductible. (2)The adjusted provision for income taxes for first nine months 2024 and 2023 is calculated applying the forecasted full year effective tax rate as shown in Table 4B.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Second Quarter 2024 |

| | Earnings Before Interest and Taxes | | Earnings Before Income Taxes | | Provision for Income Taxes | | Effective Income Tax Rate | | Net Earnings

Attributable to Eastman |

| (Dollars in millions, except per share amounts, unaudited) | | After Tax | | Per Diluted Share |

| As reported (GAAP) | | $ | 337 | | | $ | 287 | | | $ | 56 | | | 20 | % | | $ | 230 | | | $ | 1.94 | |

Non-Core and Unusual Items: (1) | | | | | | | | | | | | |

Environmental and other costs | | 16 | | | 16 | | | 3 | | | | | 13 | | | 0.10 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Interim adjustment to tax provision (2) | | — | | | — | | | (13) | | | | | 13 | | | 0.11 | |

| Non-GAAP (Excluding non-core and unusual items and with adjusted provision for income taxes) | | $ | 353 | | | $ | 303 | | | $ | 46 | | | 16 | % | | $ | 256 | | | $ | 2.15 | |

(1)See Table 3A for description of second quarter 2024 non-core and unusual items excluded from non-GAAP EBIT. Provision for income taxes for non-core and unusual items is calculated using the tax rate for the jurisdiction where the gains are taxable and the expenses are deductible. (2)The adjusted provision for income taxes for second quarter 2024 was calculated applying the then forecasted full year effective tax rate.

Table 4B - Adjusted Effective Tax Rate Calculation

| | | | | | | | | | | |

| First Nine Months (1) |

| 2024 | | 2023 |

| Effective tax rate | 26 | % | | 12 | % |

| | | |

Tax impact of current year non-core and unusual items (2) | 2 | % | | 1 | % |

| Changes in tax contingencies and valuation allowances | (1) | % | | 1 | % |

Forecasted full year impact of expected tax events (3) | (11) | % | | 1 | % |

| | | |

| Forecasted full year adjusted effective tax rate | 16 | % | | 15 | % |

(1)Effective tax rate percentages are rounded to the nearest whole percent. The forecasted full year effective tax rates are 15.5 percent and 14.5 percent in first nine months 2024 and 2023, respectively.

(2)Provision for income taxes for non-core and unusual items is calculated using the tax rate for the jurisdiction where the gains are taxable and the expenses are deductible.

(3)Expected future tax events may include finalization of tax returns; federal, state, and foreign examinations or the expiration of statutes of limitation; and corporate restructurings.

Table 5 – Statements of Cash Flows

| | | | | | | | | | | | | | | | | | | | | | | |

| Third Quarter | | First Nine Months |

| (Dollars in millions, unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Operating activities | | | | | | | |

| Net earnings | $ | 181 | | | $ | 179 | | | $ | 577 | | | $ | 585 | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | 127 | | | 120 | | | 380 | | | 380 | |

| | | | | | | |

| Asset impairment charges | 5 | | | — | | | 5 | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Benefit from deferred income taxes | (39) | | | (63) | | | (76) | | | (156) | |

| Changes in operating assets and liabilities, net of effect of acquisitions and divestitures: | | | | | | | |

| (Increase) decrease in trade receivables | (16) | | | 35 | | | (154) | | | 68 | |

| (Increase) decrease in inventories | 16 | | | 220 | | | (222) | | | 147 | |

| Increase (decrease) in trade payables | (53) | | | (73) | | | 36 | | | (363) | |

| Pension and other postretirement contributions (in excess of) less than expenses | (10) | | | (10) | | | (39) | | | (39) | |

| Variable compensation payments (in excess of) less than expenses | 64 | | | 24 | | | 44 | | | 73 | |

| Other items, net | 121 | | | 82 | | | 196 | | | 227 | |

| Net cash provided by operating activities | 396 | | | 514 | | | 747 | | | 922 | |

| Investing activities | | | | | | | |

| Additions to properties and equipment | (120) | | | (236) | | | (420) | | | (649) | |

| | | | | | | |

| | | | | | | |

| Proceeds from sale of businesses | — | | | 22 | | | — | | | 38 | |

| Acquisition, net of cash acquired | — | | | 2 | | | — | | | (74) | |

| | | | | | | |

| Additions to capitalized software | (1) | | | — | | | (4) | | | (4) | |

| Other items, net | 19 | | | 30 | | | 22 | | | 9 | |

Net cash used in investing activities | (102) | | | (182) | | | (402) | | | (680) | |

| Financing activities | | | | | | | |

Net (decrease) increase in commercial paper and other borrowings | — | | | (204) | | | — | | | 73 | |

| Proceeds from borrowings | 495 | | | — | | | 1,237 | | | 796 | |

| Repayment of borrowings | (498) | | | — | | | (1,039) | | | (808) | |

| Dividends paid to stockholders | (95) | | | (94) | | | (285) | | | (282) | |

| Treasury stock purchases | (100) | | | — | | | (200) | | | (50) | |

| | | | | | | |

| Other items, net | 4 | | | (1) | | | 14 | | | (24) | |

| Net cash used in financing activities | (194) | | | (299) | | | (273) | | | (295) | |

| Effect of exchange rate changes on cash and cash equivalents | 8 | | | (4) | | | 2 | | | (1) | |

| Net change in cash and cash equivalents | 108 | | | 29 | | | 74 | | | (54) | |

| Cash and cash equivalents at beginning of period | 514 | | | 410 | | | 548 | | | 493 | |

| Cash and cash equivalents at end of period | $ | 622 | | | $ | 439 | | | $ | 622 | | | $ | 439 | |

Table 6 – Total Borrowings to Net Debt Reconciliations | | | | | | | | | | | | | | | | |

| | | September 30, | | | | December 31, |

| (Dollars in millions, unaudited) | | 2024 | | | | 2023 |

| Total borrowings | | $ | 5,054 | | | | | $ | 4,846 | |

| Less: Cash and cash equivalents | | 622 | | | | | 548 | |

Net debt (1) | | $ | 4,432 | | | | | $ | 4,298 | |

(1)Includes non-cash increase of $8 million in 2024 and non-cash increase of $20 million in 2023 resulting from foreign currency exchange rates.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=emn_A1.875notesdueNovember2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

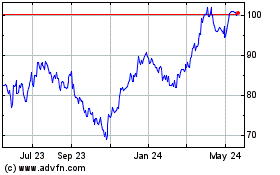

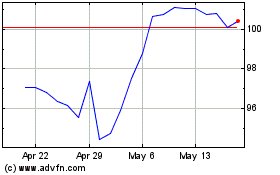

Eastman Chemical (NYSE:EMN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Eastman Chemical (NYSE:EMN)

Historical Stock Chart

From Jan 2024 to Jan 2025