Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

February 18 2025 - 3:01PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433 of the Securities Act of 1933

Registration Statement No. 333-280083

February 18, 2025

Pricing Term Sheet

Eastman Chemical Company

$250,000,000 5.000% Notes due 2029

|

|

|

| Issuer: |

|

Eastman Chemical Company (the “Company”) |

|

|

| Expected Ratings(1): |

|

Baa2 (stable) / BBB (stable) (Moody’s / S&P) |

|

|

| Trade Date: |

|

February 18, 2025 |

|

|

| Settlement Date(2): |

|

February 21, 2025 (T+3) |

|

|

| Security Type: |

|

Senior Unsecured Notes |

|

|

| Offering Format: |

|

SEC-Registered |

|

|

| Principal Amount: |

|

$250,000,000 |

|

|

| Qualified Reopening |

|

There is currently outstanding $500,000,000 in aggregate principal amount of 5.000% Notes due 2029 that were issued on August 1, 2024. After giving effect to this issuance of the 5.000% Notes due 2029, $750,000,000 in aggregate

principal amount of the 5.000% Notes due 2029 will be outstanding. The 5.000% Notes due 2029 offered hereby will be fungible with the previously issued notes of this series and both the 5.000% Notes due 2029 offered hereby and such previously issued

notes, taken together, will be treated as a single series for all purposes. |

|

|

| Interest Payment Dates: |

|

Semi-annually on February 1 and August 1 of each year, beginning August 1, 2025 |

|

|

| Maturity Date: |

|

August 1, 2029 |

|

|

| Coupon: |

|

5.000% |

|

|

| Price to Public: |

|

99.447% of the principal amount, plus accrued interest of $694,444 from and including February 1, 2025 |

|

|

| Yield to Maturity: |

|

5.140% |

|

|

| Benchmark Treasury: |

|

4.250% due January 31, 2030 |

|

|

| Benchmark Treasury Price and Yield: |

|

99-121⁄4; 4.390% |

|

|

| Spread to Benchmark Treasury: |

|

+75 bps |

|

|

| Make-whole Call: |

|

Prior to July 1, 2029 at T + 15 bps |

|

|

| Par Call: |

|

On or after July 1, 2029 |

|

|

| Change of Control: |

|

Upon the occurrence of a change of control triggering event, the Company will be required to make an offer to repurchase all or a portion of the notes at a price equal to 101% of principal, plus accrued and unpaid interest to, but

excluding, the repurchase date. |

|

|

|

| Use of Proceeds: |

|

The Company intends to use the net proceeds for general corporate purposes, which may include working capital, capital expenditures, the repayment of other indebtedness outstanding from time to time, and other matters in connection

with implementation of its strategic initiatives. |

|

|

| CUSIP / ISIN: |

|

277432AZ3 / US277432AZ35 |

|

|

| Denominations: |

|

$2,000 and integral multiples of $1,000 in excess thereof |

|

|

| Day Count Convention: |

|

30 / 360 |

|

|

| Clearing and Settlement: |

|

DTC |

|

|

| Joint Book-Running Managers: |

|

BofA Securities, Inc. J.P. Morgan Securities

LLC Citigroup Global Markets Inc. Mizuho Securities USA

LLC Barclays Capital Inc. Scotia Capital (USA)

Inc. |

| (1) |

A credit rating of a security is not a recommendation to buy, sell or hold securities and may be subject to

review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency. |

| (2) |

We expect to deliver the notes to purchasers on or about February 21, 2025, which will be the third

business day following the pricing of the notes (such settlement cycle being herein referred to as “T+3”). Under Rule 15c6-l under the Securities Exchange Act of 1934, as amended, trades in the

secondary market generally are required to settle in one business day, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes prior to the business day preceding the settlement date will

be required, by virtue of the fact that the notes initially will settle T+3, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the notes who wish to trade the notes prior to the

business day preceding the settlement date should consult their own advisor. |

The issuer has filed a registration statement

(including a base prospectus) and a preliminary prospectus supplement with the SEC for the offering to which this communication relates. The issuer files annual, quarterly, and current reports, proxy statements and other information with the SEC.

Before you invest, you should read the preliminary prospectus supplement for this offering, the issuer’s prospectus in the registration statement and any other documents the issuer has filed with the SEC for more complete information about the

issuer and this offering. We urge you to read these documents and any other relevant documents when they become available because they contain and will contain important information about the issuer and this offering. You may get these documents for

free by searching the SEC online database (EDGAR) on the SEC’s website at http://www.sec.gov. Alternatively, any underwriter or any dealer participating in this offering will arrange to send you, when available, the prospectus supplement and

the prospectus if you request it by calling BofA Securities, Inc. at 1-800-294-1322 or J.P. Morgan Securities LLC at 1-212-834-4533.

This pricing term sheet supplements the preliminary prospectus supplement issued by Eastman Chemical

Company on February 18, 2025 relating to its prospectus dated June 10, 2024 (such prospectus, as supplemented by such preliminary prospectus supplement, the “Preliminary Prospectus”). The information in this pricing term sheet

supersedes the information in the Preliminary Prospectus to the extent inconsistent with the information in the Preliminary Prospectus.

ANY

DISCLAIMER OR OTHER NOTICE THAT MAY APPEAR BELOW IS NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMER OR NOTICE WAS AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT BY BLOOMBERG OR ANOTHER EMAIL

SYSTEM.

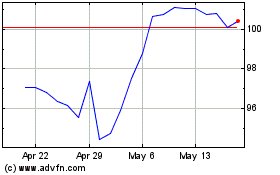

Eastman Chemical (NYSE:EMN)

Historical Stock Chart

From Jan 2025 to Feb 2025

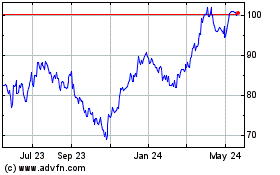

Eastman Chemical (NYSE:EMN)

Historical Stock Chart

From Feb 2024 to Feb 2025