As filed with the Securities and Exchange

Commission on January 31, 2025

Registration No. 333-194395

Registration No. 333-229347

Registration No. 333-229393

Registration No. 333-253223

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

POST-EFFECTIVE AMENDMENT NO. 1

TO FORM S-8 REGISTRATION STATEMENT No.

333-194395

POST-EFFECTIVE AMENDMENT NO. 1

TO FORM S-8 REGISTRATION STATEMENT No.

333-229347

POST-EFFECTIVE AMENDMENT NO. 1

TO FORM S-8 REGISTRATION STATEMENT

No. 333-229393

POST-EFFECTIVE AMENDMENT NO. 1

TO FORM S-8 REGISTRATION STATEMENT

No. 333-253223

UNDER

THE SECURITIES ACT OF 1933

Elk

Merger Sub II, L.L.C.

(as

successor in interest to EnLink Midstream, LLC)

(Exact Name of Registrant as Specified

in its Charter)

| Delaware |

|

46-4108528 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification Number) |

100 West Fifth Street

Tulsa, Oklahoma 74103

(918) 588-7000

(Address, Including Zip Code, and

Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

EnLink Midstream, LLC 2014 Long-Term

Incentive Plan

EnLink Midstream GP, LLC Long-Term

Incentive Plan

EnLink Midstream, LLC 2009 Long-Term

Incentive Plan

(Full title of the plans)

Lyndon C. Taylor

Executive Vice President, Chief Legal Officer and Assistant Secretary

ONEOK, Inc.

100 West Fifth Street

Tulsa, Oklahoma 74103

(918) 588-7000

(Name, Address, Including Zip Code,

and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

|

Julian Seiguer, P.C.

Ieuan A. List

Kirkland & Ellis LLP

609 Main Street

Houston, Texas 77002

(713) 836-3600 |

Brandon M. Watson

Vice President, Deputy General

Counsel

ONEOK, Inc.

100 West Fifth Street

Tulsa, Oklahoma 74103

(918) 588-7000 |

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☒ |

Accelerated filer |

☐ |

| |

|

|

|

| Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

| |

|

|

|

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

DEREGISTRATION OF SECURITIES

Elk Merger Sub II, L.L.C., a Delaware limited liability company (the

“Company”), as successor in interest to EnLink Midstream, LLC, a Delaware limited liability company (“EnLink”),

is filing these post-effective amendments (the “Post-Effective Amendments”) to the following Registration Statements on Form

S-8 (collectively, the “Registration Statements”), which were filed by EnLink with the

Securities and Exchange Commission (the “SEC”) on the dates set forth below,

to deregister any and all securities registered but unissued under each such Registration Statement as of the date hereof:

| ● | Registration

Statement on Form S-8 (No. 333-194395), filed with the SEC on March 7, 2014, registering

11,000,000 common units representing limited liability company interests of EnLink (“Common

Units”) pursuant to the EnLink Midstream, LLC 2014 Long-Term Incentive Plan and 426,647

Common Units pursuant to the EnLink Midstream, LLC 2009 Long-Term Incentive Plan; |

| ● | Registration

Statement on Form S-8 (No. 333-229347), filed with the SEC on January 24, 2019, registering

6,700,000 Common Units pursuant to the EnLink Midstream, LLC 2014 Long-Term Incentive Plan; |

| ● | Registration

Statement on Form S-8 (No. 333-229393), filed with the SEC on January 28, 2019, registering

3,416,046 Common Units pursuant to the EnLink Midstream, LLC 2014 Long-Term Incentive Plan

and 3,197,980 Common Units pursuant to the EnLink Midstream GP, LLC Long-Term Incentive Plan;

and |

| ● | Registration

Statement on Form S-8 (No. 333-253223), filed with the SEC on February 17, 2021, registering

20,000,000 Common Units pursuant to the EnLink Midstream, LLC 2014 Long-Term Incentive Plan; |

On

January 31, 2025, pursuant to the transactions contemplated by that certain Agreement and Plan of Merger, dated November 24, 2024, by

and among ONEOK, Inc. (“ONEOK”), Elk Merger Sub I, L.L.C., a direct, wholly-owned subsidiary of ONEOK (“Merger

Sub I”), the Company, EnLink, and EnLink Midstream Manager, LLC, the managing member of EnLink, (i) Merger Sub I merged with and

into EnLink (the “First Merger”), with EnLink surviving the First Merger and (ii) EnLink merged with and into the Company

(the “Second Merger” and, together with the First Merger, the “Mergers”), with the Company surviving the Second

Merger as a direct, wholly-owned subsidiary of ONEOK.

As a result of the completion

of the Mergers, the Company has terminated all offerings of securities pursuant to the Registration Statements. In accordance with

the undertakings made by EnLink in the Registration Statements to remove from registration, by means of a post-effective amendment, any

of the securities that had been registered for issuance that remain unsold at the termination of such offerings, the Company, as successor

to EnLink, hereby removes from registration by means of these Post-Effective Amendments all of such securities registered but unsold under

the Registration Statements as of the date hereof. The Registration Statements are hereby amended, as appropriate, to reflect the deregistration

of such securities and the Company, as successor to EnLink, hereby terminates the effectiveness of the Registration Statements.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933,

as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form

S-8 and has duly caused these Post-Effective Amendments to the Registration Statements on Form S-8 to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Tulsa, State of Oklahoma, on January 31, 2025.

| |

Elk Merger Sub II, L.L.C. |

| |

|

|

| |

(as successor in interest to EnLink Midstream, LLC) |

| |

|

|

| |

By: |

/s/ Walter S. Hulse III |

| |

Name: |

Walter S. Hulse III |

| |

Title: |

Chief Financial Officer |

No other person is required to sign these Post-Effective Amendments

on Form S-8 in reliance on Rule 478 under the Securities Act of 1933, as amended.

2

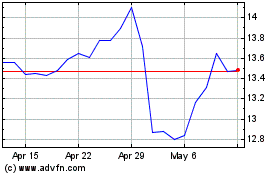

EnLink Midstream (NYSE:ENLC)

Historical Stock Chart

From Jan 2025 to Feb 2025

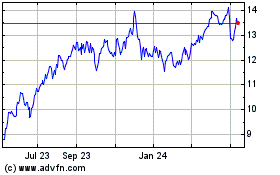

EnLink Midstream (NYSE:ENLC)

Historical Stock Chart

From Feb 2024 to Feb 2025