Form 40-17F2 - Certificate of accounting of securities in custody of management investment companies [Rule 17f-2]

August 02 2024 - 3:12PM

Edgar (US Regulatory)

U.S. Securities and Exchange

Commission

Washington, D.C. 20549

FORM N-17f-2

CERTIFICATE OF ACCOUNTING

OF SECURITIES AND SIMILAR INVESTMENTS IN

THE CUSTODY OF MANAGEMENT

INVESTMENT COMPANIES

Pursuant to Rule 17f-2 [17

CRF 270.17f-2]

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Investment Company Act File Number:

814-00098

|

Date examination completed:

July 17, 2024

|

|

2. State Identification Number:

|

| |

AL |

|

AK |

|

AZ |

|

AR |

|

CA |

|

CO |

|

| |

CT |

|

DE |

|

DC |

|

FL |

|

GA |

|

HI |

|

| |

ID |

|

IL |

|

IN |

|

IA |

|

KS |

|

KY |

|

| |

LA |

|

ME |

|

MD |

|

MA |

|

MI |

|

MN |

|

| |

MS |

|

MO |

|

MT |

|

NE |

|

NV |

|

NH |

|

| |

NJ |

|

NM |

|

NY |

|

NC |

|

ND |

|

OH |

|

| |

OK |

|

OR |

|

PA |

|

RI |

|

SC |

|

SD |

|

| |

TN |

|

TX |

|

UT |

|

VT |

|

VA |

|

WA |

|

| |

WV |

|

WI |

|

WY |

|

PUERTO RICO |

| |

Other (specify): |

|

3. Exact name of investment company as specified

in registration statement:

Equus Total Return, Inc.

|

|

4. Address of principal executive office: (number,

street, city, state, zip code)

700 Louisiana Street, 48th

Floor, Houston, Texas 77002

|

INSTRUCTIONS

This Form must be completed by the investment companies

that have custody of securities or similar investments.

Investment Company

| 1. | All items must be completed by the investment company. |

| 2. | Give this Form to the independent public accountant who, in compliance with Rule 17f-2 under the Act and applicable state law, examines

securities and similar investments in the custody of the investment company. |

Accountant

| 3. | Submit this Form to the Securities and Exchange Commission and appropriate state securities administrators when filing the certificate

of accounting required by Rule 17f-2 under the Act and applicable state law. File the original and one copy with the Securities and Exchange

Commission’s principal office in Washington, D.C., one copy with the regional office for the region in which the investment company’s

principal business operations are conducted, and one copy with the appropriate state administrator(s), if applicable. |

THIS FORM MUST BE GIVEN TO YOUR

INDEPENDENT PUBLIC ACCOUNTANT

Management Statement Regarding Compliance with

Certain Provisions of the Investment Company Act

of 1940

August 2, 2024

BDO USA, P.C.

2929 Allen Parkway, 20th Floor

Houston, Texas 77019

We, as members of management of Equus Total Return,

Inc. (the “Fund”), are responsible for complying with the requirements of subsections (b) and (c) of Rule 17f-2, “Custody

of Investments by Registered Management Investment Companies”, of the Investment Company Act of 1940 (the “Act”). We

are also responsible for establishing and maintaining effective internal controls over compliance with those requirements. We have performed

an evaluation of the Fund’s compliance with the requirements of subsections (b) and (c) of Rule 17f-2 as of July 17, 2024, and from

December 13, 2023 (the date of our last examination) through July 17, 2024.

Based on this evaluation, we assert that the Fund

was in compliance with the requirements of subsections (b) and (c) of Rule 17f-2 of the Act as of July 17, 2024, and from December 13,

2023 (the date of our last examination) through July 17, 2024, with respect to securities reflected in the investment account of the Fund.

| |

|

| Equus Total Return, Inc. |

| |

|

| By: |

/s/ Kenneth I. Denos |

| |

Kenneth I. Denos |

| |

Chief Compliance Officer |

Report of Independent Registered Public Accounting

Firm

To the Board of Directors of

Equus Total Return, Inc.

We have examined management’s assertion,

included in the accompanying Management Statement Regarding Compliance with Certain Provisions of the Investment Company Act of 1940,

that Equus Total Return, Inc. (the “Fund”) complied with the requirements of subsections (b) and (c) of Rule 17f-2

under the Investment Company Act of 1940 (the “Act”) (the specified requirements) as of July 17, 2024. Management is responsible

for its assertion and the Fund’s compliance with those requirements. Our responsibility is to express an opinion on management’s

assertion about the Fund’s compliance with the specific requirements based on our examination.

Our examination was conducted in accordance with

the standards of the Public Company Accounting Oversight Board (United States) and in accordance

with attestation standards established by the American Institute of Certified Public Accountants. Those

standards require that we plan and perform the examination to obtain reasonable assurance about whether managements assertion about compliance

with the specified requirements is fairly stated, in all material respects and, accordingly, included examining, on a test basis,

evidence about the Fund’s compliance with those requirements and performing such other procedures as we considered necessary in

the circumstances. Included among our procedures were the following tests performed as of July 17, 2024, and with respect to agreement

of security purchases and sales, for the period from December 13, 2023 (the date of our last examination) through July 17, 2024:

| • | Count and inspection of all securities located in the vault of the Amegy Bank (the “Custodian”)

in Houston, Texas with prior notice to management; |

| • | Confirmation of all securities hypothecated, pledged, placed in escrow, or out for transfer with brokers,

pledgees, or transfer agents; and |

| • | Reconciliation of all such securities to the books and records of the Fund and the Custodian. |

We believe that our examination provides a reasonable

basis for our opinion. Our examination does not provide a legal determination on the Fund’s compliance with specified requirements.

We are required to be independent

and to meet our other ethical responsibilities in accordance with relevant ethical requirements relating to the engagement.

In our opinion, management’s assertion that

the Fund complied with the requirements of subsections (b) and (c) of Rule 17f-2 of the Act as of July 17, 2024, with respect

to securities reflected in the investment account of the Fund is fairly stated, in all material respects.

This report is intended solely for the information

and use of management and the Board of Directors of the Fund and the Securities and Exchange Commission and is not intended to be and

should not be used by anyone other than these specified parties.

| |

| /s/ BDO USA, P.C. |

| Houston, Texas |

|

August 2, 2024

|

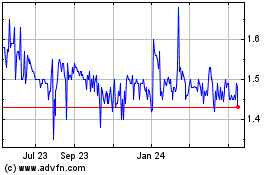

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Dec 2024 to Jan 2025

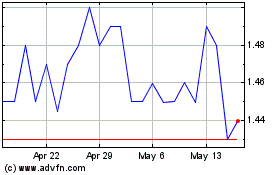

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jan 2024 to Jan 2025