ENERPLUS ANNOUNCES PLAN TO CONVERT TO CORPORATION

September 30 2010 - 7:00AM

PR Newswire (Canada)

CALGARY, Sept. 30 /CNW/ -- CALGARY, Sept. 30 /CNW/ - Enerplus

Resources Fund ("Enerplus") (TSX - ERF.un, NYSE - ERF) is pleased

to announce the proposed conversion of Enerplus from an income

trust to a corporation and will seek Unitholder approval for the

conversion at a special meeting of Unitholders to be held on

December 9, 2010. Subject to receipt of all required Unitholder,

stock exchange, Alberta Court of Queen's Bench and any other

required third party approvals, Enerplus expects the conversion

will become effective January 1, 2011. The record date for this

meeting is October 25, 2010. A management information circular and

proxy statement outlining the details of the conversion will be

mailed in early November to all Unitholders as of the record date

in advance of the December 9, 2010 meeting date. To be implemented,

the conversion must be approved by not less than two-thirds of the

votes cast by Unitholders at the special meeting. Enerplus is

proposing this conversion as a result of certain changes in

Canadian federal tax legislation specifically related to income

trusts. While conversion to a corporation will not impact the

underlying oil and gas operations of Enerplus, it is expected to

simplify the underlying structure and remove uncertainty for

Enerplus that exists in the income trust marketplace today. The new

entity will be named "Enerplus Corporation". Under the conversion,

Enerplus Unitholders would exchange each trust unit they hold for

one common share of Enerplus Corporation. Holders of exchangeable

limited partnership units of Enerplus' subsidiary, Enerplus

Exchangeable Limited Partnership ("EELP Exchangeable Units"), would

receive 0.425 of a common share of Enerplus Corporation for each

EELP Exchangeable Unit, which is the same exchange ratio for which

EELP Exchangeable Units may currently be exchanged into Enerplus

Resources Fund trust units. Enerplus expects to continue trading on

both the Toronto Stock Exchange and the New York Stock Exchange

following the completion of the corporate conversion and we intend

to maintain our "ERF" ticker symbols. The conversion will not

trigger or accelerate any payments under compensation plans or

employment agreements for the employees, executive or directors of

Enerplus. Enerplus expects the transaction to be considered a tax

deferred exchange for Canadian trust Unitholders. Holders of EELP

Exchangeable Units would be able to elect to have the transaction

effected in a tax-deferred manner. For U.S. investors, the exchange

should qualify as a tax deferred reorganization and as such no gain

or loss would be recognized. This information is not intended to

be, and should not be construed as tax advice and investors in both

Canada and the U.S. should consult with financial advisors, legal

counsel or accountants regarding the tax consequences of the

exchange and any subsequent dividend payments received from

Enerplus Corporation post conversion. Enerplus intends that,

following the conversion, Enerplus Corporation would continue to

pay dividends on a monthly basis. At this time, Enerplus

anticipates that it will maintain the monthly dividend payment at

the same rate of CDN$0.18 per common share per month, however the

actual amount of future dividends may vary depending upon commodity

prices, production volumes, capital spending and costs and cannot

provide any assurances with regard to future dividend payments.

Enerplus will utilize its available tax pools to mitigate our

Canadian cash tax obligations and does not expect to incur cash

taxes in Canada for three to five years after conversion. Enerplus

also intends to continue to offer a monthly distribution

reinvestment plan for eligible Canadian shareholders with respect

to the payment of any dividends by Enerplus Corporation following

the conversion. Assuming the conversion is approved, Enerplus plans

to make this program available to U.S. residents later in 2011.

Enerplus has also issued a Social Media Release through Canada

Newswire discussing its corporate conversion plans. This Social

Media Release includes a video message from Gordon J. Kerr,

President and Chief Executive Officer of Enerplus and can be found

at

http://smr.newswire.ca/en/enerplus-resources-fund/enerplus-announces-plan-to-convert-to-corporation

Mr. Kerr's video message can also be viewed on our corporate

website at

http://www.enerplus.com/investor_information/corporate_conversion/corporate_conversion.shtml.

FORWARD-LOOKING INFORMATION AND STATEMENTS This news release

contains certain forward-looking information and statements

("forward-looking information") within the meaning of applicable

securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "guidance", "objective",

"ongoing", "may", "will", "project", "should", "believe", "plans",

"intends", "budget", "strategy" and similar expressions are

intended to identify forward-looking information. In particular,

but without limiting the foregoing, this news release contains

forward-looking information pertaining to the following: the

conversion of Enerplus to a corporation and the timing and tax

effects thereof; the payment and amounts of future dividends and

the availability of a dividend reinvestment plan; the amount of tax

pools and time at which Canadian income taxes may be paid; and the

listing of the shares of Enerplus Corporation on certain stock

exchanges. The forward-looking information contained in this news

release reflects several material factors and expectations and

assumptions of the Fund including, without limitation: the receipt

of all necessary unitholder, Court, stock exchange and other third

party approvals; the continuance of existing (and in certain

circumstances, the implementation of proposed) tax regimes; and the

availability of cash to pay dividends following the conversion from

a trust to a corporation. The Fund believes the material factors,

expectations and assumptions reflected in the forward-looking

information are reasonable but no assurance can be given that these

factors, expectations and assumptions will prove to be correct. The

forward-looking information included in this news release is not a

guarantee of future conditions or performance and should not be

unduly relied upon. Such information involves known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking information including, without limitation:

failure to receive all necessary unitholder, Court, stock exchange

and other third party approvals; changes in tax laws; changes in

commodity prices and acquisition and disposition activity that may

affect the amount of tax pools and the time at which income taxes

may be payable; insufficient cash to pay dividends; and certain

other risks detailed from time to time in the Fund's public

disclosure documents. The forward-looking information contained in

this news release speak only as of the date of this news release,

and none of Enerplus or its subsidiaries assumes any obligation to

publicly update or revise them to reflect new events or

circumstances, except as may be required pursuant to applicable

laws. Gordon J. Kerr President & Chief Executive Officer

Enerplus Resources Fund /NOTE TO PHOTO EDITORS: A photo

accompanying this release is available at

http://photos.newswire.ca. Images are free to accredited members of

the media/ %CIK: 0001126874 Investor Relations Department at

Enerplus at 1-800-319-6462 or email investorrelations@enerplus.com

Copyright

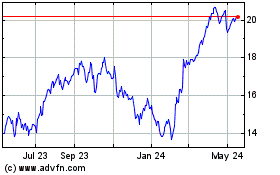

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jun 2024 to Jul 2024

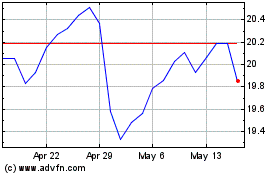

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jul 2023 to Jul 2024