Enerplus Announces Analyst Day Webcast Details and Updates Corporate Presentation

March 07 2011 - 7:33PM

PR Newswire (Canada)

CALGARY, March 7 /CNW/ -- CALGARY, March 7 /CNW/ - Enerplus

Corporation ("Enerplus") (TSX: ERF) (NYSE: ERF) is pleased to

announce the webcast details for the Enerplus Analyst Day that is

being hosted tomorrow, Tuesday, March 8, 2011 in Calgary, Alberta,

beginning at 9:00 am MT. Live Webcast Date: Tuesday, March 8, 2011

Time: 9:00 a.m. MT/11:00 a.m. ET Webcast:

http://w.on24.com/r.htm?e=287450&s=1&k=5880CBD0C0B25D95C23D43CCFCFCC4CD

To ensure timely participation in the webcast, please log in 15

minutes prior to the start time to register for the event.

The login details can also be found on our website at

www.enerplus.com. In addition, our corporate presentation has been

updated and will be available on our website. This

presentation provides an update on the company's operations,

including discussion regarding 2010 year end reserves and

contingent resource assessments which were previously announced on

February 25, 2011. Included in this presentation is an internal

assessment of contingent resources associated with our waterflood

assets of 60 MMBOE of "best estimate" contingent resources. This

represents incremental oil recovery and enhanced oil recovery

potential that has been identified in a number (but not all) of our

waterflood assets at this time. Proved plus probable reserves

(company interest) associated with our waterflood properties was

83.7 MMBOE at December 31, 2010. Electronic copies of our financial

statements, news releases, and other public information are

available on our website at www.enerplus.com. Gordon J. Kerr

President & Chief Executive Officer Enerplus Corporation Except

for the historical and present factual information contained

herein, the matters set forth in this news release, including words

such as "expects", "projects", "plans" and similar expressions, are

forward-looking information that represents management of Enerplus'

internal projections, expectations or beliefs concerning, among

other things, future operating results and various components

thereof or the economic performance of Enerplus. The projections,

estimates and beliefs contained in such forward-looking statements

necessarily involve known and unknown risks and uncertainties,

which may cause Enerplus' actual performance and financial results

in future periods to differ materially from any projections of

future performance or results expressed or implied by such

forward-looking statements. These risks and uncertainties include,

among other things, those described in Enerplus' filings with the

Canadian and U.S. securities authorities. Accordingly,

holders of Enerplus shares and potential investors are cautioned

that events or circumstances could cause results to differ

materially from those predicted. Presentation of Production and

Reserves Information In accordance with Canadian practice,

production volumes and revenues are reported on a "Company

interest" basis, before deduction of Crown and other royalties,

plus Enerplus' royalty interest. Unless otherwise specified, all

reserves volumes in this news release (and all information derived

therefrom) are based on "company interest reserves" using forecast

prices and costs. "Company interest reserves" consist of "gross

reserves" (as defined in National Instrument 51-101 adopted by the

Canadian securities regulators ("NI 51-101"), being Enerplus'

working interest before deduction of any royalties, plus Enerplus'

royalty interests in reserves. "Company interest reserves" are not

a measure defined in NI 51-101 and do not have a standardized

meaning under NI 51-101. Accordingly, our company interest reserves

may not be comparable to reserves presented or disclosed by other

issuers. Our oil and gas reserves statement for the year ended

December 31, 2010, which will include complete disclosure of our

oil and gas reserves and other oil and gas information in

accordance with NI 51-101, will be contained within our Annual

Information Form for the year ended December 31, 2010 ("our AIF")

which will be available in mid-March 2011 on our website at

www.enerplus.com and on our SEDAR profile at www.sedar.com.

Additionally, the Annual Information Form will form part of our

Form 40-F that will be filed with the U.S. Securities and Exchange

Commission and will available on EDGAR at www.sec.gov. Readers are

also urged to review the Management's Discussion & Analysis and

financial statements filed on SEDAR and EDGAR concurrently with

this news release for more complete disclosure on our operations.

Contingent Resource Estimates This news release contains estimates

of "contingent resources". "Contingent resources" are not, and

should not be confused with, oil and gas reserves. "Contingent

resources" are defined in the Canadian Oil and Gas Evaluation

Handbook (the "COGE Handbook") as "those quantities of petroleum

estimated, as of a given date, to be potentially recoverable from

known accumulations using established technology or technology

under development, but which are not currently considered to be

commercially recoverable due to one or more contingencies.

Contingencies may include factors such as economic, legal,

environmental, political and regulatory matters or a lack of

markets. It is also appropriate to classify as "contingent

resources" the estimated discovered recoverable quantities

associated with a project in the early evaluation stage." There is

no certainty that we will produce any portion of the volumes

currently classified as "contingent resources". The "contingent

resource" estimates contained herein are presented as the "best

estimate" of the quantity that will actually be recovered,

effective as of December 31, 2010. A "best estimate" of

contingent resources means that it is equally likely that the

actual remaining quantities recovered will be greater or less than

the best estimate, and if probabilistic methods are used, there

should be at least a 50% probability that the quantities actually

recovered will equal or exceed the best estimate. With respect to

the "contingent resource" estimate for our waterflood properties,

the primary contingencies which currently prevent the

classification of our disclosed "contingent resources" associated

with the properties as "reserves" is the early stage of

implementation to the specific waterfloods. Significant

positive factors related to the estimate include established

waterflood technology, the history of waterflood performance data

and the enhanced oil recovery estimates which are based on

incremental recovery from higher displacement efficiency only with

no improved recovery from additional areal sweep. A significant

negative factor relevant to this estimate is the geological

complexity and its effect on injector producer connectivity. There

are a number of inherent risks and contingencies associated with

the development of our interests in these properties including

commodity price fluctuations, project costs, our ability to make

the necessary capital expenditures to develop the properties,

reliance on our industry partners in project development,

acquisitions, funding and provisions of services and those other

risks and contingencies described above, and that apply generally

to oil and gas operations as described above, and under "Risk

Factors" in our Annual Information Form referred to above. To

view this news release in HTML formatting, please use the following

URL:

http://www.newswire.ca/en/releases/archive/March2011/07/c8811.html

pplease contact Investor Relations at 1-800-319-6462 or email a

href="mailto:investorrelations@enerplus.com"investorrelations@enerplus.com/a/p

Copyright

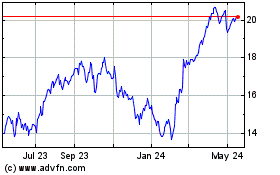

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jun 2024 to Jul 2024

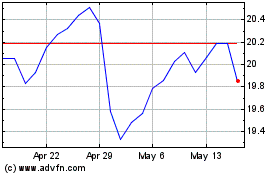

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jul 2023 to Jul 2024