Eversource Energy (NYSE: ES) today reported full-year 2024

earnings of $811.7 million, or $2.27 per share, compared with a

full-year 2023 loss of $(442.2) million, or $(1.26) per share.

Eversource also reported fourth quarter 2024 earnings of $72.5

million, or $0.20 per share, compared with a fourth quarter 2023

loss of $(1,288.5) million, or $(3.68) per share. Non-GAAP

recurring earnings totaled $1,634.0 million1, or $4.57 per share1,

for the full-year 2024, and $370.8 million1, or $1.01 per share1,

in the fourth quarter of 2024, compared with $1,517.7 million1, or

$4.34 per share1, for the full-year 2023 and $333.5 million1, or

$0.95 per share1, in the fourth quarter of 2023. The Company’s 2024

updated non-GAAP recurring earnings guidance was between $4.52 per

share and $4.60 per share.

Results for the full-year 2024 include an aggregate net

after-tax loss of $524.0 million, or $1.47 per share, related to

Eversource Energy completing the sales of its offshore wind

investments. Also, in the fourth quarter of 2024, the Company

recorded an after-tax loss of $298.3 million related to the pending

sale of the Aquarion Water Company. The full year 2024 impact of

this expected loss is $0.83 per share while the fourth quarter 2024

impact is $0.81 per share. Results for the full-year and fourth

quarter of 2023 include after-tax impairment charges of $1,953.0

million, or $5.58 per share, and $1,622.0 million, or $4.63 per

share, respectively, related to Eversource Energy’s write-down to

fair value of its offshore wind investment. In addition, results

for the full-year 2023 included other after-tax non-recurring

charges that totaled $6.9 million, or $0.02 per share. These

impacts are excluded from non-GAAP recurring earnings.

“In 2024, the diverse and talented people of Eversource once

again distinguished themselves by achieving operational excellence

and delivering solid financial results for our customers and

shareholders,” said Chairman, President, and Chief Executive

Officer Joe Nolan. “We worked hard to advance our region’s clean

energy future, improve the already strong reliability and

resiliency of our delivery networks, and enhance our customer

experience."

“With the strategic decision to divest Aquarion, which is

expected to close by late 2025, we will greatly strengthen our

balance sheet and continue to focus on our regulated electric and

natural gas utility businesses. While we see some headwinds in

2025, we also have extensive and attractive opportunities for

system investments, as evidenced by a 10 percent increase in our

five-year investment plan through 2029, that will strengthen the

infrastructure in our region and support the growth of clean

energy. We believe these opportunities will enable us to achieve

our long-term growth rate of 5 to 7 percent,” Nolan added.

Eversource Energy’s annual projection for 2025 earnings is

between $4.67 per share and $4.82 per share. The Company also

expects that its cumulative long-term earnings per share growth

rate would be in the range of 5 to 7 percent through 2029, using

2024 non-GAAP results of $4.57 per share1 as the base year.

Eversource introduced its new five-year $24.2 billion investment

plan for the years 2025 to 2029, excluding any capital investments

related to Aquarion Water Company, which is an increase of nearly

10 percent or $2.1 billion dollars over its previous plan of $22.1

billion for the years 2024 to 2028. This increase is primarily due

to higher transmission investment for the development of future

substations and replacements for aging infrastructure.

Eversource expects to raise $1.2 billion of equity, excluding

the annual equity issuances related to its dividend reinvestment

and equity compensation programs, over its forecast period of

2025-2029. The majority of this equity is expected to be raised in

the latter half of the forecast period.

Electric Transmission

Eversource Energy’s transmission segment earned $724.6 million

in 2024, compared with earnings of $643.4 million in 2023.

Transmission earnings were $184.0 million in the fourth quarter of

2024, compared with $167.0 million in the fourth quarter of 2023.

Transmission segment results improved primarily due to a higher

level of investment in Eversource’s electric transmission

system.

Electric Distribution

Eversource Energy’s electric distribution segment earned $631.7

million in 2024, compared with earnings of $608.0 million in 2023.

Electric distribution earned $110.4 million in the fourth quarter

of 2024, compared with earnings of $103.7 million in the fourth

quarter of 2023. Improved full-year and fourth-quarter results were

due primarily to higher revenues from base distribution rate

increases for Eversource’s Massachusetts and New Hampshire electric

businesses and continued investments in Eversource’s distribution

system, partially offset by higher non-tracked operations and

maintenance (O&M), interest, depreciation and property tax

expense, as well as a higher effective tax rate. Full-year results

were also impacted by the absence of the prior year benefit related

to a favorable regulatory decision in New Hampshire.

Natural Gas Distribution

Eversource Energy’s natural gas distribution segment earned

$291.0 million in 2024, compared with earnings of $224.8 million in

2023. Natural gas distribution earned $103.4 million in the fourth

quarter of 2024, compared with earnings of $76.5 million in the

fourth quarter of 2023. Improved full-year and fourth-quarter

results were due primarily to higher revenues from base

distribution rate increases at Eversource’s Massachusetts natural

gas businesses and continued investments in Eversource’s natural

gas infrastructure, partially offset by higher depreciation,

interest and property tax expense. Full-year results also benefited

from lower non-tracked O&M expense and a lower effective tax

rate.

Water Distribution

Eversource Energy’s water distribution segment, excluding the

loss on the pending sale noted above, earned $44.6 million1 in

2024, compared with earnings of $33.1 million in 2023. Water

distribution earned $7.5 million1 in the fourth quarter of 2024,

compared with earnings of $5.7 million in the fourth quarter of

2023. Improved full-year and fourth-quarter results were due

primarily to lower depreciation expense resulting from lower

depreciation rates ordered by PURA in its final decision in the

Aquarion CT rate case, partially offset by lower authorized

revenues. Results for both periods also reflect lower interest

expense resulting from the repayment of debt that matured in August

2024, partially offset by higher year-to-date O&M expense.

Eversource Parent and Other

Companies

Eversource Energy parent and other companies’ earnings,

excluding the losses on the offshore wind investments and

transaction and other charges noted above, were $(57.9) million1 in

2024 and $8.4 million1 in 2023. The earnings were $(34.5) million1

in the fourth quarter of 2024 and $(19.4) million1 in the fourth

quarter of 2023. Losses in both periods are primarily the result of

higher interest expense, partially offset by a lower effective tax

rate. Full-year results also reflect the absence of the prior year

net benefit from the disposition of Eversource's interest in a

clean energy fund.

Eversource Energy Consolidated

Earnings

The following table reconciles 2024 and 2023 fourth quarter and

full-year GAAP earnings per share:

Fourth Quarter

Full Year

2023

Reported GAAP EPS

$

(3.68

)

$

(1.26

)

Higher electric transmission segment

earnings in 2024, net of share dilution

0.03

0.19

Higher electric distribution segment

revenues, partially offset by higher non-tracked O&M, interest,

depreciation, property taxes, higher effective tax rate and share

dilution, and the year-to-date (YTD) absence of a prior year

regulatory benefit in New Hampshire

—

0.03

Higher natural gas distribution segment

revenues and lower YTD non-tracked O&M, partially offset by

higher depreciation, interest, property taxes and share

dilution

0.06

0.17

Higher water distribution segment earnings

due to lower depreciation and interest expense, partially offset by

higher YTD O&M and lower authorized revenues

0.01

0.03

At parent and other companies, higher

interest expense, partially offset by a lower effective tax rate,

as well as the YTD absence of a prior year benefit from the

liquidation of an investment in a clean energy fund

(0.04

)

(0.19

)

Losses on Offshore Wind Investments, and

absence of transaction and other charges from 2023

4.63

4.13

Loss on pending sale of the water

distribution business

(0.81

)

(0.83

)

2024

Reported GAAP EPS

$

0.20

$

2.27

Financial results for the fourth quarter and full-year 2024 and

2023 for Eversource Energy’s business segments and parent and other

companies are noted below:

Three months ended:

(in millions, except EPS)

December 31, 2024

December 31, 2023

Increase/

(Decrease)

2024 EPS 1

2023 EPS 1

Increase/

(Decrease)

Electric Transmission

$

184.0

$

167.0

$

17.0

$

0.50

$

0.47

$

0.03

Electric Distribution

110.4

103.7

6.7

0.30

0.30

—

Natural Gas Distribution

103.4

76.5

26.9

0.28

0.22

0.06

Water Distribution 1

7.5

5.7

1.8

0.02

0.01

0.01

Parent and Other Companies 1

(34.5

)

(19.4

)

(15.1

)

(0.09

)

(0.05

)

(0.04

)

Loss on Offshore Wind Investments

—

(1,622.0

)

1,622.0

—

(4.63

)

4.63

Loss on pending sale of the water

distribution business

(298.3

)

—

(298.3

)

(0.81

)

—

(0.81

)

Reported Earnings/(Loss)

$

72.5

$

(1,288.5

)

$

1,361.0

$

0.20

$

(3.68

)

$

3.88

Full year ended:

(in millions, except EPS)

December 31, 2024

December 31, 2023

Increase/

(Decrease)

2024 EPS 1

2023 EPS 1

Increase/

(Decrease)

Electric Transmission

$

724.6

$

643.4

$

81.2

$

2.03

$

1.84

$

0.19

Electric Distribution

631.7

608.0

23.7

1.77

1.74

0.03

Natural Gas Distribution

291.0

224.8

66.2

0.81

0.64

0.17

Water Distribution 1

44.6

33.1

11.5

0.12

0.09

0.03

Parent and Other Companies 1

(57.9

)

8.4

(66.3

)

(0.16

)

0.03

(0.19

)

Losses on Offshore Wind Investments

(524.0

)

(1,953.0

)

1,429.0

(1.47

)

(5.58

)

4.11

Loss on pending sale of the water

distribution business

(298.3

)

—

(298.3

)

(0.83

)

—

(0.83

)

Transaction and other charges

—

(6.9

)

6.9

—

(0.02

)

0.02

Reported Earnings/(Loss)

$

811.7

$

(442.2

)

$

1,253.9

$

2.27

$

(1.26

)

$

3.53

Eversource Energy has approximately 367 million common shares

outstanding and operates New England’s largest energy delivery

system. It serves approximately 4.6 million electric, natural gas

and water customers in Connecticut, Massachusetts and New

Hampshire.

Note: Eversource Energy will webcast a

conference call with senior management on February 12, 2025,

beginning at 9 a.m. Eastern Time. The webcast and associated slides

can be accessed through Eversource Energy’s website at

www.eversource.com or via this link

https://edge.media-server.com/mmc/p/myr8izgk/.

1 All per-share amounts in this news release are reported on a

diluted basis. The only common equity securities that are publicly

traded are common shares of Eversource Energy. The earnings

discussion includes financial measures that are not recognized

under generally accepted accounting principles (non-GAAP)

referencing earnings and EPS excluding losses on the sales and

impairments of the offshore wind equity method investments, a loss

on the pending sale of the Aquarion water distribution business, a

loss on the disposition of land that was initially acquired to

construct the Northern Pass Transmission project and was

subsequently abandoned, and certain transaction and transition

costs. EPS by business is also a non-GAAP financial measure and is

calculated by dividing the net income attributable to common

shareholders of each business by the weighted average diluted

Eversource Energy common shares outstanding for the period. The

earnings and EPS of each business do not represent a direct legal

interest in the assets and liabilities of such business, but rather

represent a direct interest in Eversource Energy’s assets and

liabilities as a whole. Eversource Energy uses these non-GAAP

financial measures to evaluate and provide details of earnings

results by business and to more fully compare and explain results

without including these items. This information is among the

primary indicators management uses as a basis for evaluating

performance and planning and forecasting of future periods.

Management believes the impacts of the losses on the offshore wind

equity method investments, the loss on the pending sale of the

Aquarion water distribution business, the loss on the disposition

of land associated with an abandoned project, and transaction and

transition costs are not indicative of Eversource Energy's ongoing

costs and performance. Management views these charges as not

directly related to the ongoing operations of the business and

therefore not an indicator of baseline operating performance. Due

to the nature and significance of the effect of these items on net

income attributable to common shareholders and EPS, management

believes that the non-GAAP presentation is a more meaningful

representation of Eversource Energy's financial performance and

provides additional and useful information to readers of this

report in analyzing historical and future performance of the

business. These non-GAAP financial measures should not be

considered as alternatives to reported net income attributable to

common shareholders or EPS determined in accordance with GAAP as

indicators of Eversource Energy's operating performance.

This document includes statements concerning Eversource Energy’s

expectations, beliefs, plans, objectives, goals, strategies,

assumptions of future events, future financial performance or

growth and other statements that are not historical facts. These

statements are “forward-looking statements” within the meaning of

the U. S. federal securities laws. Generally, readers can identify

these forward-looking statements through the use of words or

phrases such as “estimate,” “expect,” “pending,” “anticipate,”

“intend,” “plan,” “project,” “believe,” “forecast,” “would,”

“should,” “could” and other similar expressions. Forward-looking

statements involve risks and uncertainties that may cause actual

results or outcomes to differ materially from those included in the

forward-looking statements. Forward-looking statements are based on

the current expectations, estimates, assumptions or projections of

management and are not guarantees of future performance. These

expectations, estimates, assumptions or projections may vary

materially from actual results. Accordingly, any such statements

are qualified in their entirety by reference to, and are

accompanied by, the following important factors that may cause our

actual results or outcomes to differ materially from those

contained in our forward-looking statements, including, but not

limited to cyberattacks or breaches, including those resulting in

the compromise of the confidentiality of our proprietary

information and the personal information of our customers; the

ability to qualify for investment tax credits and investment tax

credit adders; variability in the costs and final investment

returns of the Revolution Wind and South Fork Wind offshore wind

projects as it relates to the purchase price post-closing

adjustment under the terms of the sale agreement for these

projects; disruptions in the capital markets or other events that

make our access to necessary capital more difficult or costly;

changes in economic conditions, including impact on interest rates,

tax policies, and customer demand and payment ability; ability or

inability to commence and complete our major strategic development

projects and opportunities; acts of war or terrorism, physical

attacks or grid disturbances that may damage and disrupt our

electric transmission and electric, natural gas, and water

distribution systems; actions or inaction of local, state and

federal regulatory, public policy and taxing bodies; substandard

performance of third-party suppliers and service providers;

fluctuations in weather patterns, including extreme weather due to

climate change; changes in business conditions, which could include

disruptive technology or development of alternative energy sources

related to our current or future business model; contamination of,

or disruption in, our water supplies; changes in levels or timing

of capital expenditures; changes in laws, regulations, Presidential

executive orders or regulatory policy, including compliance with

environmental laws and regulations; changes in accounting standards

and financial reporting regulations; actions of rating agencies;

and other presently unknown or unforeseen factors.

Other risk factors are detailed in Eversource Energy’s reports

filed with the Securities and Exchange Commission (SEC). They are

updated as necessary and available on Eversource Energy’s website

at www.eversource.com and on the SEC’s website at www.sec.gov and

management encourages you to consult such disclosures.

All such factors are difficult to predict and contain

uncertainties that may materially affect Eversource Energy’s actual

results, many of which are beyond our control. You should not place

undue reliance on the forward-looking statements, as each speaks

only as of the date on which such statement is made, and, except as

required by federal securities laws, Eversource Energy undertakes

no obligation to update any forward-looking statement or statements

to reflect events or circumstances after the date on which such

statement is made or to reflect the occurrence of unanticipated

events.

EVERSOURCE ENERGY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME/(LOSS) (Unaudited)

For the Three Months Ended

December 31,

(Thousands of Dollars, Except Share

Information)

2024

2023

Operating Revenues

$

2,971,488

$

2,694,238

Operating Expenses:

Purchased Power, Purchased Natural Gas and

Transmission

740,832

935,329

Operations and Maintenance

575,100

513,141

Depreciation

372,853

343,363

Amortization

215,369

(51,657

)

Energy Efficiency Programs

165,007

160,145

Taxes Other Than Income Taxes

257,488

235,370

Loss on Pending Sale of Aquarion

297,000

—

Total Operating Expenses

2,623,649

2,135,691

Operating Income

347,839

558,547

Interest Expense

288,696

231,300

Losses on Offshore Wind Investments

—

1,766,000

Other Income, Net

91,612

85,090

Income/(Loss) Before Income Tax

Expense

150,755

(1,353,663

)

Income Tax Expense/(Benefit)

76,355

(67,058

)

Net Income/(Loss)

74,400

(1,286,605

)

Net Income Attributable to Noncontrolling

Interests

1,880

1,880

Net Income/(Loss) Attributable to Common

Shareholders

$

72,520

$

(1,288,485

)

Basic and Diluted Earnings/(Loss) Per

Common Share

$

0.20

$

(3.68

)

Weighted Average Common Shares

Outstanding:

Basic

366,481,846

349,938,891

Diluted

366,883,093

350,167,959

The data contained in this report is preliminary and is

unaudited. This report is being submitted for the sole purpose of

providing information to shareholders about Eversource Energy and

Subsidiaries and is not a representation, prospectus, or intended

for use in connection with any purchase or sale of securities.

EVERSOURCE ENERGY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME/(LOSS) (Unaudited)

For the Years Ended December

31,

(Thousands of Dollars, Except Share

Information)

2024

2023

2022

Operating Revenues

$

11,900,809

$

11,910,705

$

12,289,336

Operating Expenses:

Purchased Power, Purchased Natural Gas and

Transmission

3,736,078

5,168,241

5,014,074

Operations and Maintenance

2,012,926

1,895,703

1,865,328

Depreciation

1,433,503

1,305,840

1,194,246

Amortization

342,864

(490,117

)

448,892

Energy Efficiency Programs

671,828

691,344

658,051

Taxes Other Than Income Taxes

997,901

940,359

910,591

Loss on Pending Sale of Aquarion

297,000

—

—

Total Operating Expenses

9,492,100

9,511,370

10,091,182

Operating Income

2,408,709

2,399,335

2,198,154

Interest Expense

1,111,336

855,441

678,274

Losses on Offshore Wind Investments

464,019

2,167,000

—

Other Income, Net

410,482

348,069

346,088

Income/(Loss) Before Income Tax

Expense

1,243,836

(275,037

)

1,865,968

Income Tax Expense

424,664

159,684

453,574

Net Income/(Loss)

819,172

(434,721

)

1,412,394

Net Income Attributable to Noncontrolling

Interests

7,519

7,519

7,519

Net Income/(Loss) Attributable to Common

Shareholders

$

811,653

$

(442,240

)

$

1,404,875

Basic Earnings/(Loss) Per Common Share

$

2.27

$

(1.27

)

$

4.05

Diluted Earnings/(Loss) Per Common

Share

$

2.27

$

(1.26

)

$

4.05

Weighted Average Common Shares

Outstanding:

Basic

357,482,965

349,580,638

346,783,444

Diluted

357,779,408

349,840,481

347,246,768

The data contained in this report is preliminary and is

unaudited. This report is being submitted for the sole purpose of

providing information to shareholders about Eversource Energy and

Subsidiaries and is not a representation, prospectus, or intended

for use in connection with any purchase or sale of securities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250211270679/en/

Rima Hyder (781) 441-8062

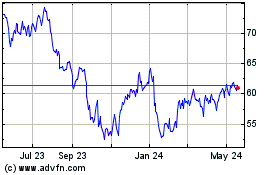

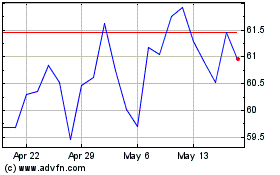

Eversource Energy (NYSE:ES)

Historical Stock Chart

From Jan 2025 to Feb 2025

Eversource Energy (NYSE:ES)

Historical Stock Chart

From Feb 2024 to Feb 2025