Element Solutions Inc Increases Second Quarter and Full Year Guidance

June 11 2024 - 3:30PM

Business Wire

Element Solutions Inc (“ESI” or the “Company”) announced today

that it is raising its guidance range for the second quarter and

full year 2024. ESI now expects adjusted EBITDA to be approximately

$135 million in the second quarter and between $530 million and

$545 million for the full year.

President and CEO Benjamin Gliklich said, "The strength in our

electronics business and improvement in our overall profitability

have continued and, in certain areas, accelerated in the second

quarter. Our wafer level packaging and circuitry businesses, in

particular, have ramped to support strong customer growth these

past two months. While electronic markets are recovering in certain

pockets, overall unit and chemistry volumes remain below long-term

trend levels. Nonetheless, and despite what is a generally weaker

industrial environment, we expect in 2024 to generate record

adjusted EBITDA since the founding of Element Solutions in 2019.

This bodes well for our earnings trajectory next year and beyond.

Our conviction in ESI’s longer-term outlook continues to

strengthen."

Updated 2024 Guidance

The Company has increased its full year 2024 adjusted EBITDA

expectation from a range of $515 million to $530 million to an

updated range of $530 million to $545 million. In addition, the

Company now expects 2024 adjusted EPS to be in the range of $1.40

to $1.46.

About Element Solutions Inc

Element Solutions Inc is a leading specialty chemicals company

whose businesses supply a broad range of solutions that enhance the

performance of products people use every day. Developed in

multi-step technological processes, these innovative solutions

enable customers' manufacturing processes in several key

industries, including consumer electronics, power electronics,

semiconductor fabrication, communications and data storage

infrastructure, automotive systems, industrial surface finishing,

consumer packaging and offshore energy. More information about the

Company is available at www.elementsolutionsinc.com.

Non-GAAP Financial Measures

Adjusted EBITDA: Adjusted EBITDA is defined as EBITDA (earnings

before interest, provision for income taxes, depreciation and

amortization), excluding the impact of additional items included in

GAAP earnings which the Company believes are not representative or

indicative of its ongoing business or are considered to be

associated with its capital structure. Management believes adjusted

EBITDA provides investors with a more complete understanding of the

long-term profitability trends of ESI's business and facilitate

comparisons of its profitability to prior and future periods.

Adjusted Earnings Per Share (EPS): Adjusted EPS is a key metric

used by management to measure operating performance and trends as

management believes the exclusion of certain expenses in

calculating adjusted EPS facilitates operating performance

comparisons on a period-to-period basis. Adjusted EPS is defined as

net income adjusted to reflect adjustments consistent with the

Company's definition of adjusted EBITDA. Additionally, the Company

eliminates amortization expense associated with intangible assets,

incremental depreciation associated with the step-up of fixed

assets and incremental cost of sales associated with the step-up of

inventories, as applicable, recognized in purchase accounting for

acquisitions. Further, the Company adjusts its effective tax rate

to 20%; which effective tax rate reflects the Company’s estimated

long-term expectations for taxes to be paid on its adjusted

non-GAAP earnings and is consistent with how management evaluates

the Company’s financial performance. The Company also believes that

providing a fixed rate facilitates comparisons of business

performance from period to period. This non-GAAP effective tax rate

is lower than the average of the statutory tax rates applicable to

the Company’s jurisdictional mix of earnings, primarily because it

reflects tax benefits derived from U.S. tax attribute

carryforwards, which consist of operating losses and tax credits.

The resulting adjusted net income is then divided by the Company's

adjusted common shares outstanding. Adjusted common shares

outstanding represent the shares outstanding as of the balance

sheet date for the quarter-to-date period and an average of each

quarter for the year-to-date period plus shares issuable upon

exercise or vesting of all outstanding equity awards (assuming a

performance achievement target level for equity awards with targets

considered probable).

Reconciliations of these forward-looking non-GAAP measures to

GAAP are excluded in reliance upon the exception provided by Item

10(e)(1)(i)(B) of Regulation S-K due to the inherent difficulty in

forecasting and quantifying, without unreasonable efforts, certain

amounts that are necessary for such reconciliations, including

adjustments that could be made for restructurings, refinancings,

impairments, divestitures, integration and acquisition-related

expenses, share-based compensation amounts, non-recurring, unusual

or unanticipated charges, expenses or gains, adjustments to

inventory and other charges reflected in reconciliations of

historic numbers, the amount of which, based on historical

experience, could be significant.

Forward-Looking Statements

This release is intended to qualify for the safe harbor from

liability established by the Private Securities Litigation Reform

Act of 1995 as it contains "forward-looking statements" within the

meaning of the federal securities laws. These statements will often

contain words such as "expect," "anticipate," "project," "will,"

"should," "believe," "intend," "plan," "assume," "estimate,"

"predict," "seek," "continue," "outlook," "may," "might," "aim,"

"can have," "likely," "potential" "target," "hope," "goal,"

"priority," "guidance" or "confident" and variations of such words

and similar expressions and include, but are not limited to,

statements, beliefs, projections and expectations regarding full

year 2024 guidance for adjusted EBITDA and adjusted EPS and second

quarter 2024 guidance for adjusted EBITDA; effective tax rate;

recovery of electronic markets in certain pockets; record adjusted

EBITDA for 2024 since the founding of Element Solutions in 2019;

the Company’s earnings trajectory next year and beyond and its

longer-term outlook. These projections and statements are based on

management's estimates, assumptions or expectations with respect to

financial performance and future events, and are believed to be

reasonable, though are inherently uncertain and difficult to

predict. Such projections and statements are based on the

assessment of information available to management as of the current

date, and management does not undertake any obligations to provide

any further updates. Actual results could differ materially from

those expressed or implied in the forward-looking statements if one

or more of the underlying estimates, assumptions or expectations

prove to be inaccurate or are unrealized. Important factors that

could cause actual results to differ materially from those

suggested are included in the Form 8-K periodic reports, 10-Q

quarterly reports, 10-K annual report and other reports filed by

the Company with the Securities and Exchange Commission. The

Company undertakes no obligation to update any forward-looking

statements, whether as a result of new information, future events

or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240611475169/en/

Investor Relations Contact: Varun Gokarn Senior Director,

Strategy and Finance Element Solutions Inc 1-203-952-0369

IR@elementsolutionsinc.com

Media Contact: Scott Bisang / Ed Hammond / Tali Epstein

Collected Strategies 1-212-379-2072 esi@collectedstrategies.com

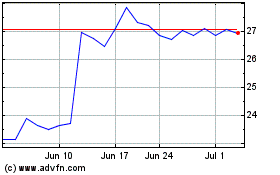

Element Solutions (NYSE:ESI)

Historical Stock Chart

From Jan 2025 to Feb 2025

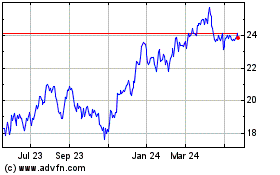

Element Solutions (NYSE:ESI)

Historical Stock Chart

From Feb 2024 to Feb 2025