Eaton Vance Announces New Financing Arrangement for Three Closed-End Funds - Proceeds to be Used for a Complete Redemption of th

March 10 2008 - 3:01PM

PR Newswire (US)

BOSTON, March 10 /PRNewswire-FirstCall/ -- Eaton Vance Corp.

(NYSE:EV) announced today that three closed-end equity funds

managed by its affiliate Eaton Vance Management have secured

committed financing totaling approximately $1.6 billion that the

funds intend to use to redeem all of their outstanding auction

preferred shares ("APS"). The three closed-end funds are: Eaton

Vance Tax-Advantaged Dividend Income Fund (NYSE:EVT); Eaton Vance

Tax- Advantaged Global Dividend Income Fund (NYSE:ETG); and Eaton

Vance Tax- Advantaged Global Dividend Opportunities Fund (NYSE:ETO)

(collectively, the "Funds"). With the new financing, the Funds

intend to change their method of leverage from APS to debt. The

Funds expect to redeem in full their outstanding APS, subject to

completion of their new financing arrangements and satisfying the

notice and other requirements that apply to APS redemptions. It is

expected that each series of the Funds' APS will be redeemed at the

next dividend date after March 28, 2008. See

http://www.eatonvance.com/ under closed-end fund press releases to

view the Funds' announcement. To receive a hardcopy of this

information call (800) 225-6265. Eaton Vance manages 29 leveraged

closed-end funds with approximately $5 billion of APS outstanding

collectively. Completion of the intended APS redemptions being

announced today will reduce the amount of outstanding APS for Eaton

Vance-sponsored closed-end funds by approximately 32%. Eaton Vance

understands that the current disruption in the auction rate

securities market imposes significant hardship on APS holders who

need access to liquidity. Eaton Vance is working diligently to

provide liquidity solutions for its funds' remaining APS holders,

and is hopeful that it will be able to do so. Different solutions

may be most workable for different types of funds (equity, taxable

income and municipal income). The financing arrangement being

announced today is only applicable to the three equity funds; other

alternatives are being pursued for other types of funds and it is

not certain when, or if, solutions will be available to these

funds. Eaton Vance Corp., a Boston based investment management

firm, is listed on the New York Stock Exchange under the symbol EV.

Through its subsidiaries, Eaton Vance Corp. manages funds and

separate accounts for individuals and institutional clients. This

news release contains statements that are not historical facts,

referred to as "forward-looking statements." The Company's actual

future results may differ significantly from those stated in any

forward-looking statements, depending on factors such as changes in

securities or financial markets or general economic conditions, the

volume of sales and repurchases of fund shares, the continuation

investment advisory, administration, distribution and service

contracts, and other risks discussed from time to time in the

Company's filings with the Securities and Exchange Commission.

DATASOURCE: Eaton Vance Corp. CONTACT: Investors, Jonathan Isaac,

+1-617-598-8818, or Media, Jeanette Harrison-Sullivan,

+1-617-598-8920, both for Eaton Vance Corp. Web site:

http://www.eatonvance.com/

Copyright

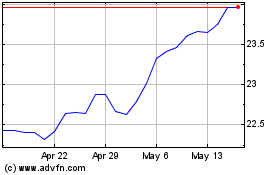

Eaton Vance Tax Advantag... (NYSE:EVT)

Historical Stock Chart

From Jun 2024 to Jul 2024

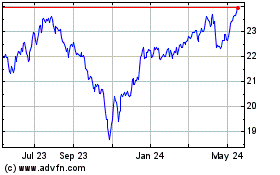

Eaton Vance Tax Advantag... (NYSE:EVT)

Historical Stock Chart

From Jul 2023 to Jul 2024