FTI CONSULTING, INC DC false 0000887936 0000887936 2025-02-20 2025-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 20, 2025

FTI CONSULTING, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Maryland |

|

001-14875 |

|

52-1261113 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

| 555 12th Street NW, Washington, D.C. 20004 (Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including area code: (202) 312-9100

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each Exchange on which Registered |

| Common Stock, par value $0.01 per share |

|

FCN |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| ITEM 2.02. |

Results of Operations and Financial Condition |

FTI Consulting, Inc. (“FTI Consulting” or the “Company”) uses a presentation from time to time in its discussions with investors and analysts (the “Presentation”). The Presentation includes FTI Consulting’s past and present financial results, operating data and other information. A copy of the Presentation is furnished as Exhibit 99.1 and has been posted to the FTI Consulting website at www.fticonsulting.com.

| ITEM 7.01. |

Regulation FD Disclosure |

In the Presentation, FTI Consulting uses information derived from consolidated and segment financial information that may not be presented in its financial statements or prepared in accordance with generally accepted accounting principles in the United States (“GAAP”). Certain of these measures are considered “non-GAAP financial measures” under rules promulgated by the Securities and Exchange Commission. Specifically, the Company may have referred to the following non-GAAP financial measures:

| |

• |

|

Total Segment Operating Income |

| |

• |

|

Adjusted Segment EBITDA |

| |

• |

|

Total Adjusted Segment EBITDA |

| |

• |

|

Adjusted Earnings per Diluted Share |

FTI Consulting has included the definition of Segment Operating Income, which is a GAAP financial measure, below in order to more fully define the components of certain non-GAAP financial measures in the accompanying analysis of financial information.

FTI Consulting defines Segment Operating Income as a segment’s share of consolidated operating income. FTI Consulting defines Total Segment Operating Income, which is a non-GAAP financial measure, as the total of Segment Operating Income for all segments, which excludes unallocated corporate expenses. The Company uses Segment Operating Income for the purpose of calculating Adjusted Segment EBITDA, which is a non-GAAP financial measure. FTI Consulting defines Adjusted Segment EBITDA as a segment’s share of consolidated operating income before depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. The Company uses Adjusted Segment EBITDA as a basis to internally evaluate the financial performance of its segments because the Company believes it reflects core operating performance and provides an indicator of the segment’s ability to generate cash. FTI Consulting defines Total Adjusted Segment EBITDA, which is a non-GAAP financial measure, as the total of Adjusted Segment EBITDA for all segments, which excludes unallocated corporate expenses.

FTI Consulting defines Adjusted EBITDA, which is a non-GAAP financial measure, as consolidated net income before income tax provision, other non-operating income (expense), depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges, gain or loss on sale of a business and losses on early extinguishment of debt. FTI Consulting defines Adjusted EBITDA Margin, which is a non-GAAP financial measure, as Adjusted EBITDA as a percentage of total revenues. The Company believes that these non-GAAP financial measures, when considered together with its GAAP financial results and GAAP financial measures, provide management and investors with a more complete understanding of FTI Consulting’s operating results, including underlying trends. In addition, EBITDA is a common alternative measure of operating performance used by many of FTI Consulting’s competitors. It is used by investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in FTI Consulting’s industry. Therefore, the Company also believes that these non-GAAP financial measures, considered along with corresponding GAAP financial measures, provide management and investors with useful supplemental information.

FTI Consulting defines Adjusted Net Income and Adjusted Earnings per Diluted Share (“Adjusted EPS”), which are non-GAAP financial measures, as net income and earnings per diluted share (“EPS”), respectively, excluding the impact of remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges, the gain or loss on sale of a business and losses on early extinguishment of debt. The Company uses Adjusted Net Income for the purpose of calculating Adjusted EPS. Management uses Adjusted EPS to assess total Company operating performance on a consistent basis. The Company believes that these non-GAAP financial measures, when considered together with its GAAP financial results and GAAP financial measures, provide management and investors with useful supplemental information on its business operating results, including underlying trends.

FTI Consulting defines Free Cash Flow, which is a non-GAAP financial measure, as net cash provided by operating activities less cash payments for purchases of property and equipment. The Company believes this non-GAAP financial measure, when considered together with its GAAP financial results, provides management and investors with useful supplemental information on the Company’s ability to generate cash for ongoing business operations and capital deployment.

1

Non-GAAP financial measures are not defined in the same manner by all companies and may not be comparable with other similarly titled measures of other companies. Non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, the information contained in FTI Consulting’s Consolidated Statements of Comprehensive Income and Consolidated Statements of Cash Flows. Reconciliations of Non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the Presentation.

The information included herein, including Exhibit 99.1 furnished herewith, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any filing pursuant to the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing, except as expressly set forth by specific reference in such filing.

| ITEM 9.01. |

Financial Statements and Exhibits |

(d) Exhibits

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, FTI Consulting, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

FTI CONSULTING, INC. |

|

|

|

|

| Dated: February 21, 2025 |

|

|

|

By: |

|

/s/ CURTIS P. LU |

|

|

|

|

Name: |

|

Curtis P. Lu |

|

|

|

|

Title: |

|

General Counsel |

3

Exhibit 99.1 FTI Consulting, Inc. Fourth Quarter and Full Year 2024

Earnings Conference Call February 20, 2025

Cautionary Note About Forward-Looking Statements This presentation

includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve uncertainties and risks. Forward-looking statements

include statements concerning our plans, initiatives, projections, prospects, policies, processes and practices, objectives, goals, commitments, strategies, future events, future revenues, future results and performance, future capital allocations

and expenditures, expectations, plans or intentions relating to acquisitions, share repurchases and other matters, business trends, new, or changes to, laws and regulations, including U.S. and foreign tax laws, scientific or technological

developments, including relating to new and emerging technologies, such as artificial intelligence and machine learning and other information that is not historical. Forward-looking statements often contain words such as estimates, expects,

anticipates, projects, plans, intends, believes, commits, aspires, forecasts, future, goal, seeks and variations of such words or similar expressions. All forward-looking statements, including, without limitation, management’s financial

guidance and examination of operating trends, are based upon our historical performance and our current plans, estimates, intentions and expectations at the time we make them, and various assumptions. Our actual financial results, performance or

achievements and outcomes could differ materially from those expressed in, or implied by, any forward-looking statements. Further, unaudited quarterly results are subject to normal year-end adjustments. The Company has experienced fluctuating

revenues, operating income and cash flows in prior periods and expects that this will occur from time to time in the future. Other factors that could cause such differences include declines in demand for, or changes in, the mix of services and

products that we offer; the mix of the geographic locations where our clients are located or where services are performed; fluctuations in the price per share of our common stock; adverse financial, real estate or other market and general economic

conditions; the impact of public health crises and related events that are beyond our control, which could affect our segments, practices and the geographic regions in which we conduct business differently and adversely; and other future events,

which could impact each of our segments, practices and the geographic regions in which we conduct business differently and could be outside of our control; the pace and timing of the consummation and integration of future acquisitions; the

Company’s ability to realize cost savings and efficiencies; competitive and general economic conditions; retention of staff and clients; new laws and regulations or changes thereto; and other risks described under the heading Item 1A, Risk

Factors in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 filed with the SEC on February 20, 2025 and in the Company’s other filings with the SEC. We are under no duty to update any of the forward-looking

statements to conform such statements to actual results or events and do not intend to do so. 2

Fourth Quarter 2024: Financial Review All numbers in $000s, except for

per share data and percentages Percentage Change in Revenues Excluding the Estimated Impact of Foreign Currency Translation for Consolidated Results Q4 2024 Q3 2024 % Variance Q4 2023 % Variance Q4 2024 vs. Q4 2023 Revenues $ 894,924 $ 926,019 -3.4%

-3.2% -3.5% $ 924,684 Net income $ 49,710 $ 66,466 -25.2 % -39.1 % $ 81,633 Earnings per Diluted Share $ 1.38 $ 1.85 -25.4 % -39.5 % $ 2.28 (1) Adjusted Earnings per Diluted Share $ 1.56 $ 1.85 -15.7 % -31.6 % $ 2.28 (1) Adjusted EBITDA $ 73,743 $

102,948 -28.4 % -42.1 % $ 127,394 (1) Adjusted EBITDA Margin 8.2% 11.1% — — 13.8% Segment Results Corporate Finance & Restructuring Revenues $ 335,713 $ 341,512 -1.7 % $ 365,554 -8.2 % -8.3% (1) Adjusted Segment EBITDA $ 44,745 $

57,919 -22.7 % $ 65,386 -31.6 % (1) Adjusted Segment EBITDA Margin 13.3% 17.0% — 17.9% — Forensic and Litigation Consulting Revenues $ 175,863 $ 168,778 4.2 % $ 165,469 6.3 % 6.2% (1) Adjusted Segment EBITDA $ 18,023 $ 19,991 -9.8 % $

19,247 -6.4 % (1) Adjusted Segment EBITDA Margin 10.2% 11.8% — 11.6% — Economic Consulting Revenues $ 206,103 $ 222,033 -7.2 % $ 206,091 0.0% -0.6% (1) Adjusted Segment EBITDA $ 15,808 $ 35,244 -55.1 % $ 38,335 -58.8 % (1) Adjusted

Segment EBITDA Margin 7.7% 15.9% — 18.6% — Technology Revenues $ 90,645 $ 110,404 -17.9 % $ 100,933 -10.2 % -10.3% (1) Adjusted Segment EBITDA $ 6,565 $ 16,465 -60.1 % $ 12,385 -47.0 % (1) Adjusted Segment EBITDA Margin 7.2% 14.9%

— 12.3% — Strategic Communications Revenues $ 86,600 $ 83,292 4.0 % $ 86,637 0.0% -0.7% (1) Adjusted Segment EBITDA $ 13,808 $ 12,124 13.9 % $ 15,636 -11.7 % (1) Adjusted Segment EBITDA Margin 15.9% 14.6% — 18.0% — (1) See

“Financial Tables” and “End Notes: FTI Consulting Non-GAAP Financial Measures” for the reconciliations and definitions of Adjusted Earnings per Diluted Share, Adjusted EBITDA, and Adjusted Segment EBITDA, which are non-GAAP

financial measures, to the most directly comparable GAAP financial measures, and for the definition of Adjusted EBITDA Margin, which is a non-GAAP financial 3 measure.

Full Year 2024: Financial Review All numbers in $000s, except for per

share data and percentages Percentage Change in Revenues Excluding the Estimated Impact of Foreign Currency Consolidated Results FY 2024 FY 2023 % Variance Translation for FY 2024 vs. FY 2023 Revenues $ 3,698,652 $ 3,489,242 6.0% 5.7% Net income $

280,088 $ 274,892 1.9% Earnings per Diluted Share $ 7.81 $ 7.71 1.3% (1) Adjusted Earnings per Diluted Share $ 7.99 $ 7.71 3.6% (1) Adjusted EBITDA $ 403,685 $ 424,799 -5.0% (1) Adjusted EBITDA Margin 10.9% 12.2% — Segment Results Corporate

Finance & Restructuring Revenues $ 1,391,206 $ 1,346,678 3.3% 3.1% (1) Adjusted Segment EBITDA $ 244,356 $ 230,837 5.9% (1) Adjusted Segment EBITDA Margin 17.6% 17.1% — Forensic and Litigation Consulting Revenues $ 690,211 $ 654,105 5.5%

5.3% (1) Adjusted Segment EBITDA $ 86,717 $ 88,109 -1.6% (1) Adjusted Segment EBITDA Margin 12.6% 13.5% — Economic Consulting Revenues $ 863,557 $ 771,374 12.0% 11.4% (1) Adjusted Segment EBITDA $ 109,498 $ 115,807 -5.4% (1) Adjusted Segment

EBITDA Margin 12.7% 15.0% — Technology Revenues $ 417,637 $ 387,855 7.7% 7.5% (1) Adjusted Segment EBITDA $ 58,541 $ 62,711 -6.6% (1) Adjusted Segment EBITDA Margin 14.0% 16.2% — Strategic Communications Revenues $ 336,041 $ 329,230 2.1%

1.3% (1) Adjusted Segment EBITDA $ 49,969 $ 50,909 -1.8% (1) Adjusted Segment EBITDA Margin 14.9% 15.5% — 4 (1) See “Financial Tables” and “End Notes: FTI Consulting Non-GAAP Financial Measures” for the reconciliations

and definitions of Adjusted Earnings per Diluted Share, Adjusted EBITDA, and Adjusted Segment EBITDA, which are non-GAAP financial measures, to the most directly comparable GAAP financial measures, and for the definition of Adjusted EBITDA Margin,

which is a non-GAAP financial measure.

Cash Position and Capital Allocation Snapshot As of December 31, 2024,

September 30, 2024 and December 31, 2023 All numbers in $000s, except for DSO As of December 31, 2024 As of September 30, 2024 As of December 31, 2023 $ 303,222 Cash and cash equivalents $ 660,493 $ 386,344 Accounts receivable, net $ 1,020,174 $

1,184,475 $ 1,102,142 (1) $ 25,461 Short-term investments — — (2) 100 Days Sales Outstanding ( DSO ) 97 108 $ 224,461 Net cash provided by operating activities $ 395,097 $ 79,782 Purchases of property and equipment $ (34,900) $ (21,748)

$ (49,562) $ (20,982) Purchase and retirement of common stock $ (10,217) $ — (3) $ 360,197 $ 174,899 Free Cash Flow $ 58,034 (1) The balance is included in “Prepaid expenses and other current assets” on the Consolidated Balance

Sheets. (2) DSO is a performance measure used to assess how quickly revenues are collected by the Company. We calculate DSO at the end of each reporting period by dividing net accounts receivable reduced by billings in excess of services provided,

by revenues for the quarter, adjusted for changes in foreign exchange rates. We multiply the result by the number of days in the quarter. (3) See “Financial Tables” and “End Notes: FTI Consulting Non-GAAP Financial Measures”

for the reconciliation and definition of Free Cash Flow, which is a non-GAAP financial measure, to the most directly comparable GAAP financial measure. 5

Reconciliations of Net Income to Adjusted Net Income and Earnings per

Diluted Share to Adjusted Earnings per Diluted Share Three Months Ended December 31, 2024, September 30, 2024 and December 31, 2023 Three Months Ended Three Months Ended Three Months Ended All numbers in $000s, except for per share data December 31,

2024 September 30, 2024 December 31, 2023 $ 49,710 $ 66,466 $ 81,633 Net income 8,230 — — Special charges (1,857) — — Tax impact of special charges (1) $ 56,083 $ 66,466 $ 81,633 Adjusted Net Income $ 1.38 $ 1.85 $ 2.28

Earnings per Diluted Share 0.23 — — Special charges (0.05) — — Tax impact of special charges (1) $ 1.56 $ 1.85 $ 2.28 Adjusted Earnings per Diluted Share 35,855 35,892 35,778 Weighted average number of common shares

outstanding — diluted (1) 7 See “End Notes: FTI Consulting Non-GAAP Financial Measures” for the definitions of Adjusted Net Income and Adjusted Earnings per Diluted Share, which are non- GAAP financial measures.

Reconciliations of Net Income to Adjusted Net Income and Earnings Per

Diluted Share to Adjusted Earnings Per Diluted Share Years Ended December 31, 2024 and December 31, 2023 Year Ended Year Ended All numbers in $000s, except for per share data December 31, 2024 December 31, 2023 Net income $ 280,088 $ 274,892 Special

charges 8,230 — Tax impact of special charges (1,857) — (1) Adjusted Net Income $ 286,461 $ 274,892 Earnings per Diluted Share $ 7.81 $ 7.71 Special charges 0.23 — Tax impact of special charges (0.05) — (1) Adjusted Earnings

per Diluted Share $ 7.99 $ 7.71 Weighted average number of common shares outstanding — diluted 35,845 35,646 (1) 8 See “End Notes: FTI Consulting Non-GAAP Financial Measures” for the definitions of Adjusted Net Income and Adjusted

Earnings per Diluted Share, which are non- GAAP financial measures.

Reconciliations of Net Income and Operating Income to Adjusted Segment

EBITDA and Adjusted EBITDA Three Months Ended December 31, 2024 and September 30, 2024 All numbers in $000s Three Months Ended December 31, 2024 Corporate Finance Forensic and Economic Strategic Unallocated Technology Total & Restructuring

Litigation Consulting Consulting Communications Corporate Net income $ 49,710 Interest income and other (7,779) Interest expense 716 Income tax provision 10,098 Operating income $ 36,096 $ 14,305 $ 14,393 $ 1,275 $ 12,534 $ (25,858) $ 52,745

Depreciation of property and 2,587 1,704 1,407 4,623 910 503 11,734 equipment Amortization of intangible assets 736 229 — — 69 — 1,034 Special charges 5,326 1,785 8 667 295 149 8,230 (1) Adjusted EBITDA $ 44,745 $ 18,023 $ 15,808 $

6,565 $ 13,808 $ (25,206) $ 73,743 Three Months Ended September 30, 2024 Corporate Finance Forensic and Economic Strategic Unallocated Technology Total & Restructuring Litigation Consulting Consulting Communications Corporate Net income $ 66,466

Interest income and other 909 Interest expense 1,197 Income tax provision 22,320 Operating income $ 54,503 $ 18,118 $ 33,880 $ 12,524 $ 11,188 $ (39,321) $ 90,892 Depreciation of property and 2,631 1,644 1,364 3,941 897 526 11,003 equipment

Amortization of intangible assets 785 229 — — 39 — 1,053 (1) Adjusted EBITDA $ 57,919 $ 19,991 $ 35,244 $ 16,465 $ 12,124 $ (38,795) $ 102,948 (1) See “End Notes: FTI Consulting Non-GAAP Financial Measures” for the

definitions of Adjusted Segment EBITDA and Adjusted EBITDA, which are non-GAAP financial measures. 9

Reconciliations of Net Income and Operating Income to Adjusted Segment

EBITDA and Adjusted EBITDA Three Months Ended December 31, 2023 All numbers in $000s Three Months Ended December 31, 2023 Corporate Finance Forensic and Litigation Economic Strategic Unallocated Technology Total & Restructuring Consulting

Consulting Communications Corporate Net income $ 81,633 Interest income and other 8,088 Interest expense 3,896 Income tax provision 21,404 Operating income $ 61,779 $ 17,415 $ 36,801 $ 8,393 $ 14,703 $ (24,070) $ 115,021 Depreciation of property and

2,597 1,680 1,534 3,992 875 475 11,153 equipment Amortization of intangible assets 1,010 152 — — 58 — 1,220 (1) Adjusted EBITDA $ 65,386 $ 19,247 $ 38,335 $ 12,385 $ 15,636 $ (23,595) $ 127,394 10 (1) See “End Notes: FTI

Consulting Non-GAAP Financial Measures” for the definitions of Adjusted Segment EBITDA and Adjusted EBITDA, which are non-GAAP financial measures.

Reconciliations of Net Income and Operating Income to Adjusted Segment

EBITDA and Adjusted EBITDA Years Ended December 31, 2024 and December 31, 2023 All numbers in $000s Year Ended December 31, 2024 Corporate Finance & Forensic and Litigation Economic Strategic Unallocated Technology Total Restructuring Consulting

Consulting Communications Corporate Net income $ 280,088 Interest income and other (10,360) Interest expense 6,951 Income tax provision 70,683 Operating income $ 225,711 $ 77,490 $ 104,090 $ 41,875 $ 45,790 $ (147,594) $ 347,362 Depreciation of

property and 10,251 6,604 5,400 15,999 3,607 2,049 43,910 equipment Amortization of intangible assets 3,068 838 — — 277 — 4,183 Special charges 5,326 1,785 8 667 295 149 8,230 (1) Adjusted EBITDA $ 244,356 $ 86,717 $ 109,498 $

58,541 $ 49,969 $ (145,396) $ 403,685 Year Ended December 31, 2023 Corporate Finance & Forensic and Litigation Economic Strategic Unallocated Technology Total Restructuring Consulting Consulting Communications Corporate Net income $ 274,892

Interest income and other 4,867 Interest expense 14,331 Income tax provision 83,471 Operating income $ 216,504 $ 81,296 $ 109,818 $ 48,196 $ 47,167 $ (125,420) $ 377,561 Depreciation of property and 9,254 6,030 5,989 14,515 3,445 1,846 41,079

equipment Amortization of intangible assets 5,079 783 — — 297 — 6,159 (1) Adjusted EBITDA $ 230,837 $ 88,109 $ 115,807 $ 62,711 $ 50,909 $ (123,574) $ 424,799 11 (1) See “End Notes: FTI Consulting Non-GAAP Financial

Measures” for the definitions of Adjusted Segment EBITDA and Adjusted EBITDA, which are non-GAAP financial measures.

Reconciliations of Net Cash Provided by Operating Activities to Free

Cash Flow Years Ended December 31, 2024 and December 31, 2023 and Nine Months Ended September 30, 2024 Year Ended Nine Months Ended Year Ended December 31, 2024 September 30, 2024 December 31, 2023 All numbers in $000s $ 224,461 Net cash provided by

operating activities $ 395,097 $ 79,782 (49,562) Purchases of property and equipment (34,900) (21,748) (1) $ 174,899 Free Cash Flow $ 360,197 $ 58,034 (1) See “End Notes: FTI Consulting Non-GAAP Financial Measures” for the definition of

Free Cash Flow, which is a non-GAAP financial measure. 12

End Notes: FTI Consulting Non-GAAP Financial Measures In this

presentation, we sometimes use information derived from consolidated and segment financial information that may not be presented in our financial statements or prepared in accordance with generally accepted accounting principles in the United States

( GAAP ). Certain of these measures are considered “non-GAAP financial measures” under the Securities and Exchange Commission ( SEC ) rules. Specifically, we have referred to the following non-GAAP financial measures in this

presentation: Adjusted Segment EBITDA Adjusted EBITDA Adjusted EBITDA Margin Adjusted Net Income Adjusted Earnings per Diluted Share Free Cash Flow We have included the definition of Segment Operating Income, which is a GAAP financial measure, below

in order to more fully define the components of certain non-GAAP financial measures in this presentation. We define Segment Operating Income as a segment’s share of consolidated operating income. We use Segment Operating Income for the purpose

of calculating Adjusted Segment EBITDA, which is a non-GAAP financial measure. We define Adjusted Segment EBITDA as a segment’s share of consolidated operating income before depreciation, amortization of intangible assets, remeasurement of

acquisition-related contingent consideration, special charges and goodwill impairment charges. We use Adjusted Segment EBITDA as a basis to internally evaluate the financial performance of our segments because we believe it reflects core operating

performance and provides an indicator of the segment’s ability to generate cash. We define Adjusted EBITDA, which is a non-GAAP financial measure, as consolidated net income before income tax provision, other non-operating income (expense),

depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges, gain or loss on sale of a business and losses on early extinguishment of debt. We define

Adjusted EBITDA Margin, which is a non-GAAP financial measure, as Adjusted EBITDA as a percentage of total revenues. We believe that these non-GAAP financial measures, when considered together with our GAAP financial results and GAAP financial

measures, provide management and investors with a more complete understanding of our operating results, including underlying trends. In addition, EBITDA is a common alternative measure of operating performance used by many of our competitors. It is

used by investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in our industry. Therefore, we also believe that these non-GAAP financial measures, considered along with corresponding

GAAP financial measures, provide management and investors with useful supplemental information. We define Adjusted Net Income and Adjusted Earnings per Diluted Share (“Adjusted EPS”), which are non-GAAP financial measures, as net income

and earnings per diluted share (“EPS”), respectively, excluding the impact of remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges, the gain or loss on sale of a business and losses

on early extinguishment of debt. We use Adjusted Net Income for the purpose of calculating Adjusted EPS. Management uses Adjusted EPS to assess total Company operating performance on a consistent basis. We believe that these non-GAAP financial

measures, when considered together with our GAAP financial results and GAAP financial measures, provide management and investors with useful supplemental information on our business operating results, including underlying trends. We define Free Cash

Flow, which is a non-GAAP financial measure, as net cash provided by operating activities less cash payments for purchases of property and equipment. We believe this non-GAAP financial measure, when considered together with our GAAP financial

results, provides management and investors with useful supplemental information on the Company’s ability to generate cash for ongoing business operations and capital deployment. Non-GAAP financial measures are not defined in the same manner by

all companies and may not be comparable with other similarly titled measures of other companies. Non- GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, the information contained in our

Consolidated Statements of Comprehensive Income and Consolidated Statements of Cash Flows. 13

Fourth Quarter 2024: Select Geographic Review All numbers in $000s,

except for percentages Consolidated Revenues by Region Percentage Change in Revenues Excluding the Estimated Impact of Foreign Currency Region Q4 2024 Q3 2024 % Variance Q4 2023 % Variance Translation for Q4 2024 vs. Q4 2023 North America $ 587,942

$ 608,066 -3.3% $ 584,260 0.6% 0.7% $ 275,632 EMEA $ 245,471 $ 251,790 -2.5% -10.9% -12.3% $ 49,427 Asia Pacific $ 49,956 $ 54,568 -8.5% 1.1% 0.4% $ 15,365 Latin America $ 11,555 $ 11,595 -0.3% -24.8% -17.3% Percentage of Consolidated Revenues by

Region Region Q4 2024 Q3 2024 Q4 2023 North America 65.7% 65.6% 63.2% EMEA 27.4% 27.2% 29.8% Asia Pacific 5.6% 5.9% 5.3% Latin America 1.3% 1.3% 1.7% 15

Full Year 2024: Select Geographic Review All numbers in $000s, except

for percentages Consolidated Revenues by Region Percentage Change in Revenues Excluding the Estimated Impact of Foreign Currency Region FY 2024 FY 2023 % Variance Translation for FY 2024 vs. FY 2023 North America 8.0% 8.0% $ 2,432,980 $ 2,253,315

EMEA 3.3% 1.9% $ 1,015,153 $ 982,381 Asia Pacific 1.3% 1.7% $ 207,037 $ 204,417 Latin America -11.5% -8.0% $ 43,482 $ 49,129 Percentage of Consolidated Revenues by Region Region FY 2024 FY 2023 North America 65.8% 64.5% EMEA 27.4% 28.2% Asia Pacific

5.6% 5.9% Latin America 1.2% 1.4% 16

Fourth Quarter 2024 17

TM Experts with Impact 18

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

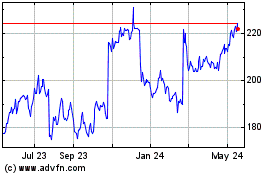

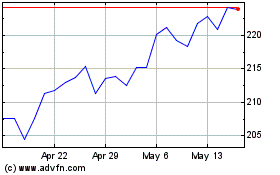

FTI Consulting (NYSE:FCN)

Historical Stock Chart

From Jan 2025 to Feb 2025

FTI Consulting (NYSE:FCN)

Historical Stock Chart

From Feb 2024 to Feb 2025